Why is real estate appraisal carried out by Sberbank, what depends on it

The assessment is required not only by Sberbank, but also by the borrower himself. It is important for the client to obtain real figures regarding the cost of the loan property. He sees them in the final report from the appraisal organization. The document along with the application is then sent to the legal service of Sberbank. There the data is checked, including a report with the assessment results.

Why is it so important to get accurate figures regarding the cost of real estate that is purchased with a mortgage without a contribution or with it:

- The exact amount of the loan depends on the amount in the report. After all, it is for housing that a loan is issued for its purchase. This means that its market price is important, which is indicated in the report. The larger it is, the higher the size of the mortgage issued by the bank.

- Down payment amount. Yes, the terms and conditions indicate the minimum amount in %. But it is calculated based on the size of the loan. And it, as we wrote above, depends on the estimated value.

- Collateral price. The terms of the mortgage provide not only guarantors (sometimes), but also other guarantees. This applies specifically to collateral. In a mortgage loan, this would be the property itself. Its price is indicated in the loan agreement. Although it is purchased with a mortgage, it is also considered collateral. And its market value depends on the assessment. When the borrower is unable to pay the mortgage, the square meters are sold by auction or at the request of the client. The amount must be compared with the previously conducted appraisal examination.

As for the assessment itself, it is not just professional, but also corresponds to the market situation. That is, the expert compares all offers on the market, other factors, and draws up a report. He must provide adequate figures and not exaggerated or underestimated ones. This is important for all parties - both the bank and the borrower. To receive a professional report, clients order it from Sberbank (from partners), or from other licensed organizations. In the latter case, they are verified by the bank.

How to evaluate an apartment for a bank with a mortgage

The market value of housing depends on many factors, which of course are taken into account. After all, not only the number of rooms and the presence of repairs are taken into account, but also the location in a particular locality or region, as well as the time of year. At the same time, during the assessment process, a comparative analysis of similar residential premises is simultaneously carried out to determine the most optimal price.

The specialist also makes an assessment based on costs, that is, the costs incurred for the construction of a residential building are taken into account to calculate the already liquid value of the apartment, as well as to calculate the collection price subsequently. And in some cases, an analysis of the profitability of residential premises is carried out, because the valuation of an apartment in a new building for a mortgage differs significantly from real estate on the secondary market.

Apartment appraisal for Sberbank accredited companies - list

When you apply for a mortgage, they are sent to the bank's legal department along with an appraisal report. It is carefully checked, as is the organization itself that carried it out. If the company was there, which is on the list of recommended ones by the bank itself, then everything is much simpler. They have already been verified and received confirmation.

The list of appraisal organizations cooperating with Sberbank itself is easy to find. It is presented on his website. But if you have already gathered in the department, then he will be presented there too. At a minimum, they will name a list of organizations or show a list of them with a description of each. The borrower has the opportunity to choose the company independently.

He can even suggest his own appraiser if he trusts him more - an organization or a private specialist. But then he should submit his certificate given to Sberbank. After receiving confirmation, the appraiser is authorized to work on your mortgage property.

As for the partner organizations listed on the Sberbank website, they have also been verified:

- They have confirmation status from Sberbank. The period until which it will be valid is indicated. That is, the status is assigned for some time, and not forever. Companies are audited periodically, not just once.

- Provide a qualification certificate. Information about him is listed in Sberbank.

- They have an insurance policy, and the date of its completion is also listed in the database.

Consequently, all organizations have been verified and have the right to conduct expert assessment activities.

What is taken into account when evaluating an apartment?

- Location of the property being assessed. In order to evaluate the apartment as accurately as possible, the expert studies the area where the property is located, social infrastructure, environmental situation, transport accessibility, remoteness of socio-cultural (schools and kindergartens, pharmacies, hospitals, etc.) and industrial facilities, and other parameters.

- The condition of the property being assessed and the house in which it is located. Analysis of the apartment consists of indicating the floor of its location, the area of housing, the number of rooms and their square footage, the presence of a loggia or balcony, the existence of visible defects in the room, the characteristics of communications, the view from the windows, and so on. When assessing the condition of a house, one takes into account its number of storeys, age and type of construction, the condition of stairwells, the entrance, the level of quality and reliability of building materials used in the construction of external walls and ceilings, and landscaping of the local area.

- Compliance with fire safety measures and the presence of security.

- Presence of burdensome factors.

What is a report and assessment of housing with a Sberbank mortgage

A real estate valuation report is not a one or two page document, but a full-fledged work of experts. It contains everything - from a description of the task itself, its purpose to calculations using various methods. The document is needed not only by the client, the bank, but also by its individual service. It is Sberbank lawyers who check the report itself, the mortgage application, and the package of documents.

The assessment results are also checked by Sberbank lawyers. It doesn’t matter which organization conducted it – the one included in the recommended list or another. In any case, the report is carefully reviewed to determine whether the calculations were carried out correctly and whether they correspond to the situation on the real estate market (real prices).

The report also includes copies of documents submitted by the borrower himself. They relate to the client and the property for which the mortgage will be issued. The appraisers' calculations are presented along with references to methods, laws, assumptions and limitations. That is, the report is the result of the work of experts, which describes the process itself. What points are included in the document, read below.

Where to order an apartment appraisal for a mortgage

Appraising an apartment is a thorough analysis of all aspects from the condition of the housing to its location, which is why monitoring of residential premises can be carried out by persons who not only have specialized knowledge, but are also members of a self-regulatory organization of appraisers in accordance with the norms of Article 4 of Federal Law No. 135.

In this case, appraisers can be either full-time employees of companies providing residential premises analysis services, or private practices. Thus, a future bank client, in anticipation of obtaining a mortgage, can apply to determine the real cost of the apartment, both from an official institution and from a private person.

However, due to the fact that the bank is very careful about the subject of collateral and determining its price, the borrower is often asked to contact a company with which the credit institution already cooperates. Of course, the client has the right to refuse and choose his own appraiser to conduct an independent assessment of the apartment for a mortgage, but the likelihood that the bank will accept the document will be in doubt. To avoid a dispute, it is advisable to agree with the future creditor; moreover, an appraiser cooperating with the bank will complete the work as quickly as possible.

Important! In pursuance of Article 15.1 and Article 15 of Federal Law No. 135, real estate valuation activities must be insured, which helps to avoid mistakes. After all, the liability of the appraiser and the company, which are responsible for the accuracy of the data presented in the report, is primarily insured.

What is included in the apartment assessment report in Sberbank - points

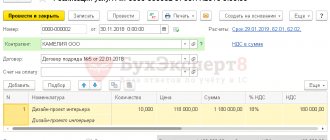

A report is understood as a finished document with the results, which describes the process itself, the calculation methods used, and the laws and standards used. It includes the following sub-items:

- Terms of reference from Sberbank, which indicate the purposes of the assessment. For example, it is indicated that it is required to obtain the market value of the property in numbers in order to issue a mortgage to the client based on these data.

- Final estimated value.

- Qualitative and quantitative indicators, results.

- Calculation methods, approaches used. Why was a particular one chosen in the end?

- What betrothals and assumptions were used.

- Standardization - list.

- Name of the parties - appraiser, customer.

- Documents from the bank and its client relating to the mortgage, the subject of assessment, including title papers (copies).

- Application, real estate photos.

- Characteristics.

- All calculations made, and in different ways and methods.

- Analytics of the market - that part of it to which housing is related.

- Explanations from the appraiser.

- Other points.

You see that the report is a large-scale work that allows you to make a thorough analysis and assessment of mortgage real estate. It is unlikely that a realtor or other specialist would be able to carry it out. That is why specialized organizations with a certificate are involved.

How much does a real estate appraisal cost?

The cost of appraising an apartment or room is from 3,500 rubles per object. The final price depends on many factors:

- volume and features of the object of assessment (for example, the layout of the apartment, its area, number of rooms, the presence of defects, technical support for housing, number of floors of the building and the general condition of the residential building, the surrounding area, and so on);

- urgency of carrying out assessment work;

- location of the object under study.

Standard execution time is 2-3 days.

Mortgage and property valuation under mortgage Sberbank

Sometimes you need to get a loan not for the real estate itself, but simply for an impressive amount. A consumer loan can be large, but often not that much is actually issued. Then a mortgage loan is suitable, even from Sberbank. In order for him to give out as much money as possible, guarantees should be provided to him. These include your real estate, which will be the collateral. A large loan is issued against it. It is called mortgage, less often - consumer.

But even if you have a house, apartment, or other housing, no one will just give you money for them. They need to be assessed correctly so that the bank receives an accurate final market value. It is indicated on the mortgage itself. This document is attached to the loan agreement. In it you will see that your home is temporarily listed as collateral. Its value is indicated based on the appraisal report.

In order for Sberbank to issue a loan, it needs grounds. First, it requires not only to hand over documents, but to write a statement. It is important to order an assessment for a future mortgage from Sberbank. For this purpose, organizations are offered either by the bank itself, or by third parties (an offer from an applicant for a loan). Borrowers often choose the first option.

Mortgage appraisals are carried out by specialized organizations that are supported by Sberbank itself. They will give you an appraisal report for the mortgage. More precisely, you need to select one company or private expert on the bank’s list. After their work, all that remains is to wait for the final result. When the borrower is satisfied with the price indicated in the report, he gives a final agreement. Sberbank draws up an agreement for him and issues loan money. The mortgage is terminated and becomes void once the entire debt is paid.

Mortgage assessment

Advice from lawyers:

1. Please tell me why a house appraisal is done when applying for a mortgage?

1.1. In order for the bank to understand how much of a loan secured by a specific house it is ready to issue you.

Did the answer help you?YesNo

1.2. To set the loan amount.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. I took out a mortgage for an apartment in a house under construction a year ago, the house was commissioned, we moved in in January of this year, is it necessary to register a mortgage to register property rights? After all, to do this you need to evaluate the apartment, and this is not cheap.

2.1. Ask the bank that issued your mortgage what you should do. I think all the necessary conditions are specified in the loan agreement.

Did the answer help you?YesNo

3. I am applying for a mortgage through an agent with whom only a verbal agreement has been concluded. I don’t know her personally, only by phone. He asks to send photographs of all pages of the passport and Dreamed to complete the assessment of the apartment and the contract. What am I risking by sending these photos?

3.1. Hello, He may be a scammer. Don't get involved with strangers. Apply for a mortgage through the bank. I wish you good luck and all the best!

Did the answer help you?YesNo

4. I purchased an apartment and signed the APP. Now I need to make an appraisal for the bank (documented with a mortgage) and draw up a mortgage, and I’m faced with the fact that the house is not registered in the cadastral register and there is no BTI plan. Accordingly, I can’t do anything for the bank and I can’t start repairs either. What actions can I take in this situation, how can they influence the developer and management company?

4.1. Hello. In this case, you need to register the apartment with the cadastral register. If the developer does not do this, you need to go to court.

Did the answer help you?YesNo

5. We paid 20 thousand to the realtor and signed an agreement. We found an apartment and made an assessment. The bank has set a time to apply for a mortgage for this apartment. And suddenly the seller had some problems... the bank was cancelled. Can I get my money back from the realtor? And for the rating.

5.1. You need to look at what documents you signed with the seller and what, in theory, it’s not the realtor’s fault, it’s the seller’s fault. It depends on how the agreements were drawn up with him, whether there were any documentary agreements.

Did the answer help you?YesNo

5.2. It does not matter to you whether it was the fault of the realtor or another party that the transaction did not take place. Having taken a fee from you, the realtor is responsible to you for the transaction and is obliged to compensate your losses in full. Try to resolve the issue with him peacefully, if that doesn’t work, then through the courts. Let him resolve his issues with the other side in a similar way.

Did the answer help you?YesNo

6. I am taking out a mortgage to purchase a home. The apartment costs one million eight hundred, but appraisers valued it at one million five hundred and sent the documents to the bank. What to do? What should I do? Is it possible to withdraw the appraisal from the bank and redo the appraisal?

6.1. Good afternoon. In general, the appraiser entered into an agreement with you, why did they send the appraisal directly to the bank? They must hand over the results of the services under the contract to you, and not to the bank; demand that they withdraw the assessment as erroneous, otherwise you will threaten to terminate the contract with compensation for losses.

Did the answer help you?YesNo

6.2. The only way to challenge the assessment in such a situation is in court.

Did the answer help you?YesNo

6.3. It is forbidden. It is possible, if the bank does not mind, to submit an assessment from another appraiser. The relationship is civil law, everything is determined by agreement of the parties, including regarding the documents that must be submitted to sign the contract.

Did the answer help you?YesNo

7. Concluded a preliminary purchase and sale agreement, which specified the conditions for purchasing an apartment through a mortgage. I paid a deposit. Made an assessment at the request of the bank. The apartment is being sold through a real estate agency. On the day the loan agreement was signed, the sellers refused to sell the apartment because they found out that they were subject to tax (ownership by one of the owners for less than 3 years). How can I get back the money I spent on a mortgage appraisal?

7.1. Hello, Natalya Yurievna! You can file a claim in court with the owners of the apartment and recover this amount as your damages. To begin with, I recommend that you resolve this issue by sending a written complaint to the apartment owners.

Did the answer help you?YesNo

7.2. Good afternoon. Submit a claim to the sellers for a refund of the real estate valuation amount. However, if the sellers do not voluntarily reimburse you for these expenses, then the only thing left to do is to demand these expenses from them through the court (according to Article 3 of the Code of Civil Procedure of the Russian Federation).

Did the answer help you?YesNo

8. The mortgage has been approved, we have found an apartment, what documents should the seller bring for the savings bank, including? How is an apartment appraisal done, when and who pays? And if there are approximately 39 days left until the end of the mortgage approval from the given 90 days, will we have time to complete the documents? Is it advisable to contact a real estate agency to register ownership of an apartment?

8.1. Sberbank itself determines the list of documents for obtaining a mortgage. If you are not confident in your abilities to conduct and control a CIT transaction, then contact an agency and not private realtors, because With such things there are very often misfires.

Did the answer help you?YesNo

8.2. An extract from the Unified State Register for real estate, certificates from the management company or homeowners association about the absence of debt, as well as a certificate from electrical networks, Gorgaz, heating network enterprises, water utilities and capital. repair. The appraisal can be ordered through the bank where you take out the loan.

Did the answer help you?YesNo

9. The house was just built and handed over, renovations were done and an appraisal was ordered for the bank, since the apartment is under mortgage. In the assessment report, we learned that a built-in closet was made in one of the rooms and this is an illegal redevelopment. There are no documents for the property other than the transfer and acceptance certificate, and permission for redevelopment was not taken from the bank. What should we do in this situation?

9.1. Good night! You need to legalize the redevelopment

. To do this, you will need the following documents for approval (According to clause 2.5.1.1.3.10 of Appendix 2 to the 508th Decree of the Moscow Government in lieu of a certificate of state registration of rights): - original or notarized copy of the apartment acceptance certificate; — a notarized copy or original of the agreement on assignment of rights or equity participation agreement; - a simple copy of the permit to put the building into operation; — written confirmation from the developer that the shareholder has fulfilled all financial obligations, if this is not specified in the apartment acceptance certificate. I would like to separately note cases of purchasing an apartment in a new building using borrowed funds. SOME banks (for example, Sberbank) do not give their consent to redevelopment before the borrower takes ownership. And since the apartment is encumbered with a mortgage, it is impossible to obtain permission to redevelop it without such consent from the bank. In this case, you will have to return the room to its original condition. Best regards, YUG Lexxy24.ru

Did the answer help you?YesNo

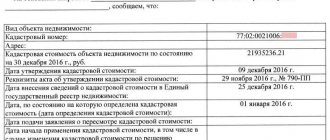

10. To obtain a certificate of ownership of the apartment, the MFC required a mortgage from the bank. The apartment was bought with a mortgage at the excavation stage in a new building. The house gave up. The bank told us that in order to obtain a mortgage, we need to make an appraisal of the apartment. The question is, why is an appraisal needed if the apartment is new and its price has already been determined 1) indicated in the purchase agreement and 2) the cadastral price is indicated on the Rosreestr website?

10.1. Hello, Vladislav! Apparently the bank needs a market valuation of the apartment. What was at the excavation stage does not correspond to the market price today.

Did the answer help you?YesNo

11. I am buying a cooperative apartment with a mortgage. A certificate of ownership is required for evaluation. There is only a BTI certificate. What should be the document on ownership of a cooperative apartment?

11.1. Elena, now they don’t issue certificates, they only issue an extract from the Unified State Register of Real Estate. It can be obtained from the MFC or Rosreestr.

Did the answer help you?YesNo

11.2. The certificate of ownership since 2020 is GAMES, but it’s not clear why you need an assessment, extra costs.

Did the answer help you?YesNo

12. What does the mortgage appraisal affect when we are already paying the mortgage and for what other documents is it needed?

12.1. Hello. Doesn't affect anything. The bank is probably doing a reconciliation or some kind of audit.

Did the answer help you?YesNo

13. We paid off the mortgage with maternity capital. Now we need to divide the house into 4 shares (mom, dad and 2 girls). Do I need to call an appraiser to evaluate a house? We are not going to sell the house. One daughter is 3 years old, the second is 4 months old.

13.1. You are not required to call an appraiser. You can draw up a share donation agreement yourself.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. Such a question, a year ago I sold a dacha to people with a mortgage, the buyers were involved in the transaction, they also prepared an appraisal report for the bank, I didn’t even see it, now they say that the price was too high and the property does not correspond to what was in the appraisal report , and are going to go to the prosecutor's office. What to do? I don’t even know what kind of report there is and what it was all for? 'Based on materials from the legal social network www.9111.ru ©'

14.1. You have nothing to worry about; in Russia the principle of freedom of contract, established by Art. 431 of the Civil Code of the Russian Federation, therefore, even if the price is clearly inflated (different from the market price) and they agreed with it, then there is no reason to challenge the transaction, much less accuse you of fraud. Sincerely, lawyer – Stepanov Vadim Igorevich.

Did the answer help you?YesNo

14.2. Let them go. There is no element of fraud in your actions.

Did the answer help you?YesNo

15. I have a mortgage debt, they called from Sberbank and said that under Federal Law 203 they have the right to come to my apartment to assess the condition of the property, is that true?

15.1. Hello! To collect a debt on a mortgage loan, the bank must file a claim in court. Bank employees do not have the right to come to the apartment to assess the condition of the property.

Did the answer help you?YesNo

16. We have a mortgage approved through an agency that cooperates with Sberbank. The agency demands 50 thousand rubles for the work on carrying out the transaction, but does not explain the points of the transaction and what it costs. Plus, they announced an additional amount of 16 thousand rubles, supposedly for bank services, which include: real estate assessment by a bank lawyer - 8000, opening a safe deposit box for transferring mortgage funds - 2000, real estate insurance (in our case, a house) - from 10 to 12 tr. Are their actions legal?

16.1. the agency demands 50 thousand rubles for the work on carrying out the transaction,

- this is logical and legal.

BUT plus this in the form of additional amounts

that should be included in the amount of 50 tr. - this is their arbitrary decision, with which you may not agree. Insurance - of course at your expense.

Did the answer help you?YesNo

17. We buy an apartment through a realtor. The realtor said that 1% was for him, and another 1% for the agency. To apply for a mortgage through a bank, you still need to make an appraisal of the apartment. Do I need to pay extra for this service separately or should this amount already be included in the 2% that we give?

17.1. Hello. Valuation of the subject of a mortgage is a service of an appraiser and a requirement of the bank to determine the collateral value of the subject of assessment. Since you take out the mortgage, you pay for the services of the appraiser. And the cost of a realtor’s services is determined by agreement of the parties.

Did the answer help you?YesNo

18. Sberbank approved my mortgage, I hired a realtor, collected documents, made an appraisal, and paid a deposit to the seller. The bank kept calling, inquiring about the selection of real estate. We received SMS about the deadline for submitting documents. When you submit an assessment of the selected property to the bank for approval. It turned out that the bank refused the mortgage altogether.

18.1. Hello! Your appeal to the lawyers does not contain a specific question. What exactly do you want? You can return the deposit you paid.

Did the answer help you?YesNo

19. I take out a mortgage to make a property appraisal for the bank from which I take out the mortgage, am I required to use their appraiser or can I hire my own? Thank you.

19.1. Victor, am I obliged to use their appraiser or can I hire my own? The bank has entered into agreements with appraisers, so you can only use the services of the appraiser with whom the agreement has been concluded.

Did the answer help you?YesNo

19.2. Hello! You can assess the market value of a property from any appraiser. The main thing is that he has the authority to conduct the assessment and qualifications.

Did the answer help you?YesNo

20. I am selling an apartment, the buyer has a mortgage, he needs a technical passport for evaluation by bank specialists. Who should order it? Me or the buyer?

20.1. Good day, dear visitor. Of course, in this situation it is by agreement, but in general it should be with the seller. Good luck to you in resolving your issue.

Did the answer help you?YesNo

20.2. Hello Nikolay, if you want to sell a house, you must have all the necessary documents for this; it is best to resolve such issues with the help of a lawyer.

Did the answer help you?YesNo

We are selling an apartment, the USR says the area of the apartment is 30.6, the registration certificate says the area is 31.5.

The bank sent an SMS that it is preparing a visit to the place of registration to assess the property and serve documents.

I want to sell an apartment with a mortgage from Sberbank, I have an extract from the Russian register in hand,

There is arrears on the mortgage. A bank employee wants to come to evaluate the house and put it up for auction. What rights does he have to inspect the collateral property?

Our mortgage was issued in Sochi in 2013 at Sberbank, we ourselves live in the Khanty-Mansi Autonomous Okrug Nefteyugansk,

We took out an apartment with a mortgage. The mortgage has not been paid off. We decided to demolish the wall between the kitchen and the room.

We bought an apartment in a building under construction with a mortgage. We are going to take over an apartment from the developer soon.

The cadastral value of the apartment is 2 million rubles, the actual sale price is 1650 thousand.

The cadastral value exceeded the cost of the apartment by 500,000. How can I challenge it if the assessment was carried out for a mortgage? Is it possible to challenge it after the transaction?

When buying a home through an agency, should I also pay for drawing up a sales contract for the agent?

My wife and I have been divorced for 8 years. 3 bedroom apartment. Four children. Preliminary assessment of the apartment by phone 12500000-13000000.

conclusions

A mortgage is issued after checking a whole package of documents by the bank’s legal service. It also includes a property assessment report. It indicates the price of housing purchased with a loan from Sberbank. The same applies to those who receive money thanks to a mortgage. Then you also need an assessment. It is carried out by individual organizations with a certificate. Sberbank already has a list of those who are confirmed by it.

Report validity period

When ordering a service, you need to understand how long the final document is valid. By law, the period during which it is considered valid is six months. If the document is required after this period, you will have to order a new assessment examination.

The reason why the event is held is not only needed by the bank. After it, the borrower will understand that he purchased the property at a normal, not inflated price. At the moment, the procedure is carried out in almost the same way as in previous years. To protect yourself and increase the chance of getting a mortgage loan at an acceptable interest rate, it is better to contact companies that are offered by the banking organization itself.