Electronic registration of transactions: concept, procedure, conditions

Electronic registration of real estate transactions provides the opportunity to carry out all formal measures for the transfer of rights from one owner to another through electronic communication and under the control of a credit institution

Category Features:

- Relevant for real estate transactions, the seller or buyer of which is located in another city;

- Registration is carried out in specialized mortgage centers organized by the bank;

- The transaction means the actual delegation of the powers of Rosreest to banking organizations;

- The procedure is carried out for a fee;

- The duration of electronic registration is from several hours to several days;

The market for providing such services is in the process of development. Today, electronic registration of a transaction with Sberbank is one of the safest.

The procedure for electronic registration of a transaction in Sberbank is as follows:

- Select the object for which you want to register a transaction;

- Prepare a complete package of documents;

- Pay the cost of state duty;

- Contact the mortgage center at the bank;

- Enter all information into the system;

- Wait until official information is entered into the Rosreestr database.

The conditions for the procedure are as follows:

- Registration will only take place with the participation of a maximum of two people in the process - the seller and the buyer (there is no registration of shared ownership);

- The procedure is not performed without the personal presence of the counter parties (by proxy);

- The service does not apply to military mortgages;

- Participants in the transaction are individuals.

Terms and cost of electronic registration

Unlike registration through an authorized state body (Rosreestr), electronic registration through Sberbank occurs in a very short time and does not take more than 3 days (Rosreestr carries out registration from 7 to 30 days).

There are the following prices for the service:

- 20 thousand rubles - installation of a software package (relevant for developers);

- 7 thousand - registration of transactions with real estate put into operation (for individuals);

The cost of registering a facility under construction will cost a thousand more than a finished one (about 8 thousand).

The cost of registering a transaction electronically includes:

- Support of the purchase and sale transaction (including verification of the authenticity of documents);

- Cost of state duty for registration activities.

If real estate is purchased from a developer who has a special program that he purchased from the Sberbank real estate center, then the registration procedure can be carried out by his employees and a trip to the bank branch is not required.

Advantages and disadvantages

Pros:

- No queues;

- Minimum costs for support and registration of the transaction (real estate agencies request about 50 thousand for transaction support);

- Quick entry of information into the register of rights and re-registration of rights to the new owner;

- Convenience and safety of remote sale of an object;

- Minimum of intermediaries in the transaction;

- Automatic receipt of completed documents by email;

- Registration is carried out on an individual basis with the involvement of a bank specialist;

- The electronic registration service allows you to reduce the interest rate on your mortgage (if indicated in the mortgage agreement);

- Possibility of receiving a 30% discount on the state fee when applying for a mortgage at Sberbank while simultaneously using the electronic registration service.

Minuses:

- Only for citizens of the Russian Federation;

- The cost of the service may vary slightly depending on the region;

- The service is available only when selling the entire object (share alienation is unacceptable);

- Does not apply to real estate acquired before 1998 (in this case, registration is carried out in the traditional way, through Rosreestr);

- Each party must reach the age of majority and have full legal capacity;

- Title documents will be generated only in electronic form (to receive them on paper, you will still need to contact the registration authority);

- Weak competence of CNS employees due to the novelty of the service;

- Little knownness of the service and slow pace of development due to conservative views.

Functionality of online services

A property license for a property can now be registered remotely without any hassle.

Key features of remote services:

- provision of a secure electronic signature for all participants in the transaction;

- consulting and other support;

- sending electronic documentation to Rosreestr;

- payment of the fee for re-registration of the PS.

This procedure is carried out in several stages:

- A bank specialist or developer employee sends a package of documents to Rosreestr in electronic format.

- Rosreestr employees begin registering the transaction after receiving the documents.

- Data on the transfer of ownership (extract from the unified state register, purchase and sale agreement with the appropriate mark) is sent to the client’s email address.

The procedure for registering a PS is paid. Its final cost depends on several factors and can vary significantly depending on the region, company, and characteristics of the property.

Required documents

- Passports of the parties to the transaction;

- Agreement for the sale and purchase of an object or equity participation;

- Mortgage agreement;

- Surety agreement;

- Preliminary agreement;

- Receipt for payment of state duty;

- An extract from the Unified State Register addressed to the previous owner of the property confirming the absence of arrests or encumbrances;

- Certificates of absence of debt on mandatory payments to resource supply organizations;

- Electronic digital signature;

- Consent of the spouse to complete the transaction;

- Application for registration;

- Receipts for receipt of funds for the purchase price of the object (including all advance payments);

- Agreement for the provision of electronic transaction registration services from the Sberbank real estate center.

What do you need to provide to the bank for registration?

When applying for electronic registration, everyone must provide a certain package of papers. The documents in this case are:

- An application in the appropriate form and completed according to the sample that can be obtained by contacting the office of a banking organization.

- Mortgage agreement or purchase and sale agreement. That is, documents on the basis of which a guarantee of ownership of a specific home is established.

- Not only the original passports of the parties to the transaction, but also their copies. You can make them, including in advance.

- Extract from the Unified State Register. It is worth remembering that its validity is only a month. For this reason, everything needs to be calculated.

- Certificate from the place of residence about the number of registered persons.

- When officially married, each spouse must have permission to carry out a real estate transaction.

Each type of document must be executed in electronic form, which is very important for the registration itself in the presented way.

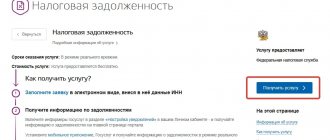

Algorithm for obtaining the service

To understand what electronic registration of a real estate transaction is, you need to familiarize yourself with the algorithm for its implementation. The procedure contains the following activities (subject to concluding a mortgage loan with Sberbank):

- Submitting an application for a mortgage from Sberbank;

- Obtaining approval;

- Collection of the necessary package of documents;

- Notifying the bank about its registration under the mortgage agreement through the bank’s electronic service;

- Signing a preliminary loan agreement with a rate on preferential terms (due to the subsequent registration of the transaction for the transfer of ownership by the Sberbank service);

- Selection of housing stock;

- Familiarization with real estate documents;

- Payment of the deposit to the seller;

- Submitting documents for verification to the bank (including title documents of the real estate seller);

- Signing a mortgage agreement and a surety agreement;

- Signing an agreement for the provision of services for electronic registration of a transaction by the Sberbank real estate center;

- Payment for services (at a bank branch, through payment terminals or post offices);

- Selecting the registration date;

- Appearing at the CNS on the specified day (personal presence only);

- Transferring a package of documents to a CNS specialist and verifying the procedure with an electronic signature;

- Checking the completeness of the information specified in the documents and their authenticity;

- Sending the package to Rosreestr for registration events;

- Carrying out registration;

- Sending documents on ownership of the object to the new owner’s email.

How does electronic registration of a mortgage transaction take place in Sberbank?

Since the majority of mortgage agreements are signed at Sberbank, its transition to electronic registration of transactions became logical. The mechanism has been agreed upon with Rosreestr, everything happens smoothly and during one meeting with the borrower. More precisely, the application and documents for online registration are submitted by the bank. He deals with these issues, and the client needs to come to the branch once for a ready-made package of documents.

Electronic registration of a mortgage transaction in Sberbank

Electronic registration and all the nuances are handled by Sberbank specialists. For this reason, the service is still paid for for those who decide to take out a mortgage. But the tariff also includes state duty. As you know, it still needs to be paid when registering rights to real estate purchased with a mortgage. Therefore, these expenses are mandatory, no matter who goes through the transaction registration procedure on the RoReestr website - bank specialists or the borrower.

As a result, on the Rosreestr website and in the Unified State Register of Real Estate it will be indicated that the borrower has the right of ownership to the property purchased with a mortgage. A notification will be sent to the email attached to the site, so there is no need to wait for a decision and constantly visit the site. Since everything is done online, the user does not receive documents in hand. They are on the site itself. A message with two attached files will be displayed on the applicant's email. This will be the same agreement in two versions, one of which has a special electronic signature. The Unified State Register of Real Estate also displays all changes and new data.

Services for electronic registration of a mortgage transaction in Sberbank

If you don’t want to submit an application yourself on the Rosreestr website, then you can entrust it to the bank. But then documents must be submitted to the department and a number of conditions must be met:

- Agreement on the purchase and sale of mortgaged real estate.

- Statement by the borrower, that is, the future owner, and not another person.

- Consent of the other party, for example, a spouse, if required by the bank.

- The applicant must be an individual.

- The purchase and sale transaction must already be completed and not at the conclusion stage.

- The transaction is not formalized if it is concluded by agreement.

- The number of buyers and sellers themselves should not be more than two.

- The service is not available for military mortgages.

The bank specialist involved in electronic filing will tell you what electronic registration of a mortgage transaction is and when you need to come for the completed documents.

Difficulties encountered in practice

Electronic registration of a transaction has not yet become commonplace in the acquisition and alienation of real estate, so in practice the following difficulties arise:

- The transaction must be confirmed by an electronic digital signature (EDS), which most Russian citizens do not have. To purchase it you need to go through a certain algorithm of actions. In addition to the above, the formation of an electronic signature is a paid service that can only be obtained in specialized centers with mandatory identification confirmation;

- The project for electronic registration of real estate transactions exists relatively recently, so bank employees authorized to carry out manipulations of collecting and sending documents to the registration authority have not received sufficient experience and the necessary qualifications to comply with all the details of the matter;

- Due to the fact that the new owner receives documents in electronic form, he may have difficulties with drawing up contracts, under the terms of which it is necessary to submit documents for real estate (with resource supply organizations, about collateral, when carrying out redevelopment of the property);

- Minor errors when submitting documents by CNS employees to the registration authority can greatly affect the duration of registration and, instead of 3 days, take the same 30 as when registering directly through Rosreestr.

- To receive title documents on the usual paper medium, you must personally apply to Rosreestr or submit an application on their official website. The period for preparing documents is from 10 to 30 working days;

- Electronic registration of real estate transactions organized by Sberbank is an alternative to the MFC, which is also authorized to collect documents for the property with their subsequent transfer to Rosreestr. The difference is that the procedure will be carried out within 10 days, but the documents will be issued on paper.