Features of tax legislation when purchasing real estate

The Tax Code has its own characteristics, which are described in the current legislation; they must be followed when making large purchases or receiving funds.

Large-scale sales and purchases are controlled by the country's tax authorities, so the current legislation is the legal framework that controls the process of concluding a transaction. Rosreestr stores information about the property of a citizen of the country. After the transaction is completed, the right to use the object passes to another individual. Having transferred his property to another owner in an official way, the owner is obliged to display this in the form of a declaration in the register of the tax institution.

The nuances of the legal procedure may be different, so by contacting a tax office, you can avoid difficulties. The purchase of an object occurs upon full repayment of the amount or in installments; all legal aspects are included in a single document, the basis of the transaction.

If the seller does not fill out a declaration or report the purchase to the tax office, then he is avoiding fulfilling obligations that are the same for everyone. The buyer of a property, in order to receive a deduction, collects documents and presents them to the tax office.

The following documents are needed:

- a receipt issued by the seller that he received money for the transaction;

- payment certificate from a financial institution about charges to the account.

The inspectorate receives information about the conclusion of the contract. To avoid difficulties, each member of the transaction for the sale or purchase of housing must provide information to the control organization.

Tax legislation consists of legal regulations that act as the basis for transactions involving the purchase and sale of real estate and other valuable objects. To receive a deduction, you need to contact the authority to obtain such a right; any monetary manipulations must be transparent; hiding income is punishable.

The Tax Code provides a citizen with the opportunity to apply for a deduction for the purchase price. This law allows you to reduce the amount payable or completely avoid tax. Each case is individual, is considered in the following order, and has additional nuances that are attached to the case.

Tenure period

If there are no documents confirming the expenses incurred when purchasing a car, then the tax base can be reduced by 250 thousand rubles at one application of the taxpayer. This option is suitable if there are no documents confirming expenses. For example, the car was inherited or the documents were lost. But such a deduction can be claimed even if there are documents confirming expenses - in some situations it is more profitable to use it.

Owned the car for less than three years

The sale of motor vehicles by an individual is subject to personal income tax. For residents of the Russian Federation the rate is 13%. A person pays the same tax, for example, when receiving a salary, selling real estate, or receiving other income.

We recommend reading: Is it possible to sell an apartment if a person is registered in it?

Calculating personal income tax is very simple. The purchase price must be subtracted from the sale price, thereby obtaining the resulting income. Then the resulting amount must be multiplied by 0.13% (13 percent tax rate) or by 0.3 if the seller is not a resident of the Russian Federation.

What purchases are tax-exempt?

You can get an apartment in various ways: this opportunity does not always lie in the act of buying and selling. Housing can be inherited in accordance with a will, received through a gift, or purchased under a rental agreement that was drawn up before the last change. If the property purchased in this way is sold over several years, then, following tax legislation, there is no need to pay a fee. Changes are regularly made to the Tax Code, new clarifications and nuances appear. Tax payment is regulated depending on the following aspects:

- If the transaction is free of charge, you do not need to pay tax when receiving the apartment. Re-registration of real estate occurs on a voluntary basis in the case of donation, privatization, or inheritance.

- The apartment is in use for the specified minimum period, which is prescribed by law; payment of tax is optional.

- The cost of the apartment affects taxation and changes made. If the transaction is completed before the amendment, then the final nuances must be taken into account.

The amount that appears in the contract is included in the database; in other circumstances, it is necessary to know the cadastral value of the object. The value of housing is taken at the beginning of the year, additions are taken into account when drawing up the act.

Three years is the period of ownership of housing, after which you can sell the property without paying tax; aspects of the transaction will be prompted by the clauses of the current legislation.

Tax interest is not paid if the property is sold after the permissible period of ownership of the property has expired. Tax legislation has clarifications on the terms that are subject to interest; the nuances of the transaction should be clarified by a lawyer.

Tax exemption

Indicate in the contract a cost of less than 250 thousand rubles. An illegal but effective method of tax evasion, very often used in Russia. The contract simply indicates a price less than the non-taxable maximum of 250 thousand rubles. However, you need to know that using this method can lead not only to problems with the tax authorities. If is terminated or declared illegal or void, returned . In this case, you can lose an amount significantly exceeding the hypothetical fee.

Conclusion

The donation and subsequent sale of the gift is also considered generation .

Advice! Thus, you can reduce the cost of a car by 30-50 thousand rubles, and the mandatory state duty will have to be paid from a much smaller amount. And this, in turn, will bring the car enthusiast some profit from the transaction.

The very first option on how to completely get rid of the accrual of public debt is to wait three years from the date of registration of the power of attorney for the car. After all, according to the law, tax on the sale of a car that has been owned for more than 3 years will not be collected in 2020. But then during this period the driver will have to pay a monthly transport fee, and after deducting these costs, the savings will not be very significant.

Duration of possession

Tax on the sale of a car owned for less than 3 years is imposed on all drivers, without exception, including people with foreign registration. When such a transaction is completed, a declaration is drawn up between the seller and the buyer, which indicates:

Which sales are not subject to tax How not to pay or reduce tax Rules for applying deductions Deadlines for filing a 3-NDFL declaration and paying tax. If you sell a car, you must pay sales tax. However, there are legal ways to reduce the tax or not pay it at all. Today we will tell you in what cases the obligation to pay tax arises, which sales tax does not require payment, how the amount of tax is calculated and how to reduce its amount. There is a concept of a minimum period of ownership of property. If you have owned the property for longer than the minimum period, you do not have to pay tax when you sell it.

Study the legal requirements regarding the payment of personal income tax when selling a car, since by using various types of algorithms you can significantly reduce the amount of tax payable. The transaction for the sale of a vehicle is subject to taxation.

Car sales tax 2020: how much personal income tax will you have to pay?

Cars for sale. Purchase request. Service promotions. Service contracts. First meeting. Painting and body repair. Service packages. Loan calculation. Credit programs. Credit application. Sign up for a test drive. Remote claims settlement. Car purchase. Commercial vehicles available. Our team. Feedback. I agree to the use of my personal data.

23 Feb 2020 etolaw 44

Share this post

- Related Posts

- Payment with maternity capital for part of the house

- Retirement points for caring for several 80 year olds

- What time is it legal to make noise in an apartment?

- Wife of Military Pensioner After Death of Husband Receives His Pension

Nuances of legislation

The tax is levied in accordance with federal legislation, which regulates relations related to the object of purchase and sale and takes into account all aspects of the concluded contract. Every citizen of the Russian Federation is a taxpayer upon reaching the age of majority; therefore, any purchases are recorded in a single tax base and are subject to tax deductions. A minor citizen does not pay tax personally; if the housing is registered in his name, this right is transferred to the legal representative. If manipulations with the property were carried out after 2020, then the following changes and additions are relevant:

- The duration of use of real estate, its minimum period changes, after the end of the period the owner does not pay tax when buying or selling. The period that was previously acceptable was three years, today the object must be in use by one entity for at least 5 years. A property that is privatized or received as a gift, as well as any other legal manipulations with housing, are not subject to taxation if the owner has been using the property for more than three years.

- The cost of an apartment may vary, but if the seller indicates a low price for housing, then the tax amount changes. The cost may be equal to the cadastral value of the housing, then the tax is calculated from the amount indicated in the documents.

Innovations are introduced into federal legislation regularly; a legally illiterate citizen may have difficulties completing the procedure for buying and selling housing. For this purpose, there are legal offices that will help you correctly draw up documentation and calculate taxes.

Rules for filing a tax return

When making large sales, the seller undertakes to fill out documents for the tax service, including a declaration. The document has a given format, which is controlled by government agencies and has a uniform template. Documents are submitted to the federal tax office at the place where the transaction was concluded. The document is submitted during the year in which the transaction was concluded.

The declaration is an important document that allows the state to control income, citizens’ profits, and monitor tax obligations. A citizen who has made a large sale is obliged to fill out a declaration, even if the tax from this transaction is minimal or equal to zero.

Today, all documents can be filled out in electronic format, or by contacting the inspector and completing everything on paper. The declaration must be submitted personally by an individual or sent by mail.

To submit papers electronically, you must register on the tax office website, create your own page, and send all files to the inspector through it.

The declaration is always submitted together with other documents:

- A copy of a document confirming the transfer of rights to the next owner, a certificate of exchange, purchase, sale, or any other document that confirms rights. Such papers contain information about the cost of the object and additional information.

- Documents that indicate the buyer's expenses; copies of checks and payment receipts are attached here.

- Additional papers, certificates relating to a specific case, the method of transferring the object for use.

When making a declaration, you must have copies of all documentation; upon request from the inspector, during the inspection of a specific case, you must present the originals upon request. All documentation is stored in the tax service; if originals are needed, the inspector who accepts the papers must make a list of the required documents.

The amount of tax depends on the profit received during the sale of the property. The total amount of tax can be calculated only upon completion of all work on a specific case, as well as after checking the documentation.

Features of deductions when selling real estate

Real estate tax is a significant amount; many are trying in every possible way to reduce this expense using tax deductions. Proper use of benefits will save money.

This benefit can be used by:

- an individual who has a passport of a citizen of the Russian Federation;

- a person who does not have an official place of work;

- citizens who do not pay taxes or pay them according to a simplified system, namely pensioners, entrepreneurs.

Groups of citizens who are exempt from paying taxes can be found in federal legislation. The document stores all the information about possible benefits and how to obtain them.

If the property was sold before the minimum period specified in the law, then the individual has the right to take advantage of the tax deduction in accordance with the current situation.

We recommend that you read:

Tax on the sale of an apartment owned for less than 3 years

This type of benefit is issued to a citizen once every 365 days. In such circumstances, tax is paid with a deduction, which allows for savings. All nuances are spelled out in the Tax Code. If the value is equal to the cadastral value, and it is not higher than the deduction, then the total cost of the tax is zero.

Each case is considered individually and has its own nuances. A tax deduction can significantly facilitate the payment required by law.

Taxes and requirements when selling a car by an individual

When selling a vehicle, the seller can save his money . He has the right to deduct from the amount of income the costs of servicing and maintaining the car.

Ways to reduce the tax rate

Owners of a vehicle that has been in their possession for more than three years should not worry about how the tax office will find out about the sale of the car and the sale amount. And they won’t have to make any calculations.

In 2020, you bought a car for 200 thousand rubles, in 2018 you sold it for 250 thousand. In 2020, you must file a 3-NDFL declaration. Let's calculate which scheme is more profitable for you: - Deduction of expenses for purchasing a car. The tax is taken from the difference between the sale price and the purchase price: 13% x (250 – 200) = 6.5 thousand rubles. — Property deduction. The tax is taken into account that income is reduced by 250 thousand: 13% x (250 – 250) = 0 rubles. Obviously, in this case it is more profitable to apply a property deduction, since after applying it you will not have to pay tax. Don't forget to submit your declaration! Despite the sale of the car without tax, you are required to notify the tax authorities about the transaction.

In 2020, you sold a car that you owned for less than 3 years. By April 30, 2020, you must fill out the 3-NDFL declaration and submit it to the tax office. Since, as a result of the calculation, you still owe, you have until July 15, 2020 to pay the tax on the sale of the car.

Rules for applying deductions when selling a car

Tax deductions for other items may offset some or all of your tax. If in the same year you sold a car and, for example, paid for medical treatment, then the deduction for treatment will be taken into account when calculating the tax on the sale of the car. Tax deductions are described in detail in articles about treatment, training, and buying an apartment.

Based on subparagraph 4 of paragraph 2 of Article 220 of the Tax Code of the Russian Federation, an individual entrepreneur who operated a vehicle in his business does not have the right to use a property deduction in the amount of 250,000 rubles provided for in paragraph 1 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation. And it cannot reduce the income received from the sale of the car by the amount of expenses incurred and documented.

- “010” is the amount of income received from the sale.

- “040” is the amount of tax deductions. Moved from Appendix 6 line 160.

- “060” is the difference between the lines “010” and “040”.

- “070” is the calculated tax amount. 13% of line "060". If the tax base on line “060” is zero or has a negative value, then the tax amount will be equal to 0.

- “150” is repeated once again from “070”.

We recommend reading: Can a Disabled Person Be Bringed to Administrative or Criminal Liability?

Submit through government services

To send 3-NDFL through the State Services website, you need an enhanced qualified electronic signature. Without this signature, the declaration cannot be sent. But the form can be printed and submitted in person to the tax office.

So, in order not to pay tax on the sale of a car, you need to wait until it is three full years from the date of purchase. The purchase date will be considered the day on which the purchase and sale agreement was signed by both parties (seller and buyer). After the taxable period has passed, you can sell your car without regard to the tax service.

Selling a shared use apartment

An individual engaged in the sale of real estate has the right to sell more than two objects during the year, then it is calculated from the total amount, which is recorded in the declaration. Shared use of housing involves several owners; the deduction amount in this case is distributed equally among all owners.

This type of transaction has the following features:

- If the apartment is sold, it is in shared use in accordance with various purchase and sale agreements.

- Each owner has a registration certificate, data from the unified register.

There are other options, ways to reduce taxes and take advantage of benefits. The property can be sold for the purpose of purchasing a new home, then all clarifications should be indicated in the documents when completing the transaction.

In shared construction, each owner has his own area, which is precisely specified and documented. The sale of such an object affects all parties to the transaction. If the property was mortgaged, then such property has additional nuances during registration; both parties undertake to follow the same rules equally.

A citizen can spend funds from the sale of an apartment on the purchase of a new home; a declaration must be filled out.

In this situation, the individual pays tax only on the difference between the two amounts. If you use this method, you must provide evidence related to this transaction, copies of checks, receipts, and purchase transaction documents.

Selling an apartment that has not reached the minimum period

An apartment that was purchased before the changes were made can be used for three years without paying tax. This clause is spelled out in legislation and has legal force.

The method of acquiring an object can be very different: privatization, gift, will. Housing can be obtained in different ways, but a document of the transaction must be available, a certificate from the donor or other evidence. The state fee is paid upon registration of all papers.

The duration of use of a property can be found out by making a request to Rosreestr; all information relating to any manipulations with land and real estate is stored there. The period begins to be calculated from the moment the rights of use are transferred and the information is entered into the unified register.

The latest adjustments were made in 2020, after which a period of five years is required to make a sale and take advantage of the tax deduction.

Last changes:

- the period of use of the property is 5 years;

- housing must be transferred upon concluding a paid contract;

- If all conditions are met, tax payment is not required.

Changes are valid for everyone and must be strictly observed by both parties to the transaction. For advice, you should contact the tax service; the inspector will tell you all the intricacies of a particular case. The minimum period is controlled by law.

Specifics of tax on the sale of real estate

Sales and income of an individual are subject to taxation in accordance with new legal and regulatory acts. The following points are considered the main addition:

- Date of conclusion of the transaction, purchase of real estate. Until 2020, the owner and shareholders must use the apartment for up to three years in order to exempt themselves from tax. Otherwise, tax will be charged upon resale of the object.

- Following the latest changes in the Tax Code, a citizen who purchases real estate after 2020 must use the property for more than five years after the deadline for paying tax obligations has expired.

The latest changes did not affect the tax deduction; it remained valid, so everyone can take advantage of their benefits. What tax on the sale of an apartment can be determined only by the tax authority upon presentation of all the papers related to the transaction.

The tax-free amount can be as high as one million, depending on various factors that are considered on a case-by-case basis for each sale transaction.

An innovation was the use of the cadastral value of the housing being sold. This value is used when the price for an apartment is much higher than its cadastral value. The legislation of the Russian Federation warns all citizens that when selling an apartment it is necessary to fill out a declaration and submit all documents to the tax office.

The declaration is filled out in any case, even in a situation where the tax is zero, it is necessary to provide information on the transaction that was concluded: the sale or purchase of real estate.

Documentary evidence is a certification of a citizen’s legal right. Using documents, you can prove your rights if necessary.

The specificity of tax legislation lies in strict compliance with all legal obligations of each party to the transaction. Changes in the code, knowledge of all the clarifications will help you draw up a deal correctly.

Car sales tax in 2020

- If the car was purchased more than three years ago (for transactions carried out in 2020 - if the car was purchased by the first owner in 2020 or earlier);

- If the profit from the transaction is negative, that is, the car is sold at a price lower than the one for which it was bought;

- If the sales price of the car is less than 250,000 rubles.

- The conditions are mutually offset, that is, it is enough to fulfill at least one of them for the former owner to receive a tax benefit.

We recommend reading: Vacation for Working Federal Veterans of Labor in 2020 Latest News

Before the transaction, it is worth checking whether the object of sale falls under tax conditions. The seller must take care of this, in whose interests it is to sell the goods legally and quickly. The seller should also check the need to prepare a 3-NDFL declaration, since he receives income.

Tax obligations for different population groups

Inheritance of housing is subject to a tax of 13%; such an apartment can be donated or transferred to the owner by will.

You can receive an inheritance only by fulfilling all the conditions, as well as by legally formalizing the procedure correctly. A tax contribution must be paid if the property has been in use for less than three years. The period is counted from the moment of donation; the date included in the will or other document transferring the right of use is the beginning of the countdown. When transferring an apartment as a gift, difficulties may arise with paying taxes if there are no documents with the primary value of the property. Then the owner cannot provide all the documents in full, and therefore cannot claim a tax deduction. The sale of donated real estate after a period of three years can relieve the owner from paying taxes.

The Tax Code does not have amendments for pensioners. The rate payable is uniform and has no nuances.

People of retirement age can take advantage of:

- tax deduction;

- take away the costs of repairs or purchasing a new home.

These benefits can be enjoyed by all citizens who purchase or sell housing. The pensioner also undertakes to fill out a declaration and report the transaction to the tax office. If you do not do this procedure, you will face a fine provided for by law.

We recommend that you read:

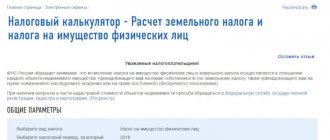

How is the tax amount calculated for an apartment or other type of housing property?

If the minimum period of use of the apartment is observed, it is not necessary to fill out a declaration and visit the tax office. All legal requirements have been met, no additional information is needed.

Benefit for pensioners on transport tax in Moscow

The Federal Tax Service Inspectorate is a structure authorized to provide clarification on whether there is a benefit for paying transport tax for pensioners in Moscow. According to Article 363 of the Tax Code, the fee is paid at the location of the vehicle. Article 83 of the Tax Code recognizes the place of residence of the individual who owns the car as the location.

Elderly people cannot claim privileges regarding the transport tax if they are recipients of state benefits due to age. Benefits for pensioners on transport tax are possible in Moscow if the taxpayer submits to the Federal Tax Service employees documents confirming the validity of the reduction in the amount of duty. Moscow legislation provides a 100% discount on passenger cars up to 200 l/s for:

This is interesting: How to fill out 3 Personal Income Tax for a Pensioner for Treatment

Registration of the declaration

The declaration is an important document for registering the income of citizens. The document has a single template and is filled out in accordance with the specified requirements. The completed document is handed over to the inspector at the place of registration of the individual or at the address where the transaction was concluded. The declaration must be filled out within a year after the conclusion of the contract; the accrued amount can be paid before mid-summer of the current tax period. If you do not complete all the manipulations provided for by law, the citizen will face a fine, which must be paid. You can submit documents in the following ways:

- by contacting the tax office;

- visiting the tax office in person.

The official website contains all the necessary information that a citizen will need. You can monitor the results online after submitting your declaration. This method is convenient and saves time and money. For additional information, you should contact the tax office; the inspector will help you register, give you personal access and all the necessary information.

The declaration must be brought to the inspection in person or through an authorized representative. Today, the declaration can be filled out not in person, but by contacting special companies that specialize in this issue and will help solve the problem correctly.

The declaration is filled out in two versions, both documents are submitted to the inspector for verification, after which one remains with the tax organization, and the second copy with stamps is given to the individual.

The declaration cannot have corrections or inaccuracies; if there are any, the document loses its legal force and is considered invalid. The document is subject to computer verification, all inaccuracies are identified immediately, filling out requires special attention and accuracy.

An employee checks the veracity of the declaration for 90 days; if an error is identified, the client is notified of this in the form of a letter or call. If a document is drawn up incorrectly, the citizen undertakes to fill out the document again within a short time.

Late payment of tax

Every citizen is obliged to pay tax after making a purchase. If a person does not submit a declaration and does not seek advice from the tax service, this does not exempt him from a fine. Penalties are assessed if the sale of real estate was made earlier than the minimum period. Even with zero tax, after applying the deduction, you should contact the tax inspector and provide information about the transactions made. A fine is assessed in the following cases:

- if the declaration was completed later than the 30th of the reporting period, as a rule, it ends in April;

- The amount of tax that needs to be paid is not paid by mid-July, then a penalty established by law will be added for one day of delay.

If a citizen does not respond to penalties and refuses to repay the debt, then he faces legal proceedings. The court can hold a citizen accountable; the presiding officer during the process chooses the punishment, as well as possible monetary sanctions. You should sell real estate correctly, using your rights and fulfilling your responsibilities.

You can enter into the rights to use housing and become a full-fledged owner only by doing everything legally correctly. Income tax is an important column in the Tax Code, which is required to be completed and submitted to government authorities. The state duty is paid within the prescribed period; for failure to comply with the sanctions, the citizen will be fined.

Late payment of taxes is punishable by law; there is legislation with a regulatory and legal framework for this. The assignment of the right to use real estate must be registered in the tax base.

What is income tax?

Income tax is a tax that is levied on amounts of money received by individuals and recognized as their income. All payments under an employment contract in the form of wages are subject to mandatory personal income tax.

How to calculate maternity leave for pregnancy and childbirth can be found here.

The personal income tax rate that applies to wages and related payments is 13 percent.

When calculating wages, the accountant calculates 13% of the accrued amount, subtracts the resulting tax amount, and the employee is given earnings minus personal income tax.

In addition to personal income tax, wage payments are also subject to insurance contributions . But unlike personal income tax, contributions are calculated in excess of the amount of income and are paid from the employer’s funds. Income tax falls on the shoulders of the individual; the employer only performs the function of a tax agent - an intermediary who withholds and transfers funds to the budget.

This type of tax is levied on wages, vacation pay, bonuses, vacation compensation, and sick leave payments. As for payments for maternity leave (maternity leave and child care), different rules apply.

Do I need to withhold maternity benefits or not?

Whether or not sick leave benefits for pregnancy and childbirth are taxable is specified in clause 1 of Article 217 of the Tax Code of the Russian Federation. This article lists non-taxable income of individuals, including maternity payments.

The accountant calculates maternity benefits after receiving an application for leave and sick leave from a pregnant employee. The period for calculating and assigning payment is 10 calendar days. About the procedure and deadline for paying maternity benefits

Latest clarifications in tax legislation

Tax, state duty from the sale of an apartment or any other real estate object is paid to the state treasury in accordance with the law. Federal legislation may have additions and clarifications that relate to taxation.

Legal acts have been changed, so the payment procedure itself has its own nuances and clarifications. These include the following changes:

- the period of use of the property has been changed;

- clarifications in the estimated cost of the object.

Apartment owners who purchased housing after 2020 do not pay tax if the apartment has been in use for more than 5 years. Otherwise, the state duty is paid in full.

Such changes are introduced for a more thorough and detailed check. Various types of fraud can be carried out on the basis of real estate, which are associated with inappropriate waste of money. With the help of changes to the Tax Code, government agencies are trying to get rid of fraud as effectively as possible and adjust the purchase and sale of real estate.

Until 2020, only the price of the apartment was included in contracts and documents, which was set by the seller himself; it could be either cheap or significantly exceed the permissible norm.

Taking into account the innovations, the documents contain information about the cadastral value of housing, which is fundamental for establishing the real value of real estate. The cadastral value is influenced by internal and external economic factors, therefore, additions or changes are made annually to the real price of the property.

If the cost of an apartment is higher than its cadastral value, then tax is charged on the balance when calculating the difference. The additions are relevant; they help to cope with difficulties when drawing up a purchase and sale agreement.