Purpose of payment

In addition to information about the volume, tariffs, payments for housing and communal services, the receipt includes voluntary home insurance. The utility consumer independently decides whether he will pay for property insurance. The insurance contract is valid if the monthly premiums indicated in the receipt have been paid.

For owners and tenants, paying for insurance is convenient:

- Simplifies interaction with insurers. There is no need for personal presence when drawing up contracts.

- Contributions are paid simultaneously with housing and communal services.

- Moderate tariffs.

The website of the Moscow mayor https://www.mos.ru/ reports that more than two million apartments are insured under the terms of the program. In 2020, more than five thousand families received compensation for damage. The average monthly costs of Muscovites for home insurance amounted to 92 rubles.

Legal violations

Every system has flaws. Insurance procedures are no exception. They need improvements and have not been fully corrected by law. There are more and more swindlers and deceivers in this area, making money through illegal fraud. Here are the most basic violations from a legal point of view:

- When choosing an insurance company, the founders of the program do not take into account the wishes of the residents.

- The owner does not always have the right to enter into an insurance contract.

- Insurance companies do not take into account the possible change of owners of the living space at all.

- It is impossible to know whether clients received the information.

- Citizens wishing to insure their property are not always provided with correct information about the agency.

Object of insurance

Compensation for damage is paid for damage and loss of property. An insured event can occur both inside and outside the insured property.

Insured events include:

- fires - flames, heat or smoke;

- explosions other than terrorism;

- accidents on sewerage, water supply, heating networks;

- natural disasters, lightning strikes.

Fully insured:

- structural elements of housing - doors, windows, floors, walls, ceilings;

- finishing elements;

- internal communications and engineering equipment.

Damage from leaks through:

- roofing;

- seams between panels.

To conclude individual contracts, you must come to the insurer in person. It is allowed to additionally insure:

- Expensive real estate at a commercial rate.

- Risks.

- Communal apartments have common areas.

The essence of voluntary home insurance

Expert opinion

Alexandra Sokolova

More than 6 years of experience. Specialization: civil law, contract law, social security law, consumer protection. 8

Legislation in this area aims to insure a person against loss of property in the event of an emergency. So, if a person loses his property as a result of a natural disaster, natural phenomenon or other emergency circumstances, then government authorities, together with regional authorities, as well as insurers, issue an apartment to such a citizen.

In this case, the issuance of housing is carried out based on the availability of housing and a valid contract.

Documentation

The insurance program was created on the basis of documents:

- Civil Code of the Russian Federation, “Insurance”, Ch. 48.

- On the organization of insurance business, Law No. 4015-1 of November 27, 1992.

- Housing Code of Russia, Art. 2.

An open competition is held among insurers. The winning companies send tenants and owners certificates of voluntary insurance of residential premises. These are public offers for 1 year, providing for monthly payment of fees.

In addition to insurers, the Moscow government is responsible for the voluntary home insurance program:

- in case of damage to real estate - additional compensation for damage;

- if destroyed, guarantees the provision of new housing.

Rates

Under the insurance program using EPD, city authorities set the insured value of one square meter of housing, which may change annually. The Moscow mayor's website above reports that it is equal to 42 thousand rubles in 2020. The insured value of residential property is calculated as the cost of one square meter multiplied by the total area.

For one square meter, the annual insurance premium is set at 22.44 rubles, which is 1.87 rubles monthly. The insurance premium is the product of the premium per 1 square meter and the total area of the housing.

Example 1

Let's calculate the insured cost of an apartment with an area of 52 square meters: 42,000 * 52 = 2,184,000 rubles.

Example 2

The insurance premium (annual premium) for real estate from the previous example is equal to 22.44 * 52 = 1,166.88 rubles. Monthly payment indicated on the receipt: 1.87 * 52 = 97.24 rubles.

Transfer of contributions

If you have decided to pay insurance premiums, put o. Payment for insurance is indicated separately in payment documents. Regardless of the timing of payments for utilities, insurance premiums must be transferred before the first day of the insurance period (month). Money can be transferred at any time - month, quarter, year.

Example 3

The November fee must be paid by October 31st. If you transfer the money later, the insurance for November will not be valid. It will resume only from December 1st.

Pros and cons of this program

| How reliable is such a service, and what guarantees can the insurance company provide? | Moscow in 1996 became one of the first cities where this program began to operate. And in May 2008 it became available to residents of Khimki. In the first year of operation alone, 480 insurance cases were registered in this district, and the total amount of payments amounted to 5 million rubles. Timely payment of receipts, as well as prompt contact with the company, serve as a guarantee of service provision. |

| How much will you have to pay for the apartment? | If the policy is issued for a separate apartment, then 1.5 rubles will be charged for each square meter of area. When insuring a room in a communal apartment, a citizen pays only for the housing of the room. The contribution amount is also 1.5 rubles per m². |

| Is it possible to insure a basement? | Each apartment building has common property, which includes basements. Insurance of such objects is carried out on the basis of a decision of the general meeting of residents. |

| What happens if I stop paying my insurance premiums? | In this case, you will not be able to receive compensation for damage. |

| How much money will they pay if a small area is damaged? | In the event of insured events, funds are accrued based on the cost of the entire area of the affected elements. So, if the ceiling area in the kitchen is 6 m², and as a result of a pipe break, only 2 m² were damaged, then the citizen will receive funds to restore the entire surface. |

| Is it possible to file an insurance claim if documents are lost? | During the investigation, company employees will be able to easily restore the necessary papers based on the data provided to them by the victim. |

| Can I apply for compensation if the roof of my house leaks? | Responsibilities for maintaining the integrity of the MKD structures lie with the management company. These include timely replacement of the roof and filling the joints of the house. The culprit of this incident will be the management company; in such cases, insurance will not be paid. |

| How to get insurance in a communal apartment? | If the living space has several owners, then each of them has the right to insure that part of the apartment that is in his property. |

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Insurance implies protection of the structural elements of the apartment - walls, floors and ceilings, windows, doors, electrical, sewer and water supply networks, as well as the finishing of the premises, which will be insured at the average market price, therefore you cannot count on insurance for the real cost of expensive finishing.

However, this type of insurance does not imply protection of personal or household property - furniture and electronics, various household appliances, clothing, and so on.

Insured events are:

- Emergency situations when using water systems or sewerage.

- The flow of water into the apartment from other rooms (flood), except for roof leaks and flooding through panel seams.

- Explosions (except terrorist acts).

- Storm, hurricane, tornado, whirlwinds (i.e. air movement at a speed of over 20 m/sec) with precipitation (rain or hail).

- Gas explosion, including one that occurred outside the insured premises.

- Fire, including one that occurred outside the house/apartment.

Pros:

- Low monthly cost of insurance premium. Such an amount will not be unaffordable for any citizen of the Russian Federation and does not increase the cost of rent too much, so this program is more than affordable for everyone.

- If housing has been destroyed and cannot be restored, the government provides the affected persons with alternative housing that complies with current social standards.

Minuses:

- Low cost per square meter of housing area. Most often, when calculating damage, the amount paid is not enough to actually compensate it.

- If, for example, flooding occurred as a result of a breakdown of a washing machine or dishwasher, the insurance company will not consider this an insured event.

But in any case, home insurance undoubtedly benefits residents of the Russian Federation, who in most cases still receive compensation for the damage caused to them.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form.

It's fast and free! Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

- How long should you keep utility bills?

- Paying utility bills without a receipt

- How and where to look at receipts for an apartment on a personal account

Payment of compensation

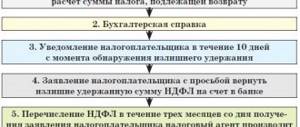

If an insured event occurs:

- Urgently contact the on-duty services - fire, emergency, dispatch.

- Notify the insurer by phone within 3 business days.

- Provide the documents requested by the insurer:

- identification (passport);

- written statement;

- confirming property rights to real estate;

- confirming the insured event;

- certificate of voluntary home insurance;

- on payment of insurance premiums.

After studying the documents provided, insurers assess the damage. The calculation is carried out according to the methodology of the MoszhilNIIproekt Institute, created in 2005. The amount of compensation is determined after calculating the ratio of the cost of damage to the insured value of the apartment. Money is paid within a week after the end of the settlement.

How to refuse voluntary apartment insurance

As stated, such insurance is not a mandatory payment. This type of insurance is not new for Russia. Moreover, in the Russian Federation this type of insurance has been used for about 20 years. However, not every person wants to enter into such agreements.

In order to refuse this service in a housing and communal services receipt (i.e., remove insurance from the receipt column), you must contact the service company (in particular, the management company) with a corresponding application.

In addition, given the fact that this type of insurance is a right, a person himself can cross out this item (or simply ignore it), and, accordingly, not make the appropriate payments.

Attention!

If a person has paid for insurance at least once (for example, if he did not read the expense items on the receipt), then he needs to contact the company to terminate the contract, as well as the service organization. In this case, you can immediately demand that insurance be excluded from the column in the receipt in the future.

Thus, voluntary real estate insurance is the initiative of a person who has the right to pay such contributions, or refuse to pay and demand that the service organization exclude such a service from the receipt.