Based on the requirements of the Housing Code, every citizen who owns or rents residential premises is obliged to pay utility bills.

In some cases, depositing funds is impossible due to certain circumstances, which leads to the formation of debt.

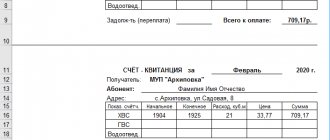

The management company notifies defaulters about the existence of a debt by sending a written notice. One way to resolve this situation is to restructure housing and communal services debt.

How to start restructuring your utility debt?

Debt is formed as a result of failure to pay the required amount or not paying it in full, which leads to the accrual of fixed penalties. The penalty is calculated from the date of delay until the debt is repaid.

If the amount of debt accumulates, a citizen can expect eviction from the apartment if he is not its owner, but this decision is made exclusively by the court, in accordance with Article 90 of the Housing Code of the Russian Federation.

Another punishment for having a significant debt is the disconnection of utilities until the entire amount of the debt is repaid, including penalties. In this case, the management company must notify the debtor in advance about this decision.

There are 2 ways out of this situation:

- a citizen’s appeal to the court for debt restructuring or write-off;

- an individual’s application to a branch of an organization providing housing and communal services with an application to restructure the debt for utility services.

In both cases, the applicant must have compelling reasons to carry out the procedure for writing off or reducing debt, supported by documentary evidence.

Such significant reasons may include the difficult financial situation of the debtor due to layoffs at work, deteriorating health, the emergence of family problems, etc. First of all, it is recommended to try to resolve the situation peacefully.

Useful article : Loan debt restructuring.

Debt repayment procedure

As a rule, the debt is divided into equal parts, which the debtor undertakes to repay over a specific period of time.

In particular, a debt of 6 thousand rubles. it is permissible to divide it into three months, paying 2 thousand rubles each month.

In this case, the defaulter undertakes, no later than the deadline approved in the contract, to transfer to the account of the utility service provider an amount of at least 2 thousand rubles.

Repayment of debt under a restructuring agreement cannot relieve a citizen from the obligation to make payments for current housing and communal services every month.

For information on calculating utility bills in a private home in Moscow and the Moscow region, see the article: utility bills in a private home.

In the case of drawing up a schedule for their payment, an amount is determined that does not exceed 20% of total income for pensioners, 25% for employed citizens.

Video: How to write off utility debts:

(No Ratings Yet)

The procedure for restructuring debt for housing and communal services

To change the procedure for repaying debt, the interested person and the organization to which the citizen has an unpaid debt enter into an appropriate agreement. Based on this document, the parties come to a consensus regarding the amount and options for paying a specific amount.

Conventionally, the process of restructuring utility debts can be divided into the following stages:

- collection of necessary documentation;

- drawing up a simple written application;

- provision of papers to a branch of an organization providing housing and communal services;

- waiting for a decision and concluding an appropriate agreement with the institution.

The application can be submitted to the department either by the debtor himself or by his legal representative in person or by post. The document does not have a clearly established form, but it must be supplemented with certain papers proving the identity of the applicant and whether he has grounds for carrying out the procedure.

Such documents include:

- debtor's passport;

- a valid power of attorney and identification card of the representative (if necessary);

- papers confirming that the debtor has reasons for restructuring the debt (for example, a medical certificate of temporary incapacity, a work record book with a notice of dismissal, etc.);

- certificate of family composition;

- documents confirming the title to the apartment (or other documents on the basis of which a person lives in the premises, for example, a social tenancy agreement);

- certificates containing information about a person’s income.

The organization providing housing and communal services to a citizen, after approval of the application, can proceed as follows:

- increase the deferment for making a monthly payment or the entire amount of the debt;

- exempt the citizen from paying penalties for the entire period of delay.

Writing off a utility debt is possible only if there are significant violations on the part of the organization providing housing and communal services, or in connection with a court decision on the cancellation of a citizen’s debt.

Completing an application and agreement

The application does not have a strictly established form, but is drawn up in writing and contains the following information:

- Full name and residential address of the debtor;

- information about the composition of his family and rights to reside in the apartment;

- information about the organization providing housing and communal services;

- description of the reasons for contacting;

- justification for the need to restructure the debt (for example, illness of the payer, confirmed by a medical report);

- options for getting out of the situation (payment in installments, exemption from paying penalties and fines);

- date of document execution;

- applicant's signature.

The agreement must also include information about the parties to the transaction, the amount of debt, methods of repayment, the grace period and other nuances agreed upon by the debtor and the management company.

The document can be drawn up by any of the co-owners of the property or a family member who has permanent residence in the apartment. The agreement continues to be valid until the debtor fulfills his obligations.

Interesting article : Bankruptcy procedure for individuals.

What information is included in the application{q}

The application is written in free form.

The application must indicate the following information:

- Full name of the applicant.

- Registration and residence address.

- Information about family composition.

- Certificate of ownership of residential premises.

- Information about the utility service provider - details, name.

- The reason for petition.

- Attachment of a certificate confirming the reason.

- Request to resolve the conflict - installment plan, removal of accrued penalties and fines.

- Date of.

- Signature.

The application should indicate as precisely as possible the reason why payments were not made on time. You need to make sure you have confirmation, a certificate from work or a medical institution, depending on the reason for non-payment of utility bills.

We suggest you read: Debt to the bank on a loan, what to do

When drawing up an application, the following information must be included in the text:

- FULL NAME. and passport details of the applicant;

- his residential address, represented by an apartment for which he did not pay utilities, which led to the formation of a significant debt;

- information about the applicant’s family members;

- list of documents attached to the application;

- details of the company provided by the utility service provider;

- the reason for drawing up the application, represented by the request to draw up a restructuring agreement based on the existing debt for housing and communal services;

- a request to resolve the conflict peacefully, for which a request is made to receive installment plans and write off accrued fines;

- the date for generating the application is set;

- the document is signed by the applicant.

Particular attention is paid to the reason for drawing up the document. It must be confirmed by official documents. A sample application for debt restructuring for housing and communal services can be studied below.

A correctly formed application can be submitted to the utility service in different ways:

- personal visit to the institution;

- sending an application by mail;

- using the help of a trusted person.

It is advisable to deal with this process yourself. When visiting the management company, you should have two sample applications with you, since one is transferred to the organization, and the other is marked with acceptance. Typically, such applications are considered within 30 days, after which the citizen receives a written response.

Judicial method of conflict resolution

At the moment, the law does not oblige the management company to enter into an agreement with debtors on the restructuring of utility debts.

If a citizen has good reasons for which he was unable to pay receipts for housing and communal services, he has the right to go to court (depending on the amount of debt - district or world) with a statement of claim for payment in installments. The claim is supplemented by a similar package of documentation required when applying to the Criminal Code.

Useful video:

Every citizen living in his own or rented apartment or room must pay utility bills on time.

But sometimes this is impossible to do for various reasons. As a result, debt accumulates, which becomes increasingly difficult to pay off over time.

One way to solve this problem is to carry out debt restructuring.

What it is

Every home owner or tenant needs to take care of timely payment of utility bills. This is his direct responsibility.

If payment is made later than the time established by law or contract, penalties are charged for each day of delay.

But in some situations, a person cannot make a payment due to unexpected unfavorable circumstances.

The resulting debt for utility bills will only increase over time.

As a result, repaying the debt becomes difficult or impossible. But the problem with him will have to be solved. After all, the management company can go to court and demand its forced collection.

One option for a fairly peaceful solution to the problem is debt restructuring.

In fact, the restructuring of utility debt is an agreement on the procedure for repaying the debt.

But first, the debtor must agree on all aspects of the procedure with the management of the management company.

The debtor may contact the management company (housing association, other service organization) with a request for restructuring. They will have to consider it.

The company may refuse to carry it out, for example, if the debt arose due to the negligence of the owner (tenant) or repaying the debt of a particular person cannot but cause financial difficulties.

Legal aspects

The obligation of owners and tenants of residential premises to make timely payments for utilities is provided for by the Housing Code of the Russian Federation.

The norms of the Civil Code of the Russian Federation also apply to contracts between the management company and residents.

But these legislative acts not only do not provide for the procedure, but also do not even include the concept of restructuring the utility debt.

However, there is no need to worry; all necessary tools are provided for in the legislation and the procedure can be carried out completely legally.

Many management companies go for it, realizing that even through the court it will be difficult for them to achieve payment of the debt; in the best case, a person will also agree with the bailiffs on installment payments, and in the worst case, a legal dispute can drag on for a year or more.

But they have the right to refuse such a request, especially if the owner (tenant) does not have the appropriate grounds.

For what reasons is it necessary

If the debt has accumulated due to the careless attitude of the owner of the residential premises to his responsibilities, then he should not count on the management company meeting halfway and agreeing to restructuring.

This procedure does not provide any particular benefit to the service organization, other than the need to prepare additional paperwork. There must be sufficiently serious reasons for its implementation.

Let's consider what reasons are usually considered suitable for restructuring housing and communal services debt:

| Serious illness of the debtor | due to which he could not work for a long time or became completely incapacitated |

| Job loss | due to staff reduction or liquidation of the organization |

| Death of the immediate debtor | and transfer of debt to heirs who might not even know about its existence |

| Other valid reasons | independent from the owner (tenant) of the property |

Whether or not the management company agrees to conclude an agreement for restructuring the rent debt depends only on whether the debtor is able to, i.e. the owner (tenant) of the property agrees with her.

Limitation periods

The management company can collect debts through the court for any period. But at the request of the tenant, the court will have to apply a general limitation period of 3 years.

The management company will be able to collect only debts for the last 3 years.

But if the tenant contributed even a small amount to repay the old debt, then the statute of limitations will begin to run from that moment.

Quite often, management companies try to use a trick and use current payments for utilities to pay off old debts.

But such actions are illegal, and the tenant (homeowner) may demand, when making payment, that it be taken into account against current, and not past payments.

If the case has gone to court, and the debt has been accumulating for many years, then you should definitely use the statute of limitations. This will significantly reduce the amount of debt.

Terms of agreement

In Russia, management companies have no obligation to carry out debt restructuring.

There are no requirements in the legislation of the Russian Federation for the agreement that is concluded during this procedure between the tenant and the management company.

This means that any conditions can be included in it if they do not violate the requirements of current legislation, and in particular the provisions of the Civil Code.

Typically, under an agreement, the management company agrees to write off penalties and fines, and the tenant undertakes to pay off long monthly payments within a certain period in accordance with the drawn up schedule.

According to general rules, the amount of payments to pay off debts should not exceed 25% of the tenant’s income, and if he is a pensioner or disabled, then the maximum payment amount should not exceed 20% of his income.

Process concept

Simply put, restructuring is a benefit for the debtor.

During the restructuring process, for a tenant who has a debt on his account, the conditions under which he pays the amount change, or the period for paying the money increases. Typically, companies are interested in returning money at any cost, and establishing such a benefit for individual citizens is a small and beneficial concession for both parties.

https://www.youtube.com/watch{q}v=2tPuY9hpozU

Therefore, there is not always a benefit for both parties, since a company interested in receiving its money wants to do it as quickly as possible, forgetting about who should pay it this money. During the restructuring process, it is recommended to contact a lawyer who is knowledgeable in this area so that, after assessing all the nuances, he can carry out the procedure correctly and with maximum benefit for the debtor. After all, this is a right, not an obligation of the organization, and they do not provide it to everyone.

Now let’s look at a detailed algorithm for how to restructure utility debt. The basis for such a transaction is a written agreement between both parties. However, this procedure involves separate stages that allow the achievement of these agreements. A subscriber who decides to take such a measure will need to take the following steps:

- preparation of a documentary base;

- drawing up an application for an installment plan request;

- transfer of papers to the HOA representative;

- waiting for the decision of the management office;

- conclusion of a contract with a positive outcome.

As you can see, there are no difficulties in this matter, however, the correct documentary support and argumentation of the defaulter’s request becomes the reason for the housing office to make a decision in favor of the debtor. Let's take a closer look at the points that need special attention.

Let's start the discussion with a list of papers that will need to be collected for the housing office. Here it is appropriate for the tenant to prepare the following documents:

- original and copies of passport;

- ownership papers for privatized apartments or social rental agreement;

- a certificate indicating the composition of the debtor’s family;

- evidence of valid reasons for delaying payments;

- documentation confirming the income of the defaulter and citizens registered in the apartment.

Let us note that it is appropriate to attach to the evidence of temporary insolvency the applicant’s illness notes from health care institutions, a work book indicating that the defaulter lost his job and other similar evidence.

The first step here is the collection and preparation of the necessary documentation

In this situation, the person’s identity card and a notarized power of attorney are added to the specified list of papers. An agreement on the restructuring of debt on utility bills is reached only after submitting the collected package of documentation and writing an application to the employees of the housing office.

Submit a petition

Now let's move on to the question of how to correctly write an application for debt restructuring for housing and communal services. Readers will find a sample of this document at the link, and we will study the main positions that will need to be indicated here. Such a paper is drawn up in free form, but here you will need to comply with the basic norms of business correspondence in order for the request to be accepted for consideration.

In order to sign an agreement with the management company, the debtor will need to submit an application requesting consideration of this debt payment option

A standard example of such a request looks like this:

- "A cap". Here the defaulter indicates the details and name of the organization to which he is applying and adds personal initials and address. In addition, it is advisable to note here information about the series and number of the applicant’s passport, indicate when and by whom the document was issued, and put the date.

- Description of the circumstances. In this part, it is appropriate for the tenant to indicate the content of the request, describing in detail the circumstances that arose and the reasons that led to this. In situations where a family is registered in an apartment, it is advisable to describe the composition of the residents, supporting the words with relevant certificates.

- Suggestions for getting out of the situation. After a brief description of the reasons why arrears have accumulated in the HOA accounts, the defaulter forms a request to restructure payments. By the way, in the same statement you will be able to ask the employees of the housing office to stop the accrual of penalties for the time that the installment plan involves.

- Applications. In this block, the subscriber lists papers in a numbered list that confirm the applicant’s words. Keep in mind that only documents that justify delays in payments and confirm the limited solvency of the consumer are relevant here.

At the end of the application, the tenant puts a date and signs the paper, deciphering the initials. Please note that it is advisable to prepare such petitions without any blots or spelling errors. In addition, it will be possible to clarify specific items that are appropriate to indicate in the application directly on the spot from the employees of the management company.

After submitting a package of papers, the management company considers the request of the defaulter and makes a decision

https://www.youtube.com/watch{q}v=VXpzUPfTScY

However, it is important to take into account that the petition will need to record the specific amount of the debt and indicate the time frame within which full payment is likely. Then the package of collected documentation is attached to the compiled paper and submitted to an employee who is competent in such matters.

Debt restructuring for housing and communal services is represented by a special process that involves making changes to the terms of the agreement drawn up between the management company and the owner of a certain premises. Based on these adjustments, the burden on the payer is reduced, so he can then easily cope with the debt and payments on receipts.

This opportunity is offered only to people who, for good reason, cannot cope with their debt. This is usually associated with the loss of a job or ability to work, so the person simply has no income. When drawing up a debt restructuring agreement for housing and communal services, the financial condition of the owner of a particular apartment is taken into account. Additionally, a payment schedule is formed, on the basis of which the debt is repaid. The process is similar to the procedure for restructuring a loan debt.

Using a restructuring is beneficial for each party, since the homeowner gradually pays off the debt, and the utility company receives its funds in installments.

Debt restructuring for housing and communal services is offered by utility services only if there are compelling reasons. Therefore, the direct owners or occupants of a certain property must prove that they had valid reasons for the debt. Under such conditions, management company employees meet the debtors halfway.

The most popular reasons for drawing up an agreement include:

- dismissal of a citizen from a permanent place of employment due to the closure of a company or layoff, but there will not be a valid reason if the person quits on his own;

- loss of ability to work due to injury, registration of a certain disability group or the appearance of a serious illness;

- the arrival of a newborn in the family, which leads to a significant increase in spending;

- death of the breadwinner in the family;

- conscription of a citizen into the army.

Debt restructuring for housing and communal services is often proposed for disadvantaged families with more than two children. Parents usually do not have a stable and well-paid salary, so they cannot pay a significant amount of money every month. They are offered the most optimal conditions depending on their income.

Even if there are serious reasons, unilateral termination of obligations under a contract by citizens is not allowed, which is prescribed in Art. 310 GK. Therefore, utility services do not always make a positive decision on a citizen’s application. If the decision is negative, then it can be appealed, for which a lawsuit is filed in court.

We invite you to familiarize yourself with: Advance payments for income tax example

Restructuring of utility debt

Restructuring utility debt is a fairly common way to solve the problem.

Indeed, in most cases, litigation is just an additional waste of time, both for the management company and for the tenant.

It is the debtor who must write to the management company with a request to carry out the procedure.

It must include the following information:

| Destination details | name of the management company, full name, position of manager |

| Information about the applicant | Full name, address |

| Request for restructuring | indicating the reasons |

| Proposal on the desired restructuring scheme | and a list of attached documents |

The application must be signed. Otherwise, he will not only not be considered, but will not be accepted at all.

Sample agreement

You cannot agree on restructuring simply in words, even with the management of the management company.

Oral agreements will not have any legal force until the corresponding agreement is concluded.

Usually it is drafted by the management company’s lawyers, and the debtor only needs to study it carefully. A sample of such a document can be downloaded here.

Description of the procedure

After receiving an application from the debtor with a request to consider the issue of the possibility of restructuring and a complete package of documents, the management company must consider it within 30 days.

The debtor is notified in writing of the decision made. If the consent of the management company is obtained, the parties must agree on all the terms of the procedure and enter into an agreement.

If a person violates the terms of the agreement and again fails to make a timely payment under it, then, according to the terms of the agreement, the debt can be collected by force, and with interest.

Video: what to do if the debt for housing and communal services has not been written off

Package of documents

It will be necessary to submit along with the application documents confirming the existence of valid reasons for restructuring.

Other papers may be required. Their specific list can be clarified in advance with the management company.

Let's consider what documents are usually attached to an application for debt restructuring for housing and communal services:

| Documents confirming the existence of reasons for restructuring | medical certificates, a copy of the work book or order, etc. |

| Title documents for the apartment | or social tenancy agreement |

| Inquiries | about the composition of the family and the income of all family members living in the apartment |

| Debtor's passport | and power of attorney (if necessary) |

What are the benefits of this operation?

As part of the restructuring procedure, it is often possible to write off already accrued penalties and fines.

The debtor is also not deprived of the right to receive subsidies for utility bills; he simply attaches a copy of the agreement instead of a certificate of no debt.

Well, the main advantage of restructuring is solving the debt problem without litigation.

The housing and communal services debt restructuring procedure helps a person who finds himself in it due to unfavorable circumstances and financial difficulties to get out of a debt hole.

But you need to take responsibility for all its stages, from preparing the application to making the last payment under the contract.

Every person living on the territory of the Russian Federation, in accordance with the norms of current legislation, is obliged to pay utility bills on a regular basis. However, quite often situations arise that can affect the timeliness of payment, resulting in the formation of significant debt obligations.

In this case, it is recommended to contact an institution that is a provider of housing and communal services and draw up an agreement on restructuring the debt on utility bills. This is one of the most effective ways to solve a problem situation.

To understand the main procedural features, it is necessary to familiarize yourself with the current regulations, the possibility of write-off, the list of documents, the procedure and places of application, key advantages, as well as objective cases when refusal is possible.

Benefits from debt restructuring

Debt restructuring benefits both parties. For utility workers, this is an opportunity to receive their money, albeit in parts, later than the deadline.

The consumer benefits are as follows:

- the amount does not have to be found in full immediately, since the money is paid gradually and in parts;

- the debtor eliminates the risk of accrual of penalties and penalties, since the utility company voluntarily provides a deferment;

- the owner of the property is protected by the terms of the contract signed by the parties.

We recommend: How much electricity does a thermopot consume?

By agreeing on a restructuring, the consumer has the opportunity to continue making current payments without further increasing the amount of debt.

Regulatory acts

In the field of housing and communal services, the main regulations are the following:

- Housing and Civil Codes of the Russian Federation;

- Federal laws;

- Regional and local laws.

Based on the above legal documentation, the activities of all housing management organizations, energy service providers and other participants in the relevant process are organized.

In addition, these regulations fully define the duties and responsibilities of all citizens consuming public services.

Sample certificate of incapacity for work

Is it possible to write off

Authorized employees of management companies often independently offer persons with debt obligations a similar payment option. However, in any case, such a solution to the problem becomes relevant only when both parties reach consensus.

It is worth noting that housing organizations have legal grounds for refusing applicants in cases where it is believed that the restructuring of obligations cannot lead to a solution to the problem.

The concept itself involves dividing the amount of debt into equal parts, which are paid monthly. Another important point is taking into account the circumstances preceding the occurrence of debt.

Debt can be written off only for those categories of citizens who find themselves in difficult life situations due to, for example, layoffs at an enterprise.

An agreement between the parties, if reached, is documented in each specific case.

Possible reasons

Restructuring will be possible if the person can prove that the reasons for his debts to the management company are valid. The procedure can take place under the following conditions:

- a serious illness of the debtor, due to which he became incapacitated;

- loss of a job by a citizen due to downsizing, dismissal, or liquidation of a company;

- death of a relative with whom the person had a common household;

- joining the army;

- being on pension if its size does not allow paying utility bills.

A citizen can contact an organization that provides housing and communal services either independently or through the judicial authorities.

We suggest you read: Response to a claim for debt

There are several reasons why a debt restructuring procedure may be carried out:

- a citizen lacks money due to job loss due to layoffs or for health reasons;

- decreased ability to work due to emerging health problems;

- family problems - illness of loved ones, other reasons.

The only correct solution is to try to solve the problem, do not let the matter take its course and not bring it to court, since the court decision may not be in favor of the tenant.

In order for restructuring to be carried out, it is necessary to prove that there is a serious problem in the family or the payer. Such evidence can be certificates from the hospital, a work record book with a record of dismissal, or a death certificate of a close relative. The reasons may be different, but they must be compelling.

Find out the dangers of evading repayment of accounts payable in the article: repayment of accounts payable. Is it possible to interrupt the statute of limitations for accounts payable{q} Find the answer on this page.

Today, tenants are accumulating serious arrears in utility payments and intend to pay off these payments, but their financial situation does not allow them to pay with one transfer. In such situations, residents are looking for the opportunity to gradually credit contributions to their utility accounts. When employees of the management company believe that there is no other way to repay the debt, the solution is to restructure the housing and communal services debt.

The subscriber’s desire to pay off debts, but lack of finances to pay off the arrears in one payment, becomes the reason for agreements with the HOA to restructure payments

HOA employees themselves offer a similar settlement option to debtors who, for certain reasons, systematically delay payments. However, such a solution to the issue requires mutual consent of the parties. Let us note that representatives of the housing office have the right to refuse defaulters if they believe that restructuring the debt for utilities does not solve the problem.

Another point here is taking into account the circumstances. Only defaulters who find themselves in difficult life situations will be able to restructure payments. This includes loss of ability to work, health problems, and job cuts. True, then you will have to present evidence confirming the debtor’s words. In addition, the agreement will need to be documented.

How is debt restructuring for utility bills carried out?

First of all, those categories of citizens who have debt obligations to the relevant companies must enter into an agreement on the restructuring of debt on utility bills. Only this can help in organizing phased payments.

The amount of obligations will be distributed over a period of up to 18 months. It is important to remember that in each case an individual approach to the debtor is applied.

One of the characteristic advantages of the process in question is that penalties for late payments are not charged. After drawing up an agreement, you need to find out whether you are eligible to receive a subsidy for utility bills.

. It is recommended to use this opportunity to minimize housing and utility costs in the future.

As background information, we can cite the fact that the total debt of Russians for utility services to local management companies reaches 400 million rubles. By 2020, about 800 corresponding phased repayment agreements worth more than 30 million rubles had been concluded.

It is worth noting that more detailed information about the restructuring procedure can be obtained by each interested party from the territorial housing company at the place of actual residence. You can also request a sample contract from the competent employees of the institution for preliminary review.

debt restructuring agreement for utilities

Required documents

To restructure debt obligations for housing and communal services, it is necessary to prepare the following documents:

- civil passport of the Russian Federation;

- notarized power of attorney, if the legal representative of the interested party applies to the organization;

- a certificate from your place of employment confirming the fact of incapacity for work resulting in no ability to pay the debt;

- certificate of family composition;

- any evidence confirming ownership of the residential premises;

- certificate of income, if any.

It is important to remember that even if a more complete set of documentation is presented, the outcome of the process may be different.

Sample certificate of family composition

Where to contact

In the vast majority of cases, debt restructuring services are provided by a local housing organization.

The procedure for concluding an agreement with service providers has the following operational algorithm:

- drawing up an application with a request to initiate the process - a sample will be provided in the office of the organization acting as a direct supplier of energy services;

- provision of the necessary documentation, including a civil passport of the owner or tenant of the premises, a certificate of income, and so on;

- drawing up an agreement on the redistribution of payments.

It is worth remembering the fact that the decision to provide the service in question is always made by the management of the service provider company. The verdict can only be changed through a trial, but often the competent authorities remain in a more advantageous position.

Among other things, to minimize tension with clients, it is the pre-trial procedure for resolving the problem that is used, and service providers make concessions.

Sample income certificate

Agreement and contract

In 2020, the current Housing Code of the Russian Federation and the established Rules for the provision of services in the utility sector do not contain a clear concept of debt restructuring. However, quite a large number of management companies are ready to meet their clients halfway and conclude an appropriate agreement

. At the same time, concluding an agreement is a right, not an obligation of the institution.

The execution of such a document allows you to effectively resolve the issue of repaying existing debt obligations in pre-trial proceedings:

- conditions are strictly individual;

- is given the opportunity to repay the debt as quickly as possible and without worsening the current financial situation of the payer;

- the debtor can continue to count on receiving subsidies and other government guarantees even after the conclusion of the contract.

In most cases, the repayment of obligations does not occur in a lump sum, as in the case of a court decision, but in stages. This takes into account the amounts that a citizen can theoretically pay and the terms acceptable to the management organization.

Certificate of state registration of rights

How to restructure utility debt

Two people live in the apartment and work at the minimum wage; we cannot pay the debt right away. And also, what could happen if the company sues us? Thank you for your attention. Answer: Hello. Before moving on to answering your question, I would like to immediately voice that you should not neglect the offers of online stores selling climate control equipment, such as https://www.klimatproff.ru/, which offer heating equipment at an acceptable price. price and, most importantly, having maximum energy-saving technologies.

We recommend reading: Agreement for the sale and purchase of a share in the ownership of an apartment

What is the advantage

Restructuring debt for housing and communal services has specific advantages. For example, the payer retains the legal right to receive benefits, subsidies and other material compensation. In addition, he is given the opportunity to repay obligations at any convenient time without deteriorating his current financial condition.

The terms of the concluded agreement are negotiated between the debtor and the employee of the institution individually without involving third parties in the process.

Can they refuse?

Not always a request for payment restructuring services can be satisfied by employees of an authorized organization. This leads to service providers quite often refusing. This may be due, for example, to the lack of obligations to implement the process in current regulations

. That is why the decision is made on a voluntary basis.

If representatives of the housing organization make concessions, the result will be positive. In such a situation, the likelihood of pre-trial regulation of the current problem significantly increases, since the debtor assumes obligations to repay the debt

. Persons with outstanding obligations cannot require utility providers to enter into the contract in question.

To minimize the number of possible conflicting payments, it is recommended to make payments no later than the 10th of each month. Otherwise, an additional penalty will be charged for non-payment, and the debt itself will grow steadily.

If the next payment for utility services is not made on time, the amount of obligations will grow almost exponentially. The rapid growth of penalties is determined by the accrual of a fine for each overdue 24 hours. When a large payment amount is reached, it becomes almost impossible for the debtor to repay the amount in full.

Among other things, other measures may be applied. For example, the service provider may temporarily limit the supply of energy resources to the apartment

. Practice shows that this operation is difficult to implement and is almost never performed.

If in the future the user of housing and communal services does not pay for the receipt of electricity, water and gas, then their supply will be stopped completely until the obligations are fully repaid. The debtor will be sent a written notification of this fact in accordance with all norms of current legislation.

Increase in utility tariffs

This is especially true in the autumn-winter period, when the heating season begins.

Find out here how utility bills are calculated.

If the owner of the apartment is a minor, who pays the utilities - we will tell you further.

Every apartment owner may find himself in a difficult economic situation. If, as a result, a significant debt on utility bills has accumulated, then you should not wait for the management company to sue.

It is much easier to conclude an agreement with her to restructure the rent debt.

Debt on utility bills

The law obliges citizens to pay for utility services on time and in full (Article 153 of the Housing Code of the Russian Federation). Unfortunately, this is not always possible.

The accumulation of debt occurs gradually, but one day its amount becomes truly unaffordable for the apartment owner.

For management companies, such debt means the inability to pay service providers, which will ultimately affect all consumers, not just the debtor.

Therefore, the law provides management companies with a wide choice of measures to influence defaulters:

- some of them are of a punitive nature;

- others, on the contrary, are intended to resolve disagreements regarding the payment of utility services to the mutual convenience of the parties.

Consequences

The first unpleasant consequence of late payment of utilities is a fine (Article 155 of the RF Housing Code). This is a punitive measure that should encourage the debtor to repay the debt as quickly as possible.

On the one hand, the size of the penalty is small - only 1/300 of the refinancing rate of the Central Bank of the Russian Federation for one day of debt. But if the rent is not paid for years, then the amount comes out to be substantial.

If such punishment was not enough to influence the debtor, then service providers have the right to limit or even stop providing them until the debt is fully repaid, for example, electricity.

This possibility is established by the Rules for the provision of public services to the population.

However, in order to make such a restriction, a certain procedure must be followed. In particular, you should notify the owner of the apartment about the debt he has incurred and the possibility of taking enforcement action against him.

A sample debt notice can be downloaded here.

At the same time, if rent is delayed for six months, the management company has the right to demand that residents repay the debt within a certain period of time. And then, if the demand is not met, file a lawsuit to collect the debt.

Moreover, if there is an agreement for the provision of housing and communal services, then consideration of the case:

- carried out without the participation of the debtor;

- ends with the issuance of a court order.

In the case where there is no agreement, the case is dealt with in the manner of claim proceedings. However, in any outcome, the decision is transferred to the bailiff service, who will collect the debt.

The most severe consequence of accumulating rent arrears is eviction. It threatens only those who occupy municipal housing under a social tenancy agreement (Article 80 of the Housing Code of the Russian Federation).

Eviction cases are resolved only in court and only by filing a lawsuit.

In this case, the owner of the apartment who insists on eviction is obliged to provide the tenants with other premises. But a much smaller area, according to hostel standards.

Despite the fact that the owner of an apartment cannot be evicted from it for debts even through the court, this is not a reason to neglect one’s responsibility to pay utility bills and other expenses for maintaining the property.

A summons to court is the most common consequence of accumulating rent arrears.

Rent debt restructuring agreement

To date, neither the Housing Code nor the Rules for the provision of public services have such a concept as debt restructuring.

However, many management companies are ready to accommodate apartment owners halfway and are ready to enter into an agreement with them on this.

At the same time, concluding an agreement on debt restructuring is the right, but not the obligation of the management company.

The conclusion of such an agreement allows you to resolve the issue of debt repayment out of court:

- conditions are negotiated individually;

- make it possible to repay the debt in the shortest possible time, but without a significant deterioration in the financial situation of the debtor, which is already not very rosy.

The execution of an agreement does not deprive the debtor of the rights to benefits, compensation or subsidies.

It’s just that repayment of the debt will not occur at once, as with a court decision, but gradually:

- in amounts that are feasible for the tenant;

- within a timeframe acceptable to the management company.

Where to go?

To formalize a debt restructuring agreement, you must contact your management company as soon as possible.

The application will have to:

- state the reasons for the debt;

- propose terms and procedures for debt repayment.

As a rule, management companies accommodate conscientious debtors and do not bring the matter to court.

Sample

A sample rent debt restructuring agreement can be found at the management company or downloaded from one of the legal portals.

The agreement is drawn up in two copies.

It must include a debt repayment schedule, which must be strictly adhered to in the future. Full payment of the debt cancels the contract.

Here you can agree on rent debt restructuring agreements.

Repayment procedure

The benefit of concluding a debt restructuring agreement is that from the moment it is concluded, the penalty for the amount of the debt ceases to increase. But only on condition that payments are made on time and in full.

The terms and amounts are indicated in the text of the agreement.

In addition to repaying the debt, the payer remains obligated to pay the current rent, accrued monthly. A receipt form with the amount of the next payment will be sent monthly, as usual.

Violation of this obligation, as well as the terms of debt payment, will lead to:

- termination of the contract;

- going to court to claim the entire amount at a time.

Appeal to the Criminal Code

An application for reduction and division of debt for utility bills is submitted by the owner of the residential premises to the management company. Without good reason, the supplier will not satisfy the request of the applicant. Therefore, the application must indicate one of the following reasons:

- Difficult financial situation resulting from job loss, delayed wages or unexpected medical expenses.

- Temporary loss of ability to work, serious illness of the owner or his relative.

- Death of the breadwinner.

- Decree.

- A large number of loans.

- All reasons specified in the application must be documented.

The document must be compiled without grammatical and stylistic errors. All information provided in it must be reliable. The application must have the following structure:

- Introductory part: name of the Criminal Code, information and address of the citizen, title of the document.

- Descriptive and motivational: data on the time of connection to public networks, the amount of unpaid fees, reasons for the delay.

- Regulatory part: a request for a temporary change in payment rules and extension periods.

- There is no need to describe the whole story of a difficult life. You just need to briefly indicate the reason for not paying the fee on time and make references to the evidence.

Also, there is no need to indicate too long or short terms for making partial payment. It is better to take a couple of months in reserve, but you should not stretch the time. The supplier himself sets the period for repayment of the debt, taking into account the time specified in the application.

If the stated reason is serious, then the competent persons must grant the requests. However, specialists have the right to refuse a citizen, and the person can appeal the refusal.

On the agreed day, an agreement is concluded between the individual and the management company. Where the procedure and time given for making full payment are indicated. The agreement is signed by both parties and each retains one copy. It is important for the owner of an apartment or a person living in a residential premises for rent to carefully read the conditions.

In the life of every person there are situations when his financial situation deteriorates greatly. Because of this, a citizen cannot pay for public utilities and fulfill his obligations. Therefore, he can agree with the management company to partially reduce the fee by providing a restructuring.

FAQ

Let's look at the questions that often arise among rent debtors.

Restructuring denied

There is currently no law in Russia obliging management companies to enter into an agreement on the restructuring of rent debt.

Service providers do this voluntarily, thereby increasing their chances of pre-trial settlement of the resulting debt.

Since this is a right, but not an obligation, it is impossible to insist on concluding such an agreement.

The refusal may not always be associated precisely with the reluctance of the management company to make concessions and extend the debt repayment period for the convenience of the payer.

An agreement can be concluded before the case is considered in court and a decision is made on it.

However, after the decision has entered into force and enforcement proceedings have been initiated on it in the bailiff service, it is possible to apply for a deferment or installment payment of the debt.

Granted for one year

There are no clear instructions regarding the deadlines for submitting installment plans to repay the rent debt.

Clause 75 of the Rules for the Provision of Utility Services states that this issue is resolved by agreement between the debtor and the service provider.

Also, the law does not oblige management companies to enter into such agreements.

In fact, a debt restructuring agreement is a voluntary concession by the service provider, with the goal of receiving the debt in full and not through the court.

Therefore, there is no point in insisting on extending the maximum period. In this case, the management company may demand repayment of the entire amount of the debt immediately in court.