What is the difference between differentiated and annuity payments

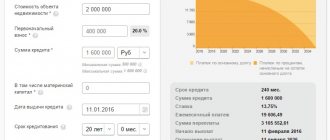

The graphical diagrams show that over time, loans from Sberbank are repaid in different ways. If this is an annuity loan, then in the first months the borrowed amount is practically not repaid. A large share of the funds goes to the bank's profit. Differentiation assumes that from the first payment more funds are used to repay the debt, and a small part is charged as interest.

Everything is designed to ensure that during the repayment period the monthly payments are the same. This is convenient for Sberbank borrowers. There is no need to constantly clarify the amount. Users of their personal account set up automatic payment and never forget that it’s time to pay. A differentiated system works differently:

- In the first payment, the borrower pays part of the body of the differentiated loan. It remains constant throughout the loan period, but the interest in the first month is high.

- Over time, the body's share remains the same until the last payment. When closing contractual obligations, the borrower pays a minimum of interest, and the total payment amount is insignificant.

Sberbank recommends the annuity method by default. Differentiated credit is not available to everyone. Income is assessed and must be sufficient to pay large payments in the first 6-12 months.

You will have to prove that your income is stable. There is no point in hoping that relatives will become guarantors. Sberbank is extremely reluctant to take this factor into account when issuing approval. But if the salary is decent, stable, regular, a differentiated loan is issued without problems. But what to do if the agreement has already been signed, a differentiated loan has been received, and the conditions are annuity, but I would like it to be the other way around?

Calculation of monthly payments using a differentiated system

So, first, it’s worth answering the question of what a differentiated mortgage payment is. Currently, banks offer two systems for calculating monthly payments - annuity and differentiated. What an annuity system is probably familiar to everyone is when the amount of the monthly payment is equal, that is, each period you need to contribute the same amount to pay off the loan. When it comes to a differentiated payment system, the monthly payment amount will decrease with each payment transfer.

In simple terms, what a differentiated payment is, we can explain it this way: the entire amount of the principal debt is divided by the number of periods; accordingly, the monthly payment will invariably include the amount of the principal debt. The other part of the payment is the interest, which will be calculated not on the loan body, but on the balance of the principal debt.

In fact, a mortgage under a differentiated system is no different from an annuity; when repaying a loan early, the client reduces the amount of the principal debt, which means he can also choose either to reduce the amount of the monthly payment or to shorten the loan term. But if you take the advice of experts, it is best to shorten the term, since when the amount of the principal debt is reduced, the interest accrued monthly will be lower, and, therefore, the amount of the monthly payment is automatically reduced.

Please note that banks rarely use a differentiated system when calculating loans and mortgages. First of all, this is unprofitable for the lender because in the end the overpayment will be less, and with the annuity system the client initially pays bank profit, and at the end of the loan period the amount of the principal debt.

Which payment method is better?

If we compare two loan repayment schemes, borrowers tend to choose the differentiated one because they see the following advantages in it:

- Saving money. If we take two schedules calculated for the same amount and repayment terms, then a differentiated loan from Sberbank is cheaper for the client. When the interest rate is identical, commissions and other fees are the same, the difference is significant. The longer the repayment period, the more noticeable it is.

- Ability to plan your personal budget. The main borrowers who are satisfied with differentiated loans are middle-aged people when it comes to mortgages. It is easy to calculate that by the time you retire, payments will become insignificant, and the apartment will be ready for renovation, as liquid funds will appear.

- Benefit on early repayment. Every month the amount required to fully close the differentiated loan decreases. Interest takes up a smaller share and is easier to repay. By deciding to repay a differentiated Sberbank loan ahead of schedule, the borrower collects a smaller amount than when repaying an annuity loan, which makes this opportunity accessible.

- Simplicity of calculations. You can always see exactly what the money is being paid for. In some cases, there are different accounts: credit and interest. The amounts in the chart are located in different columns. The receipts are separate, and at any time you can calculate how much money goes to repay the body of the differentiated loan, and how much goes to pay interest.

- Saving on insurance. The policy is issued for 12 months. Insurance premiums are calculated depending on the balance of the differentiated loan. At Sberbank, with a differentiated credit scheme, after this period the amount will decrease, and you will have to pay less than with the usual debt repayment system.

Regarding the differences in the amount of overpayment, it should be noted that if the loan is repaid halfway through the term, then with a regular loan ¾ of the amount is paid due to high interest. A differentiated schedule involves contributing 50% instead of 75%, and this is significant for the family budget.

When choosing between loan types, you need to be guided by more than just this. Make sure that Sberbank provides this opportunity. Check again whether you have enough money for the first months, the most difficult ones. Calculate how much money will actually remain, whether it will be enough for a normal life. Consider the need to leave funds in case of illness of family members. Weigh the pros and cons.

Conclusion

In conclusion, it is important to highlight the main points of the article:

- with an annuity payment system, the tranches are not large and fixed in time, but the total amount of overpayment is greater than with a differentiated one;

- there is only one advantage of annuity payments - the initial payments are lower than those of differentiated ones;

- in case of early repayment, it is more profitable to use a differentiated payment, since if the loan body decreases, then the amount of interest on it will be less;

- early repayment of debt with annuity will occur over a longer period of time in equal shares;

- For the institution providing the loan, the annuity system is more profitable, and for the borrower, the differentiated one, and also, the longer the loan term under the annuity system, the greater the overpayment.

Thus, if you need a loan, you can choose from two loan payment systems the one that is suitable for you according to its conditions.

Underwater rocks

There may be pitfalls in a mortgage:

- Banks may include clauses in the agreement that are extremely disadvantageous to borrowers.

- The ability to unilaterally change the mortgage interest rate leads to the fact that if it increases, the payment amount increases.

- The agreement may set a minimum threshold for the amount of money for early repayment. If the amount is significant, then it will be very difficult to accumulate it.

- There may be fees for early repayment of the loan or additional documents.

Important! The real estate is the subject of collateral under a mortgage agreement. If it is damaged or lost, for example by fire, the bank has the right to demand another collateral from the borrower or early repayment of the mortgage. . The benefits of credit institutions and their clients do not always coincide

There is no clear answer to the question of which payment scheme is more profitable. You should always weigh the pros and cons of payment schemes against your priorities, desires and capabilities.

The benefits of credit institutions and their clients do not always coincide. There is no clear answer to the question of which payment scheme is more profitable. You should always weigh the pros and cons of payment schemes against your priorities, desires and capabilities.

Didn't find the answer to your question? Find out,

Annuity payment and differentiated: the difference

Financial experts agree that if the borrower expects to pay off the loan in a short period of time (up to five years), then it is better to give preference to an annuity. However, there is controversy regarding medium- and long-term loans.

Does Vostochny Bank check your credit history?

For example, if a borrower takes out a long-term loan, say $100,000 for 10 years with an interest rate on the loan of 10%!g (MISSING)annual, then a differentiated payment is more profitable, and significantly. In our conditional example, the interest payment for ten years with differentiated payments will be $50,416.67, and with annuity payments - $58,580.88. Accordingly, the overpayment under the differentiated scheme will be less: by $8,447.53.

But let’s not forget that the example is conditional, and in practice everything does not look so simple. A number of banking experts do not hide that the idea of a significant financial advantage of differentiated payments is largely a marketing myth. The bank will never miss its profit. It is only important for him to convince the borrower that he can really save by choosing one or another payment plan.

“Credits.ru” note: the main thing you need to understand is that the method of calculating interest for both forms of payments is the same. In both cases, interest is calculated on the remaining balance of the debt.

Mortgage with differentiated payments

This repayment scheme is somewhat more complicated than the previous one.

In practice, the monthly payment under a differentiated scheme consists of two components:

- fixed loan body size,

- interest calculated based on the length of the month and the amount of remaining debt.

Each month the amount of the monthly contribution will be different, for example, the payment for February will be less than the payment for the following March, although the amount owed will decrease slightly. This is due to the fact that February simply has fewer days. The differentiated mortgage repayment scheme has a number of features, in particular:

- the monthly payment at the initial stage will be quite large, therefore the borrower choosing such a scheme must have a good level of income,

- by the end of the loan term, the amount of interest on the loan decreases and the monthly payment itself becomes smaller,

- the total overpayment on such a loan will be noticeably lower than in the case of annuity payments.

Calculation of differentiated payment

The size of the differentiated tranche can be calculated independently using the following formula:

DP = OK * PS / 12 + EP

where OK is the balance of the principal debt;

PS - annual % rate;

EP - monthly payment.

.

The second term in this formula is decisive and changes monthly. These funds finance interest on the loan. The balance of the principal debt is multiplied with the interest rate and divided by 100*12. This will convert the result to a monthly percentage.

Types of planned mortgage payments

According to the lending conditions, banks are ready to offer an annuity or differentiated method of repaying housing loans.

Depending on the chosen method, the size of the monthly payment and the speed of interest repayment will vary.

Annuity payment

This is the most common type of mortgage repayment, for example, at Sberbank. It comes down to depositing an equal amount every month. In this case, initially, mainly the interest on the loan is repaid, and then the principal debt. The longer the client takes to make payments, the more funds are spent on paying off the principal debt on the mortgage.

The main advantages of this method are as follows:

- Equal monthly payment for the entire loan term.

- Possibility of repaying the principal debt by making partial early repayment.

- The ability to predict your solvency over a long period.

However, you must understand that it is the interest that is initially repaid. Therefore, at the initial stage, it is especially beneficial for the client to make payments ahead of schedule to reduce the amount of the principal debt.

Differentiated payment

This type of payment comes down to the fact that each month you will need to pay a different amount

Therefore, it is important to study the repayment schedule so as not to fall behind. Its main advantages are as follows:

- More prompt repayment of the principal debt.

- Every month the amount required to pay will decrease.

- Significant savings on interest payments.

Here you need to know that initially the monthly payment amount will be overestimated. It will be 20%-30% higher than with an annuity payment.

This type of repayment is most attractive to people with high incomes who are confident that they can easily make payments according to the repayment schedule. If there is a risk of being unable to make the first payments according to schedule, it is worth abandoning this repayment method in favor of an annuity.

What are the types of mortgage payments? What are their differences?

Most Russian banks today offer credit programs to individuals that provide for a type of mortgage payment in equal installments (annuity payment).

One of the main advantages of this method is its ease of use:

- The borrower repays the same amount every month.

Annuity payment

Despite the fact that the payment amount remains unchanged throughout the entire period, its structure changes - in the first months, most of the payments are used to repay interest on the loan (in the first years, the payment consists of approximately 80% interest), and at the end of the term - to repay principal debt.

Those. The annuity system (scheme) of payments for early repayment is not so profitable.

To calculate the payment, you need to know the borrowing period, the rate and the annuity coefficient (a derivative of the number of periods for which the payment is made and the loan rate). The formula for calculating the annuity payment on a mortgage is as follows:

- Annuity amount = annuity coefficient * monthly payment amount.

There are several ways to calculate the coefficient. The most commonly used formula is: KA=(j*(1+j)m) / ( (1+j)m– 1 ) , where KA is the annuity payment coefficient, j is the loan rate, m is the number of payment periods. Banks use the following formula for calculation: Аn = Sk * (j / (1 – (1+j)-m)) , where Sk is the total amount of the loan.

Differentiated payment

However, in addition to annuity, there is another repayment method that many borrowers do not know about - differentiated payment. Its feature is a gradual reduction in payments.

This happens because, with a constant amount of payments on the principal debt, the amount of interest that accrues on the balance of the principal debt becomes less with each repayment.

Calculation of the amount to be repaid for differentiated payment is carried out in two stages:

- First we determine the amount of the main payment. To do this, divide the initial loan amount (the one specified in the loan agreement) by the loan term (in months). The resulting figure will be the amount that the borrower needs to repay. The calculation formula itself looks like this: b=S/N, where b is the principal payment, S is the loan amount, N is the number of months;

- After that we calculate the interest. You can calculate the accrued interest by multiplying the loan balance for the period by the annual interest rate, after which we divide the result by 12 (the number of months in a year). Thus, the differentiated interest rate is: P = Sn * P / 12, where p is the accrued interest, Sn is the loan debt for the period, P is the annual loan rate.

To calculate the debt balance for a period, i.e. To find the value from the above formula, you should multiply the amount of the main payment by the number of past periods and subtract all this from the total payment amount. The calculation is carried out using the following formula:

- Sn = S - (b * n), where n is the number of elapsed periods.

The frequency of debt repayment with a differentiated type of payment can be different (once a month, once a quarter, etc.), but the most common is the monthly schedule.

A differentiated loan repayment schedule has one significant drawback - the amount to be repaid changes each time. This needs to be remembered.

There is one more nuance that those wishing to apply for a loan need to know about - because. The amount to be repaid in the first months is higher, and the bank also imposes higher requirements on the client’s solvency. In addition, with the same income of the borrower, the estimated loan amount for an annuity will also be greater.

Which banks issue (offer) mortgages with differentiated payments in 2020

There are traditionally few banks that offer mortgages with differentiated payments in 2020. Of the largest, at the moment you can get such a mortgage at Gazprombank and Rosselkhozbank.

Read on the topic: How to refinance a loan received from another bank

You can view the current terms and conditions of the mortgage programs of these institutions here:

| Bank | % bid | Maximum loan term, months. | Minimum down payment | Program name |

| Rosselkhozbank | 9,05% | 360 | 0% | Refinancing |

| 6% | 360 | 15% | Offers from developers | |

| 9,2% | 360 | 15% | Mortgage housing lending | |

| 9,2% | 360 | 0% | Target mortgage | |

| 10,75% | 288 | 10% | Military mortgage | |

| Gazprombank | 9,5% | 360 | 10% | Buying apartments (SPECIAL) |

| 9,5% | 300 | 20% | Military mortgage | |

| 9,5% | 360 | 0% | Refinancing | |

| 10% | 360 | 0% | Apartment in a building from Gazprombank-Invest | |

| 10,5% | 360 | 10% | Secondary market | |

| 10,5% | 120 | 30% | Garages and parking spaces | |

| 10,5% | 360 | 10% | Primary market | |

| 11% | 360 | 20% | Buying a cottage with a plot | |

| 11% | 360 | 20% | Buying a townhouse | |

| 9,5% | 360 | 15% | Mortgage on preferential terms | |

| 9,3% | 30 years | 10% | Purchasing apartments on the primary market and apartments |

As part of the loan products of Rosselkhozbank and Gazprombank, clients have the opportunity to choose a mortgage repayment scheme (annuity or differentiated).

In addition, financial institutions provide special lending conditions for young families, including the possibility of using maternity capital.

When analyzing the conditions of mortgage programs, it is difficult to ignore the largest banks. The selection of annuity and differentiated loans at Sberbank is not traditionally presented to its clients - the bank still works only with an annuity repayment scheme. The structure of mortgage payments at VTB 24 also does not provide for differentiated payments.

Which payments are more profitable for a borrower to pay a mortgage?

Since most borrowers repay their mortgages ahead of schedule, differentiated payments are considered to be the most profitable repayment method. At the same time, if repayment is planned to be made in the first five years of the loan, calculations should be made that will confirm the real benefit for the client.

For example, having taken out a mortgage in the amount of 2 million rubles. for 10 years at 14% per annum when repaid in equal installments (annuity method), the borrower will pay 1.7264 million rubles for the entire loan period, and with a decreasing payment schedule (differentiated method) – 1.4117 million rubles. As can be seen from this example, the benefit in the second case will be about 300 thousand rubles.

However, it is also not worth focusing only on estimated figures - the maximum loan amount for loans whose repayment scheme provides for an annuity will be greater than when using a differentiated payment.

The real savings when choosing a differentiated payment will be if early repayment is not planned.

Is it possible to change the annuity payment to a differentiated one?

Many borrowers who want to switch from an annuity payment method to a differentiated one encounter misunderstandings on the part of bank personnel.

This is due to the fact that such a request contradicts the very terms of the contract, which indicate how the borrower needs to repay the loan.

To change the essential terms of the contract, it is necessary to renegotiate the contract itself. Those. carry out refinancing. It is worth noting that refinancing a mortgage with differentiated payments in favor of an annuity is especially interesting if reducing the loan burden is important to the borrower. https://ipoteka.finance

Annuity and differentiated payments: what are they and what are they, their pros and cons

When choosing a particular payment system, it is necessary to understand that the choice will have a significant impact on the final cost of the mortgage.

It is important to have a clear understanding of how much you will ultimately have to pay on the loan, what an annuity payment and a differentiated payment are, and what the difference is between them. . Let's try to figure out what the advantages and disadvantages of each are.

Let's try to figure out what the advantages and disadvantages of each are.

Annuity system

This system itself assumes that mortgage payments will be made evenly, at specified periods, throughout the entire period required for calculation.

If the borrower pays 25 thousand rubles for the first month, then in subsequent months until the end of the term the payment amount will be similar.

Many people really like this stability in payments. However, few people understand that such a formula does not always lead to absolute benefit for the person who took out the mortgage.

The calculation of annuity payments involves the difference in the ratio of accrued interest on the repaid service of the principal debt and the interest that the bank receives for the entire repayment period of the loan.

In fact, if the loan interest itself is included in the payments during the initial period of the mortgage, then the total debt will be repaid only to a small extent. In fact, this occurs before the halfway point of the mortgage term.

After the so-called middle of the period of use occurs, the main part of the total debt begins to be repaid.

Useful video:

https://www.youtube.com/embed/MOsIbIKqZHM?rel=0 It is necessary to understand why this happens. The fact is that the annuity scheme assumes that at first only interest is paid for using the loan, and payments are made for the entire period.

After paying off the interest, the borrower begins to pay the principal amount. Banks receive their benefits in advance, without waiting for the mortgage to expire.

If you try to pay off your mortgage ahead of schedule, for example, after two and a half years out of the five that were originally agreed upon, you may encounter the following problem: it may turn out that only 20-25% of payments were made for the period passed.

Thus, the negative aspects of annuity payments include:

- Inability to repay the full term in advance;

- Initial payments are a payment to the bank for using a mortgage.

This schedule also has positive aspects. For example, a person with a stable salary will be much more comfortable paying the same amount every month.

In short, the advantages of annuity payments include:

- Possibility of equal payments stretched over the entire period;

- The ability to calculate your own strength for several years;

- Reducing the burden on the borrower to make payments;

- The ability to count on receiving a larger loan amount.

Formulas for annuity and differentiated payment

When becoming a borrower of funds under a loan agreement, a citizen is faced with terms that are not entirely clear to him, such as annuity or differentiated payment regarding monthly contributions.

Each of these two types of regular settlements with a credit institution has its own characteristic features, which ultimately determine the advantages and disadvantages of a particular loan for the borrower.

What is an annuity payment

With the chosen annuity type, the settlement between the bank, which insures its activities as much as possible, and the citizen is based on completely equal monthly amounts paid. Moreover, the structure of such regular payments undergoes changes every month.

Reading on the topic: Mortgage to build a new house

At the initial stage, loan payments are distributed as follows:

- the size of the loan body is minimal;

- the amount of interest for using borrowed funds is maximum.

Gradually, the loan body will decrease, which will entail a corresponding decrease in the volume of interest charges.

Thus, by the final stage of loan obligations, the ratio of payments in the structure of monthly contributions will change significantly:

- the size of the part of the debt body will become maximum according to its balance;

- the amount of interest for using borrowed funds will become minimal.

The annuity type of payment is suitable for persons with a fixed regular income. However, the volume of overpayments will be higher than with the differentiated method.

The main difference between annuity and differentiated payments is that the debtor in the first case first pays interest on the loan, and then, gradually, with a decrease in the share of the interest burden, the volume of the repaid debt increases.

In the differentiated type, the citizen constantly pays equal shares of the loan body, so the debt to the creditor decreases much faster over the same period of payments.

Annuity payment formula

The basic formula provided for the annuity type of payment, which is used by all credit organizations that calculate interest on annuity contributions, will allow you to calculate in advance the benefits of its use:

In these calculations, the following abbreviated symbols are used:

- AP – the amount of the monthly annuity contribution;

- SC – loan size;

- PS – fixed interest rate on the obligation;

- KP – the number of months constituting the entire period of repayment of obligations.

A clear example of calculating an annuity payment can be seen on websites dedicated to loans and banking operations.

Annuity payment schedule

Any schedule of annuity payments is obtained by applying a calculation formula. In this schedule, the amount of monthly payments will remain unchanged throughout the loan period, but the ratio between the monthly part of the loan body and interest will undergo changes.

Periodic changes affecting the principal debt and interest charges will be of the following nature:

- at the beginning, interest will be greater than the share of the principal debt;

- By the end of the obligation, the share of interest in relation to the balance of the principal debt will decrease.

What to prefer in case of partial early repayment: changing the amount of the annuity payment or the term?

Citizens who have signed a loan agreement with a bank are wondering whether early repayment makes sense, or is it better to pay the annuity contribution in equal amounts as originally expected?

Of course, if the possibility of early repayment - partial or full - is available, then it is better to take advantage of it!

With a large amount of principal debt and a long lending period, the amount of overpayments can reach 200% for the entire period!

If the borrower has decided on partial early repayment, it is better to choose the latter when choosing a change in the amount of the annuity payment or the term. The fact is that the longer the lending period under this payment system, the greater the overpayment of interest.

What is differentiated payment

Previously, differentiated payments made up the absolute majority.

So what does differentiated payment mean in payment for a reimbursable cash loan? With this type of monthly payments, the entire volume of borrowed funds, the so-called “debt body,” is divided into equal parts calculated for the entire loan period.

In this case, interest for using the loan is calculated monthly based on the total amount of debt remaining during the interest calculation period.

Thus, it turns out that the greatest financial burden falls on the first months of debt obligations, since it is at the initial stage of lending that the size of the debt is maximum, and interest is calculated directly from its value.

Further, with a consistent decrease in the amount of debt on the loan, the interest on its use will be less and less, and by the final stage it will be reduced to zero.

It is important to know! Differential mortgage payments are more convenient for those who plan to pay off their mortgage early; in this case, the overpayment for using a loan to purchase a home will be less than with the annuity payment method.

Such a payment also has its significant drawbacks in the form of a huge financial burden in the first months with a large loan amount.

In addition, you will have to monitor the changing payment schedule monthly in order to provide the required amount for the next installment.

To determine whether this type of calculation is suitable, you need to calculate the financial burden in advance.

Differential payment formula

The standard differentiated payment formula, which forms the basis of all online calculators and which is used by specialists from financial institutions, is quite simple (unlike the annuity method):

- NP = OK*(PS/12)

The following symbols are used in the calculation of differentiated payments:

- NP – interest accrued during a specific payment period;

- OK – loan balance for a specific billing period;

- PS – interest rate for using a loan.

Differentiated payment schedule

Unlike an annuity, a differentiated payment schedule will vary monthly in its payment amount:

- from the highest number at the starting point of lending, to zero at the end of the debt obligations.

There will be only two values in this graph:

- Constant – equal share of the loan body;

- variable, decreasing - the amount of calculated interest for using the total amount of debt for each specific billing month.

Annuity payment and differentiated difference

The main difference between annuity and differentiated payments consists of two significant points:

- the amount of the monthly contribution - for the annuity type it is the same throughout the entire credit period, but for a differentiated type it varies, from the maximum at the beginning to the smallest possible at the end;

- in terms of the amount of overpayments for the use of credit funds - with a differentiated type, the volume of overpayments is less than with an annuity type.

It is necessary to use the formulas for calculating annuity and differentiated calculations in order to decide what is preferable when receiving a loan, especially a large one:

- overpay more for a financial loan, but regularly deposit the same amount;

- or overpay less, but receive a serious financial burden during the first period of the loan.

Calculations similar to formulas can be quickly carried out using online calculators. https://ipoteka-otvet.ru

What are differentiated transfers of funds when applying for a loan?

A differentiated payment is a payment of funds under a mortgage agreement in an arbitrary amount.

As a rule, the client must pay the largest part of the installments during the first years of the mortgage agreement. The size of payments each month differs from the previous payment period - and decreases towards the end of the loan.

With differentiated payments, the share of the principal debt in the amount of the monthly installment remains unchanged, and the amount of the obligatory payment depends on the percentage, which decreases in direct proportion to the term of the mortgage agreement. That is, every month the client repays the principal debt in the same amount, depositing less and less money every month (interest and monthly payments gradually decrease).

A feature of the differentiated payment schedule is large amounts in the first part of the term and insignificant amounts towards the end of the contract.

At the end of the contract, the client actually pays only the principal amount, since the interest was transferred to the bank at the beginning of the mortgage.

Annuity and differentiated mortgage repayment scheme: what to choose?

APPLY FOR A MORTGAGE AND FIND OUT A DECISION QUICKLY When studying the terms of housing loans, you often come across different names for repayment schemes - annuity or differentiated mortgage. These are two fundamentally different systems for calculating monthly payments, each of which has its own strengths and weaknesses.

Features of two payment options

The final amount of the overpayment will depend on the chosen repayment scheme. Also, depending on the calculation system, the amount of mortgage payments is determined. They come in two types.

Differentiated contribution

This type involves systematic repayment of debt , in which loan body is paid in equal installments , and interest decreases monthly . As payments are made, the amount of the required monthly contribution will gradually decrease.

Example. The loan amount is 1 million rubles, the loan rate is 10%, the term is 60 months.

The first payment will be 25 thousand rubles. For the second, the debt balance will decrease; accordingly, less interest is accrued, and the contribution amount is reduced and amounts to 24,861 thousand rubles. The third and subsequent payments are calculated in the same way. The last of them will be minimal and amount to 16,806 thousand rubles. The total overpayment is equal to 254.167 thousand rubles.

Annuity fee

This is a method loan repayment in which the monthly payments remain the same throughout the term of the mortgage agreement . The annuity amount includes principal and interest. The calculation formula is relatively complex. It’s easier to consider the conditions using an example:

The loan amount is 1 million rubles, the interest rate is 10%, the term is 60 months.

The fixed payment will be equal to 21,247 thousand rubles, while in the first month the maximum interest is 8,333 thousand rubles, and the repayment of the principal debt in the amount of the installment will be only 12,914 thousand. In general, the client will overpay 274,823 thousand on the loan.

Similarities and differences

Both schemes are similar in that the payment amount includes interest and principal. Moreover, with any option, at the beginning of payments, the borrower repays a larger amount of interest compared to the months before the end of the loan agreement.

The fundamental differences between repayment methods are as follows:

- in the annuity scheme the payment is fixed, in the differentiated scheme it changes every month;

- under the same lending conditions, different amounts of overpayment are obtained;

- with an annuity, in the first years, the contribution amount includes a smaller amount of the principal debt;

- all banks use the annuity scheme, while the differentiated one is used much less frequently.

What to choose: advantages and disadvantages of different types of payments

Taking into account the described characteristics and the calculations performed, it is possible to compile a list of the pros and cons of different repayment schemes (see table).

| Payment type | Advantages | Flaws |

| Differentiated | profitability (under equal conditions, the amount of overpayment is lower); reduction of monthly payment; simple calculation formula. | a significant burden on the borrower’s budget in the initial repayment period (it follows that with this method the client may not have enough income, and there is a high probability of refusal or reduction of the loan amount); different payment amounts. |

| Annuity | a fixed fee is more convenient for making payments (you can arrange an automatic payment); the maximum possible credit limit is greater. | higher overpayment of interest; a slow reduction in principal. |

Despite the fact that with a differentiated scheme the overpayment is less, this method will not always be significantly more profitable. Thus, financial analysts argue that to reduce costs, this scheme is better suited for long-term loans, which is typical for mortgages. If the loan is issued for a short period or early repayment is planned, then it is preferable to choose an annuity: due to the shorter period or reduction in the “loan body”, the total amount of accrued interest will be comparable to the differentiated scheme.

Another plus in favor of an annuity is a large amount of borrowed funds. If the borrower's income and expenses are equal, under this scheme the credit limit will be higher than under a differentiated scheme. This is relevant in cases where the client is counting on the maximum possible amount of funds, which is also typical for mortgage loans.

However, if the borrower’s income is high or the loan amount is small and the bank approves it according to any calculation scheme, an overpayment on the annuity will be unjustified, even if it is small.

Review of mortgage lending programs

Today, among banking products you can find an option with any payment method. Typically, the lender offers either an annuity or both schemes to choose from. For comparison, let's look at the offers of leading Russian banks.

Mortgage with annuity

This calculation procedure is used by all banking institutions, since it is more profitable and convenient for the lender, and payment of equal amounts is comfortable for the borrower. For example, you can compare the conditions with the annuity scheme for different types of mortgages.

Banking programs with differentiated repayments

For obvious reasons, today most financial institutions in our country issue loans with annuity payments. But there are banks with differentiated mortgage payments. Their names and conditions of the programs are presented in the table.

| Bank | Program | Loan amount, rub. | Bid, % | Term. |

| Petrocommerce Bank (Otkritie Bank) | Mortgage loan “New building” | 300 thousand - 30 million | 11.5 | Up to 30 years old |

| Gazprombank | Purchasing an apartment on the secondary real estate market | Up to 45 million rubles | 12 | Up to 30 years old |

| Rosselkhozbank | Mortgage | 100 thousand - 20 million rubles | 12,9-13,9 | Up to 30 years old |

| Surgutneftegazbank | Acquisition of residential real estate and equity participation in construction | Up to 8 million | 13,25-14,5 | Up to 30 years old |

| A private house | Up to 15 million | 13,25-14 | Up to 20 years |

You should know that in all these financial institutions you can take out a loan for housing and with an annuity scheme.

An important factor that you should pay attention to when looking for an answer to the question of which bank has the most profitable mortgage with differentiated payments is the size of the down payment. To get an idea of the current figures, check out the data in the table

| Bank | Down payment amount, % of the appraised value of the purchased property |

| Petrocommerce Bank (Otkritie Bank) | 11232 |

| Gazprombank | Minimum 15. Maximum – more than 50. |

| Rosselkhozbank | 15-30 |

| Surgutneftegazbank | Not required either from 10 |

Please note: Surgutneftegazbank has developed a differentiated mortgage program without a down payment (this is shown in the table). But it applies to the purchase of residential real estate from certain developers:

- GC "Severstroy"

- Samolet Development LLC.

- GC MIC.

- GC TIS.

- FSK "Zapsibinterstroy"

- LLC "Brusnika" Tyumen".

- OJSC "AHML".

- LLC "Promstroykompleks"

- Stroyinvest LLC.

- Stroy Mir LLC.

All of the above banks require the client to provide collateral as security for the loan. This could also be the property being purchased.

In addition, bankers have certain requirements for the age of the client applying for a mortgage, including differentiated ones. At the time of termination of the loan agreement, the borrower must be no older than 60 (Surgutneftegazbank) or 65 (Petrocommerce Bank) years. But Gazprombank demonstrated some loyalty in this matter. It consists in the fact that it is allowed to exceed the age by no more than 5 years. However, the borrower will have to provide additional security as collateral if it was not provided for in the loan agreement.

In conclusion, we should point out one negative aspect of differentiated mortgage payments. This method is not very convenient from the point of view of planning personal financial expenses. Knowing the size of your monthly regular income and using the annuity method of loan repayment, it will be easier for the client to predict his budget.

How to make a calculation

A differentiated mortgage is not always easy for the client to understand, because he is not able to calculate the payment amount on his own. In principle, this is not necessary insofar as the bank attaches a schedule of monthly payments to the loan agreement; if you want to read the mortgage according to the differentiated system yourself, then there is nothing complicated here. Let's give an example with calculations; to do this, consider a mortgage with the following parameters:

- amount 1,800,000 rubles;

- annual interest – 8.9%!;(MISSING)

- loan term – 120 months.

To begin with, let's calculate the constant part of the monthly payment as follows: 1,800,000/120 = 15,000 rubles - this is the amount of the principal debt divided by the number of payment periods. Next, you should calculate the amount of the monthly payment, taking into account interest:

- 1 month 15000+(1800000*0.089/12)=28350 rubles;

- 2nd month 15000+((1800000-15000)*0.089/12)=28238.75 rubles;

- 3 month 15000+((1800000-15000*2)*0.089/12)=28127.5 rubles;

- 4th month 15000+((1800000-15000*3)*0.089/12)=28016.25 rubles;

- 5th month 15000+((1800000-15000*4)*0.089/12)=27905 rubles;

- 6 month 15000+((1800000-15000*5)*0.089/12)=27793.75 rubles;

- 120 month 15000+((1800000-15000*119)*0.089/12)=15111.25 rubles.

Please note that independent calculation of the monthly loan payment amount is preliminary insofar as these calculations involve not the nominal annual interest rate, but the effective one.

As you can see, it is quite possible to calculate the loan yourself; from this example it follows that the amount of the monthly payment will decrease with each period. This is truly beneficial for the client, especially given the long mortgage term. But, unfortunately, not all banks are ready to provide a mortgage loan using a differentiated system for calculating monthly payments.

Is it profitable to take out a car loan for a car at a car dealership now?

Specifics of mortgage lending at Sberbank

A home loan has a number of characteristic features that distinguish it from other financial instruments. Housing loans are large in volume and require the presence of co-borrowers and guarantors. Money is provided on the security of real estate for a long time (up to thirty years).

Security issued as collateral must meet the following standards:

- The building has no wooden floors;

- The house is not in disrepair or dilapidated condition;

- There are no strangers registered in the apartment;

- The house was built in a microdistrict with a favorable environmental situation;

- There are no encumbrances placed on the housing (seizure, rent, etc.);

- The rooms have electricity, heating, hot water and cold water;

- The age of the building does not exceed 30 years;

- The premises are in satisfactory sanitary and technical condition (no insects, mold, mildew, etc.);

- The apartment building is located in an area with developed infrastructure (there are schools, hospitals, shops and public transport stops within walking distance);

- Depreciation of the housing stock cannot be higher than 70%;

- The apartment is not located on the first or ground floor.

Calculation of mortgage payments with differentiated payments

Applying for a mortgage loan is a responsible step that places a financial burden on the borrower. Therefore, many clients prefer to calculate the loan themselves so that the bank does not impose additional expenses on them (insurance, commissions or possible fines).

The calculation procedure is presented below:

Calculation of payments using a differentiated formula

| Differential payment formula | |

| RMP = TZ/CHPT + (TZ*PS*CHD)/DG | |

| RMP | Monthly payment amount |

| TK | Current debt |

| PS | Interest rate |

| CPT | The number of payment periods (months) remaining until the mortgage is fully repaid |

| BH | Number of days in the billing period (month) |

| DG | Number of days in a year |

As you can understand from the diagram, calculating differentiated payments is a very labor-intensive task. First, the borrower is required to calculate the “body” of the mortgage loan, divided into payment periods; then - interest accrued on the balance of the debt. It is not possible to calculate the contribution amount one-time, as with an annuity; recalculation is required for each subsequent month.

Luckily, you don't have to calculate your mortgage manually. Typically, a preliminary schedule is proposed by bank consultants after processing the client’s application. Even earlier, calculators will help you “estimate” the size of the payment: they are available on the website of each credit institution. In them the client enters:

- Loan size and interest rate;

- Date of registration of the mortgage and repayment period;

- Procedure and frequency of payments;

- The amount of one-time or periodic commissions.

Having processed the request, the program instantly produces a detailed payment schedule. Thus, a potential borrower, even at the deliberation stage, can assess the profitability of the offer and make the right choice.

Review of banks providing mortgages with differentiated payments

To assess the profitability of current offers on the market, for example, let’s take a family that wants to take out a mortgage loan of 5 million rubles for a period of 10 years. The initial payment is 2.5 million rubles. Given the initial data, what rate, monthly payment and final overpayment can borrowers expect?

Mortgage conditions from leading Russian banks are presented below:

Looking for which bank has a mortgage with differentiated payment, you can notice: this calculation scheme is the lot of large financial institutions. This is due to certain risks borne by the credit institution. Since the main burden with a differentiated schedule falls on the start of payments, banks evaluate a person’s profitability based on the maximum tranches. For a mortgage, they often amount to 50% of the client’s earnings, and issuing a loan on such terms is prohibited by law.

As a result, market leaders (Sberbank, Unicredit, Gazprombank, etc.) are ready to take risks. For a mortgage with differentiated payments, they offer the same conditions as for an annuity. In other banks the formula is of little use: these are the realities of the national economy.

Differentiated method of mortgage repayment - advantages and disadvantages

The main disadvantage for the borrower arises from the payment structure. Even with a profitability assessment from the bank, the client runs the risk of overestimating his capabilities. It's all about high contributions at the start, which exceed annuity payments by a third. A significant reduction in the load on a differentiated mortgage should be expected no earlier than the first 5-6 years of payments. As a result, delays and non-payments from clients occur at the beginning of lending - at the most critical stage of loan repayment.

Otherwise, the formula is the best option for long-term and large loans. A simple calculation shows: with differentiated payments, the borrower overpays less than with an annuity. In addition, it is profitable to repay such a loan ahead of schedule.

However, the advantages of a differentiated scheme always depend on the risks of banks. The latter tend to offset them with loan conditions - for example, a higher rate. That’s why experts often call this method of calculation a marketing ploy. When attracting a borrower with a formula, organizations do not talk about costs. To avoid pitfalls, calculate the payment schedule in advance. With a mortgage, it’s better to do this years in advance. 09:48 06/27/2018

Which bank has differentiated mortgage payments in 2020?

Banks offering mortgages with differentiated payments are not widespread enough, since by registering these clients, financial institutions miss the opportunity to benefit from the interest paid by the debtor.

A differentiated payment, as an alternative choice of repayment method, is a monthly mortgage payment, which, in turn, consists of different parts, principal and variable. Another important feature of the differentiated payment is that with each reporting month it decreases according to a special formula. Roughly speaking, the borrower pays the minimum minimum payment by the end of the mortgage, while the entire principal portion of all interest was paid at the beginning of the term.

The main question that concerns the population is which bank offers a mortgage product with differentiated payments in 2020?

This list includes the following organizations:

- Gazprombank. The largest well-known Russian bank, which has in its arsenal low rates, comfortable conditions for borrowers, and most importantly the ability to repay the loan in a differentiated manner.

- Rosselkhozbank. This financial company is also meeting its population halfway and is launching the process of creating differentiated mortgage payments. This almost doubled the number of potential citizens who applied.

Which bank is better to get a mortgage from? list of the best

You should pay attention to such a moment as life insurance of the borrower. If, when obtaining a consumer loan, banks often impose insurance services together with partner insurers, then here this procedure is necessary and forced

It is unlikely to be possible to refuse it in the cold period after the transaction is concluded, so it makes sense to consider how the size of the payment for this type of insurance will affect the entire loan, since this agreement is concluded for the entire duration of the loan.

- Revival - 12% per annum. Support for government programs;

- Unicredit Bank - with a contribution of 15%, you can initially get a loan of up to 15,000,000 rubles;

- RaiffeisenBnak offers loans at a base rate of 11%;

- Gazprombank issues up to 1,000,000 at 14.5% per annum.

Advantages and disadvantages of the differentiated repayment method and its comparison with the annuity method

The main advantages of the model with differentiated payments are:

- intuitive calculation methodology;

- regular uniform reduction of the principal debt;

- ease of recalculation of amounts when repaying part of the loan early.

If part of the loan debt is paid early, to adjust the schedule, you only need to recalculate the amount of the principal debt.

Differentiated and annuity payments - comparison There is a widespread opinion among borrowers that the differentiated method is more profitable than the annuity method.

Under the same conditions for which an example of calculating monthly repayment amounts is given, the total overpayment with the differentiated method will be 7,230 thousand rubles, and with payments in equal amounts (annuity scheme), using the loan will cost 9,856 thousand rubles, which is almost a third more expensive.

This difference is especially noticeable with long loan terms (more than 10 years).

This happens because with annuity repayment, monthly payments remain unchanged. In the first months, most of the premium is interest. At the same time, the loan body does not undergo significant changes, as a result, the level of interest payments remains high.

Disadvantages of differentiated payment

A bank offering differentiated mortgages definitely does not operate at a loss. The obvious advantages of this calculation option are offset by hidden, but no less significant, disadvantages.

- The amount of the first payment (the most significant) becomes the main one when calculating the income required for repayment and the possible loan amount. As a result, the available mortgage loan amounts are lower than with annuity calculations.

- The influence of inflation in the long term nullifies all the advantages of the differentiated method - the maximum costs occur in the first months of payments, when money turns out to be as expensive as possible (the inflation component is minimal).

- Budget planning taking into account various installments for loan repayment turns out to be more difficult than with a scheme of monthly payments in equal amounts.

Important! When choosing a differentiated method of repaying a mortgage, banks impose more stringent requirements on the borrower, and often, loans using this method are issued at higher interest rates.