Is it worth it?

So is it worth buying an apartment by inheritance?

Even real estate experts answer this question rather evasively.

It is difficult to identify all potential heirs, who may well show up years after the transaction and make their claims.

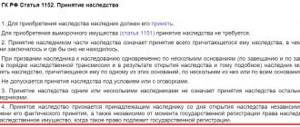

Art. 1155 of the Civil Code of the Russian Federation allows that the heir may not have been informed about the death of the testator until a certain time and provides him with the opportunity to restore his rights in court if he proves this fact.

What problems might you encounter?

The main danger that lurks when making such purchases is the “acquisition” of property claims from other heirs who were deprived. After all, there is a possibility of running into persons whose rights were violated during the distribution of property. They then have the right to go to court for a more satisfactory resolution of the issue. Legal proceedings will lead to new troubles after the purchase of an inherited apartment is completed.

Inheritance itself requires certain rules. Property can be transferred to the closest relatives:

- According to legal regulations.

- After making a will.

In the absence of a will, they begin to divide the property between the heirs who make up the queue. Parents and spouses with children are in the first line. But this issue is not without nuances.

Risks of buying an apartment by inheritance

To visualize the main risk of such an acquisition, let us turn to the list of heirs determined by law:

- The first priority is children, parents, spouse. At the same time, the children are both natural and adopted.

- The second line is grandparents on both sides, as well as brothers and sisters, full and half-blooded.

- The third line is aunts and uncles.

The list continues until the seventh line, which is completed by stepdaughters, stepsons, stepmothers and stepfathers. If we remember that each of them has his own circle of potential heirs, who in the case under consideration can inherit through representation, the fears of real estate purchasers become understandable.

In addition, often an apartment is inherited as collateral or together with the debts of the testator. In this case, the buyer will have to deal with the claims of creditors.

Another common risk is encumbering the apartment with the rights of third parties. For example, housing may be rented for a long time. According to the law, the lease agreement cannot be terminated even if the owner changes.

It is also possible that the seller may be recognized as an unworthy heir after the transaction has been completed.

How to pay for a purchase

There are several types of settlement with the former owner:

- Transfer funds in person upon completion of the agreement. Payments are made in cash; they precede the state registration of residential space.

- Transfer of money in paper form after state registration.

- Transferring an amount through banking instruments, for example, to a bank safe deposit box.

Practice shows that the latter method is the most acceptable, since there is confirmation from the banking structure that the money was transferred. Additionally, it is recommended to obtain a receipt from the recipient stating that a specific amount of money was transferred as payment for the real estate purchase transaction. Immediately indicate the passport details of the beneficiary.

Before making a payment you must:

- Double-check, using the family composition certificate, whether there are people in the apartment who cannot be discharged without permission from special government agencies.

- Check to see if there are people in the house who may qualify for lifelong residence.

- Clarify the consent of other family members who have the right to part of the property, including the seller’s spouse.

You also need to understand that the law allows you to transfer housing taken on a mortgage, so the fact that there are no debts on it must also be clarified.

Fraudulent schemes

So far we have been talking about risks caused mostly by coincidence.

However, the buyer may well become the victim of deliberate self-dealing.

The most popular fraudulent activities:

- Deliberate concealment of the heirs during the conclusion of the transaction and their subsequent appearance in order to seize the property from the buyer after the acquisition. As a rule, scammers insist on a significant reduction in the actual contract price paid for the apartment, citing this step as a tax reduction.

- Fake will. Usually used with the involvement of a notary in participating in fraud. For the buyer, such a scheme is fraught with the appearance of legal heirs.

- The use by a fraudster of a general power of attorney obtained from the deceased owner by deception. In such a situation, criminals try to sell the property as quickly as possible and escape, and the new owner has to deal with the defrauded heirs.

- Obtaining the landlord's will by fraud and his subsequent murder. This scheme was actively used in the 90s and is usually used in relation to persons suffering from alcoholism.

Buying Tips

In order to protect yourself as much as possible from a loss-making transaction, before making it, you should definitely make sure of the death of the previous owner, the identity of the seller, and find out all the transactions performed with the living space to date.

It is definitely worth finding out, if possible, about the family composition of the deceased.

If the apartment is left by will, it is recommended to obtain a written refusal from the legal heirs to challenge it in court.

If there are several legal heirs, the agreement must contain the signature of each of them.

When the seller represents the interests of all heirs, you need to carefully read the notarized power of attorney.

If it has been owned for less than three years, it is better to refuse such a deal. It will help to imagine the entire sequence of actions more clearly.

Step-by-step instruction

- Step one. Obtaining an extract from the Unified State Register in order to trace the history of housing and identify possible encumbrances.

- Step two. Request an extract from the house register and thus find out about everyone registered in a given living space.

- Step three. Obtaining information from neighbors. Sometimes this is the surest way to learn about possible pitfalls.

Typical situations are when the deceased lived with a common-law spouse, while having children from his legal wife who were not registered in the apartment, but had the right to claim a share in the apartment.

- Step four. Determining the circle of heirs, as far as possible. If refusals of inheritance are recorded, it is useful to inquire about their reason.

- Step five. Studying documents - the seller’s passport, death certificate of the previous owner, if there is a power of attorney from the remaining heirs, etc.

Is it worth it or not to purchase inherited property?

The buyer makes a decision on real estate independently, depending on the characteristics and cost of the apartment. There are also risks that should not be forgotten.

First of all, you need to make sure that a certificate of inheritance has been issued for the apartment and new rights to it have been registered through Rosreestr. By the way, when there are several heirs, the question arises of acquiring only a share in the apartment. Not everyone decides to take such a step.

When the living space being sold was the subject of an inheritance under a will, it cannot be guaranteed that it will not be revoked. With this option, a real estate transaction is likely to be subsequently invalidated.

Therefore, inherited apartments have a special status on the secondary market. And in order to protect yourself, it is advisable to take precautions. Then scenarios for further developments of events are predicted.

Purchase of an apartment received by inheritance and owned for less than three years

As you know, an apartment can only be sold by the owner.

If the seller who inherited the apartment became its owner less than three years ago, the risks of purchasing such housing increase significantly:

- First, let’s remember the statute of limitations for inheritance cases: less than three years and when buying an apartment, the likelihood of previously unknown applicants for the apartment will increase significantly.

- Secondly, careless sellers often insist on reducing the transaction amount, arguing this measure by their reluctance to pay the tax levied on the sale of housing owned for less than three years.

Buying an inherited apartment

A woman contacted our agency wanting to buy a one-room apartment. This apartment was inherited by its owner a year ago from his own father. The owner asked our client, when drawing up a sales contract for an apartment, to indicate the cost of 1 million rubles. The actual price of housing that our client had to pay was 6 million rubles. It was this moment that made her seek professional help. As it turned out, it was not in vain. Our lawyers explained the current situation.

Features of buying an apartment received by inheritance

Real estate received as an inheritance belongs to the heir as private property. Therefore, it can be sold or donated like any other property. The law does not provide for specifics of registration of transactions with such inherited property. However, in fact, when buying an inherited property, the buyer takes a risk. This is due to the fact that inheritance law has many different nuances, which are not always possible to trace. Therefore, when purchasing an apartment that the seller inherited, you should be prepared for various surprises within 10 years. You can read more in the article: Limitation periods for inheritance cases

The apartment can be inherited by law or by will. If possible, this point should be clarified with the seller. According to the law, only relatives of the deceased can be heirs. At the same time, they are divided into groups according to the order of the right to receive an inheritance:

Thus, having inherited an apartment by law, the deceased’s own son may not know that besides him there are other children who can lay claim to the inheritance. Article 1155 of the Civil Code of the Russian Federation allows you to restore the missed deadline for accepting an inheritance if the heir did not know about the death of the testator or had other valid reasons. In this case, the certificate of inheritance will be canceled and the inherited property will be divided among the heirs in new shares. The Civil Code states that the heir must go to court within 6 months from the moment he learned about the death of the testator and his possible right to inheritance. Although Article 1155 of the Civil Code of the Russian Federation does not indicate a limitation period, in practice the norms of paragraph 2 of Article 196 of the Civil Code of the Russian Federation are applied. It says: “the limitation period cannot exceed ten years from the date of violation of the right for the protection of which this period was established.” That is, a new legal heir may appear a few years later and demand his legal share in the apartment. Usually the court agrees to meet such heirs and orders the return of the apartment, and the seller in this case is obliged to return the money.

It should be noted that if a will exists, in addition to those indicated in it, only those who have the right to its obligatory share can claim the inheritance, in accordance with Article 1149 of the Civil Code of the Russian Federation:

- Minor or disabled children of the deceased;

- Disabled spouse and parents of the deceased;

- Other disabled dependents of the deceased who are subject to mandatory inheritance.

Their share must necessarily be half of the share due to them in the event of inheritance of property by law. The remaining heirs by law, regardless of the order, can count on the inheritance only if the will is declared invalid.

About statute of limitations

There is another potential problem for the apartment buyer. And it is still connected with the same statute of limitations.

The standard three years prescribed by law are counted from the moment when the remaining heirs became aware of the infringement of their rights.

This can happen many years after the death of the testator due to objective circumstances.

Some of the valid reasons:

- living in another country;

- serving a sentence in prison;

- lack of contact with close relatives due to moving to another city or country;

- confirmation of the fact of family relations in court years later.

In a claim to restore the deadline for accepting an inheritance, all factors are described in detail with reference to the evidence presented. The court evaluates them when making a final decision.

Even if the statute of limitations has expired, the judge is still obliged to accept the case for consideration. And when the second party does not indicate that time has passed, the case will be considered on the merits of the requirements put forward.

Risks when purchasing an inherited apartment up to 3 years after inheritance

The main danger that awaits a buyer when purchasing an inherited apartment is that for the sale of such housing the seller must pay personal income tax, in accordance with the requirements of the Tax Code. Therefore, a standard request in such cases can be considered an offer to understate the cost of the apartment in the documents. This is exactly what happened with our client. Under no circumstances should such an underestimation be allowed. After all, only the seller will benefit, and the buyer will receive additional risk. After all, if there are people who want to claim their inheritance rights to this apartment, and the court decides the issue in their favor, the buyer will only be required to return the amount specified in the purchase and sale agreement. This means that there is a real risk of not getting most of the money. In practice, the difference in price is formalized by a receipt for payment for inseparable improvements, such as redevelopment of an apartment or expensive repairs.

Nuances when buying an apartment after 3 years of inheritance

After 3 years have passed from the date of inheritance, risks for the home buyer still remain. The statute of limitations can be restored in court. True, there must be exceptional circumstances for this to happen. In accordance with the provisions of Article 205 of the Civil Code of the Russian Federation, this may be an illness or helpless state of a potential heir. Heirs can argue that the statute of limitations was missed by saying that they did not know about the inheritance due. However, these circumstances will be taken into account by the court if they occurred during the last 6 months of the limitation period. An heir who has valid reasons for missing the date must go to court no later than 6 months from the date the circumstances that served as the basis for missing the deadline established by law cease. Important. the expiration of this period deprives the heir of the right to go to court.

It should be noted that the period of 3 years is calculated not from the moment of state registration of ownership of real estate, but from the date of acceptance of the inheritance. Most often this is the day of the testator's death. Therefore, if the certificate of inheritance indicates a date much earlier than the certificate of state registration of property rights, this is absolutely normal and legal.

Even if 3 years have passed, the risk of new heirs still remains. Unfortunately, it is not possible to find out in advance whether there are such heirs. However, based on judicial practice, it follows that after 3 years there are very few precedents of the emergence of new claimants to the inheritance.

Registration of ownership

After the transaction has taken place, the buyer needs to contact Rosreestr, since it is after registration that he will acquire ownership of the apartment. To do this, you need to fill out an application and attach the necessary documents to it. The appeal is drawn up in a standard form.

The text should indicate the following:

- Information about the registration authority - name, location.

- Information about the initiator - full name, date of birth, number, passport series, registration address.

- Reasons for obtaining an apartment. In this case it will be a purchase and sale agreement.

- Detailed description of the apartment - area, quantity, number of rooms, location address.

- List of attached documentation indicating the number of sheets of each paper.

- Signature of the initiator and date of drawing up the appeal.

After the application is completed, it must be submitted, along with all documents, to Rosreestr. You can do this in several ways:

- Personal delivery or transfer through your legal representative. This option is the most common. It allows a person to personally verify that his message was delivered to its destination. In this case, errors and inaccuracies can be corrected on the spot or you can receive detailed advice on how to eliminate them.

- Contact the Multifunctional Center. This method allows the initiator not to perform any actions independently. The center’s specialists will send all the necessary documents to their destination.

- Direction by email. This option allows a person to carry out the transfer independently. But for this you will need to have at your disposal technical means for converting documentation into electronic format.

- Express delivery. This method entails additional costs. There is also a risk of loss or damage to documents.

A person chooses any of the options at his personal discretion, based on his capabilities and the nuances of the current situation.

List of documents

To implement the procedure for registering property rights, the initiator must submit a number of mandatory documents.

These include:

- Buyer's and seller's passports.

- Contract of sale.

- The act of acceptance and transfer of the apartment.

- Cadastral passport for the premises, indicating its area, number of rooms, sources of electricity, heat, water and gas, as well as layout. If it has changed, this should be reflected in the document.

- Receipt for payment of state duty.

It is necessary to submit original documents and their certified copies.

A power of attorney may also be required if a legal representative is acting on behalf of the buyer. If an apartment is sold, the owner of which is a minor, then the consent of the guardianship authorities, parents or persons replacing them will be required.

Contract of sale of an apartment

- Look

Timing and cost

For the implementation of the procedure for registering property rights, the current legislation establishes certain deadlines. It all depends on the method of sending documents. If a person sent information by email, the procedure will be completed within one day. When transmitting information through the MFC, the period will be five working days. If delivery was carried out independently or through a legal representative, registration will occur within three working days. The execution period is calculated from the moment the information is received. If this happened on a weekend, then the countdown begins on the next working day. Upon completion of registration, the new owner will be issued an extract from the ERPN.

The cost of the service in Rosreestr for individuals will be two thousand rubles.

What should a buyer of an inherited home pay special attention to?

Since there are cases of fraudulent actions on the part of sellers of apartments inherited, the buyer should pay attention to the following points:

- Be sure to find out from the management company, housing department or neighbors the composition of the seller’s family. Who was registered in this apartment and what kind of relationship they had with the seller or the testator, it is also necessary to order an archival extract from the house register.

- If the seller received the apartment under a will, read the text of that will. After all, there is a possibility that, in accordance with Article 1137 of the Civil Code of the Russian Federation, it contains a testamentary refusal. This means that the testator could oblige the heir to grant a lifelong right to use the housing to any person. However, a change of owner of the property does not affect this right.

Example: Gennady Petrovich, who was in a civil marriage with Marina Vasilievna, died. According to his will, he left the apartment to his only son, but included in it the condition that Marina Vasilyevna has the right to live in the apartment alone and use it until her death. According to the terms of the testamentary refusal, it was prohibited for other persons to move into the apartment until Marina Vasilievna’s death. The son sold the inherited apartment, but honestly told the new owner about the testamentary refusal. Thus, the buyer had the right to move into his home only after Marina Vasilievna died, 4 years after purchasing the apartment.

However, in practice, many sellers do not inform buyers about the bequest, and after purchasing an apartment this becomes a very unpleasant surprise.

Before purchasing an inherited apartment, we strongly recommend that you seek advice. Today in the courts there are a huge number of injured people who took the risk of buying housing from sellers who inherited this housing. The temptation to buy an inherited apartment is explained by its low price compared to analogues.

When purchasing an inherited apartment, you need to be prepared for possible surprises within 10 years. Since, only after this period has passed, you can not fear anything and safely buy such an apartment.

Inheritance was carried out according to a will: threats to the home buyer

If the living space was inherited by the seller under a will, there are also certain risks for the buyer. First of all, such threats may be predetermined by a violation of the above-mentioned legislative norms of the Civil Code, according to which assets are inherited by will. However, the dangers of probate are often underestimated by buyers of inherited apartments.

It is believed that a will implies additional guarantees for the buyer of living space inherited by the seller, since it limits the circle of potential claimants (heirs), distributes assets between specified entities, speeds up the registration of inheritance/property and, as a rule, reduces the likelihood of disputes between legal successors. However, risks for a citizen who bought an apartment from an heir under a will still arise for the following reasons:

- Lack of clear instructions in the will regarding legal successors and shares due.

- The testator may limit himself to indicating a testamentary refusal in the will, which is permitted by the first paragraph of Article 1137 of the Civil Code, or, alternatively, by depriving certain legal successors of the right to inherit, which is permitted by Article 1119 of the Civil Code.

Thus, if a valid will does not contain clear instructions from the citizen-testator regarding the distribution of assets, it may, on the contrary, create additional grounds for challenging the results of the inheritance and, as a result, invalidating the sale and purchase.

The buyer of inherited living space should pay attention to the following possible risks:

- A will can be challenged in court, having it declared invalid at the request of an interested party (for example, one of the legal successors of the current order). It can be proven that the testator drew up this paper while incapacitated, temporarily unaware of what was happening (due to passion, stress, intoxication) or while under the influence (physical, psychological).

- The citizen-testator indicated additional instructions in his own will. A typical example is the aforementioned testamentary disclaimer, which allows a specific subject to live in the inherited housing. Alienation of living space will not lead to the annulment of this right, which will result in the appearance of unwanted neighbors for the new owner of the apartment.

- The presence of certain entities with obligatory shares in the inherited living space, which is provided for by Article 1149 of the Civil Code. Legal successors of this category cannot be disinherited - even if there is a will, they can receive 50% of the inheritance due to them according to the law.

- The legal successor indicated by the citizen-testator in the will may also be recognized as an unworthy recipient of the inheritance, which is permitted by the first paragraph 1117 of Article of the Civil Code. Such a risk, by the way, is very difficult to foresee in advance.