When buying an apartment, many legal issues arise. In order not to fail, you need to study all the nuances. Often the seller asks to deposit a certain amount of money as confirmation of serious intentions. In this article we will understand what an advance, deposit, pledge is and what is the difference between these concepts.

Depending on how the deposited amount is processed, the potential buyer will (or will not) have the opportunity to take the deposited funds back if they refuse the transaction.

The concept of advance in the Civil Code

There is no clear formulation of what an advance is in the Civil Code. The meaning of this concept is interpreted on the basis of a systematic explanation of the norms in the comments to legislative acts.

⇒ Important to know! A prepayment made is considered an advance unless it is stated in writing that the payment is a deposit!

The advance serves a payment function. It is paid at the conclusion of a transaction as an advance payment for a product or service.

An advance payment is made so that the object of purchase is not intercepted by others. If either party fails to fulfill obligations, the advance is subject to a 100% refund.

The transfer of money is formalized by a bilateral agreement on the payment of an advance. The document describes the rights and obligations of the parties and liability in case of violation of obligations.

All documentation must be concluded in accordance with the legislative acts in force in the territory where the transaction is made.

If the contract stipulates obligations that are contrary to the law, then, by a court decision, liability arises in accordance with the law, regardless of what is stated in the agreement of the parties.

What is the difference between an advance and a deposit?

In the system of civil and labor relations, the question quite often arises of how an advance differs from a deposit and a pledge. In this article we will tell you what the differences between these concepts are, based on how all this is described in civil law.

Russian legal acts provide for several ways to secure obligations. The main ones are an advance payment and a deposit. In both cases, they mean a certain amount of money provided by one of the parties to the contractual relationship against future payments due.

What is a deposit?

In accordance with Art. 380 of the Civil Code of the Russian Federation, the deposit acts as a kind of guarantee or evidence that the subsequently concluded contract will be signed and executed.

In legal interpretation and practical implementation, the difference between a deposit and an advance payment is as follows.

First of all, if the client does not buy any product or changes his mind about concluding a contract for the provision of services, the seller keeps the deposit for himself.

If the situation turns out the other way around - the seller changes his mind, then he is obliged to pay the buyer an amount that is 2 times the amount of the deposit.

In addition, when transferring a sum of money with a receipt, both the seller and the buyer must clearly indicate in it that the money is being transferred specifically as a deposit.

Earnest money is a kind of security payment given by the buyer to the seller as a sign that their preliminary agreements will be fulfilled.

Thus, if we consider the deposit as a kind of prepayment of the cost of a future transaction, then it has the properties of an advance payment.

A deposit is a strict and legally enforceable form of organizing a transaction. Its terms are binding on both participants, and the law protects the interests of both the seller and the buyer.

An advance is an amount that is determined by the contracting parties as the minimum part of payment for the entire cost of a future transaction. In this capacity, the advance bears exclusively the payment burden.

An advance, unlike a deposit, may not have a serious formal basis. This follows from the fact that in the current legal acts regulating civil relations, there are no regulations on advance payments at all.

Nevertheless, in practice, an advance is a fairly common form of transactions. It is used to eliminate various types of risks associated with the circumstances of the transaction.

As a rule, in large transactions, it is better for the parties to enter into a written agreement regarding the payment of the advance.

An advance is a simpler and freer way to declare intentions regarding a future transaction on the part of the buyer. If for any reason it is not concluded within the previously agreed terms, then the advance amount paid to the seller is returned to the buyer.

Important! The categories of advance or deposit should not be confused with the concept of collateral.

In accordance with the rules of law, collateral refers to specific property used as a collateral for obligations (for example, property transferred to the bank as an obligation to repay the loan received on time). In this case, the mortgagee receives the right to dispose of the borrower's funds in the event of non-payment of the debt.

Let's sum it up

So, before choosing a form of security for a future transaction (deposit or advance) when selling or buying, you should remember that a deposit is a statutory obligation to conclude a future transaction. Advance payment is an advance payment, part of the cost of the purchased goods.

The fact of paying an advance can be considered as a kind of way for the buyer to reserve this product and ensure its guaranteed purchase within the agreed time frame. At the same time, the advance is not secured by legal regulation, although the transfer of money in this case is also formalized with a receipt.

This allows, in case of violation of the obligation, to recover from the seller to whom the money was transferred a one-time advance amount.

Source: https://zhazhda.biz/base/chem-otlichaetsya-avans-ot-zadatka

The concept of a deposit

According to Art. 380 of the Civil Code of the Russian Federation, a deposit is a sum of money that guarantees the fulfillment of obligations.

The deposit of funds is formalized by a written agreement, which necessarily stipulates the rights and obligations of the parties.

If the document does not state that the amount paid is a deposit, if a dispute arises, the court will decide that the amount is an advance and must be returned if the transaction is refused.

If the party who has undertaken the obligation to purchase the property refuses to complete the transaction, the deposit is not returned.

If the seller for some reason changes his mind about selling the property or is prevented from doing so by circumstances, he is obliged to return the funds to the potential buyer in double amount.

If force majeure occurs: war, flood, hurricane, the contract is suspended until the end of the disaster.

The recognition of force majeure circumstances as force majeure is made by a decision of the Chamber of Commerce and Industry.

It is important to understand the difference between a deposit and a pledge. These are completely different concepts.

What should be in the contract?

The more conditions are specified, the better. Try to be as specific as possible. It is necessary to indicate, regardless of the type of contract:

- Parties' data. In this case, an agreement must be concluded with the owners of the apartment.

- Detailed information about the property, all owners and registered in the apartment.

- The amount and period for which an advance, deposit or security payment is made. If the transaction is alternative, that is, several apartments are sold and bought at the same time, then prepayments must be made for the same period.

- What should the parties do during this time? For example, the buyer needs to get a mortgage or sell his property, the seller needs to collect all the documents, and so on.

- List of documents that need to be prepared: an extract from the house register, certificates of no debt, permission from the guardianship authorities, consent of the spouse if the apartment was purchased during marriage, etc.

- How the parties notify each other: by regular mail or email.

- How and when will the money be returned?

- When should tenants deregister and physically vacate the apartment?

- Factors that may subsequently affect the buyer's ownership so that he can return the money without loss. They must be identified by legal due diligence.

- Reasons that may interfere with the transaction. For example, refusal of guardianship authorities or problems with legalizing redevelopment in the BTI. Refusal of other participants if the transaction involves the simultaneous purchase and sale of several apartments, etc.

- If you buy an apartment with a mortgage, then be sure to include a clause about the bank’s disapproval of the loan or the real estate itself.

- And finally, the date and place of the transaction are stated - the bank, the notary, who bears the costs of registration, the deposit box, notary expenses and how this is compensated.

Olesya decided to buy a one-room apartment on the secondary market with a mortgage. She was approved and given 90 days to find an apartment. An option was quickly found and an advance was made through the realtor. But for some reason the bank did not approve the apartment. The seller himself bought another property and paid a deposit for it. He believed that the deal fell through due to the buyer’s fault and refused to return the “advance payment.”

What was done wrong?

The bank's refusal is considered a circumstance beyond the control of the seller or buyer. Therefore, it is no one’s fault that the deal did not take place. Of course, if all parties had initially discussed this situation and included the corresponding clause in the contracts, then the problem most likely would not have arisen. But even without such a clause, according to the law, the “advance” must be returned. Olesya needs to insist on her own and, if the money is not given, go to court.

We invite you to familiarize yourself with the difference between refusal to execute a lease agreement and termination of a lease agreement?

Pledge concept

You can pledge valuables and property owned by the pledgor. Serves as a guarantee of repayment of the loan in part or in full

When renting an apartment, a security deposit is paid, which is a guarantee of ensuring the integrity of the property located in the apartment and the proper condition of the apartment itself. The contract takes into account the degree of wear and tear during operation. When tenants move out, the owner checks the integrity of the apartment. If everything is in order, the deposit is returned. If damage is detected, the damage is assessed and paid from the deposit amount.

When purchasing a home on credit, the collateral is the purchased real estate. The bank issues funds as collateral; if the borrower fails to fulfill its obligations to repay the loan, the bank will sell the property at auction to recoup its losses.

The pledge agreement must be registered with a notary. A sum of money cannot act as collateral.

How to apply for a deposit when buying an apartment

Let's consider what is better to arrange, a deposit or an advance payment when buying an apartment.

Purchase and sale transactions are carried out in the following sequence:

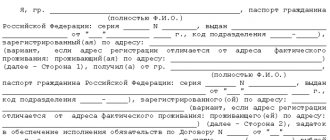

- They sign a deposit agreement, which indicates the full name, passport details, place of registration and actual residence of both parties, the amount of the deposit and a full description of the terms of the transaction.

- The deposit agreement is certified by a notary, one copy remains in his custody.

- The buyer transfers the agreed upon amount of the deposit to the seller into the hands or custody of the real estate agent.

- The documentation necessary for the sale of real estate is drawn up (certificate from the BTI, management company, if children are registered in the living space, you need to obtain permission to alienate the property from the guardianship authorities).

- Concluding a purchase and sale transaction.

- Calculation, handing over keys.

The deposit guarantees the fulfillment of obligations by both parties. The person who refuses the transaction bears financial liability in the amount indicated by the amount of the deposit.

How to make a deposit

The pledge agreement is drawn up in writing and certified by a notary. It is a guarantee of ensuring the circumstances of one party in relation to the other.

The debtor or his authorized representative can act as a pledgor. A minor cannot mortgage property without the permission of his representatives and guardianship authorities.

Instructions for concluding a contract:

- You will need documents for the mortgaged property. The collateral must be assessed by expert organizations, or by agreement of the parties.

- The agreement specifies the property being pledged and its detailed characteristics, the reasons for concluding the pledge agreement, and who will own the object of the transaction.

- The agreement is registered with a notary and the justice authorities.

After the conclusion of the agreement, the pledged property can be held by both the pledgor and the pledgee.

Upon expiration or if circumstances change, the contract may be renewed. This requires the consent of both parties.

How to apply for an advance

Unlike a deposit, the definition of an advance is more of an economic nature. This procedure is not regulated by legislative acts.

An advance payment is most often made in the amount of no more than 10% of the cost of the purchased object. It is better to confirm the deposit of the amount with documents with the signatures of witnesses or register it with a notary. The law does not impose strict requirements for making an advance payment when purchasing real estate.

If the transaction did not take place and the seller turned out to be dishonest, problems may arise with returning the amount paid if the agreement was not registered with a notary.

Lawyers' answers to frequently asked questions

What questions most often arise for the parties to a contract when concluding a transaction with prepayment?

Concluding the narration of today’s material, our resource will present lawyers’ answers to frequently asked questions from those people who have decided to buy and sell an apartment with the payment/receipt of a deposit.

“In what situations is it most common to terminate a preliminary agreement for the sale of real estate with an advance payment?”

Most often, termination of a preliminary agreement for the sale of real estate with an advance payment occurs in situations such as:

- violation of the terms of the transaction by one of the parties;

- the buyer found a more profitable option;

- additional conditions have been identified that do not satisfy the wishes of the seller or buyer.

In any situation where the contract is broken, the guilty party must bear legal responsibility.

What to do if the real estate purchase transaction did not take place, but the advance or deposit has already been paid?

“What happens to the advance/deposit if the transaction does not take place due to the fault of the seller/buyer?”

The advance payment must be returned in full by the seller to the buyer if the former is guilty of terminating the transaction or if it does not take place by mutual agreement.

If the buyer is the culprit for the failure of the transaction, then in a number of situations he undertakes to leave an advance payment to the seller of the apartment (under a preliminary agreement, for example).

The deposit is returned based on the legislative provisions of the Civil Code of the Russian Federation (Articles 380 and 381):

- if the buyer is the culprit for the failure of the transaction, then the deposit remains with the seller;

- if the seller is the culprit for the failure of the transaction, then the latter undertakes to return the entire amount of the deposit to the buyer and pay an equivalent amount on top.

“What should you do if, on the eve of the transaction, the price of your apartment was raised?”

If the preliminary agreement for the payment of a deposit or advance contains the cost of the apartment, then it is final and it is prohibited to change it.

Therefore, if the price of an apartment increases in this case, you have every right to go to court to resolve controversial issues.

In other cases, the seller has the right to change the price of the apartment. Therefore, when concluding a preliminary agreement, it is important to indicate the final price of the property, and not rely on the seller’s “honest” word.

As you can see, the legislation clearly regulates all issues regarding prepayment when purchasing an apartment, and the process of registering it is quite simple.

The main thing when executing such transactions is to document every action performed between the parties in full compliance with the legislation of the Russian Federation.

What to choose when buying an apartment: advance payment or deposit? You can learn about this from this video:

See also Phone numbers for consultation 03 Jan 2020 kasjanenko 333

Share this post

Discussion: 4 comments

- Elena says:

10/06/2018 at 11:29For the first time I come across the concept of an advance payment in a transaction for the purchase and sale of an apartment. I gave a deposit of 10% and if I refused the purchase, it would not be returned to me, it remains with the owner of the apartment. I was warned about this from the beginning.

Answer

- Larka says:

10/07/2018 at 01:13

An advance can only be given when buying an apartment only to someone you have known well for a long time, or to relatives, then the likelihood of deception is very small, and it’s somehow scary for a stranger.

Answer

- Lisa says:

10/08/2018 at 01:06

If the culprit of the failed transaction is the seller, then he at least returned the amount of money that he took, not to mention some additional money that is due for moral damage.

Answer

- Anya says:

10/09/2018 at 01:11

The seller’s “word of honor” is that it means almost nothing, everything must be documented. In general, even though I’ve read the information, I don’t understand why giving advances or deposits, it’s very risky.

Answer

What to choose when buying an apartment: advance payment, deposit, deposit

Let's consider what type of payment to arrange when purchasing real estate, which does not return the deposit or deposit.

A deposit is paid when housing is purchased with a mortgage. The bank must have guarantees of the return of funds paid. The apartment or house is pledged until the buyer pays the full amount specified in the contract.

After the pledgor fulfills his obligations, the pledge is returned to the owner.

Registration of the deposited funds as a deposit is beneficial to both parties.

The buyer is calm that the seller will not refuse the purchase and sale transaction or raise the price. If the seller refuses the buyer for some reason, he must return the amount paid as a deposit in double amount.

The seller will keep the money if the buyer backs out of the deal.

When making an advance payment, both parties bear the risks, although it is widely believed that when buying an apartment, it is most profitable for the buyer to formalize the amount paid as an advance payment as an advance payment. The seller is the opposite.

If an unscrupulous seller refuses to complete the transaction, it will be difficult to obtain the advance amount from him. Courts in such disputes last for years.

What are the main differences between a deposit and a pledge and an advance?

- Definitions of terms

- Use of deposit, advance and collateral

The acquisition of real estate involves many legal transactions, collection and processing of documents.

The conclusion of a purchase and sale agreement is often accompanied by the use of an advance payment, collateral or deposit when purchasing an apartment. Most ordinary people do not see the difference between these terms, becoming easy prey for scammers and unscrupulous sellers.

The Civil Code guarantees the protection of the rights of the parties only when a deposit or pledge is made.

Definitions of terms

An advance is a payment made by the purchaser before receiving property or services.

This is the main difference between an advance and a deposit - the first is used mainly for the purchase of services or low-cost purchases, and is also not a guarantee of a transaction.

Making an advance does not oblige the parties to enter into an agreement; funds can be returned at any time.

The deposit is evidence of the intentions of one of the parties to fulfill the obligations under the contract. Another difference between a deposit and an advance is that the transfer of funds in the form of a deposit is regulated by Art.

380 – 381 Civil Code of the Russian Federation. The deposit is documented and is a guarantee of the conclusion and fulfillment of obligations by the parties under the contract.

Deposits are often used in the real estate market as an effective measure to reduce risks for the parties.

Pledge is a way of securing obligations under a contract. The difference between a deposit and a pledge is that it grants the right to dispose of the funds received to the party who received them if circumstances regulated by the contract are discovered.

About the deposit when buying an apartment

You can read more about the pledge, as well as download a receipt and a standard form of the pledge agreement in this article. Similar circumstances include:

- Identification of debts;

- Damage to property;

- Evasion of obligations by the other party;

- Etc.

If these circumstances occur, the holder of the pledge receives the right to spend funds at his own discretion without their subsequent return to the other party.

Is the deposit refunded or not?

If the pledgor fails to fulfill his obligations to the creditor, his property becomes the property of the latter.

The deposit is returned:

- the debt is paid to the creditor;

- the creditor poses a threat of loss or damage to property, the contract is terminated in court;

- sale of the collateral to repay the debt;

- termination of the object's existence.

If the above circumstances arise, an appropriate entry is made in the register in which the agreement is registered.

Advance payment for an apartment is refundable or not

The advance payment is made as an advance payment. If the transaction does not take place, the amount of money must be returned in full.

The contract states:

- passport data in full;

- term of transfer of property;

- sequence of paperwork for sale;

- the amount paid, a receipt confirming its receipt;

- signatures of the parties.

You should not make a payment without documenting it. Notarized registration of the advance payment is a guarantee of payment of funds if one of the parties refuses to complete the transaction.

Basic legal provisions

If the transaction does not take place for any reason, the advance or deposit must be returned

The purchase and sale of real estate is a legal process that is regulated by the legislation of the Russian Federation. Most of the rules for carrying out this transaction are enshrined in the Civil Code (Civil Code) of Russia.

Since the difference between an advance payment and a deposit is significant, before using such advance payment methods in their transactions, every citizen should familiarize themselves with the basic legislative provisions that apply specifically to them.

If we consider the purchase and sale of an apartment as a legal process, then the mention of an advance in the Civil Code of the Russian Federation appears only once. The advance form of prepayment is mentioned in Article 380, and then quite partially.

The general essence of the mention of an advance in legislation is that any type of advance payment that cannot officially be considered a deposit is an advance payment.

Almost always, if either party refuses to conclude a transaction, the advance must be returned. However, neither party bears strict financial responsibility.

The refund process is extremely simple: the seller must return the full amount of the advance without any additional extra charges. The amount to be returned is calculated based on previously concluded receipts and other things that confirm the fact and amount of money transferred.

It is also worth noting that in some situations, the advance refund measure may have an individual character.

For example, the failure of a transaction due to the fault of the buyer may oblige him to leave an advance payment to the seller of the apartment and even compensate him for some losses (Articles 328 and 487 of the Civil Code of the Russian Federation). In the event that the seller is at fault or the transaction is not completed by mutual consent, a full refund on his part is required (Articles 395 and 487 of the Civil Code of the Russian Federation).

Since a deposit is a more serious type of prepayment. It shows the seriousness of the parties to complete the transaction; the legislation regulates all issues related to it much more strictly.

Deposit or advance payment when purchasing an apartment

For real estate purchase transactions, an advance payment is required. It can be issued as an advance or deposit.

If it is written in the form of an advance, the amount is refundable.

If a deposit agreement has been drawn up, then if the obligations are not fulfilled, the amount of money is counted as a fine and is not returned.

When completing the transaction, the deposit is counted towards payment of the cost of the apartment, regardless of how it is indicated in the contract.

For a buyer who is determined to buy a home, the best option is a deposit.

What risks are there for the seller and the buyer when making an “advance”?

If a participant in a transaction is not completely sure that he will be able to fulfill his obligations, it is not beneficial for him to use a deposit in the contract - he can say goodbye to this amount forever. If this participant is the seller, he risks being required to pay double the amount of the deposit. The advance payment form, the most common in civil transactions, is “softer” for both parties.

The requirement for a deposit when registering applications is common among organizers of public auctions, including when selling assets of a bankrupt enterprise. An advance will not work here. In the case of participation in public auctions, it is unlikely that it will be possible to avoid an agreement on a deposit, which, as a rule, is no more than 20% of the initial price of the lot.

We invite you to find out how OJSC and PAO differ

There is such a thing as a “strong” and “weak” side in a transaction. A strong party is one that is willing and able to conclude an agreement only on its own terms. If the strong party has decided that it is ready to enter into an agreement only with the condition of a deposit, then the weak party can only agree to such a condition or refuse to enter into a transaction at all.

If neither party wants to set strict conditions, for example, counting on further cooperation, it is better to choose an advance form of payment - this will bring the parties to parity conditions.

Irina Pryadeina, lawyer at legal

In a purchase and sale agreement, a deposit agreement is more beneficial for the buyer. In this case, if the seller violates the obligation, the buyer will return his money, receive compensation and be able to recover losses.

For the seller, an advance payment is often more profitable, because if the transaction fails due to his fault, he must return to the buyer exclusively the amount paid as an advance payment, without incurring any penalties.

Ekaterina Smoleva, lawyer

A deposit is more profitable for the buyer, since it forces the seller to comply with the terms of the contract, otherwise he will have to pay double the amount of the deposit. An advance does not provide such security; it can simply be returned to the buyer if the terms of the contract are violated.

If the seller does not want to guarantee the fulfillment of the contract for a specific buyer (for example, there are many people willing to buy an apartment), then an advance can be used. In this case, the seller will not be obliged to fulfill the conditions, but may simply return the money to the buyer.

If the seller wishes to ensure the fulfillment of obligations under the contract by the buyer, then a deposit can be applied. If the buyer refuses to fulfill the contract, the deposit remains with the seller.

Alexey Kuznetsov, General Director

The main disadvantage of a deposit is that in any unclear situation it will be recognized in court as an advance. The downside of an advance is the lack of a security function, which leads to a lack of sanctions for the parties if the deal fails.

If obligations are not fulfilled, there are no adverse consequences for the guilty party. The advance is simply returned to the person who gave it in full, regardless of which party’s actions caused the deal to fail.

When concluding a purchase and sale transaction, it is better to resort to the help of a deposit. Existing penalties encourage both the seller and the buyer to act in good faith, because if the transaction fails, they will have to answer for their guilty actions. An advance payment as such does not provide any guarantees, does not give weight and significance to the transaction, since it makes it easy to refuse to complete it without adverse consequences.

In my opinion, talking about benefits in this case is only possible if one of the parties is dishonest. If the buyer and seller act in good faith, then no one will be left in the red either when using the deposit or when making an advance payment.

Lack of guarantees that the purchase and sale will take place can lead to quite significant financial losses. For example, the buyer has already spent money on completing the transaction, and the seller at the last moment refuses and returns the advance. In the case of a deposit, possible losses are compensated: to the seller - at the expense of the deposit left, to the buyer - by the same amount in addition.

Igor signed an “advance” agreement with the seller through realtors and transferred 100,000 rubles. Three days before the transaction, the seller stated that he wanted 300,000 rubles more for the apartment. Igor could have simply taken the “advance payment”, but he regretted the time and money already spent on registration, evaluation, and so on. As a result, the apartment was bought at an inflated price.

What was done wrong?

The “advance” agreement provides virtually no guarantees regarding the transaction. To fix the price, transaction date and other important conditions, you need to enter into a deposit agreement, a security deposit or a preliminary purchase and sale agreement.