Most people know that property owners need to pay taxes on it. Therefore, everyone who has their own apartment, house, room, land and other real estate will have to give the state a certain amount once a year. It is worth noting that the amount of payment is determined individually for each case. Therefore, it is impossible to say the exact amount that would be suitable for everyone. Quite an important question is whether you need to pay property tax if the apartment has a mortgage. We'll sort this out in this article.

General information

All individuals who own real estate are taxpayers. They are forced to pay annual taxes on their house or apartment. If you do not do this, a fine will be charged. You can find out about the debt by visiting the tax office in person or using a special Internet resource.

By law, the tax receipt must be sent at least 30 days before the payment is due. That is, a person will have a month to pay off the tax. If he does not do this in a timely manner, then a fine will be imposed. And it is 20% of the tax, and then can increase to 40%. Therefore, it is better not to delay paying tax on housing.

It may happen that the property tax receipt is not sent; for example, it gets lost in the mail or is sent to the wrong address. In such a situation, you should not wait until the problem resolves itself. If the receipt did not arrive on time, you should get it yourself. To do this, you can use the Internet and visit the website of the tax service or personally contact the government agency. An invoice will then be issued for payment, which will need to be repaid.

Tax payment deadlines

The tax is payable by December 1 of the year following the year in which the tax was accrued for real estate due to its being owned by the taxpayer. The number of months and for which month the tax was calculated does not matter.

It should be borne in mind that tax payment is carried out on the basis of a notification from the Federal Tax Service. It must be sent to the apartment owner by the tax authorities before the end of November of the year following the one in which the tax was calculated.

It is worth highlighting a rather rare but common scenario in practice - when the Federal Tax Service sends a notification later than the deadline for sending it or even the deadline for paying the tax. As a result, the taxpayer may incur arrears and penalties, which the Federal Tax Service requires to pay. The requirement to pay tax in this case should be considered as legitimate. But you need to know that the application of penalties in this case is illegal.

Having received such a request from the Federal Tax Service, you need to promptly send there a request to write off penalties. As evidence of their illegal accrual, you can attach postal documents that reflect that the notification of tax payment arrived later than the due date.

The Federal Tax Service, with which the taxpayer is registered, must write off the wrongfully accrued penalties. If this does not happen, you need to complain about the actions of the inspectorate to a higher structure of the Federal Tax Service. If this does not help, go to court.

It happens that the Federal Tax Service does not send a notification, despite the fact that the tax has been calculated. This may be related:

- With the fact that the calculated tax amount is less than 100 rubles.

As a rule, such cases are associated with a short duration of apartment ownership - about 1-2 months, with a small area.

However, as soon as at the end of the billing period the tax amount becomes equal to 100 rubles or more, the Federal Tax Service will send a notification. It will also send it if 3 years have passed since the tax was calculated - regardless of the payment amount.

- With the fact that the Federal Tax Service for some reason does not have information on the object of taxation (while a person is its owner and must, in principle, pay tax).

Such cases are rare, since Rosreestr itself sends information about real estate transactions to the Federal Tax Service. Tax authorities almost always know when and for how much a person bought an apartment.

But it is possible that, due to technical failures and other circumstances, the Federal Tax Service will not have data on the real estate acquired by a citizen, which is subject to taxation by law. But in this case, the apartment owner should not ignore the current situation: by law he is obligated to inform the Federal Tax Service about the presence of taxable real estate (at least according to obvious signs) in his property.

If a notification from the Federal Tax Service is not received by the end of November of the year following the one for which the tax should be calculated, the citizen is obliged to contact the tax authorities before the end of the year and inform them in the prescribed form that he owns a taxable property.

- With the fact that the taxpayer has an account in his Personal Account on the Federal Tax Service website.

The Federal Tax Service does not send paper notifications to the owners of such accounts unless the citizen directly asks the tax authorities to do so. An ignored electronic notification sent to the taxpayer through the Personal Account and, as a result, non-payment of tax will lead to unpleasant penalties.

Therefore, a citizen must remember the fact that he has access to his Personal Account. And if in doubt, check with the Federal Tax Service directly about the availability of such access. If desired, ask department specialists to send notifications in paper form.

Through your Personal Account, you can also inform the Federal Tax Service about the emergence of new taxable real estate in your ownership - if this is required according to the scenario reflected in paragraph 2.

- With the fact that benefits are applied to the object of taxation - in the form of the opportunity not to pay tax (or due to the fact that a zero tax base is formed for a specific property).

It is useful to consider the tax benefits for mortgage housing (in principle, similar to those provided to full owners of residential property) in more detail.

Do I need to pay if the apartment has a mortgage?

Nowadays, not every person can afford to buy an apartment right away. Many people take it out on credit and then pay off the mortgage for a long time. During this period, they have the right to live in the house and use it as full owners. And now the question arises, is there a property tax on a mortgage? After all, a person has not yet become an absolute owner, and, for example, cannot sell an apartment or give it as a gift.

As you know, if a person cannot pay the mortgage on time, the home will be taken away. And it’s difficult to predict how life will turn out. Everyone has the possibility that something unexpected will happen, due to which they will not be able to fully pay off the loan. However, property tax will be charged if the apartment has a mortgage. And you will need to pay on an equal basis with the full owners. After all, a person, despite having a mortgage loan, will still be considered the owner.

As for the rules, they are no different from the standard ones. Therefore, there is no need to hope that the tax will be less or that it will not be charged at all. The law is the same for everyone.

Tax benefits when buying an apartment

Since 2014, a new rule has been in force in Russia for providing benefits when completing a transaction for the purchase and sale of residential real estate, which has a positive effect on the processing of mortgage lending by individuals. Since, due to the significant improvement in the conditions for providing benefits and other concessions from the state, citizens are allowed to return at least 260,000 when purchasing real estate.

The main differences between the new legislation and the previous one:

- When applying for a mortgage or purchasing residential premises for cash, the deduction was provided no more than once in a lifetime for each member of society. Now the deduction can be obtained regardless of the amount of real estate purchased, but the total amount of possessions must correspond to 2 million rubles.

- If the maximum established amount for the purchase of real estate is exceeded, the owner receives no more than 260,000 rubles.

- If citizens purchased real estate before 2014 or registered ownership of it, then they will not be able to receive the “missing” deduction.

Purchasing real estate with housing loans has become much more profitable, since the state compensates for part of the costs associated with overpayments on the loan. However, the total amount of compensated funds should not exceed 3 million rubles. The development of mortgage lending is also supported by a gradual reduction in payment rates. A detailed calculation of the total amount of overpayment is made by the creditor.

Conditions for receiving compensation for overpayment on a mortgage:

- Availability of white wages and official employment;

- The total amount of overpayment is 3 million rubles or less for the entire term of the loan agreement;

- The deduction can be provided to each party to the contract, i.e. if real estate is acquired as common property, then each of the parties to the agreement can count on receiving a deduction.

Individual entrepreneurs who do not make tax payments will not be able to count on deductions from actual expenses incurred.

It is worth noting that this deduction is provided to persons within the framework of:

- Reimbursement of part of the costs incurred for the construction or purchase of a dwelling, as well as for the purchase of land for the construction of a residential building;

- Reimbursement of interest payments under the agreement between the borrower and the bank;

- Reimbursement of expenses for overpayment of refinanced housing loans.

To receive any type of benefits and government support, you must collect the established package of documents and contact the authorized bodies with an application.

When concluding a home loan, you must understand that the collateral status of the home does not make it the property of the bank, which means that the property tax on the mortgage must be paid by the borrower. This payment can become the responsibility of the bank only if the agreement between the creditor and the debtor is terminated unilaterally and the apartment becomes the property of the organization.

We also now definitely recommend finding out how to return mortgage interest.

We are waiting for your further questions.

You can request individual advice using a special form on the website. It's free.

We will be grateful for your rating of the post and reposts.

How to pay

As has already become clear, it is necessary to pay property tax. But not all people understand exactly how this can be done. There are different payment methods, and a person can choose the option that is more convenient for him. For example, you can contact your bank with a receipt.

There you can pay in cash and then not have to worry about taxes for another year.

You can also use the Internet for this purpose. This option will even be more convenient, since you won’t even have to leave the house to carry out your plans. You will need to use, for example, the online version of your bank. If there is money on the card, then you can pay from it. The money will be immediately transferred to the tax service account, and the tax will be paid.

Tax amount

The tax sphere in 2020 is undergoing a number of changes that affect many aspects of its activities. In particular, the procedure for calculating property tax has changed. By 2020, the new procedure must be implemented throughout the Russian Federation.

When calculating the final amount payable, the following actions are performed:

- The cadastral value of the premises is calculated by dividing the total figure by the taxable area.

- A deduction is calculated if the citizen is entitled to one according to legal regulations.

- The amount of the deduction is subtracted from the amount of the first point.

- Contributions are calculated based on the inventory price of the property.

As a result, the amount of the fee is calculated based on three main indicators, which allows for the most accurate approach to the calculation of individual tax. The resulting amount is reduced by the size of the correction factor. Due to this, the property tax increase is carried out gradually. In 2020 it was 0.6, in 2018 it increased to 0.8, and from 2020 citizens will pay 100% of the accrued fees.

How is tax calculated?

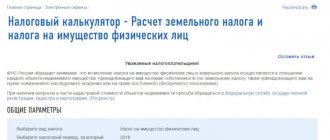

If everything is clear with payment, then the scheme by which the tax is calculated is not clear to everyone. In principle, there is no need to do the calculations yourself. The state does this, and the person only receives a notification of the amount. Therefore, just to check, you can try to do the calculations yourself.

The easiest way would be to use the official website of the Federal Tax Service. There is a special service that will calculate the approximate amount. You will need to indicate the cadastral number of the property or address, then write the area and cadastral value. Then you will need to write additional information - share size, holding period, tax deduction, availability of benefits, etc. Based on the information provided, the final result will be generated. But you should understand that the amount is only approximate. Therefore, you should not be surprised if the state calculates a slightly different tax amount. It is the received receipt that you should trust, and not the Internet resource.

Legal status of housing under mortgage

A mortgage is a special type of lending that is issued for the purchase of real estate. The amount of a mortgage loan differs in size from household loans, and is issued for a long period - from 10 to 30 years. Banks work only with those borrowers who have an official stable income that allows them to repay monthly loan installments. But it is impossible to predict the stability of income over a long period of time, so banks cover their risks in a different way.

When you take out a mortgage loan, the lender pays for the purchase and then takes the purchased property as collateral. As a result, the property is registered in the name of the buyer, but the third party to the transaction is the bank. Immediately after receiving ownership rights, an encumbrance is placed on the living space. A mark indicating its presence is affixed to Rosreestr, which does not allow the actual owner to dispose of his property at his own discretion.

Such premises cannot be sold or donated until the mortgage is fully repaid and the encumbrance is removed. Any actions in the form of redevelopment, leasing to other persons, registration of citizens who are not relatives can only be carried out with the consent of the banking institution.

Taxation on mortgages

Who has the right to a property tax deduction Citizens who have income taxed at a rate of 13% can receive a property tax deduction. First of all, these are those who are employed and have a “white” salary. If the salary is “gray”, then you can count on a deduction only from the official amount of income.

If a citizen works simultaneously in several jobs, then you can get a deduction from the income from all jobs. In addition to salary, there may be other income taxed at a rate of 13%. For example, income from leasing property, from the sale of securities or other property, etc. You can receive a property tax deduction for such income. If a citizen is an entrepreneur and uses a special tax regime (“simplified”, “imputed”, etc.), then he does not have the right to a property tax deduction on income received as a result of entrepreneurship.