What is an assignment of mortgage?

A mortgage loan agreement requires compliance with a list of rights and obligations on the part of the debtor and on the part of the banking organization that issued the loan. Each participant in the process, within the framework of the legal documents governing such transactions, has the legal opportunity to transfer these rights and obligations to a third party. This procedure in legal practice has been defined as “mortgage under an assignment agreement.” Such transactions are the main option for canceling the claims and rights of a given person with their complete transfer to the other party. The procedure will allow the borrower to free himself from debt, the buyer to purchase an apartment at a favorable price, and the bank to return its funds in full (plus interest on loan charges). How the registration process goes and what is needed for this – let’s find out.

Why is assignment of rights to a mortgage necessary?

The main borrower has the right to transfer ownership of the property to a third party along with its financial obligations to the bank as part of the mortgage lending service. The need to assign property rights may be required under the following circumstances:

- The spouses are getting divorced, and one of them is ready to voluntarily give up his shared ownership of the apartment. In this case, all contractual credit obligations are assumed by the second party.

- Need for an urgent sale - if you need an urgent loan closure, an assignment agreement is the best solution. It is processed much simpler and faster than, for example, removing the encumbrance with subsequent sale or early repayment of the loan in full.

- Receiving an inheritance - if the borrower dies, the person having the right of inheritance fully acquires not only the property, but also the financial obligations for servicing and paying for the loan agreement.

- The need for urgent closure of the loan - for example, due to a difficult financial situation and further impossibility or unwillingness to pay the remaining amount of the debt.

- The bank assigns its obligations to another company that is a legal entity. The procedure can be implemented in two ways - within the framework of trading a mortgage portfolio or by completely selling debts to collectors.

How to sell an apartment with a mortgage by assignment?

A mortgage for the assignment of rights under the DDU in the event of the sale of an apartment is drawn up as follows. The buyer studies the reputation of the construction company, and the seller collects the necessary documents:

- agreement of shared ownership of the object;

- the developer’s consent to formalize the transaction - it must be obtained in advance (with the exception of the execution of a will);

- if the owner of the apartment is legally married - written consent of the second spouse to re-register ownership rights (this document must be certified by a notary);

- receipts confirming all previously listed current mortgage payments.

After all the documents are ready, the seller must obtain from the developer official confirmation of the remaining amount of the debt or its complete absence if such obligations were assumed by the bank that issued the mortgage. The next step is to contact the State Register and order an extract from the Unified State Register there. With a complete package of documents, the seller and buyer contact the credit institution and enter into an agreement on the assignment of ownership rights. After the paper is signed by all parties involved in the process, it should be officially registered in the Unified State Register. To do this, the new owner must contact the MFC. The law allows no more than 10 working days to register an agreement.

Assignment under Russian legislation

The entire Chapter 24 of the Civil Code of the Russian Federation is devoted to the issues of changing persons in obligations https://www.zakonrf.info/gk/gl24/. Briefly and clearly - the lender can transfer the debts of the borrower to another person (individual, legal entity) to pay off his debts (for example). Assignment is the most common word among bankers. But it is also used by enterprises, organizations, individual entrepreneurs, including developers, realtors in the process of their monetary-property-debt relations and loans.

The definition of assignment is the assignment of claims, property, property rights, if there is a supporting document (title). States also use cession, but by agreement regarding territories.

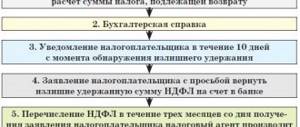

Registration procedure

To sell an apartment with a mortgage by assignment, you must proceed as follows:

- The mortgage loan applicant independently searches for potential buyers for his property.

- After a candidate for the purchase of housing has been found, the seller and buyer contact a financial institution and submit an application there about their desire.

- Bank employees will check all the circumstances, documents, and credit history of the person wishing to transfer the transaction to themselves. After this, the bank's management makes the final decision on whether to authorize or prohibit the assignment.

- A contractual agreement is concluded in writing between the credit company and the new buyer. The document is drawn up in two copies. It spells out bilateral rights and mutual obligations.

- The procedure for re-registration of the transfer of ownership of real estate to a new owner is being carried out.

- All financial transactions with the seller are carried out.

- From the moment the contract is signed, the new owner of the property begins to fulfill his obligations under it and, within the framework of the received monthly payment schedule, repays the remaining amount of the debt to the bank.

If the company that issued the loan has doubts about the financial viability of the new borrower, it has the right to demand that the borrower provide collateral or attract guarantors. As a rule, banks do not interfere with the procedure for assigning rights under a mortgage, provided that the person wishing to purchase such an apartment meets all the requirements stated by the company.

How is an assignment agreement used?

Banks, in their activities, very often enter into assignment agreements with third parties. For example, do you know why debt collectors collect debts? How do they relate to the bank lender? The most direct thing is if the bank has established a clause in the agreement with the borrower under which it has the right to transfer debt obligations under the assignment agreement to third parties. According to such a concession, the borrower no longer owes the bank, but the collection agency. Obligations under a loan agreement are sold or transferred free of charge:

- the assignor is the assignor;

- the acquirer is the assignee.

Important! Before signing a loan (mortgage) agreement, carefully read the text and check whether the bank has reserved the right to draw up an assignment agreement.

The borrower can return the money to its original lender (assignor). He must notify the assignee about this in writing - send a notice. You don't need to pay for both. If the collectors do not leave you alone, even after paying the entire amount of the debt, first contact the bank with a request to notify the assignee that you have already paid off. If the situation does not change, contact the Arbitration Court with a statement of claim.

Risks for the new owner

Despite the fact that the procedure for completing such transactions is simple and quite transparent, there are still certain nuances and associated risks that must be taken into account. The main one is if the house has not yet been completed. You can never be sure that the project will not be frozen and a person will not lose the money invested. The next point is taxes. As part of the Tax Code, the seller transfers a fee of 13% of the difference in value assigned in the DDU agreement and the assignment agreement. In standard cases, in order not to overpay extra funds, sellers insist that the documents indicate an amount less than the actual amount. In the case of mortgage lending, banks do not make such concessions, and you will have to pay tax in accordance with the amount actually received.

In addition, the new owner of the property in case of assignment of rights under the mortgage bears the following risks:

- The facility is being put into operation in violation of contractual deadlines.

- Purchasing receivables without the developer's prior consent to the transaction will inevitably lead to the assignment agreement being declared invalid. The legislation of the Russian Federation does not provide for the obligation to coordinate such transactions with the developer, but most of them stipulate this requirement as one of the clauses of the contract - in this case it will have to be fulfilled.

The financial benefit of such an acquisition is the opportunity to buy an apartment cheaper than its actual price while it is under construction. Its cost will be especially low at the initial stages of the project - for example, at the excavation stage. But the risks in this case are the most serious.

Reasons why assignment of rights is not particularly common:

- difficulty in finding a bank willing to make such a transaction (since the company takes on almost the same risks as the buyer of real estate);

- the difficult economic situation and the crisis in the housing construction industry - all this allows a person to find an option with a simpler registration method, but all the main risks will be present.

If we talk about mortgage lending by transfer of housing that was taken out on credit, then in practice this scheme is almost unrealistic. Typical loan programs do not consider such transactions, and only a few banks can agree to such conditions.

Use of assignment in the real estate market under construction

Cession is used not only in such sad situations. For example, it is widely used by enterprises - transferring accounts receivable.

Let's look at the situation: an apartment building is being built.

Characters:

- The developer has a plot of land and wants to build a building (naturally, for his own benefit). Obliges to pay the construction organization (contractor) in full, provide construction materials on time, or pay for all work and reimburse the costs of purchasing construction materials.

- Contractor - knows how to build and erect buildings. It does this successfully, in accordance with the agreement concluded with the developer.

Everything would be fine if the developer had several hundred million free rubles. But there are none. But there are buyers who want to buy apartments in a building under construction. Of course, the developer is interested in having as many shareholders as possible. Then there will be free money - you can use it to finish construction, pay the contractor and make loan payments to the bank on time (developers also take out loans).

Buyers are ordinary citizens, often families and with children. This category of the population faces the problem: “I want to take out a mortgage and buy an apartment in a new building, but I don’t have enough for the down payment.” As soon as a person addresses the developer with these words, the problem becomes common. At this moment, the well-educated and competent lawyers of the development company offer to “crank out” the assignment scheme. But no longer in the interests of the bank, but for the benefit of the buyer and developer. Naturally, the third participant will have a commission or direct benefit (if it is a customer, realtor, contractor, etc.