Home / Purchasing real estate / Buying and selling / Buying an apartment / Tax deduction

Back

Published: 04/02/2018

Reading time: 7 min

0

1010

Registration of a tax deduction for purchased housing allows you to return part of the money contributed as taxes paid. However, to receive this deduction, you must correctly prepare documents that will act as legal confirmation of the exercise of the right to a tax deduction. Spouses who have acquired real estate in shared or common joint ownership also have this right.

- Regulatory framework

- The procedure for obtaining a tax deduction for spouses

- Deduction when registering common shared property

- Deduction for joint ownership

- Registration as sole property

- Documentation

In addition, receiving a deduction is also the right of those spouses who have registered the property as sole ownership. What documents should be prepared and how to correctly register the right to receive funds?

Regulatory framework

The procedure for obtaining a tax deduction is regulated by a fairly large number of regulations adopted at the federal level.

The main regulation of issues related to obtaining a tax deduction is under the jurisdiction of the Tax Code of the Russian Federation. In particular, the main regulation is entrusted to Article 220 of this regulatory act. Within the framework of this article, the right to receive a tax deduction is recorded, as well as the main directions of documentary preparation for the implementation of such a right.

Since we are talking about obtaining a tax deduction by spouses, we should start from what regime is established in relation to acquired property, which means that the Family Code of the Russian Federation should also be considered as the basis for regulating such a regime for the acquisition and use of property (as a normative act that considers Article 34, the status of acquired joint ownership), as well as the Civil Code, which considers the possibilities of acquiring various real estate objects into ownership, including through registration as joint and shared ownership.

How is the deduction distributed between spouses?

The distribution of the deduction does not entail the obligation of both spouses to submit documents to the tax office. If one of the spouses takes advantage of the right to deduction, but the second does not do so for some reason, the latter retains his right to return the tax in the future for subsequent home purchases.

To search, you must enter your registration address (according to your passport). Please note that the territorial OKTMO code must be noted in declarations, starting with the 3-NDFL declaration for 2013. 4) Since we are considering the procedure for filling out a tax return in the service using the example of receiving a property deduction when buying a home, you must indicate your sources of income for the past year.

After January 2014, changes to the Tax Code of the Russian Federation came into force, which removed the restriction on tax benefits for a specific property. And now the right to receive a deduction is granted to each of the spouses - husband and wife. But the amount of deduction per person is still limited to 2 million rubles.

To do this, it is recommended to calculate the ratio of their expected income, subject to a personal income tax rate of 13%, starting from the year the apartment was purchased until the limit is exhausted. We offer you statements on the distribution of shares of the property tax deduction between spouses: . You just need to remember when calculating that the deduction for each individual should not exceed 2 million rubles.

The procedure for obtaining a tax deduction for spouses

Receiving a tax deduction by spouses when purchasing real estate is carried out according to the standard procedure for receiving such compensation from the state. The procedure for obtaining a deduction consists of the following steps:

- Preparation of documents confirming the completion of a transaction for the acquisition of a particular property. In particular, you will need not only a package of documents that will confirm the existence of ownership rights to a particular property, but also documents demonstrating the basis for the emergence of such a right.

- Formation of a package of documents showing the level of income, including taxable, of the applicant, as well as his expenses (this package contains certificates of all available income, as well as a declaration in a specially established form).

- Submitting an application for a tax deduction on purchased housing. This application must be accompanied by a special package of documents confirming the right to receive such a deduction, as well as information about which account the funds should be transferred to.

However, different options for registering property rights will have their own nuances in obtaining a tax deduction.

Calculation of tax deductions for both spouses when purchasing an apartment

At the end of the tax period, funds transferred by citizens to the local or federal budget through mandatory contributions are recalculated.

The intermediary responsible for the transfer of funds to the state treasury is the Federal Service (FTS) and local branches and inspectorates located in the regions. Not only funds transferred by citizens, but also those returned to them pass through the inspection.

Property deduction is a type of return to the taxpayer - an individual, of a portion of the funds spent on the purchase of real estate and other material assets. This right in relation to real estate arises from the moment of legal registration of the transaction and completion of registration of the object in Rosreestr.

Carried out after filing an application for a refund, in accordance with the provisions of Article 220 of the Tax Code of the Russian Federation.

It is deducted in favor of the person from the personal income tax resource. It makes up 13% of the total cost, but it is not issued once, but in parts corresponding to the amount of annual contributions.

13% is issued annually, calculated from the amount of taxes paid for one year, based on the 3-NDFL form issued by the employer. The outstanding deduction is carried forward to the next year and is determined by providing 3-NDFL for the new tax period.

Thus, citizens receive refunded tax funds until full repayment, provided that the buyer provides the required information from the accounting department. Retirement or loss of work does not allow deductions, since contributions to the Federal Tax Service on the part of the person are stopped.

Reinstatement at work allows you to recover lost funds by submitting a new application.

The procedure sometimes drags on for many years and has no statute of limitations.

Deduction when registering common shared property

Registration of shared ownership of acquired real estate is one of the options that can be implemented when registering transactions for the purchase and sale of property. In this case, obtaining a tax deduction will have its own nuances.

Thus, a tax deduction can be issued by spouses based on who and how contributed money for the purchased housing.

One option is to receive a tax deduction depending on what percentage of funds each spouse contributed to the purchased property. The right to receive such a deduction must be documented, in particular, by payment documents, which will reflect the amount of funds actually deposited.

Another option is for one spouse to deposit funds or use impersonal payment documents. In this case, the amount of the deduction received is established by agreement between the spouses, and confirmation of expenses must be carried out with financial documents that will not overlap when registering the right to a tax deduction.

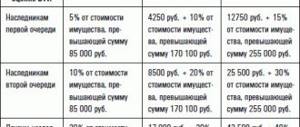

Features of calculating tax deductions depending on property status

Tax legislation distinguishes the following types of property tax deduction:

- When selling property or a share in it, part of the authorized capital, as well as when transferring funds in the event of liquidation of the company.

- When a land plot is withdrawn for state or local needs.

- When carrying out new construction or purchasing apartments in new buildings.

- When paying off interest on certain types of loans.

First, let's consider the option when a tax deduction is issued when purchasing an apartment, if two owners did not allocate shares for themselves.

If the expenses for housing purchased as common joint property were more than 4 million rubles (or exactly 4 million rubles), the deduction does not need to be distributed. Each spouse can receive a deduction of 2 million rubles. 2 million rubles is the limit established by law.

Deduction for joint ownership

If we are talking about the purchase of housing in common joint ownership, then the procedure for obtaining a tax deduction looks simpler than with the registration of a shared legal regime in relation to the acquired real estate. Receiving a tax deduction in this case can be issued to both spouses in a percentage ratio of 50/50 or in another way if the spouses draw up a special agreement, which will be submitted to the tax authorities to carry out the calculations of the amounts of tax deductions.

When preparing documents for filing for a tax deduction, you must remember that when drawing up a special agreement on shares in relation to tax deduction calculations, it will not be possible to change previously established shares in the future, since they are established only once. In addition, if the total cost of housing exceeds four million rubles, then establishing ownership shares will not be required, since according to the law, the maximum value of property in respect of which a tax deduction can be calculated cannot exceed two million rubles per person in life.

The provision of documents that can confirm the right to receive a tax deduction occurs in a double package simultaneously by both spouses, however, declarations are submitted separately by each spouse.

Determining the amount of deduction when purchasing a share in an apartment: nuances

In this case, what matters is when exactly the share in the real estate was purchased:

- until 2014;

- after 2014.

If a taxpayer bought a share in an apartment before 2014, then he is entitled to receive a deduction calculated in proportion to the size of the corresponding share.

Example.

Friends Ivanov V.S. and Stepanov A.V. In 2012, we purchased an apartment together, and its price was 4,000,000 rubles. At the same time, everyone got a 50% share in the ownership of housing.

In this regard, each of the owners of this apartment has the right to claim a deduction calculated on the basis of an amount of 2,000,000 rubles. That is, compensation in the amount of 260,000 rubles (13% of 2,000,000).

If a taxpayer purchased an interest in residential real estate after 2014, he will be eligible to receive the deduction in question based on his actual expenses for purchasing the relevant interest.

Example.

Friends Petrov A.S. and Sidorov V.N. In 2020, together we purchased an apartment worth 4,000,000 rubles. Petrov A.S. before that, he borrowed from V.N. Sidorov. a large sum - 1,000,000 rubles, and the friends agreed that:

- everyone will receive a 50% share in the ownership of the apartment;

- Petrov A.S. will pay 2,500,000 rubles for the purchase of housing, and V.N. Sidorov — 1,500,000 rubles.

Thus, Petrov A.S., despite the fact that he owns 50% of the apartment, has the right to calculate the deduction based on the amount of 2,500,000 rubles. Nominally, this deduction will be 325,000 rubles (13% of 2,500,000), but in fact Petrov A.S. will have the legal right to receive only 260,000 (due to the limitation established by law - 260,000 rubles are the maximum property deduction).

Sidorov V.N., who also owns 50% of the apartment, will be able to receive, in turn, a deduction based on the amount of 1,500,000 rubles. That is, 195,000 rubles. In this case - in full, since this amount does not exceed 260,000 rubles - the maximum deduction amount established by law.

It may be noted that this rule also applies to legal relations in which the apartment is registered as shared ownership of the taxpayer and his child. According to the law, a minor child cannot bear the costs of purchasing a home - they are borne entirely by the parent. Regardless of the distribution of shares in the ownership of the purchased apartment, the parent has the right to calculate the deduction in full from the amount that he spent on the purchase of real estate.

Example.

Frolova V.S. purchased an apartment for 1,500,000 rubles, and registered a 50% share in the ownership of this apartment for her child Masha. If Frolova wishes to apply for a property deduction, it can be calculated from an amount of 1,500,000 rubles. That is, it will be 195,000 rubles (13% of 1,500,000).

It will also be useful to study the specifics of calculating the deduction in question if the housing is not in shared ownership, but in joint ownership.

Registration as sole property

If real estate is registered as the sole property of one of the spouses, then the right to receive a tax deduction remains with both of them, regardless of who exactly the ownership title is registered to. The regime for receiving a tax deduction will be established on the basis of an agreement drawn up by the spouses, which will indicate the shares in which it is distributed between the spouses. Drawing up such an agreement is necessary in any case, regardless of the value of the acquired property - up to four million rubles or more than this amount.

If the spouses have decided that only one spouse receives the deduction, then an agreement will be required only if the documents are drawn up for the spouse who is not the owner of a specific property.

Regardless of how the ownership of the purchased housing is formalized, as well as what the ratio of shares in the resulting tax deduction is, a separate agreement must be the ratio of shares in relation to the mortgage deduction. In addition, such an agreement can be changed, which is unacceptable for a similar document in relation to the main deduction. In order to receive any of these deductions, you will need to complete a special package of documents.