The cost of real estate remains a very hot topic among all potential participants in the real estate market, however, it arouses the greatest interest among home sellers.

I want the most accurate numbers in the shortest possible time. Where can I get them if I have no experience and knowledge in the field of appraising apartment real estate? There are two ways: either turn to specialists, or decide to take independent action. Let's look at both. But first you need to get at least some basics of the procedure for evaluating the apartment you are going to sell.

…

How is an apartment appraised?

To determine the approximate amount that you can get for a sold home, you need to identify the main factors that influence the price and which all real estate sellers focus on when they need to find out the value of their goods.

- Location of the house . The area in which the property for sale is located plays an important role in determining the price. The rule: has become universal and no one has yet dared to break it. Walking distance to prestigious shops, catering establishments, large markets, offices and government agencies costs 25-35% more. But sleeping areas are also different, and therefore the price of apartments also varies depending on the proximity of the metro or recreation area, or clinic.

- Total area . The situation on the real estate market is in favor of smaller apartments - professionals value square meters of one-room apartments more expensive than the area in two- and three-room apartments. The larger the apartment, the cheaper the square meter.

- Kitchen area . In the process of assessing housing, the area of one (the most beloved by household members) room is considered as a separate factor: the larger the kitchen, the higher the total cost of the apartment.

- Layout . The convenience of the location of the rooms (separate or adjacent), the presence or absence of a loggia or a regular balcony can play a decisive role in determining the optimal housing price.

- Quality of repair . You shouldn’t ask too much for wallpaper in the style of the 90s of the last century - the buyer will not understand you. After all, he has a huge piece of work ahead of him: after the official part (notarized registration of property rights), he rolls up his sleeves and brings the apartment to the state of modern housing. And this is not cheap, so why should he overpay when buying?

- House type . An indicator of durability and comfort, to which the buyer pays close attention. Apartments in monolithic buildings are the most expensive, slightly cheaper in brick ones, and the cheapest in panel ones.

- Infrastructure . When analyzing this factor, it is necessary to take into account both positive and negative aspects. Add the presence of a kindergarten, school, hospital, parking lot to the list of advantages (and, accordingly, increase in price), and to the list of disadvantages (lower prices) - a noisy highway or a processing plant in the neighborhood.

Required documents for assessment

The borrower must provide the appraiser with a package of documents:

- a copy of your passport;

- documents confirming the right to an apartment;

- a detailed apartment layout plan drawn up in the BTI;

- a copy of the cadastral passport received by the owner at the BTI;

- a certificate confirming that the house and apartment are not planned for demolition (not required for an apartment in a new building);

- contact details for communication.

Having collected the documents, you need to submit an application for an examination to the selected appraiser company. On the agreed day, the appraiser will inspect the apartment and prepare a report.

How to do

There are four options for optimally assessing the cost of an apartment for sale or for other purposes, but our citizens use only two - it seems cheaper and faster to them. We will consider everything so that, if necessary, you have a wider choice of options.

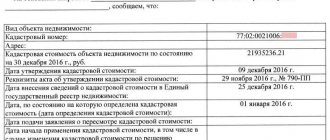

Option #1. Official documents

Until recently, the appraisal right was solely held by the BTI, which never focused on market fluctuations and market value, which in the case of the sale of an apartment is one of the main factors of assessment.

self-regulatory organizations of appraisers operating in the country , which after a certain period of work (usually it takes a week) provide the customer with a report on several dozen sheets, in which, based on the comparative method, the price of the apartment being sold is “outlined”. The appraisers reserve the right to a small percentage of error.

The price of such a service is from 3 to 5 thousand rubles, but it is used mainly by mortgage buyers who need to prove to the bank the “market value” of the price of the housing for which they are going to take out a loan.

The disadvantages of this form of assessment for the seller are obvious:

- the validity of the document is limited - a month from the date of delivery to the customer;

- appraisers focus on offer prices, not actual transactions. If the demand for such apartments falls, then the price remains very high, despite the presence of an error; in this case, its percentage does not correspond to reality.

Option #2. Agencies and realtors

A simple call to a realtor, or better yet several at once, can direct your thoughts in the right direction.

This option is the most popular among residential real estate sellers, since the average estimate from two or three experienced realtors ends up being the real price for the apartment. In addition, one should not lose sight of such an important point as the presence of professional intuition. A realtor, who has dozens of successful transactions, will accurately tell you the price of the apartment for which you can actually sell it.

If you are going to sell your home through a real estate office, then the property will be put up for sale with some premium - do not be surprised or indignant at this, everything is done to create the possibility of bargaining.

Naturally, the main job of realtors is not to give advice over the phone; they are looking for clients with whom they can sign a transaction agreement. Therefore, be ready to cooperate.

Some agencies kindly offer to determine the real value of real estate via the Internet and offer to fill out a client questionnaire, some points of which should alert you: address, number of residents and registered persons, etc. It is possible that all such actions are aimed at the benefit of the customer and the convenience of the agency’s employees, but there are no guarantees that third parties will not gain access to your data...

The advantages of this method: the appraiser operates with real figures of completed transactions. Disadvantages: possible overpricing.

Option No. 3. Your own appraiser

As a popular aphorism goes today: the Internet can help you. Fortunately, now you can find more than one independent website that allows you to independently determine the approximate valuation of the home you are going to put up for sale.

The scheme is simple: you enter the details of your apartment and the system automatically calculates how much such a property might cost. You can also make a selection of similar apartments and evaluate your own based on a comparative analysis.

Advantages of the method: very quick results. Disadvantages: approximate results. This method is only suitable in cases of idle curiosity: “I wonder how much my apartment might cost,” and is completely unsuitable for business.

Option number 4. Your own price

This method is often called authoritarian and futile, but surprisingly, it works. True, to get results, you need to have sufficient reserves of time and patience.

The scheme is as old as the world: set your price, the so-called “from the lantern”, and just wait for your buyer.

This type of valuation can work great during a rising market . No one can accurately predict how long you need to wait for your client, so patience is the main partner in this assessment method. There are cases when apartments waited for buyers for years, and then they were sold easily, quickly and without haggling.

Advantages of this method: you feel like you are in control and set the price that suits you. Disadvantages: waiting too long for a deal.

Valuation of suburban real estate for Sberbank mortgage

An appraisal of suburban real estate for a mortgage with Sberbank is provided by the borrower in two cases:

- for the purchase of a finished building (residential building or cottage, summer house, garden house);

- for the construction of a suburban building.

In the first case, the market value is determined by the purchase and sale agreement and is the result of the agreement of the parties, but this is not enough to obtain a mortgage loan.

It is important for Sberbank to know the liquidation value of the property, that is, the amount for which the property can be quickly sold in an emergency (if the borrower stops making payments on the mortgage loan).

As a rule, this is the loan amount that a purchaser of country real estate can count on.

In the second case, when the client takes out a mortgage loan for construction, the bank offers to issue a mortgage on an existing property:

- apartment,

- house,

- dacha,

- land plot,

- business,

- commercial real estate.

If there is a real estate object acting as collateral, the conditions become more lenient, that is, the tariff offered by the bank is lower than for lending without collateral (under guarantee).

Valuation of suburban real estate for Sberbank mortgage

Sberbank determines the amount of a mortgage loan for suburban real estate as the difference:

- between the market value of the building being sold (if the borrower has one) and the cost of the housing being purchased;

- between the liquidation value of the collateral property and the estimated cost of the housing being built.

In addition, the size and rate of the loan are affected by the size of the down payment. If in the first situation an independent assessment of the object put up for sale is required, then in the second - collateral real estate.

In addition, an independent expert assessment is needed to issue an insurance policy for a property. Such insurance is an integral part of mortgage lending, along with life insurance for the borrower.

The insured amount depends on the estimated value.

Sberbank allows collateral of several real estate objects at the same time.

They can belong to both the borrower and his co-borrowers or relatives who agree to provide their property for collateral.

In this case, it is necessary to evaluate several objects simultaneously. The owner of the collateral property or the borrower of a mortgage loan can be either an individual or a legal entity.

Who can evaluate real estate for Sberbank

An appraisal of suburban real estate for a mortgage with Sberbank can be provided by any independent company registered with the SRO, but preference is given to accredited companies, as they are familiar with all the requirements of this financial organization. Drawing up an appraisal report for Sberbank has a number of significant nuances, so work done by a non-accredited appraiser may be repeatedly returned for revision.

Throughout Russia, Sberbank’s partners are thousands of organizations, a list of which can be found on the official website of this financial organization. Among the organizations in the Moscow region, ours (MEN) is on this list. The fact that it is accredited by Sberbank is a high assessment of its reliability and quality of services provided.

In addition to the case of real estate pledge, the company can evaluate any property for other purposes:

- in case of division of property;

- when registering an inheritance;

- when investing an object in the authorized capital;

- when buying and selling

- and in any other case.

Country real estate appraiser for Sberbank mortgage

On the website of the independent appraiser MEN you can find a list of documents required for valuation for different types of real estate, which can act as collateral:

- for residential real estate;

- land plots;

- country houses;

- commercial real estate;

- apartments for a mortgage from Sberbank;

- apartments for mortgage lending from Sberbank

- and other objects.

Regardless of the type of property, the package of documents includes certificates confirming ownership, a cadastral passport, a land plot plan, certificates of no encumbrance, and permission for individual housing construction.

Valuation of suburban real estate for a mortgage in Sberbank - cost and order conditions

Each section of the site provides the features of the assessment, the procedure for performing the procedure, the cost of the service, and the conditions of the order.

The cost of work depends on the type of property, the duration of the work, its complexity, the characteristics of the object, its area, the number of floors and other characteristics. The average prices at which you can order an appraisal of real estate for a Sberbank mortgage are shown in the table.

The specific conditions of the assessment and its cost are stipulated in the contract. To conclude it, the customer must fill out an application for assessment work.

Calculation of services for assessing countryside real estate for a Sberbank mortgage

Peculiarities of valuation of suburban real estate for Sberbank

Typically, a mortgage is understood as a loan for the purchase of residential real estate, including suburban real estate, secured by it. For Sberbank, an expert appraiser must inspect and photograph the object, after which he analyzes many factors:

- year of construction of the facility;

- wall material;

- type and quality of finish;

- layout;

- object state;

- transport accessibility;

- surrounding infrastructure;

- ecology of the area,

- size and degree of development of the land plot;

- availability of communications;

- proximity to emergency services;

- level of security of the object;

- the cost of analogues on the market for completed transactions;

- water and attractive natural features nearby;

- and other characteristics.

When assessing suburban real estate for a Sberbank mortgage, many factors are analyzed

The expert selects one of the accepted approaches for assessing the property and draws up a report, which he draws up strictly in accordance with Sberbank’s requirements for mortgages and collateral. This document allows the borrower to take out a mortgage loan in the required amount at the optimal interest rate.

Valuation of country real estate differs from the procedure for determining the cost of an apartment in greater complexity, since apartments are built according to standard designs, and country houses can be built according to both standard and original, original designs.

Therefore, it is more difficult to evaluate suburban real estate than city apartments.

A well-founded conclusion requires many years of experience, an analytical mind and high qualifications, which specialists undoubtedly possess.

Source: https://ocenka-men.ru/capabilities/ocenka_dlya_banka/nezvaisimaja_ocenka_dlja_sberbanka/ocenka_nedvizhimosti/zagorodnaja_nedvizhimost_dlya_ipoteki/

It is impossible to raise the price...

There are several reasons that can greatly prevent you from selling your apartment at a “good” price. There are not many of them, but they spoil the price offer very significantly.

- An apartment that has constantly changed hands over the past few years (that is, a frequent change of owner) or its owners have divorced and married several times is considered a very risky purchase on the market. It will be impossible to sell it at the same price as a similar property, which has been owned by one person continuously for a decade.

- The fact that you are selling an apartment that you bought under a power of attorney may reduce the chances of it selling at market price. You will have to sell much cheaper, especially if three years have not passed since the previous transaction - due to the risk of heirs whose existence you could not know, but, nevertheless, they have the legal right to own their part of the inheritance.

- The buyer is also deterred by the fact that minor children are registered in the apartment or are even the owners of the property. In order to sell such real estate, prices must be significantly reduced.

Rent an apartment: the risks can be very high! This depends on many factors, each of which we consider.

Renting an apartment on your own is attractive to many, but are you prepared enough? Read more about this here.

Requirements for real estate appraisers

The apartment is appraised by the company that provides this service or by a private appraiser.

All appraisers are subject to certain requirements:

- insurance for a period of at least one year is required;

- the company or private appraiser must be a member of an association of self-regulatory organizations (SRO);

- availability of a civil liability policy. The insurance policy demonstrates experience and professionalism. In case of an error, the damage caused to the customer is compensated.

Please note that the private appraiser or a representative of the appraiser company and the borrower must not be relatives. This relationship may influence the outcome of the assessment.

Having chosen a company, you need to prepare documents.

The work of an appraiser during an apartment inspection

When leaving for an inspection, the appraiser:

- inspects the housing and verifies the identity of the real plan and the one provided in the BTI documents. If redevelopment is discovered, it will need to be legalized in order to receive a loan;

- take photographs of the room;

- takes into account factors:

- prestige and ecological cleanliness of the area;

- availability of infrastructure nearby (transport stops, schools, trade and cultural centers, etc.);

- area, state of finishing of the apartment, layout, floor and presence of defects;

- building material and number of floors;

- landscaping the yard of a house with an apartment.

Appraiser's report

The report usually contains about 30 pages. It must be laced, numbered, contain the signature of the employee and the seal of the appraiser company.

It can also be submitted electronically with a digital signature of the appraiser.

The report contains:

- information about the appraiser company and the customer itself;

- data on the valuation method;

- information and characteristics of the apartment;

- market and liquid value;

- application.

Report preparation usually takes up to five days. Its validity period is 6 months. It has the status of an official document.

When choosing an appraisal company, it is necessary to clarify the deadline for registration. Most documents submitted to the bank have a limited, short validity period.

Employees of the bank's credit department are primarily interested in an application with attached documents, photographs of the apartment, indicating its cost.

The most important thing is the information in the final part, it contains information about how much the bank will receive by selling the client’s apartment upon termination of the mortgage agreement.

Cost calculation methods

There are three main methods for assessing a residential property:

- Comparative (analog). The basis for the calculations is the analysis of similar real estate located within the same region. The database is narrow, and all the characteristics of the objects being studied coincide as closely as possible with those that were identified for the subject of the transaction.

- Profitable. The probability of an increase in the real value of a residential property in the near future is assessed.

- Expensive. This method is aimed at identifying probable damage (for example, damage after a flood), the elimination of which may require certain costs.

If necessary, the appraiser may use other methods to determine the value of housing.