Before you start talking about restructuring, you need to understand what a mortgage is and what it gives to the average person. In a simple sense, this is a loan provided by a bank for the purchase of housing, in which the property remains the property of the debtor, but is collateral from the creditor, that is, if the debtor does not fulfill his obligations, the creditor can exercise the right to sell the collateral property in order to compensate for his losses. On the one hand, a mortgage makes it possible to acquire housing, but on the other hand, you need to understand that if you purchase an apartment this way, you must remain solvent for a long time. In today's realities, it is quite difficult to maintain solvency due to many reasons: job loss, salary reduction or health problems. However, it does not matter to the bank why the debtor cannot make the required payment. What to do if some kind of force majeure occurs and it is no longer possible to pay contributions in the same manner? This is where a service such as mortgage restructuring comes to the rescue.

What it is?

At the moment, in practice, loan restructuring has not yet become widespread. The thing is that such a solution is beneficial only to the borrower; on the part of the bank, the only benefit is that the debtor will pay, but not in the same way as before. Restructuring is a change in lending conditions, after which the borrower receives more favorable terms for repayment of funds. This procedure does not reduce the size of the payment in the end, and certainly does not relieve the borrower of his debt; he is obliged to continue to repay the loan, but on more favorable terms.

Changes after restructuring may be different, for example, you can change the procedure for repaying debt or the size of the monthly payment. Sometimes banks provide the payer with the opportunity to repay only interest on the use of funds from a financial institution; in this case, payments on the principal debt are postponed for several months.

How to restructure mortgage debt: conditions, documents and procedure

Reading time: 7 minutes(s)

Mortgage debt restructuring in terms of its objectives and goals is not much different from similar measures in relation to other credit products. With the help of restructuring, the lender and the borrower additionally solve the problem of eliminating the extreme measure of resolving the debt problem. At the same time, the relationship between housing lending and the real estate market leaves a serious imprint on the state, trends and developments in the application of restructuring schemes for this type of lending.

What to do to restructure your mortgage debt

Mortgage debt restructuring - what is it?

If at some point the borrower becomes insolvent and cannot continue to service the mortgage line of credit, then the most beneficial solution to the problem for both parties will be to restructure the mortgage loan.

Attention: It is easier for a lender to reconsider relations with an existing regular client than to sell his property and look for a new borrower.

Restructuring allows, using various schemes and methods, to restore the possibility of normal debt repayment. In this case, the decision on structuring is made by both parties, so the terms of the new agreement will be beneficial not only to the borrower, but also to the lender.

How it works?

Housing loan restructuring is a change in the terms of the loan, as a result of which the borrower receives a more convenient option for repaying the debt.

When completing a restructuring, you should not hope for a reduction in the loan amount or debt write-off. However, the new lending conditions will allow the borrower to return to normal loan servicing.

Restructuring is available to both individuals and legal entities.

Mortgage debt restructuring implies one of the following changes to the terms of the loan agreement:

- extension of the loan repayment period with a reduction in the monthly payment amount;

- the ability to pay only the interest portion for using a loan with a deferred payment of the “body” of the debt;

- interest rate reduction;

- cancellation of sanctions for late monthly payments.

In some situations, the creditor accepts property owned by the debtor as repayment of part of the debt. However, such measures against individuals are taken extremely rarely, but some companies manage to cover part of the debt in this way.

In any case, in order to reach an agreement with the creditor, the debtor must have a compelling justification for non-payment of the debt, supported by documents. You shouldn’t just stop making loan payments and then rely on the bank’s loyalty - the amount of fines will reduce all the potential benefits of restructuring to nothing.

Banks consider the following to be good reasons for non-payment of debt by an individual:

- serious illness;

- passing away of a family member;

- loss of ability to work;

- job loss;

- significant reduction in wages.

To reach an agreement on restructuring, the borrower needs to document what happened. A positive credit history will increase the chances of the bank approving the restructuring.

Banks consider the following to be good reasons for non-payment of debt by a legal entity:

- a jump in the exchange rate (for debtors who took out a loan in foreign currency);

- drop in revenue;

- changes in the charter of the organizational and legal form of the organization.

The most common restructuring option for legal entities is to provide a credit holiday or revise the amount and payment schedule.

Mortgage Debt Restructuring Law

In 2020, the government adopted a law allowing some categories of Russians to reconsider the terms of the loan and receive support from the state in the amount of up to 20% of the mortgage amount, but not more than 600 thousand rubles, due to which the burden on the borrower will be reduced and the bank will not get into difficulty situation.

To receive such support, the following conditions must be met:

- the mortgaged housing is the only housing;

- the total share of ownership of other objects should not exceed 50 percent for the entire family;

- the cost per square meter of mortgage housing should not exceed the average market cost per square meter of similar housing by more than 60%;

- There is an area limitation of 50 sq.m per person; for two – 35 sq.m. for an individual family member, for 3 or more – 30 sq. m., but the total area of the apartment should not exceed 100 sq.m.

For foreign currency borrowers, a deferment in payment is provided provided that the amount of the monthly payment in ruble equivalent has increased by no more than 30%.

Deadline and extension of mortgage debt restructuring

Since loan restructuring is a right and not an obligation of banks, and the procedure for its provision is not regulated by law, the entire process is determined by each creditor independently.

Including the deadline for debt restructuring is set by each bank individually.

In most cases, the maximum term for mortgage restructuring among Russian lenders is 10 years. However, individual banks can significantly reduce or increase this period in accordance with the internal policies of the organization.

Despite the fact that debt restructuring makes the borrower’s plight easier, the period allocated by the bank is not always enough to stabilize the situation. Some organizations are considering the possibility of extending the restructuring based on the borrower's application. However, the decision to approve or reject such an application remains with the lender.

How to restructure mortgage debt

Required requirements and conditions

To restructure a mortgage debt, the conditions and parameters of the mortgaged property must be met, therefore the purchased property must be:

- the borrower's only home;

- inexpensive compared to average market prices for similar housing;

- small in area;

- acquired no earlier than one year before the restructuring.

In addition, requirements are also imposed on borrowers who may qualify for restructuring:

- citizens who are parents or guardians of a minor child;

- combat veterans;

- disabled people and parents of disabled children, regardless of their age.

The restructuring proposal is aimed at borrowers with a positive credit history who, for an objectively valid reason, have experienced temporary financial difficulties.

What options are there for restructuring your mortgage principal?

Banks offering mortgage loan restructuring may offer their own borrowers one of the following options for changing loan terms:

- increasing the loan term with decreasing monthly payments;

- provision of credit holidays with payment of only interest for the use of loans;

- refinancing by obtaining a new loan on more favorable terms;

- change in loan currency;

- cancellation of sanctions for overdue loans;

- full early repayment in order to eliminate overpayments on the loan.

What to do: step-by-step instructions

In order to restructure a mortgage with the help of the state, you must complete the following steps:

- collect a package of documents confirming the reasons for existing or possible future debt;

- submit an application for restructuring at a bank branch;

- declare to the creditor the reasons for financial insolvency and the amount of real income;

- wait for the bank’s decision within two weeks;

- if the restructuring is approved, sign a new agreement and receive a new debt repayment schedule.

Important: The bank is not obliged to make a positive decision on restructuring.

In case of refusal, the borrower may try to refinance the home loan by lending to another bank on more favorable terms.

Mortgage debt restructuring program with government assistance

In April 2020, a support program from the state was approved in the amount of up to 20 percent (but not more than 600 thousand rubles) for one housing loan.

The government offers assistance in mortgage restructuring to the following categories of citizens:

- young families where the age of the spouses does not exceed 35 years and have more than one child;

- families with two children, regardless of the age of the parents;

- persons who are guardians of young people under 24 years of age;

- combat veterans;

- disabled people;

- officials;

- scientists and scientific employees of state and municipal institutions.

To receive a subsidy from the state, the parameters of the mortgaged housing must be met, therefore the purchased property must be:

- the borrower's only home;

- inexpensive compared to average market prices for similar housing;

- small in area;

- acquired no earlier than one year before the restructuring.

For large families, there are no requirements for square footage and cost.

Banks working with mortgage debt restructuring

On the Russian banking market, a huge number of organizations offer their clients mortgage debt restructuring.

The most famous lenders among them are such institutions as:

- "AHML";

- "Sberbank";

- "VTB 24";

- "Opening";

- Rosselkhozbank.

- Restructuring of mortgage debt at Sberbank

Sberbank

The most famous lender in our country offers mortgage restructuring not only in rubles, but also in foreign currency equivalents. In the latter case, the amount of debt will be recalculated at the current exchange rate.

For mortgage debtors, Sberbank offers:

- deferment of principal payment;

- increasing the loan term;

- restoration of overdue principal debt on accounts for recording urgent debts.

The grounds for mortgage restructuring for Sberbank are:

- serious disease;

- passing away;

- pregnancy;

- military service;

- decrease in income.

To obtain a positive decision regarding restructuring, the following conditions must be met:

- positive credit history of the borrower;

- overdue for more than 30 days;

- availability of documentary evidence of the impossibility of repaying the loan on your own.

In some cases, a guarantor will be required.

To submit an application for restructuring, you must collect a package of documents consisting of:

- passports;

- work book;

- documentary substantiation of insolvency.

VTB 24

When processing a mortgage restructuring at VTB 24, the bank may offer the borrower one of the following options:

- write off part of the debt;

- reimburse part of the debt at the expense of the client’s property;

- change the loan repayment terms.

To carry out debt restructuring at VTB 24, the bank client must meet the following conditions:

- citizenship of the Russian Federation;

- age from 21 to 70 years;

- registration in the region where the bank is located;

- total work experience of at least one year;

- income level allows you to make regular loan payments on new terms.

The following categories of citizens may apply for changes in loan terms:

- combat veterans;

- parents or guardians of a minor child;

- families with two or more children;

- persons living in a dilapidated house;

- employees in the education sector with at least five years of work experience;

- employees of municipal institutions.

Important: The basis for restructuring may be the fact that there is a three-month delay in payment.

To submit an application for restructuring, you must collect a package of documents consisting of:

- general passport;

- work book;

- documentary substantiation of non-creditworthiness.

AHML

The mortgage restructuring program at the Housing Mortgage Lending Agency began working after the approval of the government “Program of Assistance to Certain Categories of Mortgage Borrowers” dated April 20, 2020.

In simple words: if you took out a mortgage from any Russian bank, and then radical changes occurred (a child was born, income decreased significantly, etc.), AHML can reduce the amount of your loan by 20% (but not more than 600 thousand ).

Support for mortgage lending from AHML can also be in the form of:

- changes in the foreign currency of the loan to rubles;

- setting the amount of mortgage lending for the entire required period to no more than 12%;

- reducing monthly payments by up to 50%;

- reduction of the borrower's debt obligations in an amount not less than the amount of compensation.

To participate in the AHML support program, the situation must meet certain conditions:

- over the past three months, total income has decreased by more than a third;

- the monthly payment on a foreign currency mortgage increased by a third compared to the original data;

- after making the mortgage payment, the family is left with an income not exceeding two subsistence minimums for the given region.

According to Russian legislation, the following can participate in the support program from AHML:

- families with a disabled child under 18 years of age;

- guardians and trustees of minors;

- combat veterans;

- disabled people;

- guardians of disabled children.

Among other things, requirements are put forward for mortgage housing, it must be:

- the borrower's only home;

- inexpensive: its cost should not exceed the average market cost of similar objects by more than 60%;

- small in area:

- 1-room apartment – no more than 45 sq.m.;

- 2-room apartment – no more than 65 sq.m.;

- 3-room apartment – no more than 85 sq.m.

- acquired no earlier than a year before the restructuring.

To apply for participation in the program, you must provide the following documents:

- borrower's passport;

- identity documents of all family members;

- certificate of marriage/divorce;

- a certificate indicating the amount of debt and the term of the mortgage;

- an extract and report from the Unified State Register of Housing Rights for the borrower and his family member, confirming that this property is the only home;

- income level certificate;

- documentary justification for insolvency.

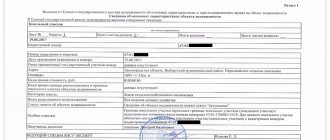

Sample application

Restructuring is carried out upon a written application from the borrower. Some lenders have developed their own application forms, but their clients can write an application in any form. The main condition is that the document reflects:

- name of the organization;

- loan agreement data;

- information about payments already made and remaining debt;

- reasons for insolvency;

- restructuring options acceptable to the borrower.

Ultimately the call will look something like this:

To the manager (name of the credit institution)

application for mortgage loan restructuring

In accordance with the loan agreement No. (loan agreement number) dated (date of the agreement) year, I am a client of your bank and am repaying the loan. As of today, the outstanding balance on the loan is (current amount of debt).

Due to the current circumstances (a valid reason for insolvency), I had financial difficulties, which led to problems repaying this loan. I am attaching copies of supporting documents to this application.

Based on the above, I ask you to consider restructuring my loan.

(date of appeal) (signature, transcript)

Reviews

Despite the seemingly favorable conditions, the government restructuring program did not gain the expected popularity.

At the very beginning of the government program, very stringent requirements were imposed on borrowers, which is why a large number of those in need of restructuring were simply refused. Subsequently, the conditions softened, the program was reworked and became more viable, but the lion's share of debtors had already applied to banks for restructuring and received the necessary support, and the remaining defaulters became malicious and are suing creditors.

Of course, it is best not to take the situation to extreme measures and try to take on debt obligations only if you are absolutely confident in your own financial well-being. But since a mortgage is a multi-year project, if unforeseen circumstances that make it difficult to repay the debt do occur, restructuring may be the only correct way out of the situation.

Video

Did this article help you? We would be grateful for your rating:

0 1

Mortgage restructuring conditions

First of all, you need to prove to the financial institution whose services you used that you really need it. To do this, you need to collect a package of documents that will confirm your difficult financial situation. It is best not to delay in asking for help, otherwise, if it comes to a delay, this will have a negative impact on the bank’s decision to restructure your mortgage. If your relationship with a financial institution has previously been good, and your supporting documents satisfy it, then you can count on more favorable settlement terms. But there are times when the bank does not meet the client halfway, in which case there is another option - to look for another financial institution that will agree to refinance your loan.

Documents to be collected

Let's consider the standard package of documents that any bank requests when completing a restructuring. So, it includes:

- Original or copy of the work book, certified by the employer.

- Certificate of income from your last job for the last year.

- If you have additional income, you must provide information about it.

- Questionnaire for the provision of restructuring.

- Passport.

- Documents about the existence of debts on other loans, as well as documents confirming already fulfilled obligations.

- A loan agreement concluded between the borrower and the financial institution that provided the mortgage loan.

- A copy of the mortgage, which is certified by the organization that issued the mortgage.

If any, you must provide the following documents:

- A copy of the marriage certificate.

- Documents about the education received.

- Confirming poor health, if restructuring was required for this reason.

- Military ID or registration certificate.

- Documents confirming the ownership of real estate or movable property.

If you use the services of a real estate agency, you will have to collect documents for them:

- Documents establishing ownership of property.

- Real estate title insurance contract.

- Documents of co-borrowers, if any.

For whom is refinancing available?

Military personnel of the Russian Federation who do not plan to leave service in the coming years and who previously received a military mortgage from one of the Russian banks can resort to refinancing.

Each institution has the right to independently establish a list of requirements for potential borrowers, but in most cases these are:

- Positive credit rating.

- An insured residential property purchased with a mortgage (sometimes the borrower also has life and health insurance).

- The minimum period of time until the completion of the mortgage agreement.

- Minimum period for obtaining a mortgage loan.

- No outstanding debts on the current mortgage.

Expert opinion

Antonov Viktor Sergeevich

Practicing lawyer with 8 years of experience. Specialization: military law. Recognized legal expert.

In addition, the current lender should not demand early repayment of the mortgage debt (usually such a condition is imposed on a borrower who does not make mandatory payments for more than 200 days).

This is important to know: Unified register of military personnel in need of permanent housing

Forms of restructuring

Restructuring can be done in various ways:

- Providing credit holidays - during this period the client is given the right not to repay the loan amount, but to pay only accruing interest. The period for which such a right is granted—several months—is determined individually. The consequences of using this refinancing method are the extension of the payment period.

- Restructuring a mortgage through refinancing is one of the best options for a client. When using it, the debtor takes out a loan from another bank for the amount of debt in the first and pays off the mortgage with this money. The benefit is that most often the conditions of the second bank are better than when paying using the usual method, so the payer wins a good amount.

- Increasing the loan term - with this method, mortgage loan restructuring involves extending the period for repayment of funds, as a result of which the amount of the monthly payment decreases.

- Repayment ahead of schedule - everything is simple here, the debtor returns only the funds he took, without interest for using someone else’s money, thus you can save a lot of money.

- Cancellation of penalties and fines in case of late payments. Such mortgage restructuring is possible only if the client contacts the bank on time and provides comprehensive evidence of a difficult financial situation.

- Changing the currency of the loan - this option is provided by some banks if there has been a jump in the exchange rate.

- There is also government restructuring of mortgages. In simple terms, this is government assistance in repaying a loan. The Mortgage Restructuring Act indicates that this could help payers pay off their loan by 25-70%. It all depends on the amount of remaining debt.

Why is there a need to refinance a military mortgage and how does it help?

The protracted economic crisis in our country has affected all spheres of life, so it is quite obvious that state assistance under the NIS from the Ministry of Defense of the Russian Federation has become insufficient to repay monthly loan payments. Indexation has not actually been carried out in recent years, which is why Defenders of the Fatherland have felt significant credit pressure.

In theory, monthly NIS contributions should completely cover the mandatory payments on a mortgage loan, but the realities of today are completely different - payments often exceed the amount of government assistance. But there is no need to wait for this situation to change, since the forecasts for indexation are unfavorable. It is to correct this situation and create more favorable conditions that a military mortgage refinancing program has been developed, which helps to pay off debt obligations on time.

However, in order to refinance the loan, the contractor will have to justify his desire, outlining specific goals and reasons. For example, a weighty argument is the birth of a child, the illness of one of the family members, or a sharp deterioration in financial situation.

OTP bank

The service is valid not only for mortgages, but also for car loans and cash loans. Here, just like at Sberbank, they provide the opportunity for restructuring by increasing the payment period or deferring payments. You need to apply for benefits from the same bank from which you took out the loan.

Remember, not all institutions list restructuring as an official service, but it is still possible. In any case, if you have any difficulties with payments, contact the bank that served you when applying for the loan. As a rule, they are all loyal to their clients, so you always have the opportunity to get help in case of difficulties. You need to provide comprehensive information about the problem that you have and try to collect all the documentation to submit the restructuring.