Early repayment of a mortgage: conditions in banking structures

When a borrower makes a premature repayment, unaccounted free funds appear in the bank account, which the credit department must immediately put into action. The work process is complex, so each bank has developed individual rules for those who wish to return their funds to the lender in advance of the date established in the contract. The special rules developed depend on the amount of repayment. The aspect of repayment of obligations is also significant - it is important for the organization whether they will be repaid in full or in part. The work of all financial and credit institutions is strictly linked to calendars; for them, every day is profit. Therefore, having decided to return its funds to a financial institution ahead of time, the person who took the money for temporary use should know that it is unlikely that such an operation will be completed in one day. Here, each lender will require advance notice from the borrower. Most often, according to official conditions, notification of debt repayment is given one month in advance, but in fact, the repayment procedure can be carried out much faster. When the conversation is that the citizen is returning only part, then with the consent of the bank, a certain date is set. Many leading lenders in Russia (Sberbank, VTB24 and many others) allow partial early payment on the day of the regular payment.

What you should definitely remember

We advise you not to forget these key points:

- If your mortgage provides an annuity payment system, then the sooner you start paying it off early, the better. The amount of overpayment on interest will be the minimum possible;

- With the help of early partial repayment of your mortgage to Sberbank, you can: reduce the loan period or reduce the amount of monthly installments. According to experts, the first option is preferable. But you should choose it only if you are sure that you have a stable source of income. If the financial burden is already too much to bear, give preference to the first option;

- Don't pay your last penny for a mortgage. Think about whether you can use these funds to greater advantage? For example, investing in high-yield assets;

- Forecast your own income and expenses. Suppose you see that in the near future you will not be able to repay your obligations on time. In this case, you should immediately contact the bank’s specialists with a request to defer payment or provide another alternative way out of the upcoming difficult situation.

Let us say once again that we recommend early repayment of a loan for the purchase of real estate only if such an opportunity really exists. You should not refuse study, treatment or vacation. Invest in yourself and you will get more.

What are the conditions for early repayment of a mortgage at Sberbank?

Sberbank does not impose restrictions on the premature closure of debt obligations. However, it has a number of conditions that do not allow differentiated payments. Thus, in a military mortgage, an annuity is used, which makes it difficult for the lender to return his money early, and early payments upon partial closure of the loan require recalculation of the interest rate. In this case, the debt payment period cannot be reduced. The conditions for early repayment of a mortgage at Sberbank are similar to the rules of many Russian lenders. Therefore, the payer, before proceeding with the premature return of money, must decide on two points:

- what payment (annuity, differentiated) does he use when closing the issued loan;

- under what conditions is it allowed to close obligations before the due date (the amount of the paid amount is taken into account).

The conditions for repaying a mortgage early at Sberbank provide for a new calculation of the debt repayment schedule after partial early payment. Having received the new schedule, the borrower puts his signature on it.

Sberbank calculator

To facilitate work with clients and quickly resolve the issue of how to repay a mortgage early at Sberbank, a special calculator operates on the pages of the website of the structure described above. It automatically calculates the amount of refund that will be returned to the lender ahead of time, taking into account many nuances:

- the date when the agreement with the banking institution was drawn up is taken into account;

- loan size;

- interest rate under the agreement;

- what type of payments;

- the amount that the borrower must repay to the financial institution;

- indicates the desired date when the debt is scheduled to be closed.

Let's look at an example. The borrower wants to repay the amount of 600 thousand rubles ahead of time to the organization that lent him the money. An application is submitted to the official institution that issued money for temporary use and the manager allows the agreed amount of money to be returned on the day when the next payment is made. The conditions for complete closure of the loan do not limit the choice of day, but the payment period and payment method are established. Funds can be accepted either in cash or by bank transfer. In accordance with the amendments made to the work of banks in 2011, each person who received a loan automatically gets the opportunity to decide when and how to repay it.

Example of debt calculation

Debt calculation is carried out according to a fairly simple scheme. So, knowing that the amount of obligations consists of the loan body and the interest rate, you can calculate the debt: the mortgage rate is divided by the number of days in a year. The resulting number is multiplied by the number of days passed from the last payment. Let's look at an example. The borrower still has to repay a debt of 60,000 rubles at an interest rate of 0.14%; the last installment was made 14 days ago. We perform the calculation like this:

- 0.14(percentage)/365 x 14(days) = 0.0053%

- 0.0053 x 60,000 rubles = 318 rubles.

Thus, the balance of the debt is 60,318 rubles, where 60,000 rubles is the body of the loan, 318 rubles is the interest accrued on this amount. Many future borrowers, before applying to a bank for a loan, carefully study various bank offers. For those who are planning to become a borrower very soon, it will be useful to study the topic: “Mortgage with state support: 5 best offers from banks for 2017 for different categories of citizens of the Russian Federation”

Methods for closing obligations

The borrower has the right to close obligations to the bank by repaying the loan in full or by depositing part of the funds. The choice depends on the client's wishes. The methods are very different from each other. When choosing the most suitable one, you should familiarize yourself with its features in advance.

Closing obligations in full

Full repayment involves providing the entire amount of funds to close the remaining debt. The method allows you to save significantly. If this method is used, the bank will recalculate the accrued interest.

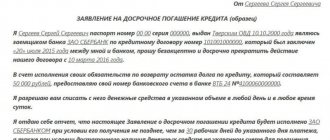

The client is obliged to notify the financial institution in advance about the early closure of obligations. To do this, you will need to make a written application. You can obtain a sample paper by personally visiting a branch of a financial institution. The document must be completed at least 1 month before the expected date of depositing funds. The paper must indicate:

- information about the citizen who wishes to fulfill the early closure of obligations;

- date of planned deposit of funds;

- payment amount;

- other mandatory information provided by the financial organization.

If you close the debt without prior notice, interest will not be recalculated. The bank will write off the credited amount monthly in accordance with the established schedule. This may lead to delays in the future.

Additionally, it is recommended to contact the bank in advance and find out the amount of the remaining debt. Liabilities must be closed in full. Failure to deposit even a small amount of money will result in debt. After closing obligations in full, it is recommended to obtain a certificate of absence of debt. The document will act as a guarantee that it was possible to repay the mortgage ahead of schedule in full. In case of disputes, the paper will act as a guarantee that the citizen is right. A fee is charged for the certificate. Its size is 500-1000 rubles.

How to partially pay off a debt?

You can close your obligations by contributing part of the funds on the loan. The bank has the right to set the minimum payment amount for early closure of obligations. It will not be possible to deposit funds in an amount less than the established amount. The rule does not always apply. To find out in advance how to repay your mortgage early, you should refer to your current loan agreement.

The effect of partial repayment of a mortgage on the further closure of the debt depends on the type of payment. If the calculation is made using annuity contributions, there will be a change in the settlement period for obligations. It will decrease. At the same time, the amount of monthly payments will remain unchanged. The amount of the final overpayment will also be reduced. If a citizen wants to reduce the amount of monthly contributions, he will need to write an application.

If obligations are closed using differentiated payments, the amount of funds that must be paid monthly will decrease. This will happen by reducing the amount of interest accrued.

What benefit will the borrower receive from closing the debt early?

Only repaying the debt ahead of schedule allows you to save money and reduce the burden of the loan. When the institution has given permission for such an action, a new relationship is established between the borrower and the lender. If the debt has been partially closed, you can use this fact and make a choice:

- subsequent installments may be reduced in amount;

- you can reduce the size of the loan body.

It is worth noting that premature release from the credit burden allows you to reduce the loan, but the rate is not subject to change. It is also not possible to eliminate interest. But their significant reduction is possible if the client of the financial institution returns the funds to the organization in the first five years of the loan term. This fact is due to the fact that during the first five years, credit structures extract all their interest from the borrower. Therefore, if the borrower wants to return the money to the financial institution ahead of schedule, the organization is forced to recalculate. Closing the loan after five years will no longer make sense, since the severity of the loan is felt from the interest paid to a greater extent in the first five-year period.

Is it possible to

Several years ago, it was impossible to close a mortgage early in Sberbank, as in any other bank, without fines and additional commissions. But in 2011, changes were made to the legislation. Now each loan agreement contains a clause that describes the procedure for both full and partial early payment of debt.

From the point of view of the law

As mentioned above, the answer to the question of whether it is possible to pay off a mortgage early at Sberbank is positive. N 284-FZ “On Amendments to Articles 809 and 810 of Part Two of the Civil Code of the Russian Federation” dated October 19, 2011 regulated this norm, relieving the tension between lenders and borrowers in favor of the latter. Now banks cannot prohibit early repayment, so they resort to tricks, hindering this process in every possible way.

From the bank's point of view

Let's consider the question of whether it is possible to repay a mortgage loan at Sberbank early, from the position of a financial institution. If the debt is repaid early, the bank loses interest income. However, he cannot go against the law, therefore, each loan agreement stipulates the client’s right to early repayment of the mortgage if certain conditions are met: you need to notify the bank in advance of your desire to pay an amount exceeding the monthly payment amount, then make the payment on the appointed day at a bank branch or through the official website of the financial institution.

Recalculation of the mortgage in case of early repayment at Sberbank is carried out depending on which option the borrower chose: reduce the monthly payment or the term of the contract.

The bank's position regarding the premature closure of a loan for the purchase of residential square meters

As you know, for banking structures, mortgage loans are a source of income with a long-term perspective. Time and certain resources were spent on the process of obtaining a mortgage. Therefore, when a loan is closed ahead of time, the source of profit stops working, which means that the efforts invested in it did not justify themselves. The second “minus” for a financial institution from closing a loan ahead of schedule is that the money issued for the mortgage was received on a fee basis. Having received the funds back, he continues to make payments to the investor for them. At the same time, they will not bring profit to the bank for some time.

To sum it up – risk or benefit?

It is impossible to say that you should definitely pay off your mortgage early.

Your situation is known only to you - your capabilities, financial resources and goals. We advise you to develop an action plan for the future - understand what you individually want, and how solving this problem will affect the budget and well-being of your family. Consider all risks, such as the possibility of serious illness or job loss. You should have your own emergency fund. Once this fund is in place, you can take active steps to make your apartment truly yours.

How types of payments affect the rules for returning funds to the bank ahead of schedule

When selecting a lending program, future bank clients most often look at the interest rate. However, it should be noted that the amount to be paid depends on the methods of accrual and closure of the loan. Currently, two different calculation methods are used: calculation using the differentiated method and calculation using annuity. Experts say that the terms of differentiated payments are more favorable. It has been calculated that at one annual rate the total return is much less than with annuity payments. The peculiarity of differentiated payments is the uniform repayment of debt, where interest is distributed over the loan balance. As a result, all subsequent contributions will be of a lower amount. In this case, early payments to pay off obligations are not limited by time and amount, and therefore allow you to win on interest. The terms of annuity payments provide for an even distribution of payments throughout the entire term of the loan agreement. In this case, the first payment period is the repayment of the interest amount. As a result, the amount of monthly payments is small compared to the overall interest rate. When closing a debt early, the following dependence on payment is observed: Differentiated payment: the smaller the debt obligation, the less interest is charged on it. Here, the favorable conditions for the person on whom the encumbrance lies are obvious: today the payment is made - tomorrow a smaller amount is accrued. The differentiated scheme does not limit the size of early payment, as well as its timing. An annuity payment can only reduce the period of loan repayment, while introducing a restriction on the minimum amount (10 - 50 thousand rubles) and setting a specific date. Therefore, early closure of a mortgage loan in such a scheme is not profitable. Practice shows that in addition to those who want to return bank money in advance, there is a percentage of citizens who want to sell their mortgaged housing. The features of this procedure are well described in the article: “How to sell an apartment with a mortgage: 4 selling options + risks and recommendations that should be taken into account when selling!” .

conclusions

Analyzing feedback from payers about such a procedure as early repayment of a mortgage loan, one can notice different opinions. Many payers are happy with the low APR and have no problem making monthly payments. Others strive to get rid of their mortgage obligations as soon as possible. Sberbank does not interfere with this decision. But experts still recommend preliminary analysis of the situation, taking into account future moments and possible life changes. And only then make the final decision.

What pitfalls are included in the conditions for repaying a mortgage early?

From the moment the loan is closed, the borrower will be on a special list of the credit institution. And the consequence of this will be a refusal to issue another loan. The reason for the refusal will be tritely simple: the borrower did not bring income to the bank the first time. Paradoxically, having a bad credit history will give a client of a financial institution a better chance of getting a new loan than a note that the bank received his money back ahead of schedule. When concluding a loan agreement with a financial institution, you should carefully study the section on the conditions for repaying the debt in advance of the date of termination of debt obligations specified in the agreement. As a rule, financial institutions are cunning, so this section with early repayment restrictions is written in small print. For example, they allow early payment after a certain period. Many credit organizations give this right one and a half years after the conclusion of the loan agreement. Since federal law introduced restrictions for bankers in receiving income due to such an operation, they came up with other rules for covering losses. Thus, financial institutions began to exercise the right to change the rate unilaterally. Therefore, you should understand that behind the courteous and beautiful words “with care for your client” there is one goal - making a profit for the bank. As you can see, the pitfalls described above that can await borrowers who wish to return funds to the lender prematurely are not critical. Therefore, every year there are more and more people who want to apply for a loan from financial institutions and for the purchase of housing. Young families who want to acquire their own residential square meters with the help of bank funds will find it useful to read the article: “How to get a mortgage for a young family - options, pitfalls and useful tips!” .

Why should you pay off your mortgage early?

If you think that you shouldn't pay off your mortgage early, you are very mistaken. Because in this way you deprive yourself of the following important advantages of the solution:

- Opportunity to save on interest payments and the total amount of overpayment. The amount of interest on a mortgage issued for 15-20 years is, as a rule, several times greater than the “body” of the loan for the purchase of real estate. Considering prices per square meter, the savings can be amazing;

- Reducing the amount of monthly contributions. The difficult economic situation in Russia means that many mortgage borrowers simply cannot cope with their previously assumed obligations in full. If you currently cannot pay off your mortgage in full at one time, pay it off early in small installments - the results will also be truly profitable;

- The opportunity to become a full owner of real estate ahead of schedule. Until Sberbank receives its money for the property in full, it will be its actual owner (including on paper). You do not have the right to sell, donate or exchange an apartment, remodel it, or rent out collateral housing. If you try to violate this mandatory requirement, you will face dire consequences. But as soon as the mortgage is repaid, the property will become yours.

There really are a lot of advantages, but it’s still too early to rush to take money to Sberbank. To begin with, you should learn a few important nuances about early repayment of mortgage loans at Sberbank.

Conclusions about the rules for early loan repayment

Based on the above material, citizens of our country should clearly understand that before concluding a loan agreement with a bank, they need to study how early repayment of a mortgage occurs, the terms of which are specified in the agreement. To do this, the main questions are clarified:

- From what period of time is it allowed to return to the bank funds that it previously provided to its client.

- What amount of payments is allowed (full, partial)?

- What restrictions are imposed on debt closure?

- Is there a fine (penalty) for returning money before the due date?

- If I repay early, will the debt repayment schedule be changed?

If the loan agreement does not allow you to obtain information about the procedure for repaying borrowed funds to the lender ahead of schedule, then you need to ask the manager who draws up the loan agreement about this.

It is important to choose in advance a loan program that will be favorable for a person who wants to borrow bank money for temporary use. Previous article: How to sell an apartment with a mortgage: 4 options for selling + risks and recommendations that should be taken into account when selling! Next article: Mortgage refinancing: 3 options, advantages and disadvantages of the procedure + description of the conditions for refinancing a mortgage in 3 banks!

What do you need to know?

A modern borrower must understand that any “obstacles” from the bank regarding early repayment of a mortgage are illegal . The application of a moratorium on the procedure during the first year, quarter, month, day is prohibited by the mentioned Federal Law. After its introduction, fines for the client’s desire to pay the bank ahead of schedule became a thing of the past (whether bans from the bank on early repayment of a mortgage and fines for this are possible today, we discuss in a separate article).

IMPORTANT : Borrowers should keep in mind: when agreeing on future loans, a note in the history of “early payment” will be considered by bankers not as reliability, but as a negative factor. Banks “don’t like” those who deprived them of the “long” payments promised by the contract.

When starting early repayment, the client should find out from the bank what the details of the procedure are:

- When is it better to make a partial early repayment amount : together with the next payment or before/after it.

In a number of banks, “overtime” payments made before the monthly installment are used to pay off accumulated interest, and only the remainder is applied to repay the principal debt. In other credit institutions, early payments are written off only simultaneously with the main payment, whenever the client deposits money into the account. In this case, interest is always repaid from the EP, and the “extra” money steadily reduces the “body” of the loan. - Do I need to notify the bank in advance ?

Article 810 of the Civil Code of the Russian Federation provides for conditions obliging to notify the creditor of the intention 30 days in advance. In practice, not all banks use this right. According to the same article, they can set a period of less than a month. Sometimes a day or two notice is enough, or there is no need to announce your plans in advance at all. Check with your lender's office. - Is it possible to make an “early payment” online ? If a client pays contributions via Internet banking, nothing prevents him from depositing an additional amount into the account and electronically submitting an application for debiting and recalculating interest. The updated schedule should still be obtained in the form of a formal Addendum to the mortgage agreement.

- Does this bank have restrictions on “early term” limits ?

Let's say right away: this point cannot be considered legal, although the legislation does not directly prohibit it. Most banks have already abandoned this condition. If your credit institution insists on it, you can challenge such a restriction in court if you wish. Or take note and save up to the required amount in cash or in your account. - What will change after making it ?

The creditor may give the client the right to choose or clearly state in the contract that early repayment of part of the debt will lead to a reduction in the monthly payment or a reduction in the term. Sberbank, for example, delegates the solution to the problem to the borrower. But there are banks where the condition is strictly fixed that the term cannot be reduced. If the client initially plans to make additional payments in order to shorten the loan period, he must immediately look for a suitable bank.

If the period of using bank funds is shortened, the “overpayment” on the loan will definitely be less. However, if the “mortgagee” is faced with an acute issue of urgent money for the family budget, then reducing the monthly payment is preferable, although strategically less profitable (we talk about how to make a profitable early repayment of a mortgage here).

ATTENTION : There is hardly any need to explain that the borrower should calculate the amount for early repayment so that there are enough funds to make the next monthly payment.

With the annuity system, it is advisable to make even the smallest early repayments regularly (at least 1,000 -2,000 rubles every month), but it is not advisable to upset the balance: loan costs should not take more than 40% of the personal budget.

Watch a video about the features of early repayment of a mortgage:

Conditions for early repayment

It is recommended to review the loan agreement before closing a mortgage loan. Read when it is allowed to repay a mortgage early and its lower amount, usually it is equivalent to the monthly payment, as well as how you can deposit the amount to close the account.

If the agreement provides for clauses with any fines and fees for early payment of the mortgage, then it will be challenged in court, since according to the law it is allowed to close off the loan ahead of schedule.