Home / Real estate / Purchasing real estate / Buying an apartment / Maternity capital

Back

Published: 01/27/2018

Reading time: 4 min

0

78

In order to buy an apartment or house using maternity capital funds, it is not necessary to resort to a mortgage loan. The state provides the opportunity to use funds from a maternity capital certificate to purchase housing, if you have enough of your own money. There is a procedure for such transactions.

- Rules and procedure for the transaction

- Restrictions on use

The concept of maternity capital

Maternity capital is a government form of support for families with children.

The assistance consists of providing a certificate in the amount of 416,617 rubles for the first child, which parents have the right to spend on purposes determined by the government of the Russian Federation. More often, MCP funds are spent on improving housing conditions, that is, purchasing housing. In 2020, the rules for obtaining a certificate and the amount of funds provided have changed, but the purposes for which the funds are allowed to be spent remain the same.

Conditions for obtaining housing for maternal capital

Parents have the right to spend funds from state support to improve their housing in five ways. Funds can be invested in:

- purchase of an apartment, house;

- purchasing a room or share in residential real estate;

- share building;

- construction of individual housing construction on our own or with the participation of a contractor;

- housing cooperative.

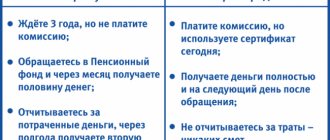

Using a certificate when buying a home without a mortgage has one important difference - you can use the certificate only after the second (third, etc.) child has turned 3 years old. Until this moment, realize the possibility of spending mat. capital is not allowed.

The main condition for the provision of family capital is the form of ownership. The residential property must become the property of all family members, that is, both parents and children. The size of shares is not defined by law, so it is determined independently. If the shares are not allocated at the time of purchase of housing, then it is necessary to certify with a notary the obligation for the subsequent allocation of shares.

The purchased (under construction) housing must be located in Russia - the certificate cannot be spent on foreign real estate. There are also restrictions on premises that do not comply with housing and sanitary rules, as well as wear and tear standards.

Restrictions on the use of maternal capital

Within the framework of the current legislation of the Russian Federation, 3 main purposes for using maternity capital funds are defined:

- improvement of living conditions (including the purchase and construction of residential real estate, reconstruction and participation in preschool education);

- children's education;

- mother's pension.

There is a widespread opinion among Russian citizens that maternity capital money can only be used to pay off a mortgage or pay a down payment. However, such a conclusion is completely unfounded, since buying a home without using a loan is also permitted by law.

Having decided to use maternal capital to purchase housing with the addition of their own funds, the certificate holder must remember the existing restrictions. These include:

- Compliance of the purchased property with all sanitary, social standards and BTI requirements.

The disrepair and unsanitary conditions in the apartment are unacceptable, as is the presence of illegal alterations.

- Maintaining favorable living conditions for all family members compared to previous housing.

The new apartment must, at a minimum, be on par with the old housing in terms of total area, condition and quality.

- Availability of operating water, gas, electricity, sewerage and heating systems that meet existing requirements and standards.

Heating must be supplied in accordance with seasonality, schedule and taking into account weather conditions. All other communications must also be in working order.

- Availability of a bathroom, kitchen, windows and doors.

The Pension Fund most likely will not allow you to purchase housing that does not meet at least one item specified in the list above. It is this government body that makes the key decision on the transfer of money from maternity capital funds for the purpose of purchasing residential real estate.

What kind of real estate can you buy with matkapital?

P. 1 part 1 art. 10 of Law No. 256-FZ establishes that maternity capital may be used to purchase residential premises in transactions that do not contradict the law (participation in an obligation). According to this provision, MSC funds without a mortgage can be used for:

- purchase of residential premises (apartment or house) under a sale and purchase agreement on the primary or secondary market;

- payment for the agreement for participation in shared construction;

- repayment of the entrance (share) contribution to a housing cooperative.

The purchased apartment must meet the following requirements :

- be located on the territory of the Russian Federation;

- meet sanitary and technical standards;

- be a separate room.

A share in maternal capital can be purchased if after this the owner of the certificate becomes the owner of the entire premises. However, first it is better to contact the Pension Fund for advice, since in such cases the order may be refused .

If housing is purchased with maternal capital without using credit funds, then you can apply to the Pension Fund only after three years .

You cannot buy an apartment unsuitable for living with maternity capital . From March 29, 2020, the Pension Fund independently requests information about the condition of purchased housing from local governments and other organizations. If it is recognized as unsuitable for living , or the apartment building has the status of an emergency and subject to demolition (reconstruction), then the order will be denied .

Purchasing a home using capital has the following restrictions :

- must not be using the transaction ;

- Living space cannot be purchased from the legal spouse.

If a family plans to purchase an apartment with maternal capital from relatives , then it is first necessary to contact the Pension Fund for advice , since such transactions are subject to careful scrutiny, and the order may not be approved .

When is it legal to use a certificate?

You can use the certificate immediately after receiving it. If a family has an existing mortgage loan or wants to get one in the near future, then there are no restrictions. It is established at the legislative level that state assistance can be used to repay the principal debt and accrued interest, as well as to pay the down payment.

Children's education and mother's pension involve the use of money only in the relatively distant future. Therefore, the question of timing in this option does not arise.

The received certificate can be used until the second or subsequent child reaches the age of 23 years. If the child is over 23 years old and the certificate has never been used, then the funds on it will be canceled in favor of the state.

Buying a home with maternity capital without a mortgage: main stages

The stages of purchasing residential real estate using a maternal capital certificate may vary significantly depending on what kind of housing is purchased. Let's look at each option in more detail.

Purchasing a home under a sales contract

When purchasing a residential property using capital under a sales contract without using a mortgage or loan, you should notify the seller in advance ; many of them do not agree to this transaction because the funds are not transferred immediately. The agreement can be concluded in two forms :

- with deferment - the buyer pays a deposit, and then during the specified period the maternity capital is transferred to the seller by bank transfer;

- with installments - after making a down payment, the cost is paid in equal monthly installments.

The contract must indicate :

- that payment is made at the expense of maternal capital;

- what part of the area is paid by MSC if the cost of the premises is more than the amount of the certificate;

- the deadline within which the application will be submitted to the Pension Fund;

- the size of the down payment, the schedule and amount of subsequent payments - in case of purchase in installments.

You can purchase an apartment under a purchase and sale agreement using maternity capital without a mortgage in several stages :

- A purchase and sale agreement is concluded, a deposit or a down payment is made.

- The buyer registers ownership rights in Rosreestr, but the residential premises will be pledged to the seller until the cost is fully repaid.

- The owner of the certificate applies to the Pension Fund office with an application and:

- Russian passport;

- marriage certificate and passport of the spouse, if he is one of the parties to the contract;

- an extract from the Unified State Register of Property Rights;

- a copy of the purchase and sale agreement;

- a certificate of the unpaid balance of the cost if the housing is purchased in installments;

- a notarized obligation to allocate shares to the spouse and children, if the shares cannot be allocated immediately.

- After full repayment of the cost, the deposit is removed from Rosreestr - you must provide an acceptance certificate indicating that the payment has been fully made.

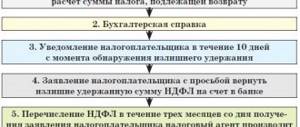

Matkapital is transferred non-cash to the seller within 10 working days after the positive decision of the Pension Fund. Consideration of the application will take a month .

Participation in shared construction

Maternity capital can be used to pay for the cost of an equity participation agreement (DPA), if the developer’s charter allows the use of certificate funds. At the same time, parents, in addition to maternal capital, must have personal funds to pay for the transaction.

Purchasing an apartment under a remote control agreement without using a mortgage loan is carried out in several steps :

Step 1. Booking accommodation. The developer must be warned that maternity capital will be used for payment.

Step 2. Signing an agreement, which contains a clause stating that payment will be made in installments , since the funds will be credited to the seller’s account within one month and 10 working days from the date of filing the application with the Pension Fund.

Step 3. Registration of the agreement in Rosreestr.

Step 4. Payment from personal funds.

Step 5. Apply to the Pension Fund and:

- Russian passport of the certificate owner;

- a copy of the registered DDU;

- a document containing information about the amount of funds deposited and the unpaid balance;

- a notarized obligation to allocate shares to the spouse and children.

For a room and a share

As already mentioned, buying a room or share of a living space will not be easy. Such real estate properties must meet certain requirements, such as a separate entrance, large area, favorable living conditions for families with children. Share and room are different concepts. A share is a part of the premises, without establishing boundaries. The room has such boundaries. You can only buy the habitable part of the house.

The order of the stages of the transaction will be similar to those discussed above.

To the land and the house

The purchase of a country house or land plot for construction is carried out through the conclusion of a purchase and sale agreement. The pension fund will carefully analyze the degree of wear and tear of the house, its characteristics, including the type of structure, the presence of communications, the status of documents, etc.

In some Russian regions, the standard of living and prices are such that maternal capital may be enough to pay the entire cost of a small house or plot of land.

Participation in a housing cooperative

If the owner of the certificate or his spouse is a member of a housing cooperative (HC) or joins it, then the family has the right to use maternity capital to repay the share or entrance fee.

According to Part 1 and Part 5 of Art. 47 of Law No. 215-FZ of December 30, 2004 on housing cooperatives, the right to purchase or build arises after two conditions :

- a member of the cooperative has contributed 30 percent or more of the established share contribution;

- the minimum established period for contribution has expired - from the second year of operation of the cooperative, this period cannot be less than 2 years.

To issue an order, the following must be submitted :

- Russian passport of the certificate owner.

- Marriage certificate and passport of the spouse, if he is a member of the cooperative or joins it.

- Extract from the register of members of the cooperative. If it cannot be provided, then a document confirming the submission of the application or the decision on admission is required.

- Certificate of the amount of the share contribution already made and the unpaid balance.

- A copy of the charter of the housing cooperative.

- An obligation to allocate shares to children and spouse, certified by a notary.

If the Pension Fund makes a positive decision, the maternity capital will be transferred non-cash to the cooperative's bank account within 1 month and 10 working days .

How to buy a home with maternity capital without a mortgage

When a certain amount is not enough to purchase an apartment, but the owners of the maternity capital certificate do not want to take out a loan, they have difficulties making the purchase. After all, the pension fund does not issue capital to parents; it can only transfer funds directly to the seller. Moreover, transferring money takes some time.

However, potential new residents successfully use several schemes that allow them to purchase housing using maternity capital funds:

- an agreement under which the buyer is granted an installment plan. With this option, you can buy housing in a new house. The purchase is made on the basis of 214-FZ. But if the development company does not work according to this scheme, then the buyer will have to wait for the house to be put into operation and for the registration of ownership of the apartment. Only then can the seller count on receiving maternity capital funds from the pension fund;

- obtaining a loan from an employer. Some employees receive the missing amount from their employer. Moreover, the loan is provided without interest. In this case, the interested party submits a loan agreement to the Pension Fund confirming the conclusion of the relevant transaction. Based on this document, funds are transferred directly to the lender. This option is very convenient, but can only be used with the consent of the employer;

- reaching an agreement with the seller. If the amount of maternity capital is not enough to purchase housing, then you can agree with the seller to conclude an agreement with a deferred payment. Moreover, payment must be deferred for at least six months. Because it only takes two months to register a transaction. The Pension Fund needs the same time to consider an application for the issuance of maternity capital. The money transfer itself also takes about two months on average. Unfortunately, not every owner agrees to this option.

It should be noted that cases when the amount required to purchase real estate fits into maternity capital are quite rare. As a rule, we are talking about purchasing a country house. In this case, the purchase is formalized by a deferred payment agreement, and the money is transferred to the seller after completing the procedures described above with the certificate.

Buying a home with maternity capital without a mortgage: main stages

First of all, you need to draw up a purchase and sale agreement. Its terms must provide for the total amount of the transaction, the amount of additional payments, if any, as well as the time frame within which they must be made.

Is it possible to buy an apartment with maternity capital if the child is under 3 years old?

Read here how to buy an apartment with maternity capital.

Read about buying a second home with maternity capital at the link:

In addition, the contract must indicate the details of the seller’s personal account, including its number and bank name. If the property is sold by several sellers, then the capital is transferred to each of them in proportion to its share in the total property.

All family members must be entered in the “buyers” column. Moreover, the signature for children who have not reached the age of majority is placed by their mother or father, as a legal representative. Even if an adult child does not live with his parents, he still takes part in the transaction and should be included in the number of buyers.

But an adult child has the right to refuse to purchase housing. To do this, you need to issue a waiver, which is certified by a notary. After this, the share of the person who refused is distributed among other family members.

Within five days after the conclusion of the transaction, its state registration is carried out. In this case, an encumbrance may be imposed on the property due to the fact that the seller did not receive funds in full. After the certificate of state registration is issued, a copy of it must be submitted by buyers to the pension fund.

Submitting documents to the Pension Fund and the procedure for their consideration takes up to two months. Its result is a decision to pay maternity capital or to refuse it. If the decision is positive, then the funds are transferred to the seller’s account. This process takes from fifteen to sixty days.

When the money under the agreement is paid in full, the encumbrance can be removed. To do this, all adult family members participating in the transaction must appear at the registration chamber.

Using maternity capital to purchase housing for up to 3 years without a mortgage

To use maternity capital to buy an apartment or a house without a mortgage before three years have passed since the birth (adoption) of a child, parents must apply for a housing loan or loan (under the terms of which the property will not be pledged ).

Law No. 102-FZ of July 16, 1998 on the pledge of real estate establishes that a mortgage is a form of collateral that ensures the debtor fulfills his obligations, while he has the right to continue to use the pledged property. If the debtor does not fulfill his obligations, then the monetary claims are satisfied from the value of the mortgaged property.

If the mortgage loan is not repaid, the bank sells the mortgaged housing: part of the proceeds is used to pay off the debt, and the debtor receives the rest. For this reason, many parents do not want to take out a mortgage - they are afraid of being left without housing.

Targeted loans and loans without collateral requirements are offered by a small number of banks and credit cooperatives, and, as a rule, they have a number of restrictions.

Credit funds can be used not only for purchases under a purchase and sale agreement, but also for:

- payment for participation in shared construction;

- repayment of the entrance fee or share in the residential complex.

A consumer loan that was used to purchase an apartment cannot , since, according to Part 6 of Art. 10 of Law No. 256-FZ, the loan or loan must be targeted at the purchase of housing, otherwise the Pension Fund will refuse the order. His decision can be challenged in a higher authority of the Pension Fund or in court if the owner of the certificate can prove the intended use of the loan funds.

How to use the mat. capital for the purchase of housing

The family can choose the most appropriate way to improve their housing conditions. The law provides for the following possibilities for using the certificate in this direction:

- Redevelopment of a home to improve living conditions.

- Home construction.

- Paying off an existing mortgage loan.

- Possibility of joining a house-building cooperative as a shareholder.

- Buying an apartment with a mortgage or without taking out a mortgage loan.

It is possible to purchase a second apartment, subject to the allocation of a share for parents and children.

The easiest and fastest way to use the funds from a home purchase certificate is to purchase an apartment without a mortgage. This option is chosen by 70% of families.

What features and nuances should be taken into account

Amounts mat. capital are credited to the seller's account only after signing the purchase and sale agreement. Moreover, the Pension Fund will be able to do this within several months. It is important to inform the seller in advance of this factor because not all owners of apartments or houses will want to receive a partial amount when selling their property.

Other nuances:

- It is mandatory to allocate a share to a minor. This will be confirmation to the state that the money was spent purposefully.

- Buying a home from a close relative is not permitted by law.

- If there is a deposit in the transaction, a receipt in free form must be drawn up.

- If there are co-owners, their written consent to the sale of the apartment (house, land), obtained from a notary, is required.

- In case of acquiring land, you will also have to obtain design and estimate documentation for the house that will be built, as well as a construction permit.

Close relatives with whom transactions cannot be concluded are:

- spouses;

- parents;

- children;

- brothers, sisters;

- grandmothers, grandfathers.

For 2020, indexing mat. capital was suspended, so the amount remained the same as in 2020.

Maternity capital for the purchase of residential real estate without mortgage obligations is a completely real and legal transaction. The main problem in this matter remains finding a buyer who would agree to receive part of the amount after signing the agreement, and even after a few months. We have to wait for the Pension Fund to transfer funds from the state budget.

Otherwise the procedure remains the same. Only in this case there is no need for a mortgage agreement to confirm the intended use of government funds. support. It is enough to present a different type of contract.