Young people are increasingly turning to banks to obtain a mortgage loan. They, in turn, provide various options and types. Mortgage rates depend on the type of home purchased.

In order to ensure that future owners of real estate are satisfied with them, it is recommended that you become more familiar with the list of services offered. The benefit for the consumer depends on the amount of bank remuneration, overpayment, availability of the first payment and commissions.

To decide on the program, it is recommended to find out in detail the possible forms and rates. Only after this can you contact the branch and submit your application.

What is a mortgage loan rate

Mortgage is a widespread type of loan among the country's population for the purchase of real estate. Many financial institutions offer their services to provide funds for consumer purposes. Therefore, it is very important to know how to choose them correctly, taking into account the best offers.

So what is a mortgage rate?

This is a numerical indicator of accrued interest on the product received by the consumer. It is calculated as an annual calculation. At its core, this is the main factor that arouses particular interest among users.

Types of bets:

- With a permanent fixed percentage (the loan is repaid by contributions in equal parts). It is the most economical for the borrower, due to the fact that when interest and inflation rise, he pays at an already set rate.

- With a fixed percentage and increasing payments on payments (allowing you to repay the loan in a short period of time).

- With a variable type (depends on market tariffs, if necessary, adjusted to take into account changes. They are tied to a specific financial market index). This form is attractive because the initial value of the number of payments is significantly less than with a fixed nature.

- Combined (combination of fixed and variable). Initially, their size is fixed, and then changes to a floating form until the end of the contract.

When choosing a deposit rate, you need to carefully calculate the number of percentages. For a correct determination, it is important to take into account the presence of additional costs that arise during the registration of the pledge and its further maintenance.

Quite often there are offers that have low interest rates on collateral, but in practice it turns out that their actual number is several times inflated.

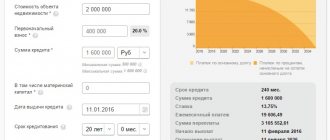

How to calculate your mortgage rate

It is calculated taking into account the initial payment. To make an accurate calculation for a loan product with capitalization, you need to use the formula:

Payment amount = Principal amount [% *(1+rate) ^ number of mandatory payments] / [(1+rate) ^ all payments -1].

Next, you need to determine the total capital that will need to be contributed. To do this, multiply their number by the amount.

To determine the total value of the interest rate that will be paid on the pledge, you need to calculate the difference between the amount of funds paid and the total amount.

To calculate the total number of loan payments, you should multiply its term by 12 (calendar months per year).

There is another popular method for recalculating the deposit fee. To do this, convert it to decimal fractions and divide it by 100.

For example, if it was 8%, then in decimal it will look like 0.08. Then you should divide it by 12, since mandatory fees are charged every month. Now you can find out the size of the loan interest rate.

You can calculate the loan fee based on the above formula. By solving the equation and entering all the necessary quantitative data, you can obtain an indicator of the total payment for the collateral.

What is a mortgage

A mortgage is a type of targeted loan that is issued exclusively for the purchase of real estate.

It combines several elements:

- Securing obligations, which is carried out by pledging real estate. As practice shows, most often the property that the borrower purchases.

- Determination of the loan issued for a strictly established purpose (purchase of real estate).

- Transfer of property to the borrower from the moment of its acquisition.

It is also worth considering that most loan programs of financial institutions require a down payment. It is at least 10% of the cost of the purchased object.

What factors does it depend on?

The amount of interest may vary from bank to bank. There are several criteria by which the amount of contributions, interest rate, etc. are calculated.

The payment of a secured loan directly depends on the following factors:

- the amount of a person’s earnings;

- credit term;

- the entire cost of the purchased housing;

- initial deposit made.

The size of each payment should not exceed the portion of the earnings of Russian citizens specified in the law. Often this is no more than 40–50% of the borrower’s income.

Many factors also depend on the product and loan object (type of apartment, house, availability of land, etc.).

The primary real estate market is more expensive than the secondary one. In order to obtain a specific numerical indicator for each type of collateral, it is necessary to take into account the conditions and the availability of a repayment scheme.

How to get a mortgage loan on your own?

Let's move on to the algorithm that will help you take out a loan for housing. Let's look at how a mortgage is obtained in two ways: independently and with the help of credit brokers.

Let's start with a situation where the borrower wants to save money on assistants and get a loan on his own. To do this, he will have to go through 6 stages.

#1. Choosing housing

Banks issue mortgage loans for the following types of real estate:

- apartments in new buildings

- apartments on the secondary market

- dachas, cottages

- private houses.

You can also get a loan for housing that is purchased under an equity participation agreement. But not all banks provide such loans.

The borrower must focus not only on desires, but also on possibilities. The bank will not give a loan if you have to pay more than 50% of your official monthly income for housing. But in order to create a safety margin, we advise you to focus on housing for which you will have to pay no more than 40% of your monthly income.

#2. Bank selection

There is no shortage of offers in the mortgage lending market. When choosing a financial institution and a specific loan, pay attention to:

- down payment amount

- credit limit

- insurance

- credit institution reputation

- reviews

- early repayment conditions

- maximum permissible delays

- number of documents to be processed.

If not all of your income is official, contact banks that offer mortgages based on two documents. In such companies, interest rates are 2-3% higher than the market average. But they give money without proof of income.

#3. Collecting papers, submitting an application

Let's look at what documents are needed for a mortgage.

Banks will ask you to present the following documents:

- loan application

- Borrower’s passport (if there are guarantors and co-borrowers, copies of their passports)

- certificate of income for the last 6 months (form 2-NDFL or bank)

- a copy of the work book certified by the employer

- business registration documents (if the borrower owns a business)

- documents for an apartment or house that you plan to purchase with a mortgage.

If you plan to get a mortgage and use maternity capital (or get an apartment through military lending), you will need papers confirming the benefits.

For holders of maternity capital:

- certificate (or certificates, if there are several)

- consent from the Pension Fund to use funds

- consent from the seller of an apartment or house to sell real estate using maternity capital.

For the military:

- permission from Rosvoenipoteka.

#4. Registration of the contract

Mortgage agreements are drawn up by banks, and clients only sign them. But this does not prevent you from studying the text of the contract from the first to the last page.

We recommend that you pay attention to the “fine print”, as well as the contents of the last pages of the document. Most often, it is there that unfavorable conditions for the borrower are spelled out.

In the agreement, carefully study the following loan parameters:

- maturity

- monthly payment

- effective interest rate

- early repayment conditions

- commissions (for opening an account, conducting transactions, etc.)

- fines for late payments.

If you are not satisfied with at least one condition, you can tell the credit manager about it. If the bank does not want to change the agreement, it is better to find another credit institution.

It is not necessary to sign the loan agreement on the same day you receive it for study. You can take a copy home and re-read it in a calm environment with a qualified lawyer.

If the conditions suit you, start looking for an apartment.

#5. Buying an apartment, signing a loan agreement

Find an apartment or house that suits both you and the bank. Typically, lending institutions take 1-2 months to select a property. If during this period the borrower does not decide on an apartment or house, the bank may cancel the decision to approve the loan.

As soon as the object is selected, you can sign an agreement on the purchase/sale of an apartment (house) and a mortgage agreement with the bank. The real estate is immediately pledged to a credit institution, for which a special document is drawn up - a mortgage.

#6. Transaction insurance

Russian legislation obliges borrowers who take out a mortgage to insure the transaction.

The requirements of the Law “On Mortgages (Pledge of Real Estate)” apply only to apartment insurance. But banks offer clients to take out insurance policies for life, solvency, health, and the risk of loan non-repayment. The cost of such insurance can reach up to 10−15% of the loan amount. Banks do not have the right to impose them and refuse to issue a loan if the client did not want to pay for the policy.

#7 Paperwork

The last thing left to do is to register the transaction with Rosreestr. To do this, bring and submit all documents to the Rosreestr office or online - mortgage agreement, purchase/sale agreement of an apartment or house, mortgage, insurance policy. In 2-3 days, information about the transaction will appear in Rosreestr, and you will become the owner of a new apartment.

Mortgage interest rates in Russian banks

The quantitative indicator of the mortgage rate is a decisive factor. Due to the fact that the economic condition of the country is not stable, construction and banking structures are in a state of crisis.

Currently, the tariff for this type of loan in various Russian financial institutions. institutions are practically no different. They are set at 11–15%. The spread in the region of 1 – 3% is not very significant.

The country's government actively cooperates with financial institutions, allowing some of them to provide borrowers with mortgage loan conditions at low rates.

Today, lending to citizens with government support is active. It is designed for people with an average level of cash income and provides for a constant interest cost throughout the entire period.

The number of financial institutions with government support is limited. If subsidies are received, they can be reduced to 8% and not exceed the level of 13%.

A loan for secondary real estate has a higher interest rate. The average value is around 3%.

comparison table

When comparing the percentage of banks that receive support from the state for issuing mortgages and those that do not participate, you can notice a noticeable difference.

The former can provide customers with more acceptable offers, unlike the latter.

| Receiving government subsidies | % | No subsidy | % |

| Sberbank of Russia | 11,4 | LOCKO-Bank | 15 |

| Opening | 12 | Soviet | 16 |

| Bank of Moscow | 13,35 | Rosgosstrakh | 16,5 |

| Gazprombank | 12,5 | MTS | 17 |

| Rosselkhozbank | 13,5 | Raiffeisen Bank Aval | 15,25 |

The numerical values for each of them clearly prove the benefits of obtaining a loan from government-supported institutions.

Where to get a mortgage at a low interest rate

In fact, you shouldn't go for a low-interest loan in the first place. For example, you want to improve your living conditions or buy an apartment. First, check your wallet, is there at least thirty percent of the amount for which you want to purchase an apartment? It is extremely important that the down payment is at least equal to this thirty percent in order to expand the boundaries of choice. The whole “trick” is that the larger your down payment, the less you will have to overpay in the future. And only after you have a sufficient amount of funds should you think about a mortgage and look for the lowest possible interest rate. To do this, you can even involve co-borrowers; carrying such a burden together is much easier than on your own.

Today, a huge number of institutions operate in the field of loans. There are both government and commercial organizations. It is extremely important that you explore all the different options available on the market before signing a contract with one of them. A great responsibility rests on your shoulders, and therefore you need to approach the matter wisely and in sober health. Compare offers, analyze and calculate. And also do not forget about your financial capabilities. You should not expect that tomorrow, out of the blue, your situation will improve and you will repay the loan. The financial situation at the moment is important, because your hopes may not come true, but the loan debt needs to be repaid.

And now I would like to open your eyes - the lowest percentage is not always the lowest percentage. Often these are really advertising ploys of companies, and borrowers are left in the “fool” and overpay. No wonder they came up with the proverb “The miser pays twice.” And it fits this question perfectly.

The most favorable mortgage conditions

2018 is characterized by an attractive fall in loan rates. It is becoming more accessible to citizens of the Russian Federation.

Gazprombank offers “Apartments on the secondary market” for a total period of up to 30 years. The course starts at 10%. You can get 500 thousand - 45 million rubles. Mandatory first payment is around 10%.

Conditions:

- at least 20 years;

- 2-NDFL;

- pledge of purchased housing or without it and guarantors.

Sberbank of Russia provides the Young Families package. Validity period 1–30 years. Rate - from 10%. The size is unlimited in amounts. The initial fee is at least 20% of the entire price.

Requirements:

- at least 21 years of age;

- Form 2-NDFL (in some cases not required).

"RosselkhozBank" provides a "Housing" loan. Duration - no more than 30 years. Tariff of 10.25%. Monetary result: 100 thousand – 20 million. The initial contribution must be at least 15%.

Criteria:

- from 21 years old;

- stability of earnings;

- with or without bail.

"Vozrozhdenie" issues a loan "Apartment-New Building" for up to 30 years at 10.9%. Loan – 300 thousand – 30 million rubles. Contribution of at least 15%.

Requirements:

- at least 18 years old;

- 2-NDLF, 3-NDLF, form confirming income;

- Possibly secured by property.

"VTB24" offers "Purchase of housing on the primary market." The tariff is 12.6%, with a total duration of up to 30 years. The initial contribution must be at least 15%. The loan is issued in the range of 600 thousand - 60 million.

Conditions:

- from 21 years old;

- minimum work experience of 1 year;

- official employment;

- life insurance of the borrower (if the user refuses to contact the insurance company, another 1% is added).

"Absolute" issues "Profitable Mortgage". Tariff - from 10% per annum. Loan size – 300 thousand – 20 million rubles for no more than 30 years. The minimum payment is at least 15% of the total value of the property.

Requirements:

- age 21;

- documentary evidence of solvency;

- It is possible both with a guarantee and without it.

Tinkoff is lending under the Secondary Market project. Loan number from 500 thousand rubles. Contribution from 30%. Annual interest – from 10%. The duration of the mortgage is 25 years.

Criteria:

- at least 21 years of age;

- confirmation of constant profit.

You can find out detailed information on collateral products from representatives of the financial institution.

Changes in conditions in some banks

Often, credit institutions make changes to loan rates. Thus, if a borrower refuses life and health insurance at Sberbank, the amount of overpayments increases by 1%. For those who do not receive salaries through this credit institution, interest will increase by another 0.3. Electronic registration will make it possible to reduce the overpayment by 0.1.

TKB provides its clients with a Favorable tariff. This service involves a one-time payment for reducing the loan rate.

Uralsib invites the applicant to determine his status by choosing from several categories: public sector employee, client of this organization, new client, employee of Rosneft Oil Company. This determines what conditions the borrower can expect.

Is it possible to reduce interest on mortgage loans?

The fixed fee for using bank funds is often overpriced.

In order to save money on payments, you can reduce the mortgage rate . Experienced specialists will help you reveal the details of such opportunities.

There are several most popular methods that allow this operation to be performed without damage.

How to reduce it

To ensure you get the most favorable mortgage terms, you need to prepare in advance. It is necessary to carefully approach the choice of loan structure and its product.

- Get a “clean” credit history. It is best to do this at the selected branch. To do this, you can take out a loan for a small amount (get a credit card) and pay off the debt.

- Find a guarantor with good solvency (maybe a relative).

- Provide collateral.

- Become a participant in state support for obtaining a housing loan.

In the case of a valid agreement to borrow funds from a financial structure, you can reduce it in the following ways:

Refinancing

This is taking a loan on an existing one. Such an operation can be carried out in “your” bank or transferred to another. At the same time, it is worth carefully calculating the feasibility of the benefits from such actions.

It is important to consider that the bank from which the mortgage was obtained may not satisfy the borrower’s request for refinancing. Then you will have to turn to someone else for help. After receiving the money, the borrower will be able to pay the primary debt.

Restructuring

The payer can independently increase or decrease the numerical indicator of monthly payments. This method will help you win on overpayment.

To do this, you need to write and submit an application for a reduction in the mortgage interest rate.

Additionally, you must provide documents confirming the increase in the borrower's income. It is recommended to act in a similar way when repaying a loan early.

Judicial proceedings

Such an action will be relevant if loopholes were found in the signed agreement in which the organization violates the terms of the loan.

Before going to court, the borrower needs to study the documents in detail. Otherwise, he will incur legal costs.

State support

You can join any of the social programs that provide subsidies or refund of part of the amount.

Revaluation of property

This can be done if you purchased housing in a new building during its construction. Banks often issue money for such real estate at a high rate for the use of loan funds.

After putting the house into operation and registering ownership, the property can be revalued and insured. A package of these documents should be submitted to the department. By decision of authorized persons, its size may be reduced to 3%.

What should be done

You can reduce the interest rate by submitting an application to a bank branch.

The following options exist:

- change in currency unit (transfer of a loan from rubles to euros or dollars, and vice versa);

- reduction in monthly payment (at the same time, the mortgage term may increase);

- revision of the term (you can pay off the debt faster than specified in the contract).

If you do one or more of the above, you will ensure that you pay off your mortgage faster. It is also necessary to think through everything so as not to pay to your detriment (for example, the currency may rise sharply).

Analysis of offers with a minimum bid

Most of the list allows you to receive a minimum overpayment only if a certain condition is met. The most popular is the commission paid upon concluding the contract. Thus, a discount of 1.5% per annum, which allows you to reach the rate of the leader of the TOP-10 TKB Bank of 4.84%, is provided upon payment of 4.99% of the loan amount at the registration stage.

An identical principle is applied by other market players from the top three. Rosbank reduces the rate to 5% per annum if you pay 4% of the borrowed amount. In this case, the discount will be 1.5% per annum. Bank DOM.RF makes it possible to reduce the commission for using borrowed funds by 1%. After which the most favorable rate of 5.1% per annum is achieved.

Bank Vozrozhdenie is more loyal to its cardholders. If the mortgage borrower makes payments in the amount of 75,000 rubles per month using the UNPROSTOCARD product, then the rate is reduced by 0.5%. Thus, reaching its minimum value - 5.5% per annum. In the case of a lower turnover of funds on plastic, for example, 50-75 thousand rubles, the discount is 0.4%. When spending 10-50 thousand - 0.3%.

Banks occupying the tenth line use different principles for lowering rates. In particular, Alfa-Bank offers the most favorable conditions for contracts with a large amount. That is, with a loan volume of more than 6 million rubles in Moscow and the region, 5 million in St. Petersburg and Leningrad Region, 2.5 million rubles in other regions.

In turn, UBRD reduces the percentage to a minimum if you do not use the minimum down payment, but pay at least 50% of the price of the apartment from your own savings. Asia-Pacific Bank supports payroll clients, public sector employees and key partners. It is for them that mortgage agreements with state support offer the lowest rate of 5.99% per annum.

Low mortgage interest rates for preferential categories

The social type of mortgage is designed for those citizens who have official confirmation of their need to improve their living conditions.

In other words, these are the people who stand in line for government registration. For them, the loan is issued at less than 10% per annum. The amount of the first payment is 10%.

Before contacting a bank to conclude a mortgage agreement, you need to check whether the borrower falls into the preferential category of the Russian population. Especially for them, there are regional and federal programs aimed at improving their living conditions.

The Russian state protects certain categories of the population and provides them with loans under special programs. Depending on their classification, they are financed by the federal or regional budget. Assistance is provided in the form of payment of the initial loan amount or a reduction in the tariff.

Special conditions are provided for the following categories of borrowers:

- military personnel;

- young families;

- large families;

- young specialists;

- police officers;

- Russian Railways employees;

- victims of the Chernobyl accident;

- victims of natural disasters;

- tax service employees;

- Ministry of Emergency Situations;

- young teachers and scientists.

Additionally, families where the second and next child was born receive state preferences. It is issued in the form of a Maternity Capital certificate, which can be used to pay the mortgage payment. For registration, you will need to provide a package of documents, including certificates from the Pension Fund, to the Pension Fund office.

In 2020, the mortgage interest rate is planned to be no more than 6% per annum, which will be available to families with two or more minor children.

It will only apply when purchasing housing in new buildings with a mortgage. The program will not be valid for the secondary market. The main direction is to improve the birth rate of children among citizens of the Russian Federation.

Currently, the list of participating banks is still being determined by the authorized bodies.

Offers from financial institutions

All lenders try to provide loan conditions that would suit each borrower, but at the same time minimize the risks associated with possible non-payment of the debt obligation.

Let's compare different offers from popular financial institutions to determine the lowest loan rate under certain conditions.

For purchase in new buildings

Purchasing housing at the construction stage or in finished new buildings is very popular. The developer is previously required to obtain accreditation from the bank for all of its properties.

Sberbank is ready to issue a loan for objects of this type from 7.5%, subject to an initial payment of 15%.

Alfa-Bank provides mortgages for new apartments from 8.99%, taking into account the fact that the borrower is its salary client.

Tinkoff offers an overpayment of 6% per annum with an initial payment of 15%.

Secondary housing

Secondary housing is more reliable for a financial institution compared to newly built housing, which is why some banks reduce interest rates for this type of real estate.

| Banks | Interest |

| "Sberbank" | 9,7 % |

| "VTB" | 8,9 % |

| "UniCredit" | 9,5 % |

| "ICB" | 9 % |

House or cottage

Mortgage lending implies the possibility of purchasing a house or cottage. The borrower has the right to either purchase a plot of land and subsequently build housing on it, or buy a ready-made one.

| Banks | Bid |

| "Sberbank" | 10,1 % |

| "VTB" | 11,9 % |

| "DeltaCredit" | 11,25 % |

| "Tinkoff" | 9,5 % |

Certain categories of borrowers

Many categories of citizens are provided with preferential conditions for obtaining a housing loan.

Citizens entitled to benefits:

- young families (spouses' age does not exceed 35 years),

- teachers and scientists,

- large families,

- military personnel,

- those who received maternity capital (repayment of part of the mortgage loan with maternity capital funds).

For example, the interest rate at Rosselkhozbank for young families ranges from 10 to 15%.

Alfa-Bank provides interest reduction to military personnel on loyal terms from 8.99%.

Mortgage in 2020 through the eyes of a borrower

The crisis is sweeping the world, but you still need to live somewhere. Of course, we should have bought a home a little earlier, when lending conditions were better. But, on the other hand, the housing market is now in deep stagnation. And right now you can beat the price: discounts and promotions from developers are just beginning. The current ones will soon be replaced by summer ones, which are more substantial (in the summer no one buys apartments, but they need to sell and continue construction).

If there is not enough money to purchase an apartment in cash or in installments, you will have to take out a mortgage. We have already written about it, but new times mean new rules. Now let’s look at the main points that are worth paying attention to (and if we miss something, we’ll wait for comments and correct them).

What kind of mortgage is there?

At the moment, there are several main types of mortgage lending: standard, with government support, the Russian Family program and a special offer from banks for military personnel.

Standard mortgage

A conventional mortgage is an extremely complex loan. In the past, to obtain mortgage funds, it was necessary to make 13% of the cost of the purchased apartment as a down payment. Now - no less than 15% for primary housing and 20% for secondary housing. The actual conditions of Sberbank are as follows:

| An initial fee | Credit term | ||

| up to 10 years | from 10 to 20 years | from 20 to 30 years | |

| from 20 to 30% | 13,5% | 13,75% | 14% |

| from 30 to 50% | 13,25% | 13,5% | 13,75% |

| from 50% | 13% | 13,25% | 13,5% |

» In this case, rates are valid if:

- the property being financed was built with the participation of bank loan funds, otherwise a surcharge of 0.5 percentage points is applied;

- the borrower insures his life and health, otherwise a premium of one percentage point is applied;

- An additional one percentage point is applied until the mortgage is registered.

Many banks have tightened their requirements for borrowers. If you play with Sberbank’s loan calculator, you can find out that for initial loan approval, a young family of two will need at least 40–50 thousand of the personal income of each spouse. Moreover, it is a confirmed income, so those receiving wages in “black cash” may find themselves in an unpleasant situation.

The average interest rate at the moment (real, not advertised) is about 15–16% per annum. Why? Even the base rate for secondary housing starts at 12.5%. The average rate for new buildings is 13%. Tariffs for country real estate and the construction of a private house are even higher.

Military mortgage

For the military, a military mortgage used to be a fairly acceptable option. Back in 2020, the interest rate on this type of mortgage was 8% per annum. Today it’s already 12.5% and higher.

Mortgage with state support

The best option at the moment is a mortgage with government support. It is a loan for the purchase of housing under construction or housing in a finished new building. Due to state subsidies, the bank provides a rate reduced to 12% (this is the minimum threshold, which in reality will be higher - about 13–13.5%).

However, this program does not apply to all housing. Basically, the one that is being built or was built with the participation of bank funds. In this case, the developer must be on a certain trusted list.

There is also a limit on the maximum loan amount:

- 8 million rubles - for Moscow, Moscow region and St. Petersburg;

- 3 million rubles for the rest of Russia.

The minimum down payment for a mortgage with state support is 20% of the cost of the purchased home.

In this case, the loan interest rate is fixed - 12% per annum in large banks. However, this type of mortgage includes mandatory life insurance for the main borrower. Moreover, the amount of the annual fee is calculated from the residual value of the loan and is 1% of the amount remaining at the time of payment that the borrower owes (interest is not taken into account). If you refuse insurance, the bank offers to increase the rate to the standard one, and this point is specified in the mortgage agreement. Accordingly, you won’t be able to pay in the first year and cancel later - the entire mortgage will be recalculated from the moment you cancel the insurance. You also need to remember that all mortgaged apartments must be insured, and this is still about 0.4% of the unpaid amount.

It is worth paying attention to the offer of Tinkoff Bank: at the time of writing, the interest rate on mortgages with state support here started at 11.9% per annum.

Russian Family Program

In official documents it is called “Providing housing for young families”. This program was supposed to expire in 2020, but in 2014 the program “Providing affordable and comfortable housing and utility services to citizens of the Russian Federation” was adopted, due to which it was actually extended until 2020.

The program covers the entire territory of Russia and is aimed at providing assistance to young families who need improved living conditions. However, all regulatory regulations are issued by the regions themselves. In order to participate in the program, a young family must meet the following conditions:

- at least one of the family members should not be older than 35 years (a family of one person can also become a participant);

- those wishing to do so must have Russian citizenship;

- the family must live in conditions unsuitable for living (cases where the area of the premises per person is less than established in the region; living in communal apartments).

According to the terms of the program, a young family is given a state subsidy, which should be used for the purchase of housing or shared construction. For a family without children, this subsidy is issued in the amount of 35% of the assessed value of housing, and for married couples with children, including single-parent families consisting of one parent and one child, in the amount of 40%. Large families are provided with additional benefits, while they are provided with full financial support.

In some regions, instead, target prices per square meter of housing and reduced interest rates apply, and the offered apartments are sold furnished.

Developer loyalty programs

In the current situation, many developers have stepped up and entered into partnership agreements with large enterprises. Their essence is as follows: the company gives a certain subsidy to the employee in exchange for an obligation to continue working, and the developer, in turn, offers a discount on housing. In some cases, the agreement is tripartite. The third place is the bank, which offers a reduced rate.

By the way, I took advantage of this offer when purchasing an apartment. The developer's discount was 8% of the total cost of housing, and the Sberbank interest rate was fixed - 11.4% per annum without changing the conditions.

What you should pay attention to

- It is better to take out a mortgage from the bank that issued the salary card. This will minimize the risk of refusal to issue a mortgage, including in the absence of income confirmed by certificates. But it’s worth paying attention: banks consider salary transfers to be salaries. Also, such a step will reduce additional surcharges on the interest rate.

- Many regions offer additional programs for purchasing housing. So, in my native Ulyanovsk there is a “Governor's Mortgage”: for borrowers participating in the program, the municipality pays the interest on the loan for the first three years.

- Similar programs may apply to some occupations (for example, doctors) or enterprises.

- Banks are much easier to approve loans for the purchase of new buildings. It is worth paying attention to the connection between the developer and the bank and going for initial approval with the already chosen apartment. This will reduce the likelihood of refusal without explanation and increase the chances of getting a mortgage.

- Shares in an apartment must be registered in accordance with current income: the higher the taxable income, the higher the share should be. Thus, thanks to the tax deduction, it will be possible to return part of your funds much faster. Let us remind you that this is not only the cost of the apartment itself (more precisely, the part of it taken on credit), but also part of the interest paid under the agreement. This will allow you to repay part of the loan a little earlier.

- Any payment above the monthly installment must be made through a bank employee. Check whether a larger amount has been debited from your account. The extra 500–1,000 rubles play a role, no matter how funny it may seem, because any overpayment goes not to pay off interest, but to pay off the principal debt.

Should I take it or not?

Despite a lot of difficulties, nerves and significant overpayments, a mortgage is the only real chance for many residents of our country to acquire housing. Real estate is rising in price much faster than the welfare of society is growing. And the average monthly payment for a mortgage apartment is comparable to rent.

In order to make a precise decision, you need to go through a serious path. You will have to consult with a lot of different specialists. Try to find out information about all the current offers in your region before going to the developer. Calculate the maximum number of repayment options and choose the one that is guaranteed to allow you to pay off your mortgage in the event of force majeure. It is better to pay more and so get back to quick repayment, than to find yourself unable to pay the monthly rate in a difficult moment.

You can find out about current government programs at your municipality. Bank offers are always available on their websites, but it’s worth going in person. The same applies to developers: sometimes the last unsold apartments in a building right before its delivery are much cheaper than at the foundation pit stage.

And, of course, remember that if you have problems, you can and should complain. For builders, the threat is to contact various government agencies. And if problems arise in the bank, you can contact the Central Bank employees.