This year the amount of maternity capital has been increased. At the birth of their first child, the state transfers 466 thousand rubles to young parents. And if a second baby was born in 2020, then the amount of maternity capital increases to 616 thousand rubles. This is a lot of money, so the question of what to spend maternity capital on should be considered carefully. Lawyer and family dispute mediator Yuri Kapshtyk .

Where to use maternity capital

It is a mistake to perceive these funds as an allowance that can be spent at your own discretion. The state views the program as a way to improve the living conditions of young families, as well as offset education costs. Therefore, money can only be spent on a limited range of tasks, but it’s up to the parents to decide what exactly.

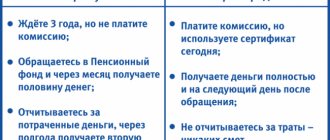

Buying an apartment, a house. Most families use the funds to purchase spacious housing. When children are born, additional square meters are needed, and the state payment allows you to purchase a larger apartment or house without spending your own money on it. You can buy a home after the child’s third birthday, at whose birth a certificate was received. This rule does not apply to housing purchased on credit: you can pay off the mortgage or make a down payment on it even before the child is three years old, immediately after issuing the certificate.

Starting this year, maternity capital issued at the birth of a third child can only be used to pay off the mortgage.

For construction. The state allows targeted payments to be directed to the construction of a house, repair and reconstruction of existing housing. And even introduced relaxations in this area. If earlier construction was allowed only on plots for individual housing construction, now it is possible to build for budget money on garden plots. The main thing is that the land is owned and permission for work has been obtained. Construction and reconstruction of a house should be planned after the child’s third birthday. The money will not be given immediately: half of the amount will be given after submitting an application for payment, and the other half will be given six months later.

To pay for training. If a child attends a paid kindergarten, then up to the age of three, you can pay for the institution’s services using maternity capital. After this, the amount can continue to be spent on education, not only for the baby at whose birth the certificate was received, but also for other children. For example, pay for kindergarten for a younger child and university education for an older one.

For a subsidy. In 2020, maternity capital became a serious help to low-income families, who were able to receive a monthly amount in the amount of the subsistence minimum to support a child. All families whose income per person does not exceed two minimum wages in Russia (today - 12,130 rubles) can apply for the payment.

The law also allows the use of funds from the mother’s funded pension for the education and adaptation of disabled children.

How can you use maternity capital to buy a home?

In order for the Pension Fund to approve the purchase of housing using maternity capital, the purchased property must meet the following conditions:

- finding housing on the territory of the Russian Federation;

- the residential premises must be separate, and not a share in the ownership;

- the transaction must comply with legal requirements;

- the application for the disposal of capital must indicate the purpose of spending the funds, indicating the recipient and the amount;

- Supporting documents must be attached to the application.

In addition, one more important condition must be met. The purchased housing must be purchased for common use by the family.

If the object is initially purchased in the name of the certificate owner, then after registration of ownership, shares must be allocated to all family members.

To comply with the rule on shared ownership, the Pension Fund of the Russian Federation requires the execution of a notarial obligation to allocate shares within six months after registration of housing ownership.

How are shares distributed? The size of the share allocated to the child is not determined by law. The division is carried out on the basis of agreement.

In this case, the size of the share is determined based on the minimum accounting standard for living space in a particular region, although in fact this condition is not mandatory.

As for permissible transactions, the list of transactions is determined by the age of the child:

| Until the child's third birthday | You can use MK for credit transactions (mortgage) |

| After the baby's third birthday | It is allowed to use maternity capital in ordinary purchase and sale transactions |

What documents may be needed

To use maternity capital for the purchase of housing, the following documents are submitted to the Pension Fund:

- MK certificate;

- passport of the applicant who is the owner of the certificate;

- application for disposal of funds;

- pension insurance certificate (SNILS);

- documents confirming the transaction.

As confirmation, a transaction agreement is provided. This could be a purchase and sale agreement, a mortgage, a loan, or participation in shared construction.

In addition, other documents may be required. In particular you will need:

- certificate of family composition;

- notarial obligation on the future allocation of shares to family members;

- certificate of ownership of the apartment;

- birth certificates of all children;

- marriage or divorce certificate.

Procedure for registration of MK

The process of obtaining the right to maternity capital is no different. Once the grounds for obtaining an MK arise, you must contact the Pension Fund and submit the appropriate package of documents.

For the amount of maternity capital in 2020, see the article: maternity capital. How to get statistics codes by TIN, read here.

The owner of the certificate can be a Russian citizen who is the parent or adoptive parent of a second or subsequent child who has not previously received maternity capital.

An applicant for maternity capital submits to the Pension Fund:

- application for a certificate;

- passport to confirm identity and citizenship;

- birth certificates of all children.

Documents submitted to the Fund are reviewed within a month and, if there are no violations, the applicant is issued a certificate.

If to improve living conditions

Improving living conditions is not only considered the purchase of finished housing. The terms of the program allow the expenditure of maternal capital on the construction or reconstruction of an object.

At the same time, construction work can be carried out either on your own or with the involvement of contractors.

You can also receive reimbursement for the costs of building a house if the property was put into operation no earlier than 2007.

If the construction or reconstruction of housing is carried out by a construction organization, then the Pension Fund will need to provide documents on ownership of the residential property and a construction contract.

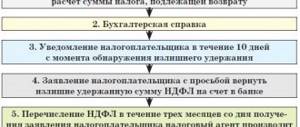

MK funds will be transferred directly to the construction company’s account. When housing is being built or reconstructed on its own, cashing out the MK is carried out in two stages.

Initially, the certificate owner is entitled to receive 50% of the amount. For this purpose the following is submitted to the Fund:

| Certificate of state registration of ownership of land | Used for individual housing construction or documents confirming the right to permanent use of land |

| Certificate of state registration of housing rights | If reconstruction is performed |

| Permission for reconstruction | Or construction |

| Bank account details | Certificate owner |

The remaining capital is transferred to the applicant’s account six months later. To do this, documents confirming the completion of basic reconstruction or construction work are submitted to the Pension Fund.

If you want to reimburse the costs of building a house, you must carefully record the costs, since all documents on expenses must be submitted to the Fund.

These are receipts for the purchase of building materials, contracts with involved organizations and specialists. It is important to remember that reconstruction is not just a renovation of a living space.

During the reconstruction process, the area of the house must increase by at least one accounting standard. Moreover, the increase in area must have documentary evidence.

Drawing up a purchase and sale agreement

You can spend maternity capital on the purchase of secondary housing without borrowing funds only after the child, whose birth became the basis for registration of the MK, turns three years old.

Moreover, you can draw up both a standard DCT and an agreement with installment payment. A regular contract is issued if the amount of capital is sufficient to cover the full cost of the home.

For example, you buy a house in a rural area. Also, a simple agreement formalizes a transaction carried out at the expense of the capital and personal savings of the buyer-owner of the certificate.

In any of the described cases, the seller will receive the full redemption value after the transaction is approved by the Pension Fund, that is, no earlier than 1.5 months later.

The contents of the purchase and sale agreement indicate:

| Full or partial payment | At the expense of MK funds with the transfer of money from the Pension Fund to the seller’s account |

| If the MK amount is not enough | It indicates how much the buyer pays from his own funds. |

| Buyer submission deadline | Documents to the Pension Fund |

The procedure for purchasing housing at the expense of MK without borrowed funds is as follows:

- The parties enter into an agreement, specifying all important conditions. Including encumbering the apartment with collateral until the full cost is paid.

- The buyer transfers part of the funds. If partial payment is provided through savings.

- The buyer registers ownership of the home with a note of mortgage by force of law.

- The contract and state registration certificate, together with the corresponding application, are submitted to the Pension Fund.

- The fund transfers funds to the seller.

- The parties to the transaction sign a transfer deed for housing.

- The seller removes the lien.

- The buyer becomes the full owner.

For your information! You can buy housing from relatives, with the exception of your spouse. But if it is subsequently established that the transaction was fictitious and was intended to conceal the cashing out of funds, then both the buyer and the seller will be held liable.

Installment payment when issuing a DCT is applied if a period of more than two months is expected before full payment.

This type of registration is used mainly when purchasing housing from a developer on the primary real estate market.

Under a share participation agreement in a new building

Shared construction is becoming increasingly popular among certificate holders, since for a relatively small amount you can buy housing in a new building.

The peculiarity of such a purchase is that at the time of execution of the share participation agreement, the owner of the certificate must have his own funds in the amount necessary to pay the cost, with the exception of the funds secured by the certificate.

You can use MK to pay for shared construction if:

- the object is 70% or more complete;

- The developer's charter allows the use of MK funds.

How does the acquisition of housing occur with the involvement of MK with shared participation in construction? The registration procedure boils down to the following sequence of actions:

- The premises are selected and booked, and the developer must be informed of partial repayment at the expense of MK.

- Drawing up a share participation agreement indicating payment by installments, since the Pension Fund of the Russian Federation will not transfer the money immediately, but after a complete verification of the transaction.

- Registration of the signed DDU in Rosreestr.

- Depositing the buyer's personal funds into the developer's account.

- Submission of documents to the Pension Fund (application for order of MK, DDU).

- Review of the application by the Fund and transfer of money to the developer’s account.

Important! You cannot use MK to pay for the cost of an unfinished construction project when purchasing it from a shareholder.

Video: how to buy a home using maternity capital

The agreement for the assignment of rights of claim does not apply to the documents giving grounds for the use of maternal capital. The solution may be to terminate the previous contract and conclude a new DDU.

How to deal with a mortgage (loan)

When the amount of MK and personal savings is not enough, you can purchase housing by taking out a loan against maternity capital for the purchase of housing.

Moreover, it is important that the loan agreement provides for the targeted use of funds, namely the purchase or improvement of housing. Most often, MK is used when applying for a mortgage.

It is noteworthy that when applying for a mortgage, you can spend the funds until the child reaches three years of age. How to use maternity capital to buy an apartment for a child under 3 years old?

In this case, matkapital repays part of the principal debt or interest on the loan. To transfer funds to the creditor, the following is submitted to the Pension Fund:

- mortgage agreement;

- a certificate from the bank about the balance of debt;

- application for order of the MK;

- certificate;

- passport of the owner of maternity capital.

If the amount declared for payment does not exceed the amount of debt, then after checking the authenticity of the documents, the Fund will transfer funds to repay the loan.

Important! You cannot pay off loan debt, penalties and fines with maternity capital. Maternity capital funds can be used as a down payment on a mortgage.

This requires a slightly different procedure:

- The bank must approve the use of MK for the down payment (not all institutions work according to this scheme).

- The housing found must comply with the requirements of the law (separate, without encumbrances, with normal living conditions, etc.).

- Conclude a mortgage agreement.

- Submit documents for consideration to the Pension Fund.

What is the best way to spend maternity capital in 2020?

Each family has different priorities and parents can, at their own discretion, manage the amount of maternity capital in the areas specified by the state. But there are the most profitable ways to use money.

“In my opinion, the most profitable way to spend maternity capital is to invest it in real estate,” comments lawyer and mediator for family disputes Yuri Kapshtyk. — This is the most established unit, a reliable investment. When you buy a home using maternity capital, you have a property asset that can be improved in the future by adding a certain amount.”

The amount of maternity capital is the same for all Russians and is determined only by the number of children in the family. But real estate prices in the regions are different. If for Moscow the amount of 600 thousand rubles will be only a tenth of the total cost of a spacious apartment, then in a small city this money can pay for half the cost of housing.

“There are no established requirements from the state for living space purchased for this money,” continues Yuri Kapshtyk. - This can be primary or secondary housing, a private house, even in dilapidated condition. If parents have the strength and desire to improve this house, complete it, create good living conditions for themselves and their children, this can be done.”

Conditions for purchasing housing

In order to redirect state financial support, issued in connection with the birth of a second or third child in a family, to the purchase of an apartment, you must first consider and fulfill mandatory conditions.

Ignoring it can lead to the collapse of the deal. By the way, parents were allowed to buy housing, both in multi-story buildings under construction, and in those that had already become a home for someone.

State aid, called mat. capital, can be used to purchase housing only if certain requirements are met:

- the banking organization or developer company must have the opportunity to receive money in non-cash form;

- a share in new housing should be allocated not only to children, but also to the parent, who is considered the owner of the certificate;

- You can buy a residential property and not use a mortgage only if the child has already reached the age of three;

- The location of the apartment or house should in any case be the territory of the Russian Federation.

Parents can independently choose the direction for using the mat. capital, but taking into account all applicable laws. The introduction of the restrictions listed below is due to the fact that such assistance is aimed specifically at improving the lives of children:

- Purchasing housing in a building under construction is permitted only if construction and installation work is completed by 70% or more.

- Mat. capital can be spent on expanding residential real estate only if it is located in Russia.

- The seller must be told that he will have to interact with government agencies.

- It is prohibited to buy housing from close people, i.e. at the first line. List of required documentation

- New housing can only be divided equally between children and their guardians.

If the amount of capital issued by the state is used to pay off the old mortgage, then there is no need to re-register the property documentation, but a certificate stating that immediately after complete closure of the debt, the child will receive his share must be generated and certified by a notary.

ATTENTION! For transferring swearing. capital is the responsibility of the Pension Fund.

What kind of papers will be required for this? Initially, it is worth recording the fact that the transaction can be carried out, that is, bring:

- document on the purchase and sale of a residential property;

- ID card or other documents confirming personal data;

- official papers from which you can find out information that the property being purchased is not subject to any type of restriction;

- a certificate stating that the seller has received all the money;

- an extract from a banking institution about the seller's account, because To transfer money, only a non-cash form is used;

How to spend maternity capital

Since 2020, at the birth of a child, the Pension Fund of the Russian Federation issues a certificate automatically. Mom does not need to submit documents; the registry office staff will do this. If PFR specialists have questions, they can call and ask for the missing document.

To receive payment you will need to collect the following documents:

- passport;

- child's birth document;

- statement on the disposal of funds indicating what the money will be spent on.

Starting this year, if you plan to spend funds on a mortgage, you do not need to contact the Pension Fund. Documents can be submitted to a bank that participates in the government program and issues a mortgage loan.

If parents want to receive funds from the account as a monthly subsidy, they will need a certificate from their place of employment for the last year and a certificate of income indicating personal income tax. The certificate must be provided by the parent for whom the certificate is issued, since this is a personal document. You can receive a monthly payment until the child’s third birthday, and the rest of the amount can be spent on housing or education for the children.

Procedure

You will need to find a seller who will agree to receive payment from the capital, that is, make a cashless payment. This is an important point, and not everyone agrees to it for the reason that funds arrive in the account several months from the date of transfer of ownership of the house or apartment.

The procedure for purchasing housing directly depends on whether or not a mortgage loan is used. If you buy an apartment without a mortgage, you need to follow the following algorithm:

- Drawing up a purchase and sale agreement for a real estate property.

- Official registration of the transaction.

- Applying for a loan from a bank equal to the amount of capital received, or entering into an agreement with the seller for the same amount.

- Submit an official application to the Pension Fund with all attached documents.

- Getting approval.

If housing is purchased with a mortgage, the sequence of actions is slightly different. First you will need to contact a financial institution to apply for a loan. If a positive decision has been received, the bank will issue a list of important documents. After this, the documents required to obtain a mortgage are collected.

After receiving approval, all that remains is to select suitable housing and purchase it with a mortgage. After purchasing an apartment, the Pension Fund provides all the necessary certificates and official papers. The Fund will immediately transfer the capital amount used to pay off the pre-arranged mortgage. As soon as the payment is credited to the account, the legal encumbrance on the apartment is immediately canceled.