Deed of gift is the transfer of rights to a thing or other property on a gratuitous basis. When donating real estate, the owners play it safe and include in the donation agreement a condition that the apartment will be donated after the donor dies. Will a deed of gift for an apartment be valid after the death of the donor? The law clearly regulates the participation of citizens in transactions. The right to participate is acquired by a person at birth and ends at death. Based on this norm of the Civil Code of the Russian Federation, the gift loses force with the death of the donor.

Important! The gift must be accepted during the owner’s lifetime. Real estate is considered accepted as a gift after state registration in the register. Otherwise, the recipient of the gift will have to turn to the judiciary to protect their rights.

What is a gift agreement

The parties to the agreement are the donor and the recipient. The owner of the property undertakes to donate his item or other property to the recipient of the gift. The deal is unconditional. Property cannot be donated with a requirement to transfer something in return or with a restriction on the rights of the recipient to dispose of the gift at his own discretion.

The apartment donation agreement is concluded in writing. Only this form is considered legal. The apartment becomes the property after registration by Rosreestr. It is not necessary to have the agreement certified by a notary; a simple written form is sufficient. The transaction must not contradict Russian laws, so it must be drawn up correctly. The subject of the donation must be clearly indicated. If this is an apartment, the address and dimensions of the home are written down, and documents on ownership are attached to the contract.

Types of donation:

- Factual – the gift is accepted immediately,

- Consensual - an agreement to give in the future.

Giving after death - is it possible?

The condition regarding the acquisition of the right to own a gift after the death of the owner is not specified in deeds of gift. This condition in itself leads to the nullity of the transaction. Such an agreement will not be considered concluded due to a contradiction with the law. The prohibition is contained in Art. 572 of the Civil Code of the Russian Federation in 3 parts. The notary who is handling the inheritance case must be informed about the nullity of the agreement. Such a transaction does not entail rights or obligations.

Please note: the transfer of a donated apartment should only be carried out during the lifetime of the owner. After his death, the property will be transferred to the heirs of the deceased.

Usually, such large gifts as an apartment are given by close relatives. This type of property transfer is not subject to personal income tax. If the donor lives in a donated apartment, he is afraid of being left without housing, this is especially true for elderly relatives: grandparents. They give the only apartment to their grandchildren, and in order not to end up on the street, they include in the contract a condition on receiving the apartment after their death. This cannot be done; such an agreement will not be registered with Rosreestr. The agreement may also include a clause on the donor’s right to reside in the donated housing. However, this clause also violates the law. The gift transaction must be completed without any conditions. There is a complete transfer of rights to property. Otherwise, it will be easily challenged in court by the heirs of the deceased owner.

The donated apartment is inherited

» Inheritance of obligations September 03, 2020

Features and nuances of a deed of gift after the death of the donor or donee: what goes to whom and to whom?

The procedure for transferring property is fraught with many difficulties.

And they relate not only to obtaining various necessary papers - of which there are many needed - but also to unforeseen circumstances.

For example, a grandfather promised his grandson an apartment with a suspensive condition - by the end of school. And he died a week before graduation

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Find out on our website about the pros and cons of a gift agreement, as well as what is better to formalize: donation or purchase and sale.

Concept

What is a deed of gift for an apartment after death? Strictly speaking - nothing.

The deed of gift that was drawn up may even have paid a notary for it, but was not supported by the re-registration of ownership.

Or it is a document containing a clause about the transfer of square meters into the hands of the recipient only after the death of the previous owner (which is directly prohibited by law).

One of the irrevocable conditions of each donation is the presence of both homeowners, former and future, during the re-registration procedure.

Both of them must appear at the Registration Chamber or the Cadastral Chamber with a package of documents to register the transaction. The agreement will be signed there - in the presence of an official. Only in this case can you expect that the transaction will be registered.

No, they can also refuse for other reasons, in particular - an incorrectly executed transaction agreement or some document is missing, but the absence of one of the parties is precisely the factor that makes further execution impossible.

The deal is completed by the cadastral extract received by the new owner from Rosreestr after successfully completed verification and registration. The shorter the period between drawing up the deed of gift and re-registration of ownership, the better.

Read about the peculiarities of registering the donation of an apartment with the right of lifelong residence of the donor in our article. Also find out whether you can re-gift. sell or return the donated apartment.

How is a deed of gift for an apartment drawn up upon death?

If the donor dies

What is a deed of gift for an apartment after the death of the donor? Is it possible to conclude a gift agreement with a deferred execution after the death of the donor?

An agreement to donate an apartment may be consensual - that is, it may imply the presentation of a gift in the future. Usually this is tied to some significant date - for example, the recipient’s twenty-fifth birthday or his graduation from university.

But when concluding such an agreement, you should remember that people are not eternal and no one can guarantee. that he will live at least another week.

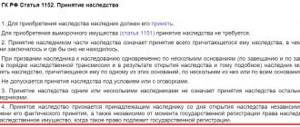

And if it so happens that the citizen who promised square meters left the world before the X day arrived, then this will no longer be considered not as a gift, but as an act of a testamentary nature (Article 1152 of the Civil Code of the Russian Federation). And then it depends.

Who will get the gifted apartment after the death of the owner?

It may indeed be that as a result of this will, everything will go to the failed recipient, or perhaps it will have to be divided - it is possible that among the relatives of the deceased there will be those who have the right to an obligatory share in the will, no matter what the will of the owner may be in this regard.

These are dependents. those who were dependent on the owner of the apartment during his lifetime - children, disabled people, disabled parents or spouse.

The transaction agreement itself, which contains a clause stating that the square meters will become a gift only when the owner departs for another world, is considered void (Article 572 of the Civil Code of the Russian Federation).

Civil Code of the Russian Federation Article 572. Donation agreement

- Under a gift agreement, one party (the donor) gratuitously transfers or undertakes to transfer to the other party (the donee) an item of ownership or a property right (claim) to himself or to a third party, or releases or undertakes to release it from a property obligation to himself or to a third party.

If there is a counter transfer of a thing or right or a counter obligation, the contract is not recognized as a donation. The rules provided for in paragraph 2 of Article 170 of this Code apply to such an agreement.

- A promise to transfer a thing or property right to someone free of charge or to relieve someone from a property obligation (promise of donation) is recognized as a gift agreement and binds the promisee if the promise is made in the proper form (clause 2 of Article 574) and contains a clearly expressed intention to make a gratuitous gift in the future. transfer of a thing or right to a specific person or release him from a property obligation.

A promise to donate all of one’s property or part of one’s entire property without indicating a specific object of donation in the form of a thing, right or release from an obligation is void. - An agreement providing for the transfer of a gift to the donee after the death of the donor is void.

The rules of civil inheritance law apply to this type of gift.

About the peculiarities of donating an apartment that has been owned for less than 3 years. As well as apartments with encumbrances, you can find out on our website.

If the recipient dies

To whom does the donated apartment pass after the death of the donee? The deal will also not be valid. because there is no one to receive it.

You can rewrite the agreement, then the donation will be registered in the name of, say, the widow or children of the recipient.

The situation is somewhat different if everything is formalized correctly and both parties survive to go to the Registration Chamber.

Donation is a very serious transaction, and you especially need to remember the point that it almost never has retroactive effect.

About in what cases the donor can revoke the deed of gift. and also about the conditions under which the gift agreement is considered invalid. you can find out from our articles.

In the event of the death of the donee, the apartment is returned to the donor? The owner can stipulate in the document a condition that if he outlives the person he is gifting, then the donated apartment will return to him after death (Article 578 of the Civil Code of the Russian Federation). This point is absolutely legal and is stipulated in the section on special conditions of the contract.

Civil Code of the Russian Federation Article 578. Cancellation of donation

- The donor has the right to cancel the donation if the donee has made an attempt on his life, the life of one of his family members or close relatives, or has intentionally caused bodily harm to the donor.

In case of intentional deprivation of life of the donor by the donee, the right to demand in court the cancellation of the donation belongs to the heirs of the donor.

If the deceased has heirs - a widow, children, other relatives - then the apartment given to him can be qualified as an inheritance and candidates must declare their rights within six months.

But this will be useless if the notorious paragraph mentioned above with reference to Article 578 is contained. That is, if a gift agreement was drawn up with return after the death of the donee.

You can find out about fraud and other special cases when donating an apartment, as well as who has the right to challenge the donation transaction during the life of the donor, and whether it can be canceled by the heirs after his death on our website.

Otherwise, the contract is no different from a standard gift.

It is not even necessary to have it certified by a notary. But this is preferable. especially for those who are not legal professionals.

After this, it is registered with Rosreestr. This can be done directly by appearing in person at the Registration Chamber or using the services of the Multifunctional Center (My Documents).

In addition to the contract, a package of papers is provided:

Title will be registered within, as a rule, seven days after acceptance of documents.

After this period, the new owner comes, provides a receipt for the acceptance of documents received on the day of registration and receives a cadastral extract (it replaces the certificate of ownership from 2020).

You should pay attention to a certificate from the registry office confirming the relationship. In fact, it is not a mandatory document and if it is not there, it will not stall the procedure.

However, the transaction will look in the eyes of the law as an ordinary gift, and therefore subject to taxation (13% of the cost of the apartment). The law exempts only close relatives from taxes - parents, children, spouse. brothers, sisters, grandmothers, grandfathers.

Read about the cost of registering a transaction for donating an apartment between close relatives in our article.

You can only give it in person and only to a living person.

By overdoing it with setting conditions, you can ensure that the deal becomes impossible altogether.

That is why you should either give and not complain, or draw up a will - which can be changed as you please.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) +7 (St. Petersburg)

It's fast and free!

Features of donation after the death of the donor

The problem of donation becomes relevant when the owner of real estate is looking for an opportunity to register in the legal field his will to freely transfer to any person (most often a close relative) the rights to this real estate.

But what if the owner of the property wants to make a gift during his lifetime, but with the proviso that the new owner (the donee) has the right to accept this gift only after the death of the donor.

The desire of the property owner to formalize just such a transaction is quite understandable. Many have heard about many years of litigation in which heirs are at odds with each other in attempts to challenge the will and divide the property of the testator (deceased) against his will. To stop disagreements between relatives, property owners are trying to find a way out by donating real estate during their lifetime.

However, the Civil Code of the Russian Federation (Civil Code of the Russian Federation) limits the circle of people willing to make such gifts. The restrictions are reasonable because they significantly protect the rights of living property owners.

As Part 2 of Art. 17 Civil Code of the Russian Federation. A citizen receives the opportunity to participate in civil transactions (acquire rights and perform duties) at the time of birth and loses this opportunity at the time of death. The obligation to donate a thing that the donor undertakes under a gift agreement. exists exactly as long as the donor is alive.

The person who accepted the gift must have time to formalize his right only as long as the donor is alive. It is considered that real estate has been accepted as a gift only after its state registration (Part 3 of Article 574 of the Civil Code of the Russian Federation). Otherwise, you will have to prove your right to the gift in court.

It is prohibited to include in the text of the deed of gift a condition that the recipient has the right to accept the gift (in the case of real estate, to register ownership) only after the death of the one who made such a gift (Part 3 of Article 572 of the Civil Code of the Russian Federation).

Concept and parties to the gift agreement

Despite the fact that the act of donation is called an agreement, civil law does not provide for any agreements between the donor and the donee. This is a one-sided deal. under which obligations arise only from the donor.

Any mutually beneficial agreements must be made according to the rules of the purchase and sale agreement or other compensated transactions. The definition of donation is given in Part 1 of Art. 572 of the Civil Code of the Russian Federation. and, based on it, we can give the following characteristics to these legal relations.

- The donor undertakes the obligation to give the donee property (part of the property) that is owned by the donor.

- The donor is prohibited from demanding payment from the recipient for transferring the gift.

- Although the donee does not assume any obligations under the deed of gift, he is a party to this agreement and must sign it. Subsequently, the recipient has the right to refuse the gift. The procedure for signing the contract itself does not oblige the recipient to any action.

Form of gift agreement

According to the general rules of civil proceedings, a gift can be made in two forms:

A verbal order for a gift that the donee can accept only after the death of the donor is illegal. This rule applies to donations between citizens of cars, household items (furniture, household appliances, etc.), and any movable property.

The form of the real estate gift transaction is more strict:

Subject of the gift agreement

Property that can be donated should not be excluded from civil circulation.

Ownership rights must be registered in accordance with the norms of the legislation that was in force at the time the ownership rights arose. This is especially true for rebuilt or completed real estate properties. A property that does not comply with the documents cannot be transferred as a gift.

The contract may contain a promise of a gift in the future. Moreover, it is valid only if it is concluded in writing and contains a clear intention to complete the transaction.

The subject of the donation must be specified in detail in the deed of gift. If we are talking about real estate, then the address, area, title documents for the object must be included (part 2 of article 572 of the Civil Code of the Russian Federation).

Is it possible to give after death?

As can be seen from the systemic analysis of civil law norms, a gift agreement. according to which the recipient accepts the gift only after the death of the donor. cannot be concluded by the parties.

In addition, the Civil Code of the Russian Federation has a direct ban on concluding such agreements (Part 3 of Article 572 of the Civil Code of the Russian Federation). According to this norm, such a gift is void.

If the contract itself contains a condition that the recipient of the gift has the right to accept it (register ownership) only after the death of the giver, then such a transaction is void.

If there is no clause in the contract, but in fact the recipient did not accept the gift (did not register) during the life of the donor. After the donor has died, re-registration will be possible only after a positive completion of the legal battle to recognize the deed of gift as valid.

Dealing with a void deed of gift. you need to realize that there is no need to challenge this document in court, since in accordance with Part 1 of Art. 166 of the Civil Code of the Russian Federation, such a gift is initially void and not controversial. This is important because courts only consider disputes between citizens.

Consequences of donation after death

Sometimes heirs are faced with situations where, after the death of a relative, it turns out that all or part of his property was donated. In such cases, the recipient of the gift provides the heirs with a gift agreement to confirm his rights.

Heirs have the right to disagree with the testator’s gift in the following cases:

When it is established that the gift agreement is void. this is reported to the notary who conducts the inheritance case. In this case, the notary is obliged to be guided by the consequences of a void transaction, which are determined by Part 1 of Art. 167 Civil Code of the Russian Federation. that such a transaction does not entail any consequences.

If the testator left a will with the wording according to which he bequeaths to the heirs all his movable and immovable property in certain shares, the gift for a void transaction is included in the inheritance and is distributed among the heirs in those parts determined by the testator.

If the will is made for specific objects of civil rights. then the heirs inherit according to the will the inheritance allotted to them, and the property included in the inheritance as an insignificant gift is inherited according to the rules of inheritance by law.

If the testator did not leave a will. all his property, including an insignificant gift, is inherited among his heirs by law.

Alternative to donation after death

An alternative is a will. In a will, everyone has the right to dispose of property at their own discretion. To exercise this right, the testator, when drawing up a will, can:

The father gave his son an apartment. The contract was certified by a notary. However, the son did not have time to register the apartment in his name before his father’s death. After the death of his father, his wife, with whom he did not live together, but did not formally file a divorce, filed an application to accept the inheritance. The notary established that the apartment donated to the son under the contract has not yet been registered in the son’s name, and on the basis of Part 3 of Art. 572 of the Civil Code of the Russian Federation included the apartment as part of the inheritance. The son filed an application to the court to recognize the donation as valid. Since the son had in his hands the act of acceptance and transfer of the apartment and the title documents on it, the court recognized that in fact the son accepted the gift from the donor and the gift agreement took place. Based on a court decision, the apartment was excluded from the inheritance.

Conclusion

The desire to wisely manage the material result of one’s life imposes responsibility on a person. That is why a citizen who wants his will to be fulfilled after death must act as competently and carefully as possible, so as not to give anyone any reason to doubt. Replacing a will with a gift is an insignificant action that will not entail the desired consequences, but will only create discord between the heirs.

Legal consultation

Does the donee have to sign a gift agreement? Does he bear any responsibility for including a void clause in the contract (acceptance of the gift after death)?

The recipient must sign the gift agreement. If a clause is included that makes this contract void, the recipient does not bear any responsibility.

Who should recognize apartment donation agreements with the clause that the recipient accepts the gift after the death of the donor as void?

These agreements are initially void. A court decision is not required to establish the fact of nullity. Such a deed of gift cannot be accepted for registration and the recipient’s ownership of the gift will not be registered.

Do you have any questions?

3 important reasons to use the help of a lawyer right now

Prompt response to all your questions!

Who will get the apartment after the death of the donee?

Hello. A deed of gift was drawn up in 2007 for a son by 2 parents. The son entered into the right of inheritance. One of the parents (father) died in 2009. The mother is alive, and the recipient died in July 2014. The son left behind his wife and 28-year-old daughter in their other apartment. The donor (mother) still has a daughter who takes care of her. How will the issue of inheriting the mother’s apartment be resolved? Is it possible to challenge the deed of gift and who will get the apartment?

October 07, 2014, 10:06 Rimma Gennadievna, Nizhny Novgorod

Lawyers' answers (1)

Good afternoon It’s not entirely clear whether the apartment was given as a gift? What does the right of inheritance have to do with it, especially if the mother is alive. If we assume that the apartment was donated by the parents to their son, in this case a gift agreement was concluded between them under which one party (the donor) transfers or undertakes to transfer the property to the other party (the donee) free of charge. Until March 01, 2013 such contracts were subject to state registration (now the transfer of ownership is subject to state registration). The donation can be canceled in the cases provided for in Art. 578 of the Civil Code of the Russian Federation, in your case, paragraph 4 of the specified article “4. The gift agreement may stipulate the donor’s right to cancel the donation if he survives the donee.” Read the gift agreement carefully. If it contains a similar condition, you can file a claim with the court to cancel the donation (of part of the apartment).

Thus, since the apartment is now the property of the deceased donee, the provisions of inheritance apply to it. Thus, if there is no will, the first priority heirs are the children, parents and surviving spouse. Thus, according to the law, the mother, wife and daughter of the testator will inherit this apartment in equal shares.

In the event of the death of the mother, her legal heirs will be her daughter and granddaughter (by right of representation); if she wants to dispose of her property before her death, a will must be drawn up with a notary.

07 October 2014, 10:37

Looking for an answer? It's easier to ask a lawyer!

to our lawyers - it’s much faster than looking for a solution.

Will I inherit the apartment my aunt gave to her husband?

Question . Good afternoon, my aunt gave her husband, during her lifetime (deed of gift), an apartment that belonged to her personally. After the death of her husband, it turned out that he wrote a will and bequeathed everything to his brother, before the opening of his inheritance, his aunt also died, since there are no other relatives, I turned out to be the heir, as the aunt’s successor and her wife’s brother under the will, can I count on this apartment ? Thank you

Answer: Vladimir, hello! If there is a will, inheritance occurs in accordance with the will. And if your aunt’s husband bequeathed the apartment to his brother, it should be inherited by him. In addition, the apartment cannot be inherited by you, since after giving it to your spouse, the apartment no longer belonged to your aunt. However, you can claim the apartment if you challenge the gift agreement in court. So in accordance with Art. 177 of the Civil Code of the Russian Federation, this agreement may be declared invalid by the court at the request of this citizen or other persons whose rights or interests protected by law are violated as a result of its commission. Thus, you can file a lawsuit to invalidate the apartment donation agreement. This agreement will be declared invalid by the court if you prove in court that your aunt signed the agreement in a state where she was not able to understand the meaning of her actions or control them. For example, due to nervous shock, alcohol and drug intoxication, etc. Please take into account that according to Art. 181 of the Civil Code of the Russian Federation, you can file such a claim within one year from the day you learned about the circumstances that are the basis for declaring the contract invalid.

If the court finds the gift agreement invalid, the apartment will be recognized as the property of your aunt, and you will be able to claim the apartment as her heir by law.

Sincerely, Lawyer for inheritance issues, St. Petersburg Legal

Useful articles

We are waiting for your question

Special offer

Challenging paternity occurs in court with or without genetic testing of DNA. Thanks to extensive experience in business [&hellip]

Inheritance of a donated apartment

Options for transferring an apartment - by inheritance and using a gift agreement

One of the restrictions for such transactions provided for by current legislation is the gift of property acquired during marriage. If we are talking about donating an apartment, then according to Article 35 of the Family Code of the Russian Federation, the disposal of the common joint property of the spouses (which includes any property registered in the name of any of the spouses and acquired by them during the marriage in a paid transaction) is possible only with the written notarized consent of the second spouse.

Have you decided to donate an apartment you inherited?

Or wait until registration is completed, receive a certificate of ownership and then contact the registration authorities with documents for the alienation of the apartment in the form of a gift to a third party.

Drawing up a gift agreement. In accordance with Art. 572 of the Civil Code of the Russian Federation, under a gift agreement, one party (the donor) transfers or undertakes to transfer the property free of charge to the other party (the donee).

Deed of gift or will?

In general, the value of donated real estate is subject to personal income tax (Clause 18.1, Article 217 of the Tax Code of the Russian Federation). But if the donation is made between family members or close relatives in accordance with the Family Code (spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half-blooded (having a common father or mother) brothers and sisters), no taxable income arises.

What is more profitable - to bequeath the apartment to your niece or to give it as a gift?

Currently, it is more profitable for you to bequeath an apartment. It is not necessary for your niece to register in the apartment. but if it is registered in your apartment. then will be exempt from paying state duty.

Payments depend on the cost of the apartment and the degree of relationship. and also from that. whether the heir (donee) lives with the testator (donor). The cost in this case is determined according to the BTI estimate.

Law Club Conference

Is it right to demand in court that the disputed property be included in the estate? Or are there other obvious and correct solutions?

The situation is as follows: at the end of 2012, the mother gives her son an apartment. The donation agreement is notarized. A month later the mother dies. The contract for state registration was not submitted.

The notary, based on the fact that there is a notarized agreement for the donation of an apartment, does not include this very apartment in the inheritance estate, but suggests going to court.

They gave me an apartment - to whom after my death

2. The right to an obligatory share in an inheritance is satisfied from the remaining untested part of the inheritance property, even if this leads to a reduction in the rights of other heirs under the law to this part of the property, and if the untested part of the property is insufficient to exercise the right to an obligatory share, from that part of the property which is bequeathed.

3. The obligatory share includes everything that the heir entitled to such a share receives from the inheritance for any reason, including the cost of the testamentary disclaimer established in favor of such heir.

A deed of gift has been issued for the apartment. if the donee dies before the donor. who will inherit the apartment?

The husband inherits. But after his death, his son inherits? - If a mother dies, she has a daughter from her first marriage and a son from her second. The husband inherits. But after his death, his son inherits. Further

1 answer. Moscow Viewed 131 times. Asked 2013-01-21 16:45:59 +0400 in the subject Inheritance law The parents' apartment was privatized in equal shares. The father bequeaths his share to his daughter. Mother to son. Father dies on the 25th.

Inheritance by law

Sources: pravo.guru, dogovor-darenija.ru, pravoved.ru, imright.ru, likvidaciya-ooo-balashiha.ru

Next

No comments yet!

Share your opinion

You might be interested in

Documents for applying for inheritance under a will

Documents for entering into inheritance after death

Application to the court for the establishment of inheritance

Entry into the inheritance of adopted children

Popular

Can bailiffs take away an inheritance (Read 463)

Is it necessary to enter into an inheritance after death (Read 379)

Tax on money by inheritance (Read 374)

Inheritance after the death of a divorced spouse (Read 370)

How can you replace a deed of gift?

How can property be transferred after death? There is a legal alternative solution to this issue. There will really only be the making of a will. This is the only legal form. Upon inheritance, ownership rights pass to the heirs. The first priority of heirs has the priority right to receive property. All property is divided equally among all heirs. If the owner wishes to leave property to a specific person, a written will is drawn up, which states what property is bequeathed and to whom.

A will can be certified by:

- Administration of local government of the settlement.

- Notary.

- When abroad, the consul of the Russian Federation has the right to make a will for Russian citizens.

If there is a real danger to the life of the owner, and if it is not possible to invite a notary, the law establishes a number of other persons authorized to certify the will:

- Chief doctors of medical institutions.

- Ship captains.

- Leaders of expedition parties.

- Commanders of military units, heads of military educational institutions.

- Heads of prisons, isolation wards, colonies. When a person is in prison.

The list of authorized persons cannot be expanded. Certification is carried out only in the personal presence of the testator.

Receiving a gift after the death of the donor

The giver entered into a contract with the recipient of the gift and died suddenly. Will the validity of the gift agreement be recognized after the death of the donor? In this case, death does not entail the invalidity of the deed of gift. Art. 581 of the Civil Code of the Russian Federation clearly states that if the agreement is consensual and the gift is given in the future, the heirs undertake to complete the transaction and transfer the property for its intended purpose.

Also, the ownership right will be recognized for the recipient of the real estate as a gift if the parties submitted documents to register the right, and the owner died. Such an agreement will also be valid, and Rosreestr will continue to register the property upon provision of a package of necessary documents.

The death of the owner after signing the gift agreement, but before registering the property with Rosreestr, does not cancel the validity of the gift agreement.

Inheritance of property

Inheritance under a deed of gift is carried out if the document did not contain a condition for the return of property to the donor. Then the apartment is included in the general inheritance. The owner can independently indicate who will receive the living space donated to him in his will.

Next, the relative can only enter into the inheritance. Inheritance itself is carried out as standard. The heirs are required to present their rights to the apartment within 6 months. They then receive the appropriate certificates and can register ownership.

In this case, the donor has no right to demand the return of the donated property. But this circumstance does not interfere with the constant inheritance disputes that arise regarding such property. Even though the courts do not satisfy such claims.