general information

Valuation of an apartment as a service is a determination of the market price of ownership , as well as other proprietary rights to real estate.

This type of activity is regulated by the Federal Law (FL) “On Valuation Activities in the Russian Federation” and the Federal Valuation Standard (FSO) “General Concepts of Valuation, Approaches to Valuation and Requirements for Valuation”.

Agencies specializing in real estate assessment take into account all the features of the apartment they are working on and, to obtain the most objective result, use three main approaches:

- expensive;

- profitable;

- comparative.

The more approaches professionals use, the more accurate the assessment result will be.

Practical aspects in real estate valuation

Among the whole complex of difficulties existing in the appraisal industry today, special attention should be paid to the most critical ones, such as the imperfection of the legislation regulating the industry, which develops the ambiguity of calculations and conclusions made by experts in property appraisal reports, summing up the calculation results to the result expected by the customer, the introduction of the law on the qualification exam Federal Law No. 172-FZ dated June 2, 2016, amendments were made to the Federal Law “On Valuation Activities in the Russian Federation” dated July 28, 1998 No. 135-FZ regarding the requirements for membership in the SROO, market relations in Russia are not sufficiently developed etc.

In this article, analyzing their practical experience of participating in projects for determining the market value of real estate for collateral purposes, in the processes of challenging the cadastral value of real estate, judicial practice, and the sale of real estate in a difficult market, the experts tried to collect practical aspects with the goal of drawing the attention of the professional community and users services of assessment activities on the described issues, try to come to a common opinion and possibly refine the methodologies used in the calculations.

The globalization processes taking place in the country raise the issue of transparency of the market for land plots and other real estate in a completely new perspective, due to objective difficulties, in fact, the market itself and dictated. And the inextricable connection with the land forms the locality of this market, not allowing direct comparison of its various territorial and industry segments. At the same time, the need for comparability of valuation reports is also growing, and the reasons for this growth are not only the development of investment funds, but also the growing mobility of private capital.

Manifestations of these processes include both the need to improve existing assessment standards and methods, and the publication of analytical materials by SRO experts in specialized periodicals, which serves as a basis for appraisers. The need to publish professional judgments of experts is demonstrated by a more detailed consideration of the most important aspects directly in the assessment mechanism itself.

One of the key stages of assessment today is the description of the process object, which allows the appraiser to avoid incorrect calculations and is based on the basic postulates of the current regulations:

• FSO 7 clause 4 “Real estate objects are developed land plots, undeveloped land plots, capital construction projects, as well as parts of land plots and capital construction projects, residential and non-residential premises, together or separately, taking into account the property rights associated with them, if this does not contradict the current legislation, shares in the right to the property.”

• FSO 1 clause 23, the assessment includes the following stages:

• a) concluding an agreement for conducting an assessment, including an assessment assignment;

• b) collection and analysis of information necessary for the assessment;

• c) application of approaches to assessment, including the selection of assessment methods and the implementation of the necessary calculations;

• d) coordination (if necessary) of the results and determination of the final value of the value of the valuation object;

• e) preparation of an assessment report.

Analysis of the quantitative and qualitative characteristics of the property being assessed, including familiarization with the obligatory documentation of the property, such as: title documents for the building and site, BTI documents, purchase and sale agreement and a full package of documents reflecting the current relationship of the owner with the tenants or the presence of encumbrances.

• Description of the assessment object, containing photographic materials of the inspection of the object. Here it is worth touching on in more detail the very purpose of the inspection, which involves not just a visual acquaintance of the seller with the object, but a full identification of the object of evaluation and the determination of its pricing factors.

At the same time, the appraiser should pay the closest attention to those details that are most important for the operation of the property according to its purpose. Thus, in refurbished retail premises, special attention should be paid to the presence of a separate entrance, display windows and storage areas. In office buildings, the availability of parking and transport accessibility will play a big role, and in residential buildings, the condition of the building, its layout and the presence of redevelopment will play a big role.

And of course, regardless of the purpose of the premises, one of the main pricing factors, of course, remains its location.

• Encumbrances, the presence or absence of which on the property being assessed must be reflected in the report, no matter what their nature. Whether it is an easement, the presence of long-term lease agreements, a lien or a mortgage.

Despite the fact that you can check the presence of encumbrances on the Rosreestr portal, where they should be reflected in the “Restrictions” subsection, the best solution for checking would be to order an extract from the Unified State Register of Real Estate. Since the site does not always reflect current data.

However, if the appraiser nevertheless decides to use the site, close attention should be paid to the date of the last changes, and if they were made more than a month ago, the portal information is no longer relevant.

• Market analysis, carried out when assessing real estate in accordance with the requirements of FSO 7 clauses 10-11, and involves determining the price range in which the assessed object is located, the final cost of which should not go beyond a given range.

• Comparative approach, according to the definition of FSO 7, clause 22 “The comparative approach is used to evaluate real estate when it is possible to select a sufficient number of analogue objects with known prices of transactions and (or) proposals for evaluation.”

Based on the definition, the key factor of the approach is the number of analogue objects, the minimum acceptable value for which is three objects, however, in the conditions of an active and developed real estate market, the number of analogue objects increases to 5-7 positions, which significantly increases the relevance of the calculations.

At the same time, the most important component of the selection of analogue objects, of course, is the reliability of the sample, which involves the painstaking work of the appraiser to consider the market as a set of data, select comparison criteria, sort the found items and, in fact, select analogues.

Often, evaluators check a sample for homogeneity using the coefficient of variation - a random variable characterized as a measure of its relative dispersion, showing the proportion of the average value of this value relative to the average dispersion. In a similar way, the relative measure of the dispersion of attribute values in a statistical population is determined. In this case, the values of the coefficient being determined are in the range from 0 to 1, and the closer the value is to 0, the more typical the found average value is for the statistical population being studied, and therefore, the better the quality of the statistical data. The criterion value in this case is a value equal to 1/3.

As a rule, the coefficient of variation is calculated as a percentage and is the ratio of the standard deviation to the arithmetic mean, allowing one to judge the homogeneity of the population, which can take the following values:

• – < 17% – absolutely homogeneous;

• – 17 – 33%% – fairly homogeneous;

• – 35 – 40%% – not sufficiently homogeneous;

• – 40 – 60%% – indicates a large fluctuation of the population

In the process of determining the coefficient of variation, evaluators consider the materials of A.N. to be dogmatic. Fomenko: “How to determine market value based on market data?” / Magazine “Valuation Issues”, No. 2, 2010 and N.P. Barinova and S.V. Griboevsky: “On increasing the reliability of market value assessment using the method of comparative analysis” / Magazine “Valuation Issues”, No. 1, 2002.

However, recently, when checking assessment reports, the opinion is increasingly expressed that the coefficient of variation in itself cannot be a criterion for sample homogeneity, because there is the possibility of selecting as analogues objects that are not such, for example, from different market segments , but with a low variation of adjusted prices, or vice versa - use analogues in a market with high volatility and low liquidity, which will ultimately give a high variation of adjusted prices.

Considering that some experts recognize the homogeneity of the sample when the price of offers/transactions between analogues differs by no more than 20%, and there is no legislative normative or methodological justification for this, the question of the reliability of the selected analogues remains open, and every specialist looks for answers to it in those sources , which are most suitable for him at a given moment in time.

Approximately the same situation occurs in the process of applying adjustments. According to FSO 7, paragraph 22d, “When applying the adjustment method, each analogous object is compared with the object of evaluation according to price-forming factors (elements of comparison), differences between objects in these factors are identified, and the price of the analogous object or its specific indicator is adjusted according to the identified differences in order to further determine value of the subject of assessment. In this case, the adjustment for each element of comparison is based on the principle of the contribution of this element to the cost of the object.”

However, the lack of published opinions of the expert community regarding practical aspects when assessing real estate using a comparative approach often leads to disagreements among valuation specialists and their opponents from various inspection structures.

In particular, such disagreements are most clearly manifested in issues of the permissible maximum value of the overall correction, when the implementation of a comparative approach is impossible using analogs directly located next to the object being evaluated. This is especially true for undeveloped markets, when there are no more than 2-3 analogues throughout the region, and instead of introducing 100% adjustments, perhaps you should find analogues in similar regions. Another example of such disagreement can be the assessment of a land plot with improvements, when, using a comparative approach, it is assessed as undeveloped, giving rise to a simple question: do the communications relate to the improvement of the land plot or to the public buildings on this site?

True, there are well-established consensus opinions in the appraisal community regarding some pricing factors, for example, when assessing large industrial and warehouse complexes, the location factor when choosing analogue objects is not the main one, and preference is given to analogues most comparable to the object being valued in terms of total area , taking into account the availability of land and the availability of office space. The assessment of office premises gives priority to the factors of having an entrance from the facade; retail objects significantly benefit in value if they are located in “first line” buildings, although with the clarification that the presence of access only “to the courtyard” does not include them in this category.

Experts also agree on some criteria for evaluating apartments, taking into account in the process the discount in relation to analogues in the event that the house is subject to demolition. Moreover, in such a situation, objects located in similar buildings should be selected as analogues - from the list “for demolition”. In this case, the discount value should take into account the psychological factor of the unknown, the amount of costs for

inseparable improvements and relocation.

• Income approach, according to FSO 7 clause 23, within the framework of the income approach, the value of real estate can be determined by the direct capitalization method, the discounted cash flow method or the capitalization method using calculation models.

When applying such an approach, a key factor is also compliance with the rules for selecting analogue objects, the main one of which is the statement that when calculating the rental rate, the object of assessment and analogous objects must be comparable in terms of their rentable area.

In this case, the leasable area of the assessment object should be determined based on a visual inspection, since technical documentation may not be relevant on the date of assessment, the register of tenants, indicating the area occupied by tenants and the list of potentially suitable premises for rent, explication, floor plan and determination of leasable area .

Particular attention should be paid to determining the rental rate of objects, which involves an analysis of existing rental agreements for premises, taking into account the current rental rate. And if the rate under the contract is a market rate, then it is advisable to use the actual rental rate, but if it does not correspond to that, pay attention to the possibility of annual changes and the conditions for terminating the contract.

The possibility of an annual change or “simple” termination of the contract, without sanctions, will allow the appraiser not to take this contract into account as an encumbrance and calculate the RTI at market rental rates. Otherwise, the PVD will be calculated based on current rental rates in accordance with existing agreements.

Another important factor, of course, is the determination of underutilization, during which, first of all, it is necessary to focus on the data of the tenant register, and, if possible, also analyze this register for the last 3 years before the assessment date, which will allow using the actual indicator of underutilization of the assessed object . However, such a possibility is not always present, and if it is impossible to conduct a long-term analysis, it is worth using reference data. In particular, those published in reviews on commercial real estate.

Factors such as operating payments and the capitalization rate are also required to be considered, which, like the previous factor of underutilization, should not only be assessed, but also verified with reference data using the materials of the SRD, SDK or the real estate appraiser's reference book, popular among appraisers, edited by L.A. Leifer.

Regarding capitalization rates separately, experts often recommend using the cumulative construction method for low-class properties, without using the market extraction method.

However, it should be noted that the ranges of capitalization rates published in analytical publications refer to high-quality, high-quality commercial real estate.

• VAT, the issue of including it in the final market value always remains open. According to the recommendations of experts, the final cost must necessarily reflect this tax, even without taking into account the taxation of the owner.

During the period 2020 – 2020 The appraisal industry has accumulated vast experience and prepared a large number of both appraisal reports and examinations of these reports. However, there is a need to develop a unified policy in the approach to the collection and analysis of market information, ensuring the work of appraisers and other experts, as well as all market participants, with reliable data. And the main criterion of this unified policy should be the recognition by appraisers and experts of different levels of a common understanding of the concept of “market value”.

Open questions leading to significant disagreements dictate the need for practical and educational materials, with expert opinions contained in them, the use of which would be recognized by SRO experts, forensic experts and experts from credit institutions, which would not only provide appraisers with significant assistance in preparing reports about assessment, but would also structure their interaction both among themselves and with various inspection bodies.

Appraisers

LLC "AVERTA GROUP"

Denisyuk E.E.

Sharov A.A.

When it is necessary?

Most often, an apartment may need to be appraised in the following situations:

- if the apartment is planned to be used as collateral;

- if the owner is going to sell the apartment;

- if there is a resolution of certain property disputes;

- to enter into inheritance ;

- when declaring property;

- to sign an insurance contract .

In addition, an assessment may be required if it is necessary to assess the damage caused to the apartment (for example, if you were flooded by your neighbors ) in order to obtain compensation through a claim in court. This procedure will also be required when dividing property.

Since the procedure for appraising an apartment is very complicated and requires a certain level of knowledge and qualifications, you should not try to do it yourself . A more reasonable and correct decision would be to turn to professional appraisers . This will allow you to find out the real cost of housing.

Who has the right to conduct an assessment?

Determination of the cost of square meters is carried out by accredited appraisal organizations in the country.

The most famous and trustworthy include:

- Atlant Score.

- Grand Real. A special feature of the company is that specialists also provide legal services (challenging the value, division in a divorce situation, litigation, etc.).

- Expert 365.

- Uphill.

- ABC-Active business consultations. Works in the business field, especially highlighting foreign companies conducting commercial activities in our country.

In a situation where you are interested in the cadastral value, you should contact the Technical Inventory Center.

Methods

Valuation of an apartment includes the following procedures:

- assessment of the market value of apartments;

- assessment of the cadastral value of apartments;

- estimates of the cost of apartments by independent experts.

Market

The procedure for assessing the market value of an apartment is in many ways similar to the assessment of any other estate . It is produced in accordance with certain standards that have been developed by the Society of Appraisers in close cooperation with international unions.

A variety of factors . First of all, we are talking about such significant points as:

- apartment location;

- condition of the residential building;

- functional characteristics of the apartment.

It is no secret that every locality has its own popular and unpopular areas. And the fact in which specific area the apartment is located largely depends on its market value .

Accordingly, real estate in elite areas will be valued much higher than real estate in remote industrial areas.

It also matters whether there is a forest and park area or a body of water near the house The appraiser will also be interested in the following points:

- distance from metro and bus stops;

- when was the last time a major renovation of the house was carried out;

- what material are the walls and ceilings of the house made of?

- in what year the house was put into operation;

- number of floors of the house.

No less attention will be paid to the condition of the apartment .

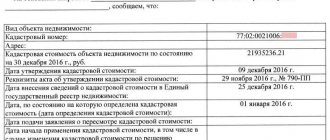

Cadastral

The assessment of the cadastral value of an apartment is carried out in several stages.

Stage 1

A factor analysis is carried out to identify the main pricing factors. Among the main factors that are taken into account when conducting a cadastral valuation are:

- level of development of transport infrastructure;

- level of development of production infrastructure;

- level of development of engineering infrastructure;

- state of the environment;

- engineering and geological conditions;

- the historical or architectural value of the development in which the apartment is located.

Stage 2

Clusters are identified on the territory of a constituent entity of the Russian Federation, according to which test objects . And based on the selected test object, the analytical relationship between the transaction prices for apartments and the main pricing factors is determined.

Stage 3

Taking into account the test objects of the cluster, the final calculation of the specific indicators of the cadastral value of the apartment is made. And, accordingly, a cadastral valuation is carried out.

Assessment by independent experts

An independent examination of the cost of an apartment has recently been in high demand .

It may be required in cases where the owner does not agree with the assessment results that were previously made.

It will be useful to carry out this procedure in case of damage to the apartment and in a number of other situations .

The certificate, which is issued by the appraiser upon completion of the work, is an official document . It can be legitimately used in court.

Appraising an apartment for a mortgage: what the appraiser will pay attention to

What is an apartment appraisal for a mortgage and what are its specifics? It is carried out according to the rules, as for a mortgage loan. But there are peculiarities in the selection of initial information. Considering that housing under construction is used as collateral, data from the primary real estate market is used for a comparative approach and justification of the results. In contrast to the traditional mortgage of an apartment, where information support is based on transactions in the secondary housing market.

In accordance with the established procedure, the expert inspects the property being assessed, stating the advantages of the location, location in a residential building, and layout. Such an assessment requires the appraiser’s attention to the technical condition: the readiness of the housing for use, the finishing done and other improvements are taken into account.

Sometimes, at the request of the bank, in addition to the market value, a calculation of the liquidation value is carried out. The indicator reflects the amount of money that can be obtained with a shortened period of sale of the collateral. The liquidation value is calculated with an estimated discount to the market value. The validity period of the mortgage report is six months from the date of assessment.

In what cases is recalculation made?

Since the market value is understood as the value at which the buyer acquires ownership of the property, there are situations in which it is necessary to recalculate the market value more relevant information

For example, this procedure will be required if significant changes . The construction of a new transport interchange, new shopping centers, etc. can significantly affect the market value of housing.

A recalculation of the assessment will also be required if a significant amount of time .

Considering the changes in the real estate market and the deterioration of the building in which the apartments are located, it is unlikely that the cost of the apartment has remained at the same level.

Nuances of the procedure: in detail

What is an apartment appraisal for a mortgage? Let’s get to the bottom of it. The methods strictly determine the content of the report, from which the expert expert has no right to deviate. For this purpose, evaluation approaches are used: comparative, income or cost. The report contains:

- expert appraiser's opinion on the value,

- presentation of the theory and methodology of assessment procedures,

- identification of the object and analysis of pricing determinants for a specific apartment,

- the calculation part, in which the result is justified, is checked for compliance with market data.

How is an apartment assessed for a mortgage? The standards used by appraisers require the use of at least two approaches, for which the contractor carefully selects information. Assessing an apartment for a mortgage means correctly applying the results approval procedure. The results obtained from the approaches are compared, and the initial information is analyzed. The main one remains comparative, based on information about completed or planned purchase and sale transactions presented by the traditional, competitive market. The opinions of the expert and users of the report on this issue are unanimous.

An integral part of the report is reliable annexes, which include:

- copies of permitting documents of the expert performer,

- documentary evidence of rights to residential real estate in the form of copies,

- inspection and photographic data, demonstration of the advantages or defects of the object,

- confirmation of sources of information about offer prices or transactions for apartments,

- analytical data: dynamics graphs, cost distribution by zones, city districts.

The main component of the report is the conclusion about the market value. This is the final part, containing the value that the lender will subsequently use when determining the loan amount. If the agreement is subject to notarization, the state duty is determined based on the estimated value and the notary's services are calculated.

Special cases

Share valuation

Valuing a share in an apartment is a rather difficult task even for professionals. There are two main assessment methods:

- If a specific residential premises is identified, which belongs to the owner, then the assessment is made of the specific premises taken. This is a simpler option.

- In some cases, the owner's share in the apartment is determined as a percentage. In this situation, the apartment as a whole is assessed, and the value of the share that is subject to the assessment procedure is allocated from the total amount.

What do we provide to provide services?

What documents will be required to evaluate an apartment for a mortgage? We list the contents of the required package:

- passport, TIN code of the owner or a person acting on his behalf,

- document confirming the right to housing,

- technical passport (cadastral),

- a notarized power of attorney giving the right to represent the owner, including for valuation issues.

Originals and personally certified copies are submitted. After identifying the rights and checking the copies with the original copies, the latter are returned to the customer. It is not allowed to accept documents from a third party without a power of attorney.

Assessment procedure

The stages of assessment do not depend on the goals and the subject being assessed. It does not matter whether the assessment is ordered by a party to the litigation or whether it is carried out by virtue of a court ruling - only the grounds for the assessment will differ. Otherwise, the general procedure for assessment activities is identical and consists of 5 stages:

- Receiving an assignment from the customer, interviewing, determining the purposes of the assessment, establishing property rights and the date on which the assessment is carried out.

- Concluding an agreement and drawing up an assessment plan: agreeing on sources of information, assessment methods, calculating costs and discussing the cost of appraiser services.

- Collection and analysis of information for assessment: analysis of title documents, information about encumbrances, study of technical and operational information, qualitative and quantitative characteristics, inspection of the object and study of its features. According to the law, it is permissible to evaluate real estate for the court without visiting the site.

- Analysis of the information received, application of valuation methods and calculation of the final cost.

- Preparation of an assessment report: entering into it data on the methods used, the information used, the sources of its receipt, the appraiser’s conclusions.

We suggest you read: Is it possible to change your license in another city without registration?