Ask a lawyer

faster.

It's free! Free legal consultation Moscow and Moscow region: +7 499 938-93-12 St. Petersburg and region: +7 812 467-39-73 Fed.

number: 8 800 350-73-54 CONSULTATIONS CONDUCTED: today - 21, per month - 687, per year - 11,345

The housing issue is very pressing for most Russians. Regularly, the Government of the Russian Federation carries out various programs related to improving the quality of life of Russians. For example, for the military there is the opportunity to purchase housing using a special certificate. The purchase of an apartment with a military certificate and the stages will be discussed in this review.

What is this document

A special feature of a military certificate is that it must be used within 60 days from the date of issue. Otherwise, it will become invalid. During this period, you must not only have time to find a suitable housing property, but also register the transaction with Rosreestr. If the purchase is made for the entire military family, then the period for selecting housing increases to six months.

Expert opinion

Stanislav Ershov

Qualified lawyer. Ready to answer any of your questions! Ask them right now!

Write to an expert

If the document expires, bank representatives submit a petition for its replacement to a special department. You can only spend funds on purchasing a home in a new apartment building or on a secondary market. It is impossible to use public money to participate in the shared construction of a new multi-apartment building.

A military certificate is a document issued in the name of the recipient. In addition to the approved information, it contains the following information:

- the final amount of state aid;

- subject of the Russian Federation in which it is allowed to purchase housing;

- passport details of the certificate holder.

Citizens who do not have housing registered in their name can obtain such a certificate. If a military man has relatives who have retired to the reserve, he also does not have the right to claim delivery of this document.

Before submitting an application for a certificate, you need to register with the registration authorities as a person in need of expanded living space.

If a military man owns housing, but its size does not meet the approved standards for the number of square meters per person, then he has the right to be awarded a housing certificate.

Who is eligible to receive? In 2020, certificates will be issued to the following categories of military personnel: :

- transferred to the reserve. The length of service must be at least 10 years;

- stopping the performance of military duty due to health conditions;

- persons in need of increased living space;

- citizens evicted from military settlements;

- family members of military personnel who died while performing public duty.

There is also a special category of military personnel who are provided with housing certificates without a queue:

- large military families with three or more children;

- citizens suffering from serious diseases established by the Government of the Russian Federation;

- living in emergency premises that cannot be repaired. The military man is obliged to provide the conclusion of the special commission.

The money can only be used to purchase residential properties. The essence of the program is that the state allocates money free of charge to a person for the purchase of real estate.

The certificate is used once. You won't be able to get it again.

Using a military certificate, you can purchase a home without a mortgage. If the cost of the property you like exceeds the subsidy amount, then the military man can pay the difference from his own savings. If the apartment you like costs less than the amount of the subsidy, then the rest of the money is returned to the state.

Algorithm for buying an apartment with a military mortgage, video instructions:

Removing the encumbrance from an apartment purchased with a military mortgage

, like any other type of housing loan, involves the transfer of the purchased property as collateral to the bank. Until the debt is fully repaid, the apartment actually belongs to the financial institution. Moreover, there is a third party here - the state represented by Rosvoenipoteka, which issues funds to repay the debt. Therefore, in order to be able to sell an apartment, the borrower must fulfill obligations to:

- by the bank in the full amount of the mortgage loan;

- by the state in the amount of the allocated subsidy.

Moreover, subsidized funds from the state are returned to the borrower’s savings account registered in his name in the NIS system. He can again use all this money to purchase residential real estate, and this can be done more than once

It is important that such a scheme is applicable until the soldier retires or leaves the service.

Using this scheme has one big drawback - the client will have to use his savings to pay off the debt. Not all military personnel have such significant savings, so many borrowers act in a similar situation as follows:

- apply for a consumer loan from a bank for any purpose;

- deposit the remaining amount of debt into the mortgage account at the bank, thereby closing the mortgage;

- selling an apartment;

- The consumer loan is repaid from available funds.

Actually, the removal of the encumbrance from the apartment in this case is carried out as follows:

- first, the serviceman notifies the bank and Rosvoenipotek that he plans to sell his home in the near future;

- then he submits an application to participate in the NIS system - this is necessary to register and receive deductions to the account for the purchase of an apartment in the future (it will be added to the already accumulated amount returned by the borrower when selling the property);

- Next, you need to clarify the amount of the remaining mortgage debt and deposit the required amount into the account;

- then you should obtain a document from the bank indicating that there is no encumbrance on the apartment;

- This is followed by registration of the apartment in your name without encumbrance at the Registration Chamber.

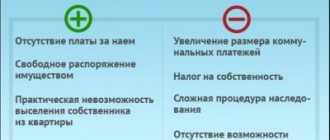

Advantages and disadvantages

There are pros and cons of the program, which are noted by military personnel who have already taken advantage of the housing improvement program.

The advantages include:

- buying an apartment you like without investing your savings;

- partial payment from public funds;

- purchase of a residential property in any region of the country.

Significant disadvantages of such a housing program include:

- long period of waiting for a document;

- citizens transferred to the reserves can buy housing only in the region in which they are registered as low-income;

- you need to buy housing in a short time;

- you need to find a seller who agrees to wait some time to complete the payment;

- You won't be able to cash out. They will go only to the account of the previous owner of the living space;

- the minimum amount for purchasing an apartment, which may not be enough to purchase the home you like.

Despite a sufficient number of disadvantages, more and more military personnel are applying for improved housing conditions.

Pros and cons of a military mortgage for the seller

The sale of housing under the terms of a mortgage for the military, like any transaction, has its positive and negative sides for the seller. The advantages of such a deal include:

- Participation in such transactions is permitted only for accredited banks;

- registering a transaction will not take you more than 5-7 days;

- lawyers consider such transactions “clean” from the point of view of the law;

- any calculations are carried out or made under the control of the bank, which makes it possible to guarantee the security of the transaction.

The disadvantages of the deal include:

- the need to pay taxes on income from the sale of property;

- To receive the money from the sale, the seller will have to wait a little longer than in a regular sale.

Despite the fact that transactions for the purchase of housing under the terms of a military mortgage have not yet been involved in fraudulent schemes, property owners should not let down their vigilance. So, when making a transaction, it will not be superfluous to double-check how much money is in the safe deposit box.

How to get a document

A housing certificate is issued in the order of priority established by the state. The procedure is divided into several stages:

- a report is drawn up addressed to the commander of the unit in which the applicant for the certificate serves;

- the document is transferred to the department of the unit responsible for improving living conditions;

- the applicant is determined a place in the queue for housing improvement;

- when a person’s turn comes, he is notified and invited to receive a certificate for the purchase of housing.

To obtain a certificate, the following list of documents is attached to the report:

- unified report form;

- ID cards of all family members;

- the applicant's military ID;

- a contract or other paper indicating the period of service of the citizen;

- extract from the house register;

- a certificate confirming the need to improve living conditions.

After submitting the documents, a housing case is opened. If the applicant provides an incomplete package of documents, he will be denied a housing certificate.

According to the terms of use of the certificate, all payments between the parties to the transaction are made by non-cash method. After purchasing an apartment, a military man is obliged to move out of the official housing provided to him .

You can apply for participation in the program no earlier than one year before the end of your military service. It must be given to the unit commander between January 1 and July 1 of the current year.

When presenting the certificate, the person responsible for issuing it puts a date on it, from which the countdown of the established deadlines begins . After acquiring living space, a serviceman is no longer considered a low-income person in need of improved living conditions.

The essence of NIS

So, what is the essence of a military mortgage? Upon entering service, a military man can become a participant in the NIS program, within the framework of which a certain amount will be credited to his account monthly (in 2015, about 20,500 rubles). This is a single cash benefit (USB) that cannot be withdrawn.

- After three years, the serviceman has the right to submit a report to receive a targeted housing loan (CHL) for the purchase of housing.

- Next, he contacts one of the banks involved in the program to apply for a mortgage. The accumulated amount becomes the down payment, which the bank receives directly from the employee’s account through Rosvoenipoteka. This contribution, as well as the money issued by the bank as collateral for the apartment, goes to the benefit of the seller.

- The serviceman registers the title documents for housing and can move into it. The bank calculates monthly payments and reports them to Rosvoenipoteka.

While the citizen is in service, the state pays the interest rate in his place. If he decides to resign early, the payments received will have to be returned.

This approach allows the state to kill two birds with one stone: firstly, the problem of providing housing for an entire category of the population is solved, and secondly, men have an additional incentive to enter permanent service.

A real estate specialist talks even more clearly about the essence of military mortgage lending in the following video:

Housing acquisition procedure

An educational video about the practice of using a military certificate from Andrey Baranov, director of the real estate agency “Server Krai”:

You can only spend money allocated by the state on purchasing an apartment. You can purchase a residential property without a realtor or use his services for legal support of the transaction. The process of purchasing an apartment begins with a visit to a bank that participates in the military housing acquisition program. An account is opened in this financial institution in the name of the owner of the certificate of ownership. The amount of the subsidy is frozen on it.

Having chosen an apartment in a new building, you must enter into an agreement with the seller, which will include a clause on payment using a housing certificate. The date of commissioning of the house is also indicated. The whole procedure takes place in several stages:

Military mortgage in Sberbank. You can always add your own money and buy a larger apartment.

- a preliminary agreement is concluded with the developer and sent to the bank;

- bank employees transfer money to the seller;

- an act of acceptance and transfer of the apartment is concluded;

- the transaction is registered and the rights of ownership of the home are formalized.

After this, the transaction is considered completed. Purchasing housing on the secondary market is no different from a transaction with a developer. The procedure is carried out in several steps:

- suitable housing is selected;

- a preliminary purchase and sale agreement is drawn up with the owner;

- the agreement is sent to the bank;

- employees of a financial organization transfer finances to the owner;

- The act of acceptance and transfer of housing is signed.

At this point the transaction is considered completed. The buyer can go to Rosreestr and register ownership of the purchased property . What is the value of the certificate? The amount of the subsidy is not fixed. It is calculated based on the average price of 1 sq.m. living space in the region where the applicant is located. The minimum square footage of the home is also taken into account:

- for one citizen - 33 sq.m;

- for two - 42 sq.m;

- married couple with a child - 54 sq.m;

- for four citizens - 72 sq.m.

After transferring money to the seller’s account, bank representatives independently notify the military department of the transaction. They also provide all reporting documents.

If a military man adds his own money when purchasing an apartment, then this clause is written down in the contract. Providing a military certificate is the only opportunity for Russians to become owners of an apartment practically free of charge.

The purchase and sale agreement is drawn up in the usual form. However, it is necessary to reflect in it the amount transferred to the account of the homeowner from public funds.

Who can become a participant in the program

According to the rules of Article 9 of Article 117 of the Law, military personnel have the right to count on participation in a military mortgage:

program participants:

- graduates of military universities who received officer rank since the beginning of 2005;

- officers called up from the reserves or entered into a contract since the beginning of 2005;

- midshipmen and warrant officers who have served for at least 3 years since 2005;

- petty officers, sergeants, sailors, soldiers serving under a second or subsequent contract after the beginning of 2005.

To become a member of NIS, you must be in the register of participants. Inclusion in the register can be either mandatory or voluntary. If you are not yet on the register (you can find out from the unit commander or on the Rosvoenipoteka website), but meet the criteria, write a report to your unit commander about including you in the register of NIS participants. After 10 days, the register will be replenished with your name.