Tax woke up

Lists of lands overgrown with weeds for individual housing construction are now being compiled in Rosreestr, warned deputy head of the department Maxim Smirnov.

He explained that this year, for the first time, the “dormant” norm of the Tax Code, according to which empty plots are subject to double tax, begins to be applied. At risk of increased taxes are also “under-registered” acres of land, which citizens registered in the cadastral register before March 1, 2008, but never registered ownership of them. Rosreestr can deregister them. However, first, owners of plots registered in the Unified State Register of Real Estate will be notified of the start of the procedure.

If a person does not register ownership, then six months after the notifications are sent, the plot will be removed from the cadastral register and purchase and sale transactions with it will become impossible.

What to do if land tax does not arrive

First of all, you need to figure out what happened to the notification. Further actions depend on this. There may be several options:

- They deliberately do not send you land tax, because... the amount of charges is insignificant. As it is written in paragraph 3, paragraph 4, Article 52 of the Tax Code, if the total amount to be paid is less than 100 rubles, no notification is sent at all. Next time, the tax office will take into account payments for several years at once.

Important!

It is allowed to collect tax for no more than 3 years on one receipt.

Example 1

- The tax was not assessed, because the owner of the plot belongs to the category of beneficiaries, federal or municipal. Thus, since the period of 2017, in relation to 600 sq. m of one land plot, a tax deduction is applied for pensioners and other categories of individuals. persons named in paragraph 5 of Article 391 of the Tax Code. At the same time, if a person has previously enjoyed benefits on other taxes, no additional applications need to be submitted to the Federal Tax Service.

Important!

- An error occurred and the Federal Tax Service did not receive data from Rosreestr that you have a taxable object. At the same time, do not forget that in the current year, accruals are made for the previous reporting period.

Example 2

House through MFC

Registration of property rights to real estate has become much easier this year, says Maxim Smirnov. “If previously it was necessary to apply to two bodies at once - the Federal Cadastral Chamber (to register property in the cadastral register) and to Rosreestr (to draw up a document on ownership), now it is enough to submit all the papers to the multifunctional office once.

And thanks to the new Federal Law “On State Registration of Real Estate”, it is now possible to register rights to an apartment or land in any city at any MFC in the country, and not, as before, at the location of the property. Since the beginning of the year, more than 40 thousand applications have already been submitted under this extraterritorial principle.

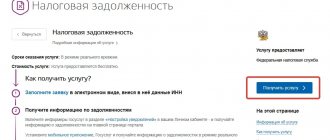

Procedure for receiving a subpoena

After the payer becomes overdue for land tax, more fines and penalties begin to accumulate against him, which leads to an increase in his debt. Within three years after the debt arises, the tax authority has the right to file a lawsuit against the payer to collect this debt, including at the expense of his property, cash or non-cash funds.

After receiving a subpoena, the landowner first of all needs to establish whether the demands of the tax authority are legal and whether any violation has been committed on his part.

In particular, demands for recovery will be illegal in the following cases:

- the inspection did not send a notification to the payer or did so in violation of the deadlines;

- the landowner is exempt from paying tax under the benefit;

- the notification was sent to the old address, although the payer notified the inspectorate of the change of place of residence;

- the tax was calculated incorrectly, and the owner of the land paid only the amount that he calculated;

- the citizen is no longer the owner of the plot (for example, he sold it or donated it).

It is worth considering that this list of cases is not exhaustive or established by law. The final decision on whether the demands of the Federal Tax Service are legal or not is made only by the judicial authority.

In each of the listed cases, the payer will need to prepare the most complete package of documents that can be used as evidence of his case.

For example it could be:

- a notification letter with a dispatch date (if it is later than the established date);

- documents confirming that the payer belongs to a preferential category (pension certificate, certificate of a large family, certificate of disability, etc.);

- papers for the plot (including information about its cadastral value, if recalculation of the tax amount is required);

- a copy of the passport page with a registration mark;

- documents on the alienation of the plot (sale and purchase agreement, exchange, deed of gift, etc.).

All these documents will need to be submitted to the court, which will make the final decision on whether the payer’s actions were at fault or not. If he manages to prove that he is right, part or all of the accrued fines and penalties will be written off.

However, if there is a real debt, he will still have to pay it off.

Technical plan required

From January 1, 2020, registration of garden and country houses requires a technical plan, which is prepared by cadastral engineers. These specialists are on staff of many private and public organizations - for example, in BTI.

Prices for their work vary and depend on the size of the buildings - the larger the square footage, the higher the cost. Specialist services rarely cost less than 10 thousand rubles.

There are 28 thousand cadastral engineers in Russia today. Everyone must be a member of a self-regulatory organization (SRO) of cadastral engineers. Each person's liability is insured for at least 2.5 million rubles. Full information about the professional and personal skills of engineers can be found on the Rosreestr website in the “Register of Cadastral Engineers” section.

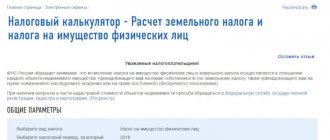

How to pay land tax if there is no receipt

You can pay land tax without a receipt if you know the correct amount. There is a special service on the Federal Tax Service website.

Operating procedure:

- Because there is no receipt, we proceed to filling out the payment order independently.

- Select the type of payment and the amount to be paid.

- We indicate the address of the site where the details of the required Federal Tax Service are determined.

- Fill in the taxpayer details.

- The service allows you to print a receipt for payment of land tax for individuals. persons to present at the bank office or transfer money online.

Another payment method is by TIN number through an online bank, for example, Sberbank. The disadvantage of this method is that this way you can only pay off overdue debt.

What benefits are there for land tax?

The following categories of citizens are exempt from paying land tax:

- Disabled people of the 1st, 2nd groups;

- Large families raising three or more minor children;

- Pensioners based solely on age;

- Military veterans;

- Victims of the Chernobyl accident.

These benefits apply only to one (!) object:

- No more than 2 hectares for personal farming;

- For the construction of a dwelling (10-25 acres depending on the locality - city, urban-type settlement or village);

- For gardening - up to 12 acres.

What does the law say?

The latest edition of the Federal Code establishes that when purchasing housing, the owner also becomes the owner of part of the common land plot. However, the very fact of owning a land plot does not mean that this or that person has become the owner of the land.

The property must be registered in the prescribed manner and assigned to the given person. That is, the land plot needs to be privatized.

Land can be in common ownership of a residential building only if it is managed collectively, for example, through a HOA. But even in this case, each homeowner is allocated his share in the land plot. The sale of land shares under an apartment building is prohibited.

It may be recalled that in Tsarist Russia all educational and scientific institutions were exempt from land tax, and scientific societies (or parts thereof) that did not generate income were exempt from real estate tax.

Books, manuals, etc., issued from abroad for scientific institutions, were exempt from paying customs duties. Scientific institutions and organizations could be exempt from paying duties on machinery, equipment, and materials imported from abroad. [p.146] The theory of sacrifice is one of the first theories that contains the idea of the coercive nature of the tax. We find the very idea of tax as a sacrifice among the physiocrats when justifying the unified land tax. If the state owes all its people's wealth, all its property to the land, to natural forces, then all the sacrifices that the state can demand from the people must be received from the same source 1. [p.84] The ideas of proportional taxation in financial science originated in the era of mercantilism, although it should be noted that even at that time there was no consensus among scientists on this issue. D. Locke in 1690 put forward a project for a single land tax, believing that in England, then an agricultural country, all taxes were ultimately transferred to land owners. He believed that in this way fair taxation could be achieved. [p.118]

The physiocrats, putting forward demands for a single land tax as a practical program, unanimously advocated proportional taxation. The belief in the fairness of taxes proportional to income has been firmly established in science since the time of A. Smith. Subjects of each state [p.118]

Direct real taxes are taxes that fall on a business enterprise or on a business object. Real taxes are taxes on the payer’s property (trade tax, land tax, building tax, etc.). They are associated not with a person, but with an object, which is why real taxes are called objective. [p.129]

While defending the dogma of a single land tax in theory, in practice the physiocrats allowed significant deviations from their doctrine. [p.145]

Having determined the basic position that any tax, no matter from whom it is levied, will ultimately fall on the landowner, D. Locke established that a tax directly levied on the landowner should be preferred to taxes falling on the land indirectly. Thus, it turned out that the land tax is a direct tax, while other taxes are indirect. The Physiocrats confirmed and deepened this division, based on the fact that the landowner's income alone is truly pure income, from which all taxes are paid. [p.178]

Land tax is a tax that falls on the owner of land and is intended to tax income from land. The object of this tax is land. The subject of this tax is the owner of the land. The source of this tax is land income, i.e. land rent. This is how the land tax was structured in all Western European countries; for example, in England, a tax was levied in the amount of 4 shillings for every pound sterling of rent received in favor of the owner. [p.199]

Until industry received colossal development, in the tax systems of European countries and Russia, land taxes were the predominant form of real [p.199]

Land tax is one of the taxes that has existed since ancient times. By the second half of the 19th century. The importance of land tax in state revenues has relatively decreased as a result of the introduction of new types of tax, but has not lost its importance for the budget. The advantages of the land tax came from the qualities that land has and from its importance in economic and political life. It is rightly said that land is property par excellence - the possession of certain political rights is associated with it. As you know, land tends to rise in price. From a fiscal point of view, land indicates the solvency of its owner. Income from landed property is much easier to estimate than any other type of income. [p.200]

Cadastres were also used in ancient times. But only a combination of recommendations from financial science and practical experience made it possible to develop a cadastre that would allow the land tax to be objectively established. [p.201]

From the general concept of the cadastre, let's move on to the profitability and structure of land tax using the example of Russia. [p.201]

In 1875, a new state land tax appeared in the Russian budget, formed as a result of the reform of the State Zemstvo Tax that had existed since 1853. All lands subject to local taxes on the basis of the Charter on Zemstvo Duties, except for state-owned lands, were subject to state land tax. The total amount of tax from each province and region was determined (with the approval of the Minister of Finance) by multiplying the total number of tithes of land subject to taxation by the average salary for the province or region for the tax on a tithe of convenient land and forest, approved by law. The amount of these salaries according to the law of 1884 ranged from /4 kopecks. up to 17 kopecks from tithes. According to the Manifesto of 1896, land tax rates were reduced by 50% for a period of 10 years. At the same time, the importance of state land taxation in Russia was small. In 1901, income from it amounted to 9.87 million rubles. [p.201]

Of great importance was the land tax levied on state peasants from 1724 under the name quitrent tax. When introducing the poll tax, an injustice was committed: the landowner peasants, in addition to the tax, also paid a quitrent to their landowners, and the state peasants paid only the poll tax. To eliminate this inequality, a quitrent tax was introduced from state peasants, the salary of which gradually increased. In 1858, salaries were 2 rubles. 86 kopecks in the provinces of the 1st class, 2 rubles. 15 kopecks - in 4th class provinces. [p.202]

The third real tax is fishing tax. Its object was fishing, with the exception of agriculture. This is a tax on any economic activity in the form of fishing, which was intended to generate income. These included trades in the field of industrial processing of raw materials, trades in the field of trade and transport, and various types of liberal professions (doctors, lawyers, writers, etc.). Agricultural fishing was not subject to fishing tax, primarily because it was subject to land tax. [p.204]

In Russia, the state land tax was introduced in 1875 in the form of an apportionment tax. The amount of land tax was established for each province and distributed by the zemstvo government among individual land owners. Land taxes are a group of direct real taxes, the object of taxation of which are plots of land or income from the ownership or use of land. [p.89]

The reduction and subsequent abolition of redemption payments were largely compensated by an increase in existing taxes and the introduction of new types of taxes. Excise taxes on alcohol were increased (first to 8 kopecks according to the Law of May 19, 1881, then to 9 kopecks per degree, according to the Law of May 18, 1885), on sugar (May 12, 1881), on tobacco (18 May 1882) increased stamp duty (January 19, 1882), increased customs duty rates on a number of imported goods (while transit through Transcaucasia was closed), increased tax rates on real estate in cities (May 13, 1883) , land tax was increased 1.5 times, taxes on foreign passports were increased. A tax on gold mining was introduced, additional and distribution fees were established from commercial and industrial enterprises (laws of July 5, 1884 and January 5, 1885), a tax on money capital and a tax on the transfer of property by gratuitous means (donation and inheritance tax) were introduced. . [p.97]

Other direct taxes either remained the same or were reduced. In particular, the state land tax, levied on all lands subject to local taxes on the basis of the Charter on Zemstvo Duties of 1851, was reduced, except for state-owned lands. The total amount of tax from each province and region was determined by multiplying the total number of tithes of land subject to taxation by the average salary for the province or region for the tax on a tithe of convenient land and forest, approved by law. The amount of these salaries ranged from /4 to 17 kopecks. from tithes. The provincial zemstvo assembly distributed the amount of land tax due to the province between counties, according to the value or profitability of the lands of each of them, and the county zemstvo councils distributed it among individual owners on the same basis as other zemstvo fees. [p.125]

The new methodology, in principle, corresponded to the system of collecting land tax and tax on urban real estate, as well as most zemstvo and city fees. [p.150]

Land collection (land tax) - 181 [p.424]

However, the previous forms were quickly filled with new content. Thus, by significantly increasing excise taxes on non-essential goods and luxury goods, the system of indirect taxation was restructured, differentiation and progression of taxation of income and property with direct taxes remaining in force increased. Some taxes were abolished due to the loss of objects of taxation (for example, land tax, tax on monetary capital). At the same time, new forms of taxation appeared. [p.210]

Taxation unit is a unit of measurement of an object (for example, a hectare of land for land tax). [p.119]

Sometimes the special royalty rate is set as a constant percentage tax on each barrel or ton of raw materials produced. This is quite rare, although royalties are sometimes called land taxes or export tariffs, as in the former Soviet Union. Another type of special royalty - a military tax of one dollar (900 pesos) per barrel - can be found in Colombia. These taxes are more regressive than regular royalties. [p.201]

The main source of income in the Roman provinces was the land tax. On average, its rate was one tenth of the income from the land, although special forms of taxation were also applied, for example, a tax on the number of fruit trees, including vines. [p.7]

Many economic traditions and foundations of Ancient Rome passed on to Byzantium. In the early Byzantine era until the 7th century. inclusively, there were 21 types of direct taxes in the empire. Among them are a land tax, a poll tax, taxes on equipping the army, a tax on the purchase of horses, a tax on recruits, by paying which one could be exempt from military service, a duty on the sale of goods (usually its rate was 10-12.5%), a duty on issuance of state acts, etc. If during the construction of a building it exceeded the dimensions established in advance, then a fine was levied, called the air tax. Special taxes were paid by senators, as well as officials and military personnel who received promotions. [p.8]

If we talk about Russia as a whole, its financial situation before the outbreak of the First World War was quite stable. According to the budget list for 1914, revenues were determined in the amount of 3522 million rubles, expenses - 3303 million rubles. In national income, one of the largest items was income from the state-owned wine monopoly - 935.8 million rubles. State property and capital brought in 805 million rubles, among which the largest income was provided by the railway and forest income. Taxes were planned for three divisions: direct taxes - 264.5 million rubles, indirect taxes - about 710 million rubles. and the duty is more than 230 million rubles. Among the direct national taxes, the fishing tax stood out - 145.8 million rubles, with an increase by 1913 by 12.2 million rubles, or 9.1%, which indicates the development of industry in Russia. Land tax, property tax and taxes together were supposed to bring the treasury 83 million rubles. [p.27]

The main types of taxes in Germany are personal income tax, corporate tax, value added tax, trade tax, property tax, land tax, land purchase tax, insurance premiums, inheritance and gift tax, car tax , fire service tax, excise taxes on coffee, sugar, mineral oils, [p.284]

Land tax is levied on agricultural and forestry enterprises and land plots. The regular rate is 1.2%. State-owned enterprises and religious institutions are exempt from land tax. This is also a local tax. When a plot of land is transferred from one owner to another, a tax of 2% of the purchase price is paid. [p.285]

French scientists are becoming the most influential exponents of a new stage in the development of financial theory and practice. The ideas of the school of physiocrats (F. Quesnay, A. Turgot, O. Mirabeau) became dominant in the second half of the 18th century. The financial system of the physiocrats had a significant influence on theory and practice. Their merit in the field of financial science is determined by the very choice and formulation of problems about the fairness of taxation, about shifting, about sources of income, about the extent of everyone’s participation in state expenditures and other problems in the theory of taxes. The physiocratic system proceeds from the fact that only land provides net income, and manufacture and trade do not create any new values, therefore the only acceptable way to generate state revenue is a land tax. [p.11]

D. Ricardo created the theory of land (differential) rent, from which he logically derived the conditions for the transfer of land taxes. His premise: if this tax were levied on pure rent, it would be irreversible, but since it is levied on all lands, including the worst, it leads to an increase in price and, therefore, is passed on to the consumer. Like A. Smith, D. Ricardo recognized the transferability of taxes on wages and indirect taxes on basic necessities. Based on the theory of differential ground rent, wages and profits, he believed that taxes ultimately fall on the entrepreneur, because a worker receiving the minimum wage will inevitably shift consumption taxes to the entrepreneur. As for land taxation, the latter, according to Ricardo, is irreducible only in the case when it is levied on pure rent; in all other cases, the land tax can be shifted to consumers. D.S. Mill agreed with A. Smith and D. Ricardo on the issue of tax shifting. [p.151]

Taking into account the conditions of shifting, we will offer an analysis of each tax from the point of view of its shiftability, the degree of which is determined by the internal structure of the tax. Let us illustrate the conditions for shifting the land tax according to E. Seligman. The specified tax is paid by law by the land owner, but who will actually pay it depends on the structure of the tax, on the methods of its collection. Let's take a Western European country where there is private ownership of land. The owner of the land will be able to shift the land tax to the consumers of bread by increasing its price only if this tax is imposed on everyone without exception. lands, including the worst ones. The law of land rent will apply here, which is formed, as is known, on plots of better quality or closer to the market. On the worst plots of land, no rent is generated. The price of bread is determined by the expenditure of labor and capital in the worst areas, which require the greatest expenditure of labor and capital. If these worst plots are also taxed, then their owners will be able to include the tax in the costs of production and raise the price of grain from their plots, and the price of grain from all other plots will correspondingly rise. With this structure of the tax, it will be transferred to grain consumers. If the tax is structured in the same way as the tax on rent, i.e. will be charged only to participants [p.167]

The school of physiocrats, having put forward the theory of a single tax in the form of a land tax, theoretically deprived of any justification for the collection of indirect taxes. O. Mirabeau insisted on the abolition of all indirect taxes, with the exception of the single land tax, which, according to O. Mirabeau, was the only direct tax. F. Quesnay theoretically allowed the use of indirect taxes only in trading states, where agriculture does not play any role, although in practice F. Quesnay's students made great restrictions and concessions. [p.183]

Concluding our consideration of the theoretical foundations of the tax system, let us move on to characterize the specific forms of taxation that were in effect in the 20s. XX century This is also important for understanding the evolution of the modern tax system. Let's start with real (direct) forms of taxation, since they were historically the first2. These include land tax, house tax, trade tax and tax on money capital. [p.199]

Land, as an object of taxation, cannot be lost. Therefore, financial science believed that land is the best object of taxation. As a general rule for all taxes, the land tax should fall on the net income from the land. The methods for determining income from land were varied at different times and in different countries. The oldest method consisted of measuring land and taxing it according to its quantity according to the Yugers - in Rome, according to the Haids - in England, according to the Gufs - in Germany, according to the Plows - in Russia. But already at a fairly early stage of civilization, due to the injustice of taxing land according to its quantity, this method changes the land and divides it according to its fertility. Thus, in Ancient Rus' there was a distinction between the plow of good and the plow of bad land. Another ancient method, even more widespread and long lasting, was tithing, i.e. levying a tax in the amount of /, gross income from land. [p.200]

In Russia, land tax was an old form of taxation; chroniclers have references to it. During the period of Tatar rule, the land tax was formed and received general development, which also included a land tax. The latter was determined by the quality and quantity of land. The land was divided into tithes, chetas and vyti. The size of the vyty, a purely fiscal unit, was not constant. With the transition at the end of the 17th century. From the land tax system to the household tax, the poll tax loses its significance and during the reign of Peter I it was replaced by the poll tax. Since then, Russia has not known a land tax. [p.201]

On the basis of the All-Merciful Manifesto of May 14, 1896, the average provincial tax salaries were reduced by half for 10 years, and in those provinces where the half salary exceeded 5 kopecks. per tithe - to this last limit. A corresponding benefit was also provided to land tax payers in the Kingdom [p.125]

With the adoption of the Regulations, trade tax benefits were introduced into the system and expanded. 1) enterprises that do not pursue commercial purposes (for example, a state-owned wine monopoly, the exploitation of state-owned forests, but not state-owned mining plants that also accept private orders, and therefore must be placed in the same conditions as similar private enterprises) 2 ) enterprises of general benefit, serving for public health, education, mutual insurance (theatres, circuses, museums, etc. shows and entertainment, canteens, tea houses and buffets, organized by trustees, committees and societies of national temperance, as well as contents (without rentals) at military units, at government, public and class institutions and educational institutions, officer economic societies with insignificant turnover) 3) all kinds of auxiliary, pension, funeral, etc. cash offices of employees in institutions and commercial and industrial enterprises, on railways 4) public pawnshops, savings and loan partnerships and savings banks at the beginning of mutual assistance, rural credit institutions, consumer societies 5) all kinds of labor partnerships or artels - with a fixed capital not exceeding 10 thousand . rub. for each enterprise, and the number of employees is not more than 4 in each labor partnership or artel. In addition, agriculture (which bore the burden of land tax), primary processing of products of own or leased agriculture and own forestry, agricultural and technical establishments located outside urban settlements, within exclusively own or leased estates and lands and serving for processing were exempted from fishing taxation own products and part of local agriculture or own forestry (brick, tile, pottery, starch, tar and dry distillation of wood factories, creameries and cheese factories, with the number of hired workers not exceeding 20, even if using mechanical engines) small mining , produced within own or leased lands (development of peat deposits and peat molding, breaking and primary processing of all kinds of stone, slate, chalk, etc., mining of clay and bog ore1) fine [p.143]

Philippine Member Incentive Discount (FPIA). 10% royalty + 0.5% land search tax (based on gross income). [p.187]

The entire set of legally established taxes, fees, duties and other payments is divided (classified) into groups according to certain criteria, characteristics, and special properties. The first classification of taxes was built on the basis of the criterion of tax transferability, which initially back in the 17th century. was tied to the income of the landowner (land tax is a direct tax, the rest are indirect). Subsequently, A. Smith, based on the factors of production (land, labor, capital), supplemented the landowner’s income with income from capital and labor and, accordingly, two direct taxes - on the entrepreneurial profit of the capital owner and on the wages of the hired worker. Indirect taxes, he believed [p.38]