Financial transactions have become firmly entrenched in our daily lives, but with them come financial fraud, account blocking and other troubles. Many problems in business or when collaborating with banking organizations can be easily avoided if you know how to check an organization’s current account using the TIN. In the article you will find recommendations that can help when collecting debts, when checking the current account of your individual entrepreneur, or simply before conducting new transactions with unknown partners.

Current account structure

A current account (CA) is a sequence of 20 digits issued by a bank to its client - an organization or an individual entrepreneur. Having this digital combination in hand, you can find out a lot about its owner, for example, the purpose of using the account, what currency the money is stored in, and even the number of the branch where it was opened.

Let's now take a closer look at what each number (or rather, a group of numbers) means using an example. Let's say the account is 111.22.333.4.5555.6666666. Each group in this combination has its own meaning.

| Group | Meaning |

| 111 | First order of bank balance. Allows you to obtain information about the account opener and intended use. |

| 22 | Second order of the bank balance. Reveals the specifics of the account owner's activities. |

| 333 | The currency in which the money in the account is stored. |

| 4 | Security Code. |

| 5555 | The number of the bank branch where the account is opened. |

| 6666666 | The bank account number itself. |

The first 5 digits of the current account have a separate interpretation. In addition, each account currency also has its own digital value. But this is described in detail in the article Decoding the current account number.

Checking an account at a bank branch

Checking your Sberbank card balance at a branch is the most inconvenient and time-consuming option to find out the necessary information. It is necessary to contact a bank employee with your passport and personally to the account owner, otherwise the information will not be provided.

The client can receive an official bank document, which will indicate the account number, card number and expiration date, as well as a statement for the required period of time.

Is it possible to find out the account number on the Federal Tax Service website?

It is impossible to check the RS number directly on the Federal Tax Service website, since the tax office issues this information only after going to court. And the court considers such appeals in situations where there is already some kind of violation. For example, there is a debt that has not been repaid on time.

However, you can check the organization’s current account online through the website form service.nalog.ru/bi.do. In the window that opens you will need to enter the following data:

- request type – “Request for current suspension decisions.”

- TIN of the organization or individual entrepreneur;

- BIC of the bank that opened the RS for you;

- Your email address.

Take note! BIC is a bank identification number. Using the BIC, they usually check the correct spelling of the RS, as well as the validity of any account. The BIC consists of 9 digits: 1 and 2 – 04 (for Russian banks), 3 and 4 – the number of your region, 5 and 6 – the correspondent account number, and 7, 8 and 9 – this is the connection with the RS.

Such a request is absolutely free, and anyone can submit it. The system will automatically check all the data and send you a detailed email, which will indicate the time the PC was blocked, if present, the amount of debt, as well as a link to the claim for collection or other reasons for blocking.

Important! If you are sure that the information received is false, then you need to personally visit the local branch of the Federal Tax Service and double-check all the data.

How to find out PM by residential address?

You can obtain information about the single drug number either remotely or during a visit to one or another authority.

Web banking

Banks today are actively modernizing the area related to payment for housing and communal services, because... Many users deposit money through bank cards. The functionality of their personal online banking account helps them with this.

Let's consider a particular example with Sberbank Online. To find out the desired number, you should:

- log in to your account;

- go to the “Transfers and Payments” tab, then – “Housing and Public Utilities and Home Telephone” – “Rent”;

Section "Rent" in the housing and communal services tab. Personal account of Sberbank Online - select the item depending on the type of receipt you receive (for example, “Single payment document”).

If you have previously paid for housing and communal services and saved the transaction settings, the number will already be entered in the field for entering your personal account.

Another way:

Open the “Personal Accounts” tab. Enter your address in the search. The results will be displayed immediately - the number itself, the amount of the last payment, and the total amount of debt (if any).

Note 2.

The data provided by the banking system is synchronized with the database of the Unified Settlement and Information Center.

Please note:

in addition to the number, the amount required for payment is also shown - without any additional requests or checks. Although the payment amount is offered by default, the user can change it.

As you can see, it is very easy to find out PM through your personal account. You can immediately implement the transaction here if the citizen has not yet paid for housing and communal services for the current billing period.

Portal gosuslugi.ru

Government services are an equally convenient way to find out your LAN number. The advantages are efficiency and an intuitively understandable procedure. The downside is that in 2020 only Muscovites can use the function.

To obtain the necessary information, you need to register on the website www.gosuslugi.ru

in the “Personal Account” section: open the data entry window and click the “Register” link.

If you already have an account in the system, please log in. Further:

- open the “Services” category;

- open one by one the subcategories “Apartment, construction and land” – “Payment of housing and communal services” – “Account information”;

Portal “State and “Payment for housing and communal services” - enter the address (city, street, house, apartment);

- click the search icon.

Note 3.

You can simply enter your address into the information search bar. The effect will be similar to the result from the actions described above.

The condition for a successful search event is a verified account. To do this, you must indicate at least a phone number in your profile. If the requirement is met, the system issues a drug number attached to the living space.

Management companies

The method is available to residents of any subject of the Russian Federation. The main requirement is that maintenance of the apartment (house) must be carried out by a specific institution

.

To find out the number, you will have to visit the office of the management company. Two other options are the organization’s website and calling its hotline.

Where can I get the name of the authority, contact numbers, email or Internet resource address? All this is indicated on the receipt that the courier leaves in the mailbox.

We find out the account through payment cards

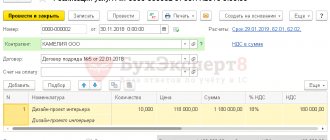

If you have already had some kind of financial relationship, you can check the organization’s RS number through the history of bank payments. All payment transactions are saved in the client-bank personal account.

For example, you can find out any current account of an organization through Sberbank in the following ways:

- On the bank’s official website in the “20-digit account verification” section. All you need to do is know the name and enter the TIN.

- through the Sberbank Online application. You need to log into your Personal Account, then select the “Deposits and Accounts” tab. In the section, find the account you are interested in and go to the “Deposit Information” tab. If the information received is not enough for you, simply go to the “Transfer details to the deposit account” tab. This will allow you to view complete information about your account details.

How to Find out the Balance of a Sberbank Personal Account

For a long time now, banking institutions have stopped making deposits using passbooks and instead use electric accounts. One of the reasons for the refusal of such an outdated banking product is the low abilities of its owner.

The Sberbank book does not fall under the law on deposit insurance; all currency transactions on it must be declared in a mandatory manner. In addition, if the bearer document is lost, anyone can use the funds, and this reduces the level of protection of the client’s savings.

Despite this, there remains a category of Russians, usually the older generation, who cannot give up their usual method of storing funds.

Necessary Advice!

Banking technologies do not stand still and the most convenient options for use are provided for such clients.

A deposit with a savings book gradually fades into history, but almost all clients still own which banking product

The ability to check your savings book using your account number online at Sberbank allows you to monitor your balance and receive a statement of transactions.

How to check a savings book account through Sberbank

For people who use this traditional method of storing their own funds, the same simple and most common method of checking their balance is typical - visiting a bank branch. The client's actions are as follows:

- With your passport and savings book, go to the branch where the account is opened;

- receive an electric queue ticket through the terminal;

- present documents to the operator with a request to check the balance;

- The operator checks the compliance of all data and announces the account status.

Separation is the most common method of how to find out the balance of a book.

Right there in the bank, the client has the opportunity to carry out any operations: withdraw funds or replenish the balance. The transactions performed will be indicated by a mark on the savings book page.

The usual method is to check your balance via the web.

There is a more convenient method for checking your balance - through Sberbank Online. This procedure has many advantages:

- remotely check your balance at any time;

- track completed transactions in payment history;

- without visiting a bank branch, make payments for utilities and other services, state duties, fines, taxes, mobile communications, etc.;

- create currency transfers.

Thus, the most convenient way to create a savings book at the moment is to check your account online. But before all this, it will be useful to connect to remote access to Internet banking. What does that require:

- visit a bank branch;

- write an application to attach the savings book to the Internet service, enter into a UDBO contract;

- then the client is given an identifier (user login) and password to log into the system;

- A bank employee will explain how to log into your Personal Account and how to check your savings book account through Sberbank Online.

Online banking may be increasingly used by bank clients and passbook holders

Another most common option is when the user has a bank card: he will be able to independently carry out the function through an ATM. To do this, you will need to insert the card into the ATM, select the “Sberbank Online” section in the menu and then perform all the manipulations according to the annotation. The ATM will issue a receipt containing your login and several one-time passwords.

How to check your balance online

Having received an ID and password , go to the bank’s website on your home computer and authorize the system. It’s better to immediately change the password to a new one and write it down separately.

Then there will be no need to find an ATM receipt with passwords every time. After logging into the system, the client will immediately see all his accounts on the main page. Here you can view all currency transactions.

Using the Internet service is free.

There is another option on how to constantly be aware of receipts in the savings book. A map will be useful for this. How to create it:

- you need to go to the bank with your passport and book;

- select the “Cards” section in the electric queue terminal;

- get a payment card;

- issue an order to transfer funds from the ledger to the card immediately after they have been accrued;

- you can connect SMS messages to the card that will notify you about the arrival of funds (pension, etc.).

To carry out the procedure, you will need to pay for the annual card service and SMS service.

Sberbank savings book: deposit or current account

Often, owners of savings books are confused about which account is opened for it - current or deposit. Let's look at the properties of each and their differences.

A current account is used for calculating wages, pensions, making payments, receiving and sending transfers, and withdrawing cash. It is not suitable for accumulation or investment. Its essence is instant withdrawal of funds at the first request of the owner of the book. Interest is not charged on the balance, and if it is, it is small.

The essence of a deposit account is that it is opened to accumulate funds and receive additional income. Funds are deposited at a certain percentage (according to the contract), which cannot be withdrawn until the end of the contract.

In fact, the main difference between accounts is access to funds: the current account can carry out any operations at any time, but access to the deposit account is closed until the end of the term.

By registering in the online service, the client receives constant access to the status of his own account

When owners of passbooks ask a question about what their account is, they simply do not understand the essence of this banking product.

The book is tied to a specific current account and at the same time works like a bill of exchange or a bearer security. This is not a personalized means of accessing a client's currency funds.

Therefore, banks are gradually moving away from this method of storing funds.

Find out the account number through government agencies

You can check the RS of an organization or individual entrepreneur not only with the help of the Federal Tax Service, but also with the Pension Fund of Russia. The latter also does not disclose information to third parties. Therefore, it is better to go to the Pension Fund through the court, as well as to the tax office.

In this case, the judicial authority issues a writ of execution, which is attached to the application for verification of the account.

In addition to such drastic methods, you can use legal portals - Bailiffs of the Russian Federation or Kartoteka.ru.

Note! Other resources offering you to find out your TIN, BIC, and also check your RS for money are scammers. Such data is obtained either through the listed methods and sites, or through the Pension Fund and the Federal Tax Service.

Options for obtaining information

You can check payment on your personal account in various ways. For example, via the Internet. There are several sites by going to which you can find out all the information about payments made for utility services:

- Website https://www.gosuslugi.ru.

- Website https://peney.net.

- Website https://kvp24.ru.

IMPORTANT: To clarify payment for housing and communal services using these online resources, you must register on the website and create a personal account.

If for some reason you do not have access to the Internet, you can also find out your utility bills:

- At the bank (at the cash desk or through payment terminals).

- At the housing office.

- By phone (call the management company or directly the resource supply organization).

BIC structure

BIC is a unique nine-digit number within the Bank of Russia payment system - a number of 9 digits (digits). The first digit of the number determines the type of participation in the payment system, the subsequent digits of the number are the identifier of the payment system participant: 0 (0x xx xx xxx) - payment system participant with direct participation;

The BIC number starting with 0 uniquely identifies the Russian bank:

- the first two digits are the country code (Russian Federation has code 04),

- the third and fourth - the code of the region of the Russian Federation in accordance with the first two digits of the OKATO code (All-Russian Classifier of Objects of Administrative-Territorial Division), in the case of “00” the territory is located outside of Russia),

- fifth and sixth - the number of the division of the Central Bank of the Russian Federation,

- the last three are the number of a credit institution or its branch, or another client of the Central Bank of the Russian Federation that is not a credit institution, unique within the division.

Notes regarding codes:

- the last 3 digits of the BIC coincide with the last digits in the bank’s correspondent account - use this to eliminate errors when specifying bank details;

- if the bank has several BICs, then it is impossible to unambiguously determine the BIC only by the card number (debit or credit) or by the bank client’s bank account number;

- TU of the Bank of Russia (territorial institution) and a structural unit within the TU of the Bank of Russia have BICs ending in “000”, “001”;

- Field institutions of the Bank of Russia, structural divisions of the central apparatus of the Bank of Russia, divisions of the Central repository of the Bank of Russia have BICs ending in “002”.

Online check

According to statistics, more than 70% of the Russian population actively uses the Internet, and this figure includes people of different ages, and not just young people. The Internet covers increasingly large segments of the population, therefore, having once set up the Sberbank online system, the user will be able not only to receive up-to-date information about the status of the account at any time, but also to replenish it virtually in the future.

In order to find out the balance of your savings book while sitting at home in front of your computer monitor, you will need:

- Create a personal account in Sberbank online. To do this, you need to go to the bank, where an employee will give the depositor a personal code and password to log in.

- Activate your account by logging into it and changing the initial data if desired.

- Go to the “Accounts and Deposits” tab.

- If there are several deposits, select the one you need and view the balance.

There you can also look at your account statement and view all transactions performed.

Step-by-step instructions: how to find out in person and watch online?

To obtain information about housing and communal services payments, you need to know your personal account. Typically, it is indicated at the top of the receipt, next to the payer’s data. If you haven't found your personal account number, don't worry. You can also check whether you have debt for utilities at your residential address.

Bank

Most payments for utility services go through various banking organizations. The bank is the place where you can also find out the amount to be paid for housing and communal services. What is needed for this?

- Take receipts from last month and your passport.

- Come to the bank and give the receipt indicating your personal account to the operator. By entering your passport details and personal account number, he will be able to view and provide all information about payments.

- Pay the amount announced by the bank employee, if necessary

By phone

Often we simply don’t have time to run through authorities to check payment on our personal account. In general, it is difficult for older people to get out anywhere. In such cases, the easiest way is to call the phone number indicated on the receipt.

For this:

- Take the receipt and find in it the phone number of the management company or resource supply organization.

- Call the number and tell them that you want to know the amount of payment for utilities.

You can find out your payment history faster if you call the accounting department directly or ask to speak with the accountant responsible for the payments. - Write down the amount you were charged for utility bills.

In some cases, you may additionally need the address of the premises, as well as information about the owner of the property.

"Government Services"

The State Services website is a very convenient and easy-to-use Internet resource. Through this site you can also learn about payments and transfers for housing and communal services.

- We go to the website https://www.gosuslugi.ru.

- At the top of the site, click on Service Catalog.”

- Scroll down the page and find the category “Apartment, construction and land”.

- Click on the “Payment for housing and communal services” section.

- Log in (enter the username and password that were specified during registration). Instead of a login, your email or phone number may be indicated.

- After authorization, click on the “Get service” button. You will be redirected to a page where you will need to check the box next to “Payment for housing and communal services (GIS, housing and communal services)”.

- In the lower field, enter the personal account from the receipt.

As we can see, obtaining information about housing and communal services payments through the government services website is quite simple.

Website "Rent 24"

Kvartplata 24 is another site for checking debts on housing and communal services. To obtain such information you must:

- Go to the website https://kvp24.ru.

- Log in to your personal account.

You must obtain a login and password for authorization from your management company. Some organizations enter authorization data directly into the payment receipt. - View payments in your personal account.

All information on utility payments on the website https://kvp24.ru/ is updated automatically monthly.

Personal visit to the management company

The most reliable way to check the debt for housing and communal services on a personal account is to personally visit the housing office or management organization. You must take your passport and receipt for any of the previous months with you. Housing office employees will enter your personal account into the database and provide you with all the necessary information.

If you do not have a receipt with you, you can check the payment for housing and communal services at the address and full name of the owner of the premises.

The only disadvantage of this method is the presence of large queues. Carefully plan your affairs on this day, as you can stand at the housing office for quite a long time.

Website "No Penalties"

- Go to the website https://peney.net.

- In the right column with sections we look for the category “Housing and Public Utilities”.

- In the first line, enter the payer code (personal account).

- In the second line we enter your email.

- We put a tick next to the item indicating consent to the use of personal data.

- Click the “Search for Accruals” button.

Reference! A convenient service for obtaining information about your debts. It is possible to activate the service via SMS. In this case, if you have even a minimal debt, you will receive an SMS notification on your phone.

Terminal

In addition to visiting the bank, you can check housing and communal services payments on your personal account at a terminal (ATM) of any banking organization. This method of obtaining information about paying for utility bills is suitable for most, since each store has several bank terminals.

Necessary:

- Approach any of the terminals (ATMs) with a receipt for payment of housing and communal services.

- Go to the “Utilities” option.

- Enter a combination of personal account numbers, the owner’s full name and residential address.

After these simple steps, you will see the amount to be paid on the terminal monitor.

You can pay it immediately or a little later. All methods of checking housing and communal services payments on a personal account are available to anyone.

To avoid penalties and fines, regularly check your utility bills for debt. How exactly it is worth receiving such information is up to everyone to decide for themselves. For some, it is more convenient to come to the housing office in person, while for others it is easier to make a couple of mouse clicks.