Personal accounts: main types

Confusion in personal accounts is common. This is due to ignorance of their features and design methods. Today the following types of personal accounts :

- Employee (used in company personnel records). This l/s contains the following data:

- Information about payroll.

- Data on financial assistance, allowances, bonuses and compensation.

Personal information is used to calculate tax payments. The storage period for documents is 75 years.

- Bank. This personal account contains information about the financial relationship between the credit institution and the account owner. Personal bank accounts are often set up for each type of transaction. For each individual account, a register is allocated and a personal account is issued.

Data in personal information is confidential. The banking institution is responsible for protecting information from outsiders, but if there is a request from the Federal Tax Service, the data is provided without delay.

- Taxpayer. Each person has an individual “tax” personal account, which is maintained in national currency. Such a personal identification number is issued simultaneously with the assignment of a TIN to the Federal Tax Service. Feature - accounting of receipts and payments, based on the characteristics of the budget classification.

- Manager. Budget allocation data is displayed here.

- Shareholders. This l/s reflects data on assets that are in the possession of citizens, individual entrepreneurs or companies.

From the shareholder's personal account you can find out:

- Type and category of exchange instruments.

- Number of securities.

- Registration number.

- Price and data on securities transactions.

- The insured person. This personal account is used to obtain information about an individual and transfer his pension. Each insured person has his own number.

Division of personal account in case of shared ownership

Section of drugs upon application to the management company

Each of the owners who has a share in shared ownership is obliged to pay for utilities in a share corresponding to the share in ownership. In the event that there is a payment dispute between the owners, then you can demand the division of the personal account and the issuance of a separate payment document. This should be done by the management company, EIRC, HOA or resource supply organization, where you need to apply.

The application must be accompanied by:

- a copy of the certificate of share in the ownership of residential premises;

- a copy of the applicant's passport.

Arbitrage practice:

Co-owners of residential premises in an apartment building are responsible for paying for residential premises and utilities in proportion to their share in the right of common shared ownership of residential premises (Article 249 of the Civil Code of the Russian Federation).

Within the meaning of Article 155 of the Housing Code of the Russian Federation and Article 249 of the Civil Code of the Russian Federation, each of these co-owners of residential premises has the right to demand the conclusion of a separate agreement with him, on the basis of which payment for residential premises and utilities is made, and the issuance of a separate payment document.

Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 27, 2017 No. 22 “On some issues of consideration by courts of disputes regarding payment for utilities and residential premises occupied by citizens in an apartment building under a social tenancy agreement or owned by them by right of ownership”

An application for division of a personal account is drawn up in free form. In addition, the ERC can provide you with a sample, which may differ in different management companies and HOAs.

Splitting a personal account through the court

If, after considering your application at the settlement center (MC, HOA, RSO), you are rejected, you must file a claim in court to determine the procedure and amount of participation in payment for housing and utilities and to issue a separate payment document.

It is possible to split a personal account based on a court decision if:

- The management company, homeowners' association, and RSO refused to satisfy the application;

- The management company, HOA, RSO did not respond to your application;

- the other owner does not agree with the division.

After the court decision comes into force, it will be the basis for issuing a separate payment document to each of the owners.

How to find out your personal bank account?

To find out your personal bank account , you should use one of the following ways:

- Through your personal online banking account.

- Check the number at the branch of the financial institution.

- Call the hotline and follow the operator's instructions.

A bank personal account may be required to withdraw money, make a transfer, or obtain personal data.

The structure of a personal account number in a bank is twenty digits that differ from the number on a bank card. The latter changes if a new “plastic” is released, but the l/s number remains unchanged.

Why do you need an account in the Treasury?

For public sector institutions, CSCs are an obligation, that is, public sector employees can receive and spend budget funds only through such DSCs. Otherwise, you will not receive government funding. But what does the commercial sphere have to do with it?

Let us determine what role the Federal Treasury plays in this issue. First of all, this is total control over the correctness, legality and expediency of spending funds received from the state budget. Since recipients of public money can be not only budgetary government institutions, but also non-profit organizations and commercial firms, control is necessary in this area of relationships.

What TOFK controls:

- Government contracts for the provision of government needs (purchase of goods, works, services) worth over 100 million rubles, the terms of which provide for an advance payment.

- Contracts and agreements on the provision of contributions to the authorized capital or property of legal entities, if these investments are sources of financing for investors.

- In terms of concluded agreements for the provision of subsidies and other budget investments to legal entities.

- Subsidizing recipients of budget funds, as well as participants in the budget process.

- In terms of control over the implementation of the terms of state (municipal) contracts and agreements of organizations.

Consequently, if a company has become one of the participants in a state or municipal contract, then it will have to open a CSC.

How to open a bank personal account?

To open a bank personal account , you should do the following:

- Contact the financial institution of interest.

- Give your passport to the employee of the institution (foreigners will need a second document).

- Select currency.

- Place a sample signature on the special card.

- Sign the contract.

- Put money on the account for storage.

To open a personal bank account , you need to spend no more than 10-15 minutes.

In the future, you can use your account - add/withdraw funds or make transfers.

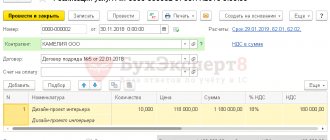

How to open a treasury account: step-by-step instructions

The current procedure for opening and maintaining personal accounts in TOFK is established by the Federal Treasury of Russia. Today, the procedure is regulated in a special order dated October 17, 2016 No. 21n (as amended on December 28, 2017).

To open a CSC for a legal entity, follow the instructions.

Prepare two key documents: an application for opening a personal account and a card of sample signatures. If the DSC is planned to be opened for a separate division of the company, then in addition to the required documents, prepare a petition from the parent organization with a request to open this DSC in TOFK. Draw up such a petition in any form and have it certified by the head and chief accountant of the head office. Or request a current form from the territorial treasury office.

Application form 05311752

Sample signature card form 05311753

IMPORTANT!

The sample signature card will have to be notarized.

In addition to the required documents, Treasury authorities have the right to request additional information. Therefore, prepare the following documentation in advance:

- A copy of the government contract on the basis of which the need to open a CSC arose.

- Extract from the Unified State Register of Legal Entities on making an entry on the creation of this legal entity (copy).

- A copy of the Charter of the economic entity.

- A copy of the certificate from the Federal Tax Service on the registration of the taxpayer.

- A certificate from the Social Insurance Fund stating that the company pays insurance premiums (if any).

TOFK specialists are required to request this information from the relevant government agencies and compare it with the documents provided. The FC must notify of its decision within 5 working days.

Application form 05311752

How to find out your number by address using the Internet?

Similarly, your personal account number can be checked using a bank terminal. Current regulatory legal acts also allow obtaining information by telephone when contacting a housing and communal services organization. Or call us by phone (24/7): If you want to find out how to solve your particular problem, call us by phone.

The basis for this is the concluded agreements. Services of this nature are provided on a reimbursable basis. That is, the user must pay money at certain intervals. To do this, he can use various methods. One of them is payment to a personal account.

Opposite the “Financial-personal account” item there are numbers printed that correspond to its number. If the owner does not have a receipt, but you need to find out your personal account to pay for utilities, you can do this at the apartment address in several ways: As you can see, using the above methods you can find out not only the number, but also check the existing debt. A paper copy of the tenant's personal statement is called an extract from the personal account.

The tenant becomes the person who has nominated his right to receive municipal housing. How to find out your personal account is to contact the management company and make a request. Opening a personal account is simple - to do this you need to contact the authorized budget authority. This will require the consent of all other residents registered in the premises.

What is it? A financial-personal account is a document that is issued for an apartment and contains information about the nature of the premises, the degree of improvement, and information about registered persons is also entered. When registering or deregistering a person from an apartment, the owner or tenant will need to make changes to this document by presenting it at the passport office.

Homeowners pay for electricity, heat, water supply, gas and other utilities. All information about transfers is reflected in banks by the company providing the services. She maintains individual records for each residential property. The owner can find out his personal housing and communal services account from a receipt or at the address, in the management company, and via the Internet.

Unfortunately, this resource does not offer to directly find out your personal account number, but it does offer to pay for housing and communal services, knowing only the address of the house. Enter the address, indicating it exactly with the information on the receipt.

Thus, you can find out your personal number at your residential address when paying at a banking organization with an operator that accepts transfers for utility services. Terminals that accept various payments are also equipped with this information. When working with the terminal, you must select the “Payment to address” option and information about the amount presented for payment and the personal number of a specific address will appear on the screen.

Any legal transactions with an apartment owned or rented for social rent must be accompanied by amendments to the relevant documents. It has the official unified form 36 and is a table with the following information: A sample extract from the tenant’s personal account looks like this: When the need arises, citizens try to find out where to get an extract from their personal account.

Housing Code of the Russian Federation Opening a Personal Account

- Paperwork

- On approval of the Regulation “On the procedure for interaction of authorized bodies with the owner (tenant, user) of a residential premises on the preparation of financial personal accounts for payment of housing and communal services. RESOLUTION of February 12, 2007 N 349 ON APPROVAL OF THE REGULATION “ON THE PROCEDURE FOR INTERACTION OF AUTHORIZED BODIES WITH THE OWNER (TENANT , USER) OF RESIDENTIAL PREMISES FOR REGISTRATION OF FINANCIAL PERSONAL ACCOUNTS FOR PAYMENT OF HOUSING AND UTILITY SERVICES In order to streamline the process of payment for housing and communal services, I decide: 1.

Approve the Regulations“On the procedure for interaction between authorized bodies and the owner (tenant, user) of residential premises regarding the registration of financial personal accounts for payment of housing and communal services"

.

2. Publish this resolution in the city newspaper “Dimitrovgrad”. 3. Personal account for the apartment

- identification document of the person applying for the extract.

Extract from a personal account An extract from a personal account is a document containing data on the area of the premises.

Financial personal account for an apartment - how to open and where to get a statement? Personal account for payment of utilities - features, requirements and example Information about persons jointly registered with the owner (tenant) (or having the right of ownership or use of this residential premises along with it) (last name, first name, patronymic, year of birth, date of registration in given residential premises, the presence of family ties with the owner (tenant); 1. 3. 3. Main characteristics of the residential premises

- home

Contents of the personal account statement

A paper copy of the tenant's personal statement is called an extract from the personal account. It has an official unified form 36 and is a table with the following information:

- FULL NAME. owner or tenant of residential premises.

- Residence address.

- Total and living area, number of rooms.

- The basis of ownership of real estate, indicating the document and its number.

- Available amenities (electricity, heating, gas, water).

- Number of registered persons with full name and date of birth, date and period of their registration.

A sample extract from the tenant's personal account looks like this:

The main purpose of an extract from a financial and personal account is to confirm the fact of registration of a person at a specific address. Upon request, a certificate is issued about the presence or absence of debts. Documents are required for any legal transactions with residential premises and other purposes. These goals include:

- registration of contracts for the sale or donation of an apartment. It is important for new owners to have no rent debts;

- privatization. An extract is one of the necessary documents to carry out this procedure;

- redevelopment. Without this document, it is impossible to legitimize any technical changes in the apartment;

- registration of a person;

- registration of various benefits, subsidies, benefits.

It is important to remember that the statement is valid for 1 month from the date of receipt. This is due to the fact that it contains information about monthly payments for housing and communal services, reflected in the personal account. And since the presence of debts for housing and communal services is unacceptable for registration of real estate transactions, the information in the certificate must be up-to-date. The validity period of the statement is not extended, but if it has expired, you can get a new one.

About tariffs

All accounts are opened at Sberbank free of charge; the credit institution does not charge money for replenishing or debiting its funds. For all deposits, Sberbank charges interest on the balance of funds. The conditions depend on the amount and term of the contract.

READ Connecting the package and its terms of service

As part of the promotion for the “Record” deposit, which is valid until December 2020, the interest reaches 7.15% per annum. For traditional products the rate reaches:

- 5.15% – on “Save” deposits, without the possibility of replenishment and withdrawal;

- 5.05% – “Gift of Life” deposit, without additional contribution and receipt of funds;

- 4.7% – “Top up” product, without the opportunity to take part of the funds;

- 4.4% – on the “Manage” deposit, with the possibility of replenishing and withdrawing funds in excess of the minimum balance;

- 4.55% – provides for the product “Top up in the name of the child”, the conditions allow you to deposit money and keep it until the child reaches adulthood;

- 4.25% – on deposits that receive social payments;

- 3.5% – on deposits to receive a pension;

- 1% – savings account for performing income and expense transactions;

- 0.01% – universal deposit, is a current account with a minimum rate “On demand”.

Increased interest rates are provided for pensioners on the “Replenish” and “Save” products and wealthy clients when opening a deposit worth more than 1 million rubles.

What is a personal account number

The identification number covers several areas of application. Let's look at them in more detail:

- The taxpayer's personal account contains records of salary accruals and payments. All transactions on it are carried out according to the bank’s special classification. Each item of the transaction performed is designated with a unique code.

- For the tax authority, l/s is a register for analytics and accounting of tax collections made.

- For the Pension Fund, l/s is a summary of information about the receipt of pension contributions and other identification information about the insured person. Each individual personal account number has a special part - a section on the receipts of insurance investments for accumulating a labor pension.

An example of decoding a personal account number.