Luxury tax on apartments and houses in the Russian Federation in 2020

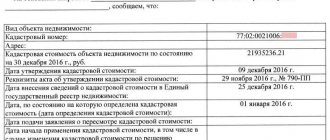

Cadastral value This category is a certain indicator - the actual value of the property. It is established during professional inspections, taking into account the following points:

- Changes of a capital nature after extreme revaluation, for example due to repairs;

- Depreciation of real estate of a physical, natural nature;

- Deterioration of the surrounding space of a natural, physical nature, affecting the condition of the immovable object (for example, the land on which the house was built);

- Various other factors that can influence the value of the property (presence of hazardous enterprises near it, whether the necessary infrastructure is available).

Regional characteristics play an important role - in the city center the cost of housing will be higher than in remote areas (for example, in the region).

Which cars will have to pay luxury tax in 2020?

Thus, in 2020, for persons who purchased an expensive car, tax will be charged even on a used car. The 2020 vehicle tax with the “luxury” increase is due by December 1, 2020. This factor should be taken into account when you need to calculate the “age” of a car. The calculation will be made for the year for which the tax is paid.

A few nuances about donation or inheritance. Persons who received luxury as a gift or inheritance are not exempt from paying tax. Let’s say that inherited real estate, after registration as ownership, becomes a “headache” for the new owner. Tax payments for houses received in 2020 will be due in a year.

Luxury tax in 2018

Until 2020, the tax on a property was determined taking into account its inventory assessment. Today, one more value has been added to these indicators:

- Cadastral value.

In 2020, certain amendments were made to the Tax Code of the Russian Federation regarding the calculation of tax on real estate. The goal of the reform is to gradually increase the tax to 20% annually, the duration of this tax program is 5 years.

Attention

Reduction coefficients should limit the growth of tax payments. This five-year time period is intended to ensure a smooth change in taxation - according to various experts, the value of the cadastral value exceeds the inventory value by 10 times. Basic provisions of the tax program The luxury tax is considered an additional fee of the state, its payment occurs under certain conditions indicating a specific level of income of a category of people.

How to calculate property taxes in 2020 online calculator

Organizations that are financed by budgets of all levels must calculate tax liabilities at the average annual cost, unless otherwise provided by law. Regional authorities have the right to establish a list of property that is subject to payment at cadastral value. On the first day of the reporting period (January 1), information is published on the official websites of the legislative body of the constituent entity of the Russian Federation.

How to calculate real estate tax in 2020 is detailed in the Tax Code of the Russian Federation. Additionally, it is recommended to familiarize yourself with the available features. The basis for calculating the required real estate taxation for legal entities and individuals is considered to be Chapter 30 of the Tax Code of the Russian Federation. At the same time, you need to remember that companies do not pay tax if there is a fact of using a special taxation regime.

Luxury tax in 2018 Moscow

Who doesn't have to pay luxury tax? The following persons are exempt:

- disabled people;

- WWII veterans;

- participants in various military operations;

- heroes of the Russian Federation and the USSR;

- as well as parents with many children.

Is it possible to avoid paying luxury tax? There are also various tricks that some people use to evade paying taxes. If the vehicle is registered with an organization that is taking part in the preparation of the 2020 FIFA World Cup, vehicles that have been converted to be driven by disabled people. Luxury tax: real estate Our legislation provides for the option of paying a real estate tax. Everything is simple here; a multiplying factor is applied when calculating property tax for individuals. If the value of your real estate exceeds 300 million rubles, please, put the money in cash. In addition, legislative acts indicate:

- Luxury housing is apartments with an area of more than 200 square meters, the price is over 30 million rubles;

- Real estate with a value of more than 300 million rubles. is recognized as a luxury object, the tax amount on it is determined in the amount of 2% of the cadastral value of this housing.

Changes in real estate taxation will affect a large number of people. The real price (market value) of a real estate property in a certain region comes to the fore. For example, the price per square meter in Moscow is 170 thousand rubles, in other cities of the Russian Federation it varies from 35-40 thousand rubles. Consequently, an ordinary apartment in Moscow will cost at least 9 million rubles; it will be able to move into the category of “luxury housing” in the region.

Luxury tax!?

Is it worth introducing a luxury tax in Russia? And how will its possible introduction affect the real estate market? About this in the “People Talk” section.Angela KUZIMINA Director of Sales Department IntermarSavills

In my opinion, the main thing in implementing the luxury tax is not to rush. I think that those who are lobbying for this bill justify it with huge figures of lost funds to the treasury, without realizing that there are a lot of nuances in this topic that can be very significant.

Are luxury yachts, cars whose price is comparable to the cost of real estate, jewelry? The results of a survey of Russians show that a private jet is considered a luxury by 81%, a yacht by 74%, antiques by 56%, and jewelry by 34%. Is housing a luxury? If so, which one? Mansions in the city center are possible. But a person who earns more than others has the right to live in a more expensive and prestigious area and have more square meters. And, most likely, he has already paid income tax of 13%. I think it’s logical to tax business, but not real estate... It’s a very difficult topic, and I don’t want people who own not unjustifiably luxurious, but simply good and high-quality housing to fall under the influence of this law.

When it comes to real estate, what is considered luxury? Number of square meters owned? What if an investor bought 5 apartments, but on the outskirts of Krasnogorsk? He has enough square meters of property, but their total cost is less than, for example, the cost of one apartment in the Ostozhenka area. What if we classify a taxable item as a luxury based on the area in which the apartment/house is located? I have seen data that there are still about 10,000 communal apartments left in the Central Administrative District... There are many people living here for whom life on Ostozhenka or on the Patriarch’s Ponds is not a tribute to fashion or status, it’s just that they were born here, live here, and not they plan to change nothing, despite the high cost of the infrastructure around them. They just can’t imagine living in another area.

Luxury tax exists in the USA, Great Britain, France, Italy, Croatia. But I believe that in Russia the level of respect for property is not yet sufficient to introduce additional regulatory sanctions.

Andrey UFIMTSEV Sales Director of the luxury real estate agency “New Quality”

In foreign countries, a luxury tax has existed for several years. I think this is right and necessary. If a person is able to buy a car, yacht or helicopter worth more than 2 million rubles each, he can and should pay luxury tax.

As for the threshold for real estate of 15 million rubles ($600,000), I think it is too high. It turns out that it covers too wide a category of people, some of whom do not even belong to the middle class. For them, this housing is not a luxury. Of course, it all depends on the tax rate.

In my opinion, if the bill is adopted with a threshold for real estate of 15 million rubles, many will begin to get rid of apartments of this cost, since they simply will not be able to pay for it. The most optimal threshold for real estate is 3 million rubles.

Olga TVOROGOVA director

The topic of introducing the so-called “luxury tax” is very controversial and controversial. If the acquisition of airplanes and yachts can somehow be qualified as the acquisition of luxury goods, then what is considered luxury in real estate is not clear. The established sanitary standards for the allocation of living space per person were adopted based on the capabilities of the state, and the goal was clear: to accommodate as many citizens as possible in separate apartments. Therefore, any excess of these standards can be considered a luxury. But, on the other hand, those who still live in communal apartments will consider those square meters in a separate apartment, which are designated as a sanitary norm, to be a luxury.

Therefore, from my point of view, it is worth taking a more professional approach to differentiating the scale of property tax for individuals. You just need to make a professional assessment of real estate, based on criteria such as the location of the property, the cost of renting land in the area, the construction characteristics of the property, etc. Such an assessment will allow you to clearly divide the property into categories and set an increased percentage of tax on really expensive real estate. By the way, this will solve another problem - to really differentiate between real estate classes: “luxury housing”, “business class housing”, “economy class housing”. Now you can come across the concept of “elite residential complex in Butovo”. Although in Butovo, simply due to the geographical location of this area, there cannot be an “elite” residential building.

Vasilisa BAZHENOVA project manager "Gagarinland"

Who will define what luxury is? If it concerns real estate, an official may consider as a luxury what is the norm of life for another. There is an element of mockery in the very formulation of “luxury tax”. It is not clear where to draw the line. It's like the middle class that everyone talks about, but no one knows who it really is.

An estate where peacocks walk, on 10 hectares with a house of 1000 m2 on Rublyovka, is probably a luxury. Three houses in Nice, each priced at $60 million, are clearly not a necessity...

Perhaps a hand-built Astin Martin could be classified as luxury. There are people who collect cars. There are people who buy vintage cars. You can start with antique cars, but it will all end with the fact that foreign cars costing more than $30,000 are a luxury... And what then, will we all drive Zhiguli cars? Dispossession of kulaks may work out.

There is no need to separate luxury items into a separate category. After all, there is a rental tax, a tax on car ownership. You can enter coefficients. Our legislators propose that Russians consider real estate and land plots worth more than 15 million rubles, cars, planes, helicopters, yachts, boats, the cost of which exceeds 2 million rubles, as well as products made of precious metals and precious stones worth more than 300 thousand rubles, as luxury goods. But if it’s still realistic to evaluate new purchases, then what about real estate and jewelry inherited?

Perhaps an apartment in the center from her grandmother is the only thing that a simple teacher has, the only value that she cannot refuse, but payments that exceed the rent are not unrealistic for her.

The wording “luxury tax” gives a lot of freedom to officials. And it's scary. It is unlikely that the introduction of such a tax will contribute to the establishment of social justice, rather the opposite.

Alexander KOROTKY Director of the Real Estate Investment Department of AG Capital Group

The new tax is currently only in draft form. The details are unknown and many questions arise. The criteria for “luxury” are not entirely clear. For example, in the field of real estate, the proposed level of 15 million rubles includes country houses, townhouses and business class apartments. Buyers of such real estate do not “luxury” at all; they often purchase apartments, country houses and cars on credit. And, in addition to loan payments, they will have to pay luxury tax?

With a high rate of price growth, in a few years ordinary 3-4-room Moscow apartments may reach the level of 15 million. It may happen that, unwittingly, the majority of Muscovites will become the owners of luxury and will be forced to pay taxes. Or will we redefine our definition of luxury every year?

Let's take as an example a family with two children. The minimum required for a comfortable stay for this family is a three-room apartment with an area of 80–100 m2. In Moscow, its cost may well be $580,000. In other cities of Russia, an apartment with similar characteristics will no longer be subject to the “luxury” tax. It turns out that in this case, a Moscow family will pay not for a “luxurious” quality of life, but for living in a specific region...

Let's say this: you earned a million dollars, paid all taxes and want to invest the money. If you transfer capital to management, buy securities or deposit money in a bank, then only additional income will be subject to tax. If you want to make an expensive purchase, then you will have to pay for the “luxury”.

A number of other questions arise: for example, how will it be possible to take into account the expensive jewelry, precious stones and metals, works of art that are not registered anywhere in the hands of citizens. It is unlikely that all their owners will be eager to voluntarily pay a few percent of their value. Will this tax turn into retribution “for honesty”? After all, a person has already paid taxes on his income.

It is not very clear how luxury and real estate taxes will coexist. In countries that have introduced a luxury tax, issues with real estate taxes have been previously resolved. I believe that all difficult points should be taken into account. Let's wait for the final version of the law.

How might the introduction of a luxury law affect the real estate market? I don't think the introduction of this tax will have any significant impact on the real estate market.

Sergey BARANOV , head of the investment department of Peresvet-Development LLC (part of the Peresvet-Group Group of Companies)

In most developed countries, differentiated taxation has been used for a very long time (for example, it is known that in the USA, after the introduction of luxury taxes, many millionaires simply could not maintain their million-dollar mansions). And this approach is more progressive and socially correct. The main question is how to define the boundaries of luxury. What criteria will be used to determine luxury housing? By market value, square footage, location, type of housing? How to determine clear boundaries of real estate subject to increased taxes and the status of housing?

For example, a 2-room apartment of less than 50 m2 in an old building with a high degree of wear and tear, but in the Central Administrative District, costs more than 8 million rubles, and a third or fourth generation family with an income of about 40,000 - 50,000 rubles can live in it. Are they the happy owners of luxury real estate, will they be able to pay increased taxes on it? Are the residents of a communal apartment within the Garden Ring, where the apartment area is more than 200 m2, owners of expensive real estate? What happens to residents who are not “wealthy enough” to pay the full tax increase?

It's no secret that income statements do not always fully reflect the real situation. Will the introduction of this tax lead to the search for further workarounds and hiding their income?

Until the system for calculating this tax, the criteria for determining the status of housing, etc. have not been determined, it is almost impossible to answer the question of how this innovation will affect the real estate market.

But it is certain that the introduction of this tax is unlikely to affect the desire to buy luxury apartments in the Central Administrative District of Moscow worth several million dollars - demand in this segment is inelastic. REAL ESTATE DIGEST | SEPTEMBER 2007 | No. 8 (27) | https://www.dn.ru/

New property tax (luxury tax) - rates, benefits and assessment

Luxury tax on apartments and houses in the Russian Federation in 2020

- The tax is not charged on a vehicle that is wanted.

- Taxation does not apply to cars that have been equipped to transport disabled people.

- The vehicle is registered with an organization directly involved in preparations for the FIFA World Cup, which is scheduled to take place in 2018.

- Payment criteria Parameters that a car must meet in order to be included in the list of vehicles with an increased tax levy:

- make and model of car;

- engine type, its volume;

- the number of years that have passed since the year of issue.

The size of the increasing coefficients The Tax Code provides for the following coefficients: Age of the vehicle up to a year 1-2 2-3 more than 3 years coefficients 1.5 1.3 1.1 1.0 If the cost of the vehicle is 5-10 million and 5 years have passed since the year of manufacture , coefficient - 2.

Expensive houses, apartments, cottages and land plots

As stated in the Tax Code, objects subject to luxury tax also include residential and non-residential real estate of citizens located on municipal territory, namely in large settlements and their environs:

- apartment or room in multi-apartment residential buildings;

- house or cottage;

- a single immovable complex structure;

- unfinished objects;

- a garage with one or more spaces;

- as well as other buildings, premises and extensions;

- summer cottages and buildings located on the territory for conducting subsidiary, agricultural, gardening, and homestead activities also fall into the taxable category.

Only those premises that are in the state register and owned by a collective farm are exempt from paying taxes.

The essence of the luxury real estate tax: nuances and concepts

What falls into the luxury category? The following objects are subject to tax:

- various land plots;

- real estate belonging to both residential and non-residential categories;

- real estate that is under construction.

Since the mentioned real estate has its own market and cadastral value, determined through a professional valuation, various factors influencing the formation of the mentioned amounts should be taken into account. If revaluation is not carried out regularly in accordance with the standards established by law, the property owner risks greatly overpaying in taxes. Based on what has been described, you need to know what cadastral value is and how it can be influenced.

This is a very important point that determines whether luxury tax will be paid in a particular situation.

Categories that are not subject to taxes

There are several points describing those types of luxury property that are exempt from this tax:

- real estate objects owned by the state;

- aircraft and vehicles belonging to the Ministry of Health;

- state awards;

- land plots and real estate that are owned by legal entities and are used directly to conduct the main type of activity;

- any flying, floating vehicles and cars, the owners of which are organizations engaged in cargo or passenger transportation;

- agricultural machinery and related transport registered to farm enterprises used for work and production;

- jewelry, works of art, cars that are wanted. But only if you have a document confirming the theft. Such paper is issued by the relevant authority.

In this case, the tax period is considered to be a calendar year. The cost of the tax at the moment is based on market prices as of January 1, 2020.

Luxury tax payment deadline 2020

For owners of business class apartments of 147 square meters (cadastral valuation 43,000,000 rubles) until 2014, they had to pay a tax of 14,500 rubles. After 2014 - more than 36,000 rubles. Moreover, there are real estate properties for which the tax will increase forty times. Now for such objects the tax is paid in a penny amount. Thus, the owner of a brick house in Krasnodar with an area of 500 square meters now pays a tax of 100 rubles. After 2014, the tax on such a building will be 4,000 rubles, that is, it will increase 40 times. In addition, such a tax will be noticeable for those who bought apartments in new buildings for rent. If the total area of the apartments, for example, is 200 square meters, then the tax will be 29,000 rubles. Tax for preferential categories The tax also provides benefits. Garages 0.1 Construction in progress 0.3 Commercial buildings 2 Administrative buildings 2 Changes in the tax program in 2020 Previously, as a result of the purchase of a two-room housing in the city on the central lands, a resident paid 500 rubles to the budget. tax, upon completion of the new reform, the tax amount will increase to 5 thousand rubles. annually (even more). The basis of taxation will be the cadastral value (and not the inventory value), which can bring real estate as close as possible to its market price. Dimensional parameters of the tax amount are 0.1-2% of the cadastral valuation.

This taxation is not uniform for owners of different real estate options; it will be updated over a period of 5 years, taking into account research by independent experts.

One percent of the market

“Transactions on objects whose value exceeds 300 million rubles are rare on the St. Petersburg market - less than 1% of the total. On average, about 10 such transactions are made per year. Almost always we are talking about purchasing real estate in the area of Kamenny or Krestovsky Islands,” says General Director Peter Voichinsky.

“A deluxe object can be on display for a year or more, often the buyer remains incognito. As a rule, these are view and attic apartments with spacious terraces. The infrastructure of the apartment may include a personal elevator, winter garden, swimming pool, parking in the apartment and much more. Such objects with an area of more than 300 m2 are located mainly on Krestovsky, Kamenny Islands or in the Central District. Often, owners buy the entire floor for their own needs. The maximum cost of such housing on the market is 600 thousand rubles per 1 m2 in penthouses and attic apartments, the upper limit in certain exclusive projects is 700 thousand rubles per 1 m2,” notes Oksana Kravtsova, General Director of the Eurostroy Group of Companies (developer of an elite real estate).

ST Dupont CEO Alan Krewe: I'm not worried about the fate of the luxury market Interview

Luxury real estate tax in 2020

In such a situation, the profit of people engaged in this type of activity will be reduced to a minimum. Owners of suburban real estate will be in a more advantageous position - 20 square meters, which are not subject to tax, will be deducted from the total total real estate area. If the area of the property is identical (or less) to the preferential square footage, its owners are not subject to taxation.

Coefficients in force in Moscow Real estate Tax rate Housing with a cadastral value of less than 10 million rubles. 0.1 Housing with a cadastral value of 10-20 million rubles. 0.15 Housing with a cadastral value of 20-50 million rubles. 0.2 Housing with a cadastral value of 50-300 million rubles. 0.3 Housing with a cadastral value of over 300 million rubles.

Results of this tax program

Changes in real estate taxation will affect a large number of people. The real price (market value) of a real estate property in a certain region comes to the fore. For example, the price per square meter in Moscow is 170 thousand rubles, in other cities of the Russian Federation it varies from 35-40 thousand rubles. Consequently, an ordinary apartment in Moscow will cost at least 9 million rubles; it will be able to move into the category of “luxury housing” in the region.

Innovations in the field of taxation concern residential properties, commercial real estate, including unfinished objects, land, and buildings. The calculation scheme is quite simple, individual for a certain type of housing.

But this tax program does not take into account the following:

- People living in the capital and various large cities of the Russian Federation will be required to pay higher for their real estate than the rest of the population living in the periphery. For example, the tax amount for Moscow residents will be 5-6 times higher than for people living in the neighboring region.

This tax is also not pleasant for those who prefer to invest money in purchasing housing in new buildings for their further rental. If the sum of the entire property area (in square meters) is greater than the established norm, then, consequently, tax payments will increase. In such a situation, the profit of people engaged in this type of activity will be reduced to a minimum.

Owners of suburban real estate will be in a more advantageous position - 20 square meters, which are not subject to tax, will be deducted from the total total real estate area. If the area of the property is identical (or less) to the preferential square footage, its owners are not subject to taxation.

Property tax for individuals in 2020-2020

To find out the exact list of beneficiaries and objects for which benefits can be obtained, you should contact the Federal Tax Service at the location of the property. Submit an application for exemption from tax calculation, and indicate in the application information about the property for which you are applying for a benefit. The right to it can be confirmed by relevant documents.

The changes directly affected real estate owned by citizens. Filling the treasury by increasing the tax burden is an extremely unpopular measure, but the government accepted it. Since 2020, the basis for calculating property tax has been the cadastral value, which is often significantly higher than the previously used inventory value.