Application for personal income tax refund when purchasing an apartment

- Direct costs of purchase or construction:

- their volume is limited to 2,000,000 rubles;

- the deduction can be attributed not to one, but to several objects;

- if the apartment is sold without finishing (and this is reflected in the contract), then it is permissible to include the costs of finishing work and materials in the amount of purchase costs.

- Mortgage interest. This deduction is also limited in amount (RUB 3,000,000). Additionally, it can only be applied to one object.

Return of personal income tax through the Federal Tax Service is possible only if a declaration is submitted for the tax period (clause 7 of Article 220 of the Tax Code of the Russian Federation), i.e. at the end of the year. The Federal Tax Service will check the submitted declaration within 3 months (clause 2 of Article 88 of the Tax Code of the Russian Federation) and after another 1 month (clause 6 of Article 78 of the Tax Code of the Russian Federation) will return the tax to the bank account that the taxpayer will indicate in the application.

Restrictions" on the refund amount

The question of what percentage is returned to the person does not arise; this is the standard - 13 percent. But there are certain restrictions that apply not to the interest itself, but to the refund amount.

But what amount will the state return if the housing was purchased with a mortgage? The interest threshold remains the same (13%), but the amount increases to 3 million rubles. But the refund applies only to a portion of the interest paid on the mortgage. If you calculate this parameter, it looks like this: a person took out a mortgage for 1,000,000 rubles, at 20%. The overpayment is 200,000 rubles. 13% of 200,000 is equal to 26,000 - the amount that is paid into the person’s hands.

Calculating the percentage is not particularly difficult; it is enough to act according to such instructions and then it is easy to understand how much of the money will be returned.

The limit on the return of funds is also the size of the person’s salary. If his loan was taken out for 2,000,000 rubles, then for the state to pay 260,000 within a year, it is necessary that his earnings per year be equal to two million. That is, the income tax already paid by a person per year cannot exceed the amount of the refund.

To calculate how much money the state will return to a person per year, you need to use this method:

- A person’s salary is 30,000 rubles. He bought the apartment for 900,000 rubles. A person will pay income tax per year in the amount of 30,000 * 13% * 12 months / 100 = "" 46,800 rubles . For the purchase of such an apartment, he is paid a deduction of 117,000 rubles, but not more than 46,800 per year. to pay the full amount of the tax deduction . Those are the rules and conditions.

Application for personal income tax refund when purchasing an apartment

The deadline for submitting a declaration, documents and an application for personal income tax when purchasing an apartment depends on whether the taxpayer is required to report on his last year’s income, or only claims a property deduction. In the first case, the entire package must be submitted no later than April 30 (in 2020 - May 2, due to holidays and weekends), and in the second - on any day of the year following the reporting one.

Having received the declaration and documents, inspectors conduct a desk check on them for up to 3 months (Clause 2 of Article 88 of the Tax Code of the Russian Federation). During the “camera session,” it becomes clear whether 3-NDFL is filled out correctly, whether all documents are attached, how correctly the tax is calculated and tax rates are applied, and whether the right to receive a deduction is justified. If there are errors, you will have to submit the declaration again. If everything is correct and the tax office gives the go-ahead for the deduction, an overpayment is generated for personal income tax, which is returned to the individual upon his application (clause 6 of article 78 of the Tax Code of the Russian Federation).

Tax deduction amount

The size of the property tax deduction is standard - 13% of the value of the purchased property. Its value cannot be adjusted; this is not provided for by tax legislation. The amount of tax refund is limited only by the cost of housing. Question: what amount will be refunded depends on whether the property was worth more than 2 million rubles or less. If the price of an apartment exceeds this size, then its owner will receive 260 thousand rubles, regardless of the cost of housing. If you purchased inexpensive real estate, it is not difficult to calculate the required amount of tax deduction when purchasing an apartment: the contract price should be multiplied by 13%, and the result will be the required refund.

Before you issue a refund, it is worth considering that every owner has the right to receive it. If the cost of the apartment is more than 2 million and there are several owners, the return amount can be more than 260 thousand, since everyone receives 13% of their share. In this case, questions often arise regarding tax refunds, which are quickly resolved by the tax office.

Features of return when buying an apartment with a mortgage

The purchase of real estate with the participation of funds from a credit institution is common, so a tax refund when purchasing an apartment with a mortgage is very relevant. In this case, the buyer can receive money not only for purchasing an apartment with a mortgage, but also for the interest paid on the loan. In this case, there are some nuances:

- reimbursement of interest paid is limited to 390 thousand;

- Receiving a mortgage refund is possible only after full payment of the main property deduction.

If the bank participates in the purchase of real estate, you will additionally have to submit several documents to the tax office:

- loan agreement;

- loan payment schedule;

- certificate from the bank about interest paid.

Documents for obtaining a deduction for interest paid are submitted when the property deduction is received almost in full and the amount of tax deductions for the year allows you to receive this money as well.

Application for a 13% refund from the purchase of an apartment: how to fill out, sample, form

The application also contains information about the reasons for the resulting overpayments. So, when excess amounts were paid or an inflated amount of tax was collected from the taxpayer, you will need to enter code “1”. In case of forced withholding of excess amounts by the relevant authorities, indicate “2”. The number “3” is entered only by legal entities (enterprises, organizations, institutions). For example, when returning tax on real estate (housing), you must enter “1”.

But today there are restrictions on refund amounts. For example, any individual has the right to return as a deduction 13% of the amount of expenses on real estate, but not more than 260 thousand rubles. If the property was acquired jointly, then each spouse has the right to the above amount. This rule has been in effect since January 1, 2014. But for mortgage lending, the amount from which the tax refund is calculated is 3 million rubles.

We recommend reading: Procedure for land surveying

What purchases are eligible for the deduction?

The tax deduction is returned when purchasing real estate:

- Apartment.

- A certain part of the apartment.

- A room in an apartment.

- A plot of land with a building on it.

- Land plot for development.

- A private house.

- Share when buying a house or land.

The money is returned to the person if the property was purchased with a mortgage or the funds were the buyer’s personal savings. In each specific case, it is better to find out whether it is possible to return 13% of the purchase amount from the tax office, in order to prevent difficulties and comply with all conditions.

Application for personal income tax refund

- Name (code) of the tax authority to which the document is submitted.

- Reason for receiving benefits.

- Information about the deduction applicant (full name, TIN, passport details, place of registration).

- Information about the current account and the bank that opened it.

- Date and signature.

Please note that if more than one source of income was included in the declaration, and the deduction is claimed for income received from all places of work, then there should be as many applications as employers were indicated in 3-NDFL. The number of applications for personal income tax refund must always be equal to the number of sections 1 of the 3-personal income tax declaration.

How to get a deduction

The process of obtaining a deduction consists of: collecting and submitting documents to, checking documents by the tax office and transferring money.

Each specific situation has its own nuances, so we recommend that you clarify the detailed requirements for filing a deduction with the tax office.

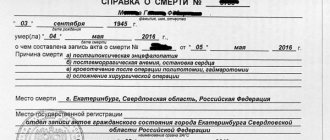

What documents are needed

- Passport

- Declaration 3-NDFL

- Tax refund application

- Documents confirming your expenses

- Documents confirming income tax paid (certificate 2-NDFL)

The process of obtaining a deduction can be simplified by using. The service is convenient if you don’t want to understand all the intricacies yourself and fill out documents.

This service - filling out a declaration and preparing a package of documents - will cost you 1,499 rubles. Submit an online application and a tax consultant will call you and tell you in detail what documents are required.

To send them to a consultant, you can scan them or simply take a photo with your smartphone. The consultant will fill out the declaration himself, and you will only need to upload it to, send it there by mail or enter it in person. The money will be returned to your card, and you don’t have to be a Sberbank client to do this.

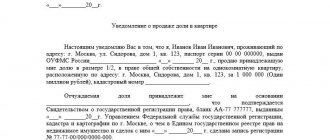

Application form for a 13 percent refund from the purchase of an apartment

A sample application for a refund of 13 percent from the purchase of an apartment at Sberbank will help you with this. You can follow the link: Refund deadlines You can return income taxes in two ways: immediately or in parts.

Application for tax refund (via the tax office)You can apply for a tax refund for the tax office in doc format by following this link. By submitting this statement with your return, you will be able to receive a tax refund from the tax authorities. Application (agreement) on the distribution (division) of a deduction for common joint property, without interest on a mortgage Application (agreement) on the distribution (division) of a deduction for common joint property, with interest on a mortgage You can apply in doc format by following this link.

When to submit documents

Documents confirming the right to a tax deduction when purchasing an apartment must be submitted along with the declaration or application. If you submit a declaration in your personal account, you can attach files there. If you bring it in person or send it by mail, you can make regular copies on a photocopier.

They will be checked by the tax office. Copies are suitable for verification.

If the tax office wants to check the information, it will make requests through its own channels: to Rosreestr, the registry office, notaries or the pension fund. If some documents are needed in the originals or something is missing, the inspector can call and ask to provide them.

Therefore, in the declaration it is worth indicating a real telephone number for communication, and having the originals at hand.

Document forms for a 13 percent refund from the purchase of an apartment

There is no doubt that the state cares about its population, and one proof of this fact is the property deduction - an amount that is withheld from the value of the property and returned to the taxpayer’s pocket. Thus, the state returns part of the taxes paid by a citizen when purchasing an apartment or other real estate, thereby reducing the cost of the purchase.

Other expenses, in addition to those listed, are not taken into account as part of the property deduction, for example, expenses associated with the redevelopment and reconstruction of premises, the purchase of plumbing and other equipment, registration of transactions, etc. The home purchase deduction does not apply in the following cases:

Refund conditions

It is worth remembering that the state does not engage in charity towards citizens who have purchased housing. Only those who pay income tax on wages can count on the deduction. Students, unemployed or pensioners will not be able to return 13 percent for the purchase of housing, since they do not contribute money to the state budget.

Of course, pensioners are unhappy with this state of affairs, because at one time they also paid taxes, but only those who had official income no more than three years ago can hope for a deduction. They can refund 1 year's income tax.

A 13 percent refund for the purchase of an apartment can only be received if the citizen made the payment with personal funds.

If maternity capital or a housing certificate for a certain amount was used, then it will not be possible to issue a deduction. Some unscrupulous citizens still try to deceive tax authorities, but such schemes are considered illegal.

It is known that most real estate is purchased through mortgage loans. In such a situation, you can also count on a return of 13 percent when buying an apartment. This takes into account not only the price of housing, but also the amount of interest paid to the bank. That is why you need to be very careful about storing all payment documents, including monthly mortgage payments.

Sample application for a 13 percent refund when purchasing an apartment

Please include your account details in your application. Otherwise, you won't be able to get the money. It is necessary to carefully fill in these fields and fill them in the same way as indicated in the bank details. Indicate the full name of the banking organization and fill in all required fields.

How to return 13 percent from the purchase of an apartment - terms and conditions?

- 2 Is it possible to return 13 percent from the purchase of an apartment again?

- 3

We recommend reading: 13 percent on mortgage

What documents are needed to return personal income tax for studies?

The listed documents for a 13 percent refund of tuition fees are submitted to the tax office, which, after a certain period of time, makes a decision on the possibility of a personal income tax refund. If the decision is positive, the money is transferred to the bank account specified in the application.

You can return an amount of personal income tax not exceeding the tax paid for the reporting year (in which the education was paid). The maximum amount of income tax refundable is 15,600 rubles. (13 percent of the social tax deduction of 120,000 rubles).

Applications and other documents for deductions

Application (agreement) on the distribution (division) of a deduction for common joint property, without interest on a mortgage Application (agreement) on the distribution (division) of a deduction for common joint property, with interest on a mortgage You can apply in doc format by following this link. This document is not required to be notarized, nor is the presence of a second owner (the owner who is not filing the return) when filing this document.

Application for tax refund (via the tax office) You can apply for a tax refund for the tax office in doc format by following this link. By submitting this statement with your return, you will be able to receive a tax refund from the tax authorities.

Employer

It is possible to receive a deduction before the end of the tax period if you contact the employer’s accounting department and confirm your right with the tax authority in advance.

To return you need:

- write an application in the established form to receive a notification from the tax authority about the right to claim;

- prepare a package of documentation confirming the possibility of the claim;

- submit an application to the tax office at your place of residence to purchase a notice of right with additional copies of documentation attached;

- when 30 days have expired, receive a tax notice confirming the right to a property deduction;

- provide the above document to the employer, which will become the basis for not withholding personal income tax from the amount of the applicant’s income transactions.

Registration of the deduction lies on the shoulders of the purchaser of the property. It can be through the employer and through the tax authority. The client chooses a convenient method for himself.

Sample application for a 13 percent refund on an apartment purchase

Documents for deduction through the inspection when purchasing real estate List of documents for deduction when receiving a deduction from the tax office This list you can use to receive a deduction when purchasing real estate through the tax office. You can download the list in pdf format by following this link. Application for tax refund (via the tax office)You can apply for a tax refund for the tax office in doc format by following this link. By submitting this statement with your return, you will be able to receive a tax refund from the tax authorities. Application (agreement) on the distribution (division) of a deduction for common joint property, without interest on a mortgage Application (agreement) on the distribution (division) of a deduction for common joint property, with interest on a mortgage You can download a sample application in doc format by following this link .

- when selling residential space (only a share of an apartment or house can be sold);

- when selling land;

- when participating in shared construction;

- when paying off interest on the mortgage program used to purchase an apartment.

Return

Returns can be made in several ways.

As soon as the right to claim a deduction arises, you can contact the tax authority at your place of permanent residence, where you can provide a complete package of documentation that relates to it. You must receive a notice of the right to deduction from the tax office in order to bring it to your place of employment.

If the entire amount is not paid in the given year, then you need to contact the Federal Tax Service again for a certificate of the remaining deduction. And every year you need to do this until full payment is made.

As soon as the right arises, a citizen can apply for a deduction through the tax authority by submitting in advance a declaration in form 3NDFL for the past period, drawn up taking into account the amount of possible acquisition for the year.

The amount of the refund may not be more than the tax paid for the same period of time.

Application forms for a refund of 13% personal income tax and tax overpayments

There are social, property and other deductions from which, by law, it is possible to return part of the tax paid to the state or to extra-budgetary funds, and this can be done by both individuals from whom the employer withholds personal income tax, and legal entities if there has been an overpayment on their part to the budget RF.

- at the very top on the right side, indicate the name of the tax authority, your passport details, TIN, contact phone number

- Then in the body, indicate the year for which you want to receive a tax deduction

- then from the list, select what you want to refund the tax for, and on the contrary, indicate the amount of deduction in rubles, and below enter the total amount for all types of refund

- at the final stage, fill in the fields for the name of your employer’s organization, tax identification number and checkpoint

- enter the date of completion, your full name. and signature

Legislative regulation

All social programs are regulated by state legislation. The tax deduction was not an exception, which is why when discussing the question of whether it is possible or not to receive money for buying a car, you first need to refer to the articles of the Tax Code. The new rules allow you to return 13% of the cost of the purchased property.

Only those persons who are residents of the country can count on such a refund.

This status should not be confused with citizenship, because they are completely unrelated to each other. To become a resident of the Russian Federation, it is enough to reside in the country for 183 days of the previous year and officially pay taxes. To do this, accordingly, you need to be officially employed. For some categories of income or expenses, the deduction can only be issued once.

For example, buying an apartment will allow an individual to get back interest on its cost once in his life. When selling an apartment, you can receive a refund of taxes paid on this income an unlimited number of times. Legislation provides the right to a deduction when purchasing the following categories of property and services:

- Education costs - for your own studies and for some categories of relatives.

- Medical procedures of a therapeutic and diagnostic nature.

- Acquisition, construction or completion of real estate.

As you can see, there is no mention of a car in this list, which means you cannot get a benefit for its purchase. For now, the rules are exactly as they are, but it is possible that they will be revised and the range of purchases with tax deductions will be expanded.

Application for personal income tax refund in 2020 when purchasing an apartment

As a rule, few people manage to fully reimburse the amount of personal income tax required by law (up to 2 million rubles) the first time. This means that the right to deduction is transferred to future periods. And in order to use its balance, you will have to submit the 3-NDFL declaration and an application for a personal income tax refund when purchasing an apartment to the Federal Tax Service. But you won’t have to resubmit documents confirming your right to deduct. Such a requirement from inspectors is illegal! (letter of the Ministry of Finance of Russia dated 06/07/2013 No. 03-04-05/21309).

In 2020, there is an application form for 3-NDFL when purchasing an apartment, which was approved by order of the Tax Service of Russia dated March 3, 2020 No. ММВ-7-8/90 (Appendix No. 8). Moreover, for the last time it was adjusted by order of the Federal Tax Service dated August 23, 2020 No. ММВ-7-8/454.

Document registration scheme

There are two main ways to file a property deduction. The easiest way is to submit an application to your employer indicating the reasons for the return. In this case, income tax will not be charged and the citizen will be able to receive a larger amount each month. This path is chosen very rarely. A more popular option is to contact the tax office to get a refund of tax already paid.

List of required papers

It is worth remembering that you need to collect a certain package of documents to process a refund from the purchase of an apartment. Thus, 13 percent of the cost of housing goes to the citizen’s account only after all data has been verified by tax inspectors.

They study the following papers:

- documents confirming the fact of purchase of housing;

- applicant's passport;

- TIN;

- certificate 2-NDFL;

- declaration form 3-NDFL.

When purchasing housing for cash, a citizen must submit to the inspection a sales contract, an extract from the Unified State Register of Real Estate and a receipt from the seller confirming receipt of money. If we are talking about mortgage housing, then we need documents from the bank, that is, an agreement, a loan repayment schedule and a certificate of the amount of interest paid for the year. And also do not forget about the papers confirming payment of the down payment on the mortgage.

When contacting the tax office, a citizen provides originals and copies of his passport and TIN. The originals are returned to him after the copies have been verified. Certificate 2-NDFL is issued at the citizen’s place of work. It is filled out according to a certain form with the seal of the organization, so the original is needed. You can fill out the declaration yourself or use the services of professionals.

When applying, a citizen is required to write an application indicating bank account details. Some specialists ask not only to write down information about where the money needs to be transferred, but also to provide full details with the bank’s stamp.

Joint acquisition of real estate

In some cases, real estate is purchased by several people at once. In this case, you need to calculate what amount of deduction is due to each of them. The money must be paid in proportion to the citizen's share. If an apartment worth 2 million rubles is purchased by four owners in equal shares, each of them can count on a deduction in the amount of 65 thousand rubles (2,000,000/4*13%=65,000).

When purchasing real estate during marriage, they most often talk about joint ownership of the spouses, unless otherwise specified in the agreement or marriage contract. When spouses purchase a home, the tax office must submit a marriage certificate and an application for the distribution of the deduction between husband and wife to receive the deduction. This statement is written if the purchase amount is less than 4 million rubles. Otherwise, it is not necessary, since each spouse will receive a deduction from 2 million.

In provincial cities with inexpensive real estate, the husband most often receives the deduction, since his earnings are much higher. And besides, men rarely go on parental leave.

Sometimes housing is registered as the property of all family members, including children. In such a situation, the parent can claim a deduction for the child, but only if he himself has not used his right to it earlier.

Application for personal income tax refund when purchasing an apartment

- through the taxpayer’s personal account on the website nalog.ru;

- by mail with a description of the attachment;

- via the Internet with an enhanced qualified electronic signature;

- personally or through an authorized representative on the basis of a notarized or equivalent power of attorney.

It is advisable to submit this application simultaneously with Form 3-NDFL. Then the tax office will have 1 month after the end of the desk audit of the declaration to return the tax. Let us remind you that the desk audit of the declaration lasts 3 months from the moment of its submission (clause 2 of Article 88 of the Tax Code of the Russian Federation).