Basic definitions

Type of land SNT what is it ? This is part of the land allocated for dacha plots, similar to plots in DNT and DNP (more about DNT and DNP). However, land in SNT is valued much higher for the following reasons:

- higher quality soil;

- environmentally friendly storage zones;

- more picturesque parts of the area;

- provision of convenient access roads;

- priority in laying out utilities.

If you are interested in private plots of land, you can find out about them in our article.

A plot of land in a gardening partnership is allocated from among agricultural lands located outside the city limits:

- in rural areas;

- in an uninhabited area.

The plots are allowed to be used only for dachas, but the regulations for use are established by the founder, who is the basic subject of ownership, allocated by the array. Read more about the permitted use of memory in another section.

The subject of SNT is a legal entity that has established an organization for the allocation of land for citizens by renting it from the local administration. All members of the Partnership are jointly owned land rights holders. This regulation is established by Federal Law 66-FZ, dated June 30, 2006.

The SNT object is agricultural land with increased quality of fertility, allocated by the administration of the locality for joint use by members of the Partnership.

Is it possible to build a residential building on agricultural land for gardening?

Question from our reader Iraida: Relatives have a large plot of land, which they only partially use. When my husband and I decided to build a country house, they suggested that we divide this land so that we could build on our own part of the plot.

- horticulture.

- use for the needs of personal subsidiary farming;

- creation of peasant farms;

- livestock farming;

- gardening;

- carrying out educational and other activities related to agriculture;

- implementation of agricultural and ecotourism;

- installation of special plantings to protect fields from dry winds, blowing away the fertile layer of soil, retaining snow cover, etc.;

- carrying out scientific research and surveys;

- farming on an industrial scale;

What is allowed to build on the SNT site and its purpose

The use of the SNT land plot for its intended purpose provides for mandatory cultivation of the land, with the planting of a garden. If desired, it is allowed to erect outbuildings and a country house. Other actions carried out by the owner of the site are agreed upon with the chairman of the board. The same applies to the criteria that apply to a country house. Any permanent building erected in SNT will be designed only as a country house, regardless of its size and the design intent of the owner of the site.

More details about the permitted use of agricultural land: types and minimum size for transfer.

As a rule, already at the stage of acquiring a land plot, the buyer is introduced to the constituent documentation and construction regulations established for this type of land. For the most part, construction standards are not set strictly enough here. In certain holiday villages, the construction of low-rise buildings of any format is permitted, without restrictions.

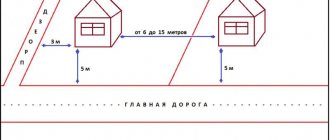

However, sanitary and fire safety standards must be observed here too (Federal Law No. 23-FZ, dated July 22, 2008). Indentations from the red lines are required, in accordance with the regulations established by law (Code of Rules SP 53.13330.2011). In case of violation of these, the owner has the right to impose an administrative penalty with penalties, forcing him to restore the required order. The Board of the Partnership is authorized to supervise these regulations.

If a separate legal entity provides for the establishment of special standards, newly joining members of the partnership familiarize themselves with the document against signature. And the document, in turn, is adopted only at a general meeting, subject to receiving a majority of votes.

If this category of land does not suit you, then you can change the purpose of the site.

Procedure for changing the type of permitted use

Article 39 of the Civil Code of the Russian Federation establishes the possibility of changing the existing classification of a site. To do this you will need to do the following:

- The owner of the property sends a request to the local municipality. Documentation for the allotment and papers identifying the applicant’s identity are attached to it.

- To consider the application, a special commission is created, the activities of which are regulated by local legal acts in force in the given region. In other areas, a different procedure may be established from the one stated above.

- The commission conducts hearings to determine the situation and the feasibility of issuing permits. They are organized for public holding with the participation of all interested parties.

- After studying the issue, a decision is made on refusal or permission and recommendations are issued on the possible use of the object.

- The results are published in official media.

- The commission's findings serve as the basis for the final decision by the head of the locality administration. Three days are provided for this. Regardless of the results, they are published in local publications.

Also on the topic: What is an easement on a land plot and how to establish it?

This method of changing the permitted use is accompanied by significant financial expenses, since all expenses associated with organizing hearings are borne by the initiator of the process.

ATTENTION! No one can guarantee a positive decision, because they can always refuse on formal grounds. But local authorities generally do not object to issuing permits for the construction of a house on agricultural land, especially if such actions will bring positive results to the area.

This solution to the problem is applicable when cottage or country house construction is carried out en masse on agricultural land.

How do individual housing construction lands differ from SNT lands?

Greater freedom of action and the permissibility of creativity during construction is due to the fact that on SNT lands there are no town planning regulations , which are mandatory for individual housing construction lands (individual housing construction). Accordingly, construction documentation by the rights holders of plots in SNT is not approved by the architectural department of the administration, as is the case with individual housing construction, but is agreed upon by the board of the cooperative.

Plots for individual housing construction are always located in the zone of a populated area and belong to the category of settlement land. Accordingly, the requirements for building a house are mandatory here, but resolutions for cultivating the local area for planting a garden or vegetable garden are not covered. In SNT, on the contrary, the owners are not obliged to carry out construction work on the site. That is, the building may not be built here.

In addition to what is indicated , it should be understood that these types of land belong to different forms of ownership. Land plots for individual housing construction can be issued:

- for rent from the city with or without subsequent privatization;

- into the property.

But this is always individual property, while in SNT the lands are always registered as joint ownership with the allocation of shares in the form of a separate plot.

Provision of land plots from agricultural lands

In order to become the legal owner of an allotment in a dacha partnership, it is permissible to take one of the following actions:

- become a member of the Partnership based on the execution of a sublease agreement with the board of SNT.

- Separate into individual ownership by drawing up an agreement with the board or by court decision.

Sublease agreement

This type of obtaining this type of land is the most common ; it is used by almost all owners of plots in the Partnership. In order to obtain a land plot, the interested person finds a suitable plot on a real estate sales website or in a real estate company. At discretion, buyers contact the board directly to view plots that remain vacant or are for sale.

It should be noted that in both cases buyers purchase only:

- plantings;

- erected outbuildings;

- garden house.

The land is not sold, but is subleased, unless the area is privatized by a cooperative or purchased from the local administration. Then the legal entity, being the founder and lessee, transfers a share in the lease right under a sublease agreement. The acquirer should keep in mind that in this case he is subordinate to two higher levels in the civil hierarchy, which are :

- tenant represented by the founder;

- The local administration is the land lessor.

Sublease agreement for agricultural land: sample

Inspection report

This act of land ownership is regulated by the norms of the Federal Law of July 24, 2002, No. 101-FZ on the turnover of agricultural land. To compile it, the interested person contacts the administration that provided the array for rent. Writes an application addressed to the head of the local administration with a request to draw up an inspection report on the land plot. This document is a mandatory attachment to the statement of claim filed in the event of a violation of the property rights of summer residents.

It is compiled as a result of a commission survey. The members of the commission are authorized officials - representatives of the administration, as well as a member of the board and disinterested persons from among the ordinary members of the SNT.

When drawing up an act, the purpose of the survey must be indicated, and the document is accompanied by survey protocols or opinions of experts, soil specialists and other certificates related to the issue. In this case, the act must reflect that the land plot is processed in accordance with its intended purpose by the person defending the ownership of the plot.

We also recommend that you find out what an extract from the household ledger is and why it is needed.

Statement of claim

A statement of claim for recognition of ownership of the land plot is filed at the location of the allotment. All controversial issues that may arise are resolved here :

- between the founder and the administration;

- between the board and members of the SNT.

Mostly, disputes arise in the event of recognition of ownership of a plot, loss of documentation, or transfer of it by inheritance. Lost land documentation is usually found in dacha settlements that were built during the Soviet period, when land was registered for permanent (indefinite) use. Currently, re-registration of such plots is required, but the basis is the title document on the allocation of the plot.

Filing a claim is preceded by a statement written to the administration (Federal Laws No. 137-FZ and 122-FZ). The chairman of the local executive committee is authorized to issue an act recognizing ownership of the land plot on the basis of a certificate attached to the application provided to the applicant by the board. In case of a written refusal from the administration, the interested person will need to obtain a court decision, on the basis of which the registration of the site will be carried out.

The statement of claim must be accompanied by documentation confirming actual ownership of the plot. The defendant is the administration that refused to issue a certificate of ownership.

Land assessment report

Sometimes a court order may require an assessment report. As a rule, such cases arise when the administration decides to purchase an agricultural land plot, but sets an inflated price for the land. Since the allotment allows redemption only at the cadastral value, setting a market price is not allowed.

In this case, the court is presented with a report on the assessment, with the exact parameters of the plot, cadastral and technical characteristics.

The preparation of this document may be required when seizing a memory for state or municipal needs. In this case the situation is the opposite. The administration is obliged to pay the market price. If the price is equal to the cadastral value, it should be challenged. The report must be based on the regulations established for assessment activities.

Examples of reports on the assessment of agricultural land:

Report on the assessment of an agricultural land plot: example No. 1 Report on the assessment of an agricultural land plot: example No. 2

Report on the assessment of agricultural land: example No. 3

Transfer of agricultural land to SNT

The application, according to the law, is considered within 2 months. After this time (and in some cases earlier), the applicant is given permission to transfer or refuse to re-register the plot, which was received under a lease agreement or purchased, from agricultural land to individual housing construction. But if any problems arise, the decision-making period can be extended to six months.

A qualified specialist can handle the collection and preparation of the necessary documents. Citizens of the Russian Federation are often interested in how much it will cost to transfer land from SNT to individual housing construction. The price of the procedure depends on a number of conditions, including the characteristics of land ownership, but most often it is no more than 30% of the value of the plot indicated in the cadastre. When submitting papers, be sure to pay the state fee.

Also read: Land tax in the Moscow region for large families

Obtaining a residence permit

The legislation provides for obtaining registration at a summer cottage, but subject to its compliance with the place of permanent residence. Such compliance is established by the local administration. The commission examines living conditions and identifies :

- Possibility of year-round transport links with your place of permanent residence.

- The presence in the village of engineering infrastructure, a driveway or passage to a highway that can be cleared of snow debris.

- The quality of the house, which must meet the criteria for living space. Providing the home with heating and running water.

Subject to compliance, which the commission determines with sufficient bias, an inspection report of living conditions is drawn up, on the basis of which a residence permit is issued.

In this case, the possibility of allocating a postal address to the site at which registration is issued is taken into account.

Features of the new law on gardening and vegetable farming partnerships - 2020

- membership cards confirming only participation in the general land allotment for gardening (vegetable gardening) or the purchase of plots made much earlier with such rights,

- old certificates, decisions of heads of administrations on the provision of land plots, any government acts on the provision of land plots.

Interesting: When Awarding in the Kremlin, a Prize is Given

New construction of permanent residential buildings for permanent residence, according to the introduced law, is permitted only on garden plots and only if such land plots are included in the territorial zones provided for by the rules of land use and development (LZZ), for which:

Allocation of land from agricultural land

The procedure provides the owner with individual ownership of the memory. In accordance with legal provisions, owners of joint property can allocate their share in the common law. However, these actions are limited by procedural frameworks that require:

- obtaining permission from the general meeting;

- approval of the received permission by the chairman of the board;

- obtaining an act on the allocation of land plots from the local administration.

In turn, the indicated procedures are preceded by mandatory land surveying . If, as a result of land surveying or for other reasons, disputes arise about the location of the boundaries of the land plot, a land survey report is drawn up. After carrying out the survey, the cadastral engineer prepares a survey file, which requires the approval of the chairman of the board and is submitted for registration to Rosreestr. The board’s refusal can be challenged in court, based on whose decision the land plot will be registered as an individual plot.

Land tax

Owners of land plots are required to pay the land tax SNT (Chapter 31 of the Tax Code of the Russian Federation). This is accrued cumulatively for all members of the Partnership and is transferred by the Federal Tax Service to the founder. The accountant of the board scatters the received amount according to the number of summer residents. These include all owners of dachas with whom a sublease agreement has been concluded or land plots have been allocated to individual ownership (Article 389-391 of the Tax Code of the Russian Federation). Responsibility for the territory of shared use is jointly and severally imposed. Citizens receive the right to stop tax deductions only after the sale of a plot or other property transaction allowing alienation.

The deceased owner's estate is taxed after the successors enter into the inheritance. They pay tax for the entire period from the moment of death of the testator. If the heirs do not show up, the board puts the property up for auction and pays off the tax debt from the amount received from the sale.

The peculiarities of land ownership in SNT require compliance with the constituent documentation of a legal entity. If the established rules are violated, citizens may be deprived of membership in the Partnership.

Read more information about the intended use of memory in our section.