A mortgage note is a document with the characteristics of a security, which indicates the right of its owner to receive credit funds secured by the mortgage, as well as to the property encumbered by it. In practice, a mortgage is used to speed up and simplify transactions with real estate. The rules for mortgage lending and the role of the mortgage in them are provided for by the Federal Law “On Mortgage” No. 102 of July 16, 1998, as amended. According to the above-mentioned law, the mortgage note must meet standard requirements and contain the following information:

- the full name and place of registration of an individual, if he is the pledgor, as well as the full name and location according to the constituent documents, if the pledgor is a legal entity;

- full details and place of registration/location of the first mortgagee (the person to whom the mortgage was issued);

- details of the mortgage agreement, date and place of its conclusion;

- complete information about the debtor, if the mortgagor is not him;

- the amount of the mortgage loan, the amount of interest or the conditions under which they will be determined at the time of fulfillment of the obligation;

- the date of provision of the mortgage loan or its terms, if the parties agreed to issue funds in installments;

- detailed description of the pledged property. The description must be carried out in such a way that the property can be distinguished from other property with similar parameters and properties;

- data of the document confirming the rights of the mortgagor to real estate, indicating the date, authority and place of state registration of this right.

Mortgage note

If the subject of the pledge is the right to lease, then the name of the property accepted for lease and the term of its validity are indicated in the mortgage; signature of the pledgor or debtor, if the pledgor is a third party;

The mortgage note is drawn up in a single copy. If it is compiled on several sheets, all of them must be numbered, laced and sealed with the seal of the body that carried out the registration. If the details of the mortgage loan agreement differ from the details of the mortgage note, the details of the latter are considered correct.

ConsultantPlus: note.

On the transfer of a documentary mortgage issued before 07/01/2018 to the depository, see Federal Law dated 11/25/2017.

Article 13. Basic provisions on the mortgage

(as amended by Federal Law dated November 25, 2017 N 328-FZ)

(see text in previous)

1. The rights of the mortgagee under the obligation secured by a mortgage and under the mortgage agreement may be certified by a mortgage, unless otherwise established by this Federal Law.

A mortgage may certify the rights of the mortgagee under the mortgage by force of law and under the obligation secured by this mortgage, unless otherwise established by this Federal Law.

A mortgage certifying the rights of the mortgagee under a mortgage by force of law and the obligation secured by this mortgage shall be subject to the provisions provided for a mortgage under a mortgage by virtue of an agreement, unless otherwise established by this Federal Law.

List of documents required for assessment

To carry out this procedure, you will need a standard package of documents consisting of:

- extracts from the Unified State Register;

- equity participation agreements;

- registration certificates;

- floor plan and technical passport of the apartment;

- act of acceptance and transfer of housing;

- title documents;

- photocopies of the borrower's passport.

You can use a certificate of state registration of ownership or a share participation agreement as title documents.

The report must provide a calculation of the market value of the apartment and its clear description. The appraiser is required to indicate the condition of the property, the degree of its deterioration, type of repair and layout. In addition, the assessment report, on the basis of which a mortgage for an apartment will be issued, must indicate the social significance of the area, the degree of infrastructure development and other important factors.

What is an apartment mortgage?

A mortgage is a security that certifies the following rights of its legal owner:

1) the right to receive fulfillment of monetary obligations secured by a mortgage, without providing other evidence of the existence of these obligations;

2) the right of pledge on property encumbered with a mortgage.

3. A mortgage is a registered documentary security (hereinafter referred to as a documentary mortgage) or an uncertificated security, the rights under which are secured in the form of an electronic document signed with an enhanced qualified electronic signature, which is stored in the depository, in accordance with Article 13.2 of this Federal Law (hereinafter - electronic mortgage).

Rights under a mortgage may be exercised by the legal owner of the mortgage and other persons who, in accordance with federal laws or their personal law, exercise rights under securities on their own behalf (hereinafter also referred to as another person exercising rights under a documentary mortgage or electronic mortgage).

4. The obligated persons under the mortgage are the debtor for the obligation secured by the mortgage and the mortgagor.

5. Drawing up and issuing a mortgage is not allowed if:

1) the subject of the mortgage is an enterprise as a property complex or the right to lease it;

2) a mortgage secures a monetary obligation, the amount of debt for which is not determined at the time of concluding the agreement and which does not contain conditions allowing this amount to be determined at the appropriate time.

6. In the cases provided for in paragraph 5 of this article, the terms of the mortgage in the mortgage agreement are void.

7. The mortgage is drawn up by the mortgagor, and if he is a third party, also by the debtor for the obligation secured by the mortgage.

The mortgage is issued to the original mortgagee by the rights registration authority after state registration of the mortgage. A mortgage may be drawn up and issued to the mortgagee at any time before the termination of the obligation secured by the mortgage. If the mortgage is drawn up after the state registration of the mortgage, a joint application of the mortgagee and the mortgagor is submitted to the rights registration authority, as well as a mortgage, which is issued to the mortgagee within one day from the moment the applicant applies to the rights registration authority or within one day from the receipt of such documents by the registration authority rights from the multifunctional center.

The transfer of rights under the mortgage and the pledge of the mortgage are carried out in the manner established by Articles 48 and 49 of this Federal Law.

8. The debtor under the obligation secured by the mortgage, the mortgagor and the legal owner of the mortgage may, by agreement, change the previously established conditions of the mortgage.

9. By order of the owner of a documentary mortgage, immobilized in the manner provided for in Article 13.1 of this Federal Law (hereinafter referred to as the immobilized documentary mortgage), or an electronic mortgage, or another person exercising the rights under an immobilized documentary mortgage or electronic mortgage, the depositary is obliged to make deposits in the securities accounts of the specified persons a special note granting the pledge holder of the specified securities the right to sell the specified securities after a certain period in order to satisfy the claims secured by the pledge (hereinafter referred to as the special pledge endorsement).

ConsultantPlus: note.

On the transfer of a documentary mortgage to the depositary, see Federal Law No. 328-FZ dated November 25, 2017.

10. Accounting and transfer of rights to an immobilized documentary mortgage and electronic mortgage, including pledge and other encumbrances and restrictions on the disposal of these securities, as well as interaction between depositories that store and (or) record the rights to an immobilized documentary mortgage or electronic mortgage, carried out according to the rules established for uncertificated securities by the legislation of the Russian Federation on securities, unless otherwise provided by this Federal Law.

11. The federal executive body exercising the functions of legal regulation in the field of state registration of rights to real estate and transactions with it (hereinafter referred to as the regulatory body in the field of state registration of rights) establishes:

1) an application form for the issuance of a documentary mortgage or an electronic mortgage, as well as a form of an electronic mortgage;

2) an application form for making changes to a documentary mortgage or an electronic mortgage, as well as an agreement form for making changes to an electronic mortgage;

3) requirements for filling out the forms provided for in this paragraph, as well as requirements for their formats;

4) the procedure for interaction between the depository storing the immobilized documentary mortgage or electronic mortgage and the rights registration authority.

12. Information interaction between the rights registration authority and the depositary storing the electronic mortgage or immobilized documentary mortgage is carried out using a unified system of interdepartmental electronic interaction.

What can you do with a mortgage as a security?

You can perform almost any action with a mortgage as an independent object of civil circulation:

- sell;

- lay;

- invest in it (invest), etc.

The features of a mortgage as a security are that:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- It is personalized, that is, it is issued to a specific person.

- It certifies the right of its owner under two contracts simultaneously.

- The rights under it are transferred to another person in the form of an assignment.

- It has an expiration date (debt repayment date).

- It can be transferred for safekeeping to a depository and quoted on the securities market.

As a standard, a security is registered by the Bank of Russia (Clause 1, Article 20 of the Law “On the Market...” dated April 22, 1996 No. 39-FZ). This rule does not apply to mortgages. Information about it is entered into the Unified State Register by a structural unit of Rosreestr if there was a corresponding request from a creditor or debtor.

The owner of the mortgage may be changed in accordance with Art. 13, 48 of Law No. 102-FZ:

- a simple written transaction is drawn up;

- a note indicating a change of owner is placed on the mortgage;

- An application to change the information is submitted to Rosreestr.

The debtor is notified of the assignment of the right under the mortgage (Clause 2, Article 16 of Law No. 102-FZ).

What kind of document is this and why is it compiled?

In accordance with the law, a mortgage is a (registered) security that certifies the legal right of its owner to repay loan obligations secured by a mortgage, as well as the right of pledge on real estate encumbered with a mortgage.

This document is subject to mandatory state registration.

The security is issued by the bank and signed by the mortgage borrower on the day the loan is received.

However, the law does not prohibit the registration of a mortgage without drawing up this document.

The subject of such securities is usually the property, the rights to which are transferred to the borrower after signing the agreement.

The spread of this instrument on the market is explained, among other things, by the ability of banks to solve the problem of lack of money in the long term with their help:

- the lender has the right at any time to sell the rights to claim the mortgage to another bank;

- a credit institution has the right to issue securities secured by mortgages and, thereby, raise funds for mortgages on the market.

But the main purpose of its execution is to provide the bank with guarantees of the borrower’s solvency.

The nuances of obtaining a military mortgage: how to find out the mortgage number in AHML or a bank

- Obtaining a certificate of participation in the NIS program - it is issued no earlier than 3 years from the date of entry into the program.

- Search and selection of specific real estate.

- Contacting the bank for advice and obtaining a list of required documents.

- Filling out the application form and providing the full package of necessary papers.

- Opening an individual client account for transferring funds accumulated through NIS.

- Signing the purchase and sale agreement.

- Registration of documents in Rosreestr.

- Transfer of real estate as collateral to the bank (drawing out a mortgage).

- Contact your lender. The mortgage note is drawn up in two copies: one of them is kept in Rosreestr, the second in the bank.

- Make a request to Rosreestr. You can view the number in the Unified State Register extract received upon the personal application of the mortgagor.

- Using your personal account. If you don’t know how to find out the AHML mortgage number for a military mortgage, then just go to the agency’s website. There you will see not only the mortgage number, but also the loan agreement, payment schedule, account balance and much more useful information.

Contents of the mortgage

The security must contain the full name of the borrower, the parameters of the collateral property, and the terms of the agreement.

- Name and location (registration) of the pledgor.

- Date, number, place of conclusion of the mortgage loan agreement.

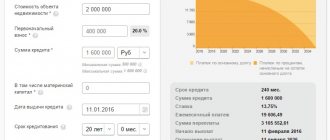

- Amount, loan interest and loan period.

- Date of loan issuance.

- Description of the collateral property.

- Details of the document establishing the rights to the pledged property.

- Marks of state registration authorities.

- The date the document was issued to the original mortgagee.

Drafting requirements are also regulated by law, but banks have the right to impose additional conditions. At Sberbank, for example, mortgages may vary slightly depending on the loan issuing offices.

A sample and what a mortgage looks like can be seen here.

Is it possible to make changes to the mortgage?

According to paragraph 6 of Art. 13 of Law No. 102-FZ, the parties to the transaction by agreement can change the terms of the mortgage.

This is done in one of two ways (Clause 7, Article 13 of Law No. 102-FZ):

- First way:

- a written agreement is drawn up to amend the mortgage;

- it is attached to the mortgage (i.e., it becomes an integral part of the document);

- The government agency registers the agreement, and in the text of the mortgage itself there is a reference to it (to the agreement), on the date of registration, the signature of the official and the seal of Rosreestr are affixed.

- The second way to change conditions:

- the parties to the transaction draw up a written agreement, which is submitted to the government agency for registration;

- the mortgagee submits the old mortgage to Rosreestr for its cancellation;

- the pledgor, in turn, draws up a new document taking into account the agreed changes;

- The government agency makes an entry in the Unified State Register of Real Estate, and a new mortgage is handed over to the creditor (mortgagee).

A canceled mortgage is stored in the archives of Rosreestr until the obligation is fulfilled and the mortgage record is cleared.