In 2018, the parent certificate (capital) contained 453,000 rubles. This figure is quite significant for most Russian families. Maternity capital was introduced, and at the same time, became relevant in 2OO7. There is not a single person who has not heard about that miraculous gift from the state. What do the data collected by statisticians say about the intensity with which the maternal certificate (capital) is used? Below is the information.

- 49% of maternity capital owners found full use of it. As you can see, these are the majority.

- 4% of people found use of resources from the maternal certificate (capital), not completely. Partial use is also possible.

- 47% of citizens have not spent a single ruble from maternity capital. These people still have a long way to go.

A must read! How quickly should I use the gift? It seems possible to use resources from the parent certificate (capital) even after the project ceases to be relevant. That is, no one will take away the money located on it.

Starting from 2007, the capital became larger every year, and this was the case until 2016. And it was right! Over the 8 years of the project’s relevance, the volume of resources located on the mother certificate has increased by approximately 200,000 rubles, which is about 80%. As of 2016, capital increases were stopped. What rules are relevant regarding capital money?

- Resources can be used both in part and in full.

- To manage resources, you should submit an application to the pension fund.

- Resources are transferred exclusively by non-cash means.

- It seems possible to use resources when the second child crosses the threshold of his third birthday. Are there any exceptions? Only the use of resources to pay a mortgage loan fee does not fall under this rule. In this situation, there is no need to wait until the child turns 3 years old.

Where can you spend maternity capital?

The modern interpretation of the law makes it possible to use part of the maternity capital funds before the expiration of a three-year period on the basis of payment at the expense of maternity capital for mortgage loans, targeted loans taken by a family for the construction or purchase of housing, for the purchase of means of rehabilitation or social adaptation and integration into society of a disabled child (children). -disabled people).

Let's talk in more detail about how you can use maternity capital.

The most popular ways of using maternity capital are to use it to pay for actions to improve the living conditions of children, to pay for their education, to pay for their treatment and to pay for loans issued for housing.

How to attract maternity capital to build a house?

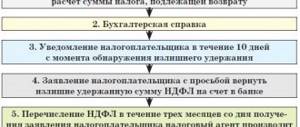

In order to direct the funds from the certificate in question to the construction of your own house, you need to submit an application, essentially to the Pension Fund. However, the application will only be approved if your second or subsequent child is already 3 years old. The pension fund makes a decision within 2 months to transfer the amount of money to the current account attached to the bank statement. That is, when building a house, the owner of family capital does not receive money in hand, but receives a money transfer of targeted funds to a bank account. Moreover, the funds are transferred in tranches: the first tranche in the amount of up to 50% of the certificate amount is transferred within 2 months from the date of application, and the second tranche – six months after receiving the first part, when the fund is certified as the intended use of maternity capital.

If the construction of a house is carried out by a contractor, then a contract with the details of the contractor is provided to the Pension Fund of Russia, and if the construction is being built independently, then the fund must submit a package of documents consisting of:

- maternity capital certificate;

- passport of the owner of the certificate.

- documents confirming his registration at the place of residence or place of stay;

- spouse’s passport (if he is involved in construction);

- marriage registration certificate;

- documents of title for the land plot on which the house is being built (these may be a certificate of ownership (extract), a lease agreement, an agreement for gratuitous use, concluded by the owner of the certificate (the owner’s spouse);

- documents on ownership of the house (during its reconstruction);

- building permit;

- a written obligation, within six months after receiving the cadastral passport of an individual housing construction project, to register the residential premises, built or reconstructed using maternity capital funds, as the common property of the person who received the certificate, the spouse, children, including the first, second, third child and subsequent ones , with the determination of the size of shares by agreement;

- the account to which the funds are supposed to be transferred (if the bank account is changed, information about the new current account is submitted to the Pension Fund).

In order to receive the second part of the funds for the construction or reconstruction of a residential building, after six months, a document confirming the completion of the main work on the construction of a house or its reconstruction, issued by the body authorized to issue a building permit, in accordance with housing legislation, is submitted to the Pension Fund.

What can you spend your maternity capital on?

The list of things you can spend your maternity capital on is, in general, quite wide. According to the government, its provisions reflect the primary needs of the family, which need to be addressed first.

Money on the certificate can only be used within a fixed list. No other option is allowed. The original paragraph on “Disposition of maternity capital funds” can be viewed in Federal Law No. 256-FZ, Article 7.

Parents, before deciding where to spend their maternity capital, need to write a list of possibilities based on legislative acts. And only after analyzing the basic needs and needs of the family, choose the appropriate direction of spending. In this case, it is allowed to spend part of the funds, for example, on education, and invest the rest in building a house. Combining costs is not prohibited.

Improving living conditions

The solution to the housing issue can perhaps be called the main option where to spend maternity capital funds. At the same time, there are several opportunities to improve your living conditions.

Certificate holders can spend state support funds as follows (paragraph 10 of Law No. 256-FZ):

- Buying an apartment or house with your own funds with the addition of the amount of capital. Moreover, if we are talking about purchasing a private house, it is important that the building meets safety parameters, has amenities for living and is located on land intended for individual construction.

- Purchasing housing using credit funds through a mortgage. Options allowed here are making a down payment on the loan, paying off the balance of a previously taken out loan to purchase a home, or paying off interest on the mortgage.

- Construction of a private house.

- Participation in shared construction and contribution of capital as the amount payable under the relevant agreement.

- Reconstruction of a residential building subject to expansion of the existing area. For example, by adding additional rooms, improving the attic space and other options.

- Compensation for expenses incurred on a house that has already been rebuilt or for previously carried out restoration or improvement of housing. Provided that the work was carried out after 2007.

- Payment of a share or first installment if the parents are participants in a housing, housing-construction or ordinary cooperative.

The acquisition of real estate is allowed for both primary and secondary real estate. Moreover, if the transaction is carried out at the expense of one’s own funds, then the certificate can be used only when the child reaches 3 years of age.

If we are talking about a mortgage, repayment of the loan or interest, it is allowed to use maternity capital at any time after receiving the certificate. This exception is considered the only one when, within the specified direction of expenses of material support from the state, spending of funds ahead of schedule is allowed.

In addition, the apartment, house, land where it is planned to build a house must be located on the territory of the Russian Federation. After completion of the transaction and payment of the mortgage, if any, the living space must be registered as the property of all family members.

Payment for children's education

If we make a ranking of the options according to which Russian families prefer to spend maternity capital, then paying for the education of a child or children is in second place after buying a home. In this case, there is an age restriction, that is, the use of funds is allowed only when the child reaches three years of age.

Training can take place at any university subject to the following conditions:

- the educational institution is located within the borders of the Russian Federation;

- an educational institution can be either public or private, the main thing is that it has appropriate accreditation and a license to operate;

- a citizen whose education is paid for by maternity capital has not reached 25 years of age at the start of classes.

In addition to education itself, money can be used for the following purposes:

- maintaining a child in kindergarten (money can be used until the age of 3);

- payment for the hostel where the child lives while studying;

- clubs, sections and other options for additional education, for example, music, art school.

When spending family capital on education, it does not matter which offspring the funds are spent on. In addition, it can be not only one child, but several children. The order of birth does not play a role, just like blood relationship - children can be adopted.

It is also important to remember that payment from the Pension Fund will be received only 2 months after submitting an application to use the certificate. Transfer of funds can be made either at a time or in installments in accordance with the schedule and agreement with the management of the educational organization.

Formation of the funded part of the mother’s pension payments

The mother of a child, with whose birth the opportunity to receive a certificate for family capital was activated, has the legal right to invest part of the funds in her own funded pension. What is of interest here is the fact that if a woman subsequently expresses a desire to withdraw funds invested in her pension, this cannot be denied to her.

To send funds in this direction, the mother will only need to submit a corresponding application to the Pension Fund. Other operations are carried out automatically.

This option for spending maternity capital is especially relevant for non-working mothers. Thus, a woman has the opportunity to receive a decent pension in old age.

Payment for services and related products for the adaptation of children with disabilities

Support and socialization of disabled children with the help of maternal capital is considered a new direction. This opportunity to spend state support funds arose only in 2020.

Here we can talk about expenses not only for the child for whose birth the certificate was received, but also the opportunity to direct funds to pay for goods and services for other children with disabilities, if any. In this case, the right to spend arises only when information is entered into a specialized individual rehabilitation program. Simply put, in order to spend maternity capital on any specific services, you will need to first prove and record the fact that the child needs it.

Now registering a disabled child has become somewhat easier. If previously a medical examination was a mandatory procedure, now the recording of data on children with pathologies of physical and mental health occurs on the basis of already received medical certificates. There is no longer a need for additional examination.

Another point is compensation for previously incurred expenses and transfer of funds for purchases already made. The parent should save all receipts and other payment documents in order to then submit them to the Pension Fund and receive compensation in the form of maternity capital funds. Additionally, the fact of availability of goods is certified by a certificate received from the social protection authorities.

The advantage here is that there is no need to wait for the child’s third birthday; in this case, funds can be spent at any time.

How to use maternity capital to buy a house?

Many owners of maternity capital are wondering how they can buy a house with maternity capital? Since the cost of maternity capital is clearly not enough to buy a house, you will need to use other sources of financing, mainly your own savings. In this case, the certificate acts as a certain basic amount for purchasing a home.

Mat capital cannot be spent on buying a car

Buying a car is not one of the purposes for which maternity capital can be spent. Since this does not apply to improving living conditions or to any other purpose permitted by law, and with 20,000, which can be received as a lump sum payment, it will not be possible to buy a car.

As a result, a car is not purchased with maternity capital, although this could solve the problem of movement for most families, since the amount of capital can be used to purchase a new car and not raise your own funds.

This goal has been discussed many times, despite a large number of advantages, it has disadvantages, and it is rejected if there are some difficulties:

- Possibility of selling your car quickly to cash out.

- Threat of car theft or damage in an accident.

- Rapid breakdown of machines, especially those from domestic manufacturers.

Is it possible to buy a summer house with maternity capital?

It is quite difficult to complete such a transaction under the current legislation. The pension fund will most likely be against such actions, since it considers such use of maternity capital funds to be a misuse.

To obtain approval from the Pension Fund for such a transaction, you need to prove that this dacha is a residential building.

In order for a dacha to be recognized as a residential premises, it must be suitable for permanent (year-round residence), have the status of a residential building, have an individual postal address, and have legal grounds for registering residents there. In addition, the purchased housing should not be considered dilapidated or in disrepair, and should have all the necessary communications and amenities for the normal living of a family with children.

Shared home purchase

The law specifies one more purpose where maternity capital can be spent in 2020 - the shared purchase of housing. The pension fund approves of the acquisition of a share in a multi-room apartment, where after registration of the share, the owner of the capital becomes the sole owner of the apartment. In some cases, this acquisition may become a source of small income.

According to the law, purchasing a share from relatives is no different from purchasing from strangers. The former owner must be evicted from the apartment if at the time of the transaction the owner of the capital becomes the full owner.

But buying shares between spouses is not recommended. You can also buy a room with capital, but this cannot be a share in a one-room apartment. The room must be completely isolated from common areas, and the accounts of the co-owners must be separate.

But it’s not always possible to purchase a room in a dorm, that is:

- If the hostel has the status of a residential building, and the room is privatized, then the transaction may be approved.

- But if the hostel is classified as specialized premises, then purchasing a room becomes impossible.

You can also purchase shares using a mortgage loan; banks approve such transactions. But only if the owner provides documents that after purchasing the last share he will become the sole owner of the apartment, he will be able to take out a loan to purchase a share in the apartment.

Is it possible to buy a house in a village with maternity capital?

When buying a house in a rural area, the following conditions must be met under which the Pension Fund will allow the transfer of a sum of money from maternity capital funds:

- the house must be recognized as a full-fledged real estate object that meets all sanitary and construction standards for the residence of minor children and their families;

- he must be located in the Russian Federation;

- have heating, electrical, water supply and sewerage systems;

- have a wear percentage of no more than 50%, not be in disrepair or dilapidated condition;

- be located on a land plot registered in accordance with the procedure established by law as ownership or lease;

- have the opportunity to register family members of the owner of maternity capital.

In order to purchase a house using maternity capital without breaking the law, it is important to understand that maternity capital funds are not issued to its owner in cash. The pension fund can only make a non-cash transfer of funds to the account specified in the purchase and sale agreement (to the seller). The seller must be warned about this nuance and agree to such terms of payment for the transaction. After the transaction to transfer funds is completed, maternity capital loses the ban on cashing it out, and the seller calmly acquires the right to dispose of the funds received into his account as he wants.

In most cases, real estate using maternity capital is purchased on the secondary housing market, which is economically beneficial for a family with children.

Before buying a house, it is worth registering ownership or long-term lease of the land plot on which it is located.

Since the law does not allow you to buy a plot of land using maternity capital, you will have to purchase it at your own expense.

To obtain permission to purchase a house using maternity capital, you need to submit to the Pension Fund a package of documents consisting of:

- applications to the Pension Fund of the established form (to be specified in the Pension Fund);

- SNILS;

- maternity capital certificate;

- passports;

- children's birth certificates;

- obligations to register ownership of the house for all family members;

- marriage certificates;

- information about the bank account of the seller of the residential premises.

After the Pension Fund approves the real estate purchase and sale transaction (within 2 months from submitting the application), a purchase agreement is drawn up. At the same time, the new owners of the house must have equal shares in it (including shares for children). Common property purchased with maternity capital funds must be registered within six months from the date of transfer of funds to the seller’s account.

Limitations, features and methods of use

At the moment, the subsidy amounts to just over 450 thousand rubles. The amount is impressive, but wait until you plan – you won’t receive any money in your hands. The “case” is stored in the Pension Fund and only with its permission will the funds be directed to one purpose or another. So, what can you spend maternity capital on?

Methods of use can be as follows:

- solving the housing problem;

- guardian's pension;

- children's education;

- payment for rehabilitation and care services for a disabled child.

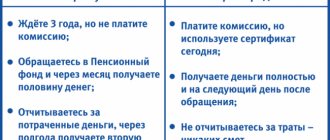

These are the restrictions on the use of mat. capital is not running out. Firstly, you will have to wait until the second (or subsequent, which gave the right to receive) offspring turns three years old.

Only after this can you write a petition to the Pension Fund for approval of the transaction. The exception is mortgage repayment.

Is it possible to use maternity capital in the form of cash? All transactions using family capital are strictly non-cash.

It will be possible to legally turn the subsidy into banknotes if the government decides to continue the one-time payment program. In 2016, it was legally possible to receive 20 and 25 thousand rubles.

For what purposes can maternity capital be spent?

Important: no matter what the family plans to use the funds for, the interests of all household members must be taken into account.

Is it possible to buy an apartment or house with maternal capital from close relatives?

According to the Civil Code of the Russian Federation, it is possible to formalize a real estate purchase and sale transaction with close relatives, but if housing is purchased for maternity capital, then there are some restrictions. This applies to cases with close relatives (mother, father, grandparents do not have the right to sell housing using maternity capital to their sons, daughters, grandchildren and granddaughters. The restriction is related to the prevention of fraudulent actions with maternity capital, namely making a fictitious purchase - sales not for the purpose of improving the living conditions of children, but for the purpose of cashing out a certificate for family capital.

There are no such prohibitions for other relatives.

What can’t you spend money from maternity capital on?

There are goals that are being discussed, but have not yet even been accepted for consideration. However, information about this periodically appears in various sources, which can mislead ignorant citizens. So what should you not spend resources on from your mother’s certificate?

- You cannot become the owner of a car.

- You cannot become the owner of land. plot.

- You cannot become the owner of a dacha.

- Repairs cannot be made.

- You cannot close a consumer loan.

How to use maternity capital for the rehabilitation of children with disabilities?

Starting from January 1, 2020, it is allowed to use maternity capital to pay for the social adaptation of disabled children. For these purposes, an individual rehabilitation or adaptation program for the child must be developed. In such cases, maternity capital can be spent immediately after the birth or adoption of a disabled child.

Payment for goods and services for a disabled child is made from maternity capital funds in the form of compensation for goods already purchased or services paid for with family funds. The Pension Fund, along with an application for disposal of maternity capital funds, is provided with an inspection report from social protection authorities, confirming the receipt of a service or the fact of purchasing a product strictly according to the list established in the Order of the Government of the Russian Federation dated April 30, 2016 No. 831-r and an extract from the ITU.

Among the goods that can be paid for from a maternity capital certificate are technical means (such as ramps, special beds, chairs, etc.), sanitary and hygiene products, special sports equipment, and communication means (phone, tablet, laptop, etc.).

It is prohibited to pay with maternity capital for medical services and rehabilitation measures, which are already provided for in the Federal Law of November 24, 1995 No. 181-FZ “On the social protection of disabled people in the Russian Federation.”

How to apply for maternity capital?

To obtain a maternity capital certificate, you can submit an application to:

- multifunctional center for state and municipal services (MFC);

- branch of the Pension Fund of the Russian Federation at the place of registration (documents can be sent by mail);

- through the government service website and the pension fund website (electronic application).

There is no time limit for applying for a maternity capital certificate.

You can dispose of mat capital funds (in full or in part) after three years from the date of birth (adoption) of the child.

Capital can be used at any time after the birth (adoption of a child) for:

- payment of the down payment on a housing loan (loan);

- payment of principal and interest on a loan for the purchase or construction of housing;

- payment for kindergarten;

- purchase of goods and services for the social adaptation of a disabled child (or monthly payment).

If the maternity capital certificate is lost, you can get a duplicate of it at the Pension Fund branch.

How to use maternal capital to educate children?

A very popular option for spending maternity capital is to spend it on children’s education. At the same time, any of the children in the family can pay for education with a family capital certificate. An important condition for such use of maternity capital is the education of a child or several children only in the Russian Federation and only according to the state program in a preschool educational institution, secondary school, college or university. Payment for training is also made by bank transfer. The Pension Fund will give permission to pay for education when the second or subsequent child turns 3 years old.

Types of educational services and the procedure for reimbursement of expenses associated with payment for education are prescribed in Decree of the Government of the Russian Federation of December 24, 2007 No. 926 “On approval of the Rules for the allocation of maternal (family) capital funds for the education of a child (children) and other expenses related to education” .

Briefly about maternity capital

The concept of “maternity capital” has been known since 2007. It was during this period that the state program of the same name was activated to support families with more than one child. In this case, it is not so important whether the child was born or became a member of the family as a result of adoption.

The project was developed after analyzing the unstable demographic situation in the country. Then the birth rate indicators were not at all rosy, after which the government came to grips with the issue of preparing all kinds of programs to support newly created families. The goal of most of these projects was to stimulate the desire of young citizens to have children, not just one, but two, three or more.

To achieve this, a plan was launched to provide families with material support in the form of a one-time payment of a fairly large amount of money, the so-called maternity capital. This was intended, first of all, to improve living conditions - buying an apartment, a house under mortgage programs or on your own. However, other possibilities for spending funds under the certificate were also provided.

If we talk about the amount of state assistance, the amount was indexed annually, but over time, the economic situation in the country deteriorated significantly and, by presidential decree, maternity capital was temporarily frozen. This happened back in 2020.

Now the amount is still not subject to increase, and its amount is 453,026 rubles. Presumably, indexation may be resumed in 2020, but there is no reliable information on this matter.

The project of presenting families with certificates for receiving maternity capital is still in effect. Although the end date of the program was initially set for early 2020. However, the validity period was extended until 2021 inclusive. It is likely that the project will be extended in the future.

Using maternity capital to accumulate a pension

Maternity capital can be transferred to the Pension Fund, state and non-state. It can be invested in the parent’s funded pension after the child, in connection with whose birth a certificate for family capital was issued, turns 3 years old. Investing a certificate in pension savings makes it possible to increase mommy's future pension. To do this, an application is written to the Pension Fund and the required package of documents is drawn up, which is specified by the Pension Fund.

What conclusions can be drawn:

- Maternity capital in 2020 is paid in the same amount as last year (453,000 rubles).

- The family in which a second child was born or adopted is entitled to a certificate.

- You can spend maternity capital in several areas: on housing, on education, on your mother’s pension, and on some other areas that we discussed above.

- Maternity capital cannot be cashed out and spent on inappropriate expenses prohibited by current legislation.

Education

Resources can be spent on paid education at school, technical school, VU3e. Funds can go towards the education of any of the children. What conditions must be met in order for the Pension Fund to approve an application for the disposal of funds?

- The program in which the training takes place must be accredited by the state.

- The educational institution should be located in the vast expanses of our state.

- At the start of the educational process, the child must be under 25 years old.

Important! Before concluding an agreement with an educational institution, you should negotiate a deferment in payment of fees necessary for the transfer of money by the pension fund.

What else can resources from the mother’s certificate be spent on?

- Payment of hostel fees.

- Payment of utility fees. services in the hostel.

- Sport. sections.

- Music education.

- Hood. education.

- School in. languages.