Where to go to review the cadastral value

In such a situation, after receiving a decision to revise the cadastral value, the taxpayer could submit an updated declaration to the tax authority and recalculate the land tax from 01/01/2017. The cadastral value changed by the commission or court is taken into account when determining the tax base, starting from the date of commencement of application of the cadastral value for tax purposes (the date of mass valuation). In this case, information about the changed value must be entered into the Unified State Register of Real Estate (USRN).

As follows from the conclusions of the Russian Ministry of Economic Development and the Russian Ministry of Construction, the inventory value of real estate can currently be calculated exclusively for purposes not related to taxation.

Federal Law of July 24, 2007 N 221-FZ “On the State Real Estate Cadastre”, carrying out a technical inventory of housing assets is not mandatory and is carried out at the request of the owner of the housing asset.

If you do not express such a desire, then you will be notified of the results in the method you choose. Also, the result of the commission's decision will be communicated to local authorities.

In which court will the dispute regarding the inventory value be heard, and in which - according to the cadastral value?

Our articles talk about typical ways to resolve legal issues, but each case is unique.

On imposing the obligation on the Interregional Inspectorate of the Federal Tax Service of the Russian Federation No. 4 for the Vologda Region not to charge V………oi E.F. penalties for late payment of property taxes for 2020.

The defendant referred to the fact that the plaintiff missed the statute of limitations, since the plaintiff should have known about the inventory value of the objects from the moment the tax inspectorate sent him a tax notice in which such value was indicated, that is, from 2011.

Based on the court decision, appropriate changes were made to the Unified State Register in January 2020. The cost is determined as of 01/01/2015.

Is it possible to challenge the data on the inventory value for 2013 now in 2020 (since the tax for 2020 was still calculated on the basis of inv.

Previously, she could have submitted information from the appraiser’s report to the technical accounting authority and asked them to either conduct a new technical inventory, or, based on the report, enter amended information to the tax authority. According to the previously existing procedure, the technical inventory authority would have transferred the changed information to the tax authority, and the tax would have been recalculated.

You write that the inventory value is growing, but at the same time you indicate that it is growing due to the tax rate.

It is indicated as of the day the cost is determined in the certificate of inventory value and in the technical passport for the object. This type of cost includes all construction costs, but does not take into account the cost of land and some other factors.

If an application is submitted by an individual: surname, first name, patronymic and address of residence, insurance number of an individual personal account (if available).

Currently, both of these objects have been removed from the cadastral register due to their absence: the flax dryer building - March 9, 2017, the hay barn building - March 13, 2020. As of January 1, 2015, these two buildings no longer existed.

If an application is submitted by an individual: surname, first name, patronymic and address of residence, insurance number of an individual personal account (if available).

In addition, a report was simultaneously ordered from the appraiser to determine the cadastral value for 2020, because The cadastral value is also inflated for some objects.

And yet, taking into account possible misunderstandings, a special procedure for submitting documents was developed, on the basis of which it is possible to reconsider the case anew, taking into account new circumstances that have emerged.

Why is a revision of the cadastral value necessary?

If there is no information on the inventory value of real estate as of the requested date, then the market, cadastral or other (nominal) value of the specified property may be used at the payer’s choice to calculate the amount of the state duty (notary tariff). Also, at present, the current legislation does not establish a body authorized to verify the accuracy of the previously established inventory value of property. In this regard, such value of the property may be challenged in court.

The new rules for applying the cadastral value established by a decision of a commission or court are certainly more attractive and now provide taxpayers with a larger time interval to decide whether to challenge it in order to determine the taxable base.

The accounting procedure stipulates that state technical accounting of the housing stock is entrusted to specialized state and municipal technical inventory organizations - unitary enterprises, services, departments, centers, bureaus.

When challenging the inventory value of a building, individual premises or other object, independent experts who have the right to carry out such activities are also involved. Based on the results of the examination, appropriate documentation is drawn up and attached to the court case.

When contacting the Bureau of Technical Inventory, you will need to fill out an application according to the sample, present your personal passport and documents certifying ownership of the object of interest. Next, the BTI has the right to make a request to the state archive, where all information is stored.

The form is intended solely for reporting incorrect information on the website of the Federal Tax Service of Russia and does not imply feedback. The information is sent to the editor of the website of the Federal Tax Service of Russia for information.

Please do not answer anyhow, speed is not important to me, but really practical advice would be very useful! And an example, perhaps, of some kind from judicial practice. Were there similar proceedings (OF COURSE THERE WERE), but with a positive outcome for the plaintiff.

Control over the implementation of this decision is entrusted to the Committee of the Tambov City Duma of the sixth convocation on socio-economic development and budget (A.V. Rybas).7.

How to file an administrative claim to challenge the cadastral value in 2020

Denisov S.K. applied to the court with the said application, citing the fact that on October 13, 2012, he received from the Federal Tax Service of Russia for the Sovetsky district of Voronezh tax notice No. on the payment of property tax for 2011 on the value of a residential building owned by him , located at: .

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

The applicant has the right to attend a meeting on his issue; he must be informed about the date in advance. To do this, when submitting an application, he must notify the commission of his desire to attend the meeting.

If you enter the cadastral number of the desired property (you can see it in the certificate of ownership) or the address in the search form and click the “Generate request” button, the desired property will be found in the database and available data sources will be shown.

A notarized copy of the title document for the property, if the application for revision of the cadastral value is submitted by the person who has the right to the property (name, details, number of sheets).

Inventory cost is too high. As a rule, it should be less than the market price of the property. The only exceptions are objects in new buildings.

The owner of a real estate property, a municipal housing tenant or a tenant who has entered into an official contract with the owner and has a notarized power of attorney has the right to request it. Despite the fact that today there has been a complete transition of the taxation system to cadastral valuation, in some cases, if we are talking about real estate that was privatized in the early nineties, the inventory value is important for determining the tax. This is due to the fact that such real estate often does not have a cadastral number.

Documents for challenging the cadastral value

A statement of claim to challenge the cadastral value of an Ekaterinburg property must be accompanied by a package of documents:

- a document certifying payment of the fee to the budget, which for a private person is 300 rubles, and for a legal entity – 2,000 rubles;

- copies of documents on ownership or lease;

- report or a copy thereof from the appraiser;

- an extract from the registration authority;

- other documents that are necessary for this case.

How to write an application to the commission to challenge the cadastral value of a plot of land, building or real estate - general requirements for the document

An application to the commission to challenge the cadastral value of real estate or a statement of claim to the court is drawn up according to the same rules.

A ready-made application form to the dispute resolution commission to review the results of determining the cadastral value of real estate can be downloaded for free here in WORD format

Document requirements:

- The application is written on an A4 sheet. It can be typed or handwritten.

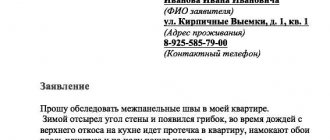

- A “header” is formed in the right corner of the sheet. It must contain the details of the body to which the citizen is applying, as well as his personal information - initials, address and contact details.

- Next, the title of the document should be indicated. If you apply to the commission, then simply write the word “Application”. If the claim is filed in court, then the title is written as follows: “Statement of claim for review of the results of determining the cadastral value of real estate.”

- Then the main part of the appeal will begin. It should disclose the meaning of your application, for what reasons you are applying to the authority, what object will be discussed (all information about the object is written down), whether you are the owner of the property or rent it.

- Information about the cadastral value of a property should not be taken out of thin air; it should be extracted from documents issued by Rosreestr. Documents must be new!

- Requirements must be made at the end of the application.

You can list them in a list. The applicant may ask the commission to re-evaluate or challenge the commission's decision. - A list of documents and applications, including calculation of the cadastral value (if any), is also drawn up at the end of the application.

- The application must be signed and dated when you submit it to the authority.

You must sign with a pen, and the date can be printed.

How and when the cadastral value of an apartment can change - the procedure for challenging the cadastral value of real estate

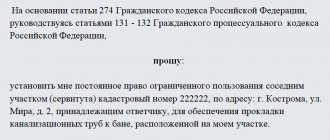

The statement of claim is drawn up with the requirements described in Article 131 of the Code of Civil Procedure of the Russian Federation.

The documents that will be submitted along with the claim are prepared in accordance with Article 132 of the Code of Civil Procedure of the Russian Federation.

Normative base

The problem with the controversial cadastral value is resolved on the basis of:

- CAS RF (Code of Administrative Proceedings);

- Land Code (Land Code of the Russian Federation);

- Federal Law-237, adopted on July 3, 2020 (came into force in January 2017);

- Cabinet Resolution No. 316 concerning rules for land valuation;

- Resolutions of the Plenum of the Armed Forces of the Russian Federation dated 09.2016 No. 36 and 28 (developed on 06.30.2015).

- Resolution of the Presidium of the Supreme Arbitration Court, issued on 06.2011 (relates to case No. A27-4849/2010).

These are the main laws and acts that provide for the possibility of appealing against an inflated cadastral value.

What information will be required for the main part of the claim?

The main section of the statement of claim causes the most controversy and difficulty.

When it comes to challenging the cadastral value, you have to take into account many different documents, consider a certain situation from the point of view of the law, etc.

Therefore, it can consist of various blocks. But the basic information is still universal:

- on the basis of what rights does the administrative plaintiff own the land plot (ownership, lease, inherited possession, etc.);

- report the area of the territory in square meters or other suitable units of measurement;

- indicate the exact address of the location of the plot whose value you will dispute, as well as its cadastral number;

- what documents confirm the rights of the administrative applicant to this territory (certificate of title, power of attorney, etc.);

- indicate the certificate number or other details of the above documents, as well as the date of their issue;

- provide an extract from the unified real estate register and other information about the land and its owner;

- if you applied to a special commission before the trial, report the results of such an appeal and refer to the relevant papers;

- Another high-quality sample application to challenge the cadastral value must contain data on the state assessment of the land.

The last document is issued on a certain date. It must be registered with the Ministry of Ecology and Natural Resources, or with another government agency, which will depend on the region where the site is located.

Application for revision of the results of determining the cadastral value

If previously such a tax was calculated based on the inventory value of real estate, the new procedure provides for its calculation based on the cadastral value, which is usually as close as possible to the market price.

Before challenging the cadastral value, you need to find out how much your property was valued at.

For example, an application to the commission to revise the cadastral value of a land plot was submitted in September 2020. The negative decision of the commission had to be appealed in court. The court decision came into force in March 2020. At the same time, the market value was established as of 01/01/2015 (the date of determination of the cadastral value).

For the report, the parameters of the cadastral and inventory assessment of the object under study will be used. Based on the results of the assessment, the owner will receive a conclusion that can be used as evidence in court. If the value obtained as a result of the assessment turns out to be lower than the inventory value, it will be possible to challenge the inflated price level in court.

In a couple of years, the authorities want to make the cadastral value the reference point for calculating property taxes. According to calculations by the Federal Tax Service (FTS), fees in this case will increase more than five times. Market experts note that the changes will most significantly affect owners of luxury real estate. But first things first.

Taking into account all the above factors and nuances, the property inventory process will not cause you intractable difficulties that may hinder the successful completion of the process.

Report on the market value of the declared property (number of sheets) (original), in the form of an electronic document.

How to reduce the cadastral value of a land plot

Art. 66 of the Land Code states that the cadastral value of land is determined based on the market price, and the valuation process itself is similar in methodology to the market valuation of real estate.

The main provisions that are worth referring to are chap. 3.1 Federal Law of the Russian Federation No. 135.

Cadastral valuation is carried out by decision of the executive authorities in the constituent entities of the Russian Federation and by decision of the local government.

The authorities approve the list of objects that must be assessed, and after the procedure, the result is approved and published in accordance with legal requirements.

If the result affects the rights of citizens or legal entities, they can submit requests to obtain data on the cadastral value.

You can also appeal the result of the revaluation to the commission. The commission may recognize the complaint as unfounded and send the data to the Cadastral Chamber of Rosreestr of Russia.

The following persons have the right to challenge the cadastral value:

- property owner;

- tenant;

- a person who has the right to privatize a land plot.

Representatives of government authorities also have such a right in relation to property that is municipal or state property.

To challenge, it is not necessary to contact the commission. You can also go to court (Article 24.18 of the Law on Valuation Activities).

Grounds for applying to the commission and court:

| Property data | What was taken into account when determining the cadastral value is unreliable |

| Market price determined | At the time when cadastral indicators were determined |

What documents may be needed

To challenge the assessment result in the commission, you should submit an application and attach a number of certificates:

| Sample cadastral certificate about the cadastral price of land | Which contains data about the disputed result |

| Title and title documents for the object | (photocopies certified by a notary), if the application is submitted by a citizen who owns the land |

| Papers about the unreliability of real estate data | What were used to establish the cadastral value if the application is submitted based on unreliable data |

| A report showing the market price (in paper or electronic format) | If the application is submitted when the market price is established |

| Positive expert opinions | In paper or electronic version |

| Other certificates | — |

If a claim is filed, additionally submit:

- a notice confirming delivery (or other certificates) of a copy of the claim to the parties to the dispute;

- receipt of payment of state duty;

- a copy of the power of attorney, which gives powers to the representative administrative plaintiff;

- certificates that will confirm the pre-trial settlement of disputes.

An application submitted without the appropriate certificates will not be considered in court, and the commission will not accept it at all.

How to make an application

The application can be drawn up in free form.

But you need to enter the following data in it:

- Full name of the applicant;

- place of residence;

- contacts;

- E-mail address;

- SNILS.

If the application is submitted by a representative of the organization, then indicate:

- company name;

- OGRN;

- actual and legal address;

- contacts, fax;

- Full name of the copyright holder.

Next, the request for revision of the cadastral value and the corresponding grounds are stated. It is necessary to indicate the cadastral number of the plot and its location.

In what year the privatization of apartments began, see the article: until what year can an apartment be privatized? Read the procedure for purchasing an apartment with an encumbrance here.

A sample application is available. The application can be submitted by the applicant himself. It is also possible to send it by registered mail with a list of attachments.

Step by step procedure

Pre-trial settlement of a dispute involves contacting a commission. To do this you need to adhere to the following order:

- The Rosreestr office receives a certificate of the assessment result, which must be contested. No need to pay.

- Take a cadastral passport from the Cadastral Chamber.

- Go to a notary office employee to certify copies of certificates.

- Contact the appraiser for a report on establishing the cadastral value.

- Obtain a conclusion that the report complies with legal requirements.

- Write a request to have the price revised.

The application will be reviewed within 1 month. Within a week, a representative of the commission will send a notification about when the application will be considered. After the decision is made, the applicant will be notified about it within 5 days.

Members of the commission:

- employees of the executive authorities of a constituent entity of the Russian Federation;

- specialists who carry out state cadastral valuation;

- employees of the federal executive body;

- representative of the business community, a self-regulatory company of appraisers.

The commission's decision may be challenged in a judicial body. Individuals may not contact the commission, but immediately file a claim.

A statement of claim to reduce the cadastral value of a land plot to the court is drawn up in accordance with the requirements of Art. 245-250 Civil Procedure Code.

Interested parties will be:

- UFS of state registration, cadastre and cartography;

- subject government;

- administrative body.

Challenging the results in arbitration courts is carried out within 3 months after the applicant learned of the violation of his rights.

The appraiser's report and the SRO's conclusion are submitted along with the application. Otherwise, the court will have no basis for establishing the cadastral value.

If the report contains a value that is 30% lower than the cadastral value, a forensic examination will be carried out to determine the market indicator.

Can a positive court decision be made to reduce the cadastral value of a land plot?

Video: reducing the cadastral value of a land plot

If the judge agrees with your evidence that the cadastral value is overstated, then you will pay the reduced tax for the tax period when the claim was filed.

There is meaning in the proceedings if the amount is approximately 50 million rubles, and, in your opinion, it is twice as high.

So you can expect that the cost of the court will be recouped in several years of tax savings.

When considering the issue of reducing the cadastral value, it is worth relying on the provisions of Chapter. 25 CAS of Russia.

You can appeal not only the assessment result, but also the commission’s decision if the applicant first applied there.

Administrative plaintiffs may make the following claims:

- establish market value indicators for real estate;

- change the cadastral value, since there is unreliable data about the objects of assessment that were used to establish the value;

- challenge the decision or action (inaction) of the Rosreestr commission.

Other claims cannot be considered together with challenging the cadastral value, since they are within the competence of other judicial bodies.

If the land owner decides to return the overpaid tax, it is worth obtaining a court decision, and only then filing a claim to recover the amount paid.

The first instance when considering such disputes is the supreme court of the republic, the regional, regional court, the court of the city, the autonomous region (clause 15 of article 20 of the CAS of Russia).

The defendants are representatives of Rosreestr and the authority that approved the disputed result of the assessment of cadastral cost indicators.

The law established a time frame for going to court - within 5 years after the state cadastre entered the disputed results.

Although if, when going to court, the cadastral value is changed, then challenging the previous one is no longer allowed (clause 3 of Article 245 of the CAS of Russia). Applications are reviewed within 2-3 months.

If, as a result of the consideration of the case, the judge satisfies the requirements, then the cadastral value of the land should be reflected in the operative parts of such decisions.

It will be a new indicator to be reflected in the state cadastre. Decisions made can be appealed within a month.

Service cost

Costs that await you when the cadastral value is reduced:

| The amount of state duty when receiving documents and cadastral passports | 600 rubles |

| Appraiser services | 80 thousand |

| Conclusion of the SRO | 20 thousand |

| Carrying out a forensic examination will cost | At 80 thousand |

| Lawyer services | 70 thousand |

| The amount of state duty when applying to a judicial authority | 6 thousand |

| Transport costs | 400 rubles or more |

The judge may award costs to the defendants, but those amounts must still be paid to you first. And it’s not so often that the court is ready to recover the lawyer’s costs in full.