Why is real estate appraisal carried out by Sberbank, what depends on it

The assessment is required not only by Sberbank, but also by the borrower himself. It is important for the client to obtain real figures regarding the cost of the loan property. He sees them in the final report from the appraisal organization. The document along with the application is then sent to the legal service of Sberbank. There the data is checked, including a report with the assessment results.

Why is it so important to get accurate figures regarding the cost of real estate that is purchased with a mortgage without a contribution or with it:

- The exact amount of the loan depends on the amount in the report. After all, it is for housing that a loan is issued for its purchase. This means that its market price is important, which is indicated in the report. The larger it is, the higher the size of the mortgage issued by the bank.

- Down payment amount. Yes, the terms and conditions indicate the minimum amount in %. But it is calculated based on the size of the loan. And it, as we wrote above, depends on the estimated value.

- Collateral price. The terms of the mortgage provide not only guarantors (sometimes), but also other guarantees. This applies specifically to collateral. In a mortgage loan, this would be the property itself. Its price is indicated in the loan agreement. Although it is purchased with a mortgage, it is also considered collateral. And its market value depends on the assessment. When the borrower is unable to pay the mortgage, the square meters are sold by auction or at the request of the client. The amount must be compared with the previously conducted appraisal examination.

As for the assessment itself, it is not just professional, but also corresponds to the market situation. That is, the expert compares all offers on the market, other factors, and draws up a report. He must provide adequate figures and not exaggerated or underestimated ones. This is important for all parties - both the bank and the borrower. To receive a professional report, clients order it from Sberbank (from partners), or from other licensed organizations. In the latter case, they are verified by the bank.

Cost of real estate valuation for Sberbank

| Property type | Square | Cost and completion time | |

| Apartments, rooms, shares in an apartment | up to 100 sq. m | from 800 rubles | 3 days |

| Business class apartments | from 100 sq. m. | 5,500 rubles | 3 days |

| Residential building with plot | up to 100 sq. m. | from 12,000 rubles | 4 days |

| Land plot | up to 10 acres | from 8,000 rubles | 4 days |

NOTES:

The price indicated is for an individual order. Collective assessment of apartments from 2,500 rubles - we provide discounts for group orders!

1. Completion time: 3 working days from the moment the apartment is photographed and all necessary documents for evaluation are received from the customer.

2. Everything is included in the price: the work of the appraiser, the appraiser’s visit to inspect and photograph the apartment, 2 original paper reports, sending the appraisal report electronically to the bank’s credit manager.

Report delivery:

By agreement with you, our courier delivers the report to Sberbank free of charge. To do this, please provide us with the address of the bank's mortgage branch and the name of the credit manager to whom you need to submit the report. Paid delivery by hand is possible. Delivery cost - 600 rubles. (MKAD), 800 rub. (beyond the Moscow Ring Road).

| The cost of the assessment depends on the type and class of real estate: Economy class apartments | Business class apartments | Elite class apartments | Rooms in apartments | Shares in apartments | Apartments in townhouses | Townhouses | Country houses | Dachas | Cottages | Estates | Country luxury real estate | Land plots | Garages | Parking spaces | Other real estate |

UP

Apartment appraisal for Sberbank accredited companies - list

When you apply for a mortgage, they are sent to the bank's legal department along with an appraisal report. It is carefully checked, as is the organization itself that carried it out. If the company was there, which is on the list of recommended ones by the bank itself, then everything is much simpler. They have already been verified and received confirmation.

The list of appraisal organizations cooperating with Sberbank itself is easy to find. It is presented on his website. But if you have already gathered in the department, then he will be presented there too. At a minimum, they will name a list of organizations or show a list of them with a description of each. The borrower has the opportunity to choose the company independently.

He can even suggest his own appraiser if he trusts him more - an organization or a private specialist. But then he should submit his certificate given to Sberbank. After receiving confirmation, the appraiser is authorized to work on your mortgage property.

As for the partner organizations listed on the Sberbank website, they have also been verified:

- They have confirmation status from Sberbank. The period until which it will be valid is indicated. That is, the status is assigned for some time, and not forever. Companies are audited periodically, not just once.

- Provide a qualification certificate. Information about him is listed in Sberbank.

- They have an insurance policy, and the date of its completion is also listed in the database.

Consequently, all organizations have been verified and have the right to conduct expert assessment activities.

What is a report and assessment of housing with a Sberbank mortgage

A real estate valuation report is not a one or two page document, but a full-fledged work of experts. It contains everything - from a description of the task itself, its purpose to calculations using various methods. The document is needed not only by the client, the bank, but also by its individual service. It is Sberbank lawyers who check the report itself, the mortgage application, and the package of documents.

The assessment results are also checked by Sberbank lawyers. It doesn’t matter which organization conducted it – the one included in the recommended list or another. In any case, the report is carefully reviewed to determine whether the calculations were carried out correctly and whether they correspond to the situation on the real estate market (real prices).

The report also includes copies of documents submitted by the borrower himself. They relate to the client and the property for which the mortgage will be issued. The appraisers' calculations are presented along with references to methods, laws, assumptions and limitations. That is, the report is the result of the work of experts, which describes the process itself. What points are included in the document, read below.

The importance of a competent approach to appraising an apartment when applying for a Sberbank mortgage

The value obtained as a result of appraising the apartment, as noted above, affects the maximum size of the mortgage loan issued by Sberbank. In addition, the specified price is included in the mortgage on the property, which is provided as collateral. Obviously, the higher the appraised value, the more favorable lending conditions the borrower can count on. As a result, the purchase and sale of housing will be cheaper for him, which will save a lot of money, which can be put to much better use than paying interest to the bank.

What is included in the apartment assessment report in Sberbank - points

A report is understood as a finished document with the results, which describes the process itself, the calculation methods used, and the laws and standards used. It includes the following sub-items:

- Terms of reference from Sberbank, which indicate the purposes of the assessment. For example, it is indicated that it is required to obtain the market value of the property in numbers in order to issue a mortgage to the client based on these data.

- Final estimated value.

- Qualitative and quantitative indicators, results.

- Calculation methods, approaches used. Why was a particular one chosen in the end?

- What betrothals and assumptions were used.

- Standardization - list.

- Name of the parties - appraiser, customer.

- Documents from the bank and its client relating to the mortgage, the subject of assessment, including title papers (copies).

- Application, real estate photos.

- Characteristics.

- All calculations made, and in different ways and methods.

- Analytics of the market - that part of it to which housing is related.

- Explanations from the appraiser.

- Other points.

You see that the report is a large-scale work that allows you to make a thorough analysis and assessment of mortgage real estate. It is unlikely that a realtor or other specialist would be able to carry it out. That is why specialized organizations with a certificate are involved.

What does the client get?

After calculating all the amounts, the execution of the report itself begins, the final version of which is in the form of a printed document with a volume of 70 - 80 sheets of A4 format. This document must be numbered and stitched, and its authenticity is confirmed by the signature and seal of a representative of the appraisal company.

The report should consist of the following sections:

- Information about the Borrower and the representative of the appraisal company;

- Complete analysis of the real estate market;

- Validity of assessment methods;

- Determination of market and liquid prices.

- Insurance;

- Photos of housing.

Required Documentation

A full assessment requires the following documents:

- Right to property;

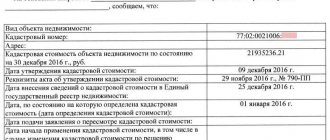

- Extracts from the Unified State Register of Real Estate;

- Photos of the apartment;

- Technical certificate;

- Client's civil passport.

- Cadastral passport.

Factors for conducting a home assessment

The main factors that guide appraisers include the following:

- Total area;

- Number of rooms;

- Type of building material of external and interior walls;

- The age of the building and its technical condition;

- Floor;

- Liquidity of the apartment.

Mortgage and property valuation under mortgage Sberbank

Sometimes you need to get a loan not for the real estate itself, but simply for an impressive amount. A consumer loan can be large, but often not that much is actually issued. Then a mortgage loan is suitable, even from Sberbank. In order for him to give out as much money as possible, guarantees should be provided to him. These include your real estate, which will be the collateral. A large loan is issued against it. It is called mortgage, less often - consumer.

But even if you have a house, apartment, or other housing, no one will just give you money for them. They need to be assessed correctly so that the bank receives an accurate final market value. It is indicated on the mortgage itself. This document is attached to the loan agreement. In it you will see that your home is temporarily listed as collateral. Its value is indicated based on the appraisal report.

In order for Sberbank to issue a loan, it needs grounds. First, it requires not only to hand over documents, but to write a statement. It is important to order an assessment for a future mortgage from Sberbank. For this purpose, organizations are offered either by the bank itself, or by third parties (an offer from an applicant for a loan). Borrowers often choose the first option.

Mortgage appraisals are carried out by specialized organizations that are supported by Sberbank itself. They will give you an appraisal report for the mortgage. More precisely, you need to select one company or private expert on the bank’s list. After their work, all that remains is to wait for the final result. When the borrower is satisfied with the price indicated in the report, he gives a final agreement. Sberbank draws up an agreement for him and issues loan money. The mortgage is terminated and becomes void once the entire debt is paid.

Assessment procedure

The procedure for assessing housing for a mortgage at Sberbank includes the following main steps:

- Selecting a company from those proposed by the bank, taking into account reputation, customer reviews and price levels (when studying available offers, you should choose the minimum price while maintaining the quality of the services provided and meeting the agreed deadlines).

- Obtaining advice from an appraiser, agreeing on terms and concluding a contract for the provision of services (at the same time the client pays the cost of the service).

- Collecting the necessary documentation package and providing it to the appraiser.

- Departure to the site by a specialist who will inspect the property in detail for assessment using a Sberbank mortgage and take photographs of the necessary locations, defects and features (a specific day should be agreed upon in advance, which will be convenient for both parties).

- Preparation of an assessment report (the preparation time depends on the complexity of the object being assessed and takes on average from 1 to 5 working days).

- Transfer of the report to the customer (the original is given directly to the borrower, and the appraisal company retains a copy in duplicate).

conclusions

A mortgage is issued after checking a whole package of documents by the bank’s legal service. It also includes a property assessment report. It indicates the price of housing purchased with a loan from Sberbank. The same applies to those who receive money thanks to a mortgage. Then you also need an assessment. It is carried out by individual organizations with a certificate. Sberbank already has a list of those who are confirmed by it.