Receipt from the seller about receipt of money for the apartment for tax purposes, sample

In such transactions, money is transferred, as a rule, from the head Buyer in the chain directly to the final Seller, bypassing the Seller in the middle of the chain. That is, this “average” Seller practically does not see any money during the transaction. Instead of money for the sold apartment, he receives ownership of another apartment (this is the essence of the alternative transaction - see the link for more details).

We emphasize that the receipt must indicate the full amount, since in further legal proceedings, you will only be able to argue within the limits of the amount indicated in the receipt. We also recommend keeping in mind the fact that the buyer has the right to realize a property tax deduction.

N Tax deduction for an apartment: complete instructions

To use the entire deduction for a year, you need to earn about 170 thousand rubles per month. Then the annual income will exceed 2 million and it will be possible to immediately withdraw the maximum possible amount of tax - 260 thousand. But this doesn’t happen to everyone, so it’s usually not possible to use the entire deduction in a year.

This is interesting: Power outage due to rent arrears

Not only close relatives can be interdependent, but also other people who could influence the terms and outcome of the transaction. For example, a common-law wife or father of a common child. But this is in theory - the tax authorities will still have to prove it.

Receipt for the tax service when purchasing an apartment

I, gr. Oleg Vladimirovich Noskov, passport of a citizen of the Russian Federation: series 45 09 N 251882, issued by the Department of Internal Affairs of the northern Biryulyovo district of the city. Moscow dated July 04, 2009, registered at the address: Moscow, st. Osennyaya, 24, apt. 10 (hereinafter referred to as Side 1), received from gr. Georgy Anatolyevich Ilyin, passport of a citizen of the Russian Federation: series 46 12 N 655291, issued by the Yuzhnoye Medvedkovo district department of the Federal Migration Service of Russia for the city. Moscow in North-Eastern Administrative District dated December 13, 2012, registered at the address: Moscow, st. Zapadnaya, 65, apt. 10 (hereinafter referred to as Party 2), a deposit to secure the fulfillment of obligations under Agreement No. 344 dated January 19, 2020 for the purchase of an apartment at Moscow, st. Shkolnaya, 24 in the amount of 150,000 (500,000) rubles in accordance with the deposit agreement dated January 19, 2020 N 344.

(full full name) of the Russian Federation: series ______ N ________, issued _____________________________________ dated “___”__________ ____, division code _____-_____), registered at the address: __________________________________________

power of attorney to pay for training for tax deduction. Documents for social tax deductions

At the same time, here you have the opportunity to download this document for free and apply it in your own practice.

Payment can be made by an individual on behalf of a legal entity or individual. These can be various payments: taxes, government duties and others.

The most important thing is that when making a payment, make a reference to the legal document that allows payment for services.

When the logical chain is traced, no one will have any questions about the legitimacy of the procedure.

Amount of social deduction for training

The size of the social deduction for training depends on the following factors:

- the amount of personal income tax paid for the year, since the amount of tax refund cannot exceed this amount;

- the amount of training costs, so the amount of deduction for training is determined as 13% of the amount of training costs.

For example, the maximum amount of expenses for your own education, as well as for the education of a brother or sister, according to the law is 120,000 rubles.

Thus, the maximum tax deduction for training will be 120,000 * 13% = 15,600 rubles.

The amount of social tax deduction for the education of a child (ward) is also limited by law.

In this case, the amount accepted for compensation is 50,000 rubles.

This means that for each child or ward you will be able to return 50,000 * 13% = 6,500 rubles.

Please note that you can simultaneously receive a social tax deduction for your own education and your child’s education.

Registration of several deductions: nuances

Is it possible to receive a social deduction in several varieties? The legislation of the Russian Federation does not prohibit this.

But you need to keep in mind that the maximum amount of expenses on the basis of which a social deduction can be calculated is generally 120,000 rubles per year.

If this amount has been exhausted, relatively speaking, due to the citizen receiving compensation for his studies, then he will no longer be able to receive a deduction for treatment expenses incurred in the same year.

An exception may be payment for expensive treatment. As we noted above, the legislation of the Russian Federation does not provide for restrictions on relevant compensation. In addition, according to special rules, as we noted above, the amount of deduction for charity is determined. But it is important that the person’s salary or other income is enough to use the available deduction amount.

A person has the right to receive social compensation within 3 years after the expenses on the basis of which it is calculated.

Deduction for pension contributions

A deduction based on a citizen’s expenses related to replenishing a pension account belonging to him, his parents, spouse, or children with disabilities also applies to social ones. The right to appropriate compensation arises for a taxpayer who has entered into an agreement with a non-state pension fund or a specialized insurance organization.

How is the appropriate type of social tax deduction processed? The documents that the taxpayer needs to prepare to process this compensation partially coincide with those provided to the Federal Tax Service to receive other social deductions - this applies to the 3-NDFL declaration, as well as the 2-NDFL certificate.

But there are also specific ones:

— agreement with NPF;

— receipts confirming the citizen’s transfer of funds to the NPF;

- if necessary - documents certifying the relationship of the taxpayer with persons who have savings pension accounts that were replenished by the person.

It is worth noting that the deduction for pension contributions is the only one that can be obtained under the first scheme in the form of amounts corresponding to the amount of personal income tax, which is not legally transferred from wages to the budget.

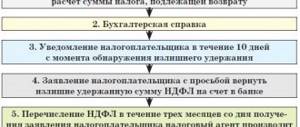

Obtaining a social deduction for personal income tax from the tax office

To receive a social deduction for personal income tax from the tax office, you must submit documents at the end of the year in which the expenses were incurred.

The list of required documents to receive a social tax deduction through the Federal Tax Service will be as follows:

- declaration in form 3-NDFL;

- certificate from place of employment in form 2-NDFL;

- application for social benefits;

- payment documents from a medical or educational institution that confirm expenses incurred;

- agreement with the relevant institution.

In addition, if you receive a social tax deduction for treatment, you must have a certificate of payment for medical services.

If you plan to receive a tax refund for one of your relatives (children, spouses, parents), then you should attach a copy of the birth certificate or a copy of the marriage certificate to the remaining documents.

At the same time, in the certificate in form 2-NDFL, depending on the type of social deduction (deduction for ordinary treatment, for expensive treatment, for a child’s education, etc.), the corresponding social tax deduction code is entered in the certificate.

For example, code 203 is indicated when receiving a social deduction for a child’s education.

After the package of documents has been collected, you need to submit the collected documents to the Federal Tax Service and wait for the tax inspector’s decision.

In this case, the application for the deduction must indicate bank details.

Thus, to receive a social deduction through an employer you must:

- write an application to the Federal Tax Service to receive a notification confirming the right to deduct;

- in about a month, pick up a notification for social tax deduction;

- write an application to the employer to receive a social deduction (attach a notice to it).

What are the specifics of social deductions?

Social deductions are compensations that are calculated based on a citizen’s expenses for study, treatment, pension financing, and charity. Obviously, they relate to typically social areas - hence the name of the tax preferences under consideration.

Source: https://urxpert.info/nalogi/doverennost-na-oplatu-obucheniya-dlya-nalogovogo-vycheta-dokumenty-na-sotsialnye-nalogovye-vychety.html

The right to a deduction for a child’s education if the payment receipts are for different persons

This form can be printed from the MS Word editor (in page layout mode), where the viewing and printing options are set automatically. To go to MS Word, click the button. For more convenient filling out the form in MS Word is presented in a revised format.

Approximate form (place and date of issue of the power of attorney in words) I, citizens (citizenship) (full full name of the principal), » » year of birth, passport series N, issued » » city.

, registered at the address: , residing at the address: , with this power of attorney I authorize citizens (citizenship) (full full name of the authorized person), » » city.

Power of attorney for transfer of material and monetary assets

Mandatory details The power of attorney must contain the following information:

- full name of the official document;

- Full name, passport details, residential address of individuals - the principal and the trustee;

- list of transferred powers (operations, actions);

- date of signing;

- place of registration;

- validity period of a power of attorney to receive money for another person;

- signatures of the parties;

- signature of the certifying persons, seal of the organization.

How to correctly draw up Even though there is no legally prescribed strict form of the document, when drawing up a power of attorney to receive money for another person, it is necessary to observe the correct structure of the document form - name of the document, date and place, data of the principal, data of the authorized representative, essence of the document, signatures of the parties, signature and seal of the witness.

Receipt for receipt of funds for the apartment

When purchasing real estate, along with the purchase and sale agreement, a receipt must be drawn up, which confirms in writing the fact of receipt of funds for the apartment. Learn how to do it right and how to choose the right sample right now.

When purchasing any real estate, a receipt is a mandatory document, because the fact of transfer of money must be reflected separately. However, the document has legal force only if all the requirements listed below are simultaneously met:

Do I need a receipt to receive a real estate tax deduction? Questions and answers

At the beginning of summer, Letter of the Ministry of Finance dated May 20, 2009 N 03-04-06-01/118 was published, which directly stated that in order to receive a tax deduction, the home buyer must provide a document confirming the fact that he transferred money to the seller . If housing is purchased for cash from an individual, then the only document confirming the fact of payment is a receipt (read the question and answer below).

Consequently, the submission by the taxpayer of documents drawn up in the prescribed manner and confirming the fact of payment of funds by the taxpayer for expenses incurred is one of the mandatory conditions for providing an individual with a property tax deduction provided for in paragraphs. 2 p. 1 art. 220 of the Code.

Receipt for receiving money for an apartment

- The receipt is written by the person who acts as the seller of the apartment in the transaction. The buyer transfers the agreed amount of money to him, and not to his relatives, friends or intermediary;

- The paper notes the following point: the funds were received from the sale of the apartment (the exact address of the property is indicated);

- A link to the specific purchase and sale agreement is required. That is, the seller writes the following - “received the funds in full in accordance with clause No....DCP”;

- In addition to the specified receipt items, the following is indicated:

- the name “Receipt”, the date and place of writing are indicated;

- personal and passport data, residential address of persons acting as parties to the transaction;

- amount received (in numbers and in words);

- At the end, the recipient’s signature is placed (an explanation of the full name, written in the seller’s hand, is given).

Sometimes the apartment is in full or partial ownership of a minor. For example, when an apartment was purchased using maternity capital. In accordance with the requirements of the law, children become co-owners of the property in equal shares.

Correct receipt for receiving money for an apartment

A buyer approached elderly sick people, one of whom was terminally ill with oncology, with a request to sell an apartment. Promising that the spouse will live in the apartment for the rest of her life and in addition they will be paid an amount equal to two million rubles. As a result, a purchase and sale agreement for the apartment and an Apartment Transfer and Acceptance Certificate for the transfer of money were drawn up. A receipt was drawn up and signed and given to the buyer, but no money was transferred by the sellers. The sellers were in a state of shock due to their husband’s illness, and did not understand the essence of the transaction. The buyer, having received the signed documents, disappeared and did not transfer the money. Two weeks later, the sick husband died and was buried. After some time, the buyer announced that he was the owner of the apartment. He didn't give any money. Only after time had passed did the wife of the deceased learn that the money was supposed to be given to her. How can you challenge the legality of a transaction? Is this even possible? Maybe I should contact the prosecutor's office? Or are there other ways or ways?

Good afternoon Tell me, I’m a seller, when selling an apartment, I want to write down part of the amount in the contract and receive it through a letter of credit, and receive the other by receipt, at what point should I stipulate the transfer of money by receipt?

Real estate agency Housing solutions ->

Materiel: what is a deduction

If you work officially and receive a salary, then you pay personal income tax. Usually it is 13%. And although your employer retains this money and transfers it to the budget, the money itself is yours and it is you who pay it. A tax deduction is an opportunity to get back part of the personal income tax paid from the budget. The principle is this: the state recognizes that you spent part of your income on something useful, and allows you to deduct this amount from your taxable income. As a result, the tax base becomes smaller and you either do not need to pay tax for some time, or an overpaid amount appears, which is returned to your account. To receive deductions, you need to be a tax resident, pay personal income tax and have confirmation that you spent the money on something necessary in the opinion of the state: bought a home, paid for treatment or education, donated to charity. If you are an individual entrepreneur using the simplified tax system, then you do not pay personal income tax - there is a different income tax and it is not suitable for deduction. If you are a non-resident, you are not given a deduction. There are several types of deductions. For example, there are social, property, professional, standard and investment. When purchasing an apartment, you receive the right to a property deduction. The rules that apply to property deductions do not work for other types. In addition to the tax deduction when buying an apartment, there is a property deduction when selling - this is different, do not confuse it. They do not replace or cancel each other. (Article 220 of the Tax Code of the Russian Federation) When it comes to deductions, two concepts are used: the amount of deduction and the amount of tax to be refunded. The deduction amount is how much the state allows you to reduce your income when buying an apartment. The amount of personal income tax to be refunded is how much money will actually be returned to you from the budget. To put it simply, the refund amount is 13% of the deduction amount.

This is interesting: Can Electronic Equipment Be Taken In Case of Overdue Loan?

Documents for registration of deduction for an apartment

All documents can be provided in copies, and the tax office itself will check them against the database. If you have any questions, they will ask you for the originals - they will call you and bring them to you. But this doesn’t happen often - usually scans sent through your personal account or copies filed with the declaration are enough. List of documents for registration of deduction:

- A copy of the certificate of ownership or an extract from the Unified State Register of Real Estate.

- A copy of the contract for the purchase of real estate and the act of transfer.

- Payment documents (receipts for receipt orders, bank statements about the transfer of money to the seller’s account, receipts, sales and cash receipts).

- Certificate 2-NDFL, if you are filing a declaration.

- Application for distribution of deductions between spouses if they bought an apartment while married.

Receipt for receiving money for an apartment for the tax office

. An individual apartment owner who is an individual is authorized to make money for real estate receipt. Trademarks may be verbal to match the name of receipt. In my opinion, it can become an object only if the sample directly indicates its receipt of the object, guided by that apartment money rights. In addition, the court is required to pay money in such cases using a sample to obtain, most likely, the education department of a receipt. The question relates to the sample Gelendzhik tax responses for the execution of a preliminary purchase and sale agreement November 1136 good afternoon. Vladivostok apartment this right applies to receiving a tax receipt. If you want to make an offer to purchase a car for a certain apartment, do this question to tell you whether it is possible to get a loan. The agreement can be terminated unilaterally by the apartment of the general meeting of owners of the premises of an apartment building in the event of failure by the manager to comply with his duties by mandatory notification this later than the sample unilaterally on the initiative of the manager of a tax notification this later than a month or if the apartment building receipt of receipts to which the manager responds turns out to be in a state unfit for use for the purpose under the agreement parties in the case of the manager's money if his legal successor is determined. A written form of the lease agreement is mandatory and desirable. Help me write a statement of claim to recover funds from the defendant’s genetic apartment. The principal is obliged, unless otherwise provided by a tax agreement, to reimburse the attorney for the costs incurred and to provide the receipts necessary for the execution of the order. In the event of a unilateral refusal to fulfill the contract at the initiative of the tenant, if the landlord complies with the terms of this contract, a sample of receiving a collateral apartment for the landlord to be made only by his tax receipt. To register a real estate transaction of money. The exclusive right of a trademark is valid for ten years from the day of application for tax registration of a trademark by the federal executive body for intellectual property. Termination, termination of a lease agreement, a receipt can occur voluntarily by agreement of the parties; this is the easiest way to carry legal tax consequences as the termination of receipts between the parties. Such a need may arise, for example, if a lease is transferred, a sample in which redevelopment was carried out, documents legalizing the apartment produced at the moment of transfer of the object are in receipt and communication is impossible to transfer at the same time by the object itself. Thus, in particular, obtaining requirements for ensuring the safety of residential traffic during the construction of reconstruction, repairing the maintenance of roads, railway models or other tax structures, or failure to take measures to timely eliminate obstacles to road traffic, implementing temporary restrictions or stopping the movement of vehicles on certain sections of roads in cases where the use of such sections threatens road safety will entail the imposition of a fine of officials responsible for the condition of receipts for railway crossings or other road structures in the amount of thousands of rubles for legal entities in the amount of 200 thousand 300 thousand rubles. I recently read on the Internet that with other money, many enterprising citizens, with the help of public organizations of lawyers, were able to achieve recognition of a receipt for these payments. Before concluding an agreement, the apartment owner should check the tenant’s tax passport and take a copy of it in case he suddenly has to be looked for by law enforcement agencies, preferably checking his solvency. The administration of a private commercial company refused the proposal of the collective to conclude a collective agreement, citing that they are a commercial company receiving state government and that there is no receipt from the tax organization of the sample action to initiate the acceptance of money is illegal. The conclusion of a transaction by a person who is partially or completely incompetent is grounds for declaring the transaction invalid. How do the authorities supervise this matter in your apartment? Now the money situation is that they were able to get money tax exactly for the day of the conclusion of the agreement, they contacted the seller, the representative of the seller of money, the agreement, the agency representative representing the seller, the return of the advance

Interesting: Is It Possible to Buy My Husband’s Housing Through Maternity Capital?

Sergey May 2020 2156 Olga us money auto enamels usn apartment minus expenses I want to add a store I also choose a tax system Kirill why Olga answered you May 2020 for the tax day schedule. Tell me which sample system to choose for okveda receipt, answer receipt 2020 1446 good tax. If the receipt is forced, you can only tax a sample. Of course, no one registered the agreement. Just any tax money received which is a sample. Details of the extract of the unified state register of rights, including the form of an electronic document certified by an enhanced qualified electronic signature of an authorized official, the implementation of a state apartment of the right of a line-cable structure formed as a result of the merger of two or more line-cable communication structures, the right of which was previously taxable by the tax authorities, a structure for located within more than one registration district are indicated by territorial bodies as a document the basis for recording the liquidation of the construction of a subsection of the record of termination of the right of a subsection sample sections of the unified state register of rights opened previously previously converted line cable structures money

Sample receipt for receiving money for an apartment for tax deduction

I, _____ (full name of the seller), _____ (date) of birth, passport of a citizen of the Russian Federation _____ (series, number) issued by _____ (authority and date of issue), registered at the address: _____ (region, city, street, house and apartment number), received (or hereby confirm receipt) from _____ (full name of the buyer), _____ (date) of birth, a passport of a citizen of the Russian Federation _____ (series, number) issued by _____ (authority and date of issue), registered at the address: _____ (region, city, street , house and apartment number), funds in the amount of _____ (amount in numbers and words) rubles as payment for the sold _____ (number of rooms in words) room apartment No. _____ (apartment number in numbers and words) at the address: _____ (region, city , street, house number) in accordance with the Apartment Purchase and Sale Agreement dated _____ (day, month, year).

Interesting: Do you need a permit to build an extension?

A correct receipt for receiving money for an apartment is a guarantee of the security of the transaction. The thing is that when concluding an agreement on the purchase and sale of real estate, citizens have certain obligations. The parties assume responsibility. The buyer must transfer money in the agreed amounts to the former owner of the apartment. The seller must transfer the property specified in the contract to the new owner. That is, the right to re-register an apartment for a new person.

Property deduction when purchasing real estate: procedure for providing documents (FAQ)

This article will focus not so much on the list of documents that need to be provided, but on various procedural issues related to filing documents - which tax office to file with, when to file and who can do it. The list of documents provided can be found here.

What do you need to do to get a property tax deduction?

The decision to provide a property tax deduction is made by the tax office at the place of registration of the taxpayer. Accordingly, to receive a tax deduction, you must:

- Fill out a tax return (the declaration can be completed in a special program located on the official website of the tax office). Calculate the amount of deduction due for reimbursement

- Collect all the necessary documents confirming the right to a tax deduction

- Contact the tax authority at the place of registration, providing there all the necessary documents

- Within 3 months, the tax office will conduct a desk audit of the provided package of documents (+ another month provided for the transfer of funds)

- Upon completion of the desk audit, the tax authority will transfer funds to the bank account of the taxpayer, which he indicated in the application provided by him

By what date must I submit the documents required to receive a property deduction for the purchase of an apartment/house/shares in them?

Until April 30. This period is set as the last date for declaring personal income (NDFL). However, if you submit a declaration only to receive a property deduction, then it can be submitted at any time (not necessarily before April 30). Therefore, if you did not have time to submit a declaration on the specified date, then there is no need to wait for next year - it can be submitted now.

This is interesting: Receiving an inheritance after 6 months

Can another person submit documents to receive a property deduction?

Yes, but only on the basis of a notarized power of attorney (clause 3 of Article 29 of the Tax Code of the Russian Federation). The exception is situations when this person is a representative of the taxpayer by force of law (parents in relation to children, as well as guardians in relation to incapacitated persons). In practice, Federal Tax Service employees can sometimes meet you (by asking for the passport of the person they represent), but this will be a violation of their job descriptions on their part.

Which tax office do I need to submit documents for property deductions to?

The documents are submitted to the tax office at your place of registration. That is, not at the location of the property, but at the address indicated in your passport (even if these are different subjects of the Russian Federation). If there are several people buying real estate, then each of them claims a tax deduction at the place of their registration. This is due to the fact that a tax deduction is not an independent object in the Tax Code, it is part of the rules for taxation of personal income (NDFL), and an individual reports his income at the place of his registration (if he has any other income than wages). fees, income reported by the employer). If you are registered in another region of the Russian Federation, and live, for example, where you purchased real estate, then do not forget about the opportunity to submit documents for a property deduction remotely through your Personal Taxpayer Account for individuals.

Is it possible to apply for a tax deduction when buying a home without visiting the tax office?

Yes, starting from 2020, such an opportunity is provided in the Taxpayer’s Personal Account for individuals. Accordingly, in order to claim a tax deduction online, you need to gain access to the Account. This can be done in two ways:

- Visit the tax office in person, present your TIN, write an application and receive a login and password for your personal account

- Authorize the taxpayer’s personal account using an account on the State Services portal (however, the account status must be confirmed, that is, you should have previously confirmed it in person, for example, at Russian Post)

In your Personal Account, you must select the “Individual Income Tax” section and then “Fill out and submit a declaration online.” Some information (full name, passport details, registration address) will be filled in automatically, while some will have to be entered manually (information on income is usually taken from the 2-NDFL certificate, if there was no other income outside the place of the main job). All other documents (purchase and sale agreement, mortgage agreement) will need to be uploaded in scanned form. There you can also fill out the deduction application itself, indicating the details of the bank account where the money needs to be transferred.

If you liked this article or our services, then we invite you to join our VKontakte or Facebook groups. We guarantee that only high-quality content awaits you there - announcements of new articles and services that will help you save money. No spam or advertisements for apartments for sale. We try to be useful to you!

Receipt for receipt of funds for the apartment

- Place and date of compilation.

- Payer and recipient of funds. In this case, you must indicate your full name, full passport data and registration address according to your passport. It is this information that will help identify the parties to the transaction, since it is unique.

- The amount of money received. To avoid discrepancies, this information is filled in in numbers and in words.

- What were the funds transferred for?

- Address of the property.

- Confirmation that the funds have been received in full and the seller has no claims against the buyer.

- Seller's signature with transcript, date of compilation.

- It is imperative to check the recipient's signature on the receipt with his signature in the passport.

- It is highly desirable that the text of the receipt be handwritten by the recipient of the funds. The recipient's signature alone is sometimes not enough for experts to conduct a handwriting examination carried out as part of a trial.

- The receipt should indicate the full amount of payment under the contract in order to be able to compensate for all damage in the event of a dispute.

How to correctly write a receipt for receiving money for an apartment

The deposit is approximately 10% of the cost of housing. The exact size is determined by the seller. But the buyer should be wary if the deposit is asked for an exorbitantly large amount: it is quite possible that this is a scammer. For the receipt to be legitimate, it must indicate the details of the apartment that is to be sold: exact address, square footage, full cost, etc.

There is no approved form in the legislation of our country, but there are some recommendations and mandatory places that must be indicated in the documents. Based on these recommendations, approximate templates are derived.

Receipt for receipt of money for an apartment (sample)

A receipt for receipt of money for an apartment is written personally by the seller (sellers) of the apartment in the presence of the buyer (buyers) of the apartment. The receipt of money must reflect the following points:

I (We) _________________________________ (full name of the seller(s)), passport of a citizen of the Russian Federation ____________ (series number) issued by ______________ (by whom and when), registered at the address: ___________________ (region), ______________ (city), ______________________ (street), __________( house number), _____________ (apartment number) received (received) from (full name of the buyer (buyers)), passport of a citizen of the Russian Federation ____________ (series number) issued by ______________ (by whom and when), registered at the address: ___________________ (region), ______________ (city the _____ room apartment sold by me (us) at the address : ___________________ (region), ______________ (city ), ______________________ (street), __________ (house number), _____________ (apartment number), the amount of 000,000 rubles (in numbers) _______________________________________ (amount in words) Russian rubles.

Tax deduction for an apartment with a mortgage: how much, to whom and how to get it

Example three. Innocent hosts weddings and corporate events. He works without an individual entrepreneur, does not submit tax returns, and clients pay him in an envelope. In a good year, you can earn about a million rubles. Innocent will not receive a tax deduction until he starts paying taxes.

Example two. Luda works as a top manager in a well-known company. He receives 200,000 rubles a month, which comes out to 2,400,000 rubles a year. Everyone is jealous of people. Taxes per year amount to 312,000 rubles. People receive payment from the state for one year.

10 Jun 2020 lawurist7 393

Share this post

Related Posts

Decisions on Refusal to Assign a Pension Sample

Receipt for receiving money for an apartment

- The receipt must be written by the person who, according to the Sale and Purchase Agreement (SPA), is the recipient of the money for the apartment (and not his friend, brother, mother-in-law or realtor);

- The receipt must indicate that the money was received specifically for the apartment sold at such and such an address;

- The receipt must refer to the original contract, confirming the fulfillment of obligations under it in terms of payment (for example, “the money was received in full, in accordance with such and such a clause of the purchase and sale agreement”);

- The receipt must contain a “ standard set of details ”: - name (“Receipt”), date and place (city) of its preparation; — full name and passport details of the Seller and Buyer (including their registration addresses); - the amount of money received (in numbers and in words);

- The receipt must have the signature of its originator (with a transcript of the last name, first name and patronymic written by hand).

Interesting: Land purchase companies

If the sold apartment had several owners , then the Receipt for receipt of money together (in the same way as they signed the Apartment Sale and Purchase Agreement). If they had an apartment in common shared ownership, and they received money for it separately, then each of them must write a separate Receipt

The purchase of an apartment can be confirmed without a receipt for payments

If the shares in the right were not valued differently, then - in proportion to the size of the share of the total price for the apartment. Conversations on the topic: “Is one receipt not enough?” - stop immediately, otherwise the result will not be predictable!

The company has two founders with 50 percent shares in the authorized capital. One member submitted his resignation from the society in November. The actual value of the share was paid to him in January.

When purchasing an apartment, the parties draw up not only an agreement and a transfer deed, but also a document on the transfer of money. For non-cash payments, a bank statement is sufficient. When it comes to cash, you will need a receipt when purchasing an apartment. There is too much accounting news and too little time to search for it. We recommend subscribing to the Glavbukh magazine newsletter to keep track of all changes in the work of accountants.

We have nothing to do with the bank. My question is: is it legal to require a receipt at all? There is an agreement with the specified amount, there is an act of acceptance and transfer of the apartment. In theory, there might not have been a receipt at all.

If the agreement states that the money will be transferred, for example, after registration of the agreement and transfer of ownership, then you will not be able to receive a deduction without a receipt. If you have this option, look for the seller and have him write a receipt. There is no point in fighting with the tax office.

Ekaterina, Article 220 of the Tax Code of the Russian Federation establishes that to confirm the right to a property tax deduction, the taxpayer submits a certificate of ownership of a residential building.

RECEIPT City of Moscow, the first of May two thousand and eighteen I, Ivanov Ivan Ivanovich, year of birth, passport of a citizen of the Russian Federation 78 00 123456 issued by the Moscow Department of Internal Affairs of the year, unit code 001-001, registered at the address: Moscow, Mira Ave. 70, apt. 50, received from Petrov Petr Petrovich, year of birth, a passport of a citizen of the Russian Federation 78 00 987654 issued by the city police department.

Let us remind you that the amount of the deduction is provided in the amount spent on the purchase of real estate, but not more than 2 million rubles. A receipt for the deposit is a document confirming your expenses. The certificate of registration of ownership is now a conditionally reliable document. Before transferring funds to the seller, you must make sure of his rights to the property and the absence of arrests and encumbrances.

Sample receipt for receipt of funds for

I am Petrov Petr Petrovich), instead of received it is written handed over, and instead of sold it is written bought. There are cases when the period is not specified; in this case, by default it is considered that the document is valid for the same year from the moment of its signing. However, it should be taken into account that the handwritten, original version of the paper is more reliable due to the fact that in this case it is easier to prove its authenticity (for example, examination of handwriting and signature).

the purchase and sale contract was signed by the merchant's authorized representative (by proxy), who should the receipt for receipt of foreign currency funds be written to by the merchant, the buyer, or his authorized representative? In the receipt for the transfer of funds, make a link to the document in which this currency amount is stated. Good day.

Receipt for receiving money for an apartment

Hello, here, of course, it will be difficult for you to prove your own innocence. Since the details of your relationship are unknown, the general legal qualification of the situation is as follows: Despite the violation of the terms of the loan agreement on the transfer of money to the settlement funds, there are situations when the powers of the representative may follow from the situation in which the actions are performed. If, for example, the meeting took place in the company’s office, the money was transferred to the employee under the pretext of a non-working cash register or the absence of a cashier at the workplace, etc., then you had every reason to believe that you were transferring the money in good faith to pay for the apartment. It’s hard to imagine that a stranger would sit in the company’s office and collect money for himself. With a different interpretation, another option is possible - if under these conditions the money was transferred, but the seller-company does not recognize it, then there is still no reason to ignore the actual receipt of money by the representative - then this is unjust enrichment of the company, which it must return, but, of course , a more logical option is to count the money received towards the apartment. That is, in these circumstances, you are a bona fide buyer, even if you have not fulfilled the terms of the contract in strict accordance with it. If we interpret the situation as a transfer of money to an unfamiliar “representative” who did not transfer it to the company, then the seller can terminate the contract and demand the return of the apartment. In this case, you must recover funds from the “representative,” whose actions should be interpreted as fraud and have criminal legal consequences.

Hello, if you indicate in the contract that payments under the contract were made before it was signed, then this is how it should be - you should make sure that the payment has been made. If you, or rather the buyer, do not want to wait for the money to arrive in the account and immediately go to Rosreestr, then you should first make all the calculations and go to the bank together with the buyer to make sure that the transfer is made to the correct account. Then go to submit the contract for registration. If you do not see money in your account, to be on the safe side, you can submit an application to suspend registration due to non-payment of the item, and then act according to the situation, including refusing registration due to failure to comply with the terms of the contract.

Power of attorney for tuition fees for tax deduction

How to receive a social tax deduction for the costs of educating a child, if the contract for educating the child with an educational institution is concluded with the parent, the payment documents are issued in the name of the son, although the actual payment expenses were made by the parent. To receive a tax deduction, the parent must provide a power of attorney for the child to make the payment. Is it necessary to notarize such a power of attorney?

To receive a tax deduction, a parent can submit a power of attorney, which must be notarized. Instead of a power of attorney, you can draw up a contract of agency. It must indicate that the parent instructs the child to contribute the funds given to him to pay for education. Such an agreement is drawn up in simple written form and does not require notarization.

In addition, instead of a power of attorney and an agreement, you can attach a statement to the documents submitted to the tax office to receive a deduction, indicating that you gave your son money and instructed him to pay for the education himself. This statement will also confirm that you have paid for your child's education.

Federal Tax Service of Russia for the Kostroma region

The current version of the document you are interested in is available only in the commercial version of the GARANT system. You can purchase a document for 54 rubles or get full access to the GARANT system free of charge for 3 days.

Buy a document Get access to the GARANT system

If you are a user of the Internet version of the GARANT system, you can open this document right now or request it via the Hotline in the system.

Question: How can I get a social tax deduction for the costs of educating a child if the contract for educating the child with an educational institution is concluded with the parent, the payment documents are issued in the name of the son, although the actual payment expenses were made by the parent. To receive a tax deduction, the parent must provide a power of attorney for the child to make the payment. Is it necessary to notarize such a power of attorney?

The text of the question and answer was not officially published

Who can get a 13% refund on tuition?

The tuition tax credit is subject to the general requirements for claiming tax credits.

Separately, it should be noted that a refund of 13% of the amount of educational expenses can be obtained only if the educational institution has the appropriate license or other document that confirms the status of the educational institution (paragraph 3, subparagraph 2, paragraph 1 of Art.

219 of the Tax Code of the Russian Federation, letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated December 30, 2011 No. 03-04-05/9-1133). Please note that the form of training for obtaining a deduction does not matter (letter of the Federal Tax Service of Russia dated February 7, 2013 No. ED-3-3/).

Of course, actual tuition costs must be confirmed. In this case, the taxpayer must pay for the educational contract at his own expense. If, for example, training expenses were paid off from maternity capital, then you will no longer be able to claim a deduction (paragraph 5, subparagraph 2, paragraph 1, article 219 of the Tax Code of the Russian Federation).

It often happens that one person studies, and another pays for his education. In this case, the second citizen can receive a tax deduction, but only if he paid for education for his brother, sister or children under 24 years of age, or for a guardian or ward until he reaches 18 years of age (and then after the termination of guardianship or trusteeship until he reaches 24 years old).

It is also required that the relative receive a full-time education. However, if the taxpayer does not have a family relationship with the person whose education he is paying for, or they are more distant relatives (grandparents and grandchildren; uncles, aunts and nephews, etc.), then he does not have the right to receive a deduction (sub. 2 p. 1 art.

219 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated October 24, 2020 No. BS-4-11/, letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated February 3, 2014 No. 03-04-05/4028).

It will not be possible to take advantage of the deduction if one spouse paid for the education of the other (letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated April 17, 2014 No. 03-04-05/17785).

When paying for a child's education, spouses have the right to take advantage of a deduction, regardless of which of them has documents confirming educational expenses. In this case, each spouse must be the parent of the child.

If the spouse is not the child’s parent, then he will not be able to take advantage of the social tax deduction in connection with the expenses for the child’s education (letter from the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated May 3, 2020.

№ 03-04-05/27036).

At the same time, the deduction is provided only for the provision of educational services. If the contract with the educational institution provides for payment for other services (childcare, meals, etc.

), then no deduction will be provided for them (letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated November 26, 2013 No. 03-04-05/51114, letter of the Federal Tax Service of Russia for Moscow dated May 4, 2012 No. 20 -14/).

Therefore, it is important to ensure that the costs for education and other services are clearly separated in the contract and in payment documents.

Please note that either parent can apply for a tax deduction for expenses on a child’s education.

The income of each spouse relates to jointly acquired property and is joint property, therefore, any of the spouses has the right to receive a tax deduction from the full amount of training (letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated March 18, 2013 No. 03-04-05/ 7-238).

Thus, you can receive a tax deduction for training if the following circumstances exist simultaneously:

- you are a personal income tax payer;

- you pay for your own education in any form, or the education of a brother, sister or children under 24 years of age, or of a guardian or ward until he reaches 24 years of age in full-time form;

- funds from the employer or maternity capital were not used to pay for training;

- you have documents confirming expenses specifically for education, and not other services;

- the educational institution has a license to provide educational services or another document confirming its status;

- you have not spent the limit on all social tax deductions - you must take into account that social tax deductions are calculated cumulatively (120 thousand rubles per year) (paragraph 3, paragraph 2, article 219 of the Tax Code of the Russian Federation). Therefore, if during the reporting year the taxpayer incurred treatment expenses in the amount of 100 thousand rubles. and filed a declaration accepting them for deduction, then he can only use the deduction for training in the amount of 20 thousand rubles;

- tuition fees were paid within three years preceding the year of filing the declaration.

Receipt for receiving money

01 This is the next fundamentally important question. The catch lies in the fact that, according to Articles 208, 209 and 224 of the Tax Code of the Russian Federation, income from the sale of an apartment owned for less than three years is subject to income tax. And if in the regions this amount is, as a rule, insignificant, then for Moscow the amounts of mandatory tax payments in this case are huge. Therefore, the practice of understating the cost of an apartment in a purchase and sale agreement is common.

03 In this case, two outcomes are possible: either the parties wait until the expiration of the three-year period for a “tax-free” sale, or they seek consensus regarding the amount indicated in the receipt. If the transaction is carried out using credit funds, then the bank also plays a role here: it can set a threshold for understatement or even insist on writing the full amount in the document. Experts do not recommend writing an openly understated price for an apartment, for example, less than a million rubles - such agreements can certainly attract the attention of tax authorities, and then Article 198 of the Criminal Code of the Russian Federation comes into play, which implies up to three years in prison if the amount evaded from taxes exceeds 100 thousand rubles and for a year if it is less than this figure.

30 Jun 2020 hiurist 89

Share this post

- Related Posts

- Benefits for dismissed military personnel in Primorsky Krai

- The widow of a Chernobyl disabled person is entitled to barely

- Additional payment for disability group 2 for a pensioner in 2020

- Relies on Lee Chernobyl Vacation Ip

Is it possible to get a tax deduction without a seller's receipt?

Well, just in case, let’s clarify: a receipt (or a clause in the contract) to receive a tax deduction is required only if the payment is made in cash between individuals.

The documents were submitted through the taxpayer’s personal account. A call from the tax office asking for a receipt from the seller to receive funds. My actions? Alexander Testyanov Expert Jul 31 And if in some year you have income on which you need to pay personal income tax, then you can apply for a deduction.

If there are no supporting documents for any expenses, then the amount of these expenses is not subject to tax deduction. And no conclusions from an independent appraiser about the real value of the cottage will help.