Home » Banks » How to get a mortgage from Sberbank

July 24, 2020 No comments

At Sberbank, Russian citizens can obtain a mortgage loan to purchase real estate.

When issuing a mortgage, the bank takes into account many factors - the financial situation of the potential borrower, the presence of official employment, age, etc. The bank applies an individual approach to each citizen, thanks to which it is the most popular bank for mortgage lending in our country.

In the article, we will consider the questions of how to get a mortgage from Sberbank, what requirements are imposed on the borrower, what documents are needed, and also on what grounds they may refuse to issue a loan.

Which branch should I apply to?

You must apply for a mortgage at the following Sberbank branches:

- in a branch located at the place of registration of the future borrower;

- at the branch at the location of the property for which the mortgage loan is taken;

- at the registration address of the organization in which the applicant works.

The borrower, before applying for a mortgage loan, should be absolutely sure that he will be able to make timely payments to the bank, as well as be confident in the stability and reliability of his employer. You need to be able to predict your expenses in order to avoid problems when repaying your mortgage.

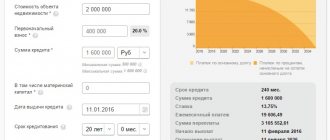

If you are in doubt about whether you will have difficulties repaying your mortgage loan, it is recommended that you pre-calculate your monthly payment amount using the mortgage calculator on our website. The mortgage payment amount can be calculated using both the annuity and differentiated options.

Step-by-step instructions for obtaining a mortgage

To obtain a mortgage loan from Sberbank, you must complete several mandatory steps. Let's look at the procedure for getting a mortgage step by step.

| Stage 1. Choosing the right mortgage program | The bank has a large number of different programs for future borrowers, varying depending on the subject and terms of the agreement. In particular, you can get a loan for a residential building, an apartment (in a new building or a finished one), a plot of land, a garage or a parking space. |

| Stage 2. Choosing a type of mortgage loan | In addition to choosing the appropriate program, for example, for purchasing a private home, the borrower can also select a specific type of mortgage lending. For example, if a citizen wants to get a mortgage at a preferential rate for the purchase of an apartment in a new building, then he can use the State Support 2020 loan. There are also special programs for mortgages for new buildings, state support for mortgages for large families, military mortgages and others. |

| Stage 3. Preparation of documents | An employee of the bank's mortgage department must provide a list of documents required to obtain a mortgage loan. As a rule, you will need the following documents:

|

| Stage 4. Filing an application | The application can be submitted via the Internet or at any Sberbank branch in person. |

| Stage 5. Valuation of real estate | If the application is approved, you will need to order a real estate appraisal report for a mortgage from an appraisal company. You must contact the bank with the prepared report, after which the amount of the mortgage loan issued is determined, which will be paid to the seller as the cost of the purchased apartment (or other property). |

| Stage 6. Drawing up a mortgage loan agreement | After signing the purchase and sale agreement for the apartment and transferring funds to the seller, the borrower will be able to register ownership rights in the Unified State Register of Real Estate, issue an insurance policy for the property and enter into an agreement with the bank. |

After checking the documents provided by the borrower, a specialist in the mortgage department of Sberbank will set a day on which the borrower needs to conclude an agreement with the seller of the apartment, draw up an insurance contract for the property being purchased or for the collateral.

When Sberbank transfers mortgage money to a real estate seller

In order not to miss the opportunity to earn extra money from the borrower, many banks offer legal services. This is convenient if you don’t have a lawyer in mind that you trust and you don’t know who to contact. Moreover, the purchased apartment will be used as collateral to the bank, so its employees are guaranteed to ensure that everything is properly completed.

When buying real estate on your own, you will only be able to study the loan agreement upon signing, which means you may miss something due to excitement and lack of time for thoughtful reading. Mortgage brokers have more opportunities - they collect samples of bank agreements, carefully study them before signing, in a calm atmosphere, and can warn you about the nuances even before submitting an application to the bank.

Yes, of course, it is possible, and there is nothing difficult here. In this case, you have a choice:

- Selling an apartment for cash and repaying the loan;

- Re-registration of a mortgage to another person (replacement of the Mortgagor). In other words, the Buyer of your apartment takes out a mortgage for the amount for which you sell it to him, as soon as you re-register ownership of it, the Bank pays off your mortgage, and the excess funds, if any, from the amount of your sale are returned to you.

That's all the main aspects of a mortgage at Sberbank for finished housing and new buildings. In fact, applying for a mortgage at Sberbank is a little more profitable, a little simpler and a little faster than in other Banks. So, weigh all the pros and cons, decide and become the owners of your brand new apartment, in which you will live more than one happy moment.

And we are waiting for your questions in the comments, which we will be happy to answer.

Mortgage for construction

There are three options:

- transfer of funds to the seller’s bank account;

- transfer of cash against receipt;

- opening a safe deposit box.

The amount of the down payment is agreed upon at the stage of signing the purchase and sale agreement, and is paid before registering the mortgage transaction.

Requirements for obtaining

To be approved, a future borrower must meet certain requirements. The conditions for obtaining a loan from Sberbank are as follows:

- Availability of Russian citizenship;

- Age at the time of receiving the loan is more than 21 years old, and at the time of repayment of the loan - no more than 75 years;

- Work experience at the last place of employment for more than six months and at least 1 year of total work experience over the last five years;

- The borrower's spouse will act as an obligatory co-borrower, regardless of his age and solvency.

No more than three citizens can be co-borrowers under a mortgage lending agreement, the amount of their income is taken into account when calculating the maximum mortgage.

Up to what age can you get it?

The age of the borrower is related to the selected program and the term of the mortgage. If applying under the regular program, a Sberbank employee must make sure that at the time of full repayment of the loan, the borrower should not be older than 75 years of age.

For example, if an application is submitted by a citizen aged 63, he will be able to take out a mortgage from a bank for a maximum of only 12 years, until he turns 75.

When providing a mortgage loan using 2 documents (without a work book and a 2-NDFL certificate), the borrower is obliged to fully repay the debt to the bank before the age of 60.

Under the military mortgage program, the age limit of a military personnel cannot exceed 45 years.

If you already have a mortgage with Sberbank

It is possible to take out another mortgage without paying off the first one in full, but it may come with some complications. Sberbank does not provide this opportunity to all citizens.

It is possible to take out a mortgage loan from a bank if you already have one mortgage, but the borrower must meet certain requirements:

- First of all, you will need to confirm your solvency. An individual's monthly income must be sufficient to repay both the old and new mortgages. Sberbank employees will be able to approve a client’s loan application only if the borrower’s regular payment on the loan is no more than 20% of his confirmed salary;

- The client applying for a second mortgage must not be in arrears on the old loan, i.e. he must have a good credit history.

- It will not be possible to get a new mortgage loan without “closing” at least 65% of the previous one. The probability of issuing a mortgage to a bank client increases, the less debt there is on the first mortgage;

- Insurance and a deposit of the property are mandatory. If the value of the collateral property is less than the amount of debt accumulated on the previous loan, then Sberbank will not approve the application for a new mortgage loan.

If you have a bad credit history

Many citizens wonder whether it is possible to get a mortgage if the borrower has a bad credit history.

If the borrower previously received a loan from a bank and at the same time violated his obligations under the loan agreement (paid irregularly, made late payments), and has a damaged credit history, then this may serve as an obstacle to obtaining a mortgage from Sberbank.

A borrower with a bad credit history can apply, but the bank may compromise and only approve it in certain cases, for example:

- if the borrower receives a salary on a Sberbank plastic card. This will make it easier for the bank to collect the required monthly mortgage payment. The bank will simply be able to automatically write off funds on a certain day of the month;

- if the borrower takes out a mortgage loan with a down payment of at least 50 percent of the cost of the purchased property;

- in the case of a small mortgage loan. If, for example, you buy an inexpensive apartment in a Khrushchev building, the bank can issue a mortgage. And if a citizen wants to purchase a large residential building, then Sberbank will most likely reject the application.

Therefore, you need to understand what you can count on when applying to a bank if you have a bad credit history. Perhaps after refusal, you will have to apply to another bank.

I am an elderly person, will they give me a mortgage?

Previously, such a commission, like the commission for issuing a loan, was quite common, and banks also charged it for reconsidering an application. Currently, Russian banks have such an additional there is no service.

Bank employees can also provoke an increase in this amount. You should find out in advance what the minimum down payment amount is currently provided. For 2020, Sberbank announced a reduction in the down payment to 15%.

Their list and size depend on the specific bank. There are both one-time expenses and those that must be paid throughout the entire loan term. They may be related to mandatory requirements of creditors and those that banks establish at their own discretion. As a result, the additional amount costs for the borrower can be up to 10% of the loan amount.

A citizen who has taken out a housing loan must be prepared for the following financial costs:

- Valuation of collateral property. The cost of mortgage housing is determined by an employee of an appraisal company accredited by Sberbank. The amount of a housing loan directly depends on the estimated value of the collateral living space;

- Property inspection. If a counterparty purchases housing in a residential complex under construction, the property must be inspected by bank experts. The bank charges a fee for this service. Financiers' remuneration depends on the size of the mortgage loan;

- Payment of the state fee for registration of rights to real estate. The amount of the fee is established by the current legislation of the Russian Federation. You can entrust the preparation of transaction documentation to a law firm. In this case, the borrower needs to be prepared for unexpected material expenses;

- Life insurance of the borrower and the collateral. Insurance premiums are transferred throughout the entire term of the loan agreement. As the debt decreases, the insurance premium decreases. The credit committee may require you to insure your ability to work, as well as the risk of loss of ownership of the collateral. The amount of the insurance premium depends on the credit program and tariffs of the insurer (the client can enter into an agreement only with organizations accredited by Sberbank);

- Services of real estate agencies and mortgage brokers. The cost of specialists’ work depends on the complexity of the transaction and is determined by the terms of the contract. The client can save a significant amount if the selection and purchase of an apartment takes place without the participation of realtors;

- Notarization of powers of attorney, copies and various certificates. The services of a notary will also be required when certifying the consent of the co-borrower to conclude a mortgage agreement;

- A one-time fee that allows you to reduce interest costs. The client can reduce the mortgage rate by depositing funds amounting to a certain percentage of the loan amount.

- Payment for the rental of a safe deposit box. This service is relevant for those who use a letter of credit form of payment to purchase a property;

- Changes to the terms of the loan agreement are carried out on a reimbursable basis. The commission fee goes to pay for the work of lawyers who draw up the necessary agreements;

- Paid issuance of certificates and permits. The bank issues some documents on a fee basis. These include permission to register family members in a mortgaged apartment and consent to a major redevelopment of the interior of the premises.

Yes, the purchased property is pledged to the Bank until the loan is fully repaid (if the terms of the loan provide for the registration of the loaned property as collateral).

In some cases, insurance companies are beginning to offer borrowers additional programs - insurance of movable property and decoration. But even if you are interested in this offer, you should not agree to include these products in mortgage insurance: in this case, the bank will become the beneficiary, that is, the person who will receive compensation from the insurance company.

Quite often, potential borrowers who want to apply for a loan are guided by the maximum amount that the bank is ready to give them. The size of the loan depends on many nuances, the availability and frequency of salaries, guarantors, and the applicant’s credit history.

The optimal option is when the borrower approaches the bank, having in hand a third of the amount needed for the apartment. However, you can take out a mortgage with a smaller financial reserve - in this case, you will need a bank with a smaller down payment amount.

Required set of documents

To draw up a mortgage agreement, the client must submit the necessary documents to Sberbank. As a rule, the standard list consists of the following papers:

- the application itself, filled out on the bank’s letterhead (can also be filled out online on the website);

- passport of a citizen of the Russian Federation and copies of passports of co-borrowers;

- 2-NDFL certificate or other document in the bank form confirming income;

- a copy of the work record book or a certificate from the employer containing information about the position and length of service;

- TIN;

- SNILS;

- Extract from the Unified State Register of Real Estate for collateral (if necessary);

In addition to these documents, Sberbank employees may additionally request other documents depending on the mortgage program:

- certificate of participation in the NIS (savings-based mortgage system) for providing housing to military personnel - to obtain a Military mortgage;

- birth certificate of children and marriage - to obtain a Mortgage with state support for families with children.

- a certificate for maternity (family) capital, a certificate from the Pension Fund of the Russian Federation about the balance of funds in the account - to obtain a loan under the “mortgage plus mat. capital".

Lending terms

Sberbank offers several targeted mortgage programs for secondary housing, aimed at different groups of borrowers - young families, military personnel, families with two or more children, as well as participants in federal programs to improve the housing situation of the population.

| Interest rate | Term | Amount, rubles | An initial fee | ||

| No promotion | As part of the "Showcase" campaign | up to 30 years old | from 300,000 | From 15% | |

| Basic | 11% | 10,7% | |||

| Promotion for young families | 10,5% | 10,2% | |||

| For participants in housing development programs | 10,6% | — | |||

| According to two documents | |||||

| Basic | 11,3% | 11,6% | up to 30 years old | From 300,000 | from 50% |

| Promotion for young families | 10,8% | 11,1% | |||

| Military mortgage | 9,5% | up to 20 years | Up to 2.5 million | From 15% | |

The interest rate may change upward depending on several factors:

| Refusal to take out life insurance | +1% |

| Cancellation of the electronic registration service | + 0, 1% |

| If you don’t have a Sberbank salary card | + 0,3% |

| Down payment more than 15% but less than 20% | +0,2% |

The “Showcase” promotion is a discount on the rate when applying for a mortgage through the DomClick service.

Sberbank puts forward certain requirements for real estate - this is the location of housing on the territory of the Russian Federation, the absence of collateral, arrest, and other risks of loss of property. And also the house should not have the status of dilapidated or unsafe (except for renovation programs in Moscow), and the apartment should not have illegal redevelopment.

Can a client take a deferment on mortgage payments?

A deferment on a mortgage taken out from Sberbank can be made only if the borrower has documented the reasons why he is currently unable to pay the loan.

To apply for a deferment, the bank client must fill out an application to the bank in a free form, in which he needs to write about the reasons for the deferment, for example, layoffs at work, etc.

The grounds for deferment of mortgage payments from a bank may include:

- the borrower's conscription into the army;

- loss of job;

- the birth of a child in the borrower’s family;

- going on maternity leave;

- delay of wages;

- loss of a breadwinner;

If the bank approves the application for deferment, the terms of the mortgage loan agreement will be subject to change - the size of the monthly payment is reduced or the mortgage term is increased.

A deferment at Sberbank can be provided for a period of 1 to 3 years, based on the reasons specified by the borrower in the application. But it does not relieve the borrower from having to pay interest on the mortgage agreement.

How much should the salary be?

The bank does not have a specific salary amount for issuing a mortgage. It will depend on several factors, for example, on what kind of real estate the client wants to purchase with loan funds.

If he is going to buy a country house worth 15 million rubles, and his salary is 25 thousand rubles, then his application, of course, will not be approved. The cost of making regular mortgage payments cannot exceed 50% of the documented salary or other income of the potential borrower.

We are talking only about wages reflected in the certificate in form 2-NDFL or in the form of Sberbank. If the client cannot document his earnings (for example, he receives his salary in an envelope), then the bank will not approve the application for a mortgage loan.

If the borrower’s income is insufficient to obtain a mortgage, the bank can take into account the client’s additional earnings, for example, funds from renting out an apartment under a rental agreement, interest on a deposit and other types of income.

How long should the work experience be?

To take out a mortgage from Sberbank under standard programs, the borrower’s work experience must be:

- more than six months at the last place of employment;

- for at least 12 months over the past five years.

But the bank can make an exception for its clients who receive wages on a Sberbank card. In this case, only the first condition must be met - the mortgage is issued if he worked for at least 6 months at his last job.

In what cases can Sberbank refuse?

Unfortunately, it is not possible to find out the reason for the disapproval of a mortgage application from a bank. Such information cannot be provided to clients by bank employees. In order to increase the likelihood of approval of the application at Sberbank, the borrower needs to familiarize himself in detail with all the terms and conditions of mortgage lending.

The most common reasons for refusal to issue a mortgage for the purchase of an apartment in Sberbank are:

- insufficient income of a citizen;

- bad credit history;

- borrower age mismatch;

- the borrower has uncovered loans to other banks;

- inconsistency of information submitted by the borrower, corrections, inaccuracies in documents.

At Sberbank, citizens of the Russian Federation can take out a mortgage loan under various programs, including for the purchase of an apartment in a new building from a developer, secondary housing, or a private house. Individual conditions apply to each borrower. Before taking out a mortgage loan from Sberbank, you must carefully study all the bank's requirements.

After choosing a suitable program, the client needs to submit an application, prepare the necessary documents, select a property, discuss all the conditions with the seller and come to an agreement, order a report from an appraiser, conclude a purchase and sale agreement, register the property in Rosreestr, and only then execute a mortgage agreement loan.

Features of permanent registration at a military unit, see here.

If a citizen has a reliable job with a high salary, has a good credit history, then the chances of getting a mortgage are very high.

But, if the borrower works for a salary “in an envelope”, cannot confirm its size, has a bad credit history, and cannot attract guarantors, then the bank will make a negative decision on the application for a mortgage loan.

Video: Mortgage conditions in Sberbank:

(No Ratings Yet)