Sometimes a situation arises between relatives when one of them is ready to purchase real estate from the other, but the required amount of money is not available. A mortgage will come to the rescue. But, as it turns out, many banks are not ready to take part in this type of transaction for several reasons.

From the point of view of the law, such a transaction is feasible and permitted, but only if the bank does not have any claims against the parties. Therefore, you will have to spend quite a lot of effort searching for a suitable credit institution.

Why is this so difficult?

First of all, it is believed that an apartment with a mortgage from relatives may be illiquid. A lot of nuances may arise, one of which is considered to be possible collusion between the parties. The price of a mortgaged apartment is not determined according to market rules, hence many negative consequences.

In addition, the bank is concerned about the potential misuse of loan funds that the borrower will receive as collateral for the purchased property. It will take so much time to check the transaction itself to see if it is fictitious, because it is likely that the family wants to spend the money on some other needs.

Military mortgage in Moscow

Mortgages for military personnel in Moscow and the Moscow region will become easier

, if you turn to professionals who always have up-to-date information about the current state of affairs in the real estate market. Our specialists undertake to comply with all the requirements of the Federal standard of service in the secondary market, developed by the association of military personnel, participants in the Military Mortgage program.

Many people believe that housing in Moscow, even with a mortgage and even with a military mortgage, is not available to military personnel. At the same time, statistics indicate the opposite - the ratio of apartments to the approximate number of military personnel serving in the capital is not much inferior to the same ratio in the Moscow region.

How to buy a home from a relative with a mortgage?

But you can still get a mortgage; to do this, we recommend that you use the following recommendations:

- There are a great many banks today, and each of them offers clients more than one mortgage program. Thus, it will take a lot of time to study all the proposals. You can use the services of a realtor or mortgage broker. Such a specialist will help you choose a mortgage program, take care of collecting documents and submitting them to the bank in a timely manner. But this is not a 100% guarantee of receiving a loan;

- If, due to a lack of money, it is problematic to buy an apartment from relatives with a mortgage, you can take out a simple consumer loan. Without collateral, you can easily get a couple of millions, but the truth is that the rates will not always be pleasant: usually from 16% and above . If you have a salary or any other social card in the chosen bank, you can count on more favorable offers;

- It is better not to hide from the bank the fact that the apartment will be purchased with a mortgage from relatives. The organization is already checking all the information provided and this fact may clearly come to light. An attempt to deceive significantly undermines the bank's trust in you, as a result of which they may not only not issue a mortgage loan, but also blacklist you.

The last point will be especially important if the buyer plans to carry out some manipulations with the property in the near future. In this case, its legal purity is of particular importance. A purchase and sale transaction carried out between relatives is in this case considered completely legal and will not spoil the reputation of the apartment.

Is it possible to buy an apartment from relatives with a military mortgage?

A military mortgage is a convenient opportunity for military personnel to become the owner of their own home in the shortest possible time. Three years after joining the program, you can enter into a loan agreement using the funds accumulated in your account and purchase an apartment in a new building or on the secondary market. However, the question remains open: is it possible to get a military mortgage from relatives?

The rules of the Housing Mortgage Lending Agency (AHML) give a clear and unambiguous answer: purchasing an apartment from a close relative using a military mortgage is not allowed. In other words, a military mortgage is a purchase from relatives; these are incompatible concepts that do not contain exceptions.

There are several reasons for this, and this principle applies to most other mortgages. A military mortgage transaction between relatives allows you to enter into an agreement and cash out money through the imaginary sale of an apartment, which still remains in the same family. Selling an apartment with a military mortgage is, of course, profitable, but the transaction must take place within the framework of the law.

Sham transactions are not permissible, so banks will most likely refuse such a purchase.

How to buy living space with a military mortgage so that the seller is not related to close relatives from the following groups of people:

- parents and children, both natural and adopted;

- spouses in a registered marriage;

- grandparents and grandchildren;

- brothers and sisters. An exception may be made here if, for example, two sisters do not live in the same territory for a long time.

The contract must be clear to the bank, but in ordinary life, a husband rarely buys a home from his wife or a son from his father. This means, most likely, such an acquisition is just a cover for transactions with money, especially money received from the state. Therefore, a scam, like I’ll buy an apartment with a military mortgage from my grandmother and no one will find out, in this case it will not pass the bank’s check.

Such commercial transactions spoil the bank’s reputation and undermine its authority among government organizations, and not a single serious institution will do this. That’s why they don’t allow military personnel to buy apartments from their relatives with the help of the Housing Housing Fund.

So, a military mortgage from relatives is an unacceptable transaction, since no bank wants to risk investing its own funds.

At the same time, other persons living with the borrower and leading a common household with him may also be considered relatives. That is, even a common-law spouse cannot act as a participant in such a transaction in order to prevent the misuse of public funds.

Are there still ways to buy an apartment from relatives, and is it worth trying to hide family relationships in the bank? The answer is clear: this is a waste of time, since the security service will certainly check all your circumstances. Moreover, an attempt to deceive will make the bank suspicious of you and will discourage management from concluding a deal.

In practice, transactions between distant relatives are sometimes concluded, especially in cases where the surnames do not match.

The procedure for purchasing an apartment with a military mortgage does not imply the participation of close relatives in the transaction, because budgetary public funds are involved in the transaction.

It is assumed, for example, that a second cousin living separately from your family will not mislead the bank, and the transaction will turn out to be genuine. But even in this case, it is better to negotiate honestly and communicate who the seller is to you.

The situation also does not allow you to buy an apartment with a military mortgage, so you can take a share from a relative who has additional funds.

Step-by-step purchasing instructions

When purchasing housing with a military mortgage, almost all stages of the registration process are the same for both an apartment in a new building and for housing on the secondary market. The difference lies only in the documents related directly to the real estate.

1 step. Submitting a report to receive a targeted housing loan.

Step 2. Selecting a bank. The serviceman independently chooses the best option for himself and submits an application for a mortgage to the bank with a package of basic documents. The bank reviews the application and informs the applicant about the conditions under which he agrees to participate in the lending. We talked about banks that work with military mortgages, collecting documents and processing them here.

Step 3. Search for an apartment.

| New building | Secondary housing |

| A serviceman can purchase housing at the commissioning stage or at the stage of building a house. When choosing a developer, you need to check the availability of documents for construction and land. An agreement to book an apartment is signed, which will indicate the initial payment and the terms of other payments. | The serviceman himself, or by attracting specialists, selects suitable housing. All terms of the transaction are negotiated with the real estate seller and a preliminary purchase and sale agreement is signed (how is an apartment sold under a military mortgage and what are the seller’s risks?). The seller transfers documents for the apartment to the buyer. |

Step 4 Housing documentation is provided to the bank for review and to a real estate appraisal firm. The assessment is made at the expense of the military personnel.

Step 5 With the consent of the bank, a loan agreement is drawn up. At the same time, a home insurance contract must be drawn up. Often, credit institutions require comprehensive insurance, which, in addition to property insurance, includes title insurance and life insurance for the borrower. The cost of insurance is paid by the military personnel. For new construction, title insurance is required during the initial construction phase.

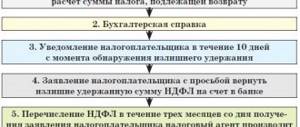

Step 6 Transfer of data to Rosvoenipoteka, where documents are reviewed within a week. After receiving consent, a CLP agreement is drawn up. The down payment funds are transferred to the buyer's bank account.

Step 7 After all formalities have been settled with the bank and Rosvoenipoteka, a purchase and sale agreement or DSA is signed. The bank transfers all funds specified in the agreement to the seller's account.

Step 8 A serviceman registers ownership of an apartment in the case of secondary housing. The apartment will be double pledged: from the bank and from Rosvoenipoteka until the loan is fully repaid. The home purchase has been completed. Rosoenipoteka will monthly transfer NIS funds to the bank to repay the amount of the military mortgage. For a new building, registration of ownership of the apartment occurs only upon commissioning of the house.

Important: The validity period of the NIS certificate is limited to 6 months. During this time, the serviceman must have time to complete all the documentation and conclude all contracts.

Additional information about obtaining a military mortgage is presented in the following video:

So, we figured out how to purchase real estate, and then whether it is possible to rent out an apartment taken on a military mortgage.

Defenders of the Motherland, just like all other citizens, dream of their own housing. Here you can find articles about obtaining a loan for contract workers and for the second time, about dividing a mortgage home after a divorce, about returning funds, about early repayment of a loan, and about buying a private house with a mortgage.

Buy an apartment from parents for an NIS participant

When asked whether it is possible to buy an apartment with a military mortgage from parents, the financial institution gave an answer approximately as follows: “A loan for the purchase of real estate from parents is provided only if the borrower provides a certificate that confirms the parents’ residence in another place or another registration.” Therefore, based on the bank’s response, real estate can be purchased from parents, but only if the borrower does not live with them in the same family.

- mother and father of spouses, adopted and relatives;

- spouses in official marital relations;

- grandmother, grandfather, grandchildren;

- common-law husband or wife;

- brother or sister, there is an exception; if they live for a long time in different territories, then they may not be included in the number of relatives.

Mortgage from relatives: design features

When applying for a mortgage loan, you must provide arguments about the need to purchase this particular property and that the transaction is not about obtaining material benefits for the family, since banks have the right to doubt whether the borrower is using the issued loan for its intended purpose. Who knows if the borrower will buy a house or apartment at a low cost from his relative, and use the rest to do whatever his heart desires. Fictitious transactions for the purpose of generating income, for example, are far from uncommon for businesses. Has your old apartment become too small or just boring? Do you want to expand or move to a new apartment? Thinking about a mortgage? Buying an apartment is always both pleasant and difficult, but buying from relatives causes more trouble, as it has a lot of pitfalls, because it is the status of “relatedness” that can significantly complicate the process of purchasing real estate with a mortgage.