The result of many years of savings for many families is the purchase of an apartment. It happens that the deal has already been concluded and the money has been paid, but the new owner cannot formalize it in his name, since the housing serves as collateral for the loan. What to do in this situation? Pay off other people's debts? Give up money and an apartment? To avoid such a situation, it is better to check the property you are purchasing in advance. We will tell you how to do it yourself.

- Everything is decided by the Unified State Register

- We check the apartment for collateral with the bank online

Types of encumbrances

An encumbrance is a legal institution that significantly limits the owner’s rights to dispose of real estate. It is imposed at the request of the owner or on the initiative of a bank, state or municipal body, and is almost always registered with Rosreestr. While there are restrictions, the owner has no right to donate, change or sell real estate.

Encumbrance of rights to real estate can be different:

- Mortgage. The owner buys an apartment with a mortgage or takes out a loan secured by real estate. In both cases, until the debt is fully repaid, it is pledged to the bank. It cannot be sold, given away or changed without the consent of the lender.

- Arrest. This restriction is applied by decision of the court or bailiffs, if the owner has debts for housing and communal services, tax and other obligations. In Rosreestr this is reflected as a ban on registration actions.

- Trust management. Here a manager is appointed; there is no actual transfer of ownership. This is typical for an owner going through bankruptcy proceedings, establishing guardianship or trusteeship, or entering into an inheritance.

- Rent. The owner enters into a rental agreement with a third party, in whose favor the property is alienated after the death of the owner. The agreement is subject to registration.

- Rent. The owner has the right to rent out the apartment under a lease agreement. It is registered if tenants rent living space for a period of 1 year or more.

Note! In all cases, the consequences of buying an apartment with an encumbrance are different. It is critical that the purchase agreement states that the seller warrants that there will be no restrictions. In this case, if problems arise, he will be responsible.

Take the survey and a lawyer will tell you for free how to avoid mistakes in an apartment purchase and sale transaction in your case

Method number two - extract from the Unified State Register of Real Estate

Up-to-date information about your property is always shown here. If your property is not under arrest or any other encumbrance, then in section number two, point number four will indicate “Not registered.” If there are restrictions, then all information will be described in detail.

Reason for arrest

It was previously reported that seizure is almost always associated with the presence of some kind of debt that has arisen for various reasons. So why are there restrictions?

Debt on utility bills

The property owner must pay all utilities. But most people have begun to ignore this obligation, as a result of which they accumulate a huge amount of debt. As a result of non-payment, they face the risk of seizure of property.

It is important to know that if utility bills are not paid, penalties will be charged from the second month, and their amount will increase each time.

If the amount of debt exceeds the permissible limit, resource organizations sue the owner demanding repayment of the debts. At this point he will be required to pay all legal costs.

This is important to know: Temporary disability benefits at the expense of the employer

After the court makes a decision, it transfers it to the bailiffs, who will demand that the owner repay the debt. At the same time, the decision may indicate information about the seizure of property.

If the owner does not take any action, he may be evicted, and the home will be sold to pay off debts.

Note! Those who live with the debtor in the same apartment are also responsible for the formation of debt. Their property may also be seized

Debt on alimony payments

Real estate can also be seized if there are alimony debts. If the debt continues to grow, then the owner will be brought to administrative responsibility, and then to criminal liability.

To seize property, the following reasons are needed:

- All alimony payments must be collected officially: by agreement, writ of execution, etc.

- Bailiffs should have information about the alimony provider.

- The total amount of debt must be more than three thousand rubles.

- The claimant demanded that a restriction be imposed on the alimony payer’s apartment or on all of his property.

In addition to arrest, the debtor may be prohibited from traveling abroad and may also be deprived of the opportunity to use a driver’s license.

Loan debt

It is important to understand here that banks have the absolute right to seize any of your property if you have debts. And here the size of the debt does not matter; the bank acts decisively when demanding to repay it.

Almost always, restrictions on real estate are imposed during a court hearing. This is a requirement of the bank, and judicial institutions comply with it without any problems. Housing taken under mortgage lending is not considered here, since it is already owned by the banking institution.

Remember that banks can take away the debtor’s only apartment in order to pay off the debt.

If the arrest is imposed, then go to the bank and negotiate, for example, about debt restructuring. If you do not act directly and do not contact the credit institution, then after the arrest, the housing may even be sold at open auction.

Arrest for non-payment of taxes and other payments

They also have the right to seize for failure to make mandatory payments, such as taxes. Authorized organizations have the right to impose such a ban:

- As a measure that can secure a claim.

- As a measure that can influence the debtor, and he will cover all his existing debts.

Note! When real estate or other property of the owner is seized for tax and other payments, penalties no longer accrue on them.

If, nevertheless, the owner’s property needs to be sold at open auction to pay off debts, then tax and customs officials do not have the right to participate in them, nor to acquire it.

This is important to know: Lease agreement with subsequent purchase: sample 2020

Debt of spouses

Remember, everything that you acquired during the marriage is considered jointly acquired property. If one of the spouses has debts, the property can also be seized.

Expert opinion

Mikhailov Evgeniy Alexandrovich

Teacher of civil law. Lawyer with 20 years of experience

If the debtor does not have enough funds to cover the amount of debt, then they have the right to demand that he allocate his share of the common marital property.

It turns out that if the apartment is the common property of the spouses, but only one of them is considered the owner, then the creditors have the right to demand that half of the property be transferred to the debtor so that they can seize it.

Risks of buying an apartment with encumbrances

If the apartment is under arrest, pledged, transferred under a rental agreement or rented by tenants for a period of 1 year or more, is in trust management, information about this will be in Rosreestr. The registrar simply will not register the transaction. The buyer will lose the deposit, which is usually paid to the seller before submitting documents to Rosreestr or MFC. The contract will have to be terminated and the money will have to be recovered through the courts.

Everything is more complicated if people live in the apartment under a rental agreement concluded for a period of up to a year. The buyer will have to wait until the contract expires. But the seller can terminate it in agreement with the tenants. In this case, the purchase and sale agreement must indicate by what date the housing must be vacated.

If a person bought an apartment and found out that there are tenants living in it who do not intend to terminate the rental agreement, their actions are completely legal. According to Art. 675 of the Civil Code of the Russian Federation, the transfer of ownership is not grounds for termination of a lease agreement. After the sale, only the lessor changes. You can try to resolve the situation peacefully, but if there is a disagreement, you will have to go to court.

In general, purchasing a home with an encumbrance is fraught with risks for the buyer:

- Loss of deposit.

- Problems with tenants.

- Refusal to register the transfer of ownership.

Advice: before concluding a purchase and sale agreement, it is better to check the property yourself or seek the help of a lawyer. Legal support of the transaction by a good lawyer reduces all risks to a minimum.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Reasons for seizing the apartment

An apartment can be seized for various reasons, including in the case of:

- debts for taxes and other obligatory payments;

- significant utility debts;

- debts to banks on loans;

- alimony debts;

- claim for division of property;

- claim for damages;

- judicial act of confiscation;

- property dispute regarding an apartment, etc.

The arrest is carried out by bailiffs as part of open enforcement proceedings. The basis for such actions is a court decision. As a result, the owner cannot dispose of the property, while the right of ownership and use remains with him.

How and where to check an apartment for encumbrances?

You can obtain information about the encumbrance of an apartment almost instantly, without leaving your home. To do this, just use any convenient method:

- Check online.

- Order an extract from the Unified State Register of Real Estate.

- Entrust the check to the bank if you take out a mortgage.

It is imperative to study the seller’s documents during the inspection of the apartment. Before signing the contract, he must submit all documents confirming the absence of debts and restrictions.

Online check

You can find out about real estate encumbrances using the “Reference Information” service. For information please go to the page. Verification is available in any of three ways:

- By cadastral number.

- By the address.

- By right or restriction number.

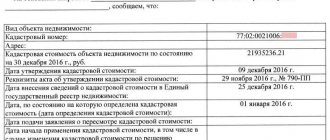

After entering the data, just click on “Generate request”. The screen will immediately display the date of cadastral registration, cadastral number and value, form of ownership, date of registration of ownership and date of application of restrictions, as well as the type of encumbrance.

Important! The service is provided free of charge. The number of requests is not limited.

Legal advice: do not rely too much on this method of verification. Rosreestr does not immediately update the information in the electronic database on the website, and it may turn out that according to old information there are no restrictions, but in fact there are. In my practice, there was a case when an apartment with an encumbrance was purchased. The buyer covered the seller’s debt with an increased deposit, the bank lifted the restriction in three days, but information about it remained on the website for several more months, although the transaction had already been registered.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Ordering an extract from the Unified State Register of Real Estate

Extended information can be obtained by ordering an extract from the Unified State Register at the MFC or through the “Obtaining information from the Unified State Register” service. There information is updated almost instantly.

What you need to order an extract from the MFC:

- Make an appointment through the department's website.

- Come to the MFC with your passport and fill out an application for issuing an extract, pay the state fee - 870 rubles.

- Receive an extract in 5-7 days.

Ordering an extended statement online makes everything easier:

- Fill out the information request form. The address or cadastral number of the apartment is enough.

- Enter the applicant's details and the email address where the document will be delivered.

- The application is sent for verification. In a few hours, the applicant will receive a notification about the need for payment.

- The state duty is paid - 350 rubles.

The extract will be ready within three days, and a message from Rosreestr will be sent by email. You need to follow the link and enter the access code. The document will be downloaded to your PC.

Legal advice: the information is downloaded as an archive from several files, and most of them are in xml format and may not be readable. To view them, you should use the “Checking an Electronic Document” service. It generates statements in printed form.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Important! If desired, you can order delivery of a paper statement by Russian Post, receipt at the Rosreestr office or through field service.

Checking the seller's documents

Not the most reliable way to check an apartment for encumbrances, but you need to study the documents before the transaction. The seller must order an extract from the Unified State Register, its validity period is 1 month. But in fact, during this time anything can happen to housing. It is better for the buyer to order the document himself, at least in electronic form, immediately before entering into a transaction.

What documents need to be checked, in addition to the extract:

- a purchase and sale agreement or other document confirming the basis for the emergence of ownership rights of the seller;

- owner's passport;

- certificates of absence of debts for housing and communal services;

- an extract from the house register confirming the absence of registered persons.

These documents do not reflect the presence of a registered restriction, but in general they are needed for drawing up a written contract and conducting a transaction.

Bank verification

If a buyer takes out a mortgage on an apartment, the bank can independently check its legal purity. He will be the mortgagee in the future, and it is extremely important for him that the client buys a “clean” home. The inspection is usually entrusted to the insurance company.

Employees will find out whether the apartment is under collateral and whether the seller’s documents are properly executed and prepared. If you need a more thorough check, it is better to contact a law firm. A good lawyer will always find out whether a third party can lay claim to the property and challenge the transaction, whether the owner is involved in bankruptcy, and will clarify other legally important details for the client.

Verification of registered citizens

The seller himself must provide an extract from the house register confirming the absence of registered people in the apartment being sold. If he refuses to formalize it, this should alert you.

An extract from the house register is issued by the management company or the HOA, or it can also be obtained from the MFC. It is issued only to the owner or person registered in the living space. The buyer cannot order it himself.

Are you planning a deal to buy or sell an apartment?

Lawyers will answer any question regarding the transaction free of charge and in detail. Ask a question so you don't waste time reading!

Lawyer's answers to frequently asked questions

How to check whether the encumbrance on an apartment has been lifted?

You can use the online service, but the database there is updated extremely rarely and often malfunctions. It is better to clarify the information on the application number for removal of the encumbrance by calling the Rosreestr hotline: 8-800-100-34-34. An alternative option is to order an electronic statement, but you will have to wait several days.

Will a realtor be able to find out if there is an encumbrance on the apartment?

Yes, a realtor can find out about the encumbrance of real estate by checking it in any convenient way. It all depends on the content of the contract: some realtors only help with finding housing and do not carry out inspections.

How to check for encumbrances on a house and land plot?

You can use any of the methods presented above. All real estate, regardless of type, is checked equally.

Based on the results of an online check, I found out that the property was encumbered due to the prohibition. How to find out who placed an encumbrance on an apartment?

You need to order an extended statement. The details of the document and the basis on which the restriction is imposed will be indicated there. This usually reflects the bailiff’s ban on performing registration actions.

I'm going to buy an apartment, it's pledged to the bank. I will cover the seller's debt with a large deposit. Does this need to be stated in the purchase and sale agreement?

Yes, definitely. The DCP indicates the amount of the deposit and the part that will be transferred to the seller after registration. When the transaction is registered, you need to deposit the rest of the money, take a receipt from the seller and submit it to Rosreestr. Until the receipt is submitted, the property will be pledged to the former owner.