What is a “balance” on electricity bills?

Balance is the debt for electricity based on the readings indicated in column No. 5. A positive balance means debt, and a negative balance means overpayment for electricity.

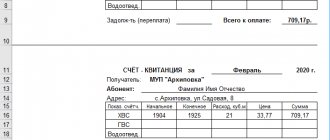

If upon receipt of an invoice for payment of electricity for the current period in the “balance”

the amount is indicated, this means the following:

1) this amount is the debt of previous unpaid periods (as indicated in column No. 3);

2) on the date of generation of the notification invoice, the amount paid for the previous period was not taken into account, since the payment was received later than the formation of the notification invoice;

3) lack of meter readings, which leads to charges based on average monthly consumption.

It is very important to transmit meter readings on time, between the 23rd and 26th of each month.

This can be done in the following ways:

— Through the consumer’s “Personal Account” on the website bashesk.ru. In the upper right corner of the main page there is a “Personal Account” button. You must register; the activation code for your personal account is indicated in your invoice notice. The citizen will be asked to enter a 12-digit personal account number, after which in the “Transfer of Information” section in the “Current Readings” field it is necessary to enter the meter data.

— In the Karaidel client office of NTO LLC “ESKB” at the address: Karaidel, st. Mira, 11A.

— By phone 8-800-775-7077, 8-800-775-30-05 (free call from any phone), from 8.00 to 20.00.

— By email of the client office specified in the notification invoice in the format: personal account number; address; date of reading; indication (indicate without spaces).

— When paying bills in banks or at Russian Post branches.

Tags:

Since January 1, 2012, payment receipts for housing and communal services have become more detailed, but the large amount of information among citizens has raised many questions. Today, Vladislav Konovalov, director of Saransk Settlement Center LLC, explains some points of the new receipt.

— There is a subsection in the receipts: opening balance on the personal account. What it is? — In relation to the personal account of a residential premises, the balance (balance) is the difference between the accrued and paid amounts. The opening balance is the balance of funds in the personal account on the first day of the month. The balance (remainder) can be either positive (overpayment on the personal account) or negative (there is an unpaid amount on the personal account). It should be noted that a negative balance on a personal account is not always a debt. In accordance with the Housing Code of the Russian Federation, consumers are required to pay for housing and communal services by the 10th day of the month following the month spent (I note that payment for January receipts has been shifted to February 25). In this regard, the opening balance (balance) will be a debt only after the 10th day of the month (in the current February after the 25th day).

— Why did they indicate the balance for December 2011 and January 2012 in January payments? — Let me explain that in connection with the transition to paying receipts based on the month lived, at the beginning of January 2012, actual receipts with the accrual of utility bills for December 2011 were printed. In January receipts there is a balance for December. (including additional receipt) and January. informs about accrued and paid amounts for this period.

— By what date do you need to pay for January of the current year and submit the readings of individual metering devices?

— In accordance with the instructions of management companies, the deadline for payment of receipts for January 2012 has been postponed. Consumers can pay utility bills for January 2012 until February 25. Readings from individual utility metering devices must also be submitted by the 26th (up to and including the 25th). In addition, management companies are currently considering the issue of further maintaining payment terms until the 25th day of the month following the previous one.

— Why do recalculations not indicate the period for which they were made? — In accordance with the current Rules for the provision of public utility services to citizens, approved by Decree of the Government of the Russian Federation of May 23, 2006 No. 307, receipts for payment must necessarily indicate the grounds for recalculating the amount of payment. Currently, the information technology service of our organization is exploring the possibility of reflecting the recalculation period in receipts. Today, consumers can find out the fee recalculation period either at the customer service department at their place of residence, or by calling the help desk (indicated on receipts).

— Now compensation under MOPs for owners of individual metering devices is transferred to special accounts for social payments. After opening such an account, what are the consumer’s next steps: should he notify the SRC about the account number, the management company, or does this somehow happen automatically? — There is no need to report information about opening a bank account with a credit institution to record the amounts of social payments to owners and tenants of residential premises. Information about open accounts is sent by credit institutions directly to KU of the city. Saransk "Center for Social Payments and Public Information". We inform you that regarding the issue of opening accounts to record amounts of social payments, consumers can contact the passport offices at their place of residence or the Housing and Public Utilities Center located at the address: Saransk, st. Rabochaya, 15.

“Today, many city residents have social accounts to receive benefits, subsidies, and compensation for housing and communal services,” adds the director of the municipal administration of the city. Saransk “Center for Social Payments and Public Information” Natalya Knyazeva. – This category of citizens, if they have individual metering devices in their apartments, compensation for the MOP is transferred automatically. If there is no such account, then it can be opened in credit institutions. The citizen also gives the bank a written instruction so that the bank transfers compensation for utility bills. The credit institution transmits this information to us, so the citizen does not need to take any additional actions - having received this data, we begin making payments.

People often ask why open an account for social payments, because we have, for example, a savings book or other bank account.

Ufa residents are confused about their payments

“In our experience, people get used to the payment system within three months,” says an employee of ESKB LLC. — After this period, the excitement goes away. And people are starting to understand the receipts well. At the same time, we in no way question the owner’s right to pay before the 10th. However, it is very important to submit your meter readings on time, between the 23rd and 26th of each month. This can be done in the following ways.

We recommend reading: Cost of Divorce Through Court in 2019

We also tried to reach the subscriber sites of the Energy Sales Company of Bashkortostan - indeed, they are busy all the time. It is also difficult to find out anything at the central office of the ESKB, which is located at 50 Let USSR, 47, because there is already a decent queue here. People wait for two, three or even four hours. As the Ufimskie Vedomosti newspaper reports, an 87-year-old man has already died in this line - he could not stand the wait...

What is a balance on a receipt?

Opening such a special account is mandatory: it is impossible to withdraw money from it. The funds received for it have a specific purpose and are intended only for the payment of housing and communal services.

In addition, citizens are wondering why open these accounts at all if the funds still go directly to paying part of the rent. These accounts need to be opened, because MOP compensation is targeted assistance. Without an account it is impossible to provide it - we simply have nowhere to transfer the money. The owner (tenant) of the property must be interested in opening an account: the rent is reduced by the amount of compensation. Thus, in January, the average compensation under the MOP was 105.5 rubles, the maximum amount of compensation was 3,104 rubles. Accordingly, the movement of these funds is reflected in the payment receipt.

What is a balance? Definition, varieties

Publication date

Almost everyone has heard of such a term as balance . What this is, of course, is known to all accountants and economists. But for most ordinary people this word is associated only with the concept of “difference”. The term, which everyone hears, is one of the main ones in accounting theory. In the most general sense, it really means the difference between the receipts of funds and all expenses for a certain period of time. But this concept is actually much broader.

Balance is an Italian word that entered Russian as an accounting term back in the nineteenth century. Literally it is translated as “calculation”, “remainder”, “reckoning”. In the economic sense, the word meant the difference between the amount of debit (receipt account) and credit (expenditure account). By the twentieth century, the meaning of the term had expanded significantly, going beyond the scope of accounting alone. And at the end of the century it had already begun to be used in a figurative sense.

A debit balance is a situation in which debit exceeds credit, that is, it shows the balance sheet asset for a given type of business asset at a certain point in time.

A credit balance is a situation in which a credit is greater than a debit, which shows the state of the sources of funds used to conduct business activities and is reflected in the liability side of the balance sheet.

When the difference between debit and credit is zero, the business transaction account is closed.

In practice, as a rule, not the entire accounting history is analyzed from the moment of the establishment of an enterprise or company, but only for a certain period, called the reporting period (month, quarter, etc.). In this regard, the following concepts are distinguished.

The opening balance (incoming) is the balance of a certain account at the beginning of the period. Calculated based on data from previous operations.

The ending (opening) balance is the account balance as of the end date of the period.

The bill for gas used in February is already available in your personal account.

Note! For gas consumers who do not have meters, the line “Repayment of the difference in consumption rates” appeared in the bill for gas used in February. This happened in connection with the recalculation of the cost of natural gas actually consumed, but unpaid by consumers without meters, for the period from May 2020 to January 2016. According to the decision of the District Administrative Court of Kiev dated 09.21.15 in case No. 826 / 16447/15, the Resolution of the Cabinet of Ministers of 04.29.15 No. 237 “On introducing changes to the norms of natural gas consumption by the population in the absence of gas meters” was declared illegal and canceled, and the natural gas consumption standards determined by it were not subject to application.

This amount may not match the current balance. The current balance takes into account cash receipts for the billing month, data received on the personal account after the calculation (for example, if you paid for gas after the 25th), payment in the current month, as well as accrual of the volumes of gas consumed in accordance with meter readings, in the event , if you transferred them within a month.

We recommend reading: Find a witness in court

Balance in utility bills

It is calculated as the sum of the opening balance and all turnover for the period.

Balance for a period is the final result of all transactions performed during a specific period.

Credit (or debit) turnover for a period – the total of accounts is calculated only for the required period.

In the modern understanding, as before, as in the nineteenth century, the balance is the difference in the final entries in the debit and credit accounts. But in addition to accounting, today the term is also used in foreign economic relations.

Foreign trade relations are often viewed as the sum of exported and imported goods over a certain period. In this aspect, there are several varieties of it.

Trade balance is the result of calculating the difference in the value of exports and imports. It is believed that a negative indicator is a bad trend, since it means that the country has a situation in which the market is flooded with imported products, which inevitably leads to the infringement of the interests of domestic producers. However, in practice this is not always the case. For example, the United States, with such indicators, runs its economy quite successfully, being a standard of economic prosperity and stability for the whole world. They have learned to use other tools to resolve such situations.

The balance of payments is the result of calculating the difference between receipts from abroad and payments abroad. A positive indicator means the excess of cash receipts from outside over payments in the opposite direction. A negative indicator indicates that payments from the country exceed money inflows into the country. This means a gradual decrease in the state's foreign exchange reserves. This situation can only be avoided if such calculations are made exclusively in the national currency of the country.

Published in Business

What is an opening balance?

In accounting, it is important to know not only what the term balance itself means, but also what is commonly understood by such terms as incoming and outgoing balance. There is a significant difference between the opening and closing balances, which every accounting professional should definitely see. The ending balance, or, as it is often called, the closing balance, is the account balance at the end of the period. It is usually calculated as the sum of the opening balance and all turnover for the period.

This is interesting: Auto theft insurance

What exactly does a balance mean on an electricity bill?

The word is of Italian origin, its translation sounds approximately like “calculation” or “remainder”. Since the 19th century, the concept began to be applied to accounting balances. Fundamentally, the semantic load of the word has not changed and has acquired an additional meaning - use in a figurative sense, use in the description of foreign economic activity. When asking the question, what is balance in simple words, we expect to hear something unusual. However, the term has not lost its origins and is still associated primarily with accounting. What is a balance in simple words? In the most general of the meanings, a balance involves a certain balance on a certain day, a difference. We will dwell on the types of balances a little later, but now we will look at examples of the meanings of this word in different areas. In accounting, this is the difference between the debit and credit values of accounts. In foreign trade, this is the difference between a country's exports and imports.

Why is the balance included on the receipt?

If you found this indicator in the received document and wondered what the balance is on the utility receipt, then you obviously thought about why it appeared. There are several reasons that can become the basis for reflecting such a balance, including the following:

- the presence of debt for past periods during which payment for electricity was not received in full;

- untimely receipt of payment for the previous period, as a result of which it was not recorded in the generated notice, which was reflected in the form of debt;

- the absence of actual instrument readings, as a result of which the calculation was made based on the average monthly cost.

This is interesting: What types of Sberbank cards are there: what the number looks like

If payment for electricity was made last month, this fact should be noted on the invoice received. For this purpose, a column is used, which is called “amount other than total”. It contains the necessary information. In this case, you only need to pay the amount that is reflected in the accruals for the current month.

It should be noted that the deadlines for submitting readings from meters installed by consumers are scheduled for a certain period of time: from the 23rd to the 26th of each month.

It is very important to adhere to them. This condition is easily met, since there are many options for how you can send your information to the relevant institution. For these purposes, it is suitable to use the payer’s personal account, call hot phone numbers, which are usually toll-free, send a message by e-mail, as well as directly when making a payment for services at any bank branch or post office.

Debt in favor of reconciliation act what does it mean

Using the analysis of the balance of payments, you can analyze the floating exchange rates of the Russian Federation and determine the pressure on the national currency exchange rate. In payments - the difference between the amounts paid and received from counterparties. In receipts for payment for housing and communal services, this is the balance (that is, overpayment from the previous month) on the apartment’s personal account. What is a balance in accounting in simple words? As mentioned above, for accounting this concept has almost sacred meaning.

Important

Reflecting the difference between the debit and credit of accounts, a balance can be on both the left and right side of the account. Let us recall that the right side is a credit, showing receipts to the account when it is passive and expenses when the account is active.

The left side is debit, where, on the contrary, receipts are displayed when the account is active, and expenses when the account is passive. Attention

Despite the fact that the meaning of the balance is to quickly check the information, in practice accountants try to create a document with similar settings that the opponent uses. If you use the output data on the collapsed balance, in most cases this will lead to a low quality inventory of settlements with counterparties.

Debit and credit in AS These parameters are important for who is generating the verification document.

- So, for the one who issues the reconciliation report, usually the debit (left tabular) part will mean shipments.

- The credit side will cover the data on the left side with payments from the consumer of goods and services. Accordingly, for another organization, the credit part will “turn over” to the left, and for the greeter, again to the right.

Accounting terminology: what is a balance

Since the beginning of 2012, receipts have become more detailed. On the one hand, this is a positive trend, but on the other hand, citizens have many questions about its content. For example, many people are interested in what the balance on a receipt is. This column shows the personal account balance at the beginning of the current month. If the value is positive, then there is an overpayment for housing and communal services, but if it is negative, then a debt has arisen. Moreover, it is considered as such only after the 10th day of the month following the billing month (it is during this time that residents are required to pay for utilities). Thus, ordinary citizens encountered the concept of “balance” in everyday life. In this case, it is considered as the opening balance on the personal account of their residential premises.

We have already considered the first two types. As for the surplus, it arises when the funds received by the organization exceed the expenses incurred by it. In the opposite situation, when income is less than actual costs, a passive balance is formed. Despite the fact that the difference can be either positive or negative, it is always written with a plus sign. This is due to the fact that when accounting for economic assets, the principle of double entry is used: on the one hand, those transactions that led to an increase in material assets are taken into account, and on the other, to a decrease.

We recommend reading: Payments for 3 children in 2020 in the Altai Territory

Balance

InfoAuthorization I don’t remember Remember Register now Create an account Restore access Forgot your password? Please enter your login and email. We will send a link to create a new password Username* E-Mail*

How to correctly enter the debtor on the balance, specifically in whose favor the debt is? Complaint Question There is a “supplier” and there is a “buyer”. For a certain period, by calculating debit and credit according to the balance, the “buyer” owes money. There is a column: For such and such a period, the debt in favor of XXX is so much... It’s a little confusing who should be on Where is XXX indicated? The one who owes or the one to whom they owe? What causes the confusion: the phrase “in favor” is confusing, :) That is.

This can be interpreted differently...

Balance

Or call us by phone (Moscow) +7 (812) 490-76-58 (St. Petersburg) It's fast and free! Balance in the reconciliation report One of the details that must be indicated in the document is the balance. A debit or credit sign indicates a debt in favor of one of the business entities.

It turns out that the reconciliation act allows you to compare data for the past and current periods. Correct reading of the document allows the accountant to check the correct and timely reflection of business transactions in the program for a specific counterparty.

Balance - what is it in simple words

On the website If you make a Reconciliation Report with your customers, then shipments will be made according to Debit 62 of the account, and payment for the goods according to Credit 62. If for suppliers (60 account) there is a debit balance, this means you are owed, you transferred an advance and the goods were not shipped to you , if the balance is on credit, then you owe for goods supplied and services rendered.

Login to the site Reconciliation reportAnd forgive us our debts: at what point can a company write off its debt to counterparties? What “other grounds,” along with the expiration of the statute of limitations, exist for writing off? The Tax Code of the Russian Federation does not contain an answer to this question. In this case, let us turn to official explanations to officials and arbitration practice. It is difficult to disagree with them, because in accordance with Article 419 of the Civil Code of the Russian Federation, the obligation is terminated by the liquidation of the legal entity.

Debt in favor of LLC - IU What is the receivables of an enterprise? In addition to customer debts for products shipped or services provided, accounts receivable may include advances that were paid to contractors and material suppliers, debts on loans issued, for example, to employees of the enterprise, and funds provided to accountable persons for the purchase of raw materials. What are the types of accounts receivable? debt in favor of Ivanov - that means you owe him, someone owes him IYU LLC 107,000 If you don’t know, think logically: you are not IYU LLC, but the debt is IN FAVOR of IYU LLC, which means they OWE it! ))) Debt in favor of the company, what does it mean? They sent me a statement of reconciliation of mutual settlements, in the columns of this company: payment of xxx rubles, receipt of xxx rubles, turnover for the period in debit and credit are the same.

Debt balance in favor of who owes whom

On the website If you make a Reconciliation Report with your customers, then shipments will be made according to Debit 62 of the account, and payment for the goods according to Credit 62. If for suppliers (60 account) there is a debit balance, this means you are owed, you transferred an advance and the goods were not shipped to you , if the balance is on credit, then you owe for goods supplied and services rendered. Login to the site You can add a topic to your favorites list and subscribe to email notifications. - does this mean that we DO NOT owe it, is it our overpayment, or should we pay an additional 200 rubles? - Nobody asks us whether we agree or not. We don't even remember how we got here. We're just driving, that's all. Nothing remains. — The most difficult thing in life remains. This is especially true in cases where the accounting department processes a large amount of incoming documentation. To check the level of debt that the opponent shows, a reconciliation report is usually used. This is information that is produced by “its” program or algorithm. Experienced accountants usually cautiously use the second method of verification due to the fact that data can be distorted (decreased) by the amount of value added tax. The coincidence of the final balance, accordingly, indicates that the past and current periods in both organizations were carried out correctly, there are no complaints. The discrepancy in the information directs the accountant to check each payment and shipment that is recorded in the period for which the report is generated. Help please! In progress 1 law 4 years ago 0 Replies 308 wordpress, question, developer Share Similar questions

- How to enter an address in the dealextreme.com form?… (1)

- Recourse claim. Urgently!… (1)

- alimony debt how to refuse... (3)

- how to file a second lawsuit in court against a debtor if one lawsuit has already been filed?... (1)

- what is the balance at the beginning of the period... (4)

- How to terminate a contract with an individual entrepreneur if he dies... (1)

- What kind of debt to a mobile operator can be prosecuted for?… (5)

- How to find out debt on the Internet by personal account... (0)

- how to correctly enter a Moscow address... (1)

- How to correctly translate the specialty “furniture assembler” into Ukrainian?...

Services for maintaining residential premises in an apartment building

- in the winter months, monitoring the removal of snow from citizens, clearing sidewalks and access roads from it, combating ice and ice on the intra-block territory;

- in the summer months, carrying out all necessary lawn care procedures;

- repair and maintenance of technical devices, household rooms, general communication systems, structural elements (this also includes all activities related to the heating systems of the house);

- 24/7 support for apartment residents in case of unforeseen emergencies;

- carrying out technical work to keep systems that are responsible for water supply (hot/cold), sewerage, electricity and heat supply up to date;

- all types of necessary actions in the event of emergencies, etc.

- monitoring property in common ownership through regular monitoring, testing and diagnostics of a technical nature, inspections and observations (technical devices, rooms for household purposes, general communication systems, structural elements located within the living area);

- seasonal preparation of an apartment building, ensuring the possibility of operating public property in all weather conditions (entrances, fences and front gardens, technical devices, household rooms, general communication systems). At the same time, they are guided by compliance with the norms and instructions of housing inspection employees, fire regulations, state energy supervision, sanitary and epidemiological stations with compliance with points, regulatory documents on technical support and equipment of a residential building in 2019;

- instant resolution of emergency situations, elimination of incidents that led to malfunction and inability to use the common property of a residential building. Immediate restoration of the life support system and violations of safety rules, repair of structures that threaten the health and life of owners and users of common living space;

- carrying out activities aimed at sanitizing and repairing property belonging to an apartment building on a general basis (adjacent land, attic, caring for trees, bushes, flowers, entrance, non-residential basement).

08 Aug 2020 piterurist 217

Share this post

- Related Posts

- Can a Parent File for Child Support?

- Technical passport of the apartment where to get

- Children's card at the birth of a child in 2020 in St. Petersburg, conditions for obtaining St. Petersburg

- If payments from maternity capital are 25 thousand in 2020

Meanings of the word balance. What is a balance?

Balance

Balance (Italian: saldo - calculation, balance) - the difference between income and expenses for a certain period of time. Balance in accounting is the balance of an accounting account, the difference between the sum of the debit and credit entries of the accounts.

en.wikipedia.org

BALANCE - the difference between cash receipts and expenses for a certain period of time; in international trade and payment settlements - the difference between the value of a country’s exports and imports (trade balance) or between its foreign...

Great Accounting Dictionary

Balance (from the Latin saldare - to equalize). — Between persons (or institutions) who are in a relationship of trust with each other, when one party has to spend their own and other people’s money at the same time, there is a mutual account.

Encyclopedic Dictionary F.A. Brockhaus and I.A. Efron. — 1890-1907

BALANCE – remainder.

Negative electricity bill

The term “balance” is most often used to designate the balance of accounts: current, settlement, loan, current account, as well as to designate the balance of mutual cash settlements.

Soviet legal dictionary. — 1953

Balance of migration

Balance of migration (net migration, net migration, mechanical population growth, migration growth) is the difference between the number of arrivals to a certain territory and the number of departures from it over a certain period...

Yudina T.N. Migration. — 2007

MIGRATION BALANCE, net migration, net migration, migrat. population growth, mechanical population growth, the difference between the number of arrivals in a given territory. and the number of those who left it beyond the definition. period (quarter, year, intercensal period, etc.)…

Demographic encyclopedic dictionary. — 1985

The migration balance is the difference between the number of people who arrived in a certain territory and the number of people who left there during the same period of time. The migration balance can be positive or negative.

glossary.ru

Balance Debit

DEBIT BALANCE is an accounting term meaning the excess of the total debit amounts of an account in comparison with the credit. It is usually shown in the asset balance sheet. Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.

Raizberg B.A. Modern economic dictionary. — 1999

BALANCE, DEBIT - an accounting term meaning the excess of the total amounts for the debit of an account compared to the credit. It is usually shown in the asset balance sheet.

Great Accounting Dictionary

Debit Balance - the excess of the total amounts in the debit of an account compared to the credit.

Dictionary of business terms. — 2001

Conversion balance

Conversion balance is the difference between the value of the convertible bonds presented for exchange and the value of the shares received in exchange. In English: Adjustment of conversion See also: Convertible bonds

Dictionary of financial terms

Conversion balance is the difference between the value of the convertible bonds presented for exchange and the value of the shares received in exchange.

glossary.ru

CONVERSION BALANCE - the difference between the value of the bonds being converted (presented for exchange) and the value of the shares received in exchange.

Financial Dictionary. — 1999

Foreign trade balance

FOREIGN TRADE BALANCE - the difference between a country's exports and imports, usually in value terms. If exports exceed imports, there is a positive balance; otherwise, there is a negative balance.

Lopatnikov. — 2003

Foreign trade balance Foreign trade balance is the difference between a country's exports and imports in value terms. In English: Balance of foreign trade Synonyms: Foreign trade balance, Foreign trade balance Synonyms in English...

Dictionary of financial terms

Foreign trade balance is the difference between a country's exports and imports in value terms. In English: Balance of foreign trade Synonyms: Foreign trade balance, Foreign trade balance English synonyms: External balance…

Dictionary of financial terms

Balance of payments

Balance of payments Balance of payments - in payment calculations - the difference between the amounts of foreign receipts and payments. It is believed that the balance of payments should always be equal to zero.

Dictionary of financial terms

Balance of payments - in payment calculations - the difference between the amounts of foreign receipts and payments. It is believed that the balance of payments should always be equal to zero.

Dictionary of financial terms

Balance of payments - in payment calculations - the difference between the amounts of foreign receipts and payments. It is believed that the balance of payments should always be equal to zero.

glossary.ru

Saldo, Vladimir Vasilievich

Vladimir Vasilyevich Saldo (Ukrainian Volodymyr Vasilyovich Saldo, born June 12, 1956, Oktyabrskoye, Nikolaev region, Ukrainian SSR) - Kherson mayor (mayor of Kherson) since 2002. Higher education.

en.wikipedia.org

Credit balance

CREDIT BALANCE The excess of credit over debit in an account. As a rule, banks have C.s.; a debit balance occurs only in the event of an overdraft. K.s.

Encyclopedia of Banking and Finance

Credit balance - in exchange transactions - the debt of a broker or dealer to a client. In English: Credit balance See also: Exchange operations Brokerage accounts

Dictionary of financial terms

Russian language

Baldo, uncl., p.

Dictionary of accents. — 2000