PRO new building (Moscow)

- Direct visit to the Rosreestr branch. It is this institution that is engaged in the formation and issuance of various extracts and certificates related to all kinds of real estate. It is important to contact the branch that is located at the location of the apartment itself. To do this, you need to draw up a special application indicating the address of the property.

- Additionally, a passport is presented to the employee of the institution. Next, you need to wait about 5 days to pick up the certificate.

- Sending documents by mail. If it is not possible to visit Rosreestr in person, you can send the necessary documents to this institution by mail.

- Apply online. To do this, you can use the Rosreestr website, for which you fill out the form available on the resource, and the necessary documents are sent in scanned form.

- Contact the MFC. This institution acts as an intermediary between private individuals and various government bodies, so you can apply for a certificate at its branch.

Often, in order to carry out various transactions, for example, transferring real estate as collateral or applying for a mortgage, you need to know what cadastral value the housing has. This information may be contained in an extract from the Unified State Register or can be requested online, and a special certificate can also be obtained from Rosreestr.

Estimated value of the apartment: inventory according to BTI, cadastral, market

- Property tax calculations;

- Notarial actions;

- Determining the amount of rent for real estate owned by the state;

- Accrual of compensation payments;

- Determination of the initial sale price of real estate by the state.

Taking into account changes in legislation and a decrease in demand for technical inventory of the housing stock, BTI bodies, in addition to the previous powers for technical inventory, examination, issuance of certificates and duplicate documents, carry out on a commercial basis :

How to get a BTI certificate for selling an apartment

A certificate of cadastral value is provided free of charge, and the fee for a cadastral passport for individuals is 200 rubles for a paper document and 150 for an electronic one.

If the assessment is carried out for the purchase of housing in new houses that have recently been put into operation, instead of title and title documents it is necessary to provide:

- Acceptance certificate certified by you and the construction company;

- Equity agreement or assignment agreement.

Property that belonged to each of the spouses before marriage, as well as property received by one of the spouses during marriage as a gift, by inheritance or through other gratuitous transactions (the property of each spouse), is his property.

Inspection of the apartment allows the Appraiser to establish its actual, operational and economic characteristics.

The procedure for obtaining a certificate from the BTI on the inventory value of a property

- an application filled out in the prescribed form;

- original passport (photocopies are made of certain pages);

- title document of the owner or tenant (social tenancy agreement);

- power of attorney certified by a notary - for representatives (in the original for making a copy);

- birth/adoption certificate – to represent the interests of minors.

Often citizens are faced with the need to calculate the inventory value of a real estate property. This calculation refers to the estimated value of the living space, which is determined by an appraiser from the public service organization Rosreestr (BTI).

How to get a?

Not only the direct owners, but also official tenants after concluding the appropriate lease or rental agreement, individual entrepreneurs and legal entities have the right to request a certificate of the inventory value of an apartment, house or any other real estate. In this case, the legal owners of the property can send their representatives instead of themselves, having previously issued a power of attorney at the notary’s office (it is important to limit the powers in it and indicate the validity period). For minor owners, the request is submitted by their parents or adoptive parents.

To obtain the necessary information in the form of a document that has legal force, you need to contact either the territorial Bureau of Technical Inventory or Rosreestr. In addition to the on-site application, you will need:

- Original personal passport (copies will also be required);

- Documents certifying ownership of real estate or a lease, lease, sublease, social tenancy agreement;

- A duly executed power of attorney (original), if his representative is applying instead of the owner;

- Birth certificate or adoption decision, if the interests of minors are represented by their actual guardians.

You can also submit a request using the official website of Rosreestr or the territorial office of the Multifunctional Center.

Let's get acquainted with the nuances

To sell an apartment, each owner must prepare a list of certain documentation. This is due to the fact that without these papers the transaction will not be formalized by the Rosreestr authorities. In addition to this, before the transaction, a potential buyer should familiarize himself with all the nuances on the basis of which the price of the property was determined.

- Lack of necessary documents.

- Errors, blots and corrections in the application.

- Transfer of false and unreliable information to employees of an authorized institution.

- If the applicant is not the owner of the property about which he is requesting information.

- Expired identification document.

The procedure for challenging the inventory value of an apartment

The results of the procedure may be incorrect. There are two reasons behind this:

- dishonest performance by employees of their duties;

- use of unreliable information for calculations.

In the first case, it is enough to write an application requesting a repeat procedure. In case of refusal to carry out the event, you can re-challenge the results through the Arbitration Court. To do this, you need to collect a package of documents. The most common errors are related to the use of incorrect data. To avoid this, you should check all documents issued by government agencies at the stages of construction or purchase of premises. To carry out the procedure correctly, you should contact a lawyer and, with their help, collect the necessary documents.

How and where can you order and receive a certificate of cadastral value of an apartment?

This paper allows future buyers to understand the state in which they are purchasing housing and, if possible, to think about the correctness of the decision they are making. And you can easily stand your ground when setting the price and not give in to buyers’ persuasion to lower the price.

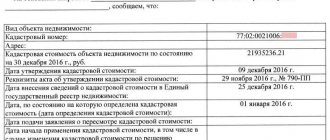

- At the top is the name of the service that issues this document.

- Next is the name of the document.

- Then the date the document was completed is indicated.

- A special cadastral number is assigned.

- If there were previous certificates, their numbers must be indicated.

- We indicate the address of the property.

- The value of the cadastral value at the current moment is indicated.

- We write the details assigned to the document on the basis of which the decision on cost was made.

- If there are special marks and nuances, they also need to be indicated.

Also read: How to discharge a person from an apartment in court

How and where to get a certificate of the cost of an apartment

A certificate of the cost of an apartment in one of two values is issued by the relevant government agencies after providing a specific list of papers. In some cases, civil service employees have the right to refuse a citizen’s application to issue these certificates.

- through the online help desk on the Unified State Register website (https://rosreestr.ru/wps/portal/p/cc_ib_portal_services/cc_ib_ais_fdgko) (you need to know the cadastral number or address);

- using a public cadastral map (https://maps.rosreestr.ru/PortalOnline/) (information should be contained in the information panel that appears when you click on a specific area on the map);

- by filling out a request on the Unified State Register website (https://rosreestr.ru/wps/portal/cc_gkn_form_new) for the issuance of a cadastral extract for a specific property or a cadastral passport.

Everything about BTI real estate valuation: where to find out the inventory value of an apartment

- have access to directories of prices for materials and work created in accordance with Order No. 87 of April 4, 1992 “On approval of the procedure for assessing buildings, premises and structures owned by citizens by right of ownership.”

- Find online Departmental building standards for accounting for wear and tear (VSN 53-86(r)).

- Obtain information on the coefficients for converting old prices into modern ones, taking into account inflation, in the corresponding region (they were regularly approved by each constituent entity of the Russian Federation until the end of 2013).

- Have perseverance and estimating skills, or at least experience in preparing generalized calculations, for example, for repairs or construction.

We recommend reading: How to find a plot of land by address on a public cadastral map

Certificate of market value of the apartment

Olga, ask the guardianship to show you a sample that suits this particular guardianship. Because some OOiPs skip regular printouts, others require evaluation albums (“lightweight”), others require a printout with a company seal, etc., etc. Well, then move on to what they require.

So, from anyone?! For example, is the website for intimate services suitable for them too? )) Olga, you should at least ask them. What are they referring to - any real estate advertising site? Cadastral Chamber website? Or do you need to determine the cost on one of the many real estate price calculators? But in general, I don’t understand why they need MARKET value. We now have an official cadastral register. Since when did they start demanding the market? Previously, the BTI inventory value was generally enough for them, but now the cadastre is not satisfactory?

Inventory cost: obtaining a certificate

In addition to the claim, it is necessary to attach a certificate of the current inventory value of the real estate, evidence that the price was set incorrectly, documents confirming ownership in the name of the plaintiff, and a report on an independent assessment.

You should also take into account the time allotted for the preparation of the inventory certificate. So, if there is no need to order an additional assessment procedure, and the applicant simply needs to obtain the available information in documentary form, no more than ten days are allotted for this. When you need paper for several real estate objects at once, for which inventory work is needed, the period for issuing the document will directly depend on how long they will take and how busy the territorial structure is with work. The terms will be agreed upon with the applicant and recorded in preliminary agreements.

Also read: How much does a medical examination cost to get a job?

Certificate of cadastral value of the apartment

The cadastral value of an apartment is a conditional value of property valuation, which allows you to compare data for calculating taxes or calculating state duties in the event of sale or transfer of property by inheritance. In this case, a certificate of the cadastral value of the apartment, where a special information resource about the cadastral system in Russia will help you obtain it. Currently, there have been fundamental changes in the field of cadastre in Russia after the introduction in 2020 of Law No. 218 “On state registration and cadastre recording in the Russian Federation.” According to the provisions of the law, the cadastral value is reflected in a special document - an extract from the Unified State Register of Real Estate, and you can order a certificate of value, indicating the cadastral price, both on the day the report was generated, and on a conditional fixed date. Thus, you can order either a certificate of cadastral value in the past on a conditional date or an extract from the Unified State Register of Real Estate with the actual cadastral value on the day the report was generated (the current document replaces the document Cadastral certificate of cadastral value according to Law No. 218-FZ from 01/01/2020)

The inventory assessment of an apartment plays a decisive role in calculating taxes and duties when making any transactions. The owner of the property right may agree or disagree with the assessment of the value of the apartment. If you do not agree with the indicated price, you have every right to challenge the assessment in Rosreestr. If you refuse to challenge the cadastral value in Rosreestr, you must contact the courts.

What is the difference between cadastral and inventory value?

Pay based on the inventory value and don’t break your head. And if the gift was between close relatives, then personal income tax is not paid at all.

Here is a letter I found from the Federal Tax Service on this issue:

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

THE FEDERAL TAX SERVICE

LETTER dated January 10, 2012 N ED-3-3/ [email protected]

The Federal Tax Service has considered an appeal on the issue of determining the tax base for real estate (1/2 share of an apartment) received as a gift between persons who are not family members or close relatives, and reports the following.

Clause 18.1 of Art. 217 ch. 23 “Tax on personal income”, part two of the Tax Code of the Russian Federation (hereinafter referred to as the Code), does not provide for exemption from taxation of income in cash or in kind received by an individual (donee), if the donor and donee are not family members and (or) close relatives in accordance with the Family Code of the Russian Federation.

When determining the tax base for calculating tax on income received as a gift, one should be guided by the general procedure established by the provisions of Chapter. 23 Code.

In accordance with paragraph 1 of Art. 210 of the Code, when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Code.

According to paragraphs. 7 clause 1 art. 228 of the Code, individuals receiving income in cash and in kind from individuals who are not individual entrepreneurs by way of gift, with the exception of cases provided for in clause 18.1 of this article of the Code, when such income is not subject to taxation, independently calculate and pay tax .

In accordance with paragraph 1 of Art. 572 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code), a gift agreement is gratuitous, therefore, indicating the value of the thing transferred by the donor into the ownership of the donee or property rights is not an essential condition of the said agreement.

Considering that the Code does not contain a methodology for determining the specific price of a gift agreement for the purpose of calculating personal income tax, the tax base is calculated by the taxpayer based on the prices existing on the date of donation for the same or similar property. Income from the transfer of real estate as a gift may be recognized as its inventory value as assessed by the BTI in accordance with the requirements of clause 3 of Art. 574 Civil Code.

At the same time, the provisions of paragraph 1 of Art. 211 of the Code do not apply to relations between individuals arising from a gift agreement, since they deal with income in kind received by individuals from organizations and individual entrepreneurs.

State Civil Service Advisor

Russian Federation

2 classes

D.V.EGOROV

10.01.2012