Buying or selling an apartment is a serious step for any citizen. But if you have found a suitable option, then do not rush to rejoice and relax, because the seller or buyer may change their mind and thereby disrupt all plans.

It is to secure the obligations of your agreement that you need to enter into a deposit agreement.

What it is?

The deposit when purchasing an apartment is essentially a sum of money, which is a guarantee of fulfillment of obligations and is transferred by the buyer to the seller.

It acts as a guarantee of the fulfillment of the contract not only by the buyer, but also by the seller.

A deposit agreement is an interim measure that has consequences for both parties. It is concluded between the future participants in the apartment purchase and sale agreement and all essential conditions are specified in it.

Both parties to the transaction undertake to fulfill the clauses specified in the contract, otherwise there will be legal consequences for failure to fulfill the contract.

The essence and concept of the deposit is set out in Art. 380 of the Civil Code of the Russian Federation , as well as the consequences of failure to fulfill obligations. You need to understand that this is not just a transfer of money, but a conclusion of an agreement with serious intentions and consequences.

If one of the parties to this agreement does not fulfill its obligations, then legal consequences arise, which are regulated by Article 381 of the Civil Code of the Russian Federation . If the buyer fails to fulfill the agreements, the latter loses the amount transferred to the seller.

If the seller refuses his obligations, then by law he is obliged to reimburse the buyer twice the amount of the deposit, as stated in the Civil Code of the Russian Federation. Refunds are made through the courts.

But force majeure situations , in which the amount of the deposit for the apartment is simply returned by the seller to the buyer.

This refers only to those situations for which neither party can be held responsible. Essentially, this is an incident that occurs regardless of a person’s will (for example, death, serious illness, natural disaster).

Deposit and preliminary agreement. YOU vs. Sun

I think that almost every lawyer has directly or indirectly encountered the directly opposite practice of the highest courts of the Russian Federation in their opinions on the possibility of securing a preliminary agreement with a deposit.

The essence of the problem is as follows.

clause 1 art. 380 of the Civil Code “A deposit is recognized as a sum of money given by one of the contracting parties against payments due from it under the contract to the other party, as proof of the conclusion of the contract and to ensure its execution.”

The Supreme Arbitration Court, in disputes about the possibility of securing a preliminary agreement with a deposit, indicates that “it is impossible to use a deposit as security for the fulfillment of obligations under a preliminary agreement, as well as to apply to the relations arising from it the consequences provided for in paragraph 2 of Article 381 of the Civil Code”, “the preliminary agreement does not contain any monetary obligations of the parties to each other."

This point of view of the judges of the Supreme Arbitration Court is presented in the Resolution of January 19, 2010 N 13331/09, the Determination of March 29, 2013 N VAS-3157/13, the Determination of April 12, 2012 N VAS-3880/12 and many other judicial acts of the Supreme Arbitration Court.

And the Supreme Court, when resolving the above disputes, indicates that “the Civil Code does not exclude the possibility of securing a preliminary agreement with a deposit.”

This point of view of the judges of the Supreme Court is presented in the Determination of November 13, 2012 N 11-КГ12-20 and older judicial acts, for example, the Determination of March 10, 2009 N 48-В08-19.

And it turns out to be a completely different position. Personally, I prefer YOU's position.

Look at paragraph 1 of Art. 429 of the Civil Code “Under a preliminary agreement, the parties undertake to enter into a future agreement on the transfer of property, performance of work or provision of services (main agreement) on the terms stipulated by the preliminary agreement.”

The obligation is to conclude the main agreement (within a certain period), and, therefore, it is logical to assume that YOU are closer to the truth.

The Supreme Arbitration Court indirectly asserts its position in paragraph 14 of the IP of the Supreme Arbitration Court dated 02.16.2001 N 59 “The subject of the preliminary agreement is the obligation of the parties to conclude a future agreement , and not the obligation regarding real estate.”

Here is the question : is it possible to ensure the fulfillment of the obligation under a preliminary agreement with a deposit? Or will this deposit always be an advance? And, most importantly, in the SOYU and the AU, it turns out that the result of resolving this dispute will be different?

I know about the freedom of ways to ensure the fulfillment of obligations (clause 1 of Article 329 of the Civil Code), but please do not mention the possibility of using an unnamed method of ensuring the fulfillment of obligations. Regarding the mixed agreement too. The question is about the deposit and the preliminary agreement.

Pros of this agreement

Concluding a deposit agreement has significant positive aspects:

- The obligation to buy and the obligation to sell the apartment will be guaranteed in cash.

- The specific sale price of the apartment is fixed, which will protect the buyer from changes in the price of the purchase object.

- The agreement obliges to conclude the main transaction (apartment purchase and sale agreement) within a specific time frame.

- If one of the parties fails to comply with the agreements, consequences arise in the form of a monetary obligation from the seller or loss of the deposit amount from the buyer.

Having concluded such an agreement, you can calmly continue to prepare documents or wait for the main agreement, without worrying that the apartment will be sold to someone else, the seller will consider the agreed sale price insufficient, the buyer will find a more profitable option, etc.

Of course, all this can happen even if there is such an agreement, but in this case the party that refused the obligations loses money, and this is the best motivation for fulfilling the preliminary agreement.

Is the deposit agreement a preliminary agreement?

- The name of the document (agreement on the transfer of the deposit under a preliminary agreement), its date and place of preparation.

- Full name and passport details of the parties.

- The basis for giving a deposit is also indicated (for example, on account of the concluded preliminary lease or purchase and sale agreement).

- Next, the specific object is indicated, that is, for what the deposit is given (living premises, vehicle, etc.).

- Penalties if one of the parties refuses the transaction (double return of the amount for the recipient of the payment or non-refund of the money for the one who transferred the deposit).

- Other conditions that do not contradict the law.

- Signatures of the parties to the agreement.

- Errors when drawing up an agreement Very often, parties can make various legal mistakes when drawing up an agreement on a deposit. Let's look at the most common ones.

Disadvantages of making an advance payment

Like any deal, there are downsides to making a deposit. This agreement should be concluded only if you are 100% sure of your intentions.

But this is not the only nuance that you should be afraid of. There are also many scammers who, with the help of a deposit, take possession of funds irrevocably.

To protect yourself from this, you just need to carefully read all the clauses of the contract. always worth indicating the real amounts that will be transferred , because this is precisely what scammers play on, persuading you to indicate an amount less than the actual amount.

It is worth carefully studying the seller’s documents, or it is better to go with him to the nearest notary office for clarification. The notary will check the compliance of all documents and explain possible problems, if any, that may arise.

Before concluding a purchase and sale agreement and making a deposit, it is worth considering the following points:

- It is advisable that all redevelopments be legalized before the deposit, otherwise it will be necessary to calculate the time for completing the documents;

- it is worth checking for arrests, encumbrances and other nuances that will make it impossible to conclude the main agreement;

- Before concluding a contract, you need to carefully examine not only the documents, but also the condition of the apartment, so that there are no unpleasant surprises.

It is better to know everything about the documents and the purchased object, so there is a greater chance of getting exactly the desired result without risks.

Registration of a deposit for the purchase and sale of real estate

Most often, the transfer of the deposit is formalized in the preliminary purchase and sale agreement for the apartment. However, other options are also possible, for example, a deposit agreement or an agency agreement with a real estate company.

In some cases, the transfer of the deposit occurs entirely on the basis of a regular receipt or without any written documentation at all. This completely deprives the deposit of its security function, and can lead to termination of the contract by the seller and to the loss of the entire amount of the deposit by the buyer.

On the one hand, failure to comply with the written form of the deposit does not deprive the interested party of the right to refer to the testimony of witnesses. On the other hand, since the legal requirement for written form is not met, the court may, at the request of one of the parties, invalidate the transaction.

In addition, transferring the deposit without proper legal registration deprives both the seller and the buyer of the opportunity to protect their interests. Therefore, we can name the basic requirements for the legal registration of a deposit:

- Receipt of the deposit by the seller must be formalized only in writing, regardless of the amount of the deposit paid;

- It is advisable to prepare a deposit as part of a preliminary agreement for the purchase and sale of an apartment;

- In the contract, the amount transferred to the seller must be called a deposit (not an advance or prepayment).

Failure to comply with these requirements may cause disputes and lead to adverse consequences for both parties.

In the preliminary agreement, the parties stipulate all the terms of the future purchase and sale agreement, including the final cost of the apartment, and also indicate the amount of the deposit and the adverse consequences that will arise for each party if they unilaterally refuse to conclude the main purchase and sale agreement.

It is advisable that the preliminary purchase and sale agreement be drawn up by a professional lawyer and certified by a notary. This will help the parties reduce risks and avoid misunderstandings.

Real estate firms very often take a deposit from a potential buyer when concluding an agency agreement. Sometimes there are even situations when a deposit is taken, but a suitable apartment has not yet been found. This is not entirely legal, especially since the deposit in this case loses its security function.

This is due to the fact that it is not transferred to the seller or his authorized representative, but to an intermediary who cannot guarantee the seller’s fulfillment of the preliminary agreement. Within the framework of an agency agreement with a realtor, we can talk about a deposit only when it is transferred directly as payment for the services of the realtor.

You should carefully check the terminology of the contract. The amount paid must be called a deposit. Otherwise, this amount will be considered by the court as an advance, even if it is not called an advance. Consequently, either party can terminate the agreement without penalty, since the advance must be fully returned to the buyer, regardless of whose fault the terms of the agreement were not fulfilled.

Another difficulty in preparing a deposit that the seller and buyer of an apartment may encounter is the loss of the security function of the deposit in case of partial fulfillment of obligations. Despite the fact that the deposit must ensure the full fulfillment of obligations under the preliminary agreement, a different situation has arisen in judicial practice. Very often, the court refuses to apply the provisions of the deposit to the injured party if the requirements of the contract have been partially fulfilled.

For example, the buyer can legally demand a double refund of the deposit if the seller does not move out of the apartment within the specified period. However, if the remaining terms of the contract were nevertheless fulfilled by the seller, the court most often refuses to collect the double amount of the deposit from the buyer.

Find out where to get an extract from the house register and what the procedure and deadlines for receiving it are.

Read all about the extract from the Unified State Register here.

If the preliminary purchase and sale agreement with the registration of a deposit is not certified by a notary, who himself checks all the necessary documents, when transferring and registering a deposit, you should pay attention to the following important points:

- the buyer must check with the seller for the availability of the original title documents for the purchased apartment;

- It is best to transfer the deposit through a safe deposit box at a bank. This, of course, will lead to additional costs, but will minimize the risk of losing money as a result of fraud. If the seller of the apartment turns out to be a fraudster, then the buyer, who personally transferred the money to him, will have to seek its return through the court. Using a safe deposit box, the buyer will be sure that the money will go to the seller only if the contract is properly executed;

- It is advisable that all apartment owners be present when signing the preliminary agreement. If this is not possible, the seller must provide a notarized power of attorney from the absent owners. For example, it should be remembered that an apartment purchased during marriage is legally the common property of both spouses, even if only one of them is the seller in the contract. The lack of consent of one of the apartment owners may subsequently lead to the recognition of the contract, and, consequently, the agreement on the deposit, as invalid;

- You should not make a deposit and sign a preliminary agreement if the apartment you are purchasing has unauthorized redevelopment. In this case, the seller must first legalize the redevelopment, since in this form he will not be able to sell the apartment and draw up the appropriate documentation for it.

If the buyer, when signing the contract, did not pay attention to the illegal redevelopment, he, at best, will be faced with the impossibility of completing the purchase and sale transaction within the period stipulated by the contract. In the worst case, the seller will refuse to sell the apartment without returning the deposit in double amount due to the impossibility of legalizing unauthorized redevelopment.

Perhaps these are all the important points regarding the deposit in real estate transactions that we wanted to bring to your attention in this article.

Agreement for donating a share of an apartment to a relative, design features

Subtleties of using maternity capital when purchasing an apartment in a new building

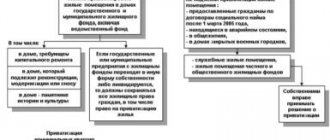

The procedure for deprivatization of an apartment

Features of mortgages in the secondary housing market

Valuation of a share in an apartment, factors affecting the cost of a share

Easement on a land plot

Preparation of contract

It is best to conclude this agreement with a notary or a real estate agency. This is a safer option, because experienced lawyers will be able to advise and explain all the clauses of the contract.

It is worth noting that they will be able to check the documents before the transaction and warn against possible problems.

The deposit agreement is usually drawn up in printed form and signed by the parties. In addition, you should also make a receipt . The fact is that this agreement indicates your intentions and will be more reliable if a receipt for the transfer of money is attached to it.

The receipt is written by the seller himself and in blue ink. It indicates who accepted the money and from whom, how much and for what. It is also necessary to indicate passport details and the amount in words.

How to apply?

Important information about what exactly is considered a deposit is contained in the Civil Code of the Russian Federation (Article 380). According to him, the deposit is an advance, i.e. a specific amount of money provided to the seller by a person wishing to purchase property in order to secure the mandatory fulfillment of future financial and other obligations (appearing when drawing up a purchase and sale agreement).

So, so that in the future, after the advance has been issued, no controversial situations arise, a deposit agreement is concluded. It helps both parties:

- The buyer will be sure that the property he likes will not go to other people, but will be sold to him.

- The person selling the property will be able to make sure that the buyer is interested in the purchase - that he will not cancel everything at the last moment and is really determined to carry out the transaction.

The agreement on the provision of a deposit is not endowed with independent legal force: it rather complements the preliminary agreement for the purchase of real estate.

Before preparing a deposit agreement, you need to understand how a deposit differs from an advance payment . The legislation does not stipulate on what grounds the payment provided to the seller is recognized as an advance. The following differences exist:

- The deposit is transferred to the real estate seller only after the corresponding agreement has been concluded. It assigns a certain number of responsibilities to the parties, and, most importantly, it states that a purchase and sale transaction will be carried out in the future. Otherwise, financial sanctions will come into force against the violator of the agreement.

- An advance is also provided to the seller, but does not guarantee that in the future he will be obliged to sell the apartment to the person who gave the deposit. If the owner decides not to conclude the deal (no matter for what reason), he can easily return the money received and not suffer negative consequences.

For more information on what a deposit and an advance payment are, see the following video:

If the agreement on the provision of a deposit does not contain clear signs indicating that the payment is a deposit, it is recognized as an advance payment. Therefore, in the agreement form (especially in its text part) it is necessary to record direct evidence that the amount was indeed issued as a deposit.

Confirmation that the money was provided as a deposit can be:

- A clause according to which the amount issued is part of the price for the purchase of real estate.

- Provisions that guarantee that the parties will carry out the transaction in the future. In case of violation, the offending party receives financial sanctions.

The Civil Code (Article 381) highlights the responsibility of the seller and buyer for violation of the contract:

- Typically, the deposit is paid to the seller when a preliminary agreement is concluded, but an advance is provided after the agreement is signed.

- If the terms of the deposit agreement are violated, the buyer loses the entire amount provided and will no longer be able to return it.

- If the seller violates the terms of the agreement, he will have to pay the buyer an amount exceeding twice the amount of the deposit. But most often this is difficult to achieve - the seller will return the entire amount of the advance, but the rest will most likely have to be returned in court.

- But an advance is not a guarantee of fulfillment of obligations: the buyer will not have to return the full amount of the advance to you, and the seller will have to keep the payment for himself legally if the contract is violated.

- In a situation where the parties are unable to make a profitable transaction and they decide to cancel it, the seller will return the full amount of the advance to the buyer.

The legislation (Article 380 of the Civil Code) states that the deposit agreement must be drawn up only in writing, and:

- Or a separate document.

- Or as part of a preliminary agreement.

An agreement to provide a deposit can be concluded even when the buyer was looking for real estate through realtors. However, remember that:

- The agency may ask you to pay a deposit before suitable premises have been found. In this case, the deposit will not be recognized as such, since no guarantees are attached.

- The buyer must ensure that the seller receives payment.

If the parties decide to enter into a deposit agreement for the purchase of living space, they are required to determine:

- The exact amount of payment and the procedure for providing money to the seller (if the parties so desire, with a receipt for receipt of the agreed amount).

- The full amount of the apartment being sold.

- Sign the agreement in front of witnesses, co-owners of the apartment (if it is in shared ownership). The document must be notarized (this is not a mandatory condition, it is determined at the request of the parties). Only after it is signed by all parties to the transaction does the agreement enter into legal force.

Prepare at least 2 copies - one for each participant in the transaction. It is better that all conditions and clauses of the agreement are agreed upon and accepted before signing the contract, since any uncertainties in the wording or controversial issues can later lead to legal proceedings. In addition, if the agreements were violated, the injured party will be able, through the court, to oblige the culprit to compensate for the losses caused.

It is advisable to involve persons who are not relatives or close friends of any of the parties to the transaction as witnesses present when signing the deposit agreement.

If the text of the contract is written by hand, you must use a pen with blue or black ink.

Therefore, prepare in advance:

- Original and copies of passport (for each side).

- Title documents for real estate, as well as permission from all co-owners for sale (spouses and guardianship authorities, if the owner is a minor child).

Essential terms of the deposit agreement

This agreement must indicate:

- FULL NAME.;

- passport details;

- registration;

- description of the subject of the contract (type of object, address, area, number of rooms, title document of the seller);

- cost (deposit amount and sales amount in words, with the proviso that these indicators remain unchanged);

- deadline for fulfillment of obligations (the exact date by which the main contract must be concluded);

- rights and obligations of the parties;

- responsibility for failure to fulfill the agreement.

All this will protect you from unnecessary problems and under such conditions the deposit agreement will be considered valid. If you neglect these points, the contract will be easy to terminate or cancel in court.

If all the essential terms of the DCT are specified in the Deposit Agreement,

The conditions that you plan to determine when concluding an agreement relate to the conclusion of a preliminary agreement.

“Civil Code of the Russian Federation (Part One)” dated November 30, 1994 N 51-FZ (as amended on August 3, 2018) (with amendments and additions, entered into force on June 1, 2019)

Civil Code of the Russian Federation Article 429. Preliminary agreement

Positions of the highest courts under Art. 429 Civil Code of the Russian Federation >>>

1. Under a preliminary agreement, the parties undertake to enter into a future agreement on the transfer of property, performance of work or provision of services (main agreement) on the terms stipulated by the preliminary agreement.

2. The preliminary agreement is concluded in the form established for the main agreement, and if the form of the main agreement is not established, then in writing. Failure to comply with the rules on the form of the preliminary agreement entails its nullity.

3. The preliminary agreement must contain conditions allowing to establish the subject matter, as well as the conditions of the main agreement, regarding which, at the request of one of the parties, an agreement must be reached when concluding the preliminary agreement.

(as amended by Federal Law dated 03/08/2015 N 42-FZ)

(see text in the previous edition)

4. The preliminary agreement specifies the period within which the parties undertake to conclude the main agreement.

If such a period is not specified in the preliminary agreement, the main agreement must be concluded within a year from the date of conclusion of the preliminary agreement.

5. In cases where the party that entered into the preliminary agreement avoids concluding the main agreement, the provisions provided for in paragraph 4 of Article 445 of this Code are applied. A claim to compel the conclusion of the main contract may be filed within six months from the date of failure to fulfill the obligation to conclude the contract.

In case of disagreement between the parties regarding the terms of the main agreement, such terms are determined in accordance with the court decision. The main agreement in this case is considered concluded from the moment the court decision enters into legal force or from the moment specified in the court decision.

(Clause 5 as amended by Federal Law dated 03/08/2015 N 42-FZ)

(see text in the previous edition)

6. The obligations stipulated by the preliminary agreement are terminated if, before the end of the period within which the parties must conclude the main agreement, it is not concluded or one of the parties does not send the other party an offer to conclude this agreement.

Fact of money transfer

There are two tried and true ways to transfer money securely:

- Transferring money to the seller after he writes a receipt.

- Bank safe deposit box. The buyer puts money there, the amount of which is checked by a bank employee. Moreover, only the seller can receive them upon presentation of a properly executed deposit agreement for the apartment with the person who put the money in the box.

The first option is dangerous because they can slip counterfeit money. Therefore, if you enter into an agreement with a notary or real estate agency, insist on checking the authenticity of the banknotes . Otherwise, it is better to order this service from the bank.

Consequences of failure to fulfill obligations

The main thing for the buyer is to receive ownership of the apartment on time and without unpleasant surprises, and it is in the interests of the seller to receive the full amount for the housing he sold on time. The consequences for failure of one of the parties to fulfill their obligations will not be long in coming.

If the buyer turns out to be the culprit of the failed transaction, then, according to Article 352 of the Civil Code of the Republic of Belarus, the deposit remains with the seller. And vice versa, if the seller fulfilled his obligations in bad faith, then he is obliged to pay the injured party, that is, the buyer, the amount of the deposit in double amount. Moreover, the party that violated the terms of the agreement is obliged to compensate for losses for failure to comply with the terms of the agreement.

If the transaction is terminated by mutual agreement of the parties or the conclusion of the transaction is impossible for reasons beyond the control of the seller and buyer, then the deposit must be returned.

After concluding a deposit agreement, it is mandatory to draw up a preliminary agreement for the purchase and sale of an apartment. Since, according to the Civil Code, this payment is made only to confirm the conclusion of the contract. And without it, it has no legal force.

Preliminary agreement

A preliminary agreement is, in essence, an agreement of intent that postpones the conclusion of a purchase and sale agreement due to the impossibility of concluding it for the time being.

This agreement is concluded in most cases by a notary, it takes into account all the points as in the deposit, but adds:

- clauses that oblige you to put documents in order;

- date of discharge of registered persons;

- date of repayment of utility bills;

- household items that will be transferred to the new owner along with the apartment are listed;

- other conditions agreed upon by the parties.

If you take into account all these points and treat the purchase or sale of an apartment responsibly, then everything will go smoothly and you will not be deceived.

Publication analytics

Attention

However, for contracts involving real estate, not entering into an agreement to transfer payment as a deposit is more than risky for the buyer. In addition, an incorrectly drawn up document can lead to unpleasant consequences.

It is best to transfer payment and draw up an agreement on the deposit of a land plot, residential or non-residential premises or other real estate with a notary. It is also important to require, in addition to the agreement, a receipt for payment.

This document is kept by the buyer until the transaction is completed. Subtleties with lease transactions Certifying the fact of transfer of the guarantee payment is important not only when concluding a purchase and sale agreement.

Such a document can, in principle, be drawn up for almost any type of transaction. Unfortunately, many people believe that if they intend to lease an object, they do not need to enter into a deposit agreement. Renting is also a serious procedure.