What it is?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Having correctly formulated the purpose of assessing a garage, it will be possible to determine:

- cost type;

- assessment method;

- cost of the appraisal company's services;

- deadlines for generating assessment reports, etc.

If there is a need to evaluate the garage, then you need to understand the features of the procedure on your own.

They are as follows:

- garages differ in design and characteristics;

- the cost depends on the number of floors, area, availability of communications;

- The cost is also affected by the year of construction, remaining service life, fire safety, and physical condition.

The garage is appraised by an independent appraiser.

Valuation of a garage - determining its value in order to perform any actions with it. The premises are inspected, prices are compared with similar objects, and the cost of a specific garage is established. In charge of assessments by the Bureau of Technical Inventory.

Cadastral value of the property

Cadastral valuation of a garage in 2020 - the results of the assessment activities of the cadastral officer. Its purpose is to correctly calculate the tax.

For each property there is a cadastral passport, which indicates the value of this property. This information is valid for up to 5 years. After this period, the cost is revised.

If there is no cadastral passport for the garage, then its cost can be found out as follows:

- Order an extract about the CS from Rosreestr or the Multifunctional Center.

- Find out the cost online on the official website of Rosreestr.

If the passport has not been updated for a long time, then the cost indicated in it is not considered current.

It will not be possible to independently calculate the cadastral value of a garage - the data will be inaccurate.

Market price

An assessment of the market value of real estate will be useful when making any transaction with a garage. For such an assessment, any of 3 methods are used.

When using the comparison method, the relationship between supply and demand for similar garages on the real estate market is examined. For example, if the average value of a property similar to a listed garage has a cap, then the garage will not be able to sell for more than that value. In this case, it is necessary to take into account various factors - location, characteristics, etc.

Based on the income method, the garage is considered as a profit-generating object. If it is rented out, the amount of rent for the year and the expenses incurred during this time are calculated.

Based on the cost method, all expenses are taken into account - for the purchase of land, renovation of a garage or its construction.

When determining the market price, it is important to take into account the size of the premises, the area of the land plot, and the availability of communications.

How much does a garage appraisal report cost for court or inheritance registration?

Services for determining the market value of a garage in Nizhny Novgorod are provided by Region-Assessment. The company's specialists have all the necessary documents to carry out this activity. The price of a garage assessment report for court and inheritance registration depends on several factors: the complexity of the process, the purpose of the assessment, the availability of documentation, timing, location of the object. The duration of work is from 1 to 5 days. More detailed advice and the exact cost of the report can be found on the website or by calling 8 (831) 422-56-83, 903-602-56-45.

The legislative framework

The valuation of real estate objects is regulated by the following regulations and laws:

- Land Code;

- Civil Code;

- Federal Law No. 135 “On Valuation Activities in the Russian Federation”, adopted on July 29, 1998.

According to Article 333.25 of the Tax Code, the assessment is carried out by a special organization or accounting authorities at the location of the object.

Garage valuation

Valuation is carried out for various purposes - for court, when registering an inheritance or for the purpose of selling property. Each procedure has its own characteristics.

Find out how to legalize a garage without documents. What documents are required when purchasing a garage? See here.

For sale

To evaluate a garage for sale, you need to submit documents to the BTI. After inspecting the property and studying the documentation, an employee of the organization will issue a certificate with the market value. It can be indicated to buyers when selling.

For inheritance

The garage should have its own value. it is appointed not by the property owner, but by an appraiser. It must be carried out in accordance with the law. Usually the assessment is carried out on the day the inheritance opens. To estimate the cadastral value, you should contact the Bureau of Technical Inventory.

After collecting documents, the premises are inspected, and based on the results, its value is determined. This assessment is carried out based on the cadastral value.

When assessing a garage for inheritance, the following factors are taken into account:

- garage location - distance from transport routes, from the city;

- features - size of the room, material of manufacture, condition, etc.

The algorithm of actions is as follows:

- The room is visually inspected.

- The documents available for the garage are being studied.

- The property is being analyzed.

- The market value is calculated.

- A report is generated.

The appraiser will need to provide documents on the right to inheritance and technical certificates.

For the court

This is a study of a property by a specialist in order to provide the court with information about this property. Conducted independently, the service is paid for by the losing party. Carried out when disputes arise that relate to the garage - to challenge.

To carry out this procedure, you must perform the following steps:

- Visit a specialist and discuss with him the price of the required work.

- Decide on the inspection time.

- Meet with the appraiser and sign the required papers.

- Pay for the service and draw up an acceptance report for the assessment report and sign it.

The first step is not to evaluate the garage itself, but the land on which it is located. After this, the judge issues a conclusion indicating the value of the land plot together with the garage.

It will become easier to challenge the valuation of real estate and land

Everyone who owns even a piece of land or a couple of square meters of living space is concerned with the issue of cadastral valuation: the amount of tax on real estate and land depends on it. Deputy head of the Federal Service for State Registration, Cadastre and Cartography Alexey Butovetsky from the State Duma rostrum called the bill being discussed “extremely important from both an economic and social point of view.” But if so (and this is indeed the case), then why are the president’s instructions on this topic, given in 2020 and 2020, only now being implemented? .

Butovetsky recalled: since 2020, cadastral valuation has been transferred from private appraisers to state budgetary institutions under the jurisdiction of the regions, and at the federal level a uniform methodology for conducting this very assessment has been established for the entire country. Now it is proposed to expand the rights of owners to familiarize themselves with the draft assessment even before its approval.

The mechanism for challenging assessments is also changing. Now a dissatisfied land or house owner has two options: either go to a special commission for resolving disputes or go to court. The government, taking into account the “accumulated discontent,” wants to send everyone first to the budgetary institution involved in the assessment, and then, if its decision does not suit it, go to court.

An important detail: according to Mr. Butovetsky, the principle of correcting errors in the valuation of his real estate is changing in favor of the owner: “it doesn’t matter when the error was made - a year ago, two months ago or five years ago, it will always be applied retrospectively if the result corrections, the cadastral value of the property will be lower.” A court decision was mentioned as a necessary condition for recalculating the tax paid for previous years in accordance with the overestimated assessment. If, as a result of correcting the error, the cadastral value of the object has increased, then the citizen will pay a larger tax only from the next year. The person responsible for the error may be fired.

The conclusion of the Duma Committee on State Construction and Legislation lists on several pages many comments that need to be eliminated by the second reading. But the new mechanism for correcting errors in cadastral valuation received the support of deputies. A government representative explained its essence as follows: “there is, for example, a gardening partnership, and today all gardeners need to individually challenge the cadastral value of their plots if they do not agree with it. But it is proposed to stipulate that it is enough for one person to go and prove that there is a mistake, and the state budgetary institution will have to recalculate all the plots in this partnership at once” - by analogy.

Natalya Boeva (“United Russia”) noted that the courts were ordered not to reduce the inflated cost of the property by more than 10%, which causes a lot of complaints from citizens. To which Mr. Butovetsky replied that “the situation is changing for the better”: in 2020, the authorities received 71 thousand appeals challenging the cost, and in 2019 - already 40 thousand.

The government took into account the experience of Holland and Sweden, the speaker noted. To which speaker Vyacheslav Volodin noted that Holland and Sweden are “very small”, and “everything is homogeneous” there, and advised it is better to use the experience of large countries like the USA and Canada.

Sergei Zhigarev (LDPR) drew attention to the fact that the subjects of the Russian Federation will primarily oppose the reduction in cadastral value, “because this tax mainly goes to their budgets.” The deputy suggested revising the cadastral valuation less often, otherwise people would be tired of going to the courts every year to challenge it. To which I received assurances that a unified cycle is now being introduced throughout the country: revaluation once every 4 years, with the exception of federal cities, where, as now, revaluation can be done once every 2 years. And the market price, that is, the transaction price, will directly affect the valuation: “We see, for example, that during the pandemic, real estate prices are significantly reduced, and this factor must be taken into account.”

The second reading may not take place until early July.

Methods for determining the value of real estate

The first method is an independent assessment. It will be needed under the following circumstances:

- when buying or selling a garage;

- when renting out;

- as collateral for the bank;

- upon liquidation;

- when insuring it;

- in case of disputes.

Market value is usually assessed by comparison. Prices for similar garages are studied and a cost is compiled. Usually garages are similar to each other, their characteristics do not differ much, so the price will be approximate. This is the most popular approach to estimating value.

There are other methods - profitable and costly. But they are rarely used because they do not reflect the full essence of value.

Profitable takes into account the cost of renting a garage. When calculating income for a specific rental period, the cost is calculated. with the costly method, investments are taken into account - the owner of the garage space, building materials, etc. This method does not take into account the cost of the land on which the garage is built. And its location is important when assessing the cost.

What documents are needed?

To estimate the cost of a garage, you must prepare the following documentation:

- on registration in Rosreestr;

- contract of sale;

- lease contract;

- gift agreement;

- on the right of inheritance of the garage;

- about membership in a garage cooperative (if any).

Based on the studied documents, a certificate of the value of the object is issued.

Read whether you need to pay tax when selling a garage. What documents are needed to register ownership of a garage? Information here.

How to draw up a garage rental agreement? Details in this article.

How to evaluate a garage

A garage is also real estate, which means that if you want to sell it, pass it on by inheritance, take out a loan against it, or simply contribute it as authorized capital to any enterprise, you first need to know how to value a garage Right. This may also be necessary in the event of any property disputes.What documents are required to evaluate the garage?

Valuing a garage on your own can be extremely difficult. Therefore, as a rule, anyone who wants to get a reliable appraisal of their garage turns to an independent licensed appraisal company for this service. To do this, you will have to provide the following package of documents:

- passport;

- documents confirming your membership in the garage and construction cooperative;

- certificate of ownership of the garage or lease agreement;

- if any, a document confirming your rights to the land plot on which the garage that needs to be assessed is located;

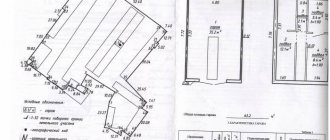

- if there is one - a technical passport for the garage, issued by the BTI and its floor-by-floor explication;

- receipts for payment of utilities and other financial documents confirming the costs of maintaining the garage.

The more documents you provide, the more accurate the final estimate will be. However, quite often, the customer does not have any documents. Not all, but some appraisal companies take on the job in this case too. To evaluate the garage, you will need to draw up a technical specification, which, according to the customer, describes the size of the garage and the conditions under which it is evaluated.

How to evaluate a garage - methods used

The main way to evaluate a garage is a combination of cost, comparative and income methods. The most accurate assessment is made by calculating the average result; as a rule, both the garage seller and his possible buyer agree with it.

The comparative method is used in the same way as it is done when evaluating apartments. In other words, a representative sample of objects with similar characteristics from those on the market is made and their average cost is taken. This takes into account factors such as the remoteness of the location, the year and material of construction, area, availability of heating, water supply, and so on.

The cost method evaluates, first of all, the expenses that the garage owner incurred in connection with its construction and the acquisition of land. This includes the cost of all work and construction materials. Including finishing. Therefore, the more documents confirming your costs you provide, the more accurately you can evaluate the garage using this method. Separately, it should be said about estimating the costs of acquiring a land plot - this process is very difficult, since the market and cadastral value of the land may change , so you should not expect high accuracy with this method.

Finally, the last, income method, is the most problematic. With this approach, they try to calculate the possible income that a garage can bring, for example, when renting it out. As you understand, this value is largely hypothetical, so valuing a garage using the income method can only be approximately estimated.

After all the work and detailed analysis have been completed, the customer is given an official garage assessment report, which can be used in the future in all necessary cases.