How to draw up a donation agreement for a share of an apartment?

An agreement to transfer part of the living space free of charge can be drawn up without the participation of third parties. For this, neither a notary nor any other specialist is required.

The law established the deed of gift form as a simple written one.

However, to ensure that unforeseen errors do not occur at the time of filling out, which will then lead to the invalidity of the transaction, a number of rules are taken into account:

- It is impossible to include in the deed of gift an order about the entry into force or transfer of the right to property only after the death of the donor. This is contrary to the essence of the transaction and applies to a will;

- you can draw up a gift agreement indicating the lifelong right of the donor to reside in the donated property;

- The obligatory or essential condition of the agreement is the subject matter. It is impossible not to indicate a specific share or not fully provide characteristics. In this case, the document is considered invalid.

In addition, it is necessary to clearly formulate and indicate all the details of the parties, the date of the actual transfer of the gift. The registration ends with the signing of the agreement.

However, after the completion of the registration of the deed of gift itself, ownership rights are secured.

Step-by-step instructions for registering a right:

- With a package of papers and a signed agreement, appear at any registration authority that accepts the apartment at the location. Payment of the state registration fee is required. The receipt is attached to the general set of papers.

- Drawing up an application for registration of rights.

- Receiving a receipt of acceptance from the employee who accepted the paper.

- Clarification of the date of application for the finished certificate.

- Show up at the appointed time to receive your results.

Only after this the recipient of the gift will become the full owner of the donated property.

Thus, the correct execution of an agreement on the transfer of part of the real estate as a gift is the key to a successful transaction. However, the entire process of assigning rights to the new owner is not limited to this. It is necessary to register in a timely and correct manner and obtain a supporting document. Only he can prove that part of the living space has become the property of the donee.

Notarization of the contract

Sometimes it is necessary to involve a notary in the process of drawing up a deed of gift. This is necessary for several reasons:

- the parties are not confident that they will be able to correctly draw up the document themselves;

- participants fear that it will be challenged by third parties.

When contacting a notary, you must submit the documents required to fill out the data in the agreement and pay the registration costs.

The notary independently prepares the text of the document, taking into account the specifics of the situation and the requirements of the parties to the transaction. After signing it, the notary sends the deed of gift and related documents to register the right.

Obviously, the process of registering a gift of an apartment through a notary is less time-consuming, but more financially expensive. That is why it is advisable to decide in advance on the choice of registration method.

State duty for donation

There are no fees for making a donation. However, drawing up an agreement is not always free.

List of expenses that make up the total cost:

- state fee for certification. It is paid if the contract is decided to be certified by a notary. The size varies depending on the value of the property share and the presence of family ties between the parties to the transaction;

- state fee for registration of rights. This expense item is mandatory. This is how part of the property is transferred free of charge; registration of the right is indispensable. That is why the state duty will be paid for any option for drawing up the contract;

- payment for notary work. A specialist of this order has the right to charge an additional fee for assistance in drawing up, certifying the contract and providing relevant advice;

- income tax. It is charged generally at a rate of 13%. The calculation is based on the cost of the share. The obligation to pay lies with the donee, who is not a close relative of the donor.

Thus, a state fee may be charged for certification of an agreement to transfer a share of real estate free of charge or for registering a right. The total cost varies and may be higher or lower depending on the circumstances.

Cancellation of a gift to two recipients

A donation can be canceled either by the donor on the grounds provided for in paragraphs 1, 2 and 4 of Article 578 of the Civil Code, or by an interested person - paragraph 3 of the same article. The list of such grounds is absolutely exhaustive. Let's consider each case separately:

- If the donee made an attempt on the life of the donor , one of his family members or close relatives, deliberately inflicted bodily harm on him, thereby causing harm to his health.

Such facts must be confirmed in the form of a certificate of bodily injury, testimony of witnesses or statements to law enforcement agencies.

In the event of the death of the donor, his heirs have the right to cancel the donation in court.

- If the donee treats the donated property inappropriately and such an attitude poses a threat to its destruction, damage and thereby can lead to its irretrievable loss.

Be sure to read it! Discharge of a deceased person from an apartment: rules and necessary documents

In this case, the donor will need to prove that the property donated by him constitutes enormous non-property value for him and the fact that he warned the recipient about this.

- If the death of the donee occurs during the life of the donor .

Such a condition must be specified in the content of the donation agreement, otherwise it will be impossible to cancel the donation.

- If the donor is a legal entity or a private entrepreneur and the donation was made at the expense of his commercial activities, in violation of the Federal Law “On Insolvency (Bankruptcy)” and six months before he was declared insolvent (bankrupt).

Important

When concluding one gift agreement for two recipients, if one of the listed situations occurs, the agreement is subject to cancellation in full.

If the grounds described in paragraphs 1, 2 and 4 of Article 578 of the Civil Code concern one of the donees, then depending on how the ownership of the donated property is formalized, the consequences of canceling the donation :

- if the property is transferred into common ownership by two donees, then the donation is canceled and the property remains in the common ownership of the donor and the donee who was not affected by the cancellation;

- if a specific share of the property is given as a gift to each of the donees and a certificate of ownership of the share in the property is issued, then after the cancellation of the donation, the property of the donee who was affected by the cancellation passes to the donor, and the property of the other donee remains with him.

Therefore, if the donor has any doubts about the donees, it is best to conclude a separate agreement for each donee.

Preliminary agreement

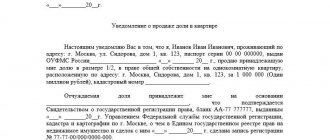

A preliminary agreement on the donation of a share of real estate is concluded by the parties. It is drawn up in order to protect the parties from the impact of various factors in the future, and is a guarantee of the preparation of the main document. According to the rules, the text indicates the date by which the main agreement for the transfer of property or part as a gift must be signed.

The provisions of Article 429 of the Civil Code of the Russian Federation, in force for 2020, apply to the preparation of a preliminary agreement.

The 2020 sample of such a document is used as source material and is filled out in accordance with the document data. If the provisions of the preliminary agreement and the conclusion of the main agreement are evaded, the injured party has the right to demand this in court.

Information about the object of the transaction

The donor, free of charge, transfers to the recipient an apartment (a share in a clearly defined volume), located at the address (filled out in accordance with the document establishing the right). The following is a detailed description of the property: square footage, number of rooms, floor number in an apartment building, presence of a balcony or loggia, square footage of the kitchen, bathroom, total and usable area of the apartment.

The described property (its share) is owned by the donor; as confirmation, all the main parameters of the certificate must be listed in accordance with the document (number, date and place of issue, document series). A separate clause must indicate that the transfer of ownership will occur from the moment the contract is signed. Its registration is carried out in accordance with the established procedure, expenses are incurred at the expense of the donor. The owner must confirm in the text of the document that the property is not currently alienated, is not pledged, is not under arrest, and has no encumbrances.

Agreement for donating a share of an apartment to minor children

A share in an apartment can be given to many people, including children. The law does not give a minor the right to sign important documents with his own hand, including a gift agreement. This is due to the fact that he does not have full legal capacity due to his age.

The legal representative has the right to sign when giving a gift to a minor.

However, the owner of the donated share will still be the donee. This document has distinctive features:

- the party receiving the gift, when making a gift to a minor, will not be called “the donee”, but “the donee represented by a representative”;

- In addition to the data of the recipient himself, the data of the representative is entered into the text.

Otherwise, donating a share of an apartment to minor children does not differ from the standard one.

Own. Methods and types of its transmission

Almost every modern person owns real estate (apartment, house, dacha, etc.). Some are its sole owner, others own a certain share. In this case, the property may be in shared common ownership or, during privatization, joint ownership of individual individuals.

The owner of even a few square meters of real estate, according to provisions 207-209 of the Civil Code of the Russian Federation, has the right to perform various types of actions with them: purchase and sale, transfer as part of inheritance, donation, rent. From a legal point of view, in the case of registered joint ownership, a number of problems may arise; in order to perform any type of action, the consent of all owners of the property is required.

Significantly complicates the process of transferring rights (in whole or share) of property if a minor child has a part of it. Guardianship authorities ensure that the interests of children are not violated when carrying out actions with the real estate they own.

The use of any method of transfer of property (rights to it) must be accompanied by specialists competent in this matter. For example, an agreement to donate a share of an apartment to minor children is quite common and is often used in practice by parents who are worried about the fate of their beloved child. But to fill it out, you will need to consult a lawyer.

How to terminate a gift agreement?

According to the Civil Code of the Russian Federation, it is impossible to terminate a deed of gift. However, the donee has the right to refuse to accept part of the apartment at any time, just as the donor has the right to refuse to transfer the gift. However, such an action is more difficult to perform and there must be a reason for it.

Refusal by the donor is allowed on the basis of Article 577 of the Civil Code of the Russian Federation 2017.

In addition, the donated share of the living space is disputed and declared invalid. Interested third parties are involved in this process.

Thus, the agreement on the transfer of property as a gift is terminated solely under the circumstances specified in the Civil Code of the Russian Federation 2017. The preparation of this document must be correct and not contrary to the law. The sample serves as a good basis for the final design. State duty is charged only in certain cases, and drawing up a deed of gift can be practically free.