Home / Real estate / Housing rights / Registration

Back

Published: 10/06/2017

Reading time: 4 min

0

230

The most common reasons for ordinary citizens to contact the Tax Inspectorate is to obtain a tax deduction or TIN.

Often citizens do not know where to go to resolve these issues: at the place of their official registration or actual residence. After all, often the address indicated in the passport does not coincide with the one where the citizen lives.

- Tax deduction

- Obtaining a TIN

Assignment methods

A little earlier, an identification number was not issued without registration at the place of residence. This was due to increased control of assigned numbers

.

The development of a new system for recording taxpayer numbers has made tracking the TIN a little easier and the requirements have been relaxed

. The possibilities for obtaining a taxpayer identification number have also expanded.

Today, a citizen of the Russian Federation can obtain a TIN:

- at the place of permanent residence;

- by temporary registration;

- at the location of the real estate of which he is the owner (such objects can be apartments, dachas, and other relevant premises);

- assigned on the territory of the given traffic police department in which the car was registered (in the absence of registration at the place of residence).

There are several ways to obtain a taxpayer number. In particular, it can be obtained from the tax authorities. To do this, the taxpayer should visit the relevant tax office.

The citizen must have the necessary documents with him: the original and a copy of the passport. Employees will provide the visitor with a sample for writing a standard application, which will serve as the basis for assigning a TIN.

Obtaining an individual number is possible for the citizen himself. However, upon presentation of the power of attorney, another person will be able to pick up the certificate

. It is worth remembering that each power of attorney is valid only if certified by a notary.

If a visit to the tax office is considered impossible, then the citizen has the right to send a letter with an attached copy of the passport certified by a notary. The notification letter must contain a completed application

. The note on the envelope says “about the assignment of a TIN.”

The code can also be obtained through an electronic service. To do this, a citizen must have access to the Internet.

. The tax service service is located at service.nalog.ru, where the taxpayer must fill out a standard application.

Here you can connect notifications that will be sent to the specified email. In addition to assigning an identification number, the service makes it possible to find out an already valid citizen number in case of loss of a certificate or other circumstances.

Of course, you can submit your application online. However, the certificate is issued by the tax office.

Application form for TIN of an individual:

What individuals need to know about the nuances of obtaining a TIN certificate

The article, and the comments, are filled with non-legal terminology. Hence the confusion in the minds of the author and readers. For example, conversations about registration. The article is published under the heading of “legal advice,” which should exclude mention of the long-obsolete institution of registration. There is registration either at the place of stay or at the place of residence.

- Has impressive experience as chief inspector of the financial monitoring department of the security department of the North Caucasus Bank of Sberbank of Russia OJSC;

- Direction : combating the legalization (laundering) of proceeds from crime and the financing of terrorism. Element of counteraction: analysis of economic and other activities of business entities and individuals;

We recommend reading: What is a land plot with an encumbrance?

Is it possible to get a TIN without registration?

According to statistics, as of 2020, more than 144 million people received individual numbers. This number of taxpayers includes not only individuals, but also companies and individual entrepreneurs.

On June 29, 2012, changes were made to the tax legislation, which affected the issues of registration of citizens. Before this period, it was possible to obtain a taxpayer identification number only at the territorial branch of the tax authority if you had a permanent or temporary registration.

But Federal Law number MMV-7-6/435 simplified the rules and conditions for obtaining an individual number. Today, the taxpayer accounting system has been updated: it has become more advanced, which has made it possible to simplify the accounting of issued license plates

. The new accounting system eliminates the need to re-issue one TIN.

It follows from this that it is possible to obtain a TIN without having registration at your place of residence; however, you need to own any real estate (land, garages, house, etc.) or be the owner of a vehicle.

It is worth noting that the taxpayer number of a deceased person cannot be assigned to a living person. It turns out that the TIN is both a lifelong and posthumous number of a citizen of the Russian Federation.

Sample certificate of registration with the tax authority

What can you do without registration and residence permit? We'll tell you in detail

You also need to be aware of the consequences that not registering your place of residence may have on you. And although in the case of employment the law is on the employee’s side, the worker may also face certain difficulties. These include:

It is worth saying that pensions are accrued to citizens at their registration address. If a pensioner has registration in one place of residence, but in fact he is in another, then he retains the right to make a request to transfer the pension to the place he needs. For this procedure, both permanent and short-term forms of registration are suitable. If there is no registration at all, then, unfortunately, it will be difficult to get the money due. The best way out of this situation would be to obtain a temporary registration. It is highly not recommended to delay this event, as this may become a reason for non-payment of a pension for the entire period of time during which the pensioner remained without registration.

We recommend reading: Where in Goa are snils made?

Registration procedure

A citizen who has not previously received an identification number should still obtain one by contacting the tax authorities. In particular, in order to obtain a TIN, a citizen of the Russian Federation should visit the appropriate branch of the tax authority, and in the absence of registration, the authority that previously registered any property or vehicle of this citizen.

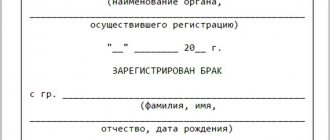

Tax office employees will provide the visitor with a sample application for assignment of an identification number. Using this sample, indicating his personal data and details of certain documents, the citizen fills out an application.

The application must indicate:

- Full name of the taxpayer;

- case of change of surname after September 1, 1996 (if it occurs);

- citizen's gender;

- Date and place of birth.

These data are entered according to the information indicated in the citizen’s passport. Passport details are also indicated. If you have an old registration address and a stamp in your passport, it is allowed to include it in the application

. In the final part, the citizen’s signature and the date of execution of the document are affixed.

After this, this application is transferred to the relevant tax officer, who, in turn, conducts an on-site inspection in front of the visitor. If an employee finds errors in the completed application, the citizen will be asked to rewrite it

. If everything is in order with the execution of the document, the employee will set a date for issuing a certificate of assignment of an identification number.

FAQ

Potential taxpayers, when wanting to issue a taxpayer code, are asked various questions.

Below are the most frequently asked questions:

| Where is the identification number issued? | The TIN is issued at branches of the Federal Tax Service located in the territory of a citizen’s temporary or permanent registration, as well as in the territory of the location of the real estate or vehicle registration authority. |

| Is it possible to obtain a TIN not at the place of registration? | Article 83, clause 7.1 of the Tax Code of the Russian Federation indicates the impossibility of obtaining a TIN from the tax authority in the territory of temporary registration if there is permanent registration. In this case, the TIN is assigned at the place of permanent registration . If a citizen only has temporary registration, then you can get a TIN at the Federal Tax Service office that serves the region of temporary registration. Article 83. Registration of organizations and individuals |

| Is it possible to obtain an individual number on the territory of real estate registration or transport registration? | If a citizen has neither temporary nor permanent registration, then he can take advantage of this case of assigning a taxpayer number. |

| Is it possible to obtain a TIN without queues? | You can issue a tax code without leaving your home, using the official website of the Federal Tax Service or the State Services portal. However, the electronic method is only available for submitting an application and required documents. The certificate itself is obtained from the tax authorities. |

| What should you do if you lose your TIN certificate? | In case of loss of a document confirming the fact of assignment of an identification number, a citizen should visit the tax office. However, receiving the document is considered optional, because each taxpayer is assigned his own individual code . You can find out by going to the Tax Service website . It is also possible to put a number on the eighteenth page of a citizen’s passport. But it is worth understanding that in certain cases the certificate itself will be required (getting a job, interacting with banks, etc.). |

| What should you do when moving to another region? | Regardless of the area of residence, once received, the TIN is valid throughout Russia. |

| How much is the state duty when replacing a TIN certificate? | When replacing a document (change of surname), no state fee is charged. |

From the above it follows that the current law carefully regulates the procedure for assigning TINs to Russian citizens. Moreover, each person must have his own taxpayer number, which is not repeated.

According to the current legislation, individuals must pay mandatory payments in the form of taxes, report on certain forms, etc. In the tax service, each person is assigned a unique identification number by which he is registered as a taxpayer

. How to obtain a TIN for an individual? For the first time, you can obtain a TIN via the Internet, or by directly contacting the Federal Tax Service or the MFC.

Obtaining and changing the TIN for temporary registration

Attention!

Starting from 2020, you can get a TIN at any tax office, but you will be registered at your place of registration. The basis is Federal Law No. 243-FZ of July 3, 2020. Amendments have been made to the Tax Code of the Russian Federation, Art. 83, paragraph 7. About that

how to find out the TIN number from a passport or other document

, if you have already received it, read here.

If a person does not live according to registration, then he needs to present a temporary registration document.

This is his individual number, therefore, neither when changing his registration, nor even when changing his civil status, this number does not change. That is, the TIN number is assigned to a person posthumously.

However, the document itself can be changed in the following cases:

- If a person has changed personal data - last name, first name or patronymic.

- In case of loss or damage to the TIN certificate.

The TIN does not need to be changed when changing your registration, since this document is valid throughout Russia.

Family Law {amp}gt; Registration {amp}gt; Is it possible to obtain or change a TIN at a location other than your place of registration?

An identification number (hereinafter referred to as INN) is an individual digital code that is assigned to each person once in a lifetime.

It is intended to streamline the taxpayer accounting process.

One of the most popular and exciting questions that people ask on numerous forums is: “Is it possible to get a TIN not at the place of registration, but at the place of actual residence in 2019?”

Let's look at this issue in more detail.

In Article 72 of the Tax Code of the Russian Federation in clause 7.1. it is said that individuals who have not previously been assigned an individual taxpayer number have the right to contact the tax service at the place of their actual residence.

That is, a person can receive a TIN not by registration, but at the place of temporary registration, if he has not been assigned a code before.

When receiving an identification code for the first time, a person does not need to pay a state fee.

TIN, or Individual Taxpayer Number, is a digital code assigned to each citizen of the Russian Federation for accounting and organization in the tax base.

Registration with the tax authorities and obtaining a certificate of assignment of a TIN are still voluntary, but most citizens prefer to receive their certificate immediately upon reaching the age of 18.

The fact is that in almost all financial transactions and legal procedures, both government and between individuals, such a number is required.

It is also possible to obtain a TIN not at your place of registration, thanks to the common database of tax services.

Any citizen of the Russian Federation becomes a taxpayer in one way or another - be it through employment, running a business, paying taxes on real estate and a car, in many cases a number is assigned automatically if it has not yet been issued to an individual, for example, when registering a person as an Individual Entrepreneur .

The concept of “Replacement of TIN” should only be understood as receiving a new certificate, and not changing its number - a digital code once assigned to a person remains with him for life.

The need to change the TIN arises in cases where it has been lost, destroyed, or passport data has changed (first name, last name, patronymic).

In the case of changing the surname after marriage - changing the TIN is also optional - it will be enough to have a copy of the marriage certificate, but some prefer to replace the paper itself in order to avoid unnecessary questions and delays with papers in various institutions.

Of course, throughout life there are often situations when a citizen asks the questions: “Do I need to change my TIN?” and “Where can I do this?” Let's try to answer them.

When changing place of residence, this document is not replaced, since the address of the person registered for tax purposes is not indicated in the certificate itself.

This number is not tied to the place of residence or registration, although the digital code itself contains the code of the territorial tax authority where it was received. However, a person can have many places of residence, he can change them often, and constantly changing the TIN would be associated with inconvenience and unnecessary work of tax services, and would also expose tax bases to unnecessary loading.

Every citizen has the opportunity to obtain a TIN and replace it due to loss or change of essential information.

By place of registration

At the place of registration or temporary registration, the TIN is obtained in the standard manner - by contacting the citizen personally to the tax service, through the State Services office, or through the Multifunctional Center (MFC).

If you are in another city, where you don’t even have registration, and you urgently need to restore a lost TIN in paper form, you can contact any nearest tax authority at your place of residence, with a passport, fill out an application there for a duplicate TIN and a new one. the certificate will be issued within five working days. The data in it will remain the same.

Without registration

Previously, obtaining an Individual Taxpayer Number was strictly tied to the presence of registration or temporary registration. After the creation of a common database, this was no longer necessary. Now, theoretically, being in a city where a citizen does not have registration, he can still get his TIN without registration.

However, there is a nuance - you will need at least some evidence that you belong to a certain territory - at least documents for a car, temporary registration.

According to the law, it is impossible to be not registered anywhere - a person must be registered with some territorial Federal Migration Service.

25.09.2017

TIN is one of the mandatory documents that every citizen of the Russian Federation must have in their hands. If it is necessary to obtain it, the question may arise as to why this certificate is needed, and also whether it is possible to obtain a TIN without registration or at a place of temporary residence.

A TIN is a certificate issued by a tax authority to a person, which contains data about the person to whom it belongs, as well as a personal numeric code, the so-called individual tax payer number.

This code has twelve numeric values, which have their own designation:

- The first two numbers indicate the area in which the document was issued;

- The next two numbers indicate the number of the tax authority that issued the certificate;

- From the fifth to the tenth – the serial number of the record about the person to whom the document belongs;

- The last two numbers are a verification code that is assigned automatically by the computer to prevent the entry of incorrect data.

As a rule, a TIN is issued at the place of registration.

This number may be needed in the following cases:

- Applications for work;

- Entering information about income;

- Receiving tax deductions;

- Registration on the official State Services service;

- Obtaining IP status.

Now the law makes it easy to obtain a TIN not only at your place of registration.

There are several ways you can do this:

- A person can apply to the tax authority, which exercises the authority to issue this number, by mail to the city where he resides permanently.

- If there is no permanent registration, the person can contact the authority located in the place where he resides.

If a letter is sent to an authorized body, it should include:

- Completed application;

- A copy of your ID.

When a citizen does not have permanent registration and only has temporary registration, he must personally contact the tax authority with the following documents:

- Statement;

- A document confirming the identity of the applicant;

- Certificate of temporary registration.

The certificate is issued within 5 days from the receipt of the necessary information about the applicant.

Since the tax registration procedure for citizens does not depend on the registration of a person, the legislator does not prohibit obtaining a number even when the person does not have a permanent registration address or a temporary residential address.

We invite you to familiarize yourself with Safety briefing for workers: key issues

In such a circumstance, the certificate can be issued at the location of the movable or immovable property owned by right of ownership.

The law allows for the possibility of obtaining a TIN under temporary registration only in one circumstance - when a person does not have a permanent address. This is stated in paragraph 9 of the order of the Federal Tax Service of Russia dated June 29, 2012.

In this case, the person must contact the authorized body at his place of temporary residence and submit:

- Completed application;

- A document confirming the identity of the applicant;

- Confirmation of temporary registration.

Despite the fact that it is considered that a tax identification certificate is a document necessary for an adult, there are several cases when a child may also need it.

A TIN may be needed in the following cases:

- When a minor is registered as the owner of property on which tax is charged.

- When it is necessary to formalize the acceptance of an inheritance for a child who has not reached the age of majority.

- If a child under eighteen years of age begins officially working or obtains the status of an individual entrepreneur.

- If the child has received the right to apply for tax deductions.

There are several ways to obtain the desired individual tax number.

First of all, a person can contact the territorial division of the tax authority. Remember that in order to issue a document, you must apply on the reception day. You can find out when the inspectorate takes action on this issue on the official website of the authority or by calling the helpline.

Remember that documents will be accepted only if the citizen provides a complete list of them established by law.

What is a TIN of an individual and why is it needed?

TIN is the identification number of tax payers, which is assigned to them by the relevant authority and is reflected in the certificate issued to them.

Currently, it is assigned to every citizen, and this is carried out even in early childhood, if children become payers of such mandatory payments.

The initiator of appropriation can be either the citizens themselves or their representatives, or the tax authorities.

This identification number for an individual consists of twelve digits:

- The first two reflect the number of the region in which the certificate is issued, the next two reflect the number of the tax authority that issued it.

- Numbers 5-10 reflect the immediate taxpayer number.

- The remaining two last digits reflect the checksum by which the TIN is verified.

Attention! Since 2020, registration is carried out at any tax office.

The TIN is affixed to all payment documents used to pay taxes by an individual. Using this number, the tax office keeps records, accrues and receives mandatory payments.

Individuals can obtain information about property taxes and personal income tax only if they know their TIN.

Despite the fact that the TIN certificate is not in the mandatory list of documents that must be provided when applying for a job, company personnel are often asked to provide a copy of it.

Important! Not only citizens of our country, but also foreigners must have a TIN. They have been charged with this responsibility since 2016.

. Now they will not be able to obtain a patent for their work unless they first register.

What documents are needed for TIN

Regardless of how to make a TIN - via the Internet, by mail or in person, you must submit a certain package of documents.

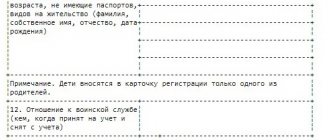

- The application (on form 2-2-Accounting) can be printed from the Federal Tax Service website or taken directly from the tax office. If a certificate is issued for a person under 14 years of age, then the application is drawn up from one of his parents.

Important! When applying to the Federal Tax Service to issue a Taxpayer Identification Number (TIN), the inspector fills out such an application independently (in most cases), based on the documents submitted.

- A copy of the taxpayer's passport or other similar document identifying the person. For a minor who is under 14 years of age, a copy of the birth certificate is provided.

- A copy of the applicant’s passport - must be presented to the parents of minors when they apply for a TIN.

- A copy of the certificate of registration at the address of residence - required for minors who do not have a passport and there is no such mark on the birth certificate.

Application for obtaining a TIN: upon loss or for the first time

— in clause 1.16 the address of the previous place of residence is indicated based on the entry in the passport with the obligatory indication of the postal code. If the applicant submits a document confirming registration at the place of residence that does not contain the address of the previous place of residence, then the address of the previous place of residence is recorded without documentary confirmation; - paragraph 1.17 indicates the date of registration (registration) at the address of the previous place of residence specified in paragraph 1.16 based on the entry in the passport, while the name of the month is written as a word. If the applicant submits a document confirming registration at the place of residence that does not contain the date of registration at the previous place of residence, then the date of registration is recorded without documentary confirmation;

Where to get a TIN for an individual

It is possible to obtain a TIN in the general manner from the Federal Tax Service at your place of permanent residence. To do this, you can order a TIN via the Internet, submit an application by mail, or bring a package of documents to the tax office or MFC in person.

When sending documents by mail, copies of documents must first be certified by a notary.

If at the time of receiving this certificate a person does not have a permanent residence permit, then the certificate is issued at the address of his temporary location or at the location of his property.

Influence factor

From where the multifunctional center is located. The thing is that in all regions of Russia MFCs are developing at different rates. In some places they have just opened and do not offer a wide range of services, and in some centers you can even get a driver’s license through this organization.

That is why it is necessary to clarify information regarding each region: for example, is it possible to obtain a TIN at the MFC (Moscow)? Yes. Just like in some other cities.

In general, there is a possibility that the document will be issued. But whether the function of issuing a TIN is implemented in a particular region is a question to be resolved on an individual basis. It is best to call a specific multifunctional center to clarify the answer. You must apply at your place of temporary registration or permanent residence.

How to obtain a TIN for an individual

An individual can obtain a TIN in various ways.

How to get a TIN via the Internet

This method makes it possible not to stand in line and send an application for issue at any time of the day or night. Currently, there are two ways to register a TIN using the Internet - on the Federal Tax Service website or through the Gosuslugi portal.

These options differ in design and procedure, but in practice they provide two opportunities to submit an application and receive a form:

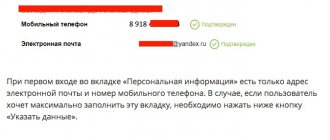

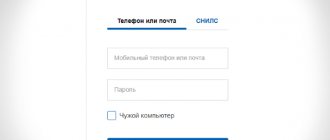

- If a citizen does not have an enhanced electronic signature, he must register on the site using his email address (or SNILS) and password. For the Gosulugi portal, you will still need to undergo identity verification in the manner established by it. After this, in your personal account you will need to indicate personal data, information about your passport and registration, and contacts

. The completed application for issuance can be sent to the Federal Tax Service in this way, but it will be possible to receive it only in personal presence with the provision of original documents. - If a citizen has an enhanced electronic signature, then it is necessary to prepare an encrypted request using a special program and send it to the Federal Tax Service. The completed form can be received by registered mail or in an electronic PDF file certified by a qualified electronic signature of the tax service.

Obtaining a TIN at the MFC

Recently, it has become available to issue a TIN through multifunctional ones. In this case, you can contact the institution either personally or through your authorized representative.

. The process of obtaining the form is included in the “One Window” mode - this means that all necessary procedures can be performed on site with one operator.

However, not all multifunctional centers perform this operation to obtain a taxpayer identification number for an individual. Check this information with your MFC.

The following documents must be submitted to the MFC:

- Passport;

- Registration document (if temporary registration has been issued);

- Form for issuing a document form No. 2-2-Accounting (you can fill it out at the MFC or bring a ready-made one with you).

In cases where it is not possible to come to the MFC on your own, a trusted representative can contact you there. However, he must have with him a notarized power of attorney, which will indicate the right to draw up and receive documents.

Attention! The positive side of issuing a TIN through the MFC is that an employee of the center can independently draw up an application for issuing a number, or check the submitted form for errors. Currently, the MFC is the most convenient option for obtaining a taxpayer identification number.

The MFC will inform you that the TIN is ready in an SMS message sent to your phone. You will need to receive the document here.

Obtaining a TIN from the Federal Tax Service (personal application)

To register and receive a TIN form through the tax office, you must have two documents:

- Completed application in form No. 2-2-Accounting;

- Passport or other identity document.

The application form can be obtained from the tax office, downloaded from the Internet and filled out by hand, or you can use one of the special programs to prepare the document. When filling out manually, all data must be entered without errors, one character in one cell, and you must use a blue, purple or black pen.

When appearing in person, the Federal Tax Service does not need to certify copies of documents. Upon receipt, the Federal Tax Service employee will check them with the originals and return them.

Attention! If documents are submitted by an authorized person, he must do so with a notarized power of attorney, which must indicate representation of interests in the tax service. Copies of documents must also be notarized.

The TIN form, after registration, can be received in person or by a representative at the Federal Tax Service, or by registered mail.

Is it possible to get or change a TIN?

Every citizen has the opportunity to obtain a TIN and replace it due to loss or change of essential information.

By place of registration

At the place of registration or temporary registration, the TIN is obtained in the standard manner - by contacting the citizen personally to the tax service, through the State Services office, or through the Multifunctional Center (MFC).

Not at your place of registration, in another city

If you are in another city, where you don’t even have registration, and you urgently need to restore a lost TIN in paper form, you can contact any nearest tax authority at your place of residence, with a passport, fill out an application there for a duplicate TIN and a new one. the certificate will be issued within five working days. The data in it will remain the same.

TIN production time and state duty amount

After all the necessary documents have been submitted to the tax office, the government agency must comply with the deadlines established by law for issuing the document. Typically, the period for issuing a TIN is 5 days. After this period, the tax officer must hand over the certificate or send it by registered mail.

. The actual period depends on the tax office - some Federal Tax Service Inspectors issue the requested document within 20-30 minutes.

Attention! There is no need to pay a state fee for the initial registration and issuance of the TIN form. If the document is reissued to replace the lost one, the payment will be 300 rubles

. Some inspections provide a service for urgent restoration of the form, and the state duty is charged at double the rate.

Living on the territory of the Russian Federation, carrying out work activities, every citizen

automatically becomes a taxpayer

, which means you must have a TIN. The procedure for obtaining a TIN in the country is carried out in such a way that each person has his own individual taxpayer number

. For some reasons, not everyone has permanent registration in their own home, but they still need to get a TIN somehow. Is it possible?

Procedure for obtaining a TIN

To obtain an individual taxpayer number you must:

- With your passport, contact the territorial tax authority;

- Write an application to receive this document there;

- There is no need to pay state duty. If this is your first application to obtain your individual taxpayer number;

- After 5 working days, receive a completed certificate.

Through the Internet

Using the Internet, you can obtain a TIN on the State Services portal and on the website of the Federal Tax Service on the nalog.ru portal. In this case, you will not have to come anywhere in person to fill out the form - the application is registered electronically, all you have to do is show up to receive it.

At the MFC

By contacting any nearest Multifunctional Center, the taxpayer can also order a TIN, for this you will need a passport, an application where you need to indicate the reason for the application - the primary issue or the issuance of a duplicate, will be issued at the MFC itself, and payment of the state fee in the second case.

How to obtain this document for a foreign citizen with a temporary residence permit is described in the video below.

Method for assigning a TIN

Initially, a TIN could not be obtained without registration and residence in one specific place. Such strict rules were associated with the need to control the numbers assigned to taxpayers; there was no unified system for checking the duplication of documents

. Since 2012, a new system for recording and tracking TINs has appeared, and therefore the rules for assigning numbers to citizens have been relaxed.

You can find out your TIN number on the portal

public services

in the Tax debt section.

Now registration of taxpayer numbers is carried out electronically, this eliminates any possibility of re-assigning a TIN to one person. Now you can get a TIN not at your place of permanent residence. There is a whole list of territorial points where a citizen can issue this paper:

- At your permanent residence address;

- At the temporary registration address;

- At addresses of real estate of any nature: up to a garage, dacha, etc.

- A TIN without registration is also assigned at the place where documents for the vehicle are issued.

Obtaining and changing the TIN for temporary registration

- when changing your place of residence, you do not need to obtain a new TIN;

- a number is assigned only once in a lifetime and does not change during its lifetime;

- if a citizen has changed his personal data (gender, full name, date of birth, place of birth), he needs to replace the document with the code with a new one. In this case, only personal data will be changed in it, but the number itself will remain the same. The application must be submitted at the place of permanent registration, or, if there is none, at the place of temporary residence.

Until 2012, citizens of the Russian Federation could receive a TIN only at their place of registration. After 2012, the process of obtaining a code was simplified. Now you can issue a TIN at your actual place of residence, for example, through the MFC.

How the new method of assigning a TIN works

With the new procedure for registering taxpayer numbers, the need to know your TIN number has almost completely disappeared; in many places you are asked to provide only passport information in order to find out the TIN number. How to get a TIN without having a residence permit? It will not be possible to become an honest taxpayer without having any documents tying a citizen to a specific place. Some documents, such as temporary registration or a registered car in a certain territory, will still be required.

To obtain a certificate with a TIN, it is enough to contact the Federal Tax Service at the place of permanent or temporary registration. If you do not have such an opportunity, then make a power of attorney to receive relatives or friends from the city of your permanent residence

. They will receive the certificate from the Federal Tax Service and send it by mail, having previously photographed it with a phone camera and sent this photo to you.

Obtaining a TIN from a foreign passport or ID card

When applying for a job in St. Petersburg, they required an INN. I myself am a citizen of the Russian Federation, but with registration in Estonia. You have temporary registration, a foreign passport, and an ID card in your hands (which is an internal document of Estonia - an internal passport). I don’t have an internal Russian passport. Is it possible to somehow obtain a TIN using existing documents? If not, is there any way to officially get a job while the necessary documents are being prepared?

We recommend reading: Challenging the cadastral value of a land plot in court