Real estate inherited and put up for sale has a bad reputation. Potential buyers avoid such apartments, even if the cost of such real estate is greatly reduced. This is due to the fact that the purchase of an apartment received by inheritance is associated with a high probability of litigation, including litigation, with heirs who have not entered into inheritance rights in a timely manner. How to take into account all the risks when buying an apartment received as an inheritance and other important nuances of such a transaction will be discussed in this article.

Risks when buying an apartment from heirs

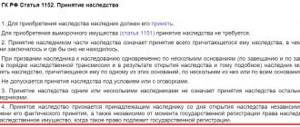

Real estate received by inheritance belongs entirely to the heir. He has the right to dispose of it at his own discretion, that is, he can donate, sell or exchange. The Civil Code of the Russian Federation does not provide for any additional requirements when concluding transactions the subject of which is real estate received by inheritance. In particular, because of this, there are risks of buying an apartment by inheritance. Even experienced lawyers, not to mention ordinary citizens, cannot take into account all the features of inheritance legislation.

Buying an apartment by inheritance means there is a high probability of property claims from heirs whose rights have been violated. Residential real estate, in particular apartments, can be inherited legally or by will.

What should you know if you are planning to buy an apartment received as an inheritance? First of all, a potential buyer of real estate from heirs needs to understand the features of each method of inheritance.

First, you should look at the more common method of inheritance - by law. This method of inheritance involves the division of relatives into queues. The first to claim the inheritance are the parents, children and spouses of the deceased. If there are no such applicants, then relatives from the second line become heirs - these are brothers, sisters, grandparents, and so on.

Quite often it happens that relatives from the first priority do not know anything about the inheritance that has opened. This is where the main risks lie for the buyer who is about to purchase an inherited apartment. The heir takes inheritance rights out of turn, and after that a closer relative appears and challenges the transfer of property. This most often happens in the following situation. The owner of the inherited property has not lived with his wife for a long time, but the marriage has not been officially dissolved. They may probably forget about such an heir, and if he himself does not appear before the notary, then the distribution of the inherited property will take place without him. Even greater confusion arises when entering into an inheritance of 4-5 lines. In such a situation, it is very easy to skip the heir who has more rights.

It is not the responsibility of notaries to search for first-priority heirs. They help those who turn to them and provide evidence of kinship with the deceased to receive an inheritance.

If the purchase of an apartment inherited was made by an heir who entered into the rights of inheritance out of turn, then most likely there will be a court that will oblige the buyer to vacate the residential property. Of course, the court will also decide to recover money from the seller in favor of the buyer, but if it has already been spent or is not in bank accounts, then the return procedure can take decades.

It would seem that buying an apartment, the inheritance of which is confirmed by a will, has fewer risks. This is true, but only partly. There are also a number of risks. The main ones include:

Procedure for selling an inherited apartment that has been owned for less than 3 years

- exclusion from the will of persons who have the right to receive part of the inherited residential real estate. These are minor children and other persons who were dependent on the testator;

- recognition of the heir who managed to dispose of the received inheritance as unworthy;

- challenging a will in court. For example, the legal heirs managed to prove in court that the will was written under duress.

The share of such cases is small, approximately 0.5% of all cases of challenging inheritance rights. But this still happens in judicial practice.

When purchasing an apartment from heirs, you should take into account such an important factor as the statute of limitations. The Civil Code of the Russian Federation provides for a six-month period for entering into an inheritance. In most cases this is enough. As practice shows, not everything is so simple. Some relatives do not know that somewhere there is an inherited house or apartments that they can receive by taking advantage of their rights, others are on long-term treatment and for this reason cannot receive an inheritance, etc. In simple words, they have good reasons for missing the deadline established by law.

According to Article 1155 of the Civil Code of the Russian Federation, a person who has the right to receive property as an inheritance, but for some reason missed the deadline established by law, must file a claim with the court within six months from the moment he learned of the death of the testator. At the same time, according to Article 196 of the Civil Code of the Russian Federation, the statute of limitations on such issues cannot exceed 10 years from the date of violation of the rights of the heirs. Thus, a buyer who bought an apartment from an heir may lose it within 10.5 years from the death of its original owner.

Additionally, it must be said that purchasing an apartment that was inherited less than 3 years ago is associated with another common risk. An heir who decides to sell the property received by inheritance within three years is required to pay a tax to the state in the amount of 13%. All residential real estate over 1,000,000 rubles falls under this rule. To avoid this, the heirs suggest that the buyer indicate a lower value in the contract. If the purchase of an apartment in inherited ownership for less than 3 years is subsequently challenged, then, according to a court decision, the buyer will be awarded a refund of the amount specified in the contract. It is almost impossible to prove that the purchase was made for a different amount.

Tax on the sale of inheritance that is less than 3 years old

What happens if the owner immediately decides to sell the property received by inheritance? In this case, the tax will be paid at a rate of 13% if the objects being sold were received less than 3 years ago. However, the taxable amount begins when the sale price of the property exceeds 1 million rubles. According to Art. 220 of the Tax Code of the Russian Federation, the taxpayer has the right to receive a deduction from an amount of up to 1 million rubles.

If property that was transferred by inheritance more than 3 years ago is sold, personal income tax will not be paid. That is why it is advisable to wait for the period of time established by law and only then proceed with the alienation of the object.

What measures should buyers take?

To obtain guarantees when purchasing an apartment that is registered as a property by right of inheritance, you must follow certain rules:

- do not accept offers to buy residential property at a suspiciously low price;

- buy an apartment with the assistance of lawyers;

- obtain title insurance for real estate for at least three years.

If the purchase of an apartment is carried out taking into account all the above rules, then the possible entry into the rights of inheritance of an unaccounted heir will be practically excluded, or at least not so painful for the buyer.

State duty upon entering into inheritance

The state duty is withheld from each heir who receives a share of the property.

When abandoning property, state duty is not withheld.

The amount of state duty is calculated individually for each recipient of valuables and depends on the following indicators:

- relation degree;

- volume of property received;

- the cost of the acquired property.

Close relatives of a person (candidates of the first stage of heirs) pay 0.3% of the value of the property. Distant relatives and outside candidates pay 0.6% of the inheritance price.

The amount of property received depends on the order of inheritance. If the transfer of property occurs on the basis of a will, then the share of property can be any. The transfer of values on the basis of legal order provides that the inheritance is divided in equal parts between representatives of the same order. The obligatory share is half of the part that the heir would receive in the general order. There is no state duty charged for the allocation of the spousal share.

The property price is determined by the cadastral or average market price. To avoid conflicts, it is better to involve an independent appraiser who will draw up a conclusion with the average price of the objects.

The heir's share is considered not as the number of objects received, but as the value of the property share.

Case study:

After the death of citizen Petrushenko, two pieces of real estate remained: a private house with a cadastral value of 3,500,000 rubles and a three-room apartment, valued by an appraiser at 2,000,000 rubles. Among the heirs are the official wife and adult daughter. The private house was purchased after the wedding, so 50% belongs to the wife. The notary prepared a decree according to which the inheritance is divided as follows:

- ½ part of a private house worth 1,750,000 rubles belongs to the wife as a spousal share;

- ½ part of the house worth 1,750,000 rubles goes to the wife;

- part of the apartment worth 125,000 rubles goes to the wife, but the woman abandoned it in favor of her daughter;

- the share of the apartment worth 1,750,000 rubles goes into the possession of the daughter.

Other expenses when entering into an inheritance

In addition to paying the state fee, there are additional costs:

- announcement of the will – 300 rubles;

- preparing a list of property, searching for inherited property – 600 rubles;

- making copies of documents – from 200 rubles;

- certification of documents – from 250 rubles.

An executor may be involved in the case, whose services are paid from the amount of the inheritance received.

Separately, it is necessary to highlight the technical and legal services of a notary. Although the law prohibits a notary from imposing services on a takita, notary offices often force citizens to pay for them.

It must be remembered that the assistance of a notary in registering an inheritance is already paid for by the state duty. Therefore, only those that are not included in the general list can be considered as additional services.

Among them:

- issuance of a certificate for the marital share (depending on the region, from 700 rubles);

- division of property by agreement of the heirs (depending on the region from 5,500 rubles).

Read more about the cost of notary services when registering an inheritance.

Exemption from payment of state duty

Article 333.35 of the Tax Code of the Russian Federation provides for complete exemption from payment of state duty for the following persons:

- WWII participants;

- Knights of the Order of Glory;

- Heroes of the Russian Federation or the USSR;

- minor heirs;

- disabled heirs;

- relatives living with the deceased testator.

Disabled people of groups 1 and 2 receive a 50% discount on the total state fee.

However, the benefit applies exclusively to state duty. Legal and technical services are paid in full.

Fraud in the sale of apartments received by inheritance

The sale of apartments received as an inheritance is also unpopular because scammers are actively operating in this segment of the real estate market. If the apartment received as an inheritance was sold unconsciously (the heir simply did not know that there were still people claiming to receive the inheritance), then there is a chance to reach an agreement, for example, the heirs will divide the money or other property inherited, but an agreement will not work. They deliberately deceive the buyer.

The fraud scheme is quite simple. The heirs know about each other’s existence, but strive to get more benefits and deliberately receive inheritance rights out of turn. After this, the deprived heir sues and usually wins. Of course, the seller will be obliged to return the money, but it is not a fact that it has not already been spent.

The procedure for inheriting an apartment under a will

The main disadvantage for the buyer is that he will not be able to prove that fraud has occurred. But there is also a positive side. If the buyer, together with law enforcement agencies, was able to convince the court that fraud had occurred, then the property remains his property, and the fraudsters will be punished according to the law. To be fair, it should be said that the latter happens extremely rarely, including due to the inaction of the police.

Personal income tax on “creative” inheritance

In 2020, tax upon receipt of an inheritance under a will (subsequent income from it) is levied only for:

Will for inheritance

To receive an inheritance, you must be a close relative or be included in the will. How to find out if there is a will for inheritance, read here.

- literary work;

- treatise;

- original art objects;

- industrial inventions.

The heirs of any of these awards are required to pay tax at the rate of 13% of the value of the inheritance. The exception is legal relations that arose before 2006.

What will you have to pay for when you inherit an apartment?

How have laws regarding inheritance changed? Why doesn't no tax mean no spending? And why is free cheese sometimes so hard to sell?

Before and now

The laws regarding inheritance have changed several times over the past quarter century. Until January 1, 2006, when heirs received an inheritance, including real estate, they paid a tax on it - 13% of the assessed value. The vast majority of heirs considered such a payment to be an unscrupulous robbery on the part of the state (by the way, in the Tax Code of the Russian Federation there was not even the concept of “inheritance tax”; inheritance was simply considered one of the types of income generation and therefore was taxed).

Illustration: Polina Vasilyeva

no tax is levied on inheritance, including real estate opened after January 1, 2006 . This provision is formulated in paragraph 18 of Article 217 of the Tax Code of the Russian Federation. Receiving an inheritance is no longer considered income, so a citizen does not have to submit a declaration of income in the form of an inheritance to the tax authority. It does not matter whether you received an inheritance by will or by law, whether you were a relative of the testator or not.

The abolition of the tax was explained by the desire to follow the principles of social justice , because often the heir simply did not have the opportunity to pay the tax and inherit. Not only citizens and residents of the Russian Federation are exempt from tax on inheritance opened in Russia; citizens of other states do not pay it either.

Just in case, let us remind you that only the property that was the property of the testator . Non-privatized apartments provided under a social tenancy agreement are not inherited. Cooperative apartments are inherited only if the share is fully paid. Otherwise, it is not the apartment that is inherited, but the share, and the cooperative has the right, having paid the share to the heir, to transfer the housing to another person.

What will you have to pay for?

You will still have to spend money when entering into an inheritance: you will need to pay state fees for government services when receiving the necessary documents. And rest assured, it won’t seem too little.

The largest and most unpleasant payment is the state duty when registering the right to inheritance. It is paid to the notary, and without this fee you will not receive a certificate of inheritance. The amount of the state duty is prescribed in the Tax Code of the Russian Federation, is the same for all notaries in all regions of the Russian Federation and does not differ in the case of receiving an inheritance by law and by will. But there is a difference in the state duty for different categories of heirs. For the testator's spouse, his parents, children, including adopted children, and full brothers and sisters, the state duty is 0.3% of the assessed value of the property. In the case of an apartment – 0.3% of its cadastral value.

Important!

Until 2014, calculations, as a rule, used

the residual value according to the BTI ; replacing it with the cadastral value increased the payment several times.

The only consolation is that for heirs of this category, the amount of state duty cannot exceed 100 thousand rubles. For other categories of heirs, the cost of obtaining a certificate will be even higher: 0.6% of the value of the property, but not more than 1 million rubles. Another bad point is that, although the cadastral value is declared to be the market value, determined by government agencies by expert means, at present it often significantly exceeds the market value due to a sharp drop in real estate prices. Cases of judicial challenge to the cadastral value are now widespread.

If there are several heirs, the state fee for issuing a certificate of inheritance rights is paid in full by each of the heirs.

Who does not have to pay a state fee when registering the right to inheritance?

Does everyone have to pay for a certificate of inheritance? No. heirs who lived with the testator at the time of his death in the inherited apartment (room, house) and continue to live there are exempt from payment In practice, this means that the heir had to be registered there. Living without registration will not save you from paying for the certificate.

In addition, minors and persons with mental disorders under guardianship, heirs of those killed while performing government duties, protecting state property and law and order, and heirs of politically repressed persons do not pay the fee. And one more thing: Heroes of the Soviet Union, Heroes of the Russian Federation, full holders of the Order of Glory, participants and disabled people of the Great Patriotic War. Disabled people of groups I and II pay 50% less.

In addition to paying the fee for the certificate of inheritance, the heir also bears other expenses: 5,000 rubles - payment for the notary’s services when issuing the certificate, 1,000 rubles - for opening an inheritance case, 1,000 rubles - for registering property rights, 200 rubles each - for a cadastral passport and an extract from the Unified State Register. Other expenses are possible depending on specific circumstances.

On the sale of an apartment received as an inheritance

The sale of such an apartment is not much different from the sale of a privatized apartment or one acquired under a purchase/sale agreement. Only because the transaction is considered risky , and it is much more difficult to find a buyer for such an apartment (this is especially true for apartments recently inherited). Buyers are afraid that some new claimant for the inheritance will appear and challenge the sale agreement.

But there is one modest joy - to sell inherited property when drawing up a purchase and sale agreement, the heir will not need the consent of the spouse . After all, such an apartment is not considered joint property.

Let us remind you that in general, when selling an apartment, a tax is charged. It will be 13% for residents of the Russian Federation (on the day of sale they were in the Russian Federation for at least 183 calendar days during the previous 12 months) and 30% for non-residents. Residents of the Russian Federation, under certain circumstances, have the right to a tax deduction, or, more simply put, are exempt from this tax. Before January 1, 2020, in order to receive a tax amnesty, they had to own the apartment for at least three years. But now the law has changed somewhat. For apartments received by inheritance, privatized, donated or purchased under a life annuity agreement, the period remained the same - three years, for other cases it was increased to five years.

What about in Europe?

Finally, let’s compare our legislation in the field of inheritance law with foreign legislation. Let's limit ourselves to Europe. There is no inheritance tax in Portugal, Austria and Cyprus (but there are various fees similar to our stamp duty). There is no tax in Latvia either, but in Estonia the tax rate is 21%. In Finland - 0-36%, in Italy - 4-8%, in Great Britain - 0-40%, in Spain - 7.65-34%, in France - 5-60%, in Germany - 7-50%.

The tax rate in European countries, as a rule, strongly depends on the degree of relationship of the heir. In addition, there are tax deductions when registering an inheritance. In addition, in different countries there are other specific mechanisms for minimizing tax payments. But more about that next time. And now let’s just note that Russian legislation in the field of inheritance law in relation to the heir suddenly turns out to be not so tough.

Alisa Orlova

28.03.2016