Everything about the procedure for assessing real estate to secure a secured loan

- dismantling all partitions inside the apartment;

- demolition or partial dismantling of load-bearing walls;

- installation of a “warm floor” system powered by a centralized central heating system;

- placing a kitchen, bath or toilet above neighbors’ living rooms;

- dismantling the wall between the room and the balcony with the installation of a heating radiator powered by a centralized system;

- dismantling ventilation systems or closing fire hatches if available.

Sometimes potential borrowers have a question about why an apartment in a new building needs to be assessed for a mortgage, since the cost of the apartments is determined by the developer. The assessment of a new apartment is carried out after registration of ownership of the object in order to obtain a mortgage. The bank, as a rule, prescribes the need to provide an appraiser’s report at this stage as one of the borrower’s obligations in the loan agreement.

How is the assessment carried out?

To make it easier to obtain a loan, it is worth taking a responsible approach to the issue of assessing the collateral. It is better to order an assessment immediately after preliminary approval of the mortgage so that the remaining documents do not lose relevance.

The step-by-step instructions for conducting the assessment look like this:

- Submitting an application for property assessment.

- Conclusion of an assessment agreement.

- Transfer of necessary papers for real estate.

- An expert’s visit to the site, inspection and photography.

- Drawing up the required report.

- Providing a conclusion to the customer.

Is there a validity period for real estate appraisals and what does the appraisal agreement look like?

- His number.

- Conclusion date.

- Information about all active parties. This is the full name or name of the organization, the full name of the representatives and the basis on which they act (power of attorney, company charter, minutes of the meeting, etc.).

- Number of copies of the assessment report.

- Information about the appraiser(s): full name, name and location of the self-regulatory organization and information about liability insurance.

- At the end of the agreement, the addresses and bank details of the parties-legal organizations are indicated.

- Permitting documentation for construction.

- Project with explanations for it.

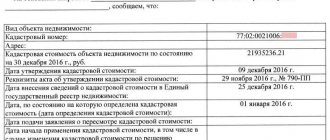

- Extract from the Unified State Register.

- Information about the structural system and the permitted power consumption of resources.

- Cadastral or technical passport. It must indicate the degree of completion of construction and the built-up area.

- If the building is conserved - an act of conservation.

We recommend reading: Tax Deduction When Purchasing an Apartment Deadlines for Submitting an Application

The report and everything in it

Like other documents with legal force, the report is subject to requirements in terms of form and content.

Form requirements:

- written form;

- availability of calculation tables;

- volume up to 30 pages.

Content elements:

- who assessed;

- by what method;

- what documents were studied;

- data on the condition of the object (exterior and internal structure, including the date of repair, redevelopment, etc.);

- market value and/or other value, if specified in the appraisal agreement;

- information about the owners;

- absence or presence of encumbrance of rights.

The conclusion is issued within 2-5 days, depending on how much time the appraiser needs. After which the borrower submits a report with other documents to the bank.

How is an apartment appraised with a mortgage?

- Market approach (a specialist analyzes completed transactions on the market, similar to the one carried out with the selected apartment);

- The cost approach, in the process of which the amount of costs for the construction of similar housing is determined;

- Income approach (the possibility of increasing the market value of the property is taken into account).

According to current legislation, an appraiser from a company or acting individually must insure activities for a period of one year, regularly pay contributions to the compensation fund of a self-regulatory organization, be its member, have a civil liability insurance policy in the amount of 300 thousand rubles or more, and not be related to for those who want to take out a mortgage.

How to choose an appraiser?

When choosing a non-accredited appraisal company, there is a risk that the bank will not accept the appraisal report, so it is better to choose accredited organizations. A list of accredited appraisers can be found on the website of the bank where you plan to take out a mortgage, or you can get it in the office when applying for a loan.

From the list, we select exactly the organization whose price for services is the lowest. All organizations work according to the same scheme and provide the same services, so there is no point in overpaying. Another advantage of contacting an accredited company is that the borrower does not have to check the documents on the basis of which the appraiser carries out his activities. If you contact a non-accredited company, you will have to check the documents, since the bank will not accept a report drawn up by a person who does not have the right to do so.

If the borrower has chosen a company not from the list proposed by the bank, then it will be necessary to agree with him on the candidacy of the appraiser. After all, the credit institution may not be satisfied with this organization.

As a rule, banks have the following requirements for what an appraiser should be:

- Member of one of the institutions that specializes in valuation activities. It, in turn, is in the Unified State Register of Legal Entities (Unified State Register of Legal Entities).

- Has a civil liability insurance policy (in the amount of at least 300 thousand rubles). This eliminates the risk associated with a possible error as a result of the real estate appraisal examination.

- Member of the SRO (self-regulatory organization), which is responsible for all issues related to the activities of appraisers.

Important! It should be noted that in this case, the bank checks the final document – the assessment report – more carefully and for longer and often returns it for revision. Credit institutions trust organizations they already work with more and agree on results faster.

Appraisal of an apartment for Sberbank, Appraisal for DeltaCredit Bank

To take out a mortgage on an apartment, you first need to contact the bank. Sberbank of the Russian Federation often becomes such a bank due to relatively low mortgage lending rates. Many years of experience in the field of appraisal services allows us to state an interesting fact - when people turn to us for an apartment appraisal for a bank, in most cases they mean an apartment appraisal for Sberbank ! Before issuing a mortgage loan, the bank will ask you to assess the market value of the apartment you want to purchase.

However, today there is a more effective option - taking out an apartment on a mortgage. The advantages of this option are obvious - for the same or even slightly less money as if you were renting an apartment, you get ownership of the apartment and pay for your own apartment. And for this you will need, to quote our clients, “a market valuation of the apartment.”

Report validity period

In addition to the above list of documents required for the report on the appraised value of the apartment, the expert must indicate the date of its completion. It is from this date that the calculation of the validity period of reports begins. In general, reports under this procedure are considered valid for six months. Although some banks indicate in their requirements 3-month reports to speed up the processing of documentation accompanying the issuance of a mortgage loan. In some cases, the deadline for reports attached to housing assessments can be extended to one and a half years.

How to estimate the value of an apartment to obtain a mortgage

- For an apartment on the secondary market, these are copies of the state registration certificate of ownership of the object and the cadastral or technical passport with an explanation and floor plan.

- If the housing is still under construction, then instead of a certificate of ownership, a share participation agreement is provided. The client must also provide the appraiser with a copy of his passport.

- Any document of title: registration certificate, purchase and sale agreement or certificate of inheritance.

- Cadastral passport from the territorial BTI.

- If you purchase an apartment in a building under construction, you must provide any agreement with the developer.

We recommend reading: 3 Personal Income Tax When Buying an Apartment with a Mortgage Sample Filling Out

Valuation of real estate for a mortgage and how much it costs

True, value judgments are made taking into account the determination of correction factors. They are calculated based on the difference between various significant indicators of housing: the newness of the house, the size of the living space, the quality of finishing, the distance of the building from significant urban infrastructure, etc. This method is also called the market method.

Based on the value at which the apartment will be assessed, the bank will determine the size of the loan to be issued. If the appraised value is equal to or slightly higher than the price set by the seller, then the mortgage loan will cover all costs of purchasing a new home. But there are often cases when the appraised value is lower than the amount needed to purchase an apartment and, accordingly, the bank cannot provide a loan for an amount in excess of that indicated in the appraisal company’s report. What to do in this case?

Why do you need an apartment appraisal for a mortgage?

- The applicant contacts the bank, and after approval of the mortgage loan, searches for a property - independently or through intermediaries.

- Information about the apartment is submitted to the credit manager for review.

- Next, an assessment is carried out with the help of the selected organization.

- They study the technical and title documentation for the apartment.

- An analysis of the market value of housing with similar parameters is carried out.

- Examine the technical condition of the property; take photos and videos of her. Information about all work can be recorded in an intermediate protocol.

- They are working on drawing up a report, with the signatures of those responsible for the work, and the seal of the organization.

Real estate valuation for mortgage in Sberbank

It is very important to take into account the time factor - how long the appraisal of an apartment for a mortgage in Sberbank is valid. According to legislative norms, the appraiser's report has legal force for 6 months from the date of its signing. After the specified period, a new examination is required.

When applying for a home loan, borrowers are faced with one mandatory requirement from the bank. This is a home appraisal with a mortgage. Sberbank, like all other credit organizations, requires the applicant to carry out a similar procedure. What is it for? Firstly, based on the report and the obtained characteristics of the property, a calculation is made of the funds allocated to the client for its purchase. Secondly, the real cost and liquidity of the housing pledged will be the basis for compensation for future costs. In fact, this is the bank’s insurance in case the borrower fails to fulfill loan obligations and repays the debt on time. And thirdly, sellers often inflate the real cost of housing. And the borrower may simply not have enough borrowed funds for the purchase, since the lender will only issue the amount that corresponds to the liquid value of the property. For this reason, the bank requires monitoring before completing a purchase and sale transaction.

Pros and cons of assessments in accredited companies

Main advantages:

- Reliability. Companies involved in legal proceedings or appraisers with a criminal record will not be included in the Sberbank register.

- Competence. The expert must have the appropriate education, certificate and three years of work experience. Based on these parameters, the bank determines professionals.

- Safety. The experts' activities are insured, therefore, if an error is made in the reporting, all the client's costs associated with this will be compensated.

Among the disadvantages of valuing an apartment for a mortgage at Sberbank, the only thing that can be highlighted is that it is impossible to agree with an employee of the company on inflating the cost of the apartment. Also, the appraiser will not be able to change the report if he discovers illegal redevelopment.