Home » Video » How to take out a mortgage correctly

June 10, 2020 No comments

Choosing the right mortgage is a rather difficult question. Each mistake can, at a minimum, lead to significant financial costs, and at maximum, to the loss of the acquired property. First of all, you need to ask yourself: do you need a mortgage at all and is it possible to do without it? For example, if a beneficiary is on a waiting list to receive social housing or there are other conditions (maternity capital, rent, government subsidies, etc.) in order to get an apartment, then in this case it is better not to take out a mortgage loan from a bank. If you have no other options, borrowing money from a bank will allow you to acquire your own home (or other real estate).

However, do not rush to immediately apply for a mortgage loan at your nearest bank. By concluding a mortgage agreement, you bind yourself to a relationship with the chosen bank for many years or decades, so this decision must be approached responsibly.

Additional costs for the borrower when applying for a mortgage

The down payment and registration fee are far from the only costs payable by the borrower directly when applying for a bank mortgage. The lending bank itself is directly interested in most of the additional expenses that a client has to face in the situation of obtaining a mortgage loan, which, in fact, makes quite good money from them. First of all, we are talking about numerous commissions that are charged by the financial institution providing the mortgage, as well as payment for the services of the insurer and the appraiser.

Summarize

Before applying for a mortgage, you need to carefully read the financial conditions offered by a particular bank. Let the manager immediately calculate all the costs associated with drawing up a loan agreement, including commissions, appraisals and all types of insurance. You need to take home a sample loan agreement and study it carefully, or even better, show it to a lawyer in order to identify clauses that complicate the life of the borrower.

In this article we will analyze the pitfalls associated with obtaining a mortgage. Let's find out what risks there may be when buying an apartment on the secondary market and what you need to pay attention to when concluding an agreement with a bank. We have prepared useful tips for you and collected reviews on getting a mortgage.

Bank commissions

The recipient of a mortgage loan must be prepared to pay the bank commissions for the following services:

- reviewing the client's loan application;

- provision of funds for an approved loan;

- currency exchange (conversion);

- transferring money from one account to another;

- issue of a bank plastic card.

This list of fees typically charged by the lending bank is not complete. Before applying for a mortgage, the client is advised to clarify what additional payments will be required to make to the lender in order to obtain the necessary loan.

Valuation of purchased real estate

A significant amount will have to be paid for a qualified assessment of the purchased property , which, upon registration of the mortgage, is transferred to the bank as collateral. Many lenders often insist that the client order such an appraisal only from a company that is accredited by the financial institution providing the mortgage loan. Such a requirement deprives the borrower of the opportunity to independently choose an appraiser . The cost of real estate valuation services is set by the organization providing this service. The bank client cannot influence this price . It is also not possible to challenge the results of the assessment. Thus, the borrower will most likely have to agree to the lender's request to conduct an appraisal through a specific organization on the terms that will be offered. If the debtor in the future wishes to refinance a previously issued mortgage through another bank, he will have to re-order an assessment of the collateral property.

Loan terms

The second important indicator when determining the interest rate is the loan term. Today, with rare exceptions, banks offer mortgages for up to 30 years. There are restrictions on the age of the borrower, that is, on the expiration date of the contract, your age should not exceed a certain threshold; the same rules apply to financial and property guarantors.

So, you can save on a mortgage by shortening the loan term: firstly, the total overpayment will decrease, and secondly, the nominal rate will be lower.

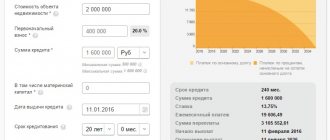

Let's look at the example again.

Loan - 1,200,000 rub.

Term – 180 months (15 years): payment: 15,380.84 rubles/month overpayment: 1,568,551.20 rubles

Term – 240 months (20 years): payment: 14,273.17 rubles/month overpayment: 2,225,560.80 rubles

That is, you will need to pay 1,143.67 rubles per month. more, and the total savings will be RUB 657,009.60. (and this is at an equal interest rate).

The final decision on the loan term must be made based on your own financial situation, but still you should not artificially inflate it.

Insurance

A separate topic is the borrower’s purchase of insurance services, which is necessary when applying for a mortgage from a bank. The creditor's requirement that the debtor insure the real estate pledged as collateral is legal, justified and appropriate. The obligatory nature of property insurance in this case is beyond doubt, but it does entail additional costs for the client, which must be taken into account initially.

However, as current practice shows, many banks issuing mortgages do not intend to stop only at putting forward a requirement for insurance of collateral. Lenders often offer the borrower to purchase related insurance products:

- personal insurance of the debtor (health, life);

- insurance of title to purchased housing pledged as collateral;

- insurance of risks associated with possible violation of conditions,

- provided for in the loan agreement.

Typically, the beneficiary (beneficiary) of such insurance is always the creditor bank. The costs of paying the relevant insurance premiums in the amount of 0.5-1.5% of the loan amount must be paid by the recipient of the mortgage. The Borrower may attempt to opt out of purchasing the related insurance products listed above. After all, these services are sometimes openly imposed on the client by bank employees.

Limitation of the borrower's rights when applying for a mortgage loan

Of course, any agreement on the provision of a mortgage loan by a bank is always replete with a variety of requirements, instructions, clauses, one way or another limiting the rights and capabilities of the borrower in relations with a specific lender. It is important for the recipient of a bank loan for the purchase of housing to distinguish between expedient restrictions, the presence of which is dictated by the desire to protect the legitimate interests of the creditor, and ambiguous tricks of the counterparty, aimed at putting the debtor in an initially uncomfortable position, dependent on the bank.

Reasonable restrictions, for example, include all kinds of encumbrances associated with the collateral status of real estate purchased with a mortgage. We are talking about a ban on redevelopment, sale, donation, exchange, rental and other actions to dispose of a residential property that is pledged without the appropriate permission of the lender. These restrictions will be lifted when the borrower fully repays his debt to the bank.

However, some credit institutions stipulate provisions in the mortgage agreement that, as an option, do not give the borrower the opportunity to repay the loan received ahead of schedule or, which also happens quite often, allow the lender to change the annual interest rate unilaterally.

Most of these orders are direct violations of civil law.

This means that such unlawful demands of the lender can be successfully challenged by the borrower in court.

Risks of adverse changes in exchange rates

Significant fluctuations in the exchange rate, the unstable position of the ruble, falling prices in the residential real estate market - all these threats with a fairly high degree of probability can become real for the borrower, given the long-term nature of the housing loan provided on mortgage terms. The realization of such risks in practice can lead to adverse consequences for a debtor who has obligations under a long-term mortgage loan:

- an increase in the amount of the loan payment due monthly;

- the amount of the final overpayment on a mortgage loan may turn out to be much higher than originally expected;

- the actual amount of the loan can be many times higher than the market value of the housing purchased with a mortgage.

Taking out a mortgage loan exclusively in rubles will allow the borrower to minimize the impact of risks associated with exchange rate fluctuations in foreign exchange markets.

It is not recommended to take out a mortgage that provides for the use of a “floating” interest rate , since the lending bank can easily increase this rate even with the most minor changes in the exchange rate, which will lead to a natural increase in the actual cost of lending for the client. The uncertainty associated with the “floating” interest rate is a serious threat to the borrower, which is easier to avoid in the first place.

Video description

For a few more thoughts on choosing between a mortgage and a non-mortgage, watch the video:

Having analyzed the ruble exchange rate today, we can safely say that the best option for solving the housing issue is a gradual increase in capital. By purchasing now the property for which you already have money, you will not only save the cash equivalent, but perhaps even earn money. Gradually, saving a certain amount, improve your living conditions by selling your previous property and adding to your existing nest egg. Thus, in 10-15 years, you will receive your good-quality country house without debts and without using loans.

Collateral is a risk factor for a mortgage borrower

You should be aware of some risks associated with real estate secured by a lender.

Threat of loss of collateral property

A natural disaster, fire, or malicious actions of third parties can lead to the destruction or damage of mortgaged real estate. Significant damage or complete loss of the collateral will have extremely unfavorable consequences for the debtor, who will not only lose his home, but will also be obliged to provide the lender with other property as new security for the mortgage (in replacement of the lost one). If the residential property is badly damaged, but can be repaired, the borrower will have to inform the lender about this, agreeing with him on the conditions and terms of restoration. It is recommended to do this in writing.

If the new mortgage collateral does not satisfy the lender, then the borrower should be aware that the financial institution has the right in this case to demand that the debtor repay the obligations in full ahead of schedule.

Pitfalls of special programs in 2020

In 2020, effective programs are being implemented to assist special categories of Russian citizens when applying for a mortgage:

- family mortgage at 6% per annum;

- military mortgage;

- maternal capital;

- young family;

- social mortgage;

- wooden mortgage.

Each has its own nuances.

Mortgage at 6% per annum for families with children

Such a mortgage will be available to families who will have a second or third child between the beginning of this year and the end of 2022. The rate of 6% will apply for a maximum of 8 years from the date of loan issuance. After this period expires, the rate will be tied to the refinancing rate (its current value + 2 percentage points).

You can only buy housing under this program from legal entities. The purchase amount is limited to 3 million rubles for the regions and 8 million for Moscow.

Military mortgage

A mortgage for military personnel who have been participants in the savings-mortgage system for over 3 years will allow them to buy comfortable housing worth up to 2.33 million rubles at 9.5% per year.

With the help of NIS, the borrower can save up for a down payment, and through monthly payments transferred from the budget, the debt under the loan agreement is repaid. It is impossible to resign during the validity period of such an agreement, otherwise the bank will terminate it and the military man will be obliged to return the funds received to the state.

Maternal capital

Maternity capital funds can be used for credit purposes immediately after the birth of a child who has given such a right. The amount of 453,000 rubles can be used to pay the principal and interest or pay the down payment.

The expense item is determined by the borrower himself in agreement with the Pension Fund, who will transfer the money to the bank within one month.

Young family

Young families in which spouses are under 35 years old can apply for a preferential mortgage with subsidies from the state budget. The size of such a subsidy depends on the number of family members, region of residence and the average price of 1 sq. m. m. in a specific municipality.

To participate in this program, you will need documentary evidence of your need for improved housing conditions.

Social mortgage

Social mortgages are issued for an approved list of categories of citizens of the Russian Federation - single-parent families, large families, low-income citizens, disabled people and families with disabled children, employees of budgetary organizations. Such persons are offered free subsidies or an interest rate compensated from the budget.

Registration is carried out in the order of placement on the queue as those in need of housing.

Wooden mortgage

A wooden mortgage means obtaining a loan for the purchase of suburban wooden real estate, thereby stimulating the development of low-rise construction and the development of remote areas.

The purchase of environmentally friendly housing will be subsidized by the state by reducing the interest rate to 10%. The subtlety of a mortgage is that there is no need for collateral for the home being purchased. The loan amount cannot exceed 3.5 million rubles, and the down payment will be from 10%.

A mortgage has many nuances and pitfalls associated with the need to transfer the purchased housing as collateral to the bank, currency risks, and significant risks of eviction from the living space for non-payment. It is also important to consider the severity of your debt burden, take into account the additional costs of home repairs and maintenance, and save money in a personal freedom fund. Knowing all the secrets of a mortgage, you can avoid possible mistakes and get the maximum benefit from such a transaction.

We discussed all the risks of a mortgage in a separate article, and you can find out more about whether you should take out a mortgage further.

We look forward to your questions and remind you that you can sign up for a free consultation with a specialist in a special form on the website.

We would be grateful for your rating of the article. Like and repost.

A mortgage loan involves a lot of money, and it takes a long time to pay it back. It is not surprising that such lending has nuances that are not always obvious. These can easily include additional costs when concluding a contract, the risk of losing the mortgaged apartment, the bank’s ban on transactions with mortgaged property and the inability to repay the loan early.

Let's take a closer look at the pitfalls of mortgages.