Legal consultant Olesya Obizhaeva answers:

If in fact the money is not transferred to you, and you write a receipt stating that you received it, this will put you at an extreme disadvantage. Firstly, this contradicts the real facts, and secondly, the receipt is a document that is of a legal and legal nature, and should not be taken lightly. In judicial practice, there are many disputes that relate to receipts for receipt of funds.

Thus, if the buyer receives a receipt from you for the transfer of funds, then the amount that will be indicated there (20%) may in fact not be returned to you at all. You will have to prove in court the fact that the receipt was written under the influence of the buyer and that in fact no money was transferred. However, your chances of winning the trial are extremely low. Therefore, we recommend that you do not sign documents if they do not reflect reality. Let the buyer use other methods, look for the required amount and transfer it to you - then the receipt can be drawn up without problems.

Why is it needed and who compiles it?

A receipt for receiving the goods is drawn up to confirm the fact of delivery of the item. The document will be required if:

- transfer of valuable property for sale;

- sales of goods, especially with deferred payment;

- taking things for storage;

- providing it for temporary use;

- issuing material assets to the employee.

In accordance with Art. 27.14 of the Code of Administrative Offenses of the Russian Federation, when seizing vehicles or goods as an interim measure, the things that are seized may be transferred for safekeeping to persons appointed by the official who seized the seizure. A receipt is taken from such persons certifying when and what property they received for storage, and their obligation to ensure the safety of this property until the competent authorities make a decision on its fate.

Depending on the purpose of receiving the property, the person receiving it undertakes:

- pay its cost on time (if purchased with deferred payment);

- sell goods and transfer funds to the owner of the item or return unsold material assets (when accepting goods for sale);

- use the property carefully and return it to the owner after a certain period in good condition (when accepting it for temporary use);

- carefully store the property and return it to the owner within the agreed period (upon accepting it for storage).

Olga Belova, lawyer of the Samara Chamber of Lawyers, answers:

Any games with numbers in a contract are fraught with consequences, often irreparable. Of course, you can take from the buyer a receipt for a cash loan for the amount that he lacks to pay the down payment and for which the corresponding amount can subsequently be recovered. However, you should clearly understand: if we are talking about a significant amount, it will have to come from somewhere from the buyer - this time. Secondly, you need to understand that the buyer’s solvency must allow him to pay both the loan and the debt on the receipt. In other words, try to get as much information as possible from the buyer about his financial capabilities. I believe that in your case it is necessary to consider the possibility of registering a pledge of property: for example, a vehicle. For greater confidence, try to involve specialist lawyers in completing the transaction. Proper examination of documents and competent execution will help to foresee all possible consequences and avoid problems in the future.

How is money transferred when buying an apartment?

7 main mistakes when transferring money when buying an apartment

Sample receipt for deposit when purchasing an apartment

When, after a long search, you finally find the home you have been dreaming about for so long, the problem of paying for it arises. Often, if the buyer cannot pay the entire amount at once or asks to postpone this moment to “think it over,” the seller has no choice but to ask him for a deposit - a small amount that will help him gain confidence in the buyer’s actions.

A receipt is a paper that is written in the name of the recipient of the money. It fully confirms that the seller has received the amount specified in the receipt, and in the future this document can be used to protect their rights in the event of a difficult situation.

Interesting: Details of the Supreme Court of the Russian Federation for paying the state fee for a cassation appeal

Receipt for car pledge

Such a receipt is called a promissory note;

- one party transfers a certain amount of money to the other party, for example, to pay for a product/service.

A cash receipt can be drawn up for the entire cost of goods (services) or for a certain part (advance); - one party transfers a certain form of collateral to the other party to secure any obligations, including the return of borrowed funds - a collateral receipt.

In some situations, receipts may be combined. For example, when applying for a loan with collateral, you can specify both the terms of the loan and the terms of the collateral in one document.

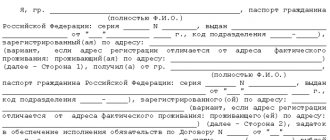

The receipt does not have a specific form fixed at the legislative level.

The main rule is that the document must indicate all the essential aspects of the agreement concluded between the parties, which include:

- place of drawing up the document (indicate the name of the city or other locality);

Receipt for receipt of funds - sample No. 2

I, Petrov Petrovich, born March 01, 1995 (passport series 01 No. 001001, issued on January 1, 2020 by the Department of Internal Affairs of the Sosnovsky district of the city of Orekhovka, registered at Orekhovka, Internatsionalnaya St., 98, apt. 113) received from Ivan Ivanovich Ivanov on 02.02.1992. (passport series 02 No. 002002, issued on February 2, 2012 by the Department of Internal Affairs of the Sosnovsky district of the city of Odintsovo, registered at the address Orekhovka, Eshpaya St., 87, apt. 53) a sum of money in the amount of 11,858 (eleven thousand eight hundred fifty-eight) rubles to pay the cost of renting a one-room apartment located at Odintsovo, st. Indusskaya, 657, apt. 37 under agreement dated September 8, 2020

I received the money for renting the apartment in full, claims against Ivanov I.I. I do not have.

___(signature)___ Petrov P.P.

___(signature)___ Ivanov I.I.

If you are confident in the integrity of the borrower/buyer, a simple receipt is sufficient. If there is no such certainty, it is better to support the legal force of the document with notarization and testimony of witnesses.

Receipt for receipt of material assets

Moscow in the region ______, date of issue: 02/01/2014), received from his classmate, Petrov Petr Petrovich, living at the address: Moscow, Pushkin Street, 222, apt. 22 (passport series 00 02 No. 222222, issued by the department of the Federal Migration Service of Russia in the Moscow region ______, date of issue: 03/02/2014), a set of textbooks in the amount of 10 (ten) pieces.

I have no complaints about the appearance of the textbooks.

May 31, 2014 _________

(signature)

Used sources

- Office work (documentation support for management): a methodological manual for students. – M.: 2004.

Sample receipt for borrowed money

A person who does not often have to draw up various official papers may find it difficult to independently issue a receipt for borrowed money.

In this case, it is recommended to use the sample that you can. In any case, the template will have to be slightly modified, for example, by adding additional conditions to it.

[Show slideshow]

And preparing your own document based on a ready-made sample will be much faster.

At interest

The parties to the transaction can independently determine the interest rate on the loan, the procedure for paying interest and other necessary parameters.

If only a specific rate is indicated in the receipt, then the borrower (debtor) will be obliged to pay interest to the lender monthly and repay the principal amount before the date specified in the document.

This point is very often forgotten by borrowers, but experienced lenders remember it and then sometimes force debtors to pay huge penalties.

[Show slideshow]

Interest can be indicated not only in the form of an interest rate, it can also be a specific amount that the parties agreed upon in advance.

receipts for borrowing money at interest can be found here. But it is necessary to modify it taking into account the specific situation.

No interest

Any loan issued by a legal entity is initially considered interest-bearing.

For individuals, a similar rule applies if the amount of money loaned exceeds 50 minimum wages.

If you plan to lend money without interest, then you should take care in advance to eliminate unnecessary questions and make the appropriate note on the receipt. You can download a ready-made sample receipt for borrowing money without interest here.

On bail

Loans for large amounts are often issued against the security of liquid property owned by the borrower.

This provides a guarantee to the lender that even if the debtor fails to repay the money on time, he will be able to receive his funds.

The receipt must include information about the security deposit. A sample receipt for receiving money as a loan secured by property can be found here.

Comment. The pledge of some property against a receipt will be quite difficult to use if necessary.

We are primarily talking about various real estate, for the collateral of which it is necessary to draw up a full-fledged agreement and register it properly.

Document structure

Russian legislation does not contain specific requirements regarding the structure of a receipt for receiving money as a loan.

The parties can independently agree not only on the terms of the transaction, but also on the execution of a document confirming it. But a certain established structure of the document has emerged.

It is shown in the following table:

| A cap | Title, place and date of document preparation |

| Main part | A detailed description of the terms of the transaction, indicating the specific amount borrowed, the presence or absence of interest and other important conditions |

| Final part | Borrower’s signature, witness details and their signatures (if any) |

Video: how to write a document on cash transfer

Templates: receipt for receipt of inventory items

Department of Internal Affairs of the Sosnovsky district of the city of Orekhovka, registered at the address Orekhovka, st. Internatsionalnaya, 98, apt. 113) received from Ivan Fariseevich Ivanov born 02/02/1992. (passport series 02 No. 002002, issued on February 2, 2012 by the Department of Internal Affairs of the Sosnovsky district of the city of Odintsovo, registered at the address Odintsovo, Eshpaya St., 87, apt. 53) a sum of money in the amount of 7,00 (seven thousand) rubles.

I, Petrov Petrovich, undertake to return the funds given to me in full to Ivanov Ivan Ivanovich by April 4, 2017 (if necessary: with interest of 0.3% per annum).

___(signature)___ Petrov P.P.

___(signature)___ Ivanov I.F.

How to correctly draw up a receipt for a security deposit for an apartment

Important! Most resources on the Internet claim that the receipt must be written by hand and such a document cannot be printed. In practice this is not the case. The main requirement for a receipt is a simple written form. This only means that the document does not have to be oral and does not have to be notarized.

Info The Civil Code of the Russian Federation does not contain instructions on the method by which the document is executed. Under the printed document, it is only necessary to decipher it along with the signature, for the same handwriting examination, if required.

It is important to avoid ambiguity and inaccuracies when drawing up a receipt.

Documents that may also interest you: New for August 09, 2020

- Entered into database 21

- Documents downloaded 3280

- Corrections made to 12

Lawyer explains

- Treaties

- All documents

Receipt

Receipt

is a document that will confirm certain actions that took place between two persons or a person and an institution. For example, transfer and receipt of documents, money, material assets.

There is a distinction between a private receipt, when one person receives something from another, and an official receipt, when a person or representative of an institution receives material assets or documents from some organization or institution.

The receipt can be of any form with the following information:

1.

Document's name.

2.

Last name, first name and patronymic (position and full name of the institution for the official version), name of the document (with its introductory data), which certifies the person who gives the receipt and will confirm receipt.

3.

Last name, first name and patronymic (position and full name of the institution - for the official version) of the person to whom the receipt is given.

4.

A specific indication of what the receipt is given: the exact name of material assets, documents, etc.; condition (new, used, in working order); quantity, weight, cost, size, amount are marked in numbers, and in the arms - in words.

5.

In the official version, it should be noted on the basis of which order, order or other document the value was transferred and received.

6.

Date of receipt (on the left side).

Signature of the receipt maker (on the right side).

7.

In a private version, the signature of the person who gives the receipt is certified by the head of the institution or subsection (indicating his position, initials, surname) or a notary office.

8.

Date of certification (on the left side).

Deposit when purchasing an apartment

If the buyer changes his mind about completing the transaction, the deposit is not returned. This is its difference with an advance payment - an advance payment can be transferred without a written agreement, it is also taken into account in the total amount of payment, but if the buyer refuses the transaction, the seller returns it. The difference between a deposit and a deposit when buying an apartment is that the guarantee is not money, but some kind of property. For example, a car or a plot of land. What to choose - a deposit, a deposit or an advance payment - when buying an apartment is up to you.

A deposit when buying an apartment is money that the buyer transfers to the seller before concluding a purchase and sale agreement in order to confirm his intention to complete the transaction in the future. According to Article 380 of the Civil Code of the Russian Federation, a written agreement on the deposit must be concluded regardless of the size of the amount. The money that the buyer paid as a deposit is taken into account in the total amount of the transaction.

26 Apr 2020 glavurist 191

Share this post

- Related Posts

- Which taxation system to choose for cargo transportation?

- Benefits for combat veterans in 2020 latest housing and communal services news

- How to get an insurance pension certificate for a child

- Sanpin distance from the playground to the parking lot

Receipt secured by real estate

You need to not only draw up a receipt, but also a loan agreement and a collateral agreement. If you need help, write. 3.2. One receipt is not enough.

It is necessary to conclude a loan agreement, a real estate pledge agreement and register the encumbrance in the form of a pledge in Rosreestr.

4. Loan agreement secured by real estate from a private person. The contract has expired and the money is returned against receipt. What documents do I need to remove the encumbrance from real estate? 4.1. A loan agreement, a real estate pledge agreement, a document confirming the ownership of real estate, a receipt for payment of the debt, the pledge holder himself - you will have to submit a joint application for the removal of the encumbrance to the MFC (the procedure is free).

Receipt for the pledge agreement

The insurance amount in case of loss or damage to the collateral property is paid to the pledge holder if it is not his fault.

As a rule, a lien arises in the following cases:

- proceeding from the current legislation as a result of the occurrence of circumstances that led to the recognition of the borrower’s property as one that is pledged as security for a certain obligation.

- based on the terms of the contract;

The essential data that the pledge receipt must contain are:

- sanctions that will be applied to the borrower in case of failure to fulfill contractual obligations.

- its amount, percentage;

- the period for which the loan is provided;

In most cases, the collateral is material assets whose market value is sufficient to cover the loan amount in the event of non-repayment by the borrower, and whose liquidity is high.

Pledge receipt – Receipt of deposit for an apartment sample – Procedure and form of preparation – Catalog of samples

The document is notarized at the request of the parties.doverus.ru A collateral receipt is a document issued by the borrower to the lender in the case where the loan agreement is secured by collateral. In this case, the lender is also the mortgagee.

We recommend reading: The best places for Russians in America

A collateral receipt is drawn up for the purpose of obtaining funds or other assets by the lender by selling the collateral, if the borrower cannot or does not want to fulfill contractual obligations regarding the repayment of the loan.

The subject of the pledge must be such that, at its value, it secures the amount of the loan, interest, expenses for its maintenance, as well as fines and penalties as a result of late payments under the agreement. According to the current legislation, the right of the pledgee to return the loan through the sale of the pledged property is superior to the right of others creditors claiming to return the funds provided to the borrower.