How to draw up a receipt for an advance payment for an apartment: sample

An advance payment when purchasing an apartment in 2020 is a sum of money that one of the parties transfers to the other towards a future payment. The need to transfer an advance is usually stipulated in the main purchase and sale agreement, however, the buyer transfers the advance to the seller before the main transaction is completed (that is, first the parties sign the agreement and one of the parties transfers the advance - and only then the remaining money is transferred and the apartment is transferred). A sample purchase and sale agreement can be downloaded here.

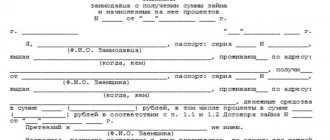

Receipt for advance payment when purchasing an apartment: form

The receipt form is here.

Receipt

I, gr. ________________, __________ year of birth, place of birth: __________________, citizenship Russia, passport ____________, issued __________, _____________, registered and residing at: _______________________________________, received an advance from the city. ________________, __________ year of birth, place of birth: __________________, Russian citizenship, passport ____________, issued __________, _____________, registered and residing at the address: _______________________________________, towards the execution of a purchase and sale agreement for a house located at the address: _______________________________________ in the amount of __________ (_______________ ) rubles. The total cost of the house is ___________________ (________________) rubles.

The final deadline for fulfilling obligations under this receipt is ___________________.

The money was transferred in the presence of witnesses: gr. _______________________, _____________ year of birth, place of birth______________________ and gr. ____________________, _____________ year of birth, place of birth______________________.

Date of__________________

Full name _________________ (signature)

Full name _________________ (signature)

Full name _________________ (signature)

What is an advance?

An advance payment is used to confirm the seriousness of the buyer's intentions, as well as to partially repay the main payment . The main purchase and sale agreement must include the following points regarding the advance payment:

- full market value of the apartment;

- date of transfer of advance money;

- advance amount;

- information about whether the advance money will be used to partially repay the main payment for the apartment or not.

- separation of responsibilities of the buyer and seller (notary services, payment for safe deposit boxes);

- the procedure for returning the advance in the event of failure of the main transaction;

- liability of the parties and force majeure.

Prepayment

When purchasing an apartment, the condition for prepayment of the apartment is stated as an advance or deposit in the preliminary purchase and sale agreement. A separate agreement on a deposit (advance payment) can also be concluded, but it is more convenient to specify all the conditions in the PDCP.

Deposit or advance

The deposit is included in the PDCP to secure the preliminary agreement financially. The essence of the deposit is as follows:

- The buyer, in confirmation of the seriousness of his intentions, transfers a pre-agreed amount to the seller. When concluding the main transaction, this amount is counted towards payment for the apartment.

- If in the future the buyer refuses to conclude a deal, the money transferred as a deposit will not be returned to him.

- If the seller refuses the transaction, then he returns the deposit amount to the buyer in double amount.

An advance is simply the first payment under a contract. It is not protected by law like a deposit. If the deal falls through, the advance will need to be returned.

This is a direct bypass of the law, an artificial substitution of the concepts of advance and deposit. The condition may not hold up in court. Call all forms of payment by their proper names to avoid problems in the future.

These two formulations differ only in the name of the payment, however, the legal nature of the money paid depends on the formulation.

Most often, the prepayment amount is transferred after the conclusion of the preliminary purchase and sale agreement and before the documents are submitted for state registration. The amount of the advance (deposit) can be any; it is established by the parties independently, taking into account the specific situation.

For example, if an apartment is sold at a price of 2,500,000 rubles, encumbered with a mortgage in the amount of 2,000,000 rubles, then the deposit to remove the mortgage may be 2,000,000 rubles.

On average, up to 50% of the cost of housing is transferred as an advance payment.

- If the seller refuses to conclude the main transaction, the prepayment amount will need to be returned.

Some sellers do not want to do this voluntarily, so they will have to go to court to protect their rights. In this case, it is very important how the prepayment was specified in the contract. The deposit is returned in double amount, and the advance payment is returned in single amount.

- If registration of property rights does not take place, then in some cases the money will have to be returned in court.

Advance and deposit - the difference

In its meaning, a deposit is very similar to an advance - it also represents a certain amount that the buyer transfers to the seller as part of the main payment, the deposit is also used to confirm the seriousness of the buyer's intentions. The difference lies in the amount of money that must be returned if the main transaction fails:

- If a purchase is made, an advance has been made and the transaction is cancelled, the seller must return the money to the buyer. This does not take into account the fact of guilt of either party;

- If a purchase is made, a deposit has been made and the transaction is cancelled, then several situations are possible depending on whose fault the cancellation occurred. If the deal falls through due to the fault of the seller, then he must return the deposit in double amount. If the buyer is the culprit, the seller may not return the money to him.

In other words, the difference is that the deposit provides certain guarantees to both the seller and the buyer, while the advance payment only performs a payment function and does not provide any guarantees. In practice, buying an apartment usually means making an advance payment.

How to correctly draw up a deposit agreement when buying an apartment: sample 2020

Let's start by advising you to seek help from lawyers. After all, they are the ones who can tell you the most advantageous positions that should be indicated in this document.

In the form of the deposit agreement when purchasing an apartment, which is regulated by Articles No. 380 and No. 381 of the Civil Code, it is worth noting the following important points:

- Full names of all owners of the property being sold and buyers.

- Passport details of representatives of both parties.

- The final final cost of the property.

- The amount of the deposit, which is written down several times: in words and in numbers.

- Apartment characteristics: area, address, etc.

- Responsibilities of both parties: in case of interruption of the transaction due to the fault of the seller, the buyer is returned the entire amount of the deposit in double amount. And provided that the buyer is at fault, the money remains with the owner of the apartment.

- Other conditions (optional). Here you can write about whether the owner leaves the furniture in the apartment, who will pay for housing and communal services, and whether the buyer needs an existing telephone line.

This agreement is drawn up in 2 copies. One for the seller, one for the buyer. It does not require notarization.

Important

Do not agree to draw up such an agreement in the form of a simple receipt. After all, the owner of the property may not sell it to you and may not return the money, and his relatives will provide a fake certificate stating that he was not himself when he took the deposit amount from you. Then you will have to go to court and spend a lot of time and effort on this. And no one will give you a guarantee that his decision will be in your favor.

To sign up for a deposit agreement when purchasing an apartment, follow this link.

Receipt for advance payment - sample

When transferring an advance payment for an apartment, it is recommended to draw up a receipt to confirm that the seller has received the money. The receipt can be either an appendix to the contract or an independent document.

The first method is more common because it is safer and emphasizes the legality of the transaction. If the seller refuses to return the money or says that he did not receive an advance payment, then to protect his interests the buyer needs to go to court, and a receipt will serve as solid proof of the fact of transfer of money.

A receipt for an advance payment when purchasing an apartment can be drawn up on any sheet of paper . The sample should include the following items:

- passport details of the parties;

- reference to the main agreement in accordance with which the money is transferred;

- address of the apartment and brief technical data about it;

- full name of the payment (deposit or advance);

- amount of money;

- signatures of the parties and date of preparation.

A receipt must be drawn up by the seller at the time of transfer of money . The document can be certified by a notary, however, this is not necessary (except for cases where the receipt is drawn up in printed form - such a document must be registered with a notary).

In the absence of a receipt, it is much more difficult to prove the fact of receiving an advance.

Compilation rules

A specific sample receipt has not been approved at the legislative level, so it is drawn up in free form. But practicing lawyers advise to state as precisely as possible the conditions under which the loan is provided. The receipt must be formulated in such a way that it is clear that we are talking about a loan, and not about a gift or payment for goods. Therefore, it will not be enough to record the fact of receiving money.

It is also necessary to indicate that the funds were transferred as a loan. As for the size of the amount, it is best to write it in words and be sure to indicate the type of currency - rubles, US dollars or euros.

It is also necessary to indicate information about the debtor and creditor, with the help of which you can easily identify their identity. Such data includes the following information:

It is very important to clearly formulate the conditions under which the debt must be repaid. If the money was transferred at interest, then the receipt must indicate the amount of the rate, as well as the order of their payment, for example, monthly, once a quarter or at the time of repayment of the principal debt.

In addition, you need to clearly indicate the deadline in the format of day, month and year, no later than which the debt must be repaid.

It is also advisable to indicate the form of liability in the form of a fine or penalty that the borrower must bear in the event of non-fulfillment or improper fulfillment of its obligations.

Receipt for repayment of advance payment - sample

If the purchase of an apartment falls through, then it is necessary to return the advance payment. To legally secure the fact of transferring money back, it is recommended to draw up a receipt for the return of the advance . A sample of such a document should include the following information:

- passport details of the parties;

- reference to the terminated contract;

- information that the seller returns money due to cancellation of the agreement;

- amount of money;

- signatures of the parties and date of preparation.

The return receipt must be drawn up by the failed buyer, to whom the money transferred to him in the past is returned . If a receipt for the transfer of money was previously drawn up, then on the reverse side of it, the buyer of the apartment must indicate that the seller, according to this receipt, returned the money to him in full. The return receipt is also not subject to mandatory registration with a notary. You can download a sample receipt here.

Claim for refund of funds against receipt

If the debtor refuses to repay the debt within the period established by the receipt or at the request of the creditor, then the only option is to go to court with a corresponding claim.

As a general rule, the creditor, who is also the plaintiff, submits documents to the court in whose territory the debtor resides.

The claim consists of several parts:

The header must indicate the name of the court to which the creditor is applying, the surname, first name and patronymic of the defendant and plaintiff, as well as their place of residence. In the text of the document itself, the plaintiff indicates when, under what circumstances and for what period the funds were lent. In this case, you must refer to the prepared receipt to confirm your words.

In the final part, the plaintiff must formulate his demands as clearly as possible. Moreover, you need to ask not only to collect the amount of debt from the defendant in your favor. In addition, one should not forget about the state duty, as well as the funds spent on a lawyer, in particular, on drawing up a statement of claim and fees for his participation in the case.

This is official confirmation of payment of the debt to the creditor. It is necessary to protect yourself from the unfriendly intentions of the lender (for example, you did not draw up a receipt, but simply returned the borrowed money - after a while a summons arrives: the creditor demands the return of the money - you will have to pay again, because it will not be possible to prove payment without a receipt).

Features of the document

The receipt of receipt has a number of features that are regulated by the civil code. The first difference is in the form. The document itself, drawn up between the seller and the buyer in receiving part of the contribution, does not have a clear form established by law. However, the Civil Code notes what details must be indicated in the paper for the paper to have legal force.

The buyer's and seller's receipt must be certified with signatures as in a passport from each party. Each party to a future transaction must leave their initials in the guarantee of receipt of funds. It is important to consider that there are cases in which the transferred contribution will not be returned.

If the buyers, after transferring the money, subsequently refuse to purchase the property, this will be a complete reason for the seller not to give them the deposit. This is due to the fact that the guarantee contribution is an interim measure that makes it possible to subsequently conclude a purchase and sale agreement. If there is no sale transaction due to the fault of the buyer, the seller suffers losses.

As a result, the deposit under civil law must cover losses. Another case is when the deposit transferred by buyers is returned in double size. This situation is permissible if the payment on the receipt was transferred, and later the seller himself refused the transaction. Then, based on the current articles of the Civil Code, the seller must return it in double amount.

How to return funds - pre-trial decision and court

If the funds were not returned within the prescribed period, then this problem can be solved in several ways.

Pre-trial regulation of the issue

In most cases, they first try to resolve the issue of returning funds out of court when the deadlines specified in the promissory note are overdue. It is important to mention that all legal costs when filing a claim will be borne by the defendant, that is, the debtor.

Often this argument allows you to return funds faster. In addition, other arguments can be made: waste of time, nerves, loss of trust, if we are talking about a debt taken out by your friend.

Instructions for resolving the issue in court

If the debt issue cannot be resolved peacefully, you need to go to court.

There are several recommendations that you should follow in order to win your case:

All procedures can be carried out independently, but if you are not sure of a positive outcome of the case in your favor, it is better to contact a lawyer to draw up an application and conduct cases in court.

A receipt is a document certifying the receipt of money, property, cargo or documents, as well as the fulfillment of obligations. It can also certify the return of these valuables by the borrower.

An IOU is a quick way to borrow money. Most often, the lender is a relative or acquaintance who entrusts money to the borrower with the condition of return.

In order for a receipt to be used in court (if the borrower is unscrupulous), you need to know the basic rules for writing it. Insufficient data can be a real reason for non-refund of money even through court. The following are required to be specified:

As a rule, a receipt for receiving funds from a creditor is written by hand , but a printed version is also allowed. However, if disputes arise, a handwritten document is more provable. The receipt is not certified by a notary in most cases, but if the parties mutually agree, it can be notarized. When lending money to a person you do not completely trust, you can invite several witnesses to confirm the fact of the transaction. They must indicate their data under the signature of the author of the receipt: full name, residential address and signature (in full and abbreviated).

Make sure that the opposing party has signed the document, and also check the passport details in person or take a copy of the passport from the person to whom you are lending money.

Types of deposit receipt

Types of contribution transfer guarantees are not limited to real estate. When selling an apartment, this form is common if buyers do not have the required amount at the time of concluding the purchase and sale agreement.

Then, based on the agreement of each of the parties, a period can be established by which the seller undertakes to delay the sale of his real estate. The motivation for this is the down payment in the form of an amount of money, which is also agreed upon by the parties.

The text must indicate the exact period when the purchase and sale transaction must be concluded and the dates for drawing up the paper and transferring the contribution to the buyer.

In addition to the purchase of real estate, this form of receipt is found when selling cars. An expensive vehicle is checked against documents before making a deposit.

It is important to remember that, according to current criminal practice under Article 159 of the Criminal Code “Fraud,” there are a number of cases in which vehicle owners mislead potential buyers, receive deposits from them and hide.

This becomes possible due to the inattention of the other party. Before drawing up the paper, it is important to check all the details and, if necessary, check the WIN numbers on the body and engine. It would also be a good idea to check by license plate whether the vehicle has been stolen and whether the car is encumbered in the form of an arrest.

The same actions should be carried out with all types of movable real estate before concluding an agreement in a receipt for the transfer of the established amount of the deposit.

How to write a receipt if you still need to pay part of the money for the apartment

You can pay for the apartment in the following ways:

- Pay partially by prepayment.

- Transfer the entire amount (remaining amount) at a time after registering ownership to the buyer in cash, through a safe deposit box, letter of credit, escrow account or notary deposit (the most secure payment for a purchase).

- Pay in installments.

We suggest you read: Can I exchange low-quality shoes on the 13th day from the date of purchase

You can view the DCT form through a safe deposit box here.

If the seller insists on making a deposit, and there is no possibility of making a payment after the transaction is completed, then it is best to transfer the money by receipt. It must be drawn up in writing, it indicates the passport details of the parties, the date of transfer of funds, the amount transferred and the purpose of the transfer of money - prepayment for an individually determined apartment.

The receipt should also indicate the planned date for concluding the contract and the conditions for the return of funds if the contract is not concluded on time, or the offset of the amount against the cost of the apartment if the transaction takes place. After drawing up the receipt, it is certified by the signature of the person who received the money. It is good if the receipt is drawn up in the presence of two witnesses who will confirm the fact of transfer of money by putting personal signatures.

Note: it is important to understand that if the sale of the apartment does not take place, you will only be able to return the amount paid, since such a payment does not oblige the seller to conclude an agreement. In other words, an unscrupulous seller will be able to continue searching for better options without any adverse consequences for himself.

Documents that are drawn up before receipt

Receiving funds on paper in the form of a deposit imposes certain obligations on each of the parties. As a result, they must comply with the stated points in the agreement. In addition to the receipt, documents can be drawn up before the purchase and sale transaction is carried out.

These include:

- Certificates confirming ownership of the property being sold. These papers should be checked immediately before completing the paperwork, since the apartment may be in shared ownership. Please note that the deposit must be divided between all homeowners, which must be indicated in the receipt.

- Extract from the Unified State Register of Real Estate. This type of certificate confirms that the owner of the property being sold has no debts or encumbrances on it.

- The BTI plan must be compared with the current apartment layout so that there is no illegal redevelopment, for which the buyer will have to pay in the future to re-register the details.

- Documents establishing ownership. These are papers in the form of a purchase and sale or gift agreement, which indicate that a given person or group of persons has received ownership of real estate.

- Passport of all owners.

Most common mistakes

An incorrectly drawn up receipt may prove to be a problem in the future for those whose interests it protects. Some mistakes make debt collection much more difficult, and sometimes even impossible.

Let's describe some of the most common mistakes.

It must be taken into account that in court, when considering a dispute, the judge will not only consider the evidence, but also use sound reasoning. This is exactly how you should treat it when drawing up such an important document as a receipt; the samples presented in the article and tips will help you avoid problems.

In the vast majority of cases, relatives or friends approach a potential lender with a request to borrow money. Given the fact of close acquaintance, many lenders frivolously take their acquaintances at their word. By doing this, they put themselves in an obviously losing position from a legal point of view.

Because in the future they will not be able to provide evidence that they even borrowed the money. Therefore, the document according to which money is lent or the loan is repaid must be drawn up in writing.

In practice, it has already been proven that a signature is much easier to forge than a receipt as a whole. Based on this, it is necessary to insist that the entire text of the receipt be written by the debtor independently. Moreover, the longer the text, the more difficult it is to fake the handwriting. Thus, the creditor insures himself in case the document is challenged in court.

A receipt, the text of which is made using technical means, is suitable only in one case. If it was drawn up in the presence of a notary, and he witnessed the borrower’s signature.

Design rules

After a receipt for the deposit has been issued, it is necessary to prepare other documents in order to obtain ownership of the apartment in the future. There are also registration rules, according to which each party is obliged to perform certain actions.

These include:

- Drawing up a purchase and sale agreement. The text must be prepared when signing the paper and transferring the deposit. The contract must clearly reflect that the deposit transferred goes towards future payment of the cost of the real estate and all deadlines for transferring money.

- The citizen's passport must be fully indicated in the details. It is necessary to ensure that this document is not expired and is replaced on time. Otherwise, the transaction may subsequently be declared invalid.

- The data of representatives is registered only if the owners themselves are unable to complete the transaction due to certain circumstances. Here it is important to check whether these persons are acting under a power of attorney executed by a notary.

- When preparing a receipt, it is better to transfer the deposit in the presence of witnesses from each party. This will confirm the reality of the paper transaction.

- At the end of the text, signatures from each party are placed with a decoding of the initials.

Depending on the subject of the contract, such rules may vary. It is important to always check the original documents and issue a notarized receipt for the transfer of the deposit.

When is the receipt made?

The deposit agreement is drawn up in two copies and signed by both parties to the main agreement.

The transfer of the deposit occurs after the purchase and sale agreement is drawn up, but before the buyer takes ownership.

Having agreed verbally with the seller to transfer some advance payment to him, the buyer must:

- view the title documents for housing;

- check the technical plan and its compliance with the actual layout of the premises;

- check the certificate of residents registered in the apartment;

- find out if there are any rights of third parties to the selected housing (certificate from the Unified State Register).

Next, the deposit amount and currency are agreed upon. Both parties to the transaction and witnesses are invited.

Then, in the presence of witnesses, a receipt for receipt of the deposit for the apartment is drawn up according to a standard template, signed by the parties to the transaction and certified by a notary. The transfer of money is carried out on the spot, but in front of witnesses.

Receipt text

The text of the paper must contain a number of points that are necessary for the document to have legal force. If detailed information is not provided, the document is considered invalid.

Receipt items include:

- The amount is agreed upon by the seller and the buyer. Written in numbers and words.

- Buyer - his full passport details.

- Seller - passport details.

- Clause regarding receipt of funds with date and time.

- A detailed clause on the terms of a purchase and sale transaction when transferring an advance on a security.

- Dates and signatures.

- Signatures of witnesses.

It is important to indicate in detail the subject of the contract being concluded. Here you need full details of the real estate and its cadastral number with the number of the certificate of registration of ownership.

Examples of receipts for different occasions

Let's look at some examples of writing receipts on several topics. This will allow you to more accurately understand how to compose them correctly.

Receipt without notarization

Since we are drawing up a document without notarization, it is best to certify it with the signatures of at least one witness, write down their full name, passport details and registration address.

An example of a receipt would be as follows:

I, Ivanov Petr Nikolaevich, born in 1975, living at the address Moscow (identification number 00000000, passport SI No. 000000, issued by the Kanavinsky Regional Department of the Ministry of Internal Affairs on October 15, 1986), give a receipt to US citizen Nicholas Sparks, born in 1987, incl. that I, Peter Ivanov, received a loan of 1000 (thousand) US dollars from Nicholas Sparks. The loan is interest-free. I undertake to return the borrowed funds no later than March 30, 2020.

The receipt was handwritten on February 21, 2020, signature: P.N. Ivanov

Present: Petr Ivanovich Lozovik, living at Moscow, st. Bubble, 14..

February 21, 2020, signature.

Receipt indicating interest on debt

An example document would be as follows:

I, Evgeniev Ivan Aleksandrovich, born in 1980, who lives in Ivanovo (Bulyzhnaya St., 14.), give a receipt to Ivanchuk Vlad Ivanovich, born in 1975, a native of Moscow, that I received a loan from Vlad Ivanchuk in the amount of 500 (five hundred) US dollars at 12% per annum.

I undertake to return the funds no later than June 20, 2020, paying interest every two months. Written by hand on September 1, 2020, signature – Evgeniev I.A.

Present: Nevnyatov Petr Gennadievich, living in Ivanovo, st. Bubble, 12.

September 1, 2020, signature.

Legal advice

If the transaction is disrupted due to the fault of the buyer, the advance payment is not returned. This is important to understand. Therefore, when drawing up paper, it is always necessary to indicate the validity period of such an agreement. It is not necessary to indicate the shortest possible period. It’s better to make it a few days longer so that in case of force majeure the money is not wasted

In the purchase agreement, always check all the details of the seller and the object itself in relation to which such document is concluded. This is to protect the person from fraudulent attempts.

The prescribed amount, which is indicated in the contract, is entirely at the expense of the seller. It is better to transfer money in cashless form. This will confirm the fact of transfer of the deposit and the subsequent purchase of the apartment.

Video on the topic:

Legal force of the document

In order for a receipt to gain legal force, two conditions (or at least one of them) must be met:

- certification of the fact of transfer of the amount by witnesses;

- notarized certificate.

It is obligatory to write in writing and clearly write all points of the receipt, filling it out with a blue or black ballpoint pen, without blots or typos. Cross-throughs and the use of corrective means are also not allowed.

A receipt for receiving a deposit for an apartment is important, first of all, for the buyer, so it is he who must worry about its correct execution.

If any situations regarding the transaction are resolved in court, the receipt will be recognized by this authority as a loan agreement. Therefore, it is so important to draw up the document confirming the receipt of the amount from the buyer correctly.

The document itself must contain certain information in order to obtain legal significance for the purchase:

- “Receipt” is written on the first line, then the place of preparation (city, village), the date of transfer of money and signing of the paper is indicated;

- then the seller indicates his data - full name, passport, registration address, writes “received from”;

- indicates the buyer’s details – full name, passport, registration address;

- the amount received is written in numbers and words;

- it is indicated on account of which agreement and property the money was received;

- then the completion is written “the payment has been made in full, the seller and the buyer have no claims against each other”;

- finally, the seller puts his signature and decryption - full name.

If there are witnesses present during the purchase, they put their data and personal signatures below the main text of the paper.

Advance payment for an apartment

to transfer an advance payment for an apartment to real estate transaction support specialists. After all, it does not have security force and is simply returned to the buyer in the event of a failed transaction.

-Where do we go now with our suitcases? We have already taken a deposit for our apartment.

-Therefore, I recommend that you transfer a deposit, not an advance. Nevertheless, I answer your request.

Advance payment to the apartment seller

Since the advance is returned to the buyer in full, it is transferred in transactions, the result of which largely depends on third-party factors.

- the apartment buyer plans to use credit funds, but the mortgage loan has not yet been approved

- the buyer of the apartment plans to use credit funds, the mortgage loan has been approved, but there is a risk of bank refusal due to the high price of the apartment

- there are doubts whether the apartment will meet the requirements of the Pension Fund if funds from Maternity (family) capital are used

- there are doubts about obtaining permission to sell from the guardianship and trusteeship authorities if the owner of the apartment being sold (or a share in the right) is incompetent or a minor

Features of purchasing housing

Features of registration of a real estate acquisition transaction:

- It is important to make sure that the seller is fully capable and is not intoxicated - this will avoid challenging the transaction and its recognition as void.

- If one of the owners is a person under eighteen years of age, then the transaction cannot be carried out without the consent of the guardianship authorities. The buyer must personally see this document and make a copy of it to prevent future undesirable situations.

- Transfer of funds for an apartment can be carried out in person (in a safe place, with witnesses and a receipt) or by bank transfer (for example, through a safe deposit box).

Documentation

The documents required to purchase an apartment include:

- passports of both parties to the legal relationship – the seller and the buyer;

- documents of title to alienated real estate (these include purchase agreements, donations, exchanges, etc.);

- proof of ownership;

- technical passport, cadastral documents, floor plan of the building;

- permission to sell from the guardianship authorities if one of the owners is a minor child;

- consent to the alienation of real estate from the remaining owners is drawn up in writing and certified by a notary;

- permission from the seller’s spouse to purchase an apartment (certified by a notary);

- a receipt confirming payment of the state fee;

- if a mortgage is used to purchase an apartment, a loan agreement is attached;

- an extract from Rosreestr and the house register, this is necessary to determine the number of owners;

- certificates from a drug treatment and psychiatric clinic confirming that the seller is not registered;

- certificate of absence of debts for payment of utility bills.

Here you can download a sample of a spouse’s consent to purchase an apartment, a sample technical passport, a sample cadastral passport for an apartment.

Samples of receipts for receiving money for an apartment: for renting an apartment, deposit for an apartment upon purchase

- The words “Receipt” are written in the center of the sheet.

- Below it is recommended to indicate the date of registration and the city in which the transaction took place.

- The main part contains all the previously listed information. In it you need to write information about the property, as well as about the parties involved in the transaction. Do not forget about the amount of money transferred to the citizen.

- The document must be completed with the signature of the seller (recipient of funds).

- If there are several owners of the apartment, each one signs on the completed paper.

More to read: Dad Died Was Liquidator of Chaes In 1987-1988 Category 2 Benefits Are Given to Daughters

I, (data about the owner), the owner of the apartment (data about the property), confirm that the citizen (data about the citizen) transferred to me (date of transfer of money) funds for renting my property for (month of calculation) in the amount of (amount in words and figures ). The calculation has been completed in full.

How and when the receipt is transmitted

A receipt for accepting cash must be drawn up each time you transfer money. This document is drawn up by the seller himself. The receipt must indicate:

- date and place of drawing up the receipt;

- names, passport details and addresses of the parties;

- amount transferred;

- the basis for the transfer - what the money was paid for;

- indication of no claims;

- seller's signature and transcript.

You will find the receipt form for the purchase (sale) of an apartment at the link.

The original receipt is given to the buyer, the seller can keep a copy for himself. It is better if the seller writes the receipt completely by hand - this will help during a handwriting examination in case of a trial.

In some cases, the parties to the transaction note the payments made on the last page of the purchase and sale agreement. In this regard, the receipt has greater legal force, since it has all the necessary details.

Collateral receipt

A collateral receipt is a document issued by the borrower to the lender in the event that the loan agreement is secured by collateral. In this case, the lender is also the mortgagee. A collateral receipt is drawn up for the purpose of obtaining funds or other assets by the lender by selling the collateral, if the borrower cannot or does not want to fulfill contractual obligations regarding the repayment of the loan. The subject of the pledge must be such that, at its value, it secures the amount of the loan, interest, expenses for its maintenance, as well as fines and penalties as a result of late payments under the agreement.