Each tax resident is obliged to pay certain taxes to the Russian state for the right to use certain objects: property tax, land tax, motor vehicles, etc. Many questions are related to land tax: how to check the land tax debt, how it is determined and what it depends on.

The tax office can send a citizen of the Russian Federation a receipt with the calculated amount, which must be paid on time. However, this may not happen and the taxpayer will have to independently calculate the amount of tax in accordance with the law. Let's consider how you can determine the amount required for payment and how you can find out if there is a tax debt.

How is land tax determined?

Before answering the question: how to find out the land tax debt, let’s understand the basic concepts. Land tax is a mandatory fee in favor of the state, which is calculated on each plot of land and is payable on the right of ownership, perpetual use, and inherited property.

At the same time, the territory transferred for use under an agreement free of charge or for rent is not subject to tax. In addition, tax collection is not calculated for the following lands:

- on which forests and groves are located;

- located under bodies of water that are the property of the Russian Federation;

- on the territory of which there are monuments of cultural heritage;

- limited in circulation or not included in it;

- which have apartment buildings.

The algorithm for determining the principal amount is determined by the period of acquisition or loss of the right to use land and the available benefits. The standard formula boils down to multiplying the established rate by the tax base, taking into account the share and tenure.

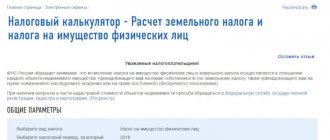

The formula for calculating land tax: CH * NB * D * KV, where CH is the tax rate adopted for a particular municipality, NB is the tax base (description of taxable plots based on the cadastral value, which is often equal to the market price), D is the amount of the share in the right to own the territory, KV - ownership coefficient (subject to ownership of the land for less than 12 months).

Based on the Tax Code of the Russian Federation, we can talk about two tax rates: 0.3 (for agricultural lands, horticultural and livestock farming, maintaining the security of the country, construction of residential facilities and infrastructure) and 1.5 (for all other lands). At the same time, regional authorities are empowered to set their own rates not exceeding these figures.

It is important to know the cadastral price of the plot on the first day of the new reporting year; it can be viewed on the official website of Rosreestr in the “Reference information on real estate” section. However, it is possible to adjust the value as a result of a technical failure or according to a court decision to recalculate the cadastral value.

It is worth noting that the taxpayer, at his discretion, can reduce the tax base for one land property . You just need to submit an application to the tax service, which will indicate the area for tax deduction. If this is not done, the reduction in the amount will affect the territory with the largest tax amount. At the same time, additional tax deductions are provided for Sevastopol, St. Petersburg and Moscow.

Also, the amount of tax depends on the benefits provided; each municipality has its own values and categories of persons . However, there are also federal benefits that are intended for disabled people from childhood, groups 1 and 2, veterans of the Second World War and other military operations, Heroes of the USSR and the Russian Federation, individuals who took part in the liquidation of accidents at nuclear facilities, who received radiation sickness, and pensioners (Article 391 Tax Code of the Russian Federation).

The final amount of land tax depends on the cadastral value of the land plot, the tax rate, the tax base, the benefits available to the citizen and the tenure period.

Pay land tax by cadastral number

What is land tax? Land tax is a tax levied on individuals who own land plots on the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession. Who pays land tax? Land tax is paid by persons who own plots of land under the right of ownership, permanent (perpetual) use or lifelong inheritable possession. If land plots are owned by individuals under the right of free, fixed-term use or were transferred to them under a lease agreement, land tax in this case does not need to be paid.

The taxpayer has the right to provide documents confirming his right to a benefit within three years from the date such a right arose. The tax authority will be able to recalculate the benefit for the last three years and return the excess amount; they must provide you with an answer within 10 working days. Then transfer funds within a month Examples of tax calculation Land tax = Kst*D*St*Kv

We recommend reading: Do bailiffs have the right to call the debtor’s relatives

Where to look at land tax debt

Land tax debt may arise as a result of non-payment of the corresponding receipt. However, the tax office may not send a notice to the debtor, and in the meantime the amount will increase due to interest for each day of delay. How to find out the tax debt for a land plot in this case?

Previously, the tax authority sent citizens a notice indicating the amount to be paid, the deadline for repaying the debt and the calculation of the tax. Now, in case of non-receipt of a receipt, a tax resident must independently inform the Federal Tax Service about the availability of land plots. In this case, the defaulter may be fined an amount equal to 20% of the debt for not informing about his objects.

Therefore, it is important to have complete information on land tax. Where can I find out the debt? Let's consider the sources of obtaining this information:

- Personal visit to the tax authority at your place of residence with a passport and TIN certificate. In this case, the employee will give a detailed overview of the debts and print out a payment document for paying land tax (this can be done without a commission at a bank branch).

- Personal application to the MFC with a passport and TIN, where you can also get all the necessary information.

- The official website of the Federal Tax Service , where in the taxpayer’s personal account you can check the debt (land tax, property tax, etc.). However, first you need to visit your local tax office to obtain an access code to your account.

- Portal "Government Services". After registration, you will be able to check your debts for all taxes for several years.

- Internet services for using electronic money: Yandex. Money", "WebMoney", "Qiwi Wallet". In a special online payment section you can view the history of all overdue payments.

- Internet banking: Sberbank, VTB, Alfa-Bank, B&N Bank, etc. In your personal account as a bank card holder, you can find out all the information you need in a special tab.

- Official website of the FSSP. This option is suitable for cases where enforcement proceedings have already been initiated.

You can calculate land tax yourself or using a virtual specialized calculator ; you can view the debt on various official resources. In some cases, entering personal information will be sufficient, but a tax identification number may also be required. Let's take a closer look at ways to obtain information on tax collection.

If you do not receive a receipt calculating the amount of land tax, you must independently check your accounts on the official government websites. structures, at the local branch of the tax authority or at the MFC, using Internet banking or electronic wallets.

How to order an extract from the Unified State Register of Real Estate

Order a credit rating report

Are you going on vacation?

Check for a travel ban

Control your debts

Order a full report on your debts

Russian laws establish various obligations for citizens and legal entities. Timely payment of taxes is just one of these obligations, the implementation of which is closely monitored and controlled by the state. There are three types of taxes for individuals. So, one of them is land tax. That is, for certain land plots, persons who own such plots are required to pay land tax to municipal budgets once a year. This payment is local, and therefore is paid to the budget of the municipal district or entity where this land is located.

How to find out your land tax debt

You can obtain the necessary information on land tax at the local tax service office or at the MFC; you must take your identification document and TIN with you. But this method is not suitable for everyone; there are simpler and faster methods for clarifying tax debts; you only need the Internet and certain documents.

How to find out the land tax debt of individuals using the TIN via the Internet? First, you need to register on one of the previously listed sites, in order to receive a login and password for your personal account, you need to contact a branch of the Federal Tax Service, a bank, or send a request to “Government Services”, depending on your choice.

Once you have been able to log in to the site, you can safely use all available services. If you have a personal taxpayer account on the Federal Tax Service website, then in the “Accrued” tab you can see information about the taxes that are yet to be paid; the payment history is available in the “Overpayment” tab. The land tax debt will be displayed in the appropriate section, and you can pay it off there.

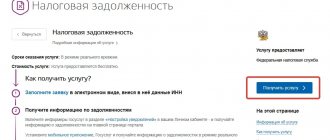

You can also find information about the amount of debt on the State Services service; you can do this as follows:

- authorization on the site using a password, SNILS number or contact information (phone number, e-mail);

- enter all the required data in the empty fields, including the TIN number;

- activate ;

- information about the amount of land tax and accrued fines will appear on the screen.

Attention! On the State Services website you can pay land tax without commission in the appropriate section, but payment processing may take 14 days.

Using the TIN number, you can find out the amount of land tax debt on the website of the Federal Tax Service, State Services, and on the electronic resources of some banks (for example, Sberbank Online or Tinkoff Bank).

If you have an electronic wallet on Yandex. Money", "Qiwi Wallet" or "WebMoney", personal account in an online bank, you can view the debt in a special section. For example, after logging in to the Sberbank-Online website, in the Payments tab, you can select the tax section and, indicating your Taxpayer Identification Number, view the amount of the overdue payment.

The listed Internet services are also convenient because after receiving information about tax debt, you can immediately pay it off with your bank card . To pay debts, it is important to use official and reliable sites, otherwise your personal data may fall into the hands of fraudsters.

How can I find out the land tax debt using the TIN without authorization? This can be easily done on the Tinkoff Bank website or in the electronic resource of the tax authority. There you can also obtain the necessary information using the UIN number (located on the receipt). However, to pay debts, registration and subsequent authorization on the site will be required.

If an enforcement process is initiated, you can find out the land tax debt of individuals by last name on the FSSP website. In the “Find out about debts” section, you just need to enter your full name and date of birth in the search bar, after which a list of all enforcement proceedings, debts and fines will be displayed on the screen.

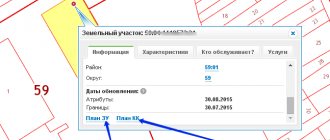

In addition, you can find out the debt on land taxes by the cadastral number of the plot. All registered real estate items have this number, so obtaining information on a particular area will not be difficult.

If you do not know the number of your plot, it can be found on a special Rosreestr map or in the relevant documents, for example, in a cadastral passport. You can also contact the cadastral chamber or send a request to the Unified State Register, where you can get complete information about the site.

Then on the Rosreestr website you need to go to the “Land and Property Tax Calculator” section, select the desired type of tax levy and indicate the reporting period. The next thing to do is fill out the form, writing the cadastral number, and information about the cost and size of the plot will appear on the screen. After providing information about your share, the period of ownership of the object, the tax rate, benefits and deductions, the amount of tax to be paid will appear.

Thus, you can find out about the land tax debt directly at the tax office or at the MFC, on the official website of the Federal Tax Service, FSSP, the State Services portal, using the properties of electronic wallets and Internet banking. In this case, you may need an INN or cadastral number, passport details to establish land tax. How to find out the debt by address? One address is not enough, but on the Rosreestr website you can get information about the site using it.

We check the cadastral number of the land plot online

Also, a license plate according to the cadastre is necessary to obtain an extract about the owners or owner, their rights to real estate, about the imposition of restrictions by a judicial or executive body, which is the main indicator when making contractual transactions with an eligible individual owner of the land. An extract is issued upon first request without restrictions.

For example, the owner needs to make transactions with registered real estate; the title was registered in another place, but is issued as local real estate. You can check the number online on the card through the Rossreestr portal; thanks to this procedure, the possibility of falsifying documentation is eliminated.

We recommend reading: Is it possible to get insurance back after paying off a mortgage at Sberbank

Buying a plot in SNT

Since targeted contributions are essentially funds for the creation of infrastructure, a specific payment period and procedure can be established. That is, if membership dues are directly related to membership, area or number of lots owned, then the target fee can be “fixed” to the lot. In this case, the deadline for payment may not be set at all. For example, a partnership built an electrical network. To connect to this network, you must make a contribution of a certain amount. If the site was not previously connected and such a need arose only for the new owner, then the new owner will have to pay the connection fee.

Buying a plot in SNT. Who should pay the fees for the former owner?

When choosing a plot of land in SNT, the buyer is often faced with the problem of having arrears in payments “behind the plot”. It’s worse when a newly-minted gardener finds out about the existence of a debt on membership fees after the purchase and sale transaction has been completed. Let's figure out who should pay for what, and how the courts look at it.

residential premises (parts thereof), if for the debtor citizen and members of his family living together in the premises owned, it is the only premises suitable for permanent residence, with the exception of the property specified in this paragraph, if it is the subject of a mortgage and on it in accordance foreclosure may be subject to mortgage laws;

We recommend reading: Shock Absorption Group for Tennis Table