Alternative deal: what is it?

An alternative transaction is a purchase and sale transaction in which the seller of an apartment simultaneously acquires housing for himself.

An alternative transaction has the following features:

- at least 2 purchase and sale transactions are carried out simultaneously , and in the second the buyer is the seller of the first transaction;

- transactions are related to each other , cancellation of the first transaction automatically entails the failure of the second.

These principles distinguish an alternative transaction from a regular transaction , in which the receipt of money by the seller is not timed to coincide with any events.

In the future, he can dispose of them at his own discretion and, for example, also buy an apartment. In an alternative transaction, the main principles are precisely connectedness and simultaneity .

As a rule, this situation arises for one single reason - the seller has nowhere to live if he simply sells the apartment.

And selling is a way to improve or change your living conditions.

How to draw up a purchase and sale agreement for an apartment? Read here.

Deal options

All transactions on the secondary market can be divided into three types:

- direct (net) sale;

- alternative deal;

- "chain" of apartments.

Direct sale is a transaction in which the seller simply receives money and subsequently disposes of it at his own discretion.

This is the simplest type of transaction , and its principles differ little from purchases on the primary housing market.

An alternative transaction is the sale of an apartment with the simultaneous purchase of another property.

Such a transaction has at least 3 participants : Buyer - Seller / Buyer - Seller .

The money received by the Seller/Buyer from the Buyer is fully or partially transferred to the Seller .

Alternative ways to organize a transaction:

- improvement of living conditions , for example, the sale of a one-room apartment and the purchase of a two-room apartment;

- change in living conditions without a clear improvement in quality, for example, moving to another area, changing floors, etc.;

- travel , when a multi-room apartment is sold and 2 homes are purchased;

- moving out is a rather rare option when two or more homes are sold at the same time and one is bought.

move-out option is quite rare, since it can be difficult to find two or more buyers for the properties being sold at the same time.

In addition, usually those moving in can “painlessly” sell one apartment through direct sale, so as not to complicate the alternative transaction .

When executing an alternative transaction, the second purchase and sale transaction is always a “net sale” ; otherwise, a “chain” of apartments .

It consists of several alternative transactions ending in a " net sale ".

You can learn about the rules of bargaining when buying an apartment from our article.

Procedure

An alternative transaction essentially consists of several ordinary transactions , the order of which depends on the number of participants .

If there are three of them (Buyer, Seller/Buyer, Seller), you can roughly describe the procedure for all parties .

Stages of implementation

The stages of an alternative transaction have minor nuances compared to a direct purchase and sale transaction:

- The seller puts the apartment up for sale, while simultaneously looking for an alternative (counter option) . When finding a buyer for his apartment, he must finally decide on his purchase;

- The seller/buyer enters into an advance/deposit agreement with the buyer of his/her living space , which specifies the preliminary dates and conditions for the upcoming transaction;

- At the same time, an advance or deposit agreement is concluded with the seller of the selected apartment; the agreement specifies the same deadline for registering the transaction with government agencies. registration;

- All necessary documents for both transactions are After the documents are collected, the day of the upcoming transaction is set and sales contracts are prepared ;

- On the appointed day, it is advisable for all participants in the transactions to gather at the same time in order to avoid unforeseen disruptions. Both purchase and sale agreements are signed , money is transferred along the chain (in cash or by depositing it in a safe deposit box);

- Sale and purchase agreements, along with the necessary documents, are submitted to government agencies. registration .

Read our article about how to correctly draw up a deposit agreement when purchasing real estate.

Watch a video on how to safely conduct a transaction to purchase an apartment through a safe deposit box:

Required documents

To conduct an alternative purchase and sale transaction, the same list of documents is required as when completing a standard transaction .

Both sellers must provide:

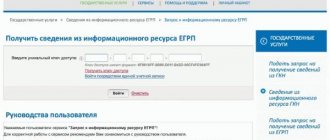

- title documents (extract from the Unified State Register of Real Estate);

- agreement according to which the apartment became the property (purchase and sale, privatization, donation, etc.);

- cadastral passports;

- certificate for sale from the housing cooperative (about the absence of debts, the number and composition of registered persons);

- general power of attorney , consent of the guardianship authorities, consent of the spouse (if necessary).

All participants in the transaction must provide identification documents . Buyers - consent of the spouses to purchase.

Briefly about buying an apartment with minor owners

It is possible to buy apartments with minors, but the process is more complicated than a regular transaction. If the buyer does not participate in the process and does not check whether the sellers have permission from the guardianship authorities for the transaction, then in the end he may lose the apartment. It will be returned to the seller, and he will have to return the money to the buyer.

- Check the extract from the Unified State Register and the archival certificate - you need to find out whether the child is the owner, or whether he only has the right of residence.

- If the minor is simply registered, ask the seller to sign him out before the transaction. For example, to relatives. When a child owns a share in housing, permission from the guardianship authorities is required.

- Make sure that the transaction does not contradict the principle of the law - the child’s living conditions should not worsen. This means that the parents must allocate the minor a share in the new housing; it must be larger in area and cost, plus the proportions must be observed. If a child owned 50% of the apartment, then it would not be possible to allocate him 1/16th share, even if it was the same area.

- Write down all the terms of the transaction in the contract. Add a clause there that explains how the seller will compensate you for losses in the event of termination of the transaction at the initiative of the guardianship authorities.

- If the sellers do not yet have an apartment to allocate a share to the child, and they are going to purchase it, conduct both transactions simultaneously or as soon as possible. Write down all the conditions in the contract.

- Seek help from a lawyer who specializes in such transactions.

If you are not sure that the child’s living conditions will improve as a result of the transaction, then do not buy such an apartment.

“Chain” of apartments: what is it?

A “chain” of apartments refers to those alternative transactions in which the number of participants exceeds 3 and can reach a dozen or even more.

Although in practice such cases are rare. Typically, a “chain” refers to interconnected purchase and sale transactions of at least 4 participants.

Such a transaction can be illustrated with the following formula:

Buyer - Seller/Buyer 1 - Seller/Buyer 2 - Seller

Any “chain” ends with a “pure sale,” that is, a purchase and sale transaction in which an alternative option is not purchased .

A “chain” of apartments is an even more complex option than an alternative transaction, since the number of participants in it is greater, and the likelihood of disruption of the entire “chain” grows exponentially.

Therefore, many sellers or buyers of apartments have difficulty agreeing to participate in “chains” due to the high probability of failure of a personal purchase and sale transaction due to the fault of one of the participants in the “chain”.

The concept of “alternative to selling an apartment”

(French alternative, from Latin alternatus - other) - the need to choose one of two or more mutually exclusive possibilities, as well as each of these possibilities.

- a one-time transaction for the sale of one property and the acquisition of another.

Usually the combination “alternative sale” is used in slang, since the purchase is always “regular”.

An alternative sale is often the only possible transaction if the apartment or a share in it belongs to minor children, pensioners (that is, “socially vulnerable owners”).

Notarial form of agreement

Transactions with minors or ward owners are carried out only in notarial form.

Risks and privileges

An alternative transaction has its pros and cons , but the person who is most interested in it is the person who sells and buys an apartment at the same time .

Other buyers and sellers become parties to such an agreement involuntarily due to the fact that it was not possible .

The main risk of an alternative transaction is the complexity of its organization and execution.

The more participants , the more difficult it is to organize them, agree on conditions and requirements, draw up and sign preliminary and main purchase and sale agreements, and at the same time register transactions with state registration authorities.

Therefore, such transactions almost never happen without realtors , and support can be carried out by one or even several agencies depending on the number of participants.

Such a transaction may fail not only at the preparation stage, but also after the documents are submitted for registration.

For example, if the registration authorities suspend one transaction , then the parties to the second agreement will also have to apply for suspension.

A large number of participants in the transaction , especially in a “chain” of apartments, sharply increases the likelihood of the appearance of inadequate participants , due to which the entire overall transaction may fail.

Therefore, in an alternative transaction, you should especially pay attention to the psychological and moral qualities of the parties , since one participant can break the entire “chain”.

Particularly at risk is the person who buys and sells a home at the same time .

Other participants in an alternative transaction have less interest in conducting it, since it may be easier for them to complete conventional direct sale transactions.

Quite often, the Seller/Buyer has to provide a discount on their apartment and buy housing a little more than market value so that other participants agree to participate in an alternative transaction.

An alternative sale and purchase transaction can theoretically be broken down into two simple transactions , but this option also has disadvantages.

The advantages of an alternative transaction include the possibility of direct relocation and registration at a new address, bypassing intermediate living spaces.

In addition, if the purchase fails, the seller does not risk being stuck with money and frantically looking for new purchase options.

Conducting two regular transactions will not protect the seller from having his purchase option disrupted, which is especially dangerous in a volatile market with rising prices.

During the period that a new purchase option is being sought, prices may rise by 10 percent or more , which is in no way in the interests of the seller.

We recommend watching a video about what an alternative transaction is and the nuances of its implementation:

Subtle Differences

In most cases, apartments are chosen for more attractive prices. A square meter here will be cheaper by about 15–20% compared to secondary and primary objects of the classic format. At the same time, the quality characteristics of apartments are usually not inferior to the level of residential complexes. One building can have both apartments and apartments - and the layouts of the two formats are also the same or have minimal differences.

Status matters: apartment sales increased by 30-40%

Most transactions in the capital take place in the mass segment

Director of the Est-a-Tet project consulting department Roman Rodiontsev believes that the location of the new building may also be a key factor for buyers.

— Apartment complexes are often built in areas of business activity, near transport hubs. Such projects are the most attractive for investment for the purpose of subsequent sale or rental, he added.

And according to Sergei Kovrov, head of the analytics and consulting department at NDV - Real Estate Supermarket, buying apartments is a good way to invest money, an opportunity to save and increase the amount by leasing or further resale of the space.

“Due to their price, they are in good demand among students, young couples and people who are planning to open their own business, for example, a design studio or photo studio,” he noted.

Taxation

According to Russian tax legislation , the sale of housing is considered income and should be subject to personal income tax at the rate of 13% if two conditions are met :

- the housing was owned for less than 5 years (for housing purchased before 01/01/2016 - less than 3 years);

- the cost of housing exceeds 1 million rubles , while income in excess of this amount is taxed (1 million is the amount of tax-free property deduction).

It is a common belief that when executing two sales transactions, if the purchase price is equal to or exceeds the sale price, then the person is exempt from personal income tax .

This opinion is a little erroneous , since a tax resident is not exempt from paying tax.

But he can take advantage of offsets if he has not previously enjoyed the right to receive a tax deduction when purchasing housing.

In this case, you can issue a tax refund in the amount of 13% of the cost of the purchased housing, while the taxable amount cannot exceed 2 million rubles .

When carrying out offsets, depending on the cost of sold and purchased housing, you can reduce the taxable amount to zero and be completely freed from the obligation to pay tax, but only if the person has not previously used a tax deduction.

When guardianship authorities may not allow a transaction to be carried out

The law specifically states only one factor for refusal - a decrease in the value of the share. But the response from the guardianship authorities is usually not specific - if they refuse, it is with something like this: “The rights of the minor will be violated.”

In practice, guardianship authorities are guided by various regulations and recommendations, which differ depending on the region. For example, in Moscow, methodological recommendations have been developed specifically for guardianship authorities, and in Saratov you need to look for reference information for commissions on juvenile affairs.

Here are some other reasons why a permit may be denied:

- Parents are planning to buy an apartment from an unreliable developer;

- They are planning to move to another city, which, in terms of environmental or other parameters, is worse than the one where they are selling the apartment.

- There are no kindergartens, schools or hospitals near the new apartment;

- The general condition of the house is worse - for example, it is in disrepair and is planned to be demolished.

- With the money from the sale of the apartment, the parents plan to build a house and only then allocate a share to the child in it.

When you buy an apartment with minor owners, check all the details of the transaction with the sellers. This is normal, there is no need to be shy - it is important for you, as a buyer, to know what apartment they are buying to replace the one they are selling, what share is being allocated to the child.