House tax

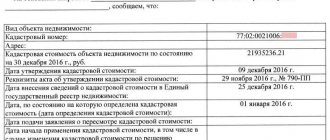

In the window that appears, you will have to indicate: the cadastral number of the property (not necessary, but desirable), conditional number, area and type of property that will be taxed.

You will also have to register the cadastral value of housing. And after that you can click on “Continue”. A few minutes of waiting - the amount due for payment will appear on the screen. The thing is that the tax on a private house or any other property is levied on all taxpayers. That is, if a citizen is 18 years old, he is fully capable, he owns either a house, or part of it, or at least a room, then he will have to pay money. More on calculations later.

Taxation of real estate as a “single real estate complex” pros and cons

Both of the above legal structures assume that they may include both immovable and movable things, which are generally recognized as immovable property by virtue of a direct indication of the law. However, these designs also have significant differences, which, in particular, include the following:

From an accounting point of view, including issues of writing off the cost of fixed assets, it is also difficult to predict whether an economic entity will in any case be obliged to account for the unified asset as one inventory item or will have the right to account for objects within the unified asset separately if the useful lives of such objects differ significantly. Also, at this stage, it is difficult to assess whether, and to what extent, the rules used for accounting purposes in relation to property complexes and complex things will be applied to ENK.

Taxation of real estate

Enterprise property tax. Currently, the property tax of an enterprise, including real estate, is charged at a rate set by the legislative authorities of the constituent entities of the Russian Federation depending on the type of activity of the enterprise in an amount not exceeding two percent of the tax base.

Legislation may provide for categories of citizens who are exempt from paying this tax. So, at present, these include, in particular, disabled people of groups I and II, disabled people from childhood, participants of the Second World War, citizens who received or suffered radiation sickness and other diseases associated with radiation exposure as a result of the Chernobyl disaster, citizens who became disabled as a result of the Chernobyl disaster etc.

We recommend reading: Unilateral termination of a purchase and sale agreement

How to correctly pay property tax based on cadastral value

- Residential premises (house, apartment, room)

- Unified real estate complexes, which include at least one residential premises

- Commercial buildings or structures whose area does not exceed 50 square meters. m, located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction

Taxed depending on value:

Important: if during one tax period (equal to a year) a person sequentially owned several properties, for example, first sold an apartment and then purchased a room, the benefit will apply to each of them.

Taxation of real estate

The legislative basis for assessment for tax purposes is another defining characteristic of the tax on real estate residential property. Taxation can be carried out on the basis of two fundamental approaches: on a value basis and on a non-value basis.

In Japan, individuals and businesses pay property taxes at the same rate. This is typically 1.4% of the property's value. They are reviewed every three years. The tax base includes all real estate, including residential premises and land; securities, bank deposits Shuvalova E. B., Klimovitsky V. V., Puzin A. M. Tax systems of foreign countries / M.: Dashkov and Co., 2009. - P. 104.

Property tax at cadastral value in 2020 in Moscow

- determine the amount of tax received from the cadastre;

- calculate the inventory payment;

- subtract the inventory payment from the cadastre to obtain the exact difference between them;

- multiply the resulting difference by the reduction factor;

- add inventory tax to the result obtained.

Any officially registered property of individuals and legal entities is subject to property tax at the cadastral value. In the new year 2020 in Moscow, the list of objects of legal entities subject to taxation includes:

Taxation of real estate of foreign legal entities

If a foreign (international) organization has property on the territory of the Russian Federation related to its branch in the Russian Federation, but located on the territory controlled by another tax authority, it is obliged to inform both tax authorities by sending a message provided for in clause 2.4.5 of the Regulations.

In accordance with the Law of the Russian Federation “On Enterprise Property Tax,” the value of the property of a foreign legal entity located on the territory of the Russian Federation, calculated for tax purposes, may be reduced by the book (standard) value:

Property tax based on cadastral value

The property tax of organizations for individual objects is now paid from the cadastral value. Let's consider how to calculate and pay such a tax, which organizations fall under it. We will also listen to the lecturer’s comments on how to reduce the cadastral value of property, because it is often greatly inflated, and sometimes even has nothing to do with the real value.

- erection of a building on land specially designated for this purpose for its intended purpose - administrative or commercial use;

- the purpose of its construction is to use it to service business activities.

Taxation of real estate - categories of taxes that an investor should know about

- property on the balance sheet of an enterprise is something that belongs to a specific legal entity;

- taxes on all kinds of property (in this article we mean real estate) of individuals;

- land taxes (if the subject has property rights to a specific land plot, even if there are no buildings on it).

Responsibility for offenses in the tax sphere may fall under criminal law in cases of evasion of payment by failure to submit mandatory documents or submission of knowingly false documents. The amount of non-payment must be large or especially large.

Taxation of real estate

3. The amount of real estate tax is determined only for completed construction projects that are actually in use, even if they are not registered with the appropriate state authorities and the relevant technical or other documentation has not been drawn up for them.

Tax rates may vary depending on the location (city, district, town, microdistrict, isolated territory, street, etc.), functional use of the tax base and other factors (in particular, the type of building materials used to create real estate, degree of depreciation (year of commissioning of real estate)), affecting the value of the tax base.

We recommend reading: Harm to health from alcohol

Taxation of real estate

Tax on property transferred to individuals by inheritance

, will not be charged. Since 01/01/2006, income received by citizens of the same family or close relatives when inheriting real estate, vehicles, stocks, shares, shares is not subject to personal income tax. For everyone else, there is a “hard” personal income tax rate of 13%, which does not depend on the value of the inheritance.

The Department of Applied Economics and Marketing was founded on May 25, 1995 in connection with the start of training bachelors in the direction 521600 “Economics” at St. Petersburg State University of Information Technologies and Communications. In 1997, the department began to train first bachelors and then specialists in specialty 071900 “Information systems in economics.” Since its foundation, the department has been headed by an honorary worker of higher professional education, Doctor of Economics, professor, full member of the Russian Academy of Natural Sciences Oleg Valentinovich Vasyukhin.

Tax on real estate and transactions with it

Until 2006, the legislation of the Russian Federation established a special tax on property transferred by inheritance or gift, which was abolished by federal law dated July 1, 2005 No. 78-FZ. After the adoption of this law, taxation of gift and inheritance agreements is carried out in accordance with the provisions of the Tax Code of the Russian Federation. According to the above-mentioned normative act, property received as a gift was classified as the income of individuals. Inherited property is completely exempt from taxation.

The tax rate on the property of an organization is established by the law of the constituent entity of the Russian Federation and cannot exceed 2.2%. However, the law allows differentiated (different) tax rates for property tax depending on the category of taxpayer or property that is recognized as an object of taxation. The provisions of the Tax Code of the Russian Federation establish two types of tax benefits for the property of organizations: these are benefits that are approved at the federal level (Article 381 of the Tax Code of the Russian Federation) as a complete exemption from paying tax, as well as deductions that are established by the constituent entities of the Russian Federation.

The new property tax in Primorye will hit individuals and the housing market - experts

From 2020, the property tax for individuals in Primorye will be determined only on the basis of its cadastral value. This is expected to have a major impact on the real estate market. What should owners prepare for, why the tax on a small Khrushchev apartment could increase 10 times, and what additional costs will appear during transactions for the purchase and sale of apartments, experts told PrimaMedia.

The new order will be the same for everyone

As of January 1, 2020, Chapter 32 of the Tax Code of the Russian Federation came into force, which provides for the procedure for calculating property tax not from the inventory, but from the cadastral value of real estate. In many regions, property owners have already become accustomed to the new order. In the Primorsky Territory, local legislators gave a reprieve to the population, deciding to delay changes in taxation for individuals. The calculation system has changed only in relation to business. From 2020, the new order will be the same for everyone.

As Galina Tkachenko , explained, property tax is a local tax - that is, it is paid to the municipal budget in accordance with the interest rate established at the local level, for example, by the Vladivostok Duma. Taxpayers are individuals who own (including shared ownership) a residential house, apartment, room, garage, parking space, unfinished construction site, other buildings, structures, structures and premises.

For now, the tax is calculated based on the inventory value of the property. The cadastral value is established in the process of state cadastral valuation and is close to the market value; the inventory value takes into account the year of construction, the degree of deterioration of the building, utilities and may differ from the cadastral value by several times. Roughly speaking, experts explain, if the owner paid two thousand rubles in tax per year for an apartment in the city center before the legislative changes came into force, now this amount can increase to 20 thousand.

— It turns out that the inventory value of apartments in the old housing stock in the city center is very low, given the deterioration of buildings, and the cadastral value is high, because it is close to the market value and is primarily based on the location. For owners of such apartments, the tax could increase five times,” said Galina Tkachenko.

"Golden" squares

Real estate agencies expect that the change in the tax system will affect the housing market in Primorye. According to experts, owners will be forced to take tax into account when dealing with real estate, consumers will have fewer opportunities to improve their living conditions, the demand for small apartments will most likely increase, and cash-strapped owners of expensive housing that does not generate income will get rid of "golden" squares.

— The cadastral value can be 40-60% of the market value, depending on the location of the property, year of construction and other factors. With the change in taxation, buyers will look not only at the cost of the transaction, but also the maintenance of the home. There is likely to be an even greater divide between those who can afford an apartment in the city center and those for whom it is too expensive. In addition, the problem of improving living conditions will become acute. Sergei Kosikov , head of City Realtor Center LLC .

— That is, the owner of a modest dacha near the city will have to pay a hefty tax annually, since it will be calculated based on its cadastral value, taking into account its favorable location. Where it leads? My opinion is that the number of sales of fairly expensive apartments and large land plots will increase. Owners will sell real estate that has become burdensome, which, for example, was inherited and does not generate significant income. In this regard, we should expect that on the secondary market prices for 3-4-room apartments in old houses will decrease, and for two-room Khrushchev-era apartments, on the contrary, will increase, because demand will increase. Ivan Solovyov, a representative of the Metra real estate agency .

If the cadastral value is higher than the market value

Also, according to Galina Tkachenko, already now owners who purchased real estate starting from January 1, 2020, and sell it, having been the owner for less than 5 years, have to take into account the cadastral value of the property when taxing income from the sale.

If the income from the sale of such real estate is less than 70% of its cadastral value, exactly 70% of the cadastral value is recognized as income for the purpose of determining the tax base for personal income tax.

— Let’s say I sell such an apartment for 4 million rubles, according to the documents its cadastral value is 6 million, 70% of 6 million is 4.2 million, that is, for calculating personal income tax it will be considered that you received an income of 4.2 million, and not 4. Next, there is a property deduction, that is, your expenses for purchasing an apartment are 4 million. 200 thousand remains. This amount will be subject to personal income tax. Standard 13% personal income tax from 200 thousand rubles – 26 thousand rubles. You pay a tax of 26 thousand rubles on a transaction worth 4.2 million rubles, although you actually sold the apartment for 4 million rubles. According to the old scheme, there would be no talk of any 70%. They bought it for 4 million and sold it for 4 million; accordingly, there was no tax base,” explained Galina Tkachenko.

At the same time, she noted that owners should not panic; the cadastral value of objects in most cases is less than the market value. From her own experience, Galina Tkachenko has never encountered declarations where the price of real estate at sale was less than 70% of the cadastral value.

— In addition, the percentage rate of property tax for individuals is determined at the local level, so there is still an opportunity to work with the Vladivostok City Duma.

For citizens who do not agree with the cadastral valuation of their real estate, there are 2 ways to challenge it - submit an application to the commission at the Office of Rosreestr for the Primorsky Territory. If she still does not make a decision in your favor, the next authority is the judicial authorities. When going to court, you will have to seek services specifically to assess the market value of real estate, since evidence is required that it is much lower than the cadastral value,” said the agency’s interlocutor.

Today the commission receives a large number of requests from residents of Primorye. Many experts attribute this to the fact that the calculations were carried out by an invited company from Siberia, which won the tender. Since 2020, the cadastral value of land plots has increased 30–50 times for many owners in Vladivostok.

“We have contacted the commission and are trying to achieve a revaluation of the plots,” Anatoly Belyakov, .

Owning real estate is expensive

Galina Tkachenko advises all taxpayers, “without delay,” to find out the cadastral number and value of their property in order to avoid possible problems.

— Vladivostok has not yet approved interest rates for apartment owners, but I advise all property owners to try to get as much information as possible - how much the cadastral value of the property is greater than the inventory value, how different it is from the market value. Errors are possible. In my own practice, I came across a case where, due to an incorrectly placed comma, an entrepreneur had to seek a 10-fold reduction in the cadastral value.

— Owning real estate in Russia is very inexpensive; almost no developed country has this; owners bear increased costs. Due to this, the rental sector is actively developing. In our country, on the one hand, property ownership is becoming more expensive, on the other, no one is offering any alternatives,” states Sergei Kosikov.

According to the administration of the Primorsky Territory, in order to prevent social tension for the first three tax periods from the beginning of the application of the new procedure, temporary reducing coefficients are provided. Experts believe that this will allow for a uniform increase in the tax burden.

During the first year, taxpayers will pay the same amount as they paid when collecting NIFL from the inventory value plus 20% of the difference between the amounts of the new and old taxes; during the second year, 40% of the difference will be added, and the third - 60%. Only starting from the fourth year will the tax be paid in full without taking into account the reduction factor. At the same time, for 15 categories of citizens who are currently exempt from paying property tax on individuals, and these are primarily pensioners and disabled people, benefits have been preserved and even expanded.

Taxation of real estate of individuals

Immovable things (real estate, real estate) include land plots, subsoil plots and everything that is firmly connected to the land, that is, objects the movement of which is impossible without disproportionate damage to their purpose, including buildings, structures, unfinished construction objects (Art. 130 GK).

If property recognized as an object of taxation is in the common shared ownership of several individuals, each of these individuals is recognized as a taxpayer in relation to this property in proportion to its share in this property. Taxpayers are determined in a similar manner if such property is in the common shared ownership of individuals and enterprises (organizations).

Taxes and Law

You can already find out the preliminary tax amount on the Federal Tax Service website - just indicate the cadastral number of the property. “According to my calculations using the Federal Tax Service website, this year the tax amount, taking into account the preferential 20 square meters. m and a coefficient of 0.2 increased 3 times compared to last year,” says Tatyana Zatsepina, the owner of a three-room Khrushchev house on the outskirts of Moscow: the cadastral value of her apartment turned out to be 23 times higher than the inventory value. And the tax on a 100-meter apartment near the Timiryazevskaya metro station for one of the Vedomosti employees, calculated by a calculator on the Federal Tax Service website, was 1000 rubles. less than last year.

“If an apartment or house is in common shared ownership of several citizens, its cadastral value is reduced by the cost of 20 square meters. m, and, based on the balance, each owner pays tax in proportion to his share,” explains Leonenkova.

We recommend reading: When studying part-time, do I have benefits for the loss of a breadwinner?