Details about options for changing the payment schedule

Options for changing the payment schedule

Currently, many families use the services of financial organizations to improve their living conditions. It is well known that a mortgage loan is issued for a long period, and the bank is not prohibited from making payments ahead of schedule.

First you need to carefully study the terms of the contract. In most cases, financial institutions allow early repayment of debt, but this must be specified in the relevant document.

Those who intend to prematurely pay a certain amount to pay off the debt on a mortgage loan should pay attention to the clauses of the agreement, which indicate:

- Is it necessary to notify bank employees before repaying an extraordinary payment;

- what commission is provided;

- payment period - there may be special days for making payments outside of the schedule;

- minimum and maximum contribution amount;

- bank branch where debt repayment is allowed.

Important! If the client does not pay attention to the repayment schedule and makes payments prematurely, this does not exempt him from paying the mandatory monthly installment.

The bank sets the repayment date for every 28th day of the month. The client makes an extraordinary payment on the 15th, and the amount of the contribution exceeds the amount of the mandatory monthly payment. Despite this, payment will have to be repeated on the 28th to avoid delays and not violate the terms of the contract.

A payment made not according to the schedule goes towards early repayment and reduces the total debt under the contract. Interest accrued on the debt amount is usually recalculated.

The repayment schedule is prepared in several ways:

- Annuity payment - the client pays in equal installments throughout the entire term of the contract. After paying the required monthly amount, the funds are distributed in this way: one part goes to repay the loan body (the principal amount of the debt), the other pays off the accrued interest.

- A differentiated repayment schedule is when the principal amount of the loan is divided into equal parts, and interest is charged on the balance of the debt, as in the annuity repayment schedule. This payment method is not entirely convenient, since the payment at the beginning of the term is quite large, but at the same time it benefits from the increase in price. If we compare the same conditions, then the first payment under a differentiated repayment schedule is on average 25% higher than the annuity.

Note! The repayment schedule with annuity payment is used most often by financial institutions.

There are two options for changing the schedule:

- shorten the term of the contract by increasing the payment or paying additional amounts;

- reduce the payment amount, but leave the repayment period unchanged.

Before reworking the debt repayment plan, it is necessary to determine which method is most beneficial for the borrower:

- some want to reduce the price increase;

- others want to reduce their monthly payment amount.

In what case is it beneficial to reduce the period?

Most often, those borrowers who took out a mortgage with an annuity repayment schedule reduce the loan term. Such people usually:

- they have funds, i.e. they can make payments in large sums, and they choose a long term as a “safety net”, you never know what will happen in life;

- want to reduce the amount of overpayment;

- have paid off more than half of the debt and are trying to get rid of the “credit ties” as quickly as possible.

The client pays a monthly amount greater than specified in the contract. The “extra” money covers part of the principal amount of the debt, while the amount of the required payment remains the same.

Borrower Behavior Options

Depending on the available cash reserves, the borrower chooses one of the possible ways to repay the existing loan ahead of schedule: partial repayment or full repayment. Most often, partial repayment is chosen, since full repayment, although more profitable, is more expensive. With this option, the debtor deposits an amount into the account that is greater than the scheduled monthly payment. After such an entry, the schedule changes, becoming more profitable for the borrower.

Even if in the future the borrower does not repay the loan early, the amount of the monthly installment under the new schedule will be less. How much less? This will depend on the amount deposited and the share that has already been repaid.

Full repayment involves depositing the entire amount of the remaining debt into the account at a time, while the obligation is closed ahead of schedule, and part of the interest for using bank money is returned to the debtor. It will not be possible to perform all these actions automatically. Each stage, starting from depositing the amount into the account and ending with the return of interest, as well as part of the insured amount, requires approval and preparation of certain documents. If you do this without the knowledge of Sberbank, the funds will be written off only in the amount of the regular monthly payment and the borrower will not receive the benefits that he expected.

Rosdengi: how to find out your debt?

Before closing the loan early

Just like that, without an additional agreement, you cannot contribute a large amount to pay off the debt. Although, even at the stage of concluding a loan agreement, you can do a “good deed” and write an application for direct withdrawal of money that is on the loan account. What will it give? And this, precisely, will allow you to deposit, at any time, any amount to not fully repay the loan, and each schedule will be redone based on the payments made by the borrower.

Early repayment can be made through the Sberbank Online system.

It seems to be profitable and you don’t have to run to the bank every time. Sberbank employees themselves often suggest leaving such a statement, but there is a “pitfall” in this action. The fact is that when automatically reworking the schedule, the amount of interest that the bank must return to the debtor is not taken into account. And if you don’t contact the bank on time, it will appropriate the money, which by law is obliged to return to the borrower. So remote interaction with the bank is not always profitable. What does a debtor need to do under normal conditions to repay the loan in full or in part?

- First of all, the debtor clarifies with the bank how much he currently owes to the credit institution. You can go to the Sberbank Online system, where such information is also available.

- Next, you need to calculate how profitable repayment is at a given time, and in what amount it needs to be made.

- We go to the bank and write an application in the prescribed form, where, among other things, you will need to indicate the amount you plan to deposit, the amount of the balance and the amount of the current debt. You will also need to indicate on what date this additional amount for early repayment should be written off.

- Next, the employee with the borrower draws up a standard additional agreement, in which he writes down all the necessary data, the debtor reads this agreement and signs.

- After this, the bank employee invites the borrower to familiarize himself with the new debt repayment schedule and deposit the required amount.

How the schedule will change

In case of partial repayment of the loan, banks offer borrowers two options: shortening the contract term, but maintaining the original amount of payments, or reducing the amount of monthly payments while maintaining the term. Sberbank is trying to save the term by reducing the size of monthly loan payments; the second option is not offered.

Bank employees, drawing up a new schedule, subtract the deposited amount from the amount of the remaining debt (loan body + interest). Interest for the saved period is also deducted from the resulting result. For example, if the deposited amount is equal to payments for 5 months, then from the total amount of interest on the loan you need to subtract the amount of interest for 5 months, proportionally reducing the payment for subsequent months. You can make the calculations yourself and check how honestly the credit institution treats its clients.

Will the bank return the interest?

I would like to especially note the fact that Sberbank does not always return “extra” interest to borrowers who have fully repaid their loan obligations ahead of schedule. In some cases, the bank returns these interests, but recalculates them incorrectly, which disappointed clients have repeatedly reported on various forums and social networks.

The task of the borrower who has fully repaid the loan ahead of schedule is, firstly, to take a certificate from a Sberbank branch stating that he no longer owes the bank, and secondly, to write an application for a refund of interest and attach this certificate and the loan agreement to it. If you have an application and documents, Sberbank will soon recalculate the “extra” interest and return the money to the borrower. If the bank’s calculations seem incorrect to the former debtor, he can complain to the manager of the Sberbank branch or to the regional office.

So, is it profitable to pay off a loan early if it is paid off with annuity payments? If you have free money, this is very profitable, and if you do everything correctly, you can get nice bonuses from Sberbank. Good luck!

Where can a pensioner get a loan with a bad credit history?

Annuity payments - early repayment: features, calculation

Any of us understands that it is unprofitable for banks to repay loans early. After all, they need to reimburse interest to individuals and legal entities on funds raised and make a profit. This means that each “unscheduled” repayment is a “blow” to the profitability of the credit institution. Therefore, banks previously either set time limits or charged a penalty for early repayment. The law was on the side of the bankers, but thanks to the fact that the president approved amendments to Articles 809 and 810 of the Civil Code, from January 2012 it became possible to repay the loan early without much damage to the borrowers’ wallets.

If you are just about to take out a loan, you should ask in advance whether early repayment is possible, whether there are options and how beneficial it will be for you.

If you are determined to repay the loan early using the annuity form of payments, then follow the tips below:

- When concluding a loan agreement, write an application for unaccepted early repayment of the loan when funds arrive in your account, which is opened with the creditor bank. Thanks to this, you do not have to come to the bank every time to write a special application (as a rule, in order to make an early payment, you will need to provide the bank with an application indicating the amount). This means that basic acceptance debiting will greatly help you out if you do not want to waste time on trips to the bank, but will transfer funds for early repayment either by non-cash method or using terminals, banks and other devices with a cash acceptance function.

- Don’t be lazy each time to check with the loan officer the date of crediting of funds to the account (for a non-cash transfer) and the date of repayment of the loan, since money or transactions have a tendency to “freeze”.

- After making your final payment, keep for a while all the information confirming that the loan has been repaid. It may come in handy in case of misunderstandings.

With annuity payments, the borrower is essentially paying interest in advance. For example, you took out a loan for 6 months, but used it for 3 months, and on the fourth you already returned it. But it turns out that as part of the first payments you paid the same interest as if you had used credit funds in the 4th, 5th, and 6th months.

When there is no early repayment, interest is paid according to the agreement. If there was an “early payment”, then the annuity may contain overpaid interest. To put it simply, the borrower, based on the actual repayment period, overpaid.

In case of early repayment (both partial and full) of a loan to Sberbank using the annuity method, you will need to do the following:

- contact the Bank branch where the loan agreement was concluded on any convenient day;

- inform the employee of the intention to fully repay the loan or pay an amount exceeding the monthly contribution at the nearest date determined by the schedule;

- after the employee draws up a new schedule, sign it;

- ensure the receipt of funds into the repayment account not 21:00 on the day of early repayment (according to schedule) in the specified amount.

How to repay a loan early

According to the law, as stated earlier, the bank does not have the right to prohibit the client from repaying the loan early. A few years earlier, the bank charged a fee for early repayment in the form of a fixed amount, today this is prohibited by law, even if you entered into an agreement before this law came into force, the bank still does not have the right to charge fines and penalties.

The next nuance is that the client can repay the loan ahead of schedule in full or part of it. In the first option, he pays the bank the amount that he currently owes, taking into account interest, corresponding to the actual date of payment. In case of partial repayment of the debt, the client has the right to pay any amount, unless otherwise provided by the contract, and choose which condition will be more beneficial for him: a reduction in the monthly payment or a reduction in the loan term.

By the way, a separate clause in the loan agreement specifies the conditions and procedure for early repayment of the loan.

If you decide to end your financial relationship with the bank ahead of schedule, you must notify the lender. Early repayment of a loan with annuity payments at Sberbank begins with a written request to the lender about your intention to make a payment. You can do this at the bank branch where you entered into the agreement; it is important to do this no later than thirty days before the date of the expected payment.

Now let’s look at all the nuances and features of early repayment for annuity payments. First of all, the bank must tell you the date when funds will be written off to repay the loan; as a rule, it should not coincide with the next scheduled payment. And after that you will have to visit the bank again and get a new payment schedule. If you want to repay the debt in full, the bank must make a calculation and name the exact amount to be paid, taking into account the recalculation of interest.

Is it possible to take out a loan for temporary registration?

Sample application

Calculation of early repayment for annuity payments

In the case of annuity payments, 2 types of early repayments are used:

- Repayment after which the monthly payment amount is reduced.

- Repayment with maternity capital.

- Calculate the remaining amount of debt on the loan, subtract the early repayment amount from it;

- Determine the remaining term after repayment;

- Use the annuity formula to calculate the next payment.

- To determine the balance of the debt, we take the original amount of the debt, subtract from it the payments made for 3 months “to repay the debt” and the amount of early repayment.

- The new loan term is determined by subtracting the payment number from the total number of loan months.

This is interesting: Labor disputes - Lawyer in Rostov-on-Don

18 – 3 = 15. The new loan term is 15 months.

- Now you have a new loan with the following data:

- S (amount) – 87,270.06;

- N (term) – 15 months;

- P (interest rate) – 15%.

The first payments (before early repayment) are displayed in the table: No. Year/month Total contributed To repay debt To repay interest Early payment Debt balance after payment 01/0 - 150,000.000.000.00 150,000.0011/19 357.727 482.721 875.00 142 517.2821/2 9 357.727 576.251 781.47 134 941.0331/39 357.727 670.961 686.7640 000.00127 270.0787 270.06

- 40,000.00 – early payment;

- 87,270.06 – balance of debt minus early payment.

As you can see, the difference is only in pennies. From the above examples, we can conclude that early repayment of an annuity is not so profitable, since when determining the new amount of debt, only payments to repay the debt are deducted, and those that go to repay interest (and they are maximum at the beginning of lending) are simply are donated to the bank. In some banks, you can still receive overpaid interest, but they are recalculated at the final closure of the loan (when it is possible to establish the actual period for using the money).

Recalculation of interest

Surely everyone has a question about whether the bank will recalculate your interest, since you have already paid it at the beginning of the loan term. If you look at the loan agreement, then note that in the first months most of your payment went towards repaying interest, and towards the end of the schedule, on the contrary, you pay the body of the loan. Thus, if you have already paid interest, or rather, most of it, then it would be fair to return the previously paid interest for the period when the borrower did not actually use the borrowed funds.

This question concerns borrowers who partially or fully decided to repay the annuity loan early after half the lending period, because if you look at the schedule and calculate the amount of the principal debt, it has practically not changed. Here the bank must recalculate and charge interest from the borrower only for the period of use of the loan. If the lender did not do this, although this is rather an exception to the rule, because banks operate within the law, you will first have to pay the required amount to repay the loan, then collect interest from the bank in court.

Please note that if you repay the loan ahead of schedule, you will in any case save on interest payments; you can calculate the benefits using an online calculator; the calculations will be preliminary.

How to calculate overpaid interest

Annuities are not very common in commercial loans; they can most often be found in consumer lending. Lending to commercial organizations has its own characteristics - early repayment of the loan is prohibited for them at the initiative of the borrowers. In this case, a refund of interest is possible only when the bank collects the debt ahead of schedule due to deterioration of the loan collateral.

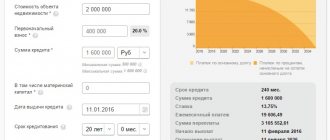

If you want to calculate what amounts you will have to pay on the loan using the annuity form of payments, as well as how they will change after early repayment, then use the annuity loan payment calculator located on this page.

It will be useful!

———————

Minicourse “Snowball Method” from Timur Mazaev (MoneyPapa). A unique and one of the most powerful ways to reduce terms and interest on loans! You can purchase this course here. Price 890 rub.

———————

Step-by-step Plan for Accelerated Return (Repayment) of Loans and Debts in PDF. Reduce terms and interest on loans and debts by 2-3 times! Download PDF for Free!

Calculation of early repayment of a mortgage loan. Formulas for calculation or how to calculate it yourself

Sooner or later, when dealing with a bank, people think about the question: how does the bank count loans and deposits? It is important for a person to know how the bank calculates the loan, builds a payment schedule, and calculates early repayments on the loan. This article sheds light on this issue. It provides formulas and shows how to calculate an annuity loan and how to calculate early repayment of a loan with annuity payments. Let's say you're trying to calculate a payment schedule. There is usually a hiccup in the payment table calculations. The payment schedule is especially interesting if early payments are made. The bank itself will not count for you, but you need to know how much the payment will be after early repayment. A financial tool will help you answer this question - a loan calculator with early payments online. It implements loan calculations taking into account early repayments. There are 2 types of early repayments possible - with a decrease in the payment amount and with a decrease in the loan term.

Formula for calculating annuity loan

Formula for calculating annuity payments:

Where

- n is the number of months in which the mortgage is paid.

- i is the interest rate on the loan per month.

- If you have an annual rate indicated, you need to divide it by 12. That is. let's say the annual rate is 12 percent, then

This value should be used when calculating the annuity payment. Loan amount - the amount of the mortgage issued under the bank agreement. This formula is the most common and is used in banks such as VTB 24, Sberbank, Deltacreditbank (mortgage bank). However, there are other formulas, more on that below.

An example of calculating an annuity loan with early payments

Now let's try to calculate the mortgage. For example, let’s take a loan with the following parameters

where OD repayment is the amount to repay the loan body. Interest is the amount of interest on the loan for the month.

Where OD amount is the amount of the principal debt as of the settlement date. Rate — interest rate in the current period. If there was a change in the interest rate, the new rate is taken. The number of days between dates is the difference in days between the “Current payment date” dates and the date of the previous payment. Number of days in a year is the integer number of days in the current year. If we calculate the interest payment, for example, from December 22, 2011 to January 22, 2012, then the interest formula looks like this:

That is, you need to calculate the interest for December and January separately, depending on the number of days in the year. In our example, you do not need to do this during the first payment. Let's calculate the first payment of interest on the above loan for the month of September (the difference between the dates is 31 days). As you can see, the amount of OA for the first month is 1 million rubles. Let's substitute dates, rates and the number of days in a year.

As you can see, 10191.78 should be used to pay interest. Let’s calculate the amount to repay the loan body

Now let’s calculate the amount of principal after paying the first mortgage payment

The amount calculated above will be the loan amount after early repayment. It is on the basis of this amount that the monthly annuity payment will be calculated after early repayment. Obviously, the loan term will also change; you need to subtract from the total term the number of months that have passed before early repayment from the moment the loan was issued.

Substitute the new amount into the annuity payment formula and get a new loan payment.

This is what intermediate calculations look like

Let's check this using the loan calculator program

As you can see, the result is completely identical. You can also use the online version of the loan calculator. The annuity payment formula indicated above is used there. The loan calculator chart can be used to check your loan calculations against the bank's calculations. Sometimes the data may not match. There are a lot of reasons for this. One of them is that the bank uses a different formula to calculate annuity payments. There are actually 3 formulas for annuity payments. The denominator can be the difference (n-1), (n-2) or just n. The formula itself can be found in the loan agreement. The parameters that need to be substituted into the formula are also indicated there. Here, for example, is the annuity forum at Levoberezhny Bank

According to the formula Amount of monthly payment - annuity payment PS - interest rate PP - interest period, i.e. mortgage term in months. The formula is a little different. It is taken from a standard mortgage agreement. You must understand that early repayment is not always beneficial from a financial point of view. I suggest trying a calculator that determines the profitability of early repayment.

How is it calculated?

The formula for calculating the annuity payment is quite complex. But, knowing it, it is quite possible to calculate the approximate monthly payment for the desired loan amount and assess your possibilities of obtaining it.

This formula looks like this:

- AP=SC*((PS/12)*((1+(PS/12))^n)/(((1+(PS/12))^n)-1);

Where:

- AP is the amount of the calculated annuity payment;

- SC - loan amount excluding interest rate;

- PS – annual interest rate on the loan;

- n is the number of periods (in this case, months) for the entire loan period;

Let's give an example to make the calculations clearer.

What it is?

Annuity from the Latin annuus, annual, annual, means like a financial annuity and reflects in numerical terms a payment schedule:

- debt;

- percent;

- other obligations, divided into certain equal periods of time, contributed by the debtor in equal parts.

Payments calculated using this form make it easier for the mortgage borrower to make initial payments and allow them to plan their monthly budget.

There are two types of annuity - post-numerando and pre-numerando, each of which is tied to the payment date, which is determined by the prefix post or pre:

- in the first option, payment is made at the end of the reporting period;

- in the second just before it starts.

For both types, the calculation of payments is determined based on a formula using the annuity coefficient.

How to calculate?

The coefficient converts the current one-time payment into a payment series.

For further calculations, the interest rate and the parameter indicating the period (loan term) are used.

Monthly amounts may be rounded, and calculation errors are reflected in the payment for the last period. You can do the calculation yourself using two formulas.

The bank can make changes to the mathematical result if the annuity amount includes:

- additional commissions;

- other obligatory payments (insurance, rent of a safe deposit box, account maintenance, etc.).

To calculate the monthly payment, you must use the basic coefficient formula (K), which consists of the full interest rate (i) and the term (loan period).

If the loan is divided into months, the calculation must be made as follows:

The final monthly payment amount (S) will be:

where A is the loan amount, including the principal and interest for use (rent).

Calculation of annuity payments on a mortgage, among other things, reduces banking risks by increasing the total loan amount.

What is an annuity payment

To understand which method of repaying a loan is the most acceptable, you first need to understand what an annuity payment is. Its main difference is the ease of loan repayment. In this case, there is no need to clarify the payment amounts each time; the loan body and interest are repaid in equal installments throughout the duration of the agreement. The monthly payment consists of the amount of repayment of the loan body, that is, repayment of the principal debt, and interest that is accrued for the use of loan funds.

With any payment method, one of the main factors of a loan is a small rate. We have looked at for you how to get a loan for pensioners with a low interest rate.

Of the monthly debt repayment amount, the largest part of the payment is the payment of interest, and the smaller part is the amount of the loan outstanding. In this case, in the first months of debt repayment, the loan body is practically not repaid; the main payments come from interest. Loan payments are not large, so interest on the use of credit funds increases.

Annuity mortgage payments

A mortgage involves the issuance of a significant amount and, as a rule, for a long period:

- differential payments reflect the actual use of money and payment of rent for a certain period, but differ in amount for each reporting month or quarter;

- An annuity allows you to stabilize the borrower’s expenses and bring them to the same amount.

This method is especially beneficial for people who have a stable, equal income.

For those whose profits may vary significantly over time, a differentiated system may be more appropriate.

Regardless of the source of income, the main desire of the borrower is the opportunity to speed up payments and relieve himself of debt obligations.

Currently, almost all banking institutions have waived penalties for early repayment, and in some cases they encourage borrowers to fulfill their obligations faster.

Among other things, the annuity allows banks to comply with the conditions of the Federal Law (FL) On Mortgage, which stipulates that the amount of the monthly payment cannot exceed half of the borrower’s basic income.

How to pay for a Sberbank mortgage? See here.

How to pay off faster?

If the client adheres to the payment plan, then the repayment system does not affect the speed of fulfillment of obligations to the creditor.

The loan term will not exceed that set by the bank, and in the case of a mortgage, when the loan is issued for a period of 10 years or more, the difference of one or 2 months does not make a significant difference.

However, partial early repayment is relevant and can significantly change further payment parameters.

There are two types of accelerating the loan repayment process by early payments, which are aimed at:

- to reduce the loan amount;

- to shorten the loan term.

In the first case, the annuity is calculated (using the same formula), based on the fact that the loan period remains the same, and the amount paid ahead of schedule is used to pay off the loan. This operation reduces monthly payments for all subsequent periods.

In the second option, the client requests to change the loan term, without changing the previously established monthly payment amount.

In both cases, the bank changes two components in the formula, which ultimately leads to the inclusion of an early partial payment, which affects either the total term or the monthly payment.

Annuity and differentiated payments: what they are and what they are, their pros and cons

When choosing a particular payment system, it is necessary to understand that the choice will have a significant impact on the final cost of the mortgage.

It is important to have a clear understanding of how much you will ultimately have to pay on the loan, what an annuity payment and a differentiated payment are, and what the difference is between them.

Let's try to figure out what the advantages and disadvantages of each are.

Annuity system

This system itself assumes that mortgage payments will be made evenly, at specified periods, throughout the entire period required for calculation.

If the borrower pays 25 thousand rubles for the first month, then in subsequent months until the end of the term the payment amount will be similar.

Many people really like this stability in payments. However, few people understand that such a formula does not always lead to absolute benefit for the person who took out the mortgage.

The calculation of annuity payments involves the difference in the ratio of accrued interest on the repaid service of the principal debt and the interest that the bank receives for the entire repayment period of the loan.

In fact, if the loan interest itself is included in the payments during the initial period of the mortgage, then the total debt will be repaid only to a small extent. In fact, this occurs before the halfway point of the mortgage term.

After the so-called middle of the period of use occurs, the main part of the total debt begins to be repaid.

Useful video:

It is necessary to understand why this happens. The fact is that the annuity scheme assumes that at first only interest is paid for using the loan, and payments are made for the entire period.

After paying off the interest, the borrower begins to pay the principal amount. Banks receive their benefits in advance, without waiting for the mortgage to expire.

If you try to pay off your mortgage ahead of schedule, for example, after two and a half years out of the five that were originally agreed upon, you may encounter the following problem: it may turn out that only 20-25% of payments were made for the period passed.

Thus, the negative aspects of annuity payments include:

- Inability to repay the full term in advance;

- Initial payments are a payment to the bank for using a mortgage.

This schedule also has positive aspects. For example, a person with a stable salary will be much more comfortable paying the same amount every month.

In short, the advantages of annuity payments include:

- Possibility of equal payments stretched over the entire period;

- The ability to calculate your own strength for several years;

- Reducing the burden on the borrower to make payments;

- The ability to count on receiving a larger loan amount.

The latter applies specifically to mortgages and, to a lesser extent, to car loans, since in these cases a truly significant amount may be required.

Differentiated system

A differentiated rate will mean a reduction in the amount of payments if the borrower repays his debt on time every month.

The reason for this is that the total debt will be divided into equal parts and distributed over the entire payment period. However, interest is charged on the outstanding balance after each monthly payment.

Thus, the part of the payment that falls on the principal debt will be the same throughout the entire period, while the interest part will be calculated differently every month.

Differences from differentiated payment

Long-term lending is based on the client’s stable financial condition, this is especially important when the borrower, an individual, takes out a mortgage.

Annuity payments in this case allow the bank to predict the balance between the client’s income and expenses and, accordingly, understand its stability in a certain long-term perspective.

Differentiated payments, although they allow the borrower to save:

- initially form a significant amount;

- may become a burden that will affect his future stability.

Advantages

Depending on the credit institution, annuity has the following positive aspects:

- you can get a larger loan amount, since the margin between income and expenses will be smaller over a long period of time;

- over time, due to inflation, the amount becomes easier;

- low lending rate (0.5 – 1%).

If you calculate globally, for example, for 30 years, then at first glance, under the annuity system the total payments are greater, but using inflation, even at the level of 8%, we can conclude that in fact the method of paying off the debt in equal shares is more profitable.

How to apply for a mortgage at Sberbank? Find out here.

What are the mortgage rates at Soyuz Bank? Detailed information in this article.

Borrower between two fires

The question of how to pay off a loan does not have a clear answer.

On the one hand, the benefit of repaying a loan with differentiated payments is obvious - the borrower will simply pay the bank less interest .

However, banks are very reluctant to approve applications for large loans when choosing this repayment method .

This is due to the risk of late payment of the loan during the initial period of using it, when the borrower bears an increased payment burden .

The likelihood of receiving a loan if you agree to repay it with annuity payments is higher, and the size of the loan that the bank will approve will be larger . The fact is that the vast majority of credit institutions evaluate borrowers using scoring .

It works based on the borrower's information about his income and expenses, and then automatically calculates the amount of the contribution that he is able to pay.

Differentiated payments initially high , and some borrowers simply do not pass this selection .

Choosing a differentiated payment is advisable for those borrowers who plan to repay the loan early .

According to this payment schedule the amount of the debt is reduced faster , and in case of early repayment, the amount of the monthly payment is .

However, a number of banks offer a reduction in the size of the payment when choosing to repay the loan with annuity payments .

How to pay off your mortgage early? Find out from our article.

A pleasant bonus in case of obtaining a mortgage loan can be a property tax deduction provided under clause 1 of Art. 220 of the Tax Code of the Russian Federation .

The borrower will be able to return the amount paid to the bank in the form of interest on the mortgage , but not more than 13% of his official income.

It would seem that since when repaying a loan using annuity payments, the amount of accrued interest is higher, it is more profitable to pay this way .

But it must be taken into account that loan payments are made in the current year , and at best they can be repaid in the middle of next year .

There is no universal advice on which loan repayment method to choose ; each case should be considered separately .

If it is possible to deposit large amounts at the beginning of the loan term and there are no plans for early repayment, it is advisable to repay the loan in differentiated payments .

After all, this reduces the amount of overpayment to the bank.

The difference between the overpayment on a loan depending on the repayment method is especially noticeable when servicing long-term loans , such as mortgages, and can reach 15% .

Is it profitable?

For a period of up to 10 years, it is more profitable to take out a mortgage with payment according to a differentiated system. This option is better when the borrower is confident that he will repay the loan ahead of schedule.

- a larger portion of the loan is paid off first;

- If you repay early, the amount will be less.

In other cases, an annuity is more effective. This system also includes a psychological factor.

The borrower, receiving a certain income, must use part of it to service the loan, which, in the case of differentiation, amounts to a significant amount and will force him to give up many expenses.

An annuity encourages the formation of a habit, which, as we know, becomes second nature, and, therefore, over time will not be able to significantly influence the level of well-being of the household.

Annuity payments: what are the differences from other schemes?

Loan products with annuity payments are most often sold on the market. In this scheme, it is assumed that each month the client contributes equal amounts to pay off his debt.

The first half of the contract term is spent paying off interest in connection with the use of borrowed funds. And only by the second half of this period the main part, which is called the body, is repaid.

On the one hand, such a schedule has advantages. The risks of possible overpayments and their number are reduced. But clients often benefit from differentiated payments. According to this option, it is the principal debt that is reduced. And interest is accrued on the balance on it.

But when choosing the annuity option, the approval rate of applications increases. That’s why many clients choose this particular solution. In addition, the amounts of planned payments are small at first.

Another advantage is transparency. That is, everyone immediately understands what and how it works.

Types of payments

Differentiated

This is a payment, when choosing which the borrower must pay the body of the loan in equal parts , and the loan interest is accrued on the balance of the debt .

You have to pay monthly:

- Loan debt , equal to the loan amount divided by the number of months of using credit funds,

- Bank income in the form of interest on a loan.

The portion of the principal paid monthly does not change , but the interest payable will decrease as the loan is repaid.

As a result, at the beginning of the term of the loan agreement, the borrower bears an increased payment burden - he must pay both the principal amount and the interest accrued on it.

As the loan body , the interest amount decreases , and in the last quarter of the loan term the total payment will be significantly lower.

Determining on your own how much you need to pay each month when repaying the loan in differentiated payments is not at all difficult.

First of all, the payment for the loan body . This is the quotient of dividing the amount of loan debt and the term of the loan agreement in months:

where: B – payment of a fixed part of the principal debt, S – loan debt, N – period for which the loan funds were issued (months).

The interest payment is then calculated by multiplying the loan interest rate by the outstanding balance . The resulting value is divided by 12 (the number of months in a year):

where: p – interest accrued for payment in the current month, Sn – balance of loan debt, P – loan interest.

The principal balance subtracting previously paid principal payments from the loan amount :

where: n – paid months.

The monthly payment is the sum of the payment to cover the loan debt and the bank interest accrued for the month.

For example, for a loan in the amount of 500 thousand rubles , taken at 15% per annum for 5 years , the first payment will be 14583.33 rubles :

Payments on the loan body: RUB 500,000. / 60 months = 8333.33 rub.

Amount of accrued interest: RUB 500,000. × 15% / 12 months = 6250 rub.

Total payment: RUB 8,333.33/month. + 6250 rub./month. = 14583.33 rub.

To calculate all subsequent payments, you only need to adjust the amount of the principal balance by subtracting from it the previously paid principal payments .

So, the monthly payment after 4 years (48 months of using the loan) will already be 9583.33 rubles:

Balance of loan debt: RUB 500,000. – (RUB 8,333.33 × 48 months) = RUB 100,000.16

Amount of interest accrued on the balance: RUB 100,000.16. × 15% / 12 months = 1250 rub.

Total payment: 8333.33 rub. + 1250 rub. = 9583.33 rub.

The amount of overpayment on the loan when repaying using differentiated payments is calculated as:

where: I is the bank’s income in the form of interest for using the loan, S is the loan debt, N is the period for which the loan funds were issued (months).

In our example , the amount paid to the bank for using the loan is 190,625 rubles : 500,000 rubles × 15% × (60+1)/2400 = 190,625 rubles.

Annuity

Another name is rent payment .

It represents fixed payments on a loan and also consists of payment of the body of the debt and payments of loan interest .

However, initially the borrower mostly has to pay interest payments , and payment of the loan itself is shifted to the last third of the payment schedule.

Such a payment , according to established banking practice, is calculated as:

where: P1 – tranche size, S – loan debt, P – loan interest, T – loan term (months).

If we consider an example with loan debt in the amount of 500 thousand rubles. issued for 5 years at 15% per annum , then the amount of the monthly payment in this case will be equal to:

pay this amount ; the components will change: obligations to the lender to return the funds issued and interest .

The first payment includes interest payment in the amount of RUB 6,250 .

That is, less than half of the total amount will be used the principal debt .

The percentage component calculated using the same formula as for differentiated payments .

In our example, this is: (RUB 500,000 × 15%)/12 months. = 6250 rub.

Accordingly, the first payment will repay 5,644.98 rubles of the principal debt.

But after four years, the next payment will include 10,271.68 rubles . payments on the principal debt and 1623.60 rubles . repayment of interest .

The amount of overpayment on a loan repaid with annuity payments can be easily calculated by multiplying the amount of the monthly payment with the number of months of using the loan and subtracting the loan body from the resulting value :

(RUB 11,894.98 x 60 months) – RUB 500,000. = 213,698.80 rub.

In general, the differences between differentiated and annuity payments are quite significant.

| Differentiated | Annuity | |

| Amount of payment | Descending | Constant |

| Payment structure | The share of the principal is constant, the interest on the unpaid balance varies | Floating values of the share of the principal debt and accrued interest |

| Payment load distribution | Increased payment schedule in the first quarter, minimum – in the last quarter | Uniform throughout the entire term of the loan agreement |

| Overpayment of loan in relation to each other | Less | More |

What is early repayment for annuity payments?

There are two ways to repay a loan early with annuity payments for those who want to pay off their debts ahead of time. Each option has its own characteristics. This issue deserves consideration already at the stage of signing agreements.

For example, let’s assume an option with partial early repayment. It is assumed that the body of the principal debt is reduced. But there are also options when the amount remains unchanged, but the terms are reduced. You just need to pay off the last monthly payment, otherwise the account will not be closed.

This is interesting: What is long-term land lease and what income can you get from it?

Delays under contracts most often occur during the holiday period. Therefore, many try to make payment in advance, several months in advance in such a situation.

But some organizations provide for automatic debiting of funds from accounts when certain conditions are met. Then the schedule automatically changes. Then it is recommended to find out additional information regarding the new solution so as not to create problems.

If this option is not provided, then you will have to write a corresponding application in advance. Only after the funds have been written off is it possible to receive a new schedule.

On the official websites of organizations there are special calculators that will help calculate the early repayment scheme. And find out specific numbers for the program.

Advantages and disadvantages of annuity payment

The main advantages of annuity payments are:

- Convenience – since the payment amount does not change from month to month, there is no need to constantly check it with the bank.

- Benefit - due to the priority of interest payments on the loan, the borrower receives maximum tax deductions and can use them for early repayment of his obligations or for other needs.

- Versatility - the annuity scheme is suitable for a borrower with a limited budget, as it evenly distributes the financial burden throughout the entire period.

- Allows you to borrow a large amount on comfortable terms, without infringing on the borrower’s needs.

The main disadvantages of the annuity repayment scheme:

- An increase in the cost of the loan - the overpayment of interest is much higher than with a differentiated scheme.

- First of all, the borrower pays interest to the bank , and the principal debt practically does not decrease. But there is a way out - partial early repayment at the initial stage, when interest is still being paid. Thus, the debt amount is recalculated and you will pay less interest.

What is the benefit of early repayment?

Typically, banking professionals try to avoid conversations related to this opportunity. After all, if the bank uses any option for early payments, it loses part of its profit. But is this solution beneficial for the clients themselves?

Of course, there are advantages:

- Reducing not only the principal debt, but also the amount of funds deposited each month. There comes a feeling of satisfaction, because after making a decision, finances do not decrease so much.

- Using money to solve problems that really matter.

But with annuity payments, early repayment of debts does not always have only advantages.

For example, instead of solving this issue, you can spend money on your own development. So that you can get a better job later. And find a place with a higher salary. And already use it to pay off. If the loan is issued in a large amount, then the monthly payments will not change much, even after partial repayment of the debt.

Early repayment of mortgage

As you know, when it comes to mortgage lending, both the bank and the borrower choose exclusively an annuity system for calculating monthly payments. Otherwise, loan payments will be unaffordable in the first months. Early repayment of a mortgage with annuity payments at Sberbank is a completely different matter. Over a long loan period, almost every borrower finds opportunities to repay the loan ahead of schedule.

How to pay off a mortgage early at Sberbank with annuity payments? Quite simply: you can deposit any amount if the contract does not specify a minimum value, but you only need to leave a statement thirty days in advance. By the way, it is at Sberbank that you can repay part of your mortgage loan with the help of maternity capital.

What nuances should be taken into account in advance?

- Any bank provides information about this possibility. But for the repayment itself, only the possible minimum is indicated.

- Sometimes certain fines and sanctions are imposed for committing such actions.

It is recommended to study the conditions of the credit institution in advance so that its employees are not left with any options. Information about early repayments must be indicated in a copy of the contract that remains with clients.

- For example, the usual payment deadline is July 15. But the payment is made on the 10th. But recalculation is still done only for the next period. The monthly payment amount decreases after the 15th.

- Going to the bank and drawing up an application is a mandatory step for early repayment; the selected action plans and amounts do not affect this situation. Such banking standards cannot be violated.

What is differentiated payment

The main advantage of differentiated payment is, first of all, the opportunity to save on interest. When calculating the monthly payment amount in this way, the loan amount is divided into equal parts over the entire loan period. Thus, interest is calculated on the actual remaining amount of debt and will gradually decrease towards the end of the term. In this case, the largest amounts are paid by the borrower during the months of using the loan; with each subsequent payment, the amount will decrease significantly.

It should be taken into account that depending on the number of days in the month and the balance of the loan amount, different interest will be calculated, and therefore the monthly payment will be different. The contracts pre-calculate the monthly payment, and banks often inform their clients about changes in the payment amount through available communication channels. But before paying, it would be a good idea to call the bank back and clarify the amount that needs to be deposited.

Overpaid interest: calculation rules

Commercial loans prefer to refuse annuity. But in consumer lending, this scheme has become widespread.

Commercial lending has other features.

Banks usually reserve the decision whether to recalculate overpaid interest or not. This also applies to mortgage programs. Here again it is necessary to mention the need to carefully study contracts before everything is signed.

If recalculation is unacceptable, then the following actions can be taken:

- Write a claim requesting the procedure.

- If the bank refuses, the client has the right to file a lawsuit.

A claim can be filed a maximum of three years after the loan agreement was concluded. The main thing is to provide as much evidence as possible in favor of your position.

Using this scheme, you can reimburse not only the interest itself, but also the costs of compulsory registration of life and health insurance. You just need to provide supporting documentation.

The amount of interest to be reimbursed is easily determined independently.

It is usually expressed in the form of the difference between the amount of interest accrued over the entire term of the contract, as well as the amount of interest that is determined during the use of borrowed funds in a particular case.

Additional tips for borrowers

The scheme for early loan repayment in all banks is almost the same:

- The borrower draws up a statement expressing a clear intention for early repayment. Usually this is required to be done at least 30 days before the date of the planned monthly deposit of funds.

- To get an answer, additionally call managers. Sometimes you need to wait up to 5 days, although in most cases the solution is given immediately.

- The institution’s specialists name the deadlines before which payment must be made. This is usually the standard time for monthly transfers. There is no need to try to devote this day to visiting bank branches. Let’s assume an option where funds are deposited into the account in advance. But in any case, the recalculation of the schedule is carried out only within the planned time frame. Time frames and restrictions are almost never used if the debt is planned to be covered in full.

- If the repayment is partial, then after some time you need to contact the office to receive a modified payment schedule.

- In a full repayment scheme, it is important to obtain written confirmation that the debt has ceased to exist. And the fact that the loan agreement itself is closed.

Most often, for this purpose, banks issue a letter issued using company letterhead. The head of the department puts his signature on this document.

Receiving a notification is mandatory, at least in order to be sure that you are right. The client will know that the bank does not have any claims against him. When applying for loans from other organizations, such letters may also be required as confirmation of the borrower’s positive history.

Some banking organizations can organize debt recalculation at any convenient time. Therefore, the client himself chooses the time when he pays off his debts.

In general, credit institutions often strive to simplify the process of early repayment as much as possible. For example, you can deposit amounts into your account yourself, without prior notification. It is acceptable to use Internet banking services. But then it is still recommended to receive a letter confirming that there are no complaints against the client.

![eCabbage [CPL] RU](https://standart-rzn.ru/wp-content/uploads/ekapusta-cpl-ru-330x140.jpg)