Often, the owner of real estate possesses it without the right to dispose of it.

This is possible in case of incomplete or untimely execution of documents upon receipt of the property.

This situation most often occurs when receiving property by inheritance by law and lack of proper documentation.

To eliminate the problem, it is necessary to file a statement of claim to establish the fact of acceptance of the inheritance.

The role of the application to establish the fact of acceptance of inheritance

In accordance with the Civil Code of the Russian Federation, the heir can receive the inheritance that remained after the death of the testator, or he can refuse this opportunity. In the first case, the law gives the heir several options:

- Document the entry into property rights. To do this, you must contact a notary no later than 6 months from the date of death of the testator and write an application. If documents are submitted in a timely manner, the applicant will receive a certificate of right to inheritance.

- In fact, come into your own. This option requires no documentation. It is acceptable only for inheritance by law and for those who do not plan to sell or donate inherited housing.

The first option is the most preferable, since only after its implementation can you freely dispose of the acquired property.

As a result, an application for acceptance of an object passing through the order of inheritance can have two varieties:

- submitted to the notary within the period allotted by law for entering into inheritance rights;

- filed as a claim in court when this deadline is missed to establish the circumstances of the entry into rights - in fact.

The form and methods of presenting these options differ. In addition, they are provided in different places and under different circumstances.

Deadline for accepting inheritance

To exercise their inheritance rights, heirs must contact a notary within 6 months from the date of death of the testator. The notary, in turn, must open an inheritance case, establish the estate and determine the circle of heirs who have the right to claim the property left by the testator.

Missing the six-month period entails refusal to open an inheritance case. Extension of the period for accepting an inheritance is possible only on the basis of a court decision.

However, there is another opportunity to enter into inheritance rights, and it is provided for in Art. 1153 of the Civil Code of the Russian Federation. Thus, in accordance with this article, the commission of certain significant actions in relation to inherited property is confirmation of the actual entry into inheritance rights.

Significant actions mean:

- acceptance of property and its use;

- continued residence in the house of the deceased testator;

- payment of utilities, insurance and property taxes after the death of the testator;

- return of debts of the deceased testator;

- funeral of the testator at his own expense;

- carrying out repairs and reconstruction of inherited property.

Documents confirming the actual acceptance of the inheritance, therefore, can be receipts confirming payments, changes in cadastral plans, etc.

That is, a person who is an heir by law or by will, who for any reason did not contact a notary on time and did not receive inheritance rights, may, nevertheless, retain ownership of the inherited property by applying:

- to a notary with a statement about the actual acceptance of the inheritance;

- to the court with a claim to establish the fact of acceptance of the inheritance, if the notary considers that there was no fact of acceptance of the inheritance, and without first contacting the notary.

From what was said above, several patterns can be deduced that give the right to file a claim:

- the plaintiff must be a proper heir at law or an heir under a will;

- an indefinitely long period of time may pass from the moment of death of the testator; the main thing is that the inherited property is taken into actual ownership no later than 6 months from the date of death of the testator. For example, in the case when the heir remains to live in the apartment immediately after the death of the parent, pays utility bills, taxes, etc.;

- other heirs should not claim the property or there should not be any.

The same grounds are listed in the Resolution of the Federal Tax Chamber of February 28, 2006 “On guidelines for registration of inheritance rights.”

Application to establish the fact of acceptance of inheritance through the court

If the heir did not want or was unable to complete the necessary papers in a notary office on time, but actually took over the rights within the established period, he is still the new owner of the object. However, such a person has the right only to use and own it, and only the owner can dispose of it.

That is why the need to confirm entry into inheritance rights often arises precisely when the received property is intended to be sold or exchanged.

Without a paper on property rights or a court decision establishing the fact of entry into inheritance, this will be impossible.

The parties will be able to draw up an agreement and sign it, but not register the transfer of rights.

It is necessary to go to court only if the deadline for contacting a notary has expired.

Thus, a lawsuit is filed only in a situation where there was no timely entry into rights and documentation of this event. This fact must be confirmed through the court and secured by a decision.

If the deadline set by law was missed, then a claim is filed to restore this deadline and only if there are justifying reasons and their evidence.

Arbitrage practice

Case No. 1. After the death of the father of three adult sons, housing was left in which all three were registered together with their father. None of the heirs turned to the notary; all three continued to live in the abandoned apartment.

When the need arose to sell the home, it became obvious that the certificate of ownership was invalid, and a new one could only be issued with a document from a notary.

Since the six-month period was missed, the notary did not issue an inheritance certificate. The brothers went to court. The judge examined the data of the deceased, the documents of the sons, payment receipts for utility services (for each month they paid in turn by transfer from bank cards) and made a decision in favor of the plaintiffs.

Case No. 2. Mikhail did not contact a notary after his mother’s death. He was sure that the deceased left a will for a private house and land, where she indicated him and her older sister as heirs. Mikhail lived in another city, did not communicate with his sister, and believed that what was bequeathed “wouldn’t go anywhere.”

However, it later turned out that there was no will, and the sister accepted the inheritance alone. Mikhail went to court. There he claimed that he actually owned the house and land along with his sister. For example, he allegedly agreed that the house would be rented out, and the money owed to him would be used to pay taxes and maintain the house.

Mikhail also claimed that he periodically visited the house and made minor repairs. His testimony was corroborated by several witnesses. Mikhail’s sister refuted her brother’s arguments, presented various documents and also brought witnesses (neighbors) to court. As a result, Mikhail’s claim to establish the fact of acceptance of the inheritance was denied.

Next, we will talk about the cases in which you may be refused to establish the fact of accepting an inheritance.

The video below contains a lot of useful information on the issues of recognizing the fact of accepting the inheritance of a deceased person and the nuances of such an event:

Some nuances of applying

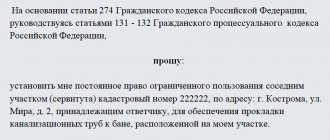

A claim to court to confirm the actual acceptance of property by inheritance is filed in a form strictly established by law.

The text of the claim should be written clearly, concisely, but as completely as possible.

The application must be supported by documentary and other evidence. That is why it is necessary to attach:

- Receipt confirming payment of the state duty. Without a receipt attached, the claim will be left without consideration or rejected.

- Documents and any other evidence determining the validity of the fact that a person has entered into an inheritance in fact.

The main task of the applicant is to prove that he accepted the due property on time and in accordance with all the rules. To do this you can attach:

- witness statements. For example, neighbors that the applicant lived in the inherited apartment, looked after it, repaired it, etc.;

- utility bills;

- receipts confirming repairs and other papers.

Such a claim may be filed at any time after the expiration of 6 months, as determined by law. There is no limitation period for the rights of an heir.

Based on the results of the consideration, the court will make one of the following decisions:

- Will satisfy the claim. In this case, instead of a certificate from a notary that was not received in a timely manner, the heir will have a court decision in his hands. It is accepted by all authorities in the event of sale, division, exchange of real estate, etc., and acts as an alternative to a certificate;

- Refuse satisfaction. Such a decision can be made if there is insufficient evidence and if there is an unfinished dispute regarding the object.

It is better to draw up and file a claim with the participation of a lawyer, since mistakes cannot be made in it. The court may not accept or leave such a claim without progress until the errors are corrected.

Required documents

Important! The following documents can be used as evidence of acceptance of inheritance:

- extracts from the passport office indicating that the heir lived with the testator at the time of his death and continues to use this residential premises;

- certificates from the chairman of a housing, garage, dacha cooperative, or local government bodies stating that the heir is actually using the property of the testator, for example, repairing a garage or plowing a dacha plot;

- receipts for payment of utility bills, taxes, various types of fees for the maintenance and use of the property. It is important that the certificate from the relevant institution contains the name of the applicant;

- agreement on rent, renovation of premises, installation of a security alarm;

- receipts for repayment of loans and debts of the testator;

- a copy of the heir's statement of claim against the persons who illegally took possession of the property, with a court mark on the acceptance of the case for proceedings;

- any other evidence of the conscientious use of the inherited property and the incurrence of costs for its maintenance.

READ ALSO: How much does it cost to register an inheritance with a notary?

The list is far from exhaustive, but includes the most commonly used evidence. The main point of the documents is to confirm the actual acceptance of the inheritance within the period allowed for opening the inheritance.

Certificates from state, municipal and any other bodies and organizations are drawn up according to the general rules of office work on letterhead with a stamp. Mandatory details are the seal, the originating number, the date of compilation and the signature of the official indicating the position and decoding.

Agreements must have the signatures of both parties and the seal of the legal entity. If the payment was made through a bank, then the payment documents must contain a bank mark indicating that the payment was accepted for execution and made.

Watch the video. Actual acceptance of inheritance:

How to prove the fact of acceptance of an inheritance

The fact of acceptance of an inheritance can be proven in several ways. Let's look at them in detail.

Written evidence

Written evidence (including documents) is used most often. They must confirm that the heir took steps to enter into inheritance within the 6-month period - by virtue of clause 1 of Art. 1154 of the Civil Code of the Russian Federation.

Such written evidence may be:

- a certificate issued by the management company or HOA stating that the heir lived in the testator’s residential premises before and after his death;

- certificates issued by state or municipal authorities, governing bodies of cooperatives (country houses, garages, gardens) on the heir’s use of the testator’s property (for example, use of a garage, cultivation of a summer cottage, harvesting fruit trees in the garden, repair of a country house or garden house);

- receipts for payment of utility and insurance payments, taxes, shares in relation to the property of the testator;

- bank statements, certificates of receipt of payments from the heir;

- checks and receipts for the purchase of materials, spare parts, components, consumables for the maintenance of the testator’s property;

- agreements on the provision of various services for the maintenance of property (repairs, installation of alarms, rental, transfer for storage, transportation of things);

- certificates from the bank confirming payment of regular loan payments or full repayment of the loan;

- receipts for repayment or receipt of debt;

- a claim against persons who illegally took possession of inherited property (with a note from the court office that the claim has been accepted for proceedings);

- application to the bailiff service;

- other documents confirming the heir’s actions aimed at accepting the inheritance.

Documents provided as evidence of inheritance must be drawn up in accordance with the general rules of office work. They must be drawn up on letterhead, have a stamp and a round seal, the date of compilation, the originating number, and the signature of an official.

Witness testimony

Witness testimony is another common type of evidence that can be used to confirm the fact of inheritance. It is strangers who often become eyewitnesses to the heir’s performance of actions related to the possession, use, and disposal of the testator’s property.

may be called upon to testify :

- Persons who visited the heir during his residence in the testator's residential premises (relatives, friends and acquaintances);

- Neighbors (in the house, entrance, floor) who communicated with the heir while he was living in a residential building or performing other activities (repairs, equipment of a security system, rental);

- Persons who participated in the removal from the residential premises of things belonging to the testator (furniture, equipment, equipment, utensils);

- Persons who participated in construction, repair, and finishing work in the testator’s residential premises;

- Persons who can confirm the use or maintenance (repair, refueling, security) by the heir of the testator's vehicle;

- Neighbors in a dacha or garden plot who can confirm that the heir used the plot;

- Owners of adjacent garages to the testator's garage, who can confirm that the heir used the garage (and not necessarily for parking a car, but also for other purposes, for example, storing things);

- Persons who were present during the transfer of funds (no more than 10 minimum wages) between the heir and the debtor or the heir and the testator's creditor.

Evidence

Material evidence includes material objects, the presence of which can confirm the actual entry into inheritance. These may include:

- Furniture;

- Interior items;

- Spare parts;

- Accessories;

- Other names.

The ownership of each material evidence must be documented.